Investing in the stock market…a beast unto itself. A potential goldmine for building wealth. Long-term, that is. At Top Wealth Guide, we’ve got a list—top 10, mind you—of stocks to buy now if you’re eyeing growth over time.

So, what’s the deal? These companies—rock-solid track records, beefy financials, and strategies that scream innovation—are geared for the long haul. Let’s break down what makes these winners tick and how you can hitch a ride on their growth train effectively.

In This Guide

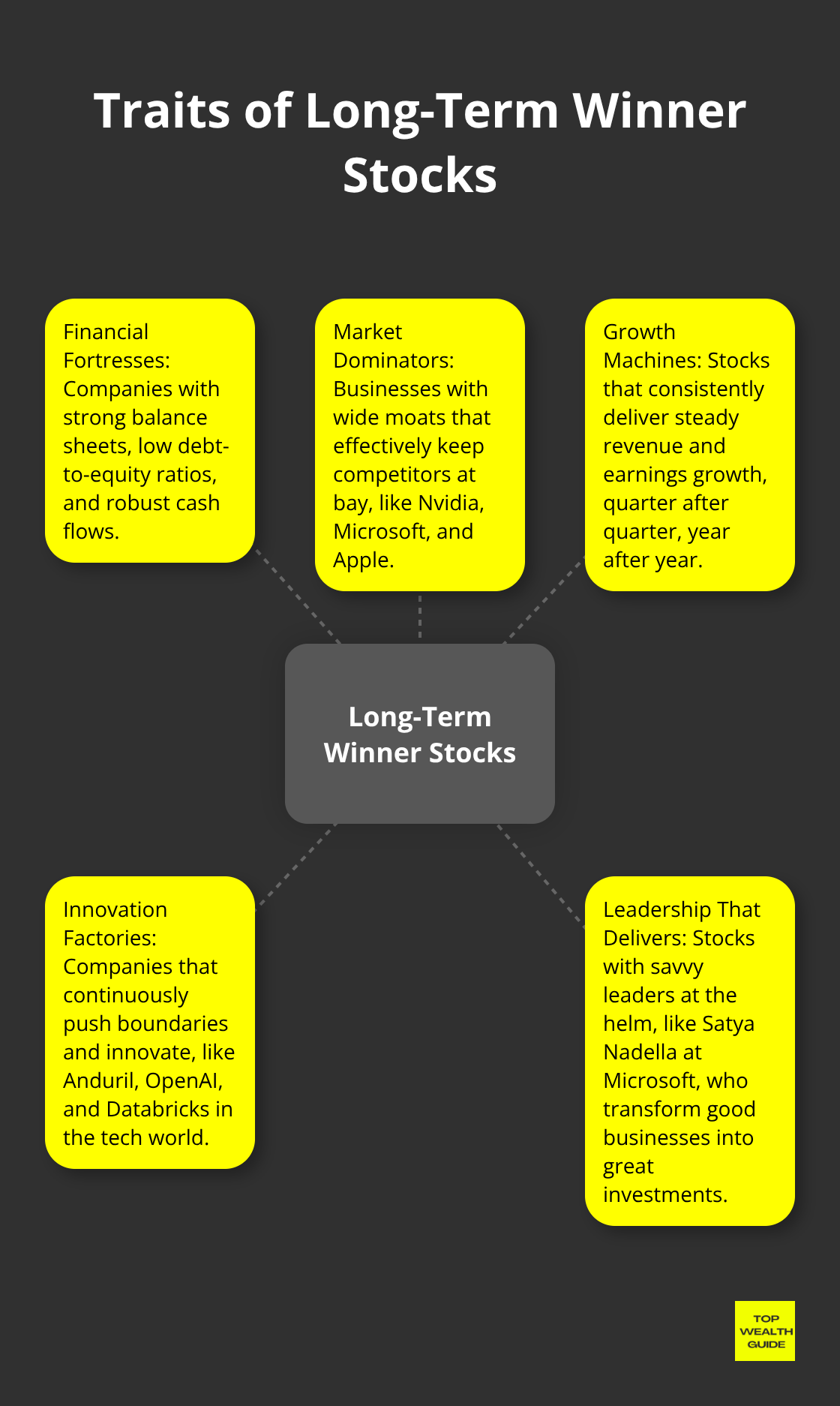

What Makes a Stock a Long-Term Winner?

