Most people never build real wealth because they make the same preventable mistakes in their twenties and thirties. At Top Wealth Guide, we’ve identified the psychological barriers and financial missteps that derail wealth building before it starts.

This post breaks down exactly what goes wrong and how to fix it. You’ll learn the actionable strategies that separate people who build long-term wealth from those who stay stuck.

In This Guide

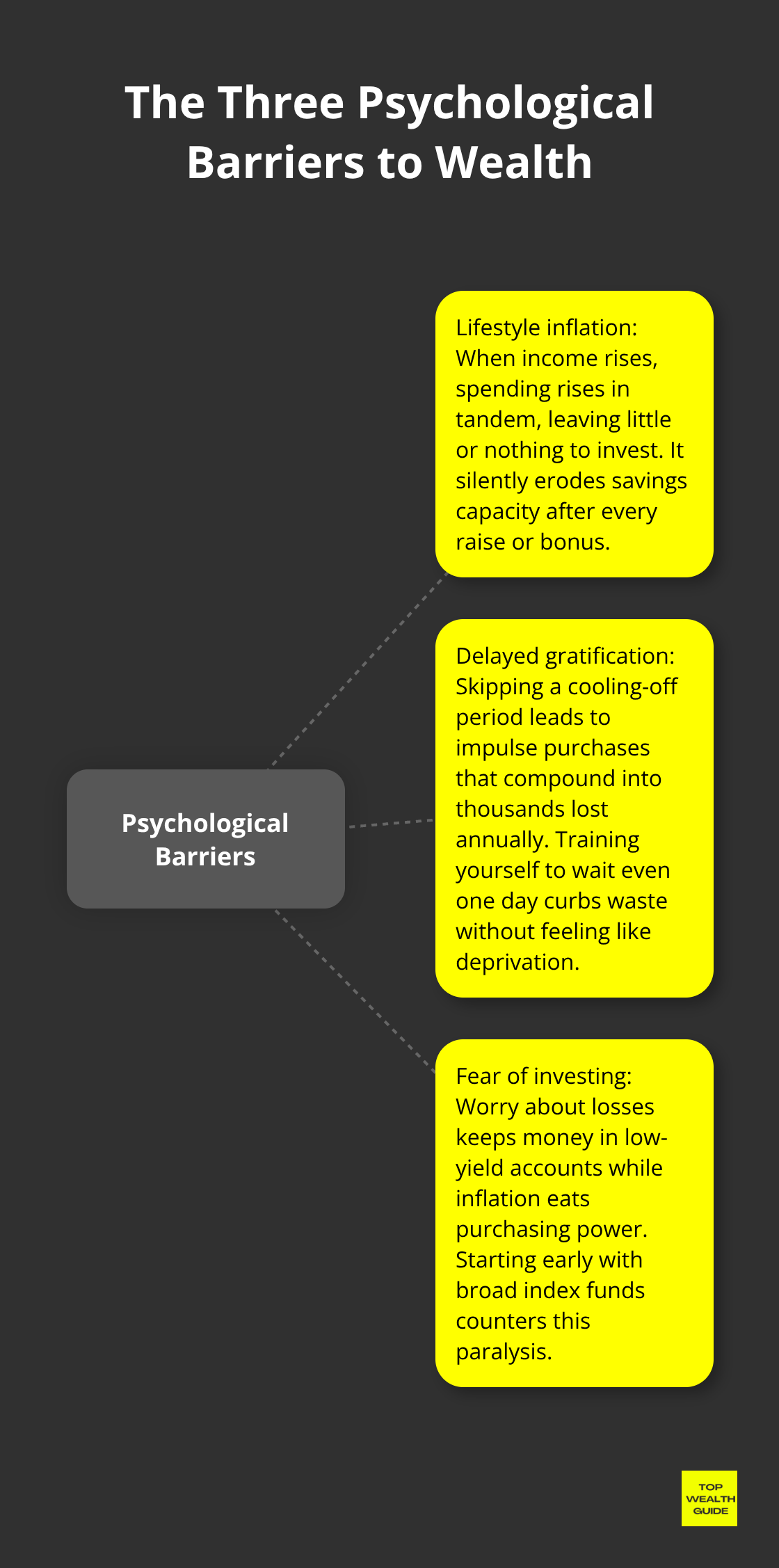

Why Your Brain Sabotages Your Wealth Before You Realize It

Lifestyle Inflation Eats Your Raises

The real enemy of wealth building isn’t market crashes or economic recessions. It’s what happens inside your head the moment you receive a raise or bonus. Lifestyle inflation destroys wealth faster than most people can build it. When your income increases, expenses rise proportionally, leaving nothing extra to invest or save.

