By the Editorial Team at Top Wealth Guide, updated January 15, 2025

Real estate has consistently proven to be a cornerstone of wealth creation, offering a tangible path to financial independence. However, the sheer number of available avenues can make identifying the right approach feel overwhelming for both new and experienced investors. This comprehensive guide is designed to demystify the landscape, providing a clear and detailed breakdown of the top 10 best real estate investment strategies available today.

We cut through the noise to deliver actionable insights based on first-hand experience and in-depth research, not just theory. Whether you are a first-time investor with limited capital, a seasoned professional looking to diversify your portfolio, or simply exploring your options, this roundup provides the clarity you need. Inside, you'll find a deep dive into each method, from traditional Buy and Hold rentals to more modern approaches like Real Estate Crowdfunding. We will explore the specific pros, cons, and real-world applications of each strategy.

Our goal is to equip you with the knowledge to confidently select the investment path that best aligns with your financial goals, risk tolerance, and lifestyle. By understanding the mechanics of each option, you can take the next decisive step on your wealth-building journey.

In This Guide

- 1 1. Buy and Hold Rental Properties

- 2 2. House Flipping (Fix and Flip)

- 3 3. Real estate Investment Trusts (REITs)

- 4 4. Wholesaling

- 5 5. Short-Term Vacation Rentals (Airbnb Strategy)

- 6 6. Real Estate Syndication

- 7 7. BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat)

- 8 8. Commercial Real Estate Investing

- 9 9. Real Estate Crowdfunding

- 10 10. House Hacking

- 11 Comparison of Top Real Estate Investment Strategies

- 12 Choosing Your Path to Real Estate Wealth

- 13 Frequently Asked Questions (FAQ)

1. Buy and Hold Rental Properties

The buy and hold rental property strategy is a cornerstone of real estate investing, favored for its dual wealth-building potential. This approach involves purchasing a property not to flip it quickly, but to hold onto it long-term, renting it out to tenants. This method generates consistent monthly cash flow while the property's value (equity) appreciates over time. It’s one of the most foundational and best real estate investment strategies for building a durable portfolio.

Real-Life Example

Sarah, a marketing manager in Austin, Texas, wanted to start building passive income. She purchased a three-bedroom single-family home in a growing suburb for $350,000. Her total monthly PITI (Principal, Interest, Taxes, Insurance) was $2,100. She rented it out for $2,800/month to a young family. After setting aside 10% for maintenance ($280) and 5% for vacancy ($140), her net cash flow is $280 per month. Over five years, her tenants have paid down over $25,000 of her mortgage, and the property has appreciated by nearly $100,000 due to market growth.

Key Actionable Steps

- Financial Safeguards: Before you even make an offer, establish a reserve fund. Aim to have 6-12 months of total expenses (mortgage, taxes, insurance, utilities) saved to cover potential vacancies or unexpected major repairs like a new HVAC system.

- Market Analysis: Focus on markets with strong fundamentals such as job growth and population increases. A rising economic tide lifts all properties. Look for neighborhoods with good schools and low crime rates.

- Thorough Tenant Screening: Implement a strict screening process. This includes credit checks (look for a score above 650), background checks, income verification (aim for gross income at least 3x the rent), and calling previous landlords. Good tenants are the lifeblood of a successful rental.

- Accurate Expense Calculation: Don't just focus on the mortgage. Meticulously account for all potential costs, including property management fees (typically 8-10% of rent), routine maintenance, property taxes, insurance, and a vacancy buffer (plan for 5-10% of the year to be vacant).

By mastering these fundamentals, you can effectively manage risk and maximize returns. If you are interested in a deeper dive, you can explore more about building wealth with real estate for additional insights.

2. House Flipping (Fix and Flip)

House flipping, also known as the fix and flip strategy, is a popular, active approach to real estate investing. It involves purchasing an undervalued or distressed property, renovating it to increase its market value, and then selling it relatively quickly for a profit. Unlike long-term holds, this strategy is designed for short-term capital gains, making it one of the more fast-paced and best real estate investment strategies.

