Dividend investing—it’s the trusty old pickup truck of wealth-building strategies. Not flashy, but dependable, and it’ll get you where you want to go over the long haul. Now, top dividend stocks? They’re like hitting the jackpot in slow motion… you collect steady income while watching your portfolio swell like a hot air balloon.

Here at Top Wealth Guide, we’ve done the heavy lifting—sifted through hundreds of dividend-paying juggernauts across various sectors to spotlight the true workhorses. This guide lays bare which stocks are the real deal when it comes to delivering consistent returns. And hey, we’re talking about building a portfolio that’s not just for you, but for your grandkids to inherit and thank you for (maybe even in their trust fund speeches).

In This Guide

Which Dividend Stocks Actually Deliver

Meet the real legends-dividend aristocrats. We’ve got companies like ExxonMobil, which have raised their dividends for over 25 years straight. Yep, that’s what you call the real deal, not some dividend wannabes. PepsiCo’s got our attention with a forward dividend yield of 3.89% and forecasts that say mid-single-digit annual dividend growth for the next decade. Why do these numbers matter? Simple-consistency always kicks flashiness to the curb.

Track Record Beats Marketing

Morningstar? They’ve got the receipts. Companies rocking high Distance to Default scores rarely hit the brakes on dividends. Check out Federal Realty-63 years and counting without missing a beat. Avista’s no slouch either with 26 consecutive years of payments. Then there’s Canadian Natural Resources-24 straight years of raising the bar with a 5.7% yield. Here’s the math: companies that shell out dividends during those doom-and-gloom times-recessions and market crashes-are the real MVPs.

Financial Strength Creates Dividend Safety

So, who’s making the cut? Companies with sustainable payout ratios. Take Kinder Morgan-they’re chill with a conservative 50% payout ratio paired with a 4.4% yield, leaving room for operations and growth. Post-divestment, AT&T aims for a solid 50% payout ratio, supporting a 3.9% yield. When a company’s paying out 80% or more of profits? Red flag. For most sectors, the magic number falls between 40-60%.

Growth Potential Protects Your Income

Those dividend growth companies-yep, they outshine the static players over time. Mondelez International? Expecting high-single-digit dividend increases through 2033 alongside a 3.24% yield. Lockheed Martin’s in the game with a 5% dividend raise this year, bolstered by long-term government contracts. Enterprise Products Partners? They fund growth internally, upholding a sweet 6.9% yield over 28 years of raising the distribution. When companies grow dividends faster than inflation, they’re shielding your buying power and boosting your wealth.

Quality Metrics That Matter Most

Savvy investors? They’ve got their eyes on key metrics predicting dividend sustainability. Grab your pen-the dividend coverage ratio is net income divided by dividend declared. Free cash flow coverage? Overshadows earnings coverage (because, hey, cash pays dividends, not just the numbers in accounting). Debt-to-equity ratios below 0.5? Signal that companies can ride out economic storms without cutting payouts.

These quality indicators pave the path to identifying top-performing stocks as you assemble your sector-specific dividend portfolio.

