Financial independence… not just a pipe dream for the one-percenters. Seriously, folks. With a solid strategy (and, yeah, a little discipline), even someone pulling down a middle-class paycheck can stack enough chips to retire early — or work because you want to, not because you have to.

We here at Top Wealth Guide, have crunched the numbers behind thousands of successful FI journeys — and voila! — a comprehensive roadmap. This isn’t just any guide, folks. It’s your step-by-step, no-nonsense playbook, chock-full of the exact moves, calculations, and strategies to jumpstart your path to financial freedom. Faster than you can say, “Early retirement.”

In This Guide

Understanding Financial Independence Fundamentals

Defining Financial Independence vs Financial Freedom

So, here’s the deal – financial independence is when your money’s working for you, not the other way around. Your assets are pulling in enough to cover your life’s tab without you punching the clock. Enter financial freedom, stage right: it’s having enough stash to live the dream, indefinitely. Important? You bet. Most folks blend these like a morning smoothie.

Think of financial independence as having your investments toss in $40,000 annually for the basics. Financial freedom? That’s $100,000+ to jet-set, indulge hobbies, and savor the good life. The Trinity Study gives us the lowdown on safe withdrawal rates from stock-laden portfolios – we’re talking about that nifty 25x rule.

Calculate Your FI Number with the 25x Rule

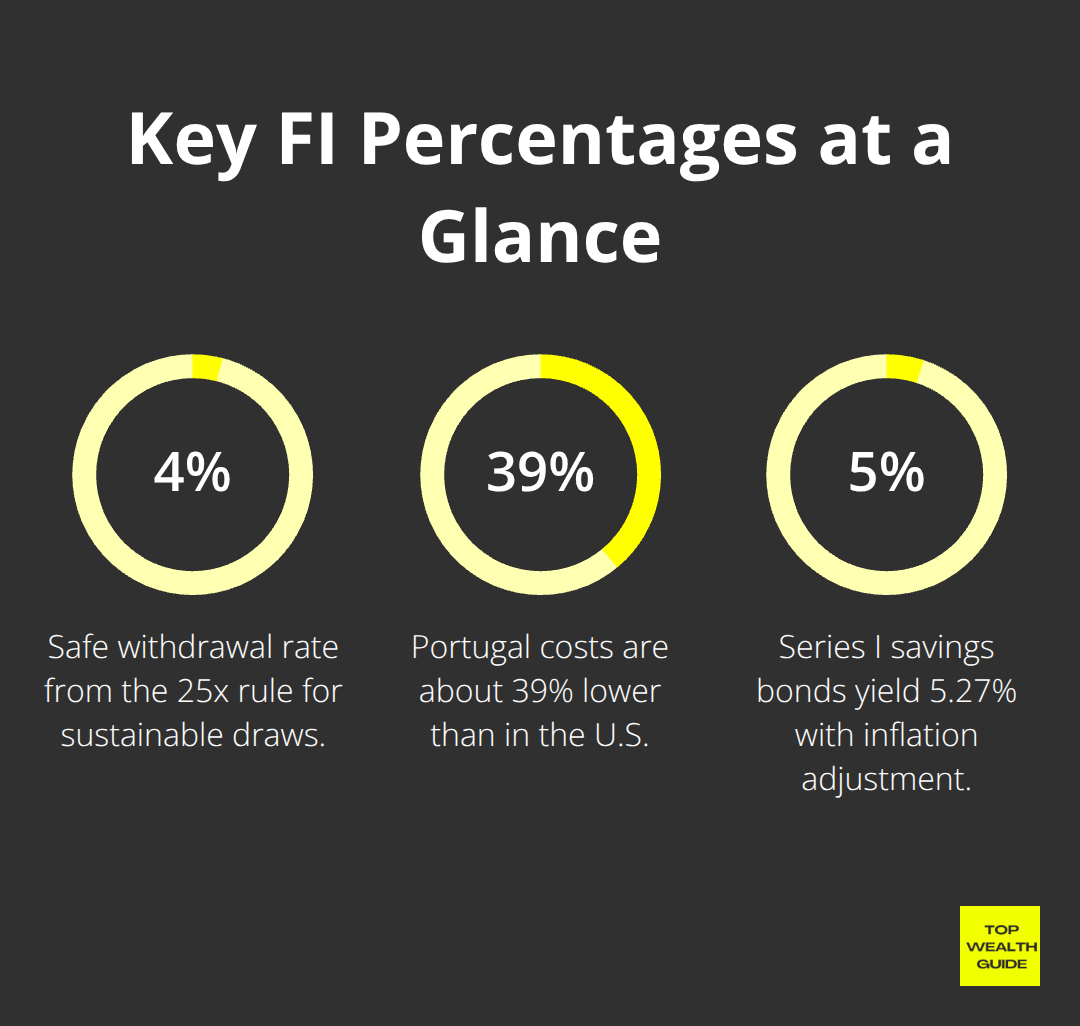

Picture this: you figure out your FI number by multiplying your yearly expenses by 25. Spending $50,000 a year? Ding, ding – your FI sweet spot is $1.25 million. This magic number is born from the 4% safe withdrawal rate, meaning withdraw 4% annually, and keep your nest egg intact.

