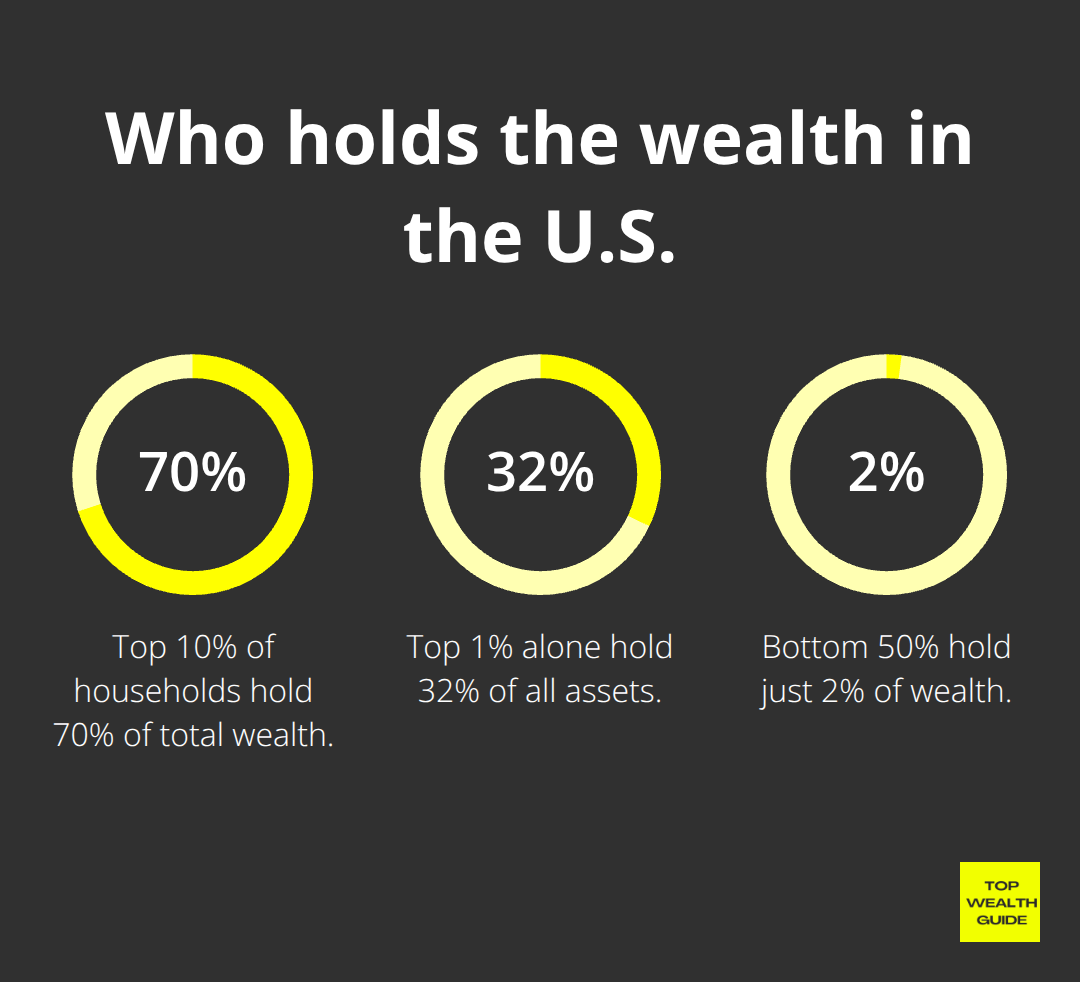

Wealth inequality in America — it’s off the charts, folks. The top 1%? They’ve got their hands on 32% of all wealth. Meanwhile, the bottom 50% are just scraping by with a measly 2%. That’s… yeah, not good.

But here’s the thing — it’s not set in stone. The team at Top Wealth Guide (that’s us) is all about the idea that smart moves and savvy strategies can help you climb that wealth ladder, no matter where you’re starting from.