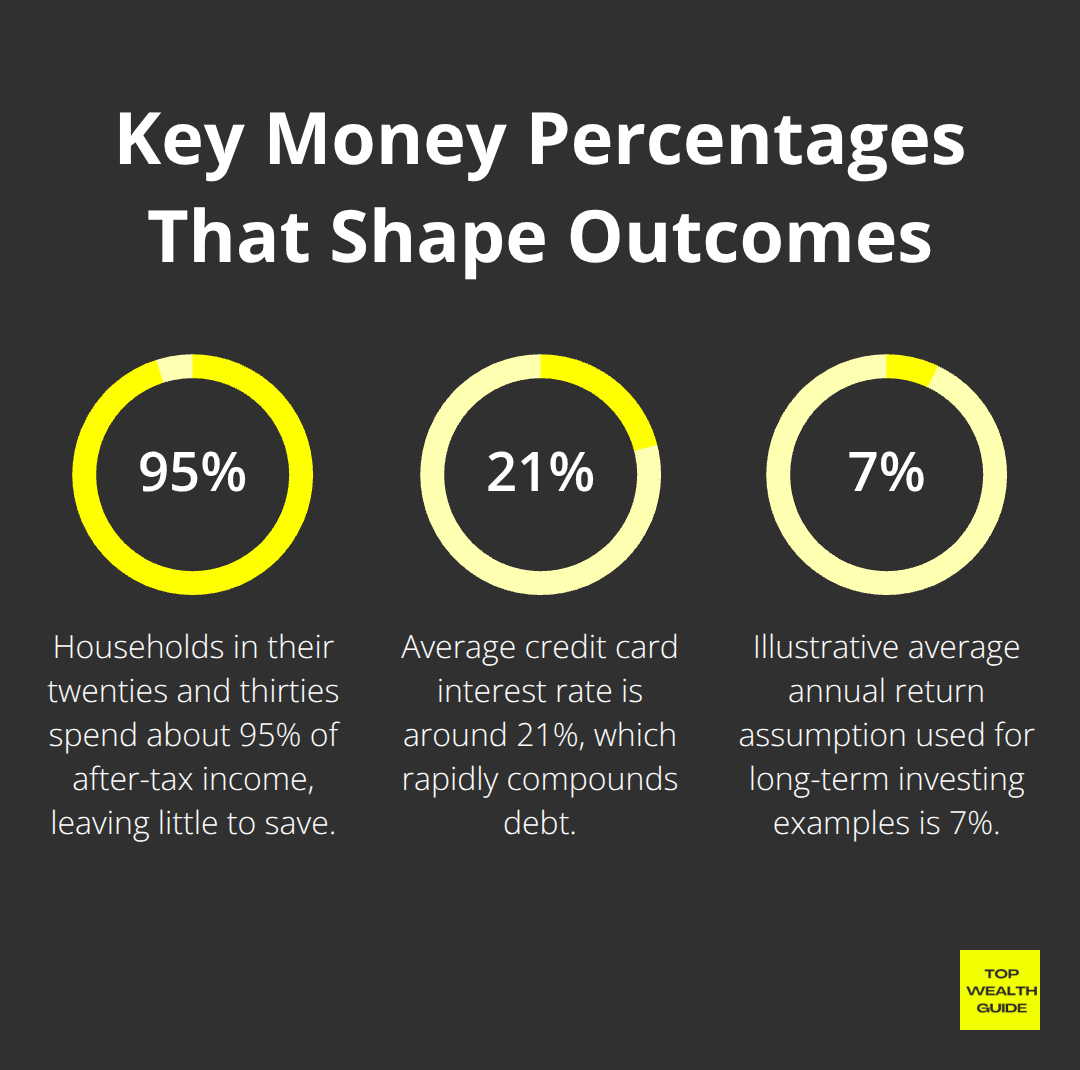

Research from the Urban Institute’s study on wealth building among young Americans shows that even people earning modest incomes can build substantial wealth when they stay disciplined with spending. Most people don’t. A 2023 Bureau of Labor Statistics report found that households in their twenties and thirties spend approximately 95% of their after-tax income, leaving almost nothing for wealth accumulation. The gap between income growth and spending growth is where wealth building dies.

