Your day job pays you once a month. Rental properties pay you every single month, year after year, without you showing up to an office. At Top Wealth Guide, we’ve seen firsthand how passive income sources from real estate outpace traditional employment over time.

The math is simple: while your salary might grow 3% annually, rental income compounds through property appreciation, equity buildup, and reinvestment. This guide shows you exactly how to make it happen.

In This Guide

How Rental Income Wins Against Your Paycheck

Cash Flow That Never Stops

A $300,000 rental property that generates $24,000 in annual rent produces roughly $3,400 in cash flow after a typical 40% operating expense ratio and mortgage payments. That $3,400 hits your account every year while you sleep. Your W-2 salary, by contrast, stops the moment you stop working. The real advantage emerges over time: rental income compounds through three mechanisms your employer never offers.

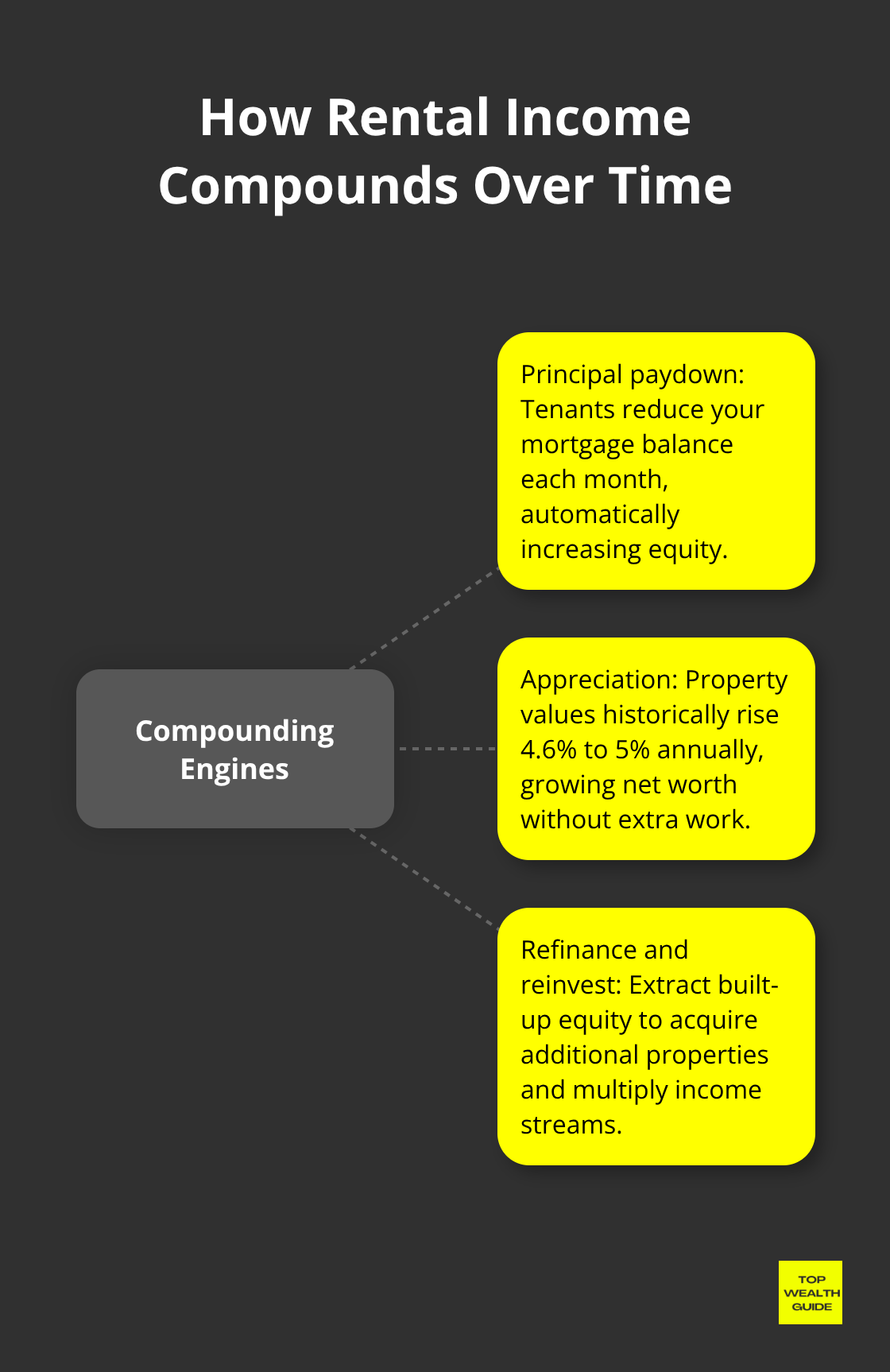

First, tenants pay down your mortgage principal each month, building equity automatically. Second, property values historically appreciate at 4.6% to 5% annually, meaning a $300,000 property grows substantially over ten years. Third, you can refinance that equity to buy additional properties, multiplying your income streams without proportional effort increases.

