Wealth management — the backbone of long-term financial well-being. Here’s the thing, at Top Wealth Guide, we get it. Navigating the murky waters of today’s economic circus? Easier said than done.

This guide right here? It’s your Swiss Army knife for mastering wealth. Think diversification tricks and tax-savvy investing. We’re talking tried-and-true methods to not just grow your wealth… but keep it growing. Your financial future — secured and on a steady upward trajectory.

In This Guide

What Is Wealth Management?

The Comprehensive Approach to Financial Growth

Wealth management – it’s not just about tossing your cash into stocks. It’s about wrapping a warm blanket around your assets, nurturing them, and watching them sprout over time. A solid wealth management plan is a must-have for hitting those long-term financial dreams.

Key Components of Wealth Management

Building a strong wealth management game requires a mix of vital ingredients:

- Asset Allocation: Imagine spreading your bets across stocks, bonds, real estate… You get the picture. A Vanguard study says this mix does the heavy lifting – about 88% of your portfolio’s ups and downs.

- Risk Management: Know your risk appetite – and protect yourself. Think stop-loss orders when diving into stocks to cap losses. It’s like setting a backup parachute.

- Tax Planning: The Tax Foundation reports the crème de la crème pays Uncle Sam an average of 26.1%. Tax-savvy moves mean keeping more of what you earn.

Defining Clear Financial Objectives

Sailing aimlessly in the financial seas is a no-go. Set clear waypoints – short-term like an emergency stash or saving for the starters’ home; long-term eyeing the golden years of retirement. Fidelity says goal-setters are 42% more likely to hit their savings mark. Goals are your roadmap.

The Importance of Regular Portfolio Reviews

Keep an eye on that nest egg. A Spectrem Group survey found 44% of millionaires peek at their portfolios every quarter. Regular check-ups ensure your investments and goals are still tangoing together. Twice-a-year dive-ins stave off panicky short-term jitters.

The Role of Professional Guidance

Do-it-yourself is great – but pros can push your wealth management to the next level. Financial advisors? They bring the brains and cool-headedness to finesse your financial plans. They’ll help you surf the investment waves, fine-tune taxes, and tweak that portfolio when life throws curveballs.

A Vanguard study noticed that advisors could boost your returns by around 3% a year (thanks to portfolio mastery, behavioral coach mojo, and tax tricks). Over time, this can make a serious dent – in a good way – in your wealth curve.

So, what’s next? We dive into how diversification is the bedrock of killer wealth management – a rock-solid launchpad for financial greatness.

Diversification: The Bedrock of Smart Wealth Management

The Real Deal About Spreading Your Bets

Putting all your eggs in one basket-terrible idea. Diversification is your financial safety net. It’s not just about dodging risk; it’s also about thinking smart and enhancing growth.

Don’t think of diversification as just a trendy term-it’s got credentials. A diversified portfolio tames risk while still giving you that long-term growth edge. And let’s be clear, that’s huge.

And hey, diversification doesn’t mean you’re giving up on returns. Check it out-the S&P 500, a diverse mix of 500 top U.S. companies, has averaged a cool 10% annual return. Stack that against your average stock, which, as JP Morgan found, usually tanks over a 7-year stretch.

Match Your Mix with Your Risk Mojo

Your investment lineup should vibe with your risk attitude. If you’ve got the gift of time-i.e., you’re young-you might lean toward more stocks. Rule of thumb alert: subtract your age from 110-that’s the stack you might consider for stocks.

So, if you’re 30, you might wanna shoot for 80% in stocks (110 – 30 = 80). But let’s not kid ourselves, your personal scene holds more weight than any rule of thumb.

Beyond the Usual Suspects: Stocks & Bonds

Your diversification play doesn’t stop at stocks and bonds. Hey, check out listed equity REITs-they posted the second-highest average annual return, landing at 9.74%. That’s better than stocks and bonds.

Commodities like gold? They’re your inflation-hedging pals. Over the past 50 years, gold’s clocked an average of 10.6% annually. The game isn’t just about returns-it’s also about how these assets dance differently compared to stocks and bonds.

For the adventurous-think private equity, hedge funds-they’re a thing. Not for every investor, but for the high-rollers, they bring unique openings. McKinsey spills the beans: private markets trumped public ones by 500 basis points over the last decade.

The Drill of Regular Rebalancing

Diversification’s not a “set it and forget it” gig. Nope, needs regular tuning. Vanguard’s got research showing that annual or semi-annual rebalancing hits the sweet spot between managing risk and keeping costs in check.

