Warren Buffett — the Oracle of Omaha — turned a measly $10,000 into a jaw-dropping $96 billion. How? Disciplined value investing… sounds fancy, huh? But it’s something anyone (yes, you!) can learn. Buffett’s game? Snapping up quality companies at bargain-bin prices and then sitting on them for… well, forever.

At Top Wealth Guide, we’ve distilled his magic into bite-sized, actionable steps. Want to know how to scout for those undervalued gems? Or dodge those newbie traps everyone falls into? We’re here to help you build wealth… the patient way. Grab a chair and let’s get started.

In This Guide

What Makes Buffett’s Value Investing So Powerful

Target Companies That Trade Below Their True Worth

Buffett’s on a treasure hunt-searching for those stocks priced at a comfy 50-60% of their true value. How’s he do it? By crunching numbers on earnings, assets, future cash flows… the whole nine yards. Remember when he snagged Coca-Cola for $5.22 per share in ’88, all while the company’s fundamentals screamed $8-10? That stock skyrocketed over 1,000%-because, duh, buying quality at a discount is the name of the game.

Keep your eyes peeled for companies rocking price-to-book ratios under 1.5 and rocking above a 15% return on equity. And let’s not forget consistent profit margins. Trendy stocks at 30x earnings? Just because they’re the talk of the town-it’s time to swipe left.