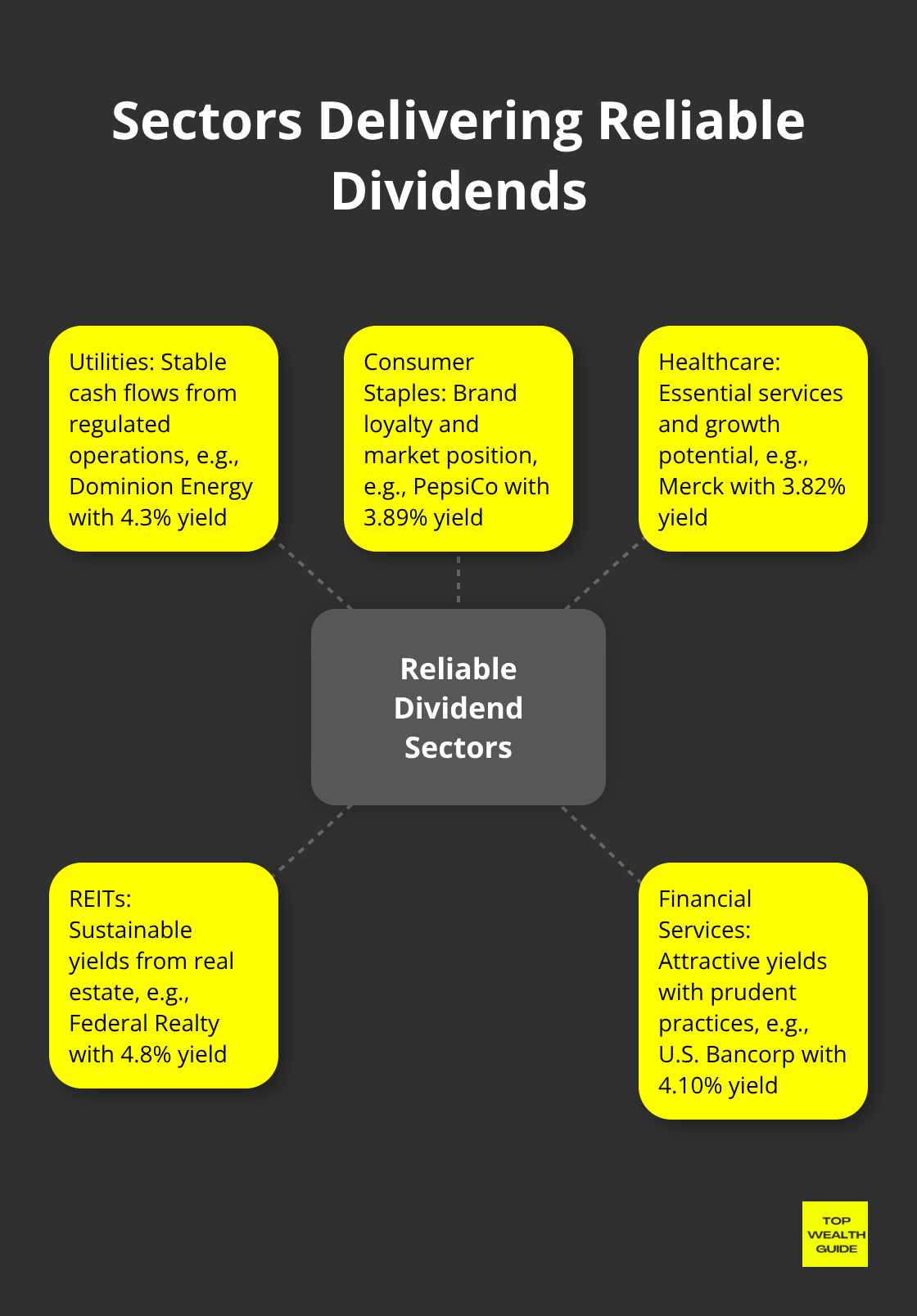

Which Sectors Deliver the Most Reliable Dividends

Utilities Lead the Pack for Steady Income

Utilities rule the dividend roost – thanks to those rock-solid fundamentals. Take Dominion Energy. It’s dishing out a 4.3% yield, all while keeping its focus sharp on pure-play electric utilities. Why? They pump out cash flows as predictable as a Swiss train schedule. Avista? It’s a standout with a 5.2% dividend yield and 26 years straight of payments – all thanks to regulated operations delivering the stable earnings. Then there’s Evergy, maintaining a 3.7% yield and 21 uninterrupted years of payouts – all cozied up in rate-regulated revenue streams. These streams? They’re like a financial shield against market ups and downs.

The secret sauce for the utility sector? It’s all about the insatiable demand for electricity. People flick the switch, and the dollars roll in – rain or shine, boom or bust. These companies? They’re monopolies in their own backyards, allowing costs to skip right along to customers. Columbia Banking System – yeah, they’re offering a 5.38% forward dividend yield – way above the financial crowd, thanks to their spot-on stable cash flows. And those regulated utilities like Dominion and Avista? Rarely do they fumble the dividend ball.

Consumer Staples and Healthcare Dominate Long-Term Growth

Peek over at the consumer staples aisle, and PepsiCo is leading with a 3.89% forward dividend yield – plus some mid-single-digit growth expected to last all decade long. The power of brand loyalty and primo market spots? They’re like a profit margin secret recipe. Meanwhile, Merck steps in with a 3.82% forward dividend yield. It’s trading 24% below its fair value, says Morningstar. It’s a two-for-one deal: income and capital appreciation potential.

Medtronic? The healthcare giant is tossing out a 3.06% forward dividend yield, giving back 50-70% of annual free cash flow to shareholders. Dividends and buybacks galore. The secret for food, drink, and healthcare sectors? Folks need them come what may. Eastman Chemical? A steady 5.1% yield with a 30-year dividend tale to tell, spun from stable demand for specialty plastics and additives supporting the essential industries.

