Think of an investment account as your personal launchpad into the world of building wealth. It's a special account where you can buy, sell, and hold financial assets like stocks, bonds, and mutual funds. It's not for your daily coffee run; it's the vehicle you use to put your money to work in the financial markets, aiming to grow it over time.

In This Guide

- 1 Understanding Your Gateway to Building Wealth

- 2 How an Investment Account Actually Works

- 3 Choosing The Right Type Of Investment Account

- 4 What You Can Own Inside Your Account

- 5 Why Investing Is Your Most Powerful Wealth-Building Tool

- 6 Frequently Asked Questions About Investment Accounts

- 6.1 1. How much money do I really need to open an account?

- 6.2 2. Is my money actually safe in an investment account?

- 6.3 3. What’s the real difference between an investment account and a savings account?

- 6.4 4. Can I lose money in an investment account?

- 6.5 5. What are the most common fees to watch out for?

- 6.6 6. How often should I be checking my investments?

- 6.7 7. How are my investment gains taxed?

- 6.8 8. Is it a good idea to have more than one investment account?

- 6.9 9. What's the difference between a mutual fund and an ETF?

- 6.10 10. Can I invest if I have debt?

Understanding Your Gateway to Building Wealth

A regular bank savings account is designed for safety and earning a tiny bit of interest. An investment account, on the other hand, is built for growth. The whole point is to help your money grow faster than inflation over the long haul, which is a critical piece of the puzzle for hitting any major financial goal, from retirement to a down payment on a house.

The process is more straightforward than you might think. You open an account with a brokerage firm (think of them as the marketplace), deposit your money, and then use those funds to buy different investments. The brokerage provides the secure platform for all your transactions.

Key Features of an Investment Account

So what really separates this from your everyday checking account? It boils down to a few core features designed specifically to help you build wealth.

- Access to Markets: This account is your ticket to the stock and bond markets, letting you buy a piece of a company (stocks) or lend money to a government or corporation (bonds).

- Potential for Growth: Your money isn't just sitting idle. It's actively invested with the potential to earn returns from price increases (capital appreciation) and payouts (dividends or interest).

- Long-Term Focus: These accounts are really meant for goals that are years or even decades away—think retirement, a down payment on a house, or your kids' education.

An investment account is less like a piggy bank and more like a garden. You plant seeds (your money), tend to different plants (stocks, bonds, funds), and over time, you aim to harvest a crop that's much larger than what you initially planted.

Getting a handle on this concept is the essential first step for anyone starting out. To dive deeper, our complete guide to investing for beginners is the perfect place to continue your journey.

How an Investment Account Actually Works

Let's demystify what’s happening behind the scenes. Think of an investment account as the special container you use to hold and manage your investments. It's not the money itself, but the tool that gives you access to the financial markets where you can put that money to work.