Hold Winners for Decades, Not Months

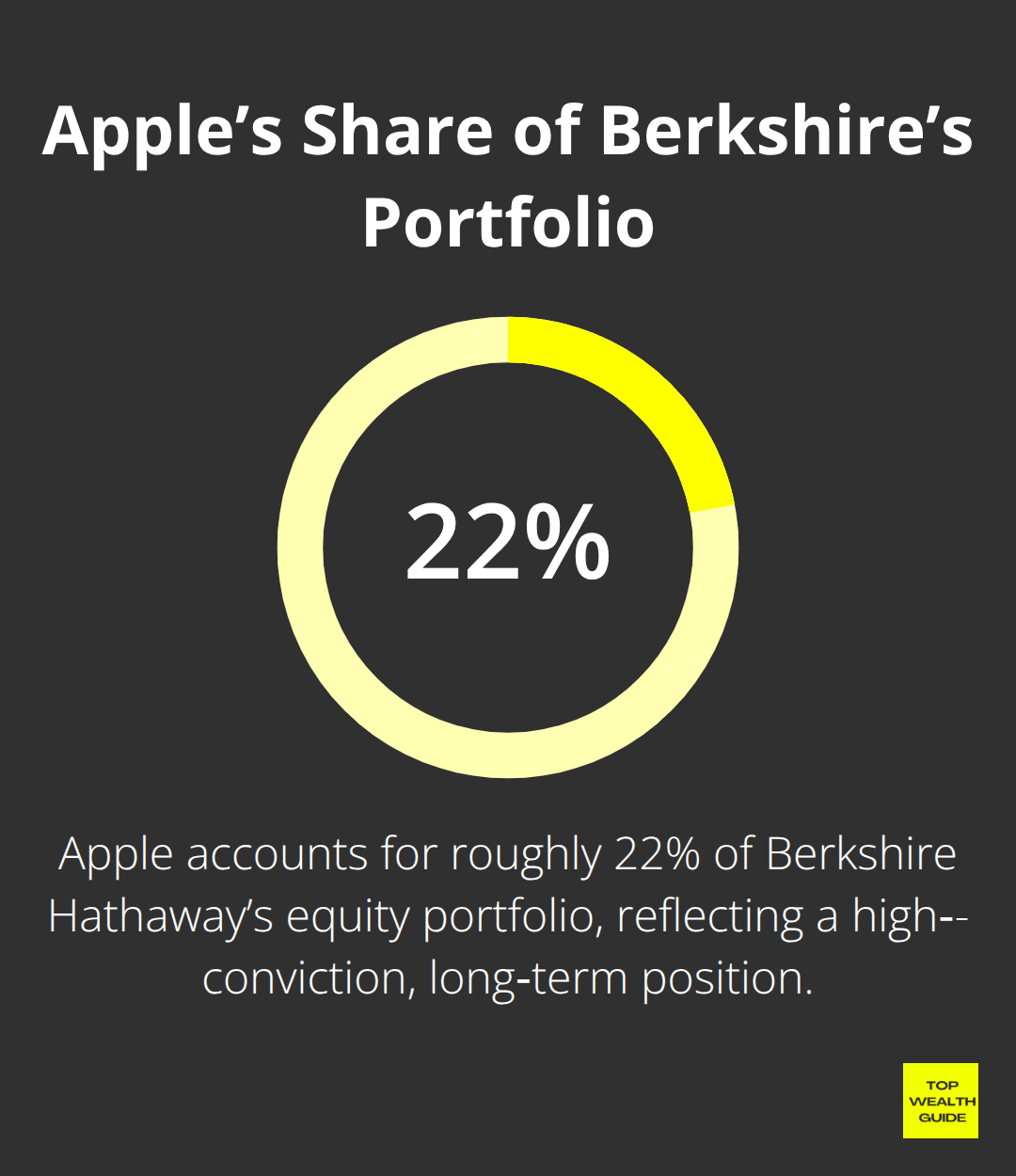

While Wall Street’s busy with quarterly jitters, Buffett’s clock ticks in decades. His Apple move from 2016 morphed into the heavyweight champ in Berkshire’s portfolio with almost 22% of its muscle. Ignored the daily noise… let it simmer; only way to let wealth stew.

Amazon-a 20-year rollercoaster to justify its sky-high worth. And Netflix? Pounded the pavement for 15 years to be a streaming behemoth. Set a 10-year lock-up on your buys. Nixes knee-jerk sell-offs during crashes and cashes in on compound growth-the secret sauce jumpy investors often miss hopping around like it’s a game of musical chairs.

Master Your Circle of Competence

Biotech? Mining? Crazy derivatives? Buffett’s like, “Nah, not my gig.” He sticks close to consumer goods, insurance, banking-his playground where he’s got a crystal ball on cash flows. Prime example: his See’s Candy score-$25 million in, $2 billion out, all ’cause he got brand loyalty and pricing power.

Drill down into 3-5 industries instead of playing jack-of-all-markets. Devour annual reports, spy on competitor chess moves, and get the lowdown on how these players rake in the dough. This Circle of Competence is all about zoning in on what you know, dodging those costly flubs in unknown turfs.

Got these cornerstones down? Awesome. Now, leveling up in value investing means getting systematic about stock picking. Next move? Master the analytical voodoo to spot winners, dodging money-pit mistakes like a boss.