Real-Life Example

Mark, a former contractor, found a foreclosure property in a desirable Phoenix neighborhood for $250,000. He estimated renovation costs at $45,000 for a new kitchen, updated bathrooms, flooring, and paint. His all-in cost, including holding and closing fees, was around $305,000. After a four-month renovation, the property's after-repair value (ARV) was appraised and sold for $400,000. Mark realized a gross profit of $95,000, demonstrating the high-return potential of this method.

Key Actionable Steps

- Follow the 70% Rule: A critical guideline is to pay no more than 70% of the property's ARV, minus the estimated repair costs. This formula builds a crucial profit margin into your deal from the very beginning.

- Build Your Team First: Before you even find a property, assemble a reliable team of contractors, a real estate agent specializing in investment properties, and a hard money lender. Having this network in place allows you to act decisively when a good deal appears.

- Focus on High-ROI Renovations: Concentrate your budget on cosmetic improvements that buyers value most. These typically include modernizing kitchens and bathrooms, upgrading flooring, and applying fresh, neutral paint throughout the house.

- Budget for Contingencies: Your initial renovation budget is just a starting point. Always add a contingency fund of 15-20% to cover unexpected issues like hidden structural damage or plumbing problems that can derail your timeline and profitability.

3. Real estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) offer a compelling way to invest in large-scale, income-producing real estate without ever owning a physical property. This strategy involves buying shares in a company that owns, operates, or finances real estate across sectors like residential, commercial, or industrial. As one of the most accessible real estate investment strategies, REITs provide the liquidity of stocks combined with the income potential of real estate, making them a cornerstone for diversifying an investment portfolio.

Real-Life Example

An investor named Maria wanted exposure to the booming e-commerce and data center sectors but lacked the millions needed to buy a warehouse. She invested $10,000 into a mix of two REITs: Prologis (an industrial warehouse REIT) and Digital Realty Trust (a data center REIT). Over the year, she received over $350 in dividend payments (a 3.5% yield) and her initial investment grew to $11,200 due to stock price appreciation, giving her a total return of 15.5% without any property management responsibilities.

Key Actionable Steps

- Diversify Across Sectors: Avoid concentrating on a single type of property. Build a resilient portfolio by investing in a mix of REITs across different sectors such as residential apartments (AvalonBay), data centers (Digital Realty), and healthcare facilities.

- Analyze Key Metrics: Look beyond the current dividend yield. Evaluate a REIT's funds from operations (FFO), a key measure of cash flow, along with its occupancy rates and debt-to-equity ratio to gauge its financial health and stability.

- Prioritize Dividend Growth: A high yield can sometimes signal high risk. Focus on REITs with a consistent history of increasing their dividend payments, as this often indicates strong management and a sustainable business model.

- Use ETFs for Broad Exposure: For beginners or those seeking instant diversification, consider a REIT ETF like the Vanguard Real Estate ETF (VNQ). This allows you to own a piece of hundreds of real estate companies in a single, low-cost investment.

4. Wholesaling

Wholesaling is a rapid-entry strategy that requires minimal capital, making it one of the more accessible real estate investment strategies. This approach involves finding a distressed property, getting it under contract at a deep discount, and then assigning that contract to another buyer, typically a cash-heavy flipper or landlord, for a higher price. The wholesaler profits from the assignment fee without ever taking ownership of the property, acting as a middleman connecting motivated sellers with investor buyers.

Real-Life Example

David, a savvy marketer, launched a direct mail campaign targeting absentee owners in his city. He received a call from a landlord tired of managing a rundown property. The property’s ARV was $250,000, but it needed significant work. David negotiated a purchase price of $150,000 and secured it under an assignable contract. He then emailed the deal to his network of cash buyers and found a flipper willing to pay $160,000. At closing, the flipper paid $160,000, the seller received their $150,000, and David collected a $10,000 assignment fee for his work.

Key Actionable Steps

- Build a Robust Buyers List: Before you even hunt for deals, build a substantial cash buyers list of at least 50-100 investors. Your ability to sell a contract quickly is your most valuable asset.

