Before you can even think about investing and growing your wealth, you have to get your financial house in order. It's not the glamorous part, but it's absolutely non-negotiable. This is all about building a solid base—creating a budget that actually works, getting rid of toxic debt, and setting up a cash cushion for when life inevitably happens. Get this right, and you'll have the stability to invest for the long haul.

In This Guide

- 1 Building Your Financial Foundation

- 2 Making Your Money Work for You Through Smart Investing

- 3 Branching Out Beyond the Stock Market

- 4 Advanced Strategies to Kick Your Growth into Overdrive

- 5 Protecting Your Wealth for the Long Term

- 6 Frequently Asked Questions About Growing Wealth

- 6.1 1. How much money do I need to start investing?

- 6.2 2. Is it better to pay off debt or invest?

- 6.3 3. What is the safest way to grow wealth?

- 6.4 4. How long does it realistically take to become a millionaire?

- 6.5 5. Should I use a financial advisor?

- 6.6 6. What's the biggest mistake beginners make?

- 6.7 7. Is real estate a better investment than stocks?

- 6.8 8. How can I protect my wealth once I've built it?

- 6.9 9. What are tax-advantaged accounts and why are they important?

- 6.10 10. Should I invest in cryptocurrency?

Building Your Financial Foundation

Think of it like building a skyscraper. You'd never start on the 50th floor; you'd spend most of your time and effort pouring a massive, reinforced concrete foundation. The same logic applies to your finances. A weak base will make the entire structure crumble under the slightest pressure.

This first phase isn’t about chasing big returns. It's about instilling the discipline and creating the systems that make long-term growth possible. It all starts with a crucial shift in your mindset. Many of us are wired to see money from a place of scarcity—a limited resource we need to guard. To build real wealth, you have to flip that script and adopt an abundance mindset, viewing money as a tool you can put to work.

This small psychological tweak changes everything, from how you buy groceries to how you plan for retirement. This mental framework is a huge piece of the puzzle, something we dive into deeper when we talk about why financial literacy is the key to building wealth.

Create a Budget You Can Actually Stick To

Let’s be honest, the word "budget" can feel restrictive. But really, it’s about taking control. A budget is just you telling your money where to go, instead of scratching your head at the end of the month wondering where it all went.