How Do You Pick Stocks Like Buffett

Start With the Numbers That Matter

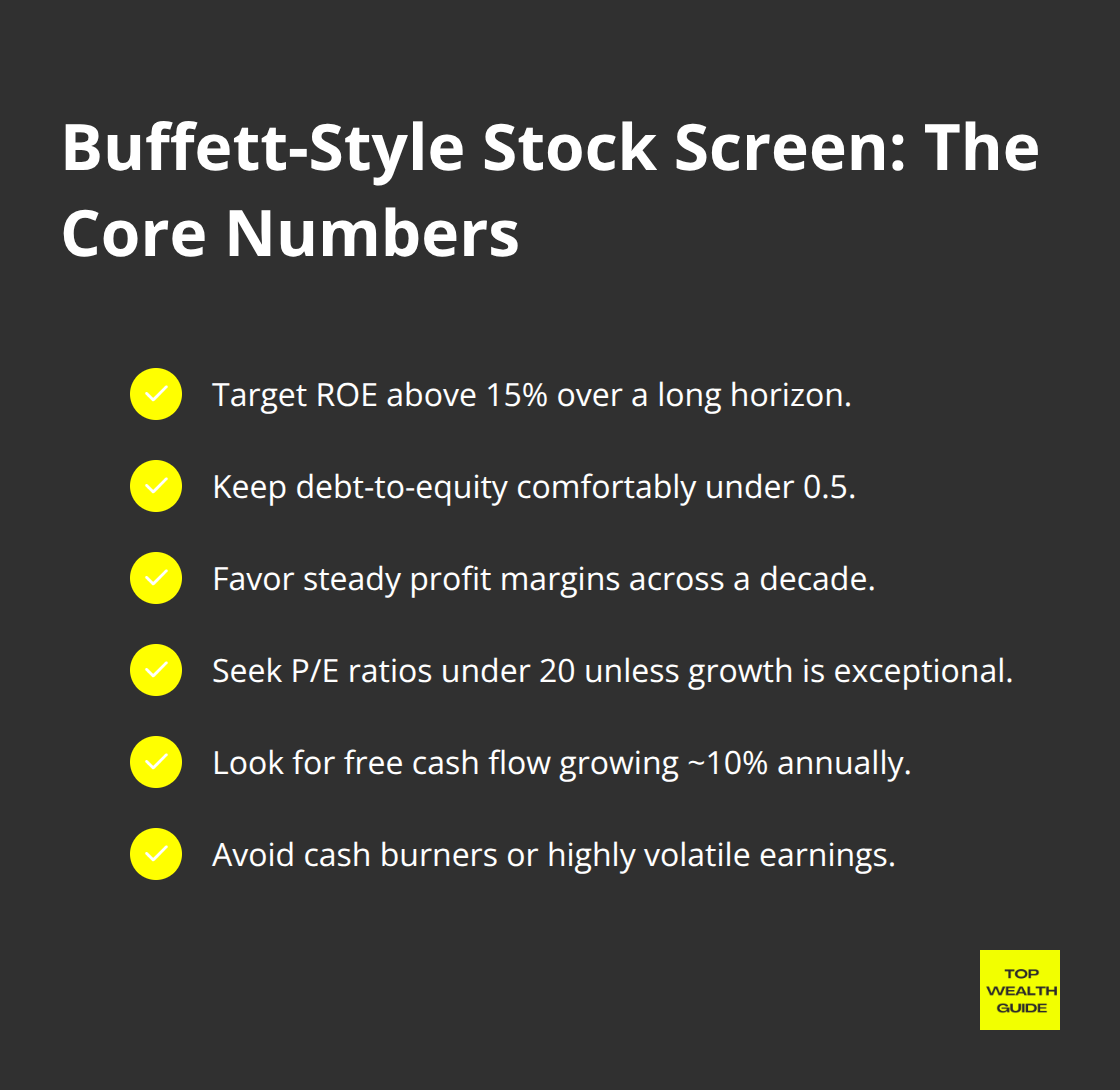

Buffett doesn’t just throw darts at a board-it’s all about the numbers. We’re talking return on equity floating above 15%, debt-to-equity ratios not even flirting with 0.5, and those sweet, steady profit margins over a decade. Take a cue from Apple when Buffett jumped in during 2016 at $26 a share-20% ROE and debt that barely existed. If a company’s burning through cash or has earnings that look like a roller coaster-it’s a hard pass.

Price-to-earnings ratios sitting under 20? Now that’s reasonable. More than 30? You better be looking at some exceptional growth. Free cash flow growing at 10% every year? That’s your ticket to separate the champs from the chumps-it shows if the company’s making real moolah or just printing funny money.

Hunt for Unbreakable Business Moats

Now, we’ve got to talk moats. The serious kind-those killer competitive advantages no one can just copy and paste. Coca-Cola, for instance, it’s all brand magic-they can hike prices, and you still crave that fizzy stuff. Railroads like BNSF? Competitors would need bags of billions to lay down new tracks.

Think patents, exclusive licenses, and network effects. Amazon’s logistics network? Two decades and $100 billion in the making-touché to anyone who wants to mimic that. Just steer clear of commodity businesses where products are like clones, and margins get bulldozed when markets go south. True moats shine through with a solid 40% gross margin and defiant market share during stormy times.

Management Makes or Breaks Everything

A gold-star business with dodgy managers? Recipe for mediocrity. Zero in on CEOs with their own skin in the game-like Mr. Bezos owning 10% of Amazon, syncing his goals with investors perfectly.

Watch their moves-do they buy back shares when prices dip? Do they keep new shares on a short leash? Red flags are like frequent executive chair-switching, over-the-top paychecks, and acquisition sprees that sink shareholder value. Dive into those shareholder letters-where strategy’s spelled out clearly and failures are admitted without sugarcoating-that’s transparency you can trust.

Companies with founder-CEOs? They usually outshine those led by mercenary execs. These leaders know their empire inside out and play the long game rather than the next quarter’s numbers.