In this guide, we dive into what’s really causing this gap to widen, and, more importantly, we lay out some practical steps you can take to boost your financial health. Let’s get to it.

In This Guide

What Forces Drive Wealth Gaps Wider

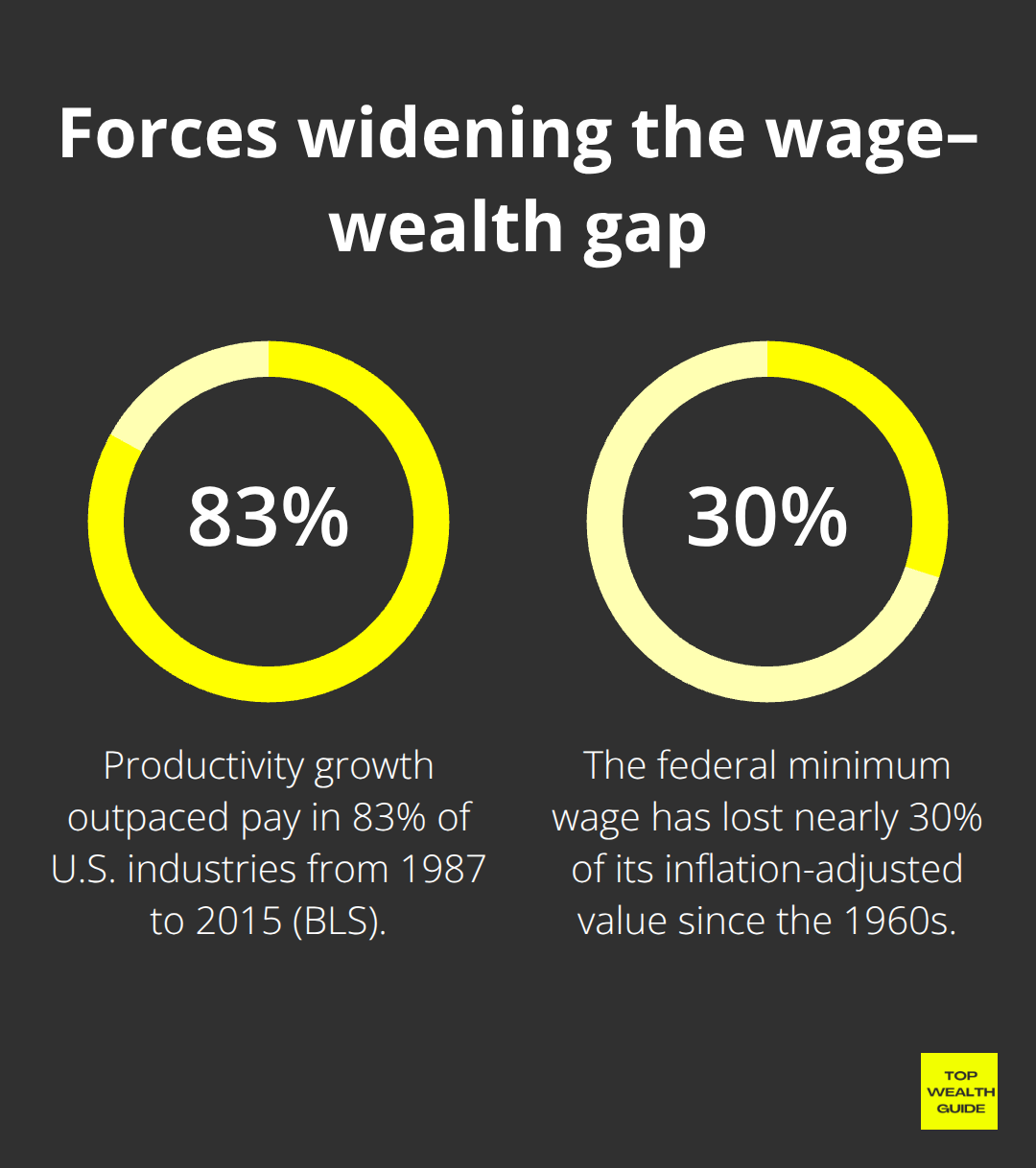

Alright, here’s the deal. Wealth inequality isn’t just a one-hit wonder. It’s more like a three-album series of hits tearing through the middle class. First up – wages… haven’t moved an inch despite productivity shooting through the roof. According to our friends at the Bureau of Labor Statistics, from ’87 to ’15, productivity growth outpaced pay in 83% of industries. Workers get more efficient, companies pile up the profits, and… wait for it… paychecks? They’re snoozing.

