Real estate investing in 2025—yeah, it’s a rollercoaster. Interest rates doing the up-and-down mambo and market dynamics morphing faster than a teenager’s mood swings… it’s a wild terrain. What does this mean for investors? Well, potholes and peaks, folks.

Our team at Top Wealth Guide (we’re your reality-check compass) has dissected the market genome, so you don’t have to. One word: adaptability. Rising construction costs (hello, supply chain woes) and an avalanche of new regulations—you know, to keep things spicy—are flipping the script on traditional investment playbooks. But hey, if you’re a glass-half-full type, emerging markets are like the new treasure maps—X marks the cash.

In This Guide

How Do Current Market Conditions Shape Real Estate Profits?

Interest Rates Hit Investment Returns Hard

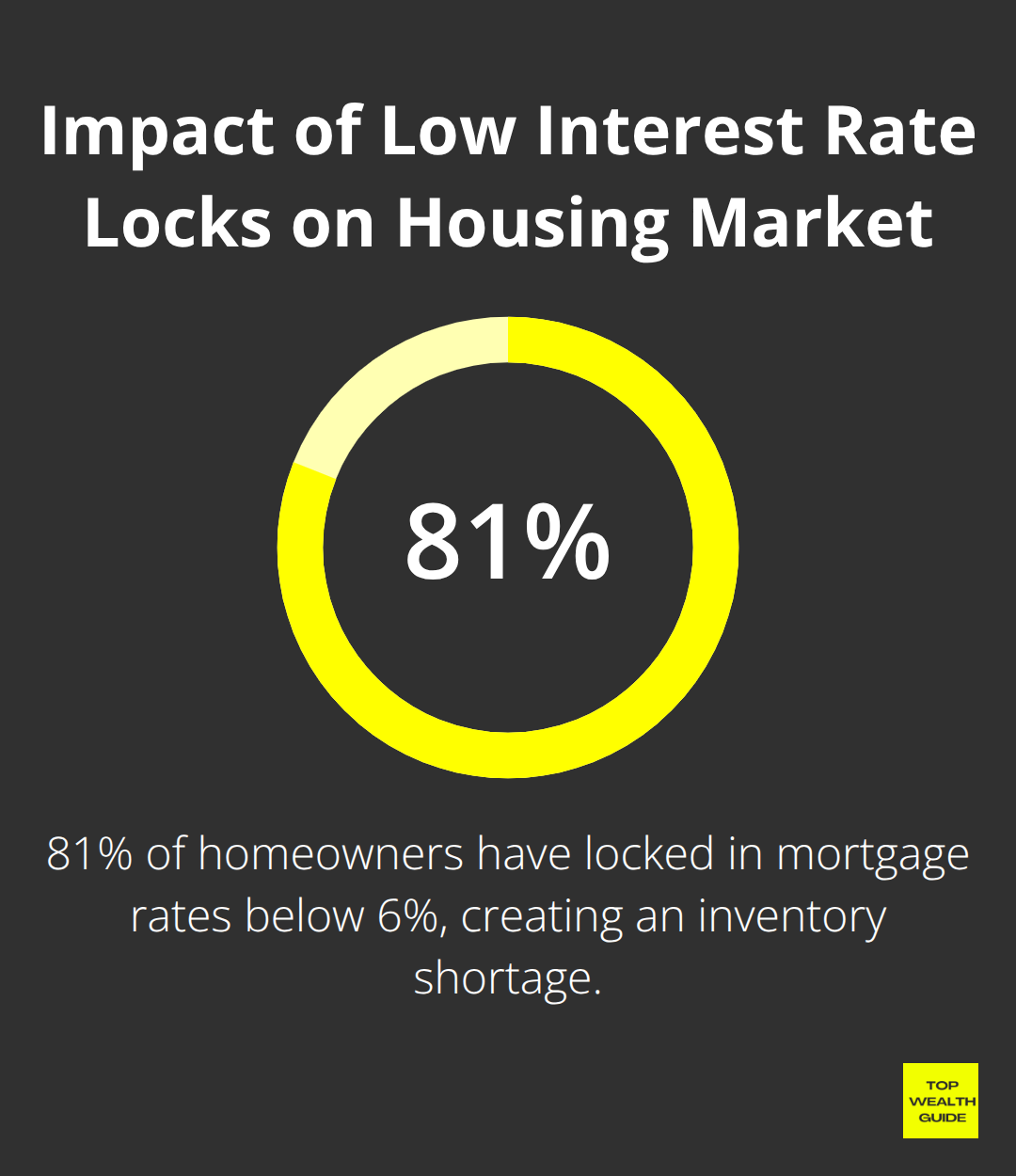

So, the Federal Reserve finally decided to give interest rates a haircut for the first time in 2025, snipping the federal funds rate down by a measly 0.25%. But don’t get too excited… mortgage rates are still flirting with the 6-7% range. Here’s the no-nonsense version: 81% of homeowners locked in deals below 6%, creating an inventory drought of epic proportions. This lock-in is like a vise – fewer properties up for grabs, and bam, prices bump up 2% yearly. Investors? You’re looking at steeper buy-in prices, but hey, rental demand is through the roof as buying becomes a pipe dream for many.

Supply Shortages Create Golden Opportunities

Got new home construction? It’s now 30% of single-family inventory-yeah, that’s twice the usual chunk. Builders are feeling the squeeze, shaving prices by 5% on average and tossing in mortgage rate buydowns as sweeteners. Savvy investors, pay attention-these are prime pickings. We’re short about 800,000 to 900,000 single family homes a year just to keep pace with household growth. So, zero in on markets where builders dangle these incentives-62% are waving sales incentives like flags in recent polls.

Buffalo and Indianapolis Lead Regional Winners

Look out for Buffalo and Indianapolis-heading for 3% and 3.4% home value appreciation in 2025 respectively. These markets? They hit the sweet spot: affordable entry with sturdy growth potential. Sure, Texas, California, and Florida might flash the investor bling, but it’s places like Hawaii, Alaska, Montana, and Maine showing the highest investor ownership percentages. Aim for those secondary markets – the big guys aren’t all over them yet, buying at $279,889 and flipping at $334,787, which gives smaller players the upper hand.