Smart diversification shapes up a robust portfolio-the kind that laughs in the face of any storm while still grabbing those growth chances. Stick around; next up, we dig into strategies for sustainable wealth growth, all laid on this solid foundation of diversification.

How to Grow Wealth Sustainably

Building wealth, folks, is like planting a tree. You need smart, consistent strategies that compound over time. We at Top Wealth Guide have seen how these approaches can reshape financial futures… big time.

Tax-Efficient Investing: Maximize Your Earnings

Wanna win the wealth game? Focus on what you keep, not just what you rake in. Tax-efficient investing can massively impact your wealth trajectory. The structure and financing of tax changes are key-like the secret sauce-to their effects on economic growth. Back in 2021, Americans shelled out nearly $14.8 trillion in total reported income on Form 1040. That’s serious dough that could’ve been working hard for you.

One clutch tactic? Max out contributions to tax-advantaged accounts like 401(k)s and IRAs. For 2023, folks under 50 can stash up to $22,500 into a 401(k). This money grows tax-deferred. For anyone chillin’ in the 24% tax bracket, that’s potentially saving $5,400 in taxes this year alone.

And let’s not forget municipal bonds in taxable accounts. Often, the interest here is a slick move-exempt from federal taxes (and maybe state and local, too). The Securities Industry and Financial Markets Association notes that as of 2021, there were $3.9 trillion in municipal securities floating around, offering a huge pool of possibly tax-free income.