Long-term growth stocks: the investor’s holy grail. They’re those magical companies that keep expanding year after year, beefing up your portfolio and prepping you for a retirement filled with piña coladas and beachfront sunsets. So, how do you pick these pearls from the sea of stocks? Buckle up-let’s dive into the traits that sift out the duds from the dynamos.

Financial Fortresses

First up-numbers. They’ve gotta make sense. We’re talking about companies with balance sheets you could practically balance a tank on. Low debt-to-equity ratios, cash flows that could rival the Mississippi, and margins fat enough to keep a hundred accountants busy. Undervalued stocks on the S&P 500, judged by their trailing PE ratio, offer clues to financial brawn and potential growth spurts.

Market Dominators

These aren’t your just-keeping-afloat types-they dominate. They’ve got moats around their business wider than the Pacific Ocean, shooing competitors like pesky mosquitoes. Take a peek at Nvidia, Microsoft, and Apple; kings of market cap, strutting their market-dominance stuff like peacocks on steroids.

Growth Machines

Consistency, folks. It’s not just a word; it’s the name of the game. The cream-of-the-crop stocks dish out steady revenue and earnings growth, every quarter, every year. Microsoft? Well, it’s basically the mascot here, with Azure flexing those cloud muscles, growing at a 30%+ annual sprint for the past half-decade.

Innovation Factories

Stagnant companies? Yeah, they’re dinosaurs waiting for extinction. Long-term winners-they’re the ones shoving the boundaries. Anduril, OpenAI, and Databricks are storming the tech world-military innovations, AI wizardry, and building the blocks of intelligence-those are the power moves charting paths to long-haul success.

Leadership That Delivers

Behind every juggernaut, there’s a savvy captain at the wheel. These folks steer the vessel through stormy seas and tranquil bays. Look at what Satya Nadella’s done at Microsoft-taking a lumbering tech behemoth and turning it into a sleek high-speed train exemplifies captaincy that transmutes good businesses into great investments.

These traits? They’re not mere theories-they’re the battle-tested attributes driving companies to long-term triumph. As you build your investment castle, keep these signposts in your peripheral vision. They’re your blueprint for navigating to stocks that’ll keep expanding, even after you’ve snagged them.

So, with these long-term winner traits unpacked, let’s scope out some specific companies that scream potential-prime candidates to enrich your portfolio.