The Compounding Power of Real Estate

A W-2 employee earning $75,000 sees salary growth averaging 2-3% per year, reaching maybe $98,000 after a decade. A landlord with that same $300,000 property plus two additional acquisitions funded through equity pulls $10,000+ monthly in combined cash flow-tax-advantaged income that compounds faster than any promotion ever could. The difference accelerates dramatically when you factor in property appreciation rates alongside cash flow management.

Deductions That W-2 Employees Never Access

Landlords access deductions W-2 employees never see. You write off mortgage interest, property taxes, insurance, maintenance, repairs, and depreciation deductions. A W-2 employee with the same income gets a standard deduction around $14,600 in 2026 and that’s it.

The True Value of Tax-Advantaged Income

Research comparing rental income to W-2 wages suggests $1 of rental cash flow is worth approximately $1.40-$1.60 in W-2 wages when accounting for tax advantages (though your specific situation depends on tax bracket and state taxes). A landlord earning $36,000 in annual cash flow from three properties might only owe taxes on $20,000 of that due to deductions, while a W-2 employee earning $56,000 pays full income tax on every dollar. This advantage accelerates wealth building substantially and compounds over decades, turning modest rental income into genuine wealth.

The question isn’t whether rental income outpaces your paycheck-the math proves it does. The real question is how to acquire that first property without substantial capital, which is where most aspiring landlords get stuck.

Getting Your First Rental Property When Cash Is Tight

Start With Properties That Work on Paper

The biggest myth about real estate investing is that you need $100,000 sitting in a bank account to start. You don’t. Most successful landlords started with conventional financing that required just 20% down, not 50%. A $250,000 property needs $50,000 down, which is achievable through savings, a home equity line of credit, or a partner.

The real skill is finding properties where the numbers work before you even make an offer. Most beginners buy properties and hope the rent covers expenses. That’s backwards. You analyze the deal first, then buy only if cash flow is positive from day one.

Start by looking at properties priced $150,000 to $350,000 in markets with job growth and population inflows. These price points generate monthly cash flow of $300 to $800 after all expenses, which is where beginners build momentum. Run the math on at least 20 properties in your target market before making an offer on any single deal. This forces you to recognize patterns and avoid overpaying.