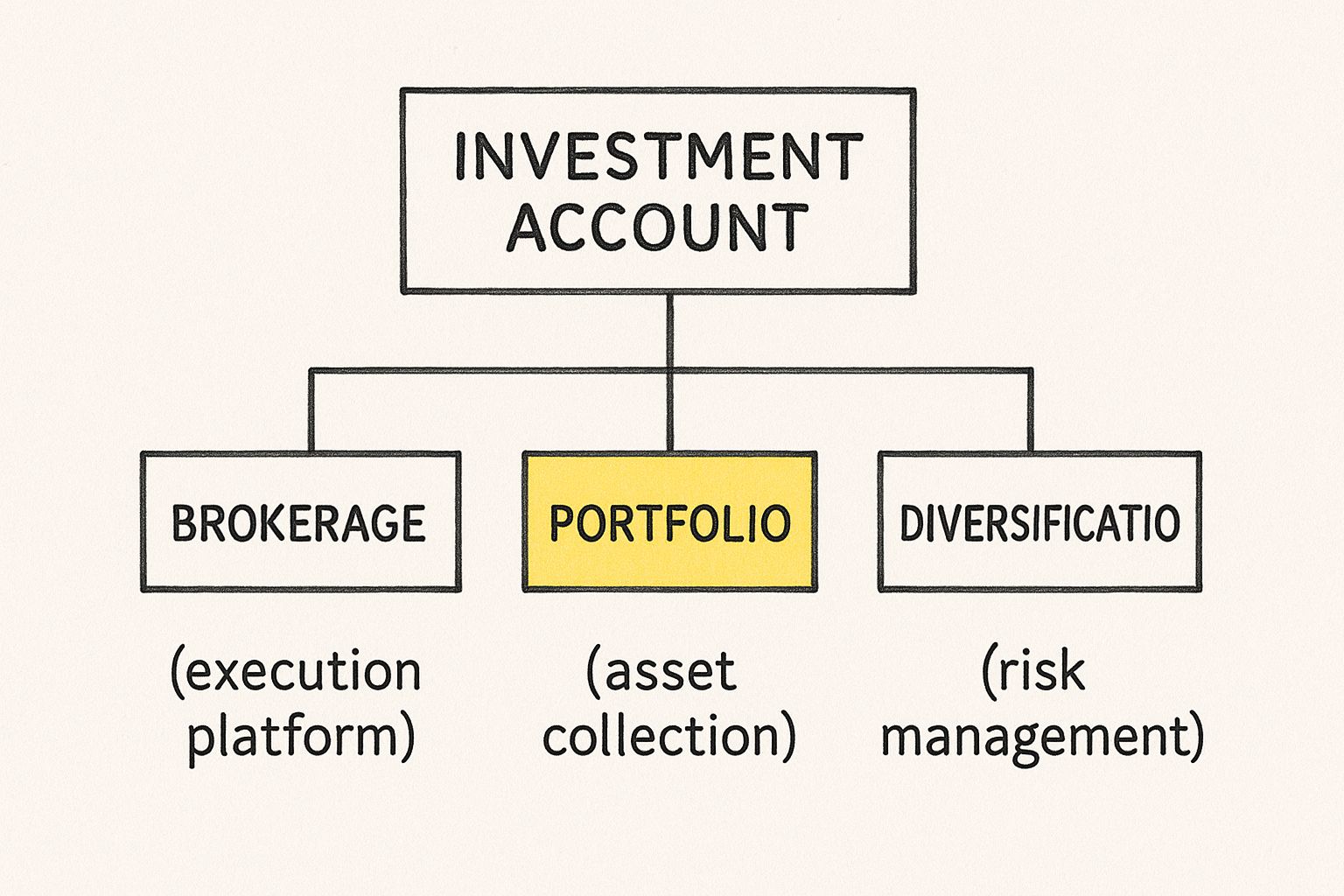

Three key pieces have to work together to make this happen: the brokerage, your portfolio, and your strategy.

A brokerage firm is the financial company that gives you the platform to invest. You can think of it as the secure marketplace where you’re allowed to buy and sell things like stocks and bonds. Without a brokerage, it's nearly impossible for an everyday person to tap into the markets.

Your portfolio is simply the collection of all the different investments you own inside that account. It’s like your personal team of financial assets—stocks, bonds, mutual funds, and so on—all working together toward a common goal.

The Core Components Explained

These three elements are completely intertwined. Here’s a quick breakdown of the role each one plays:

- The Brokerage (Your Platform): This is the institution that holds your account and follows your instructions to buy or sell. They provide the software, research, and customer support you need to manage everything.

- The Portfolio (Your Assets): This is the specific mix of investments you choose. A good portfolio is built around your personal goals, whether you're aiming for rapid growth or just want to generate some steady, reliable income.

- Diversification (Your Strategy): This is probably the most important rule in investing: don't put all your eggs in one one basket. Spreading your money across different asset types is how you manage risk and protect your portfolio from the inevitable ups and downs of any single investment.

The infographic below illustrates how these pieces all fit together.

As you can see, the account is the main container. The brokerage provides the access, and your portfolio and diversification strategy are the actions you take to build wealth.

At the end of the day, the goal is simple: use this structure to make your money grow. This is where you get to witness the magic of compound interest explained in action, as your earnings start to generate their own earnings. An investment account is the essential tool that unlocks that entire process.