- Master Motivated Seller Marketing: Focus your marketing efforts on finding highly motivated sellers. This includes direct mail campaigns to absentee owners, networking with divorce attorneys, or targeting pre-foreclosure listings.

- Calculate Your Maximum Allowable Offer (MAO): Use a strict formula to make offers: ARV x 70% – Repair Costs – Your Desired Fee = MAO. This ensures the deal is profitable for both you and your end buyer.

- Understand Legal Structures: Work with a real estate attorney to understand the laws in your state. You may use an assignment of contract or a "double closing," where you buy and immediately resell the property, sometimes using transactional funding.

5. Short-Term Vacation Rentals (Airbnb Strategy)

The short-term rental strategy, often called the "Airbnb strategy," involves renting out a property on a nightly or weekly basis to tourists and travelers. This approach can generate significantly higher monthly revenue, often 2-3 times more than a traditional long-term lease, by capitalizing on high-demand travel seasons and premium daily rates. It has emerged as one of the best real estate investment strategies for those seeking higher cash flow and a more hands-on, hospitality-focused business model.

Real-Life Example

A couple purchased a two-bedroom condo near a popular beach for $400,000. As a long-term rental, it might fetch $2,500 per month. As a short-term rental on Airbnb, it commands $300 per night during the peak summer season and $150 during the off-season. With an average annual occupancy of 75%, it generates over $82,000 in gross revenue. After subtracting operating costs like cleaning fees, management (20%), utilities, and platform fees, their net income is over $45,000 per year—far surpassing what traditional renting would provide.

Key Actionable Steps

- Regulatory Diligence: Before anything else, thoroughly investigate local municipal and HOA regulations. Many cities have strict licensing requirements, zoning restrictions, or outright bans on short-term rentals. This is a non-negotiable first step.

- Invest in Guest Experience: Success hinges on reviews. Invest in professional photography, high-quality mattresses, high-speed Wi-Fi, and a fully stocked kitchen. Small touches like a welcome basket or local guide can significantly boost your ratings.

- Automate Operations: Implement technology to streamline management. Use smart locks for keyless entry, dynamic pricing software (like PriceLabs) to optimize rates, and automated messaging systems to communicate with guests efficiently.

- Build a Reliable Team: You need a dependable cleaning crew that can handle quick turnovers and a local handyman for immediate repairs. If managing remotely, consider hiring a co-host or a professional property manager for 15-25% of the revenue.