Vanguard tells us this play is solid across different market seasons. First move – log every expense for three months to nail down those figures. The biggies? Housing, chow, wheels, and healthcare – they eat up 70-80% of the pie.

Beware, healthcare costs sneak up, with annual premiums for employer-backed family health plans hitting a cool $26,993 this year.

Common Misconceptions About Early Retirement

First off – the whopper of all myths: you need multi-millions to duck out early. Nope. Geographic arbitrage is your friend, letting you punch out with $500,000-$750,000 by setting up shop in cheaper digs. Think Thailand, Portugal, or some quiet corners of the U.S. – chop living costs by 40-60%.

Another piece of fiction: that retirement accounts are Fort Knox until you hit 59½. Truth is, Roth IRA contributions? Grab them anytime, penalty-free. Got a 401k? Explore Rule 72t distributions or Roth conversion ladders. Biggest headache – healthcare. COBRA extends as far as 18 months, then it’s the marketplace, shelling out $400-$1,200 monthly (location and coverage deciding the pinch).

Armed with a fresh understanding of financial independence and the digits to aim for, your next mission is laying the groundwork to support your FI strategy.

How Do You Build Your Financial Foundation for Independence?

Emergency Fund Size for FI Seekers

So, you’re chasing financial independence? Your emergency fund needs to be bigger… much bigger. The usual spiel is 3-6 months of expenses, but if you’re serious about FI, think in terms of larger cushions. Why? Market volatility can smack you around when you’re living off your investments. Remember the 2008 crash? Yeah, that beast took 18 months for a full recovery. Bigger cash cushions? They rode the storm without turning their portfolios into firewood.

Look, high-yield savings accounts like Marcus by Goldman Sachs or Ally Bank are tossing out 4.5-5.25% rates as of December 2024. Not too shabby. These accounts keep your emergency stash doing backflips while you wait out financial hurricanes.