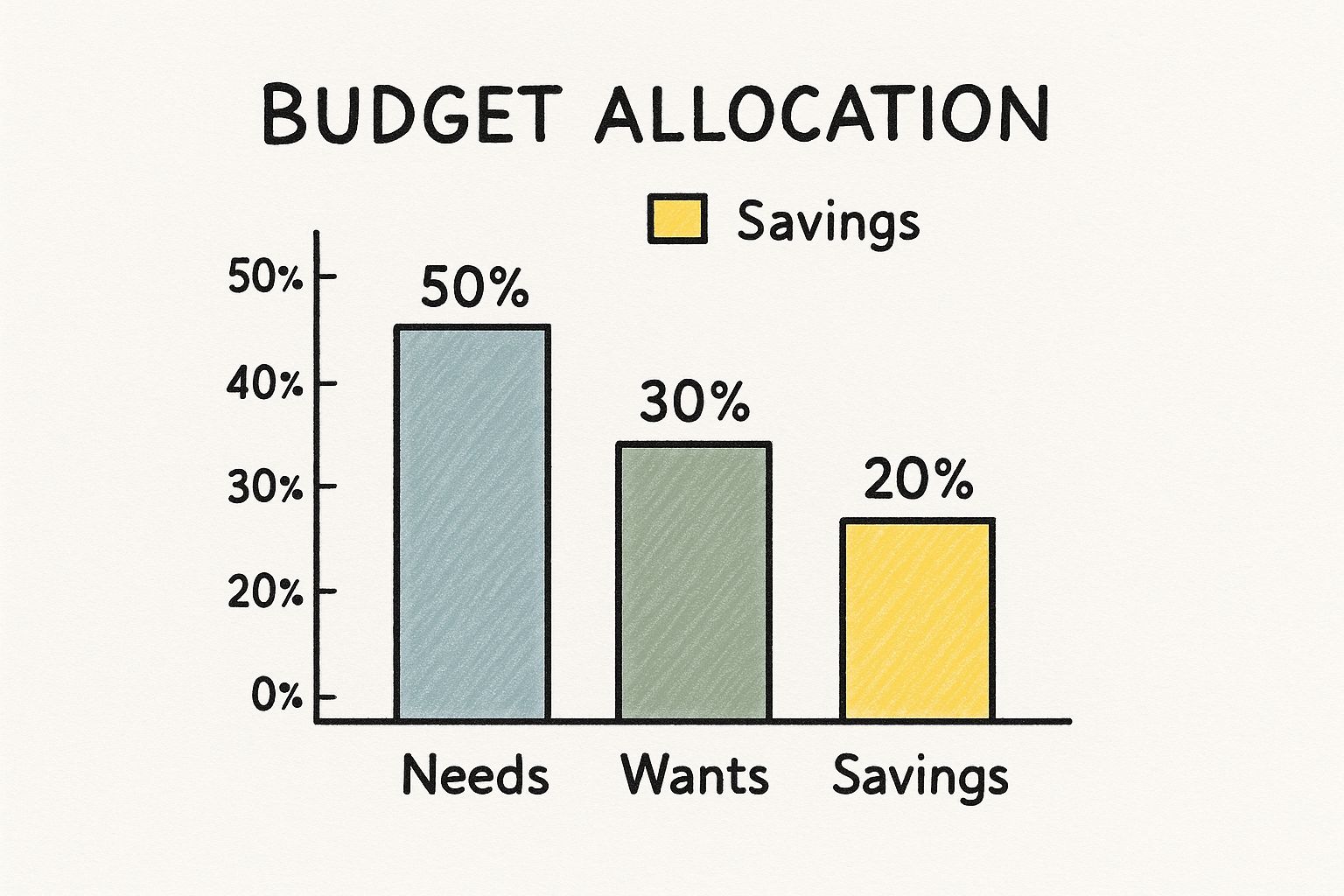

You don't need a complicated spreadsheet if that's not your style. Something simple like the 50/30/20 rule is a fantastic starting point because it’s easy to remember and implement.

- 50% for Needs: This is your non-negotiable stuff. Think rent or mortgage, utilities, groceries, and getting to work.

- 30% for Wants: Here's your fun money. It covers dinners out, hobbies, subscriptions, and anything else that makes life more enjoyable but isn't a strict necessity.

- 20% for Savings & Debt: This is the slice of the pie that directly builds your future. It goes toward your emergency fund, extra debt payments, and eventually, your investments.

The goal here is consistency, not perfection. Just track your spending for one month. The results might surprise you. From there, you can make small tweaks to line up your spending with your actual goals.

Go to War with High-Interest Debt

High-interest debt is a financial emergency, plain and simple. Credit card debt, with average APRs climbing past 20%, is a wealth-destroying monster. The interest you're paying is actively canceling out any investment gains you could be making.

Paying off that debt gives you a guaranteed, risk-free return on your money equal to the interest rate. You can't beat that.

One of the most effective strategies is the "debt avalanche." Here's how it works: list all your debts from the highest interest rate to the lowest. Keep making the minimum payments on everything, but throw every single extra dollar you can find at the debt with the highest rate. Once it's gone, you take that entire payment amount and roll it onto the next debt on the list. This tactic saves you the most money in interest over time.

Real-Life Example: Sarah's Debt-Free Journey

Sarah, a graphic designer, found herself with a $15,000 credit card balance at 22% APR and $20,000 in student loans at 6%. The monthly interest on her credit card alone was crippling her progress. By creating a tight budget and applying the debt avalanche method, she directed an extra $800 each month to the high-interest card. In under two years, she cleared the credit card debt entirely. This freed up nearly $1,000 per month that she now channels directly into her investment portfolio, turning a wealth-draining liability into a wealth-building asset.

