Most folks are all about stacking more cash, but then—surprise, surprise—they completely ignore how it streams through their finances. Poor cash flow management? It’s like pouring water into a bucket with a hole. High earners, low savers…yeah, it’s a thing.

At Top Wealth Guide, we see this movie over and over: six-figure pros who can’t seem to stack real assets because they’ve never got the basics of money movement right.

The real kicker? The difference between the wealth-builders and the paycheck-to-paycheck crew often boils down to mastering the cycle of cash—when it rolls in and when it leaks out.

In This Guide

Understanding Cash Flow and Its Impact on Wealth

What’s the Real Difference Between Cash Flow and Net Worth

Here’s the deal-cash flow tracks the movement of your dough over time, while net worth is just a still-life snapshot of your financial landscape. Yeah, maybe you’ve got $500k in assets, minus $200k in debt, leaving you with a tidy $300k net worth. But if you’re bleeding out $2k a month in negative cash flow… well, you’re on the fast train to a financial meltdown. Think of it this way: CB Insights tells us cash shortages are the runner-up in reasons startups go belly up. And guess what? This plays out the same way in the personal wealth rollercoaster.

Why Positive Cash Flow Beats High Net Worth Every Time

Remember this-cash flow is king. Why? It’s all about that liquid cash opening doors. A solid $50k annual positive cash flow lets you toss $4,167 into appreciating assets every month. Now, contrast that with someone who’s high net worth but drowning in negative cash flow-they might have to dump investments when the market takes a dive.

Real estate moguls know this truth like the back of their hand: they snap up properties for the $100-300 monthly cash flow each unit rakes in, not just hoping for appreciation alone.

The Cash Flow Mistakes That Keep You Broke

The big oops? Folks treat erratic income like it’s a clockwork payroll check, blowing those windfalls instead of smoothing out the tough months. It’s the freelancers, the commission chasers-they live like royalty when times are good and then hit panic mode when things slow. Another cash-crusher is parking too much green in investments you can’t touch (we’re looking at you, stocks, and crypto) without having a three to six months’ expenses cushion. Even the big earners pulling $150k a year-if they’re living paycheck to paycheck, they never set up the right cash flow buffer for the inevitable waves.

Now that we’ve untangled the cash flow-net worth web and why the former wins every time for wealth building, let’s dive into some killer strategies to revamp your money mojo.