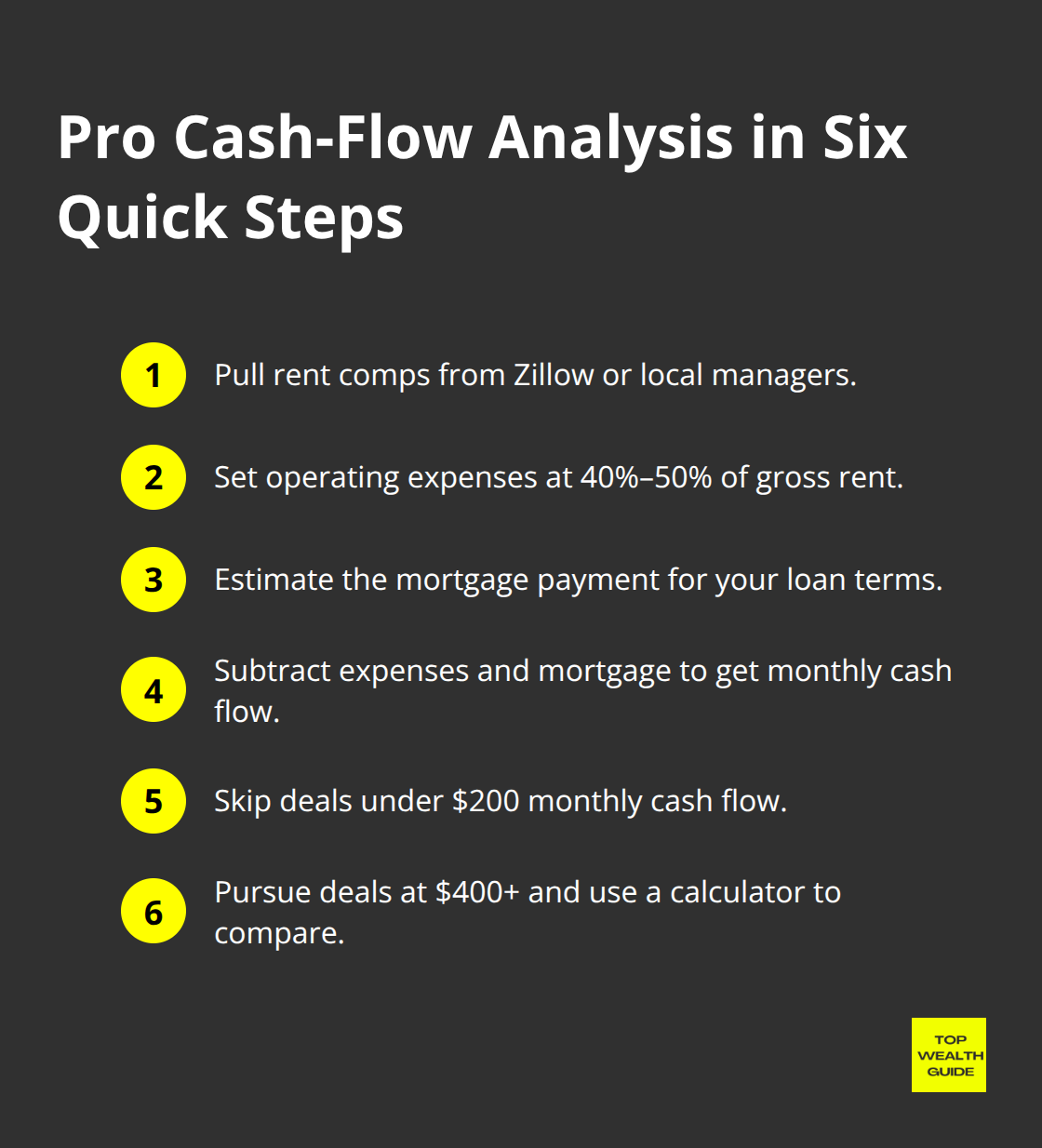

Calculate Cash Flow Like a Professional

Use Zillow rental comps or local property management firms to estimate monthly rent for comparable units. Then calculate operating expenses at 40% to 50% of gross rent, which covers property taxes, insurance, maintenance, vacancy, and management fees. Subtract your estimated mortgage payment and you have your monthly cash flow.

If cash flow is under $200 monthly, skip the deal. If it’s $400 or higher, move forward with due diligence. This discipline separates profitable landlords from those who struggle to cover expenses. An investment property calculator can streamline this analysis and help you compare multiple deals quickly.

