A rental property ROI calculator is an investor's most crucial tool. It cuts through the noise of purchase prices and gross rent figures to reveal one thing: the true profitability of your investment. It tells you exactly how hard your money is actually working for you by comparing your net profit against your total cash invested.

In This Guide

- 1 Why Rental ROI Is Your Most Important Metric

- 2 Gathering the Right Numbers for Your Calculation

- 3 How to Calculate Your ROI: Two Core Methods

- 4 Making Sense of Your ROI Numbers

- 5 Watch Out for These Common ROI Calculation Traps

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. What is a good ROI for a rental property?

- 6.2 2. How do I account for future repairs like a new roof?

- 6.3 3. Should I include property appreciation in my ROI calculation?

- 6.4 4. How does using a property manager affect my ROI?

- 6.5 5. How much does financing impact my ROI?

- 6.6 6. What is the difference between ROI and Cap Rate?

- 6.7 7. How can I accurately estimate the vacancy rate?

- 6.8 8. Are closing costs part of the initial investment?

- 6.9 9. Is it possible to have a negative rental property ROI?

- 6.10 10. How often should I recalculate my property's ROI?

Why Rental ROI Is Your Most Important Metric

Before we dive into formulas, let's establish what Return on Investment (ROI) truly represents. Think of it as your investment’s annual report card. For any real estate investor, it is the ultimate measure of financial efficiency—how effectively your cash generates more cash.

A high purchase price doesn't automatically mean a bad deal, just as high rent doesn't guarantee a great one. ROI is the great equalizer that tells the real story behind the numbers.

This is especially true in today's market. The global rental sector is expanding rapidly, with projections showing real estate lease revenue could reach a staggering $5.35 trillion by 2025. With that much capital in play, knowing your numbers isn't just a good practice; it's essential for survival and success. You can explore rental property trends to understand the broader economic landscape.

Two Lenses for Viewing Profitability

To get the full picture, savvy investors analyze profitability through two distinct lenses. Each metric answers a different, vital question about an investment's performance.

-

Cash on Cash Return: This is my personal go-to for measuring how my actual cash is performing year over year. It answers the simple question, "For every dollar I put into this deal, how many cents did I get back in my pocket this year?" It completely ignores things like potential appreciation and focuses only on the cash flow relative to your out-of-pocket costs.

-

Total ROI: This metric takes a much broader, long-term view by factoring in equity growth from paying down your loan and any market appreciation. It answers the question, "What was my total financial gain from this property, including both cash flow and the increase in my equity?" This is the number you'll want to look at when you're evaluating the overall success of a deal after a few years, or when you're getting ready to sell.

Key Takeaway: Using both of these calculations gives you a really balanced perspective. Cash on Cash Return tells you about your immediate, liquid returns, while Total ROI captures the full wealth-building power of the asset over time.

Real-Life Example: Leverage in Action

To illustrate, let's compare two investors, Sarah and Tom, buying identical duplexes for $400,000. Both properties generate the same rental income and have the same operating expenses. Their approach to financing, however, is completely different.

| Investor | Purchase Method | Down Payment | Loan Amount | Total Cash Invested |

|---|---|---|---|---|

| Sarah | All Cash | $400,000 | $0 | $415,000 (incl. $15k closing costs) |

| Tom | 20% Down | $80,000 | $320,000 | $95,000 (incl. $15k closing costs) |

Even before calculating returns, we can see Tom's initial cash outlay is significantly lower. This use of leverage will dramatically impact his Cash on Cash Return, as we'll see later. Understanding the why behind the numbers is your real superpower.