Foreclosure Activity Signals Market Stress

Foreclosure filings are on a six-month climb in 2025. It’s a flashing light of financial strain for some homeowners. But don’t panic – a record-setting 47% of mortgaged homes were equity-rich in Q2 2025 (compared to a paltry 26.5% in Q1 2020), offering a shield against a flood of foreclosures. Sharp investors? They’re cashing in on distressed bargains while the market remains overall steady, cushioned by those solid equity levels.

These conditions? They’re setting the stage for strategies that can excel despite the hurdles. Real estate investing success still rests on consistently putting money into assets that pay off over time, much like any other wealth-building journey.

What Investment Strategies Actually Work in 2025

Real estate investors are raking it in big time in 2025, but only the savvy ones who really know their strategies. Rental properties in booming markets are just cash cows – investors snapped up 25.7% of all residential home sales in 2024, the highest slice of the pie in five years. So, where’s the magic happening? Zero in on places like Buffalo and Indianapolis, where appreciation knocks it out of the park at 3-4% annually while prices stay, well, pretty sane. And get this – small-time investors owning 10 properties or fewer control over 90% of the market, so you don’t need a mountain of cash to play.

Target High-Growth Rental Markets Now

Buffalo is turning into a goldmine – out-of-state investors are swarming in, sending multifamily rental profits through the roof. Indianapolis, right on its heels, boasts 3.4% projected appreciation with rock-solid fundamentals. Ditch the overpriced coastal markets overrun by institutional behemoths. Look to secondary cities where job growth is buzzing and entry points won’t break your bank. On average, investors fork out $455,481 per home, a good bit lower than the national average of $512,800, meaning that sweet, sweet cash flow potential starts from day one.

REITs Beat Direct Ownership for Most Investors

Public REITs – they’re like magic. Instant liquidity, pro management, none of those dreaded midnight tenant calls. Real estate funds give you a taste of property markets without the ball-and-chain of direct ownership, and are leaps and bounds safer than those platforms that only open the gates to the filthily rich. Fundrise, RealtyMogul? They want a cool $1 million net worth or $200,000 annual income, thanks to SEC rules. REITs, however, offer consistent dividends and trade like stocks – perfect for retirement accounts, giving you real estate exposure sans management headaches.