Choosing The Right Type Of Investment Account

Not all investment accounts are built the same. Honestly, picking the right one is like choosing the right tool for a job—you wouldn't use a sledgehammer to hang a picture frame. Your choice really boils down to what you're trying to achieve with your money. Are you saving for retirement decades away? A down payment on a house? Your kid's college fund?

Each goal has an account type that’s practically made for it, complete with its own set of rules and perks.

Real-Life Scenario: Choosing an Account

Imagine Sarah, a 28-year-old graphic designer. Her primary goal is saving for retirement, but she also wants to save for a down payment on a condo in about five years.

- For Retirement: A Roth IRA is a great choice for her. She's in a lower tax bracket now than she expects to be in the future. By contributing post-tax money today, she ensures all her withdrawals in retirement will be 100% tax-free.

- For the Down Payment: A standard brokerage account is perfect for her mid-term goal. It offers complete flexibility—she can invest in a conservative mix of assets and withdraw the funds in five years without any of the age-based restrictions that come with retirement accounts.

Retirement vs. Taxable Accounts

The main distinction between accounts is how they are treated for tax purposes. This table highlights the key differences:

| Feature | Tax-Advantaged (Retirement) | Taxable (Brokerage) |

|---|---|---|

| Primary Goal | Long-term growth for retirement | Flexible, any-term goals |

| Tax Benefit | Tax-deferred or tax-free growth | No special tax breaks |

| Contribution Limits | Yes, set annually by the IRS | No, you can invest as much as you want |

| Withdrawal Rules | Strict, often with penalties for early withdrawal | None, you can access your money anytime |

| Example Accounts | 401(k), Traditional IRA, Roth IRA | Standard Brokerage Account |

Comparing Common Investment Account Types

To make sense of all this, it helps to see the options side-by-side. Each account has a unique job to do, and understanding its purpose is key to picking the right one for your financial strategy. This table breaks down the essentials.

| Account Type | Primary Purpose | Tax Treatment | Contribution Limits (2024) | Best For |

|---|---|---|---|---|

| Standard Brokerage | General Investing & Wealth Building | Pay taxes on dividends and capital gains | No limits | Flexible, short-term to mid-term goals |

| Traditional IRA | Retirement Savings | Contributions may be tax-deductible; taxed on withdrawal | $7,000 (+$1,000 catch-up if 50+) | Savers who want a tax break now |

| Roth IRA | Retirement Savings | Contributions are post-tax; withdrawals are tax-free | $7,000 (+$1,000 catch-up if 50+) | Savers who want tax-free income in retirement |

| 401(k) | Retirement Savings (Employer-Sponsored) | Contributions are pre-tax; often includes an employer match | $23,000 (+$7,500 catch-up if 50+) | Employees with access to a company plan |

Choosing an account isn't just a financial decision; it's a strategic one. Aligning the account's purpose with your life goals is the most effective way to optimize your savings and minimize your tax burden over the long term.

Getting a handle on your options is the first big step. The next is figuring out where to put your money first. Deciding which investment accounts you should prioritize in 2025 can dramatically accelerate your progress. A smart account strategy ensures your money is working for you in the most efficient way possible.

What You Can Own Inside Your Account

Once you've picked the right type of account, the next logical question is: what do you actually put inside it? Think of your investment account as the container—the assets you fill it with are the real engines that will grow your money.

The most common types of investments are often called asset classes. Each one plays a unique role, and knowing how they work is the first step toward building a smart, balanced strategy that fits your goals.

The Building Blocks of Your Portfolio

Most investment portfolios are built from a mix of a few core asset types. Combining them is how you manage risk while targeting the kind of growth you’re comfortable with.

- Stocks: When you buy a stock, you're buying a tiny piece of a public company. If the company does well, your share price can go up, and you might even get paid a portion of the profits, known as dividends. Stocks offer the highest potential for long-term growth, but they also come with more volatility.

- Bonds: Think of buying a bond as loaning money to a government or a large corporation. In exchange, they promise to pay you regular interest payments for a set period. Once that period is over, you get your original investment back. Bonds are generally much safer than stocks, making them a great tool for stability and income.