6. Real Estate Syndication

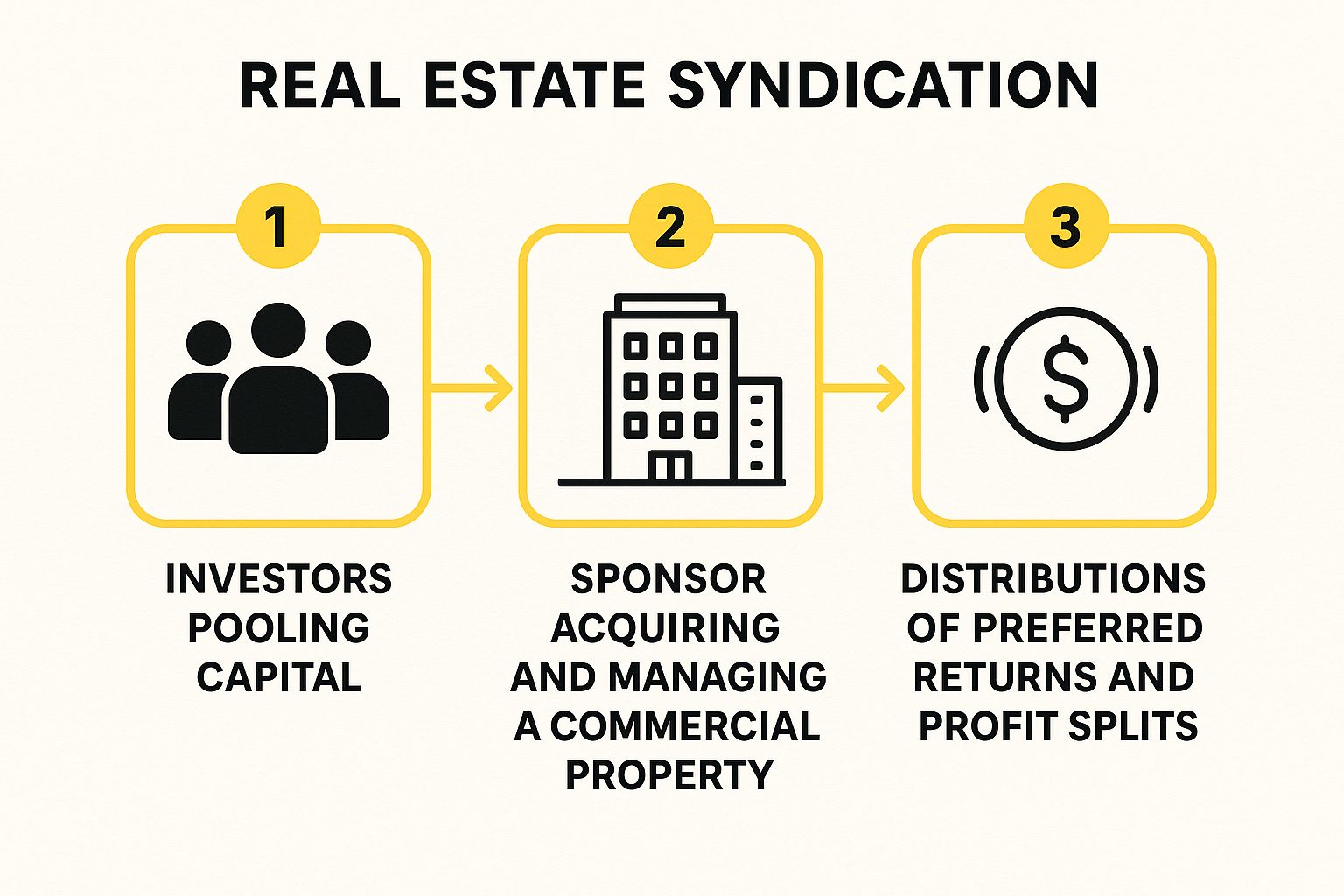

Real estate syndication offers a pathway for individual investors to access large-scale, institutional-quality properties typically out of reach for a single buyer. This strategy involves pooling capital from multiple investors (Limited Partners or LPs) to acquire assets like apartment complexes or office buildings. An experienced sponsor (General Partner or GP) finds the deal, manages the property, and executes the business plan, making it one of the best real estate investment strategies for passive income and equity growth.

Real-Life Example

A syndication sponsor identified a 150-unit apartment complex in Dallas for purchase. They needed to raise $4 million for the down payment and renovations. Dr. Chen, a busy surgeon, invested $100,000 as a Limited Partner. Over the next three years, he received a 7% preferred return ($7,000 annually). The sponsor then successfully renovated the units, raised rents, and sold the property. At closing, Dr. Chen received his initial $100,000 back plus an additional $45,000 profit share, achieving an average annual return of over 18% without ever visiting the property.

This infographic illustrates the fundamental flow of a real estate syndication deal.

The visualization shows how individual contributions are combined to acquire a major asset, which is then managed to produce returns for all partners.

Key Actionable Steps

- Sponsor Vetting: The sponsor is the most critical element. Thoroughly investigate their track record, past deal performance, and experience in the specific asset class and market. A great sponsor with an average deal is better than an average sponsor with a great deal.

- Document Review: Scrutinize the Private Placement Memorandum (PPM) and other offering documents. Understand the fee structure (acquisition, asset management, disposition fees) and the profit split (the "promote").

- Verify Skin in the Game: Ensure the sponsor is co-investing a significant amount of their own capital alongside the limited partners. This alignment of interests is a crucial indicator of their confidence in the deal.

- Strategic Diversification: Avoid concentrating all your capital into a single syndication or with one sponsor. Diversify across different sponsors, asset types (e.g., multifamily, self-storage), and geographic markets to mitigate risk.