Fix-and-Flip Opportunities Emerge in Distressed Markets

Foreclosure activity spiked 18% year-over-year as of August 2025, with 35,697 total filings, according to Attom Data Solutions. It’s a treasure trove for seasoned flippers who can swoop in fast on distressed properties. Big shot investors buy at $279,889 and sell at $334,787 on average, a testament that juicy profit margins still linger. But, rising construction costs and 6-7% interest rates? Yeah, they pinch margins tighter than before (builders are slicing prices by 5% on average to clear inventory).

The secret sauce that determines whether these strategies soar or crash in today’s wild market goes beyond plain old buy-low-sell-high tactics.

What Hidden Costs Are Killing Your Real Estate Profits

The fate of real estate investors in 2025? Under siege. Construction costs have mounted an aggressive offensive against profits, and savvy investors must confront this head-on. Material prices? Off the charts. Lumber’s having mood swings; steel’s partying with price hikes-15-20% up from last year. The National Association of Home Builders reveals that builders are practically pleading, slicing prices by 5% to move inventory-with 62% flashing sales incentives like they’re going out of style. Investors face a paradox: renovations now cost 25-30% more, yet builders’ distressed properties are practically shouting “discount!”

Property Taxes Slash Investor Cash Flow

Welcome to the harsh reality of property taxes, where soaring home values serve up some brutal math. High property tax rates gobble up rental income, slashing net returns. Multi-property landlords? Brace yourselves. Savvy players migrate to tax havens-New Hampshire, where zero income tax whispers sweet nothings to your wallet; Florida with its homestead exemptions? A cost-control delight. Before diving in, calculate that total tax bill. A $300K home in Texas will rob you of $7,500 in taxes annually. Compare it to Alabama’s $2,100-you get the picture. That $5,400? It’s a kingmaker or a budget buster.