Build Your Emergency Fund

An emergency fund is your firewall. It's the cash you have tucked away that stops a surprise expense from turning into a full-blown crisis. Think of it as a buffer between you and life's curveballs—a sudden car repair, a surprise medical bill, or a job loss.

Without this safety net, a single setback could force you to sell your investments at the worst possible time or rack up more high-interest debt, completely derailing your progress.

Your target should be 3 to 6 months of essential living expenses. If your bare-bones monthly costs are $2,500, you're aiming for a fund between $7,500 and $15,000. Keep this cash somewhere safe and accessible, like a high-yield savings account. Building this fund is a top priority, and it’s what gives you the peace of mind to take calculated risks with your investments later on.

Making Your Money Work for You Through Smart Investing

Okay, you've built your financial foundation. Now it's time to go on offense. This is the fun part, where you stop just saving money and start growing it. Investing is hands-down the most effective way to build serious wealth, essentially turning every dollar you've saved into a tiny employee working for you 24/7.

Forget the intimidating Wall Street jargon or the chaotic image of day traders glued to six monitors. Real, successful investing is usually pretty boring—and that’s a good thing. It’s all about consistency, patience, and letting the power of time do the heavy lifting for you. The goal isn’t to get rich quick by timing the market; it’s to systematically build wealth by participating in the long-term growth of the global economy.

Getting a Grip on Your Main Investment Options

To get started, you really only need to understand three core investment types. Think of these as the fundamental building blocks for almost any solid long-term portfolio.

| Investment Type | What It Is | Best For | Risk Level |

|---|---|---|---|

| Stocks (Equities) | A small piece of ownership in a public company (e.g., Apple). | High long-term growth potential. | High |

| Bonds (Fixed Income) | A loan made to a government or corporation in exchange for interest payments. | Stability, income generation, and lowering portfolio volatility. | Low |

| ETFs / Index Funds | A basket holding hundreds or thousands of stocks or bonds in a single fund. | Instant diversification, simplicity, and low costs. | Medium |

For most people dipping their toes into investing, starting with low-cost, broadly diversified ETFs is a fantastic strategy. It takes the guesswork out of picking individual stocks and automatically spreads your risk. If you want a deeper dive, our complete guide on how to start investing money walks you through everything.

The Undeniable Magic of Compound Interest

If there's one concept you need to burn into your brain, it's compound interest. This is the process where your investment returns start earning their own returns. It’s like a snowball rolling downhill—it starts small, but it picks up mass and speed exponentially over time.

Real-Life Example: The Power of an Early Start

Meet Ben and Chloe, both starting with $0.

- Ben starts investing $200/month at age 25. He stops adding new money at age 35 but leaves his investments to grow. Total contribution: $24,000.

- Chloe waits until she's 35 to start investing $200/month. She continues investing until she is 65. Total contribution: $72,000.

Assuming an 8% average annual return, by age 65, Ben will have over $600,000, while Chloe will have around $295,000. Ben invested one-third of the money but ended up with more than double the wealth, purely because he gave his money an extra decade to compound.

To make sure you have enough fuel for this compounding engine, a simple framework like the 50/30/20 budget is a game-changer.

As the visual shows, dedicating a disciplined 20% of your income to savings and investments is what makes all this possible.

Choosing Your Investment Platform

Getting started is easier than ever, but picking the right platform can feel overwhelming. Each brokerage has its own strengths, from beginner-friendly apps to powerful tools for seasoned investors. Here's a quick comparison to help you find the best fit.

| Platform | Best For | Account Minimum | Key Features |

|---|---|---|---|

| Fidelity | All-around investors, retirement savings | $0 | Robust research tools, fractional shares, excellent customer service, no-fee index funds. |

| Vanguard | Long-term, passive ETF investors | $0 for most ETFs, $3,000 for mutual funds | Industry leader in low-cost index and mutual funds, strong focus on retirement. |

| Charles Schwab | Investors seeking great service and research | $0 | Top-tier research, wide range of investment products, excellent checking account integration. |

| M1 Finance | Automated, portfolio-based investing | $100 | "Pie" based investing, automated rebalancing, fractional shares, good for building custom portfolios. |

No matter which one you choose, the key is to just start. You can always move your assets later if your needs change. The most important step is the first one.