REITs and Financial Services Offer Premium Yields

Pop open the real estate investment trusts trove, and you’ve got sustainable yields galore. Federal Realty? It rocks a 4.8% dividend yield, riding high on a 63-year streak of uninterrupted payments. It’s all about that diversified tenant list, sitting pretty in the prime locales. W.P. Carey steps up with a 5.5% dividend yield, and guess what? Nearly 100% occupancy rates and a BBB+ credit ribbon signal financial nimbleness.

Look over at financial services, and dividends are attractive when prudence reigns like a conservative king. U.S. Bancorp? A 4.10% forward dividend yield backed by prudent practices and strong capital muscles. Valley National Bank’s got a 4.21% yield on offer – a siren call to income investors angling for sector exposure. The bonus? Rate environments fattening net interest margins juice up dividend growth.

Smart investors mix these sector smarts with nimble portfolio construction – all part of maximizing that dividend income ride. Ready to dance, dividend-style?

How to Build Your Winning Dividend Portfolio

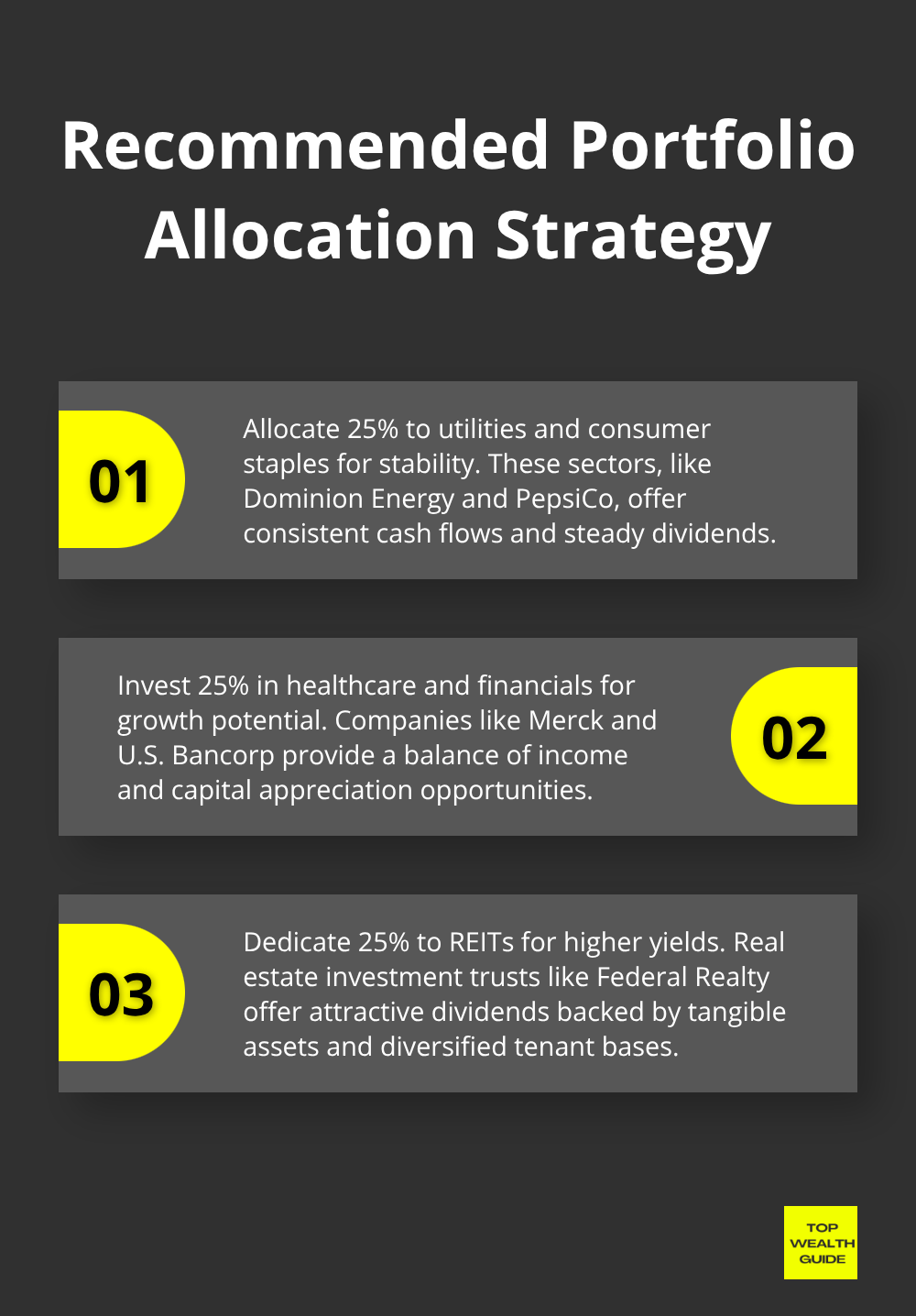

Diversify Across Sectors and Market Caps

Alright, folks, let’s talk smart dividend investing like it’s a game of chess, not checkers. The play? Spread those bets across sectors and market caps like you’re some kind of investing ninja. You want 10 or more stocks spread across various sectors-now, that’s the sweet spot. Why? It reduces single-stock risk without watering down your returns. Here’s your playbook: aim for 25% in utilities and consumer staples for some rock-solid stability, another 25% in healthcare and financials for a bit of growth spice, 25% in REITs to crank up your yield, and cap it off with 25% in industrials plus energy for a splash of diversification flair.

Oh, and market cap? Yeah, that’s your unsung hero-mix it up with large-cap dividend aristocrats like ExxonMobil and mid-cap up-and-comers like Rexford Industrial. The VanEck Durable High Dividend ETF? Spot-on example, tracking companies who pass the financial fitness test with flying colors…proving yet again, financial health outshines high yields all day long.

Reinvestment Supercharges Your Returns

Here’s the secret sauce, my friends-dividend reinvestment plans. Think of it like throwing your wealth into compound growth on steroids. Companies like Enterprise Products Partners offer DRIPs that let you snag extra shares commission-free with your dividend dough. Do the math: over 20 years, reinvest those 4% yields, and boom! You’ve got 119% more wealth compared to taking cash payments.

But hang on-here come the tax considerations to shake things up. Tuck those dividend stocks into tax-advantaged spots like IRAs to duck annual tax hits. Taxable accounts? They’re more of a fit for qualified dividends taxed at capital gains rates (yep, currently 0%, 15%, or 20% depending on your wallet size).