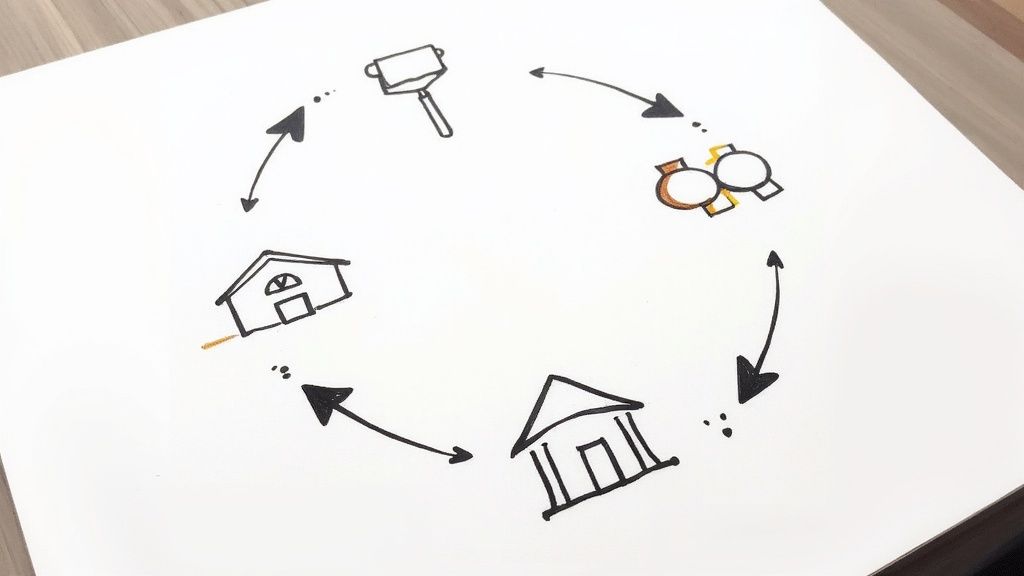

7. BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat)

The BRRRR Method is a powerful real estate investment strategy designed for rapidly building a rental portfolio by recycling a single pool of capital. It combines elements of flipping and the buy-and-hold approach, allowing an investor to acquire properties with minimal to no money left in the deal post-refinance. As one of the most dynamic real estate investment strategies, it focuses on acquiring distressed properties, forcing appreciation through renovations, and then pulling the invested capital back out.

Real-Life Example

An investor named Alex used a short-term loan to buy a distressed duplex for $150,000. He invested $50,000 in renovations, bringing his total investment to $200,000. After the rehab, the property's new appraised value was $280,000. Alex rented out both units, and once stabilized, he applied for a cash-out refinance at 75% of the new value, which was $210,000. This new loan paid off his initial $200,000, returning all his capital plus an extra $10,000. He now owns a cash-flowing duplex with no money left in the deal and can use his original capital to repeat the process.

Key Actionable Steps

- Secure Financing First: Before you buy, build relationships with lenders who specialize in both short-term financing (hard money) for the purchase and rehab, and long-term conventional loans for the refinance. Understand their "seasoning" period requirements, typically 6-12 months of ownership, before a refinance is possible.

- Analyze the "After Repair Value" (ARV): Your entire strategy hinges on the property appraising for significantly more than your total cost. Run conservative numbers, ensuring your all-in cost (purchase, rehab, holding costs, closing fees) is no more than 70-75% of the expected ARV.

- Create a Detailed Rehab Scope: Document every planned upgrade and its associated cost. This detailed plan is crucial not only for managing your budget but also for presenting to an appraiser to justify the new, higher valuation.

- Stabilize Before Refinancing: Lenders offer the best terms on stabilized assets. This means completing renovations, placing a high-quality tenant with a signed lease, and demonstrating a history of on-time rent payments before you apply for the refinance loan.

This cyclical approach can be a game-changer for portfolio growth. To better understand the nuances, you can find a comprehensive guide on what the BRRRR Method is and how it works.