Your Most Powerful Asset: Consistency

Markets go up, and markets go down. It's a non-negotiable part of investing. Your success will be determined by your ability to tune out the daily noise and stick to your plan. This is where a simple but powerful strategy called dollar-cost averaging (DCA) comes in.

DCA just means you invest a fixed amount of money on a regular schedule—say, $200 on the 1st of every month—no matter what the market is doing. By doing this, you automatically buy more shares when prices are low and fewer when they're high. It takes all the emotion and guesswork out of the equation.

Your discipline is your greatest asset. Emotional reactions—like panic selling during a downturn or getting greedy during a bull run—are the primary destroyers of wealth. A simple, automated investment plan is your best defense against your own worst instincts.

Of course, your potential for growth is also shaped by the economic environment you're in. Average wealth per adult varies dramatically across the globe. Projections for 2025 show Switzerland leading with an average wealth of $687,166 per adult, with the United States at $620,654 and Hong Kong at $601,195. These figures highlight how stable economies and strong financial markets create fertile ground for building wealth.

Branching Out Beyond the Stock Market

A solid portfolio of low-cost index funds is a fantastic engine for building wealth. No doubt about it. But putting all your eggs in the stock market basket can feel like riding a roller coaster without a seatbelt.

To build real, lasting wealth, you need to think beyond Wall Street. The secret is diversifying into assets that don't always zig when the stock market zags. This strategy creates a more stable financial foundation, where a downturn in one area is often balanced by stability or even growth in another.

Let's dig into a couple of the most common and effective ways to broaden your investment horizons.

Getting into Real Estate

For centuries, property has been a cornerstone of wealth, and for good reason. It’s a tangible asset—something you can actually see and touch—and it comes with some unique perks that stocks just can't offer. Most people go one of two routes here, and the right one for you really depends on how hands-on you want to be.

- Direct Ownership (The Hands-On Approach): This is the classic path—buying a physical property like a house or a duplex and renting it out. It's a great way to generate consistent monthly income (cash flow), benefit from the property's value going up over time, and tap into powerful tax advantages like depreciation.

- Real Estate Investment Trusts (REITs): Want the benefits of real estate without the late-night calls about a leaky faucet? REITs are your answer. These are essentially companies that own and operate huge portfolios of income-producing properties, like apartment complexes, office buildings, or shopping malls. You can buy and sell their shares on the stock exchange just like you would with Apple or Google, giving you instant diversification without the landlord headaches.

Each path has its own set of trade-offs when it comes to effort, liquidity, and control. It’s well worth understanding them before diving into building wealth with real estate.

Comparing Your Real Estate Options

So, which is better: buying a property yourself or investing in a REIT? It really boils down to your goals, how much cash you have, and how much time you're willing to sink into it.

Here’s a quick breakdown:

| Feature | Direct Rental Property | Real Estate Investment Trust (REIT) |

|---|---|---|

| Liquidity | Low: Selling a house isn't quick. It can take months. | High: Shares can be sold in seconds on the stock market. |

| Effort Required | High: You're the landlord. Think tenant screening, maintenance, and management. | Low: It's completely passive. A professional team handles everything. |

| Initial Cost | High: You'll need a hefty down payment, often 20% or more. | Low: You can start with the cost of a single share, sometimes under $100. |

| Control | High: It's your property. You call all the shots. | Low: You're just a shareholder with no say in day-to-day decisions. |

| Diversification | Low: Your investment is concentrated in one property, in one market. | High: You're instantly invested in dozens or even hundreds of properties. |