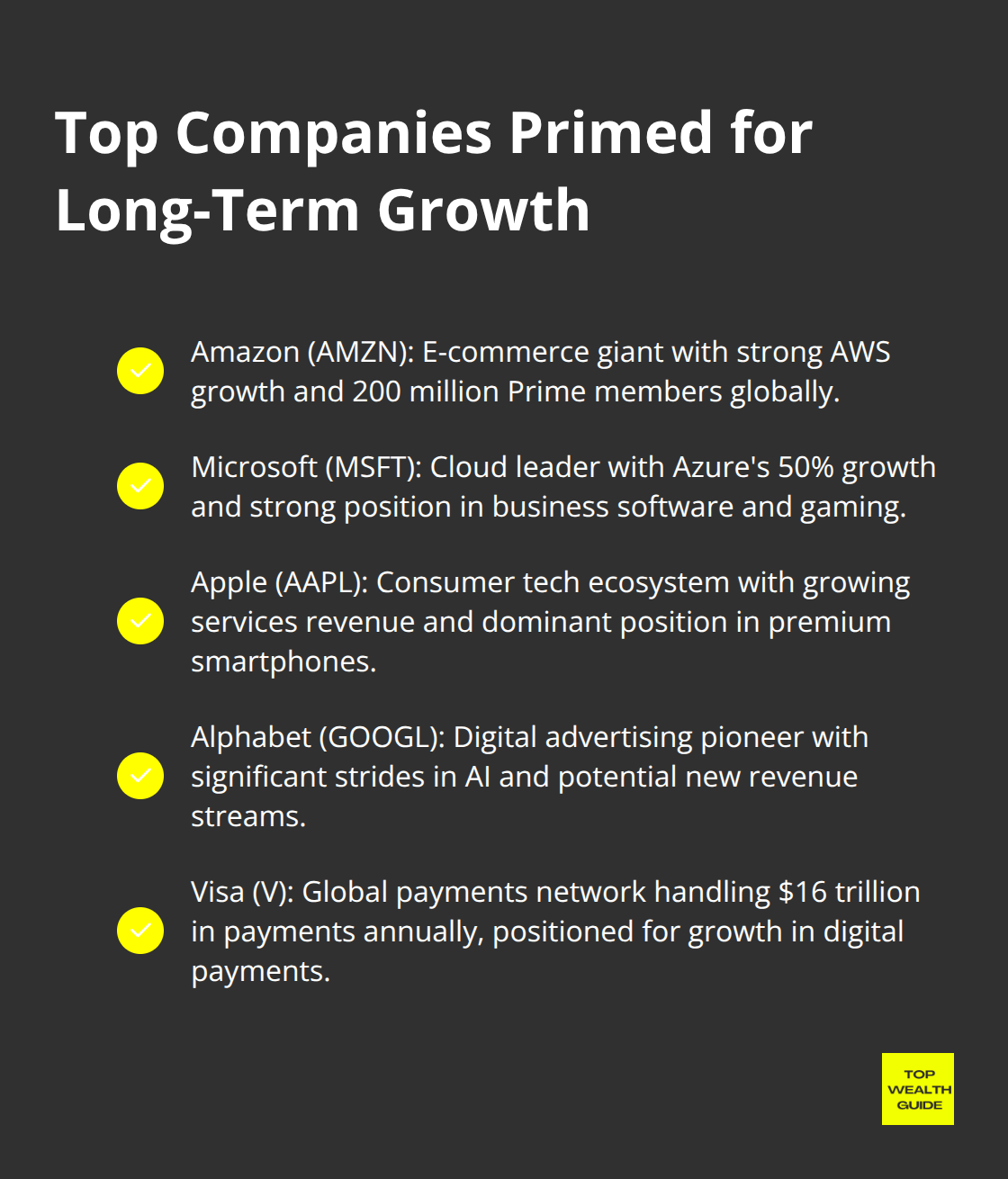

Which Stocks Are Primed for Long-Term Growth?

At Top Wealth Guide, we’ve crunched the numbers, sifted through the data, and emerged with some stocks that show a lot more than just potential-they’ve got staying power. No one-hit wonders here, folks. Let’s unravel why these companies could be your golden ticket to a supercharged portfolio.

The E-commerce and Cloud Computing Powerhouse

Amazon (AMZN)-no longer just that place you buy gadgets, folks. Its Amazon Web Services (AWS) division pulled in $108bn in revenue last year, marking a sweet 19% rise. This cloud powerhouse is riding the wave as businesses flock to digital solutions. Oh, and did we mention Prime’s 200 million global members? Yeah, Amazon’s still ruling the e-commerce roost with zero sign of slowing.

The Software King Turned Cloud Leader

Microsoft (MSFT)-what’s up with these sky-high numbers? Under CEO Satya Nadella, the Azure platform rocketed up by 50% over the year, leaving AWS feeling the heat. Office 365? Still king in business suites. Mix in the acquisition of Activision Blizzard, and Microsoft’s gaming division is set for a meteoric rise in the gaming and metaverse arenas.

The Consumer Tech Ecosystem

Apple (AAPL)-breaking news, they still wow us. Services revenue soared to $85.2 billion, with a steady 19% climb last year. The iPhone? Holding a lion’s share at 62% in the premium market. And that Vision Pro headset rolled out in ’25-herald of new frontiers in augmented reality. Pair that with a fiercely loyal fan base, and Apple’s future? Rock solid.