And then there’s the federal minimum wage. Compared to the 1960s, it’s lost nearly 30% of its oomph adjusted for inflation. Meanwhile, CEO compensation-in the stratosphere-peaked with a ratio of 386-to-1 back in 2000. These stagnant wages hit hardest at the bottom while exec pay goes… to the moon.

Asset Ownership Creates the Real Divide

Now, let’s chat about assets. Stock market gains and real estate appreciation? They’re a nice party-but only for those who already RSVP’d. The S&P 500 jumps 10%, someone’s $100K investment nets them $10K. Zero investments? Zero gains. Federal Reserve data drops the bombshell: top 10% owns 89% of all stocks and mutual funds.

Home prices? Surging way faster than wages in most metro areas. First-time buyers can’t compete, while current homeowners enjoy the ride. Asset inflation is like the ultimate wealth gap magic trick (and it’s hands-free-no effort needed from owners).

Skills Premium Leaves Workers Behind

Education-you guessed it, it plays a huge part here. The college premium shows wages linked tight to education levels. Tech eliminates middle-skill jobs, opening doors only for those with higher-level skills. Union membership took a nosedive from 30%+ to around 12%, stripping away what once helped even out pay scales.

Today, companies are pouring their money into stock buybacks-over worker investment. They shell out billions for repurchases while skimping on training or wage boosts. Workers without specific skills get stuck in wage quicksand. Meanwhile, specialists with sought-after expertise? They cash in on premium salaries.

These three forces are the trifecta of wealth concentration at the top, no doubt. But within these diagrams, you can spot some intriguing tactics to build wealth-even when swimming against the current.

Where Does All the Wealth Actually Go

Let’s roll up our sleeves and dig into the numbers. It’s like a financial horror story. Federal Reserve data throws us a cold, hard truth: the top 10% of households? Yeah, they’re hoarding 70% of the wealth. Meanwhile, the bottom 50%? A measly 2%.

And get this – within that top chunk, the wealthiest 1% grabs a whopping 32% of all assets. So, in plain English: three families in every 100 have more wealth than the bottom 50 million households combined. Mind-boggling, right?

The Geography of Wealth Concentration

But wait, there’s more. It’s not just about fat wallets – it’s zip codes. Geography plays a sneaky role in your financial destiny. Take San Francisco Bay Area, where median household wealth is a cool $280,000. Head over to Detroit? Whoa, it drops to $18,000. Manhattan’s Upper East Side? More millionaires per square mile than states like Wyoming or Vermont. These disparities? They create so-called wealth deserts. Think communities cut off from the magic circle of asset growth, quality schools, and killer business networks.

Inheritance Amplifies the Wealth Gap

Generational wealth. It’s not just a buzzword. It’s a turbocharger for inequality. Over the next 25 years, wealthy families will hand over $100 trillion. Pretty slick if you’re on the receiving end – think college paid off, home down payments, startup funds. For others? Debt and stress are the family heirlooms. Federal Reserve says households with inheritances have median wealth of $285,000 against $54,000 for those who don’t. It’s like winning a lottery you didn’t even know you had a ticket for – except it keeps the family tree standing tall while others struggle to sprout.

Asset Ownership Drives the Real Divide

Here’s the kicker: owning assets? It’s the real game-changer. When markets go up, owners cash in. S&P 500 rises 10%? That $100K in stocks turns into $110K. No stocks? No gains. Federal Reserve data shows the top 10% own a staggering 89% of all stocks and mutual funds. Home prices climb and wages? Yeah, they crawl. First-time buyers get left in the dust while homeowners coast along. Asset inflation is like a magician’s trick for the rich – no sweat, just watch the gains multiply.