Real-Life Example: Mark’s Diversified Portfolio

Mark, an engineer, had 80% of his net worth in tech stocks. During the 2022 market correction, his stock portfolio plummeted by 25%. However, he also owned two rental properties that he had purchased years earlier. The steady monthly rent checks from his tenants not only covered his mortgage payments but also provided enough income to cover his living expenses. This crucial cash flow meant he wasn't forced to sell his stocks at a massive loss to pay his bills, allowing him to wait for the eventual market recovery. This is a perfect demonstration of how asset class diversification can provide stability when one part of your portfolio is under pressure.

A Word of Caution on Speculative Assets

In any modern conversation about wealth, you're going to hear about cryptocurrency. The stories of people making fortunes overnight are tempting, but you absolutely have to approach this space with a healthy dose of caution.

Crypto isn't like stocks or real estate. It doesn't produce income or pay dividends. Its value is driven almost entirely by market sentiment and speculation. Because of this, it should only ever be a very small, speculative piece of your overall plan.

A smart rule of thumb is to allocate no more than 1-5% of your total portfolio to high-risk assets like crypto. And you should only do this after your emergency fund is full, you're clear of high-interest debt, and your core retirement accounts are on track. Think of it as "casino money"—capital you can afford to lose completely without derailing your long-term financial security. This discipline lets you play in a high-growth area without betting the farm.

Advanced Strategies to Kick Your Growth into Overdrive

Once you've built a solid financial base and have your core investments humming along on autopilot, it's time to shift gears. You can move from playing defense as a passive saver to playing offense as the active architect of your financial future. This is where you really start to see things take off.

It’s all about layering in smart tactics that boost your income, slash your tax bill, and intelligently use other people's money to your advantage.

Build More Than One Income Stream

Relying on a single salary is one of the biggest bottlenecks to building wealth. Your day job is your foundation—it’s stable and predictable. But adding extra income streams is like pouring rocket fuel on your financial goals.

The idea isn't to just work more hours. It's about creating scalable income sources that aren't directly handcuffed to your time. You want to build assets that can make money for you while you sleep.

- Scalable Side Hustles: Think beyond trading time for money, like driving for a rideshare service. Instead, focus on something with real growth potential. Maybe you create an online course teaching a skill you've mastered, write an e-book on a niche topic, or build an affiliate marketing website around a hobby you love.

- Full-Fledged Entrepreneurship: This is the ultimate wealth-creation vehicle. Owning a business means you're building equity in an asset that can generate serious cash flow and, one day, be sold for a life-changing sum.

Don’t be afraid to start small. A little side project can teach you more about business than any textbook ever could, all while generating extra cash you can plow directly into your investments.

Get Serious About Your Tax Strategy

For most people, taxes will be the single largest expense of their entire lifetime. It's a massive, silent drag on your investment growth, so minimizing it is non-negotiable. The easiest way to do this is by taking full advantage of tax-advantaged retirement accounts.

Think of your 401(k) or an Individual Retirement Account (IRA) as superchargers for your portfolio. They let your money grow year after year without getting hit with taxes on every dividend or capital gain.

The absolute golden ticket of a workplace 401(k) is the employer match. This is 100% free money—an immediate, guaranteed return you simply cannot get anywhere else. Not contributing enough to get the full match is like telling your boss you don’t want a raise.

Once you’ve captured that full match, your next goal should be to max out your contributions every single year. The long-term difference between money growing in a taxed account versus a tax-deferred one can easily be hundreds of thousands of dollars. As your portfolio expands, it's also a good idea to dig into portfolio rebalancing strategies to keep your investments aligned with your goals.

Use Debt as a Strategic Tool (Yes, Really)

We’ve talked a lot about wiping out high-interest debt, but not all debt is bad. When used carefully, certain kinds of debt—specifically low-interest, long-term loans—can be an incredibly powerful tool for amplifying your returns. The pros call this leverage.