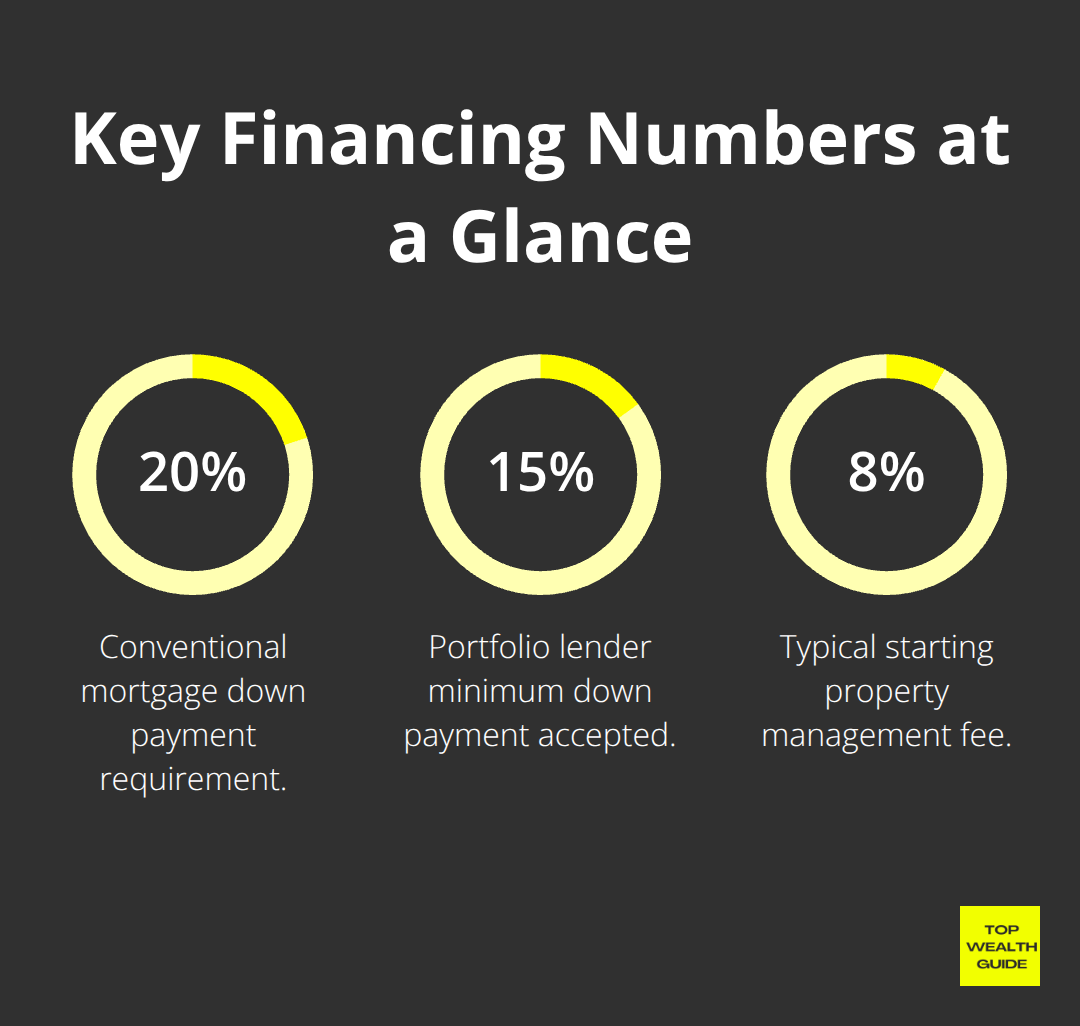

Choose the Right Financing Path

Conventional bank mortgages work if your credit score is 720 or higher and you have 20% down. Expect rates around 6.5% to 7.5% and a 30-year term. Portfolio lenders, which hold loans in-house instead of selling them, often approve borrowers with 680 credit scores and accept 15% down, though rates run 0.5% to 1.5% higher. Private lenders charge 8% to 12% but fund in weeks and care less about credit scores.

House hacking accelerates your first deal dramatically. Buy a duplex, triplex, or fourplex under FHA financing with just 3.5% down, live in one unit, and rent the others. Your tenants cover most or all of your mortgage while you build equity and experience. After 12 months of owner-occupancy, you can convert to a rental and move to your next deal. One investor in New York bought a $465,000 duplex with 5% down and the other unit’s rent covered the entire mortgage, essentially living for free while accumulating equity. This is the fastest path to a second property.

Protect Your Profits Through Tenant Selection and Maintenance

Once you own the property, protect your profits through ruthless tenant screening and preventative maintenance. Run background checks through services like Checkr or Landlord.com, verify income at three times the monthly rent, and call previous landlords directly. Bad tenants destroy cash flow faster than any market downturn. A single eviction costs $5,000 to $15,000 in legal fees and lost rent, wiping out years of cash flow.

Preventative maintenance on the property itself matters equally. Budget 1% of the property value annually for repairs and maintenance. A $250,000 property needs $2,500 per year set aside for roof repairs, HVAC maintenance, and plumbing issues. This discipline prevents small problems from becoming $10,000 emergencies that force you to deplete reserves.

Decide Between Self-Management and Professional Help

If you manage the property yourself, expect 5 to 10 hours monthly on rent collection, tenant communication, and vendor coordination. If that sounds exhausting, hire a professional manager at 8% to 12% of rent. The fee cuts into cash flow but preserves your sanity and protects your investment from amateur mistakes.

Once your first property generates consistent cash flow, you face a choice: reinvest that income into additional properties or hold and wait. The landlords who build portfolios fastest choose reinvestment, using their monthly cash flow plus equity to acquire a second property within 18 to 24 months. Learning proven real estate investment strategies helps you scale faster and avoid costly mistakes.

Scaling From One Property to a Portfolio

Your first rental property produces cash flow. Now the real wealth building starts. Most landlords with one property stay stuck there, treating real estate as a side hobby rather than a wealth engine. The ones who build portfolios of five, ten, or twenty properties make a deliberate choice to reinvest aggressively and systematically. The difference between a landlord with one property earning $400 monthly and one with ten properties earning $4,000 monthly isn’t luck or access to special financing. It’s a documented strategy of capturing cash flow, deploying it strategically, and building systems to manage complexity without burning out.