- Funds (ETFs and Mutual Funds): Instead of buying one stock or one bond at a time, you can buy a fund. These are essentially pre-packaged baskets holding hundreds or even thousands of different investments. They give you instant diversification, which is a fantastic way to lower your risk without having to do all the legwork yourself.

Exchange-traded funds (ETFs) have completely reshaped the investing world. Total assets in U.S. ETFs soared past $9 trillion by the end of 2023. This growth has made investing more accessible than ever, with over half of U.S. households now owning stocks either directly or through funds. You can discover more insights about these investment trends on ici.org.

Active vs. Passive Investing Strategies

The assets you choose often come down to your investment philosophy. Do you want to be hands-on or hands-off?

Active investing is the hands-on approach. It involves trying to beat the market by carefully hand-picking individual stocks and bonds you believe will outperform. This takes a lot of research, time, and a higher tolerance for risk.

On the other hand, passive investing is all about matching the market's performance, not beating it. This is usually done by buying low-cost index funds or ETFs that track a major market index, like the S&P 500. It’s a "set it and forget it" strategy that's become incredibly popular for its simplicity and proven track record.

For anyone just getting started, passive investing through ETFs is often one of the best investments for beginners. It’s a straightforward, low-cost way to get your money working for you across the entire market.

Why Investing Is Your Most Powerful Wealth-Building Tool

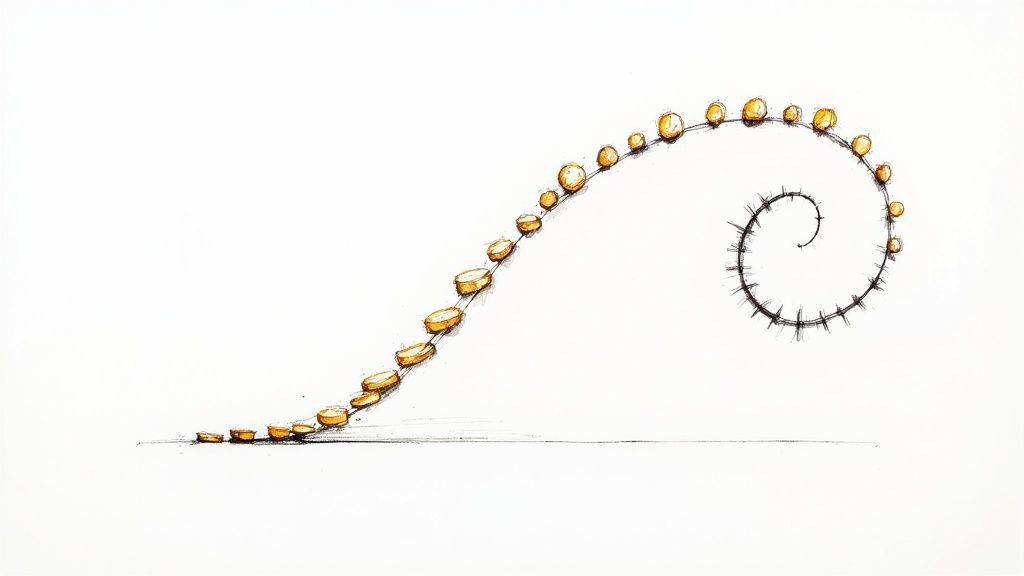

An investment account isn't just a place to park your money; think of it as a growth engine for your savings. The fuel for this engine is a concept that sounds simple but is incredibly powerful: compounding. It's the magic that happens when your investment earnings start generating their own earnings.

Imagine a small snowball at the top of a hill. As it rolls, it picks up more snow, getting bigger and bigger, and rolling faster and faster. Compounding works the same way. The returns you earn are reinvested, and your next round of returns is calculated on that new, larger total. This cycle repeats, accelerating your wealth without you having to do anything extra.

Real-Life Example: The Power of Starting Early

Let’s look at a classic example that really drives this point home with two investors, Anna and Ben.

- Anna (Starts Early): She begins investing $300 a month at age 25. After 10 years, at age 35, she stops adding money but leaves her investments to grow. Her total contribution is just $36,000.