If you received a 10% raise last year, your savings rate should have increased by at least 7–8% of that raise. If it didn’t, lifestyle inflation already has you trapped.

The Paralysis of Delayed Gratification

The second psychological barrier is far more insidious: the inability to delay gratification. Financial discipline isn’t about being cheap or miserable. It’s about making conscious trade-offs between what you want today and what you want in five years.

Young adults who delay major purchases reduce impulse spending, according to consumer behavior research. Most people skip this step entirely. They see something, want it, and buy it. This pattern compounds into thousands of dollars lost annually. A simple practice-waiting one day before any non-essential purchase-transforms your financial trajectory without requiring sacrifice.

Fear Keeps You Broke

The third barrier stops people cold: fear and paralysis around money decisions. Many young adults avoid investing because they’re terrified of losing money. This fear is rational but ultimately counterproductive.

Someone who invested $100 monthly in a broad index fund starting at age 25 would have approximately $185,000 at age 55, assuming a 7% average annual return. Someone who waited until age 35 to start the same investment would have only $85,000. That ten-year delay costs $100,000 in compound growth. Fear keeps people in savings accounts earning 0.5% interest while inflation erodes their purchasing power at 3–4% annually.

These three barriers work together to create a wealth-building vacuum. Lifestyle inflation consumes your income, lack of discipline prevents you from fighting back, and fear keeps you from taking the actions that actually build wealth. Understanding these obstacles is the first step-but knowing what goes wrong is only half the battle.

The real damage happens when you make specific financial mistakes that compound these psychological barriers into permanent wealth gaps.

The Three Money Mistakes That Cost You Decades

The psychological barriers we discussed create the conditions for financial failure, but specific money mistakes transform those barriers into permanent wealth gaps. These aren’t theoretical problems-they’re concrete decisions that young people make repeatedly, and each one costs thousands or tens of thousands of dollars over a lifetime.

Waiting Too Long to Invest Erases $100,000 in Wealth

The first and most expensive mistake is waiting too long to invest. Someone who starts investing at 25 with $100 monthly contributions reaches approximately $185,000 at age 55 with a 7% average annual return. Someone who waits until age 35 to begin the same investment ends up with roughly $85,000.

That ten-year delay erases $100,000 in wealth-money you can never get back. The mathematics of compound growth punishes hesitation brutally.

Most people believe they need a large sum to start investing, but this is completely wrong. How to invest with little money shows that consistent small contributions outperform sporadic large ones because regular investing captures market movements across all price points. Starting with $50 monthly at age 25 beats starting with $500 monthly at age 35 almost every single time. Yet the average person in their twenties has zero retirement savings and no investment account whatsoever.

Emergency Funds Prevent Debt Spirals

The second mistake is treating emergency funds as optional. When unexpected expenses hit-a car repair, medical bill, or job loss-people without emergency savings turn to credit cards or payday loans. Emergency funds prevent debt spirals, with research showing that many young adults cannot weather financial emergencies exceeding $400. A single unexpected $1,500 expense can trigger a debt spiral that takes years to escape.

You need a starter emergency fund of $500 to $1,000 immediately, then build toward three to six months of living expenses in a high-yield savings account earning 4–5% annual interest. This isn’t negotiable. Insurance compounds the problem. Young people skip health insurance, auto insurance, or renters insurance to save money monthly, then face catastrophic costs when something goes wrong. A single medical emergency without health insurance can generate $50,000 in debt.

High-Interest Debt Destroys Wealth Faster Than You Build It

The third mistake is allowing high-interest debt to exist unchecked. High-interest debt destroys wealth faster than any other financial decision, with the average credit card interest rate at 21%. If you carry a $5,000 credit card balance at 21% interest while making only minimum payments, you’ll spend over $8,000 total and take more than five years to pay it off. The solution is ruthless: pay off credit card balances in full every month, or stop using credit cards entirely until you develop the discipline.