Cash Flow Management Strategies That Build Wealth

The 70/20/10 Rule Beats Traditional Budgets

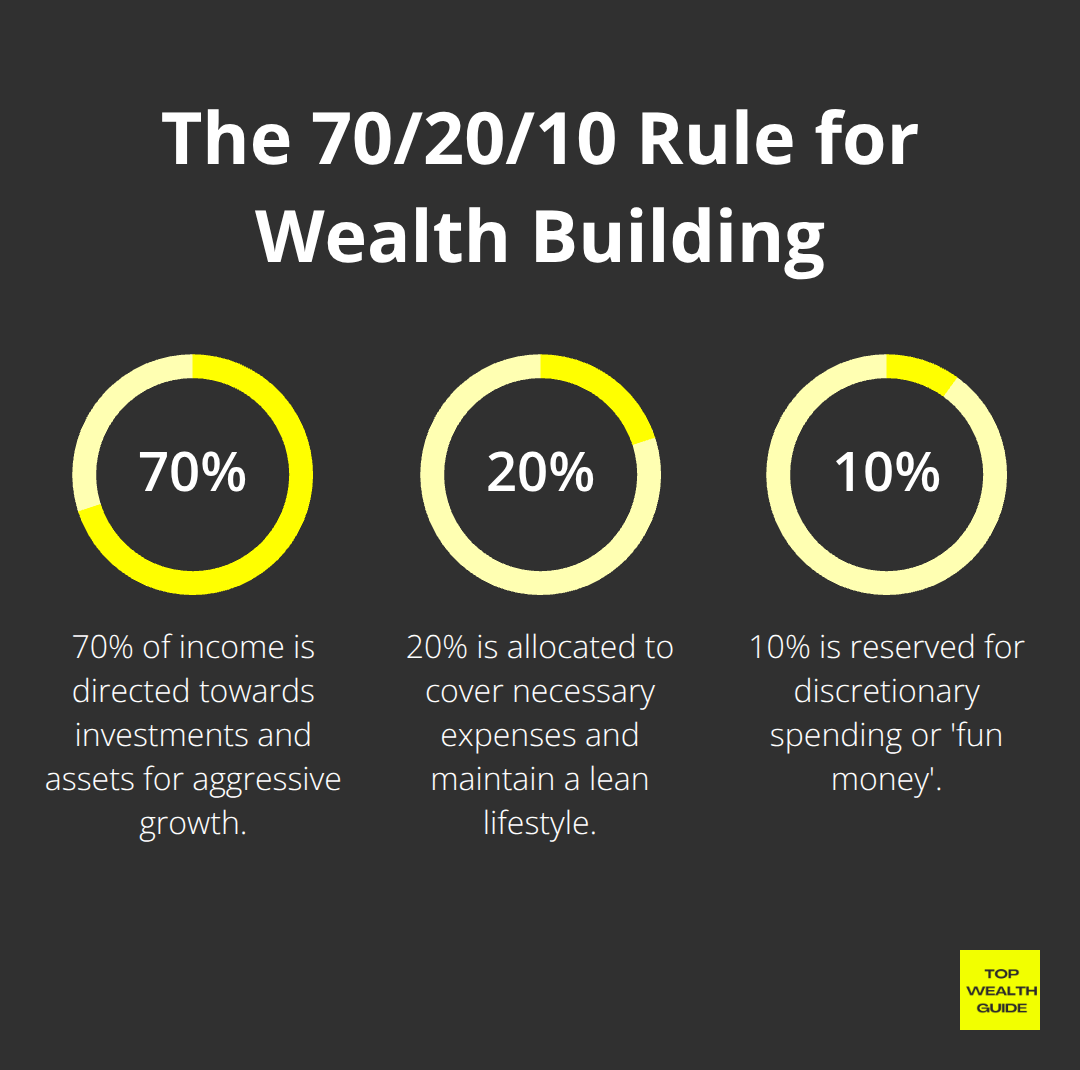

Forget that 50/30/20 rule-it’s for those settling for middle-class comfort, not for building empires. The big players? They rewrite this script entirely: max out savings and investments first, then make do with what’s left. Exhibit A: Warren Buffett’s Berkshire Hathaway-funnels almost 100% of profits back into expansion instead of doling out dividends. The savvy wealth architects out there are all in on the 70/20/10 formula: 70% aimed at investments and assets, 20% to cover expenses, and a tiny 10% for fun money. This aggressive method keeps lifestyles lean while it sets asset growth on steroids.

Automation Eliminates Human Error

Manual savings are a bust because we humans… well, we’re inconsistent. Get those automatic transfers locked in within 24 hours of payday-before temptation has you spending on Amazon. Automated investors pack more punch into retirement savings than the human-directed kind. Here’s the play: direct deposit divides your paycheck right off the bat, shooting money into high-yield accounts, index funds, and real estate trusts before it hits your pocket. Tech like Acorns and Betterment makes it effortless; even the plain old bank automation will do.

Multiple Income Sources Accelerate Wealth

Relying on a single income stream? Walking a tightrope without a net. The diversified earners? They’re the rockstars who sail through downturns and boost wealth while they’re at it. Millionaires average about 7 income streams, whereas your typical household scrapes by with 1.2. Start with scalable gigs: rental properties can yield $100-300 monthly per unit, dividend stocks hand out quarterly, and online businesses offer location-free income. Real estate investment trusts get you into property without the landlord headaches, while peer-to-peer platforms like LendingClub aim for around 5.5% annually.