Screen for Financial Stability

Debt-it’s quicker than any competitor when it comes to bringing a company down. Aim for firms with debt-to-equity ratios under 0.3 and interest coverage ratios north of 5-that’s insurance even if earnings take a nosedive by 80%. With cash-loaded pockets, these companies outlast downturns and go shopping for faltering rivals.

Look for revenue growth that’s smooth over a decade-not a one-hit wonder followed by a meltdown. Dependable players like Johnson & Johnson or Procter & Gamble won’t hit you with bankruptcy drama. They’re the tortoises in the race, building wealth while those flashy hares burn out.

Even if you’ve got your analysis locked down, avoid the usual pitfalls that can sink your returns. Seasoned investors dodge these mistakes from the get-go, and sticking to savvy portfolio rebalancing strategies keeps your wins from smart picks intact.

What Destroys Value Investors Before They Win

Value Traps Disguised as Bargains

Here’s the thing – value traps, they’re like the siren songs of investing, luring you in with their oh-so-tempting façades while hiding nastiness below. Take Sears, right? Looked like a Sweet 16 at $40 back in 2013 – I mean, a price-to-book ratio of 0.6! But, oh dear, it was a retail Titanic, hemorrhaging cash and sinking faster than you could say “Blue Light Special.” GE, too… in 2017, 8x earnings seemed like a steal. But don’t let the shiny numbers fool you – accounting shenanigans and a mountain of debt, and bam! Down 80%.

True value? They’ve got growing free cash flow and a stranglehold on growing market share – not disappearing sales masked by financial smoke and mirrors. The big question: is this bargain basement because it’s a temporary hiccup, or is it more like a one-way ticket to nowhere? Short-term speed bumps in solid companies? That’s opportunity. Permanent nosedive? That’s goodbye assets.

Market Timing Murders Returns

And then there’s market timing – the sneaky wealth assassin. Want proof? Dalbar data spells it out: average investors barely beat inflation with 3.1% returns over 30 years, while the S&P 500 did a cool 10.5%.

Why? Buying in a frenzy, selling in a panic. Classic.

Buffett knew when to hold ’em – scooped up Bank of America in 2011, amidst banking hysteria. $5 billion in preferred shares morphed into $45 billion. Where’s the magic? In the slow lane, my friends. Ignoring the daily drama and clutching onto quality for years – that’s how you let compound interest sprinkle its fairy dust. Those dubious traders chasing yesterday’s glitter? Chasing rainbows.

Debt Levels Separate Survivors from Casualties

Debt… it’s like gravity for companies. Too much? You get crushed. Look at Lehman Brothers, Bear Stearns, the list goes on. Strategies? Not the problem. Crushing debt loads? Tick, tick, boom.

Wise up: find companies with less than 30% debt-to-equity ratios and steady free cash flow, even when the economy’s on a rollercoaster. Those firms? They’re the ones snapping up growth investments when rivals are stuck in quicksand, often emerging tougher after the storm. Cash flush and light on debt – they sleep easy, and so do their shareholders.

Final Thoughts

Let’s break down a legend – Warren Buffett. His recipe for success? It’s got three main ingredients: snagging solid companies for less than they’re worth, holding onto them like a dog with a bone, and playing only in his wheelhouse. Those 20% annual returns over nearly six decades? They scream patience beats frantic speculation. Value investing exists because it hinges on what’s real, not what people think is real … you get me?

So, where do you start your own journey? Easy – scan for businesses posting over 15% return on equity, sporting debt-to-equity ratios below 0.3, and showing steady cash flow growth. Zero in on three to five industries you really get. Don’t fall for the traps – declining businesses are trip wires, market timing is fool’s gold, and high debt levels? They’re wrecking balls for your returns.

And math? Oh, it doesn’t lie: $10,000 at Buffett’s 20% annual rate swells to a mind-boggling $96 billion across six decades (while the Average Joe or Jane racks up a measly 3.1% because they’re too busy playing the trading game and freaking out at every market sneeze). Think long-haul: minimum 10-year holding periods, reinvest those dividends, and just tune out the daily market static. Check out Top Wealth Guide, where we’re all about helping you systematically nail these strategies – all with some sweet insights and tools to build that wealth.