The classic example is a mortgage on a rental property. You might put down 20% of your own money, but you get to control 100% of an asset that appreciates over time and pays you cash every month.

It's interesting to see how different generations are putting these ideas to work. The UBS Global Wealth Report 2025 found that worldwide wealth grew by 4.6%, and noted a clear trend: Millennials are increasingly using leverage to invest in real estate and private businesses compared to older generations. It's a real shift in how wealth is being built. You can read the full report on generational wealth trends from UBS for more insight.

Know the Difference: Good Debt vs. Bad Debt

It’s absolutely critical to understand which debt builds you up and which one tears you down.

| Characteristic | Good Debt (Leverage) | Bad Debt (Liability) |

|---|---|---|

| Purpose | To buy an asset that grows in value or produces income. | To buy something that loses value or for pure consumption. |

| Interest Rate | Usually low and often tax-deductible (like mortgage interest). | Usually high and almost never tax-deductible. |

| Example | A mortgage on a rental property or a well-structured business loan. | Credit card debt from a shopping spree or a car loan. |

| Impact on Wealth | Amplifies your potential returns and builds your equity. | Erodes your wealth through a constant drain of interest payments. |

A word of caution: leverage is a double-edged sword. It magnifies gains, but it also magnifies losses. You should only even consider using it once you have a rock-solid financial foundation, a deep understanding of the risks, and a healthy cash reserve to weather any storms.

Protecting Your Wealth for the Long Term

Learning how to grow your wealth is a thrilling part of the journey. But the game doesn't stop once you hit your magic number. The second, and arguably more critical, phase is figuring out how to keep it. True financial security isn't just about accumulation; it’s about building a fortress around what you've earned, ensuring it lasts for your lifetime and for generations to come.

This final stage is all about making a subtle but powerful shift from aggressive growth to smart preservation. It involves putting systems in place that shield your assets from market swings, life’s curveballs, and messy transfers to your heirs. Without a solid defensive strategy, even a substantial nest egg can be surprisingly fragile.

Rebalancing Your Portfolio Periodically

Over time, your investments will naturally drift away from your original allocation. Let's say you started with a balanced 60/40 split between stocks and bonds. If tech stocks have a monster year, you might look up and find your portfolio is now 70% stocks and 30% bonds. That "portfolio drift" has quietly dialed up your risk, leaving you overexposed if that hot sector suddenly cools off.

The fix? Regular rebalancing.

This is simply the discipline of selling some of your winners and using the proceeds to buy more of your underperforming assets to get back to your target mix. It’s a beautifully simple way to force yourself to sell high and buy low, taking emotion completely out of the equation.

Rebalancing isn't about timing the market; it's about managing risk. Think of it as routine maintenance for your investment engine. It keeps everything running smoothly and aligned with your long-term goals, which will inevitably change as you get older.

Building a Financial Firewall with Insurance

Your ability to earn an income is your single most powerful wealth-building tool. An unexpected illness or a serious accident could take that tool away in an instant. This is where insurance comes in, acting as a non-negotiable firewall to protect everything you've built.

These policies aren't investments—they are pure risk management. They exist to prevent a personal catastrophe from turning into a financial one.

Here’s a look at the essential coverage you should consider:

| Insurance Type | What It Protects | Who Needs It Most |

|---|---|---|

| Life Insurance | Provides a tax-free lump sum to your loved ones if you pass away. | Anyone with financial dependents (a spouse, kids, or even aging parents). |

| Disability Insurance | Replaces a chunk of your income if you're too sick or injured to work. | Every working professional. Your risk of disability during your career is actually higher than your risk of premature death. |

| Umbrella Insurance | Adds an extra layer of liability coverage on top of your existing home and auto policies. | Anyone with a growing net worth who could become a target for a lawsuit after an accident. |

Planning Your Legacy

Estate planning isn't just for the ultra-rich living in mansions. It's for anyone who wants to decide how their assets will be managed and passed on after they're gone. A well-crafted plan makes sure your legacy is transferred efficiently, minimizes taxes, and saves your family from a world of stress and legal chaos during an already difficult time.