Tax-Advantaged Account Hierarchy

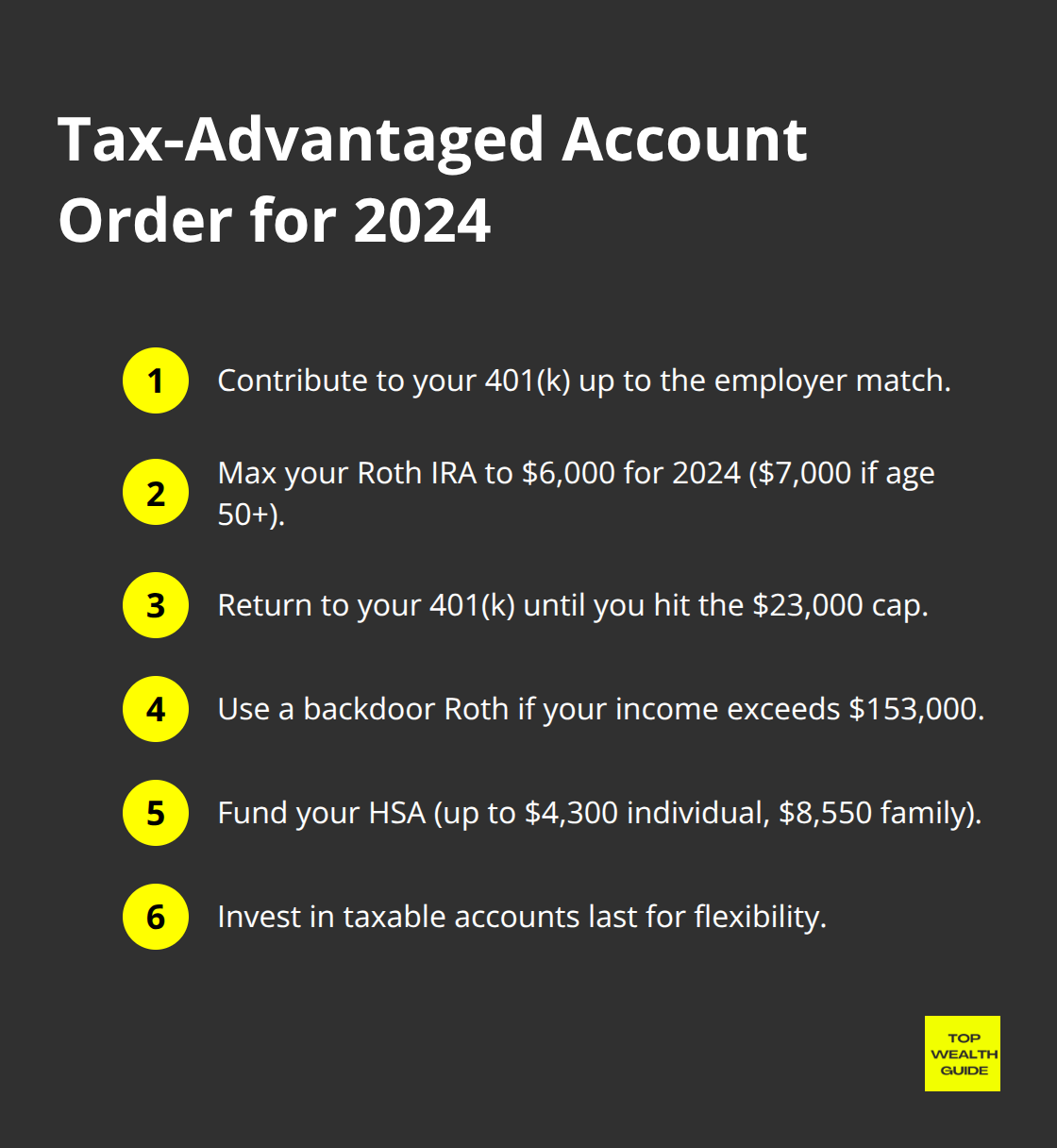

Okay, here’s your playbook: Max out accounts in this order, no exceptions-401k up to your employer match, then Roth IRA to the $6,000 limit for 2024 ($7,000 if you hit the big 5-0 this year), swing back to 401k for the remaining $23,000 cap. High rollers above the $153,000 income mark? You’ve got the backdoor Roth conversions.

HSAs? They’re golden-triple tax advantage with $4,300 individual and $8,550 family limits. After 65, use HSA funds like a traditional IRA for non-medical spending. Taxable accounts? Dead last, but they’re your lifeline for early retirement access.

Passive Income Target Calculations

Your passive income’s got to cover 80-90% of your current expenses, forget about gross income. Dividend-focused portfolios churn out 3-4% yields with REITs and dividend aristocrats leading the charge. Real estate investment trusts, like Realty Income, dish out monthly dividends, averaging 5-6% annually.