The Digital Advertising and AI Pioneer

Alphabet (GOOGL)-so much more than search these days. YouTube brought home $30 billion in ad cash last year, with Google Cloud growing 43%. The real kicker? Alphabet’s strides in AI with DeepMind cracking protein folding and predicting climate patterns. New revenue streams in healthcare? Environmental solutions? Alphabet’s got its hands in impactful pies.

The Global Payments Network

Visa (V)-who handled a staggering$16 trillion in payments last year? That’s right. With cash use on the decline, its network just got even more precious. Diving into the vast $120 trillion B2B payments market, Visa’s positioning itself to ride a massive growth wave. Stellar brand, global access-Visa’s surfing on the digital payment revolution.

These stocks boast solid track records, robust financials, and are seated in burgeoning markets. But remember: past performance isn’t a crystal ball into the future. Always do your homework, line up your finances, and think it through before jumping into investments. Now that we’ve spotlighted some exciting long-term stocks, let’s dive into strategies to invest for sustainable growth.

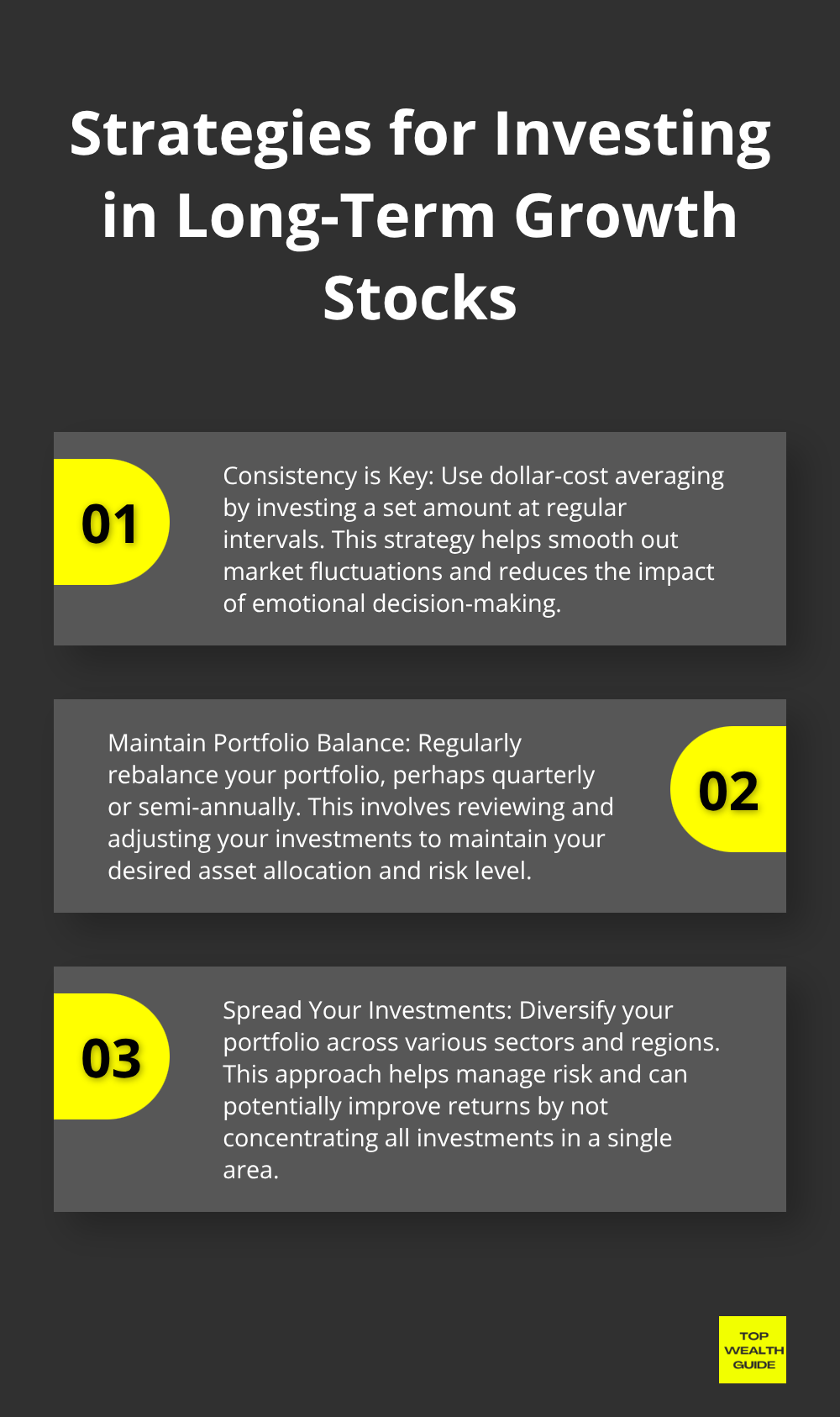

How to Invest Smartly in Long-Term Growth Stocks

Investing in long-term growth stocks isn’t about just picking winners-nope, it’s about having a game plan that works. Let’s dive into some strategies–tried and true–that will take your investing to the next level.

Consistency is Key

Let’s talk dollar-cost averaging-it’s like the MVP of strategies. You’re putting in a set amount of dough at regular intervals, which helps keep those pesky emotions at bay. Timing the market? A pipe dream. Instead, you’re investing a fixed amount regularly, smoothing out the market’s ups and downs, and dodging the peaks.

Maintain Portfolio Balance

Portfolio rebalancing-essential stuff here. The market is like shifting sands, and your portfolio should move with it. Have a plan-maybe every quarter or twice a year-to look over what’s in your basket and make the necessary tweaks. Tech stocks on a roll and hogging your portfolio? Trim them. Shift those funds to sectors dragging their feet. This keeps your risk in check and can give returns a nice little nudge upwards.

Spread Your Investments