At its core, estate planning means getting key documents in order, like a will, and maybe setting up trusts for more complex situations. This process ensures your hard-earned wealth goes to the people and causes you care about most, cementing the security you've worked so hard to build.

The scale of this planning can be immense. As of 2025, the world's 3,028 billionaires hold a staggering $16.1 trillion in wealth, much of which is subject to incredibly complex succession plans. You can discover more insights about global billionaire wealth distribution on coinlaw.io.

Frequently Asked Questions About Growing Wealth

1. How much money do I need to start investing?

You can start with as little as $5 or $10. Thanks to fractional shares and zero-minimum brokerage accounts, the barrier to entry is gone. The most important factor is not the amount you start with, but the consistency you maintain over time. Starting early is far more powerful than starting with a large sum later.

2. Is it better to pay off debt or invest?

This depends entirely on the interest rate of your debt. A good rule of thumb: if the debt's interest rate is higher than the conservative return you expect from investing (e.g., credit card debt at 20%+ vs. market returns of 7-8%), prioritize paying off the debt. For low-interest debt like a mortgage below 5%, it often makes more mathematical sense to invest.

3. What is the safest way to grow wealth?

While no investment is 100% safe, a well-diversified portfolio of low-cost index funds or ETFs is considered one of the most reliable and time-tested strategies. By investing in the entire market (like an S&P 500 index fund), you avoid the risk of a single company failing and benefit from the long-term growth of the broader economy.

4. How long does it realistically take to become a millionaire?

This is a function of your savings rate and investment returns. For example, if you invest $500 per month and earn an 8% average annual return, it would take approximately 34 years to reach $1 million. If you increase that to $1,000 per month, the timeline shrinks to about 27 years. The more you save, the faster you get there.

5. Should I use a financial advisor?

It depends on your confidence and the complexity of your situation. If you are comfortable setting up a simple, automated investment plan with index funds, you may not need one. However, for complex scenarios involving tax planning, estate planning, or managing multiple income streams, a qualified, fee-only financial advisor can be invaluable.

6. What's the biggest mistake beginners make?

The most common and destructive mistake is trying to time the market. Investors often panic and sell during downturns, locking in losses, and then miss the best recovery days. The second biggest mistake is letting "lifestyle inflation" eat up pay raises instead of increasing their savings rate.

7. Is real estate a better investment than stocks?

Neither is inherently "better"; they serve different purposes. Stocks offer high liquidity and easy diversification. Real estate offers potential for steady cash flow, tax advantages, and the ability to use leverage. Many successful wealth-builders use a combination of both asset classes.

8. How can I protect my wealth once I've built it?

Wealth protection involves shifting focus from aggressive growth to preservation. Key strategies include periodic portfolio rebalancing to manage risk, ensuring you have adequate insurance (disability, life, umbrella), and establishing a proper estate plan (will, trusts) to protect your assets for the future.

9. What are tax-advantaged accounts and why are they important?

These are retirement accounts like a 401(k) or an IRA that offer significant tax benefits. Contributions may be tax-deductible, and your investments grow tax-deferred or tax-free. Over decades, these tax savings dramatically accelerate your wealth growth compared to investing in a standard taxable brokerage account.

10. Should I invest in cryptocurrency?

Cryptocurrency should be treated as a highly speculative asset, not a core part of a wealth-building strategy. If you choose to invest, it should only be after your foundational goals are met (emergency fund, debt-free, retirement savings on track) and should represent a very small portion (1-5%) of your total portfolio that you can afford to lose.

At Top Wealth Guide, we're committed to giving you the insights and strategies you need to build and manage your wealth with confidence. For exclusive access to proven tactics that can secure your financial future, subscribe to our newsletter today.

Find out more at https://topwealthguide.com