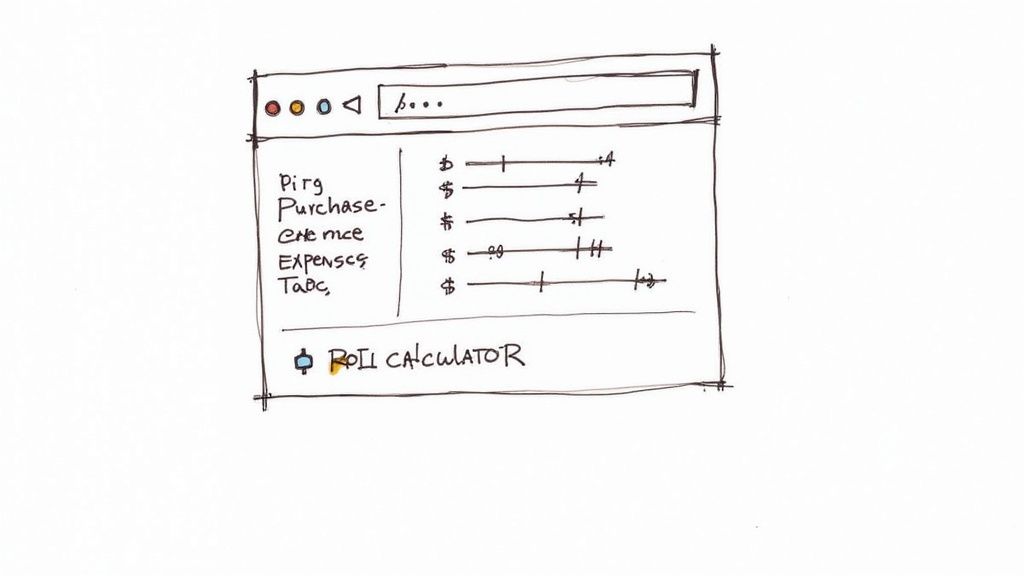

Gathering the Right Numbers for Your Calculation

Any ROI calculation is only as good as the data you feed it. Garbage in, garbage out. This is where many new investors falter—they rush through the numbers and end up with a wildly optimistic (and dangerously inaccurate) result. Let’s slow down and build a solid financial foundation.

I find it easiest to categorize the numbers into two buckets: the cash you need upfront to acquire the property, and the ongoing costs you'll incur to operate it.

Your Initial Cash Outlay

This is every single dollar that leaves your bank account to close the deal. It's much more than just the down payment, and forgetting these ancillary costs will artificially inflate your ROI from the start.

Here’s a quick checklist of what goes into this number:

- Down Payment: The largest component of your initial investment.

- Closing Costs: These can be a shock if you aren't prepared. Budget for 2-5% of the home's purchase price to cover loan origination, appraisals, title insurance, and attorney fees.

- Immediate Repairs & Renovations: I call this the "make-ready" budget. Does the property need new paint, carpet, or a water heater before a tenant can move in? These costs are part of your initial investment, not a future operating expense.

From Experience: Always get a professional inspection, but I also build in a contingency—at least $1,000 to $2,000—for surprises. My very first property had a slow leak behind a shower wall that the inspector missed. That small contingency fund prevented my initial cash flow from going negative.

Recurring Operating Expenses

Next, you need an honest assessment of all costs that will reduce your rental income each month. Underestimating these is the single biggest mistake that turns a "great deal" on paper into a money pit.

Key Operating Expenses to Track

| Expense Category | Pro Tip for Estimation |

|---|---|

| Mortgage (P&I) | Your principal and interest payment. This is a stable number with a fixed-rate loan. |

| Property Taxes | Never trust the seller's old tax bill. A sale often triggers a reassessment. Check the local assessor's website for current rates and methodology. |

| Homeowners Insurance | Get quotes for a landlord policy, which is different from a standard homeowner's policy and typically costs more. |

| HOA Fees | If applicable, find out exactly what the fees cover. They may include utilities like water or trash, which you can then remove from your expense list. |

| Maintenance & Repairs | A good rule of thumb is the 1% Rule: budget 1% of the property's value annually. For a $250,000 house, that's $2,500 a year, or about $208 per month. |

| Vacancy Reserve | Your property won't be occupied 100% of the time. I always set aside 5-8% of the gross monthly rent to cover gaps between tenants. |

| Property Management | If you're not self-managing, expect to pay a professional 8-12% of the monthly rent. |

The good news is that many of these operating costs can be written off, lowering your overall tax bill. You can dig into our complete guide on property investment tax deductions to learn how to maximize those savings.