Diversification, folks-it’s your lifeline. Spread that cash over various sectors and regions. Sure, tech might be the flashy star, but don’t neglect the unsung heroes like consumer staples or utilities. A diversified portfolio can weather those market thunderstorms better than one pinched in a few places. Aim for a balance that jives with your risk appetite and goals.

Stay Informed and Patient

In the world of investing, knowledge isn’t just power-it’s the whole shebang. Keep an eye on company updates, industry moves, and those economic teasers. But here’s the kicker-don’t let short-term noise knock you off your long-term path. Patience is often the magic wand for investors who play the long game.

Use Technology Wisely

Tech can be your sidekick here. Investment apps and platforms? Use ’em to streamline. They come packed with automated features, real-time data, and more educational stuff than you can shake a stick at. But remember, these tools are the side dish-not the main course-of your research and decisions.

Investing in long-term growth stocks isn’t a sprint-more like a marathon. With these strategies in your kit, you’re ready to craft a growth-oriented portfolio that can go the distance.

Final Thoughts

Okay, here’s the deal. Investing in long-term growth stocks-yeah, we’re talking about building that wealth mountain over time, not overnight. We dove into key traits of stocks that stand out: solid financials, market dominance (think king of the hill), consistent growth, innovation that doesn’t just talk the talk, and yep, rockstar leadership. Companies like Amazon, Microsoft, Apple, Alphabet, and Visa-they’re nailing it, positioning themselves as top picks for long-term growth.

Here’s where it gets meaty: smart investing should jive with your financial goals. Really want to ace this game? Try dollar-cost averaging, keeping that portfolio rebalance game strong, and spreading your investments across sectors to manage risk and ramp up returns. And for goodness’ sake, stay in the loop-know what’s up in the company and industry world while keeping a cool, patient, long-term eye on things. Yeah, we’re talking research and due diligence; they’re your best friends in the whirlwind that is the stock market.

Top Wealth Guide is all about continuous learning and analysis-just saying, it’s packed with insights, tools, and solid market info. Make those investment decisions with clarity. At the end of the day, your strategy should vibe with your unique financial picture, how much risk you can stomach, and those long-term dreams of yours-no cookie-cutter solutions here, folks.