Harnessing Compound Interest and Dollar-Cost Averaging

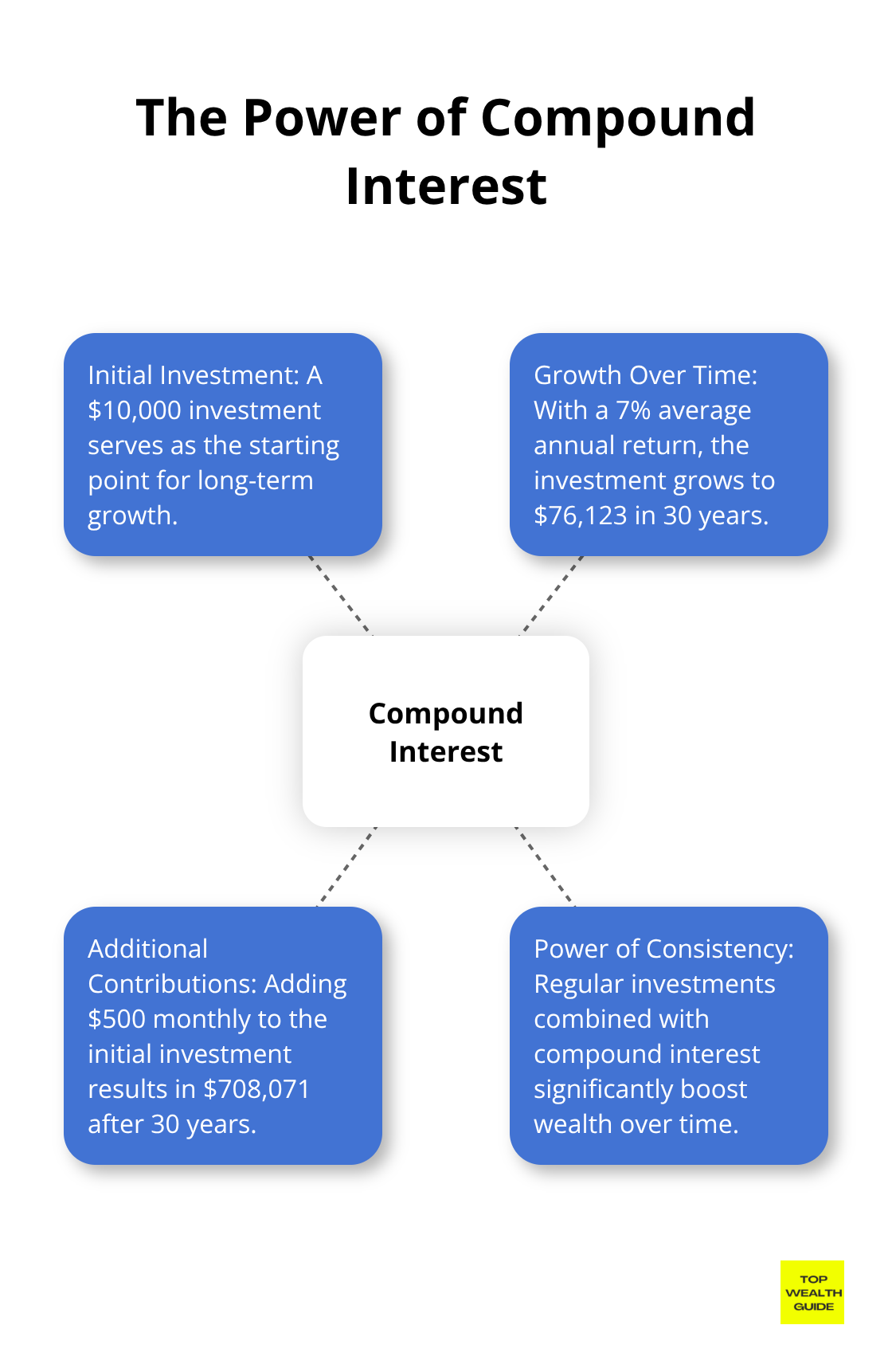

Compound interest-often dubbed the eighth wonder of the world-can seriously beef up your wealth. Take a peek at this:

A $10,000 investment today, pulling in a humble average of 7% return, will balloon to $76,123 in 30 years. That’s $66,123 in growth… just sitting there. Toss an extra $500 monthly into that initial pot, and after 30 years, you’re eyeing $708,071. That’s the power of compound interest paired with consistent investing in action, friends.

Now, dollar-cost averaging? A rockstar move in volatile markets. Instead of trying to outsmart the market (a Herculean task even for the pros), just invest a fixed amount regularly. A Vanguard study found that over a decade, throwing a lump sum in the market beat dollar-cost averaging only about 66% of the time. In the other 34% of cases, dollar-cost averaging came out ahead.

Expanding Beyond Stocks: Real Estate and Business Ownership

Diversification isn’t just about stocks and bonds, my friends. Real estate and business ownership can also be heavy hitters in the wealth-building arena.

Real estate-historically a solid long-term performer. According to the Federal Reserve, as of 2022, real estate made up about 27% of household assets in the U.S. Real Estate Investment Trusts (REITs) offer a handy way to dive into real estate without all the hassle of being a landlord. Per Nareit, equity REITs have churned out an average annual return of 11.9% over the past 25 years.

Business ownership, whether it’s launching your own venture or investing in someone else’s, can turbocharge wealth growth. The U.S. Small Business Administration notes that small businesses generated 12.9 million net new jobs over the past 25 years… a whopping 66% of all net new jobs since 1995. That’s big-time wealth creation potential right there.

Sustainable wealth growth isn’t about chasing that next buzzy stock or sketchy get-rich-quick scheme. It’s about sticking with tried-and-true strategies over time. Zero in on tax efficiency, embrace the magic of compound interest, and branch out into real assets like real estate and businesses to pave your way to long-term financial success.

Final Thoughts

Let’s talk wealth management. It’s a game of dedication, knowledge, and a bit of strategic mojo. Diversification-a fancy word for not putting all your eggs in one basket-tax-savvy investing, and the magic of compound interest (your financial Fairy Godmother) are what give your money a chance to strut its stuff over the years. These aren’t just buzzwords; they’re the bedrock beneath those resilient portfolios that not only weather the storm but also dance in the rain of market volatility to seize those juicy growth opportunities.

Dive deeper-tax-efficient investing and compound interest are like a one-two punch for your wealth-building plans. Dumping max contributions into tax-advantaged accounts and sticking to tried-and-true strategies (yes, say hello to dollar-cost averaging) put you on a fast track to those sweet, sweet long-term gains. And hey, don’t forget to pop the hood on your portfolio every now and then to check that the engine’s still humming along in sync with your financial dreams and tolerance for risk (a.k.a. your capacity to sleep at night).

Here at Top Wealth Guide, we arm you with insights and strategies to navigate the wild world of personal finance and investing. We’re your co-pilot, offering resources to help you make savvy moves in managing wealth. So, buckle up and grab the wheel of your financial future-apply sound principles, stay disciplined, and maybe even enjoy the ride a little.

4 Comments

Pingback: Is Real Estate a Good Investment? -

Pingback: How to Create Generational wealth

Pingback: 10 Proven Wealth Building Strategies for 2025

Pingback: 9 Best Ways to Build Wealth in 2025: A Complete Guide