- Ben (Starts Later): He starts investing the same $300 a month at age 35 and continues all the way until he’s 65. He invests for 30 years, contributing a total of $108,000.

If we assume a reasonable 8% average annual return, the results are staggering. By age 65, Anna's portfolio would be worth over $600,000. Ben, despite investing three times as much money, would end up with around $440,000. That 10-year head start gave Anna’s money an extra decade to compound, and it made all the difference.

Outpacing Inflation and Building Real Wealth

Growing your money is one thing, but protecting its value is just as crucial. Cash stuffed under a mattress or sitting in a low-interest savings account actually loses its buying power over time due to inflation. A well-managed investment account is one of the most effective ways to stay ahead of the game.

History backs this up. The UBS Global Investment Returns Yearbook shows that U.S. stocks have delivered an average real return (after inflation) of about 6.1% per year since 1900. This isn't a short-term trend; it's a century-long track record demonstrating how a disciplined investment strategy has consistently built wealth that outpaces the rising cost of living.

Investing is the most accessible tool for the average person to achieve financial independence. It transforms your savings from a static resource into a dynamic asset actively working to secure your future.

Frequently Asked Questions About Investment Accounts

https://www.youtube.com/embed/lNdOtlpmH5U

Even after getting the basics down, it’s totally normal to have a few questions rattling around in your head. Let's clear up some of the most common ones so you can feel confident taking the next step.

1. How much money do I really need to open an account?

Thankfully, the days of needing a small fortune to invest are long gone. Most of the big-name brokerage firms now have $0 account minimums. You can literally start with whatever you have, even if it's just $50 to get your feet wet.

2. Is my money actually safe in an investment account?

Yes, your money has some serious protection. In the U.S., most brokerages are members of the SIPC (Securities Investor Protection Corporation). This isn't market insurance—it doesn't protect against investment losses—but it does protect the assets in your account for up to $500,000 if your brokerage firm fails.

3. What’s the real difference between an investment account and a savings account?

Think of a savings account as a safe harbor for your cash—it’s there for short-term needs and emergencies, but it won’t grow much. An investment account is your engine for long-term growth. It comes with risk, but also the potential for much higher returns over time.

4. Can I lose money in an investment account?

Yes, and it's important to be honest about that. The value of your investments will fluctuate. Stocks go up, and they also go down. But over the long haul, a smart, diversified approach has proven to be an effective way to manage that risk and build wealth.

5. What are the most common fees to watch out for?

Keep an eye out for account maintenance fees, trading commissions (though many are now $0), and the expense ratios on any funds you own. This is a big reason low-cost ETFs have become so popular—they keep those pesky fees from eating into your returns.

6. How often should I be checking my investments?

For anyone investing for the long term, checking too often can be a recipe for panic-selling. A quick check-in once a quarter is plenty to make sure you’re still on track with your goals without driving yourself crazy.

7. How are my investment gains taxed?

You're typically only taxed when you sell an investment for a profit. The tax rate you pay depends on how long you held it. Hold for over a year, and you’ll get a much friendlier long-term capital gains tax rate. Retirement accounts like IRAs and 401(k)s have their own special tax rules.

8. Is it a good idea to have more than one investment account?

Absolutely. In fact, it’s a smart strategy. Using different accounts for different goals—like a 401(k) for retirement and a separate brokerage account for a future down payment—helps you stay organized and can save you a bundle on taxes.

9. What's the difference between a mutual fund and an ETF?

Both are baskets of investments. The key difference is how they trade. Mutual funds are priced once per day after the market closes. Exchange-Traded Funds (ETFs) trade throughout the day on an exchange, just like a stock.

10. Can I invest if I have debt?

Yes, but it requires a balanced approach. A common strategy is to prioritize paying off high-interest debt (like credit cards) while simultaneously contributing enough to your 401(k) to get the full employer match. Once high-interest debt is gone, you can increase your investing contributions.

Getting a handle on these basics is your first big win. For a complete walkthrough from start to finish, take a look at our guide on how to start investing for beginners—it’s got everything you need to get that first account opened.