8. Commercial Real Estate Investing

Commercial real estate investing moves beyond residential properties into the world of business. This strategy involves purchasing properties used for commercial purposes, such as office buildings, retail centers, industrial warehouses, or medical facilities. Unlike residential real estate, which is often valued based on comparable sales, commercial properties are primarily valued based on their income-generating potential, specifically their Net Operating Income (NOI). It's a key strategy for investors looking to scale their portfolio with larger assets and longer lease terms.

Real-Life Example

An investment group acquired a small, multi-tenant retail strip center for $2 million. The property generates $200,000 in annual rental income. After subtracting operating expenses of $60,000 (taxes, insurance, maintenance), the Net Operating Income (NOI) is $140,000. The property was purchased at a 7% cap rate ($140k NOI / $2M price). With long-term "triple-net" (NNN) leases, the tenants are responsible for most property expenses, providing a relatively passive and predictable income stream for the investors.

Key Actionable Steps

- Master the Metrics: Focus on understanding commercial-specific calculations. The Capitalization Rate (Cap Rate), which is NOI divided by property value, is essential for comparing investment opportunities. A higher cap rate generally indicates higher risk and higher potential return.

- Focus on Tenant Quality: A commercial property is only as good as its tenants. Scrutinize tenant financials, business history, and the terms of their leases. A long-term lease with a creditworthy national brand like Walgreens is far more secure than a short-term lease with a new, unproven business.

- Specialize in a Niche: Each commercial property type (industrial, retail, office) has its own unique market dynamics. Choose one sector, such as self-storage or small-bay industrial warehouses, and become an expert in its operational nuances and market trends.

- Conduct Rigorous Due Diligence: The due diligence process for commercial properties is far more extensive than for residential. This includes analyzing rent rolls, tenant lease agreements, service contracts, Phase I environmental site assessments, and detailed property condition reports.

By focusing on these areas, you can effectively navigate the complexities of this sector. If you are assessing the current market, you can explore more about whether real estate investing is still profitable for additional analysis.

9. Real Estate Crowdfunding

Real estate crowdfunding democratizes property investing, allowing individuals to pool their capital with others through online platforms to fund large-scale projects. This strategy opens doors to commercial and residential deals previously accessible only to institutional or accredited investors. It offers a passive way to diversify into real estate with a relatively low barrier to entry, making it one of the most innovative and best real estate investment strategies available today.

Real-Life Example

A young tech professional, Chloe, wanted to diversify her portfolio outside of stocks. She invested $5,000 into an eREIT (electronic Real Estate Investment Trust) on the Fundrise platform. Her investment was automatically spread across a portfolio of dozens of residential and commercial properties throughout the U.S. Sun Belt. She receives quarterly dividend distributions and can track the portfolio's appreciation online. This allowed her to gain exposure to institutional-quality real estate with a small investment and zero management effort.

Key Actionable Steps

- Platform Due Diligence: Start by researching and verifying the credibility of crowdfunding platforms. Check their SEC registration, historical performance, assets under management, and investor reviews.

- Diversify Your Investments: Mitigate risk by not putting all your capital into a single project or platform. Spread your investments across different property types (multifamily, commercial, industrial), geographic locations, and deal structures (debt vs. equity).

- Scrutinize the Sponsor: The success of a project heavily depends on the developer or sponsor. Carefully review their track record, experience, and the specifics of the deal they are presenting. A great platform can still host a poorly managed project.

- Understand Fees and Timelines: Be crystal clear on the fee structure, which can include platform fees, asset management fees, and performance fees. Also, confirm the expected investment hold period and exit strategy, as your capital will be illiquid for several years.

10. House Hacking

House hacking is an ingenious and accessible strategy where an investor buys a property, lives in one part of it, and rents out the other parts to tenants. The goal is for the rental income to significantly offset, or even completely cover, the property's mortgage and living expenses. This approach dramatically lowers personal housing costs, making it one of the best real estate investment strategies for beginners with limited capital, as it provides a low-risk entry into property ownership and management.