How to Calculate Your ROI: Two Core Methods

Alright, you've done the hard work of gathering your numbers. Now, let's put them to work. While a good rental property roi calculator automates this, understanding the math is what separates professional investors from amateurs.

We're going to break down the two most important ways to calculate your return, using a consistent example to highlight how each method tells a different part of the investment story.

This flowchart provides a bird's-eye view of how your financial inputs flow into that final, all-important ROI number. It’s about turning complexity into clarity.

As you can see, the calculator simply processes the financial inputs you provide to generate a powerful metric. Think of it as the final score that defines how well your investment is performing.

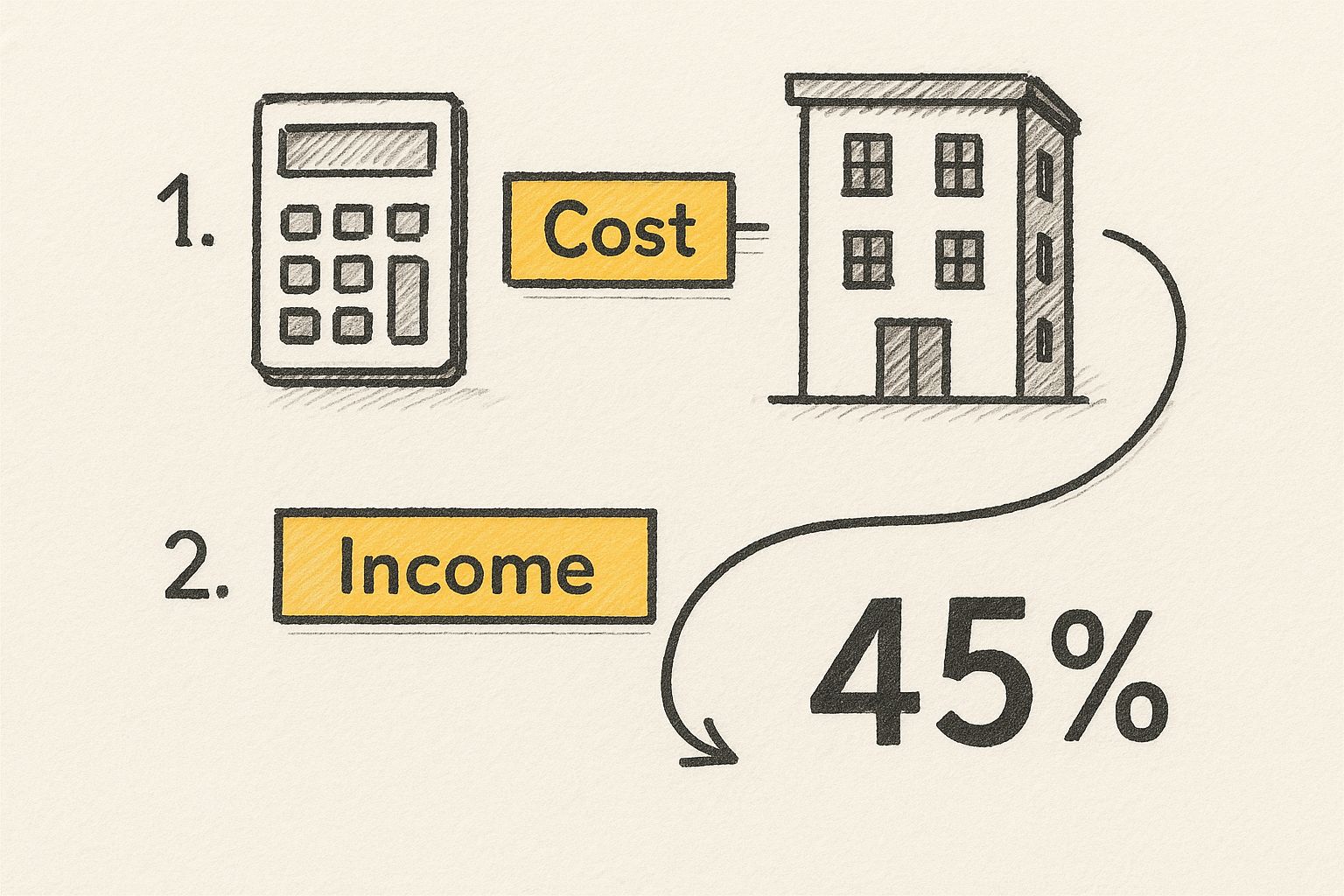

Method 1: Cash on Cash Return

First up is Cash on Cash Return. This is my go-to metric for judging a property's performance on a year-to-year basis. It answers a simple, critical question: "For every dollar I put in, how many cents am I getting back in my pocket this year?" It cuts through the noise and focuses purely on cash flow.

The formula is straightforward:

Cash on Cash Return = (Annual Pre-Tax Cash Flow / Total Cash Invested) x 100

Let's plug in some real numbers. Suppose you bought a single-family rental for $300,000.

- Total Cash Invested: You put down 20% ($60,000) and paid $10,000 in closing costs. Your total cash out-of-pocket is $70,000.

- Annual Pre-Tax Cash Flow: After collecting all rent and paying all bills (including the mortgage) for the year, you have $5,600 in cash left over.

Now for the quick math:

($5,600 / $70,000) x 100 = 8% Cash on Cash Return

Your $70,000 cash investment produced an 8% return for the year. That's a solid number. In many markets, a good rental property ROI sits between 8% and 12%. For context, recent global real estate market trends from Aberdeen showed the UK market delivering an 8.1% total return, so an 8% cash-on-cash return is definitely competitive.

Method 2: Total ROI