This wealth concentration? It exposes a silver lining: opportunities for strategic asset accumulation. Yes, even if you’re starting from scratch.

How Can You Actually Build Wealth Despite the Odds

The wealth gap? Feels like the Grand Canyon, right? But guess what – a few savvy moves and you’re in the game. Let’s talk diversification: Rideshare drivers snag $15-25 an hour during peak times (yeah, that’s per hour). Freelancers? Anywhere from $25 to $75 based on their chops. And here’s one for you – online tutors grab $20-80 hourly. Those Uber pros who hustle during surge hours? They can rake in $1,200-2,000 monthly for part-time. Amazon FBA wizards who really nail the product research knock out $2,000-5,000 monthly after year one. The gig economy hit $400 billion in 2023 – chew on that. Freelancers, per Upwork, pocket 36% more than your average Joe with a nine-to-five when you stack their hourly rates.

Start Your Investment Journey Today

Listen, you don’t need a big bankroll to dive in. Fractional shares from M1 Finance or Charles Schwab have you picking up pieces of pricey stocks for just a buck. Index funds like VTSAX have been the tortoise in the race, delivering solid returns over the decades, transforming $100 monthly into a small fortune over 30 years through the magic of compounding. High-yield savings accounts are doing 4-5% APY these days (Marcus by Goldman Sachs and Ally Bank lead the pack). Think target-date funds-they intelligently downshift risk as you age, all on autopilot. Real Estate Investment Trusts give you a slice of the property pie sans hefty down payments, and Realty Income? They’ve been dishing out dividends for 54 years straight.