Rental properties? A juicy 8-12% cash-on-cash return in hot markets (just watch that management time sinkhole). Bond ladders offer predictability-Treasury I-bonds, at a sweet 5.27% yield with inflation padding. Aim for $1,000 monthly passive income for every $300,000-400,000 you’ve invested across different streams.

With your financial foundation solid, kick it up a notch. Focus on turbocharging your progress with smart income and expense optimization strategies.

How Do You Fast-Track Financial Independence?

Supercharge Your Income Beyond Your Day Job

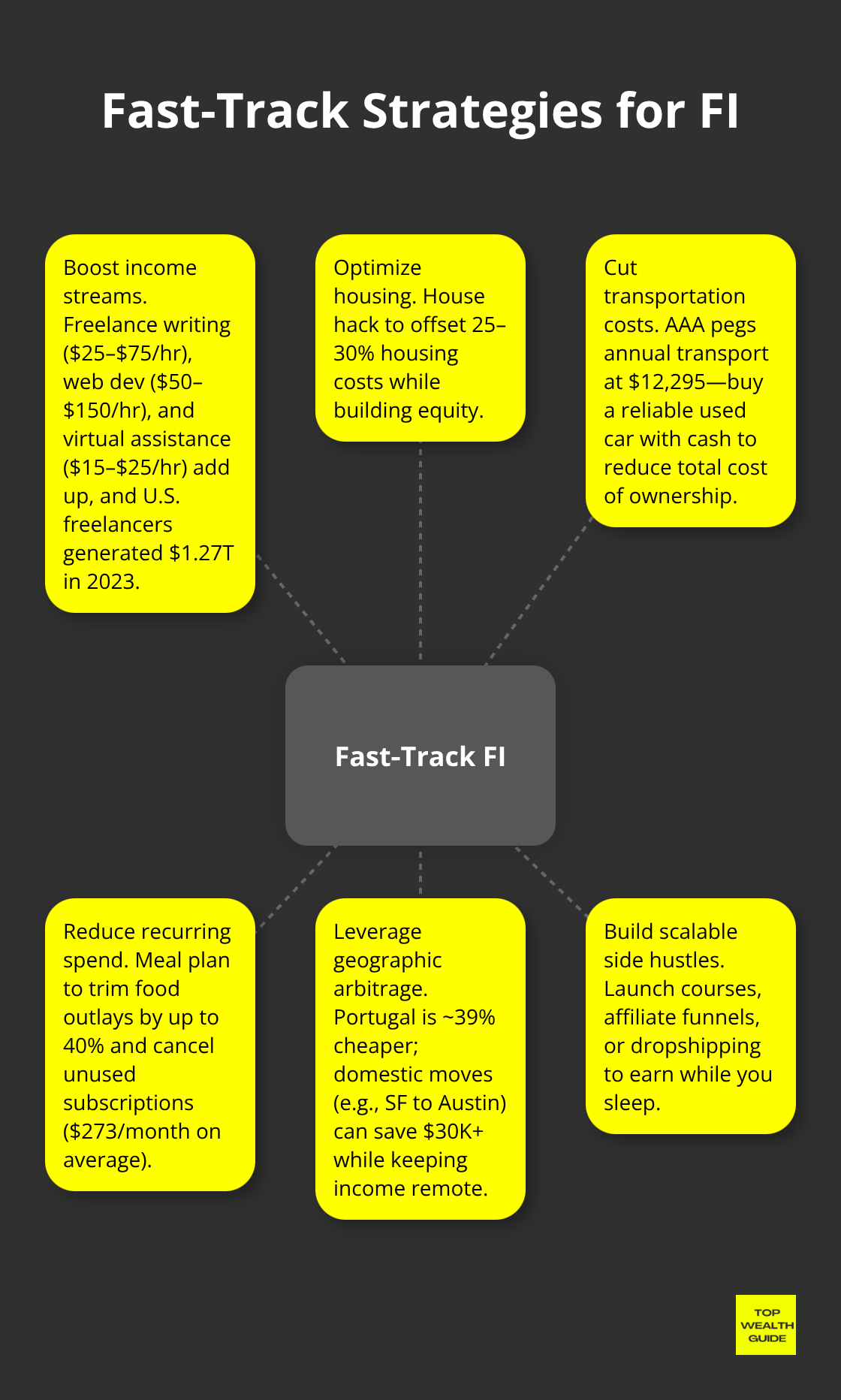

Your 9-to-5 salary – not gonna cut it. Period. The median household income in the U.S. is parked at $70,084, but millionaires average 7 income streams. Start where you are – got some skills?

Freelance writers are clocking $25-75 an hour, web developers rake in $50-150 hourly, and virtual assistants pocket $15-25. Freelancers raked in $1.27 trillion in 2023. Boom.

Real estate wholesalers can score $5,000-15,000 per deal with zilch capital investment. Zero. Focus on side hustles that scale without sucking up all your time – crank out online courses, set up affiliate marketing funnels, or dive into dropshipping. Let these money machines work round the clock.

Slash Expenses Through Strategic Lifestyle Changes

Housing – that’s your budget’s black hole, gobbling 25-30%. How to fight back? House hacking. Rent out properties and poof, there goes your housing cost, while equity builds. Transportation costs? $12,295 a year, according to AAA. Buy a solid used car with cash, ditch the depreciation drama.

You’re spending $7,729 annually on food – chop that by 40% with meal planning and bulk buys. And subscription services? Ruthlessly cut ’em. Americans shell out $273 monthly, says West Monroe. Geographic arbitrage – a fancy term for smart moves – works stateside, too. Flee San Francisco for Austin and pocket $30K+ yearly, while keeping the same income through remote gigs.

Optimize Location and Lifestyle for Maximum Savings

Want your dollars on steroids? Try international geographic arbitrage. Portugal’s got costs slashed by 39% compared to the U.S., with top-notch healthcare and infrastructure. Thailand offers a 60-70% savings rate, living comfy on $1,500 a month. Mexico lets you stretch dollars 50-60% further while staying close to the good ol’ US of A.