While cash flow is king for daily operations, it doesn't paint the complete picture. That's where Total ROI comes in. This metric provides a broader view by factoring in the wealth you're building in the background—your equity. It combines your cash flow with both your loan paydown and the property's appreciation.

The formula adds these equity components into the mix:

Total ROI = (Annual Cash Flow + Equity Growth) / Total Cash Invested

Let's stick with our $300,000 house example:

- Annual Cash Flow: Still $5,600.

- Equity from Loan Paydown: Over the first year, your mortgage payments reduced the principal by $4,000. That's money in your equity pocket.

- Equity from Appreciation: Let's say the market was stable, and the property value increased by 3%. That's another $9,000 in appreciation.

Your total equity growth for the year is $13,000 ($4,000 from loan paydown + $9,000 from appreciation).

Now, let's run the Total ROI calculation:

($5,600 + $13,000) / $70,000 = 26.5% Total ROI

See the difference? This number is significantly higher because it captures the full wealth-building power of the asset, not just the cash it generates. To experiment with these numbers yourself, our real estate investment calculator is a great tool for visualizing these moving parts.

Comparing ROI Calculation Methods

It's easy to wonder which metric is "better," but they serve different purposes. This table clarifies when to use each one.

| Feature | Cash on Cash Return | Total ROI |

|---|---|---|

| Primary Focus | Measures annual cash flow performance against cash invested. | Measures overall wealth creation, including cash and equity. |

| Best For | Evaluating immediate, liquid returns and comparing to other cash-flow assets. | Assessing long-term investment performance, especially before a sale or refinance. |

| Includes | Annual Pre-Tax Cash Flow, Total Cash Invested. | Cash Flow, Loan Paydown, Market Appreciation. |

| Key Question Answered | "How hard is my cash working for me right now?" | "What is the total financial gain from this asset over time?" |

Ultimately, successful investors use both. Cash on Cash Return tells you if the property can sustain itself and provide income today, while Total ROI reveals the long-term wealth you're building.