Smart Home Tech Commands Premium Rents

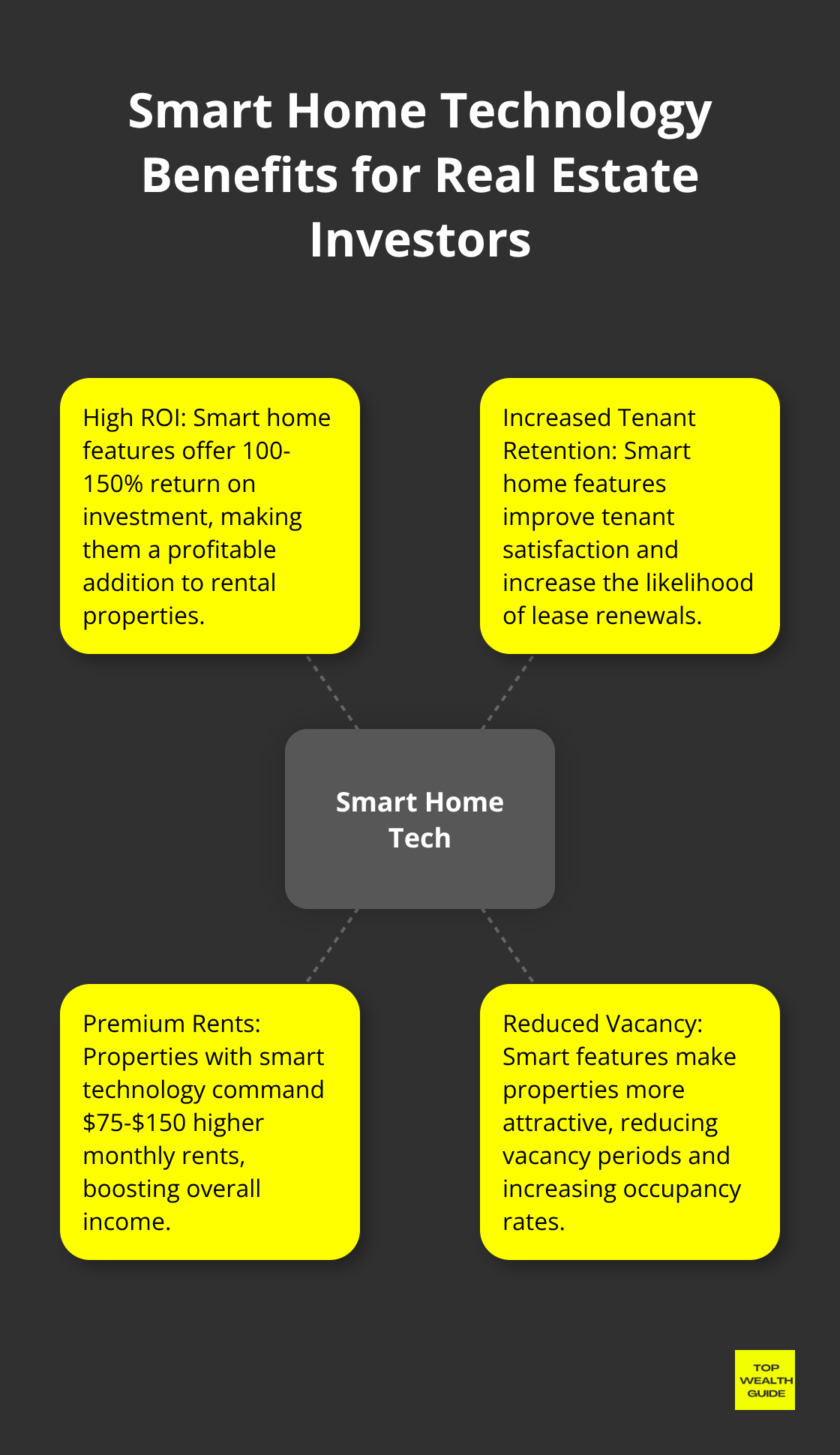

Tech in properties isn’t a luxury-it’s a lifeline. Properties with smart home technology? They print money. We’re talking 100-150% ROI, turbocharged tenant retention, premium rents. Tenant expectations are evolving. Don’t have smart features? You might as well have a “Vacancy” sign out front. Initial investment? $1,500-$3,000 per unit for the essentials. Monthly rent hike? $75-$150. When vacancy reduction kicks in, we’re talking 200-300% annual returns. Stick to the basics-smart locks, thermostats, doorbell cams. Keeps tenants happy, headaches low.

Construction Labor Shortages Drive Up Costs

Ah, the talent drought. It’s hammering the construction scene. Skilled trades? They’re the rock stars of 2025-deservedly demanding 20-25% more pay than their 2023 gigs. Good luck booking an electrician or plumber without months of forethought, and flipping timelines? Stretch Armstrong. Factor these delays into your spreadsheets-a six-month flip could become an eight, nine-month odyssey. Smart planning? It’s not just suggested-it’s necessary.

Final Thoughts

Real estate investing in 2025? It’s still a money game, but you better be strategic-like a ninja with spreadsheets. We’re talking about a landscape full of both hurdles and golden tickets. Foreclosures jumped by 18%… which means distressed deals for those ready to pounce, yet nearly half of all mortgaged homes are holding strong-47% to be precise, sitting pretty with solid equity. Investors made their mark by snapping up 25.7% of residential sales last year, a clear sign that demand is alive and kicking, even with those 6-7% mortgage rates trying to mess with the vibe.

Newbies-start by aiming your sights on secondary markets like Buffalo and Indianapolis. These spots are gold mines, offering 3-4% appreciation without the coastal price sticker shock. Dip your toes in the REIT pool for quick cash-in-hand and expert oversight, then when you’re feeling brave, dive into owning property directly. Seasoned pros, it’s time to adjust your lenses-higher construction costs are the new normal, so zero in on value-add properties in tax-advantaged havens such as New Hampshire and Florida.

Here’s the deal-look at the numbers and you’ll see where we’re headed. Small investors, those doing their thing with 10 properties or less, own a whopping 90% of the market. Meanwhile, institutional giants have been selling like there’s no tomorrow for six quarters straight. Then there’s tech-making your pad smarter isn’t an option anymore, it’s a must. Smart home gadgets aren’t just flashy toys; they offer a 100-150% return through better rents and fewer vacancies (tenants are smiling, too). Our verdict here at Top Wealth Guide? 2025 is set to reward investors who keep their eyes open and stick to tried-and-true wealth-building strategies.