Time Your Purchases Strategically

Now, let’s get strategic-time your buys when market dips boost yields. Check it: Merck is trading 24% below fair value at a tasty 3.82% yield, beating those premium buys hands down. Dollar-cost average monthly to ride out volatility while building positions in quality champs like Federal Realty, rocking a 63-year dividend streak.

Keep those eyes peeled during earnings season for payout ratios. Companies upping ratios beyond 70%? What’s that I hear? Potential trouble ahead. On the flip side, ratios around 50% (say, the Kinder Morgan way) set the table for dividend growth when the economy is ready for takeoff.

Monitor Key Performance Metrics

Here’s the playbook on performance monitoring-check dividend coverage ratios every quarter: net income divided by total dividends paid. Pay close attention to free cash flow because, folks, cash-not accounting mumbo jumbo-pays the dividends. Companies flaunting coverage ratios below 1.2? Big risk for cuts when the going gets tough.

And don’t sleep on debt-to-equity ratios below 0.5-they signal who can weather economic storms without chopping payouts. Just peek at Canadian Natural Resources, sticking to this steady approach and serving up 24 consecutive years of dividend growth at a solid 5.7% yield.

Final Thoughts

Dividend stocks-think of them as your personal wealth treadmill, running 24/7. Picture companies like Federal Realty with a whopping 63-year streak of payments, or Canadian Natural Resources cranking out 24 years of consecutive growth. They’ve got the goods-income plus some tasty capital appreciation. The numbers don’t lie: dividends that get reinvested? They compound like nobody’s business, doubling your wealth in just a couple of decades.

Here’s the thing: success here? It’s like a three-legged stool-financial strength, diversification, and a big ol’ dose of patience. Zoom in on companies rocking payout ratios under 60%, debt-to-equity ratios below 0.5, and unyielding rivers of free cash flow (that’s how you sort the wheat from the chaff). Diversify-spread your bets across utilities, consumer staples, healthcare, and REITs. This way, you’re weatherproofing your portfolio while maintaining those sweet, steady income flows.

So what’s the action plan? It’s go-time, folks. Open up that brokerage account, aim for 10-15 quality dividend payers straddling different sectors, and get those automatic reinvestment plans rolling. We at Top Wealth Guide have got your back with practical insights and actionable strategies for slicing through financial complexity and hitting your stride toward success.