Reinvest Cash Flow Into Your Second Property

Your monthly cash flow from that first property is your most valuable asset in portfolio scaling. A $250,000 property that generates $400 monthly cash flow produces $4,800 annually, which most landlords waste on lifestyle spending. Instead, funnel that $4,800 into a dedicated investment account and combine it with equity from your first property to fund acquisition number two within 18 to 24 months. One investor in New York scaled to ten rental units over a decade through reinvesting every dollar of cash flow and refinancing appreciated properties to extract equity for down payments on new acquisitions. This strategy compounds aggressively because each new property’s cash flow accelerates the timeline for property number three, four, and five. After three properties that generate $1,200 combined monthly cash flow, you can acquire a fourth property within 12 months using that cash flow plus equity refinancing. The math accelerates exponentially from that point forward.

Extract Equity Through Strategic Refinancing

Property appreciation is real. Homes historically appreciate 4.6% to 5% annually according to long-term housing market data. A $300,000 property purchased today worth $360,000 in four years has built $60,000 in equity. That equity sits dormant unless you extract it strategically through a cash-out refinance. A cash-out refinance lets you borrow against that appreciation at current mortgage rates, typically 6.5% to 7.5%, and deploy that capital as a down payment on a second or third property. The key is refinancing when rates drop or when property values surge enough to justify the transaction costs. If you refinance that $300,000 property now worth $360,000, you might pull out $40,000 to $50,000 in cash after accounting for closing costs and maintaining adequate equity cushion. That $40,000 becomes your down payment on a $200,000 property, which generates its own cash flow and appreciation. The original property continues producing cash flow and appreciating while the new property does the same. This is how portfolios scale faster than most people’s primary income grows.

Hire Professional Managers to Scale Without Burnout

Beyond three properties, self-management becomes unsustainable unless you want to spend weekends handling tenant disputes and repair calls. Professional property management fees of 8% to 12% of gross rent feel expensive until you calculate the alternative cost of your time and the mistakes amateur management creates. A single eviction costs $5,000 to $15,000 and destroys months of cash flow. A missed maintenance issue that becomes a major repair costs $10,000 or more. Professional managers use screening software, coordinate maintenance vendors, handle tenant communication, and manage legal compliance consistently across all your properties. They also collect rent reliably, which matters when you own five properties that generate combined monthly revenue of $5,000 or more. The property management fee is a business expense that scales your portfolio without scaling your stress proportionally. Successful landlords with ten or more properties almost universally use professional managers and often use the same firm across multiple properties to create consistency and leverage in vendor negotiations.

Build Systems to Operate Like a Business

Systematizing your operations matters equally. Use accounting software like QuickBooks or Landlord Studio to track income and expenses for each property separately, which is essential for tax planning and identifying underperforming assets. Create standardized lease agreements, maintenance request forms, and tenant communication templates so you operate consistently across properties. Store documents digitally in a shared system accessible to your property manager and accountant. Document everything because disputes with tenants, insurance claims, or tax audits require documented proof of income, expenses, and maintenance decisions. The landlords who scale successfully treat their portfolio like a business with documented processes, not a collection of random properties managed ad hoc. This operational discipline transforms real estate from a side project into a genuine wealth-building machine that produces income month after month without proportional increases in your effort.

Final Thoughts

Rental income builds wealth faster than paychecks because it compounds through three simultaneous mechanisms your employer never offers: monthly cash flow, property appreciation, and equity extraction. A W-2 employee earning $75,000 annually reaches maybe $98,000 after a decade, while a landlord with three properties generating $1,200 combined monthly cash flow pulls $14,400 yearly in tax-advantaged passive income sources that compound into substantially larger wealth over the same period. The math is documented and repeatable across thousands of investors who started exactly where you are now.

Most landlords derail themselves through preventable mistakes: they overpay for properties through emotional buying instead of mathematical analysis, they underestimate operating expenses and get blindsided by vacancy or maintenance costs, they fail to screen tenants rigorously and face evictions that cost $5,000 to $15,000, they self-manage beyond three properties and burn out, or they refinance at the wrong time and extract too much equity. Avoiding these mistakes requires discipline-analyze at least 20 properties before buying your first one, budget conservatively for expenses, screen tenants ruthlessly, hire professional managers at property three, and refinance strategically only when the math clearly supports it.

Your timeline to financial independence through real estate depends on your starting capital and market selection, but the pattern holds consistently across disciplined investors. We at Top Wealth Guide have documented this progression across hundreds of investors, and the timeline accelerates when you systematize operations and reinvest aggressively. Start now with your first property, execute the strategy consistently, and let compounding do the heavy lifting.