Build your credit score by using a starter credit card for one small recurring charge like a streaming service, then paying the balance in full monthly. This takes discipline, but discipline is the entire point. These three mistakes work together to trap people in a cycle where their money flows outward through debt and fear rather than inward through investment and growth. The good news is that fixing these mistakes doesn’t require a six-figure income or perfect market timing-it requires specific actions that you can implement this week.

How to Actually Start Building Wealth This Week

Automate Your Path to Wealth

The psychological barriers and money mistakes we’ve covered explain why most people fail at wealth building, but understanding the problem doesn’t solve it. You need a concrete system that removes friction from saving and investing, forces discipline without requiring willpower, and compounds your money over time. The difference between people who build wealth and those who don’t isn’t intelligence or income-it’s whether they’ve automated the right financial behaviors.

Automation is the single most effective wealth-building tool available to you, and it costs nothing to implement. Set up automatic transfers from your checking account to a separate high-yield savings account on the same day you receive your paycheck, before you see the money or spend it. Start with 10% of your after-tax income if that feels manageable, but try to increase this to 20% within six months. A 2024 Federal Reserve report found that households using automatic savings increased their savings rates by an average of 8 percentage points compared to those relying on manual transfers.

Next, automate your retirement contributions through your employer’s 401(k) plan and maximize any company match immediately-this is free money that vanishes if you don’t claim it. If your employer doesn’t offer a plan, open a Roth IRA and set up automatic monthly contributions of at least $100. Research on wealth building demonstrates that automation transforms saving from an act of discipline into an invisible habit that compounds for decades.

Build a Budget That Actually Works

Your budget should reflect your actual spending patterns, not theoretical ideals. Track every dollar for 30 days using a budgeting app like YNAB or even a simple spreadsheet, categorizing expenses as needs, wants, and savings. Most people discover they waste 15–25% of income on subscriptions they forgot about, food delivery fees, and impulse purchases they don’t remember making.

Apply the 50/30/20 rule as a starting framework: 50% of after-tax income for necessities like rent and food, 30% for discretionary spending, and 20% for savings and debt repayment. If 20% feels impossible, start with 5–10% and increase by one percentage point each month until you reach 20%. The difference between a realistic budget you’ll actually follow and an aggressive budget you’ll abandon after two weeks is the difference between building wealth and staying broke.

Create Multiple Income Streams

Diversifying your income prevents the wealth-building trap where your entire financial future depends on a single employer. Start a side project that generates $200–500 monthly-freelance writing, virtual assistance, or selling digital products on platforms like Gumroad require minimal startup capital and scale without your direct time investment once established. One side income stream earning $300 monthly equals $3,600 annually, which invested at age 25 grows to approximately $11,000 at age 55 with a 7% return.

That single decision compounds into generational wealth. Invest this additional income aggressively into a diversified portfolio of low-cost index funds and ETFs rather than keeping it as cash. A three-fund portfolio consisting of a total stock market index fund, an international stock index fund, and a bond index fund provides maximum diversification with minimal fees. Vanguard, Fidelity, and Charles Schwab all offer these funds with expense ratios under 0.10% annually.

Avoid individual stock picking unless you have genuine expertise and genuine interest-the data consistently shows that 90% of active investors underperform broad index funds over 15-year periods.

Final Thoughts

The ten-year delay between starting to invest at 25 versus 35 costs you $100,000 in wealth. That’s not theoretical-it’s the mathematical reality of compound growth. Every year you wait, you erase potential wealth that you can never recover, which is why your long-term wealth strategy must start immediately, not when conditions feel perfect.

Your wealth-building journey doesn’t require perfection or a six-figure income. You need three concrete actions this week: automate a transfer of 10% of your after-tax income to a high-yield savings account before you see the money, set up automatic contributions to your employer’s 401(k) or open a Roth IRA with monthly deposits of at least $100, and track your spending for 30 days to identify where you waste money on forgotten subscriptions and impulse purchases. These actions remove the psychological friction that stops most people from building wealth.

The difference between someone who builds $185,000 in retirement wealth at age 55 and someone who builds $85,000 isn’t intelligence or luck-it’s whether they started early and stayed consistent. Top Wealth Guide provides the practical frameworks and step-by-step guidance you need to implement these strategies. Make your first automated transfer today.