Cash Flow Timing Maximizes Growth

The wealthy elite know it’s all about timing those cash flows rather than the grand totals. They orchestrate payments to hit home before major investment windows (think quarterly stock grabs or hot real estate deals). This savvy timing lets them seize market dips and compounding growth paths that less organized folks miss because their cash flow choreography is out of sync.

Nailing these strategies is just the starting point-you’ll need the right tools and systems in place to track progress and fuel up that wealth-building machine you’ve set in motion.

Tools and Systems for Effective Cash Flow Tracking

Professional Software Handles Complex Wealth Flows

Let’s cut to the chase-those simple budgeting apps that do nothing but categorize your latte spending are a no-go. Wealth building? It’s a different ball game-you need systems screaming precision, tracking cash velocity and perfect investment timing. Enter QuickBooks, the heavyweight champ of cash flow management, cranking through over 4.2 million small business transactions daily and offering real-time updates of your cash position. This software doesn’t nudge; it syncs-with bank accounts, credit cards, investments, you name it-painting a complete money movement picture in no time. And Mint? Well, it’s like bringing a knife to a gunfight if you’re in the high-net-worth league-it just can’t hack the complex investment flows or rental income that serious wealth players juggle.

Automated Systems Outperform Manual Methods

Now, let’s talk automation-manual methods are so passé. YNAB and Personal Capital-they’re ruling this realm by hooking up directly to financial institutions, effortlessly updating cash flows without a human finger lifting. Personal Capital goes the extra mile, tracking investment performance alongside cash flow, spelling out exactly how much liquid cash is on hand for those ‘carpe diem’ investments. It monitors a whopping over $13.1 trillion in assets, catching patterns that those clunky spreadsheets miss entirely. Automatic categorization rules? Set ’em up and watch as wealth-building expenses untangle themselves from lifestyle splurges-revealing how much cash is hustling towards assets versus being frittered away each month.

Cash Flow Velocity Metrics Drive Results

Let’s talk about velocity-the cash conversion cycle-how fast can you turn that income into investable assets? The pros, the wealthy-they’re eyeing a cash conversion rate of at least 25%. That means, out of every $100 earned, a cool $25 is funneled straight into assets that appreciate like fine wine. Tools like Tiller? They’re your best mate here-calculating your monthly investment rate, getting your earnings into investment accounts within 30 days (snappy, right?). And those Days Sales Outstanding principles? Personal finance isn’t exempt-measure how fast you can transform earned income into invested capital. Shoot for under 15 days from paycheck to portfolio-quicker, the better. That’s compound growth in action. Effective cash flow tracking-it’s the backbone, the sturdy scaffolding, supporting those broader wealth building strategies-propelling you down the fast track to financial freedom.

Final Thoughts

Cash flow management-it’s the magic trick that turns wealth from a “someday” fantasy into a “right now” action plan. The numbers don’t lie: automated investors beat manual savers repeatedly, and having multiple streams of income? That’s your safety net when you’re aggressively building your asset base. The 70/20/10 rule? It’s all about speed. You funnel 70% of your income into investments that grow-not into just living larger.

So, where do you start? Start now. Set up automated transfers within a day of your next payday. Get QuickBooks or Personal Capital onboard to watch how cash flows like a river-fast and purposeful. Aim to get that cash into investments in under 15 days. Yeah, that’s what the rich folks do.

A steady, positive cash flow of $4,167 a month gives you a $50,000 annual shot at investing. Give it 20 years at a 7% return, and boom-you’ve got $2.04 million. We’re here at Top Wealth Guide to share the no-nonsense tactics to fine-tune your financial machinery and speed up your journey to becoming financially untouchable.

2 Comments

Pingback: How to Save 100k: A Practical Guide

Pingback: How to Finance Investment Property: Your Complete Guide