Real-Life Example

Recent college graduate, Ben, purchased a duplex in Denver for $500,000 using an FHA loan, which required only a 3.5% down payment ($17,500). His total monthly mortgage payment, including taxes and insurance, was $3,200. He lived in one unit and rented out the other for $2,500 per month. This meant his personal living expense for a home he owned was only $700 a month, far less than he would have paid in rent. After a year, he moved out and rented his unit, turning the property into a fully cash-flowing investment.

Key Actionable Steps

- Secure Owner-Occupant Financing: Leverage loan products like FHA or VA loans, which offer low down payments (0% to 3.5%) for owner-occupied properties. This is the key to getting started with minimal upfront cash.

- Analyze Cash Flow Potential: When evaluating a property, calculate if the potential rent from the other units or rooms will cover the PITI (Principal, Interest, Taxes, and Insurance). Your goal is to live for free or as close to it as possible.

- Choose the Right Property Type: While multi-family homes (duplexes to fourplexes) are ideal, don't overlook single-family homes. You can rent out individual bedrooms, a basement apartment, or even an accessory dwelling unit (ADU).

- Establish Clear Boundaries: When sharing a property with tenants, set clear rules and expectations in the lease agreement regarding common areas, noise levels, and guest policies. This is crucial for a peaceful living arrangement.

Comparison of Top Real Estate Investment Strategies

To help you decide which path is right for you, this table provides a side-by-side comparison of the key attributes of each strategy.

| Strategy | Capital Required | Time Commitment | Risk Level | Skillset Needed | Best For… |

|---|---|---|---|---|---|

| Buy and Hold | Medium to High | Low (if managed) | Medium | Market analysis, tenant management | Long-term wealth builders |

| House Flipping | Medium to High | High (Active) | High | Renovation, project management | Active investors seeking quick profits |

| REITs | Low to High | Very Low | Low | Stock market basics | Passive investors seeking liquidity |

| Wholesaling | Very Low | High (Active) | Medium | Marketing, negotiation | Entrepreneurs with low capital |

| Short-Term Rentals | Medium to High | High (Active) | High | Hospitality, marketing, operations | Hospitality-focused, high cash flow seekers |

| Syndication | High | Very Low | Medium | Due diligence on sponsor/deal | Passive investors seeking large assets |

| BRRRR Method | Medium | High (Active) | High | Renovation, financing, management | Scaling a portfolio with recycled capital |

| Commercial RE | Very High | Medium | Medium-High | Financial analysis, deal structuring | Sophisticated, high-net-worth investors |

| Crowdfunding | Very Low to High | Very Low | Medium-High | Due diligence on platform/deal | Passive investors wanting diversification |

| House Hacking | Low | Medium | Low | Landlording, people skills | Beginners with low capital |

Choosing Your Path to Real Estate Wealth

The journey to building substantial wealth through real estate is not a linear path but a landscape of diverse opportunities. As we've detailed, the best real estate investment strategies are not one-size-fits-all. They range from the hands-on, high-intensity world of house flipping and the BRRRR method to the more passive, portfolio-driven approaches of REITs and real estate crowdfunding. Each path offers a unique blend of risk, reward, required capital, and time commitment.

Your ideal strategy hinges on a clear-eyed assessment of your personal circumstances. The long-term stability of buy-and-hold rentals might appeal to an investor focused on steady cash flow and appreciation, while the rapid potential returns of wholesaling could attract an entrepreneur skilled in negotiation and marketing. Similarly, a busy professional might find the accessibility of real estate syndication or crowdfunding platforms perfectly suited to their lifestyle, allowing them to leverage the expertise of others without swinging a hammer themselves.

Key Takeaways for Your Investment Journey

The most critical takeaway is that knowledge precedes action. Understanding the fundamental mechanics of each strategy, from calculating cap rates for a rental to performing due diligence on a syndication deal, is non-negotiable.

Here are the essential steps to move from learning to earning:

- Define Your "Why": What are your financial goals? Are you seeking early retirement, supplemental income, or generational wealth? Your objective will act as a compass, guiding you toward the most suitable strategies.