Domestic arbitrage is a play too – Tennessee skips state income tax, saving high-earners big bucks. Pick locations with solid internet for remote work flex. Lifestyle optimization? It’s buying experiences over stuff. Travel hackers? They’re vacationing for pennies on the dollar with credit card rewards, stacking up points for the next great adventure.

Final Thoughts

Ah, financial independence-sounds fancy but let’s break it down. How fast can you get there? Well, that all depends on how much you make and how committed you are to pinching pennies. If you’re pulling in $50,000 a year, you’re looking at a 15-20 year haul assuming you’re stashing away 50% of that. But hey, if you’re fortunate enough to rake in $150,000+, you could shave that timeline down to 8-12 years if you live judiciously and pump up your investment contributions to the max.

So, what should you do-right now? Start by nailing down your exact financial independence (FI) number using the 25x rule. Next, get yourself a high-yield savings account for that rainy day fund. Then, go ahead and automate your investments into low-cost index funds… make it mindless. Keep an eye on your progress every month, maybe with tools like Personal Capital or Mint. You’re just watching numbers climb-your net worth going up, your expenses becoming clearer. It’s pretty straightforward math, but boy, does it take discipline. Every dollar that goes into savings or investments? It grows and grows.

Think a little outside the box: geographic arbitrage. Move where your dollar stretches further and bam-your timeline gets a chop. Get a side hustle going to really juice up that wealth growth fast. We at Top Wealth Guide are here to champion your journey with solid market insights and smart investment strategies. Let’s be clear-your financial independence isn’t a dream. It’s a planned reality, as long as you stick to the plan and keep hustling.

![Your Roadmap to Financial Independence [Guide] Your Roadmap to Financial Independence [Guide]](https://topwealthguide.com/wp-content/uploads/emplibot/financial-independence-hero-1765156304-1024x585.jpeg)