Making Sense of Your ROI Numbers

Once you've run the numbers, the real work begins. That figure—say, 8%—is a story about your investment's health. Learning to read that story is what separates professionals from amateurs.

So, what’s a “good” ROI? It depends. Many seasoned investors target a cash on cash return in the 8% to 12% range, but this is a guideline, not a rule. An investor focused on immediate cash flow in a stable market might not consider a deal under 10%.

Conversely, someone buying in a rapidly appreciating area might accept a 4-5% cash on cash return. They're playing a different game, betting that long-term appreciation will deliver a massive total ROI when they eventually sell or refinance.

Your personal financial goals and risk tolerance define a "good" ROI. Don't chase someone else's benchmark; determine what success means for your strategy.

The Levers You Can Pull to Improve Your ROI

Think of your property as a machine with a set of levers. A small adjustment can have a huge effect on your bottom line. Knowing which levers to pull gives you the power to actively manage and improve your property's financial performance.

For example, your mortgage is a massive lever. A small reduction in your interest rate can drastically improve your return over the loan's life. Exploring different ways to finance an investment property can be one of the most impactful moves you make.

Let's look at how different choices can play out.

Scenario Comparison: How Decisions Impact ROI on a $300,000 Property

| Decision Point | Scenario A (Base) | Scenario B (Change) | Impact on ROI |

|---|---|---|---|

| Property Management | Hire a professional (10% fee) | Self-manage the property | Increases net operating income, directly boosting ROI. |

| Financing Terms | 4.5% interest rate | Secure a 3.9% interest rate | Lowers monthly debt service, increasing cash flow and ROI. |

| Renovation Budget | Basic cosmetic updates | Add a high-demand amenity (e.g., in-unit laundry) | Higher upfront cost but can justify higher rent, potentially leading to a better long-term ROI if the rent increase outweighs the cost. |

| Leasing Strategy | Standard 12-month lease | Furnish and rent as a mid-term rental (30+ days) | Higher management effort and turnover risk, but potential for significantly higher gross rent, which can supercharge ROI if executed well. |

Putting Your Numbers in a Global Context

It also helps to zoom out. A key metric investors watch globally is the gross rental yield—the total annual rent divided by the property's price. For 2025, South Africa is projected to have the world's highest yield at 10.15%. Other top performers include Latvia (8.06%), Ireland (7.85%), and Italy (7.38%), demonstrating that strong rental income exists in diverse markets.

Placing your property's performance against these international benchmarks provides valuable perspective. It can tell you whether your local market is a hidden gem or if you're facing an uphill battle. Your ROI isn't just a number; it's a compass pointing you toward smarter investment decisions.

Watch Out for These Common ROI Calculation Traps

A rental property ROI calculator is a fantastic tool, but it's only as accurate as the data you provide. I've seen countless investors, even experienced ones, get tripped up by simple errors that make a bad deal look like a home run. Avoiding these common blunders is key to getting a forecast you can trust.

One of the biggest slip-ups is underestimating the total cash needed to acquire the property. Everyone remembers the down payment but gets fuzzy on closing costs. Appraisals, loan origination fees, and title insurance can easily add 2-5% of the purchase price to your initial investment. Forgetting those costs will give you a dangerously inflated ROI figure from the start.

Don't Ignore the Big-Ticket Replacements

Another classic mistake is failing to plan for Capital Expenditures (CapEx). These aren't your everyday leaky faucets. I'm talking about the major, inevitable replacements every property will face someday.

Think about things like:

- A new roof ($8,000 – $20,000)

- An HVAC system ($5,000 – $12,000)

- A water heater ($1,200 – $3,000)

Many new investors budget for minor maintenance but completely ignore the 15-year-old furnace in the basement. When that furnace finally fails, the emergency replacement can wipe out years of cash flow in a single day.