- Assess Your Resources: Honestly evaluate your available capital, your credit score, the time you can dedicate, and your existing skills. A strategy like house hacking requires a low capital entry point but a high commitment to living in your investment, while commercial real estate often demands significant capital and expertise.

- Start Small, Think Big: Don't feel pressured to start with a massive apartment complex. Your first step could be a single share in a REIT, a small contribution to a crowdfunding project, or house hacking a duplex. The experience gained from these initial ventures is invaluable and builds the confidence needed for larger projects.

- Build Your Network: Real estate is a team sport. Connect with real estate agents, lenders, contractors, property managers, and other investors. This network will become your most powerful asset, providing deals, advice, and support.

Ultimately, the power of real estate lies in its tangible nature and its multiple avenues for wealth creation, including cash flow, appreciation, loan amortization, and tax benefits. By mastering one of the best real estate investment strategies we've outlined, you are not just buying property; you are building a resilient financial future. The key is to overcome analysis paralysis, select a path that aligns with your vision, and take that first, decisive step. Consistent, educated action is the true engine of wealth creation in this dynamic industry.

Frequently Asked Questions (FAQ)

1. What is the best real estate investment strategy for beginners with little money?

House Hacking is widely considered the best strategy for beginners with limited capital. By using an owner-occupant loan (like an FHA loan), you can purchase a multi-unit property with as little as a 3.5% down payment and have your tenants' rent cover most, if not all, of your mortgage.

2. Which strategy offers the most passive income?

Investing in Real Estate Investment Trusts (REITs) or participating in Real Estate Crowdfunding/Syndication deals are the most passive strategies. They require no hands-on property management and allow you to invest in real estate like you would in the stock market.

3. How much capital do I need to start investing in real estate?

The amount varies drastically by strategy. You can start investing in REITs or crowdfunding platforms with as little as a few hundred dollars. For direct property ownership, strategies like House Hacking can be started with a few thousand dollars for a down payment, while traditional rentals or flips may require $50,000 or more.

4. What is the difference between cash flow and appreciation?

Cash flow is the net profit you make from rental income after all expenses (mortgage, taxes, insurance, maintenance) are paid. Appreciation is the increase in the property's market value over time. The best strategies, like Buy and Hold, aim to capture both.

5. Is real estate investing risky?

Yes, all investments carry risk. Real estate risks include market downturns, vacancies, unexpected repairs, and difficult tenants. The key is to mitigate these risks through thorough due diligence, maintaining cash reserves, and choosing a strategy that aligns with your risk tolerance.

6. What is the "70% Rule" in house flipping?

The 70% Rule is a common guideline for flippers. It states that an investor should pay no more than 70% of the property's After Repair Value (ARV) minus the cost of renovations. This helps ensure a sufficient profit margin after all costs are accounted for.

7. Can I invest in real estate without buying a physical property?

Absolutely. REITs allow you to buy shares in a company that owns a portfolio of properties. Real estate crowdfunding allows you to invest directly in specific projects (like an apartment complex renovation) through an online platform.

8. What is the BRRRR method?

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. It's a strategy to acquire a rental property, force appreciation through renovations, and then pull your initial investment back out through a cash-out refinance, allowing you to use the same capital to buy the next property.

9. Are short-term rentals (like Airbnb) more profitable than long-term rentals?

They can be, often generating 2-3 times the gross revenue of a traditional rental. However, they also come with higher operating costs (cleaning, supplies, management fees) and more intensive management, and are subject to stricter local regulations.

10. How do I find good real estate investment deals?

Finding good deals requires proactive effort. Common methods include working with an investor-friendly real estate agent, using direct mail marketing to find motivated sellers, networking with wholesalers, and searching for off-market properties like foreclosures or estate sales.

Ready to take the next step and transform your financial future? At Top Wealth Guide, we provide in-depth resources, expert analysis, and powerful tools designed to help you master the best real estate investment strategies and build lasting wealth. Explore our guides and start your journey today at Top Wealth Guide.

1 Comment

Pingback: Your Practical Real Estate Investment Guide