Build Financial Skills Through Practice

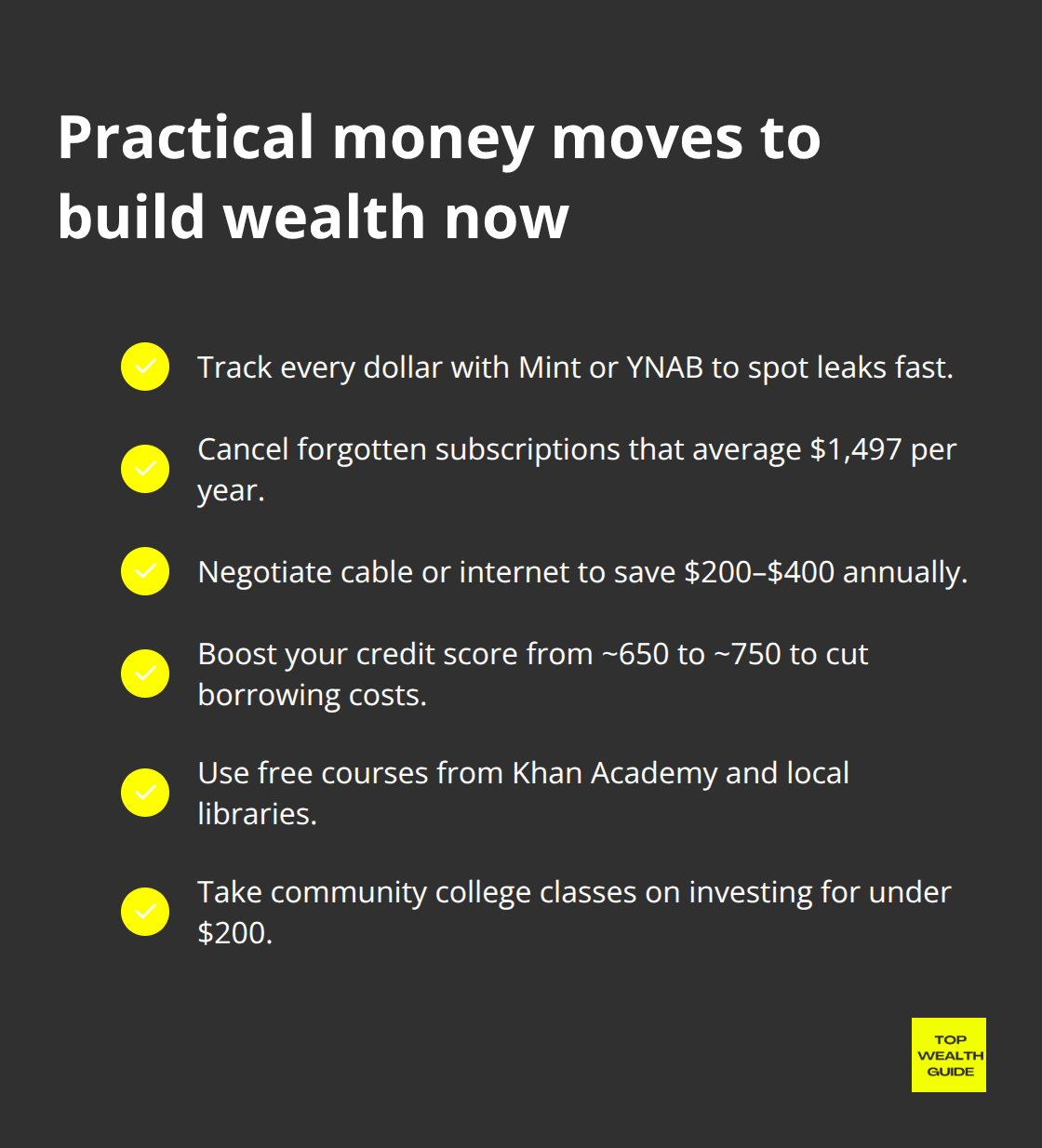

Financial literacy isn’t about reading dusty textbooks – it’s street smarts. Get real by tracking where every penny goes with Mint or YNAB, you’ll quickly see where you’re bleeding cash. The average American blows $1,497 a year just on sneaky subscriptions they forget. Give your cable company a ring – negotiate those fees – it’s a $200-400 save annually in your pocket. Flip your credit score from 650 to 750, and bam! You’ve saved $50,000 on a $300,000 mortgage. Khan Academy tosses out personal finance courses gratis, and libraries give you the keys to premium financial education resources.

Community colleges? A steal for investment basics, usually under $200 a pop.

Automate Your Wealth Growth

Robo-advisors like Betterment? They charge a mere 0.25% annually, handling portfolio management on autopilot. Set those auto-transfers from checking to investment – $50 a month? It seriously adds up. Dollar-cost averaging – that’s your steady hand in a fickle market, building up that bank. Stash emergency funds in high-yield accounts, they’re your first line against surprise expenses. Tax-advantaged accounts like 401(k)s and IRAs are the jackpot, leveraging tax deferrals and those juicy employer matches to grow your wealth like clockwork. Zero in on creating scalable income streams – they’ll shower you with passive returns as time marches on.

Final Thoughts

Alright, let’s get real-those wealth gaps in America? Not a quick fix. But hey, your financial future doesn’t need to sit around waiting for the system to catch up. Dive into the basics: spread out your income streams with side gigs and hustle, set up those investments on autopilot with fractional shares and index funds, and stash away some emergency cash in those juicy high-yield accounts. Trust me, these little steps snowball into big, hefty gains over time.

Here’s the kicker – the stats aren’t pretty. The top 1%? They cling to 32% of wealth, while half of Americans are hanging onto a measly 2%. Location and legacy? They just crank up these disparities. But here’s the twist-there’s a silver lining for the savvy ones out there. Get strategic, let technology be your friend, and you’ve got a fighting chance (hello, robo-advisors making investment management accessible for just 0.25% annually).

Your wealth journey kicks off with that very next choice. Whether you hit that button to open an investment account, kickstart that side gig, or even break down your spending habits-moving forward is always your winning play. Swing by Top Wealth Guide to scoop up more strategies that turn savvy financial knowledge into enduring wealth.