My Two Cents: I always tell people to play it safe. Set aside at least 1-3% of the property’s value every single year just for CapEx. This builds a dedicated fund so those big expenses are planned projects, not financial crises.

The Problem with Rose-Colored Glasses

Finally, nothing will sink your investment faster than overly optimistic projections. Assuming you'll have a tenant paying rent 100% of the time is a rookie move. In the real world, people move out. A vacancy rate of 5-8% is a much more realistic and safer buffer to build into your numbers.

The same goes for rent growth and appreciation. It's tempting to assume rents will skyrocket and the property value will double, but a solid analysis is grounded in reality, not wishful thinking. After all, solid forecasting is a cornerstone, as effective cash flow management is crucial for wealth building.

A quick way to stress-test your numbers is the 50% Rule. This guideline suggests that, over the long term, about 50% of your gross rent will go toward operating expenses (everything except the mortgage). If your projections show expenses far below that mark, it’s a red flag that you’ve probably missed something important.

Frequently Asked Questions (FAQ)

Here are answers to the most common questions investors have about calculating rental property ROI.

1. What is a good ROI for a rental property?

While there's no single magic number, many investors target a Cash on Cash Return between 8% and 12%. However, a "good" ROI is highly dependent on your market, strategy, and risk tolerance. In a high-appreciation market, a lower cash-on-cash return might be acceptable.

2. How do I account for future repairs like a new roof?

This is done by budgeting for Capital Expenditures (CapEx). A common practice is to set aside 1-3% of the property's value annually in a separate savings account. This ensures you have funds available for major replacements without devastating your annual cash flow.

3. Should I include property appreciation in my ROI calculation?

It depends on the question you're asking. For day-to-day performance and cash flow analysis, use Cash on Cash Return, which excludes appreciation. To measure the overall long-term wealth creation of the asset, use Total ROI, which includes appreciation and loan paydown.

4. How does using a property manager affect my ROI?

A property manager's fee (typically 8-12% of gross rent) is an operating expense that directly reduces your net income and, therefore, your ROI. However, a great manager can increase ROI over time by reducing vacancy, securing higher rents, and managing maintenance efficiently.

5. How much does financing impact my ROI?

Financing has a massive impact. Using more leverage (a smaller down payment) can dramatically increase your Cash on Cash Return because you have less of your own money in the deal. However, this also increases risk and makes your cash flow more sensitive to interest rate changes.

6. What is the difference between ROI and Cap Rate?

Cap Rate (Capitalization Rate) measures a property's unleveraged return and is used to compare different properties on an apples-to-apples basis. ROI (specifically Cash on Cash Return) is a personal metric that measures the return on your actual cash invested, factoring in your specific financing terms.

7. How can I accurately estimate the vacancy rate?

A conservative starting point is to budget 5-10% of the gross annual rent. For a more precise figure, contact local property management companies. They have real-world data on vacancy rates for specific neighborhoods and property types.

8. Are closing costs part of the initial investment?

Yes, absolutely. For an accurate Cash on Cash Return calculation, your "Total Cash Invested" must include every dollar required to acquire the property: the down payment plus all closing costs (loan fees, appraisals, title insurance, etc.).

9. Is it possible to have a negative rental property ROI?

Yes. If your total annual expenses (including mortgage, taxes, insurance, and repairs) exceed your rental income, you will have a negative ROI. This means the property is costing you money to own each year, a situation often caused by extended vacancy or underestimated costs.

10. How often should I recalculate my property's ROI?

It is an excellent practice to recalculate your ROI annually. Rents change, taxes increase, and insurance premiums fluctuate. An annual review helps you track the property's true performance against your initial projections and make informed decisions about your portfolio.

Ready to take control of your financial future? At Top Wealth Guide, we provide the insights and strategies you need to build and manage your wealth effectively. Explore our resources today at https://topwealthguide.com.