Most folks are on this never-ending treadmill, snagging higher salaries and thinking — voilà! — more money equals more wealth. Spoiler alert: this strategy faceplants for a ton of those pulling down six figures but still find themselves in the monthly paycheck hustle. Yep, even with fat paychecks.

Here’s the game-changer — financial education. At Top Wealth Guide, we’ve spotted a bazillion instances of folks with “just okay” earnings stacking up real wealth, all while their high-rolling buddies are still crunching numbers.

The secret sauce? It’s not the digits on your paycheck — it’s what you actually understand (and do) about money.

In This Guide

Why High Earners Stay Broke Despite Big Paychecks

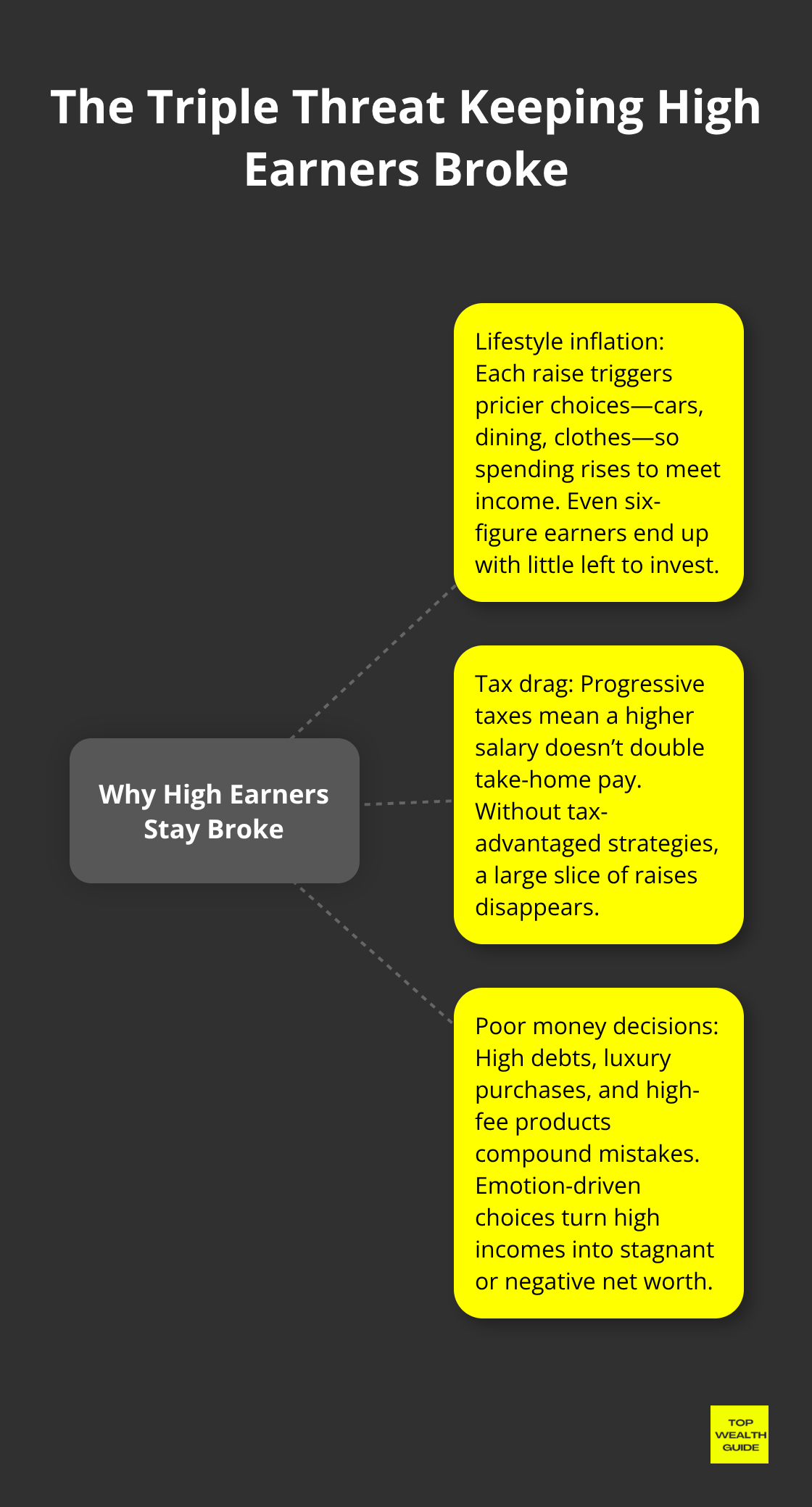

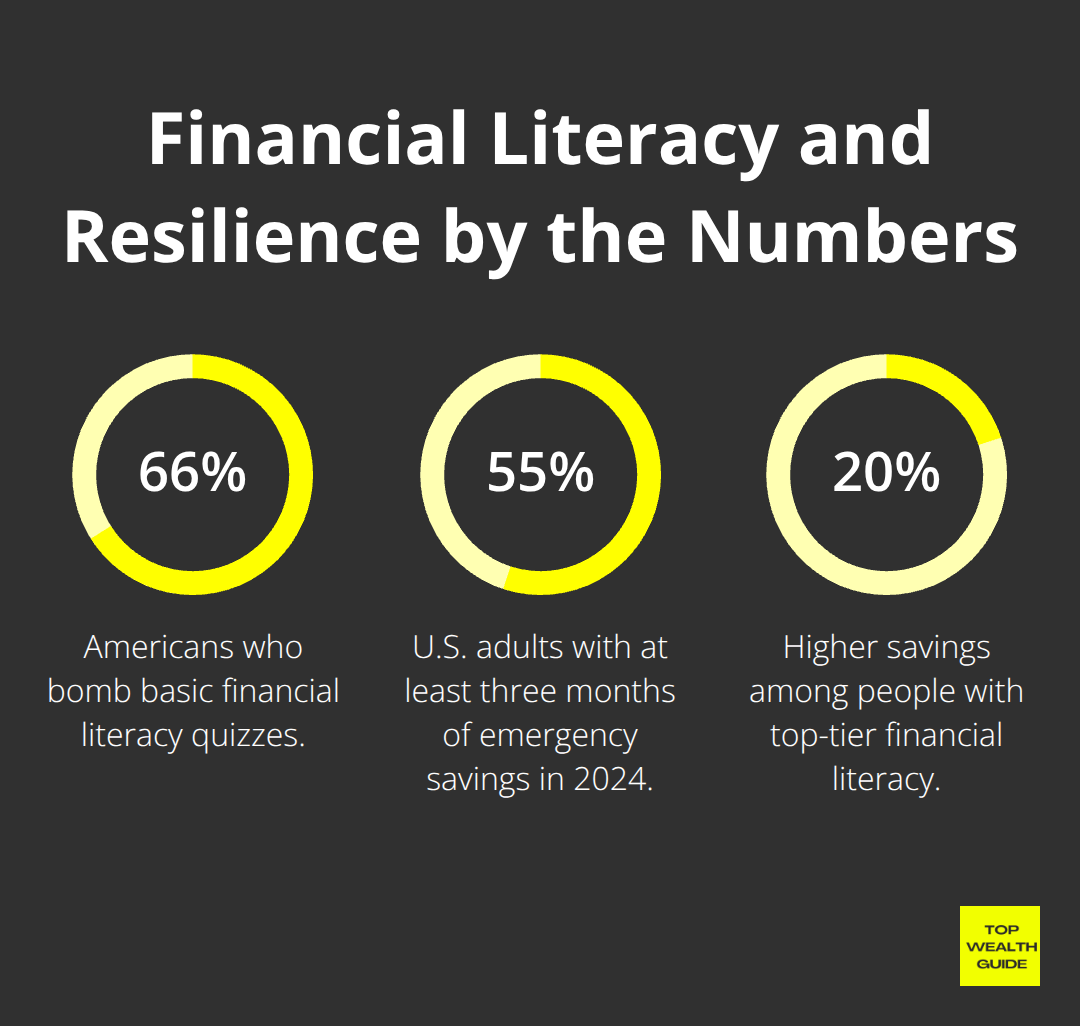

The numbers tell an unvarnished story-29% of lower-income households are living paycheck to paycheck, and that cozy group includes a bunch of six-figure earners. The Financial Industry Regulatory Authority’s data… yeah, it shows 66% of Americans bomb basic financial literacy quizzes-proof that a fat paycheck doesn’t mean you’ve got money smarts. High earners are stuck in a triple threat that keeps ’em spinning their wheels financially, no matter how big their salary.

Lifestyle Inflation Eats Your Raises Faster Than You Earn Them

Every pay bump? It’s an automatic upgrade on the lifestyle scale. That shiny $20,000 raise no longer looks so spiffy when it morphs into a $500 car payment, $200 more in restaurants, and a beefed-up $300 clothing budget. Research has a say here: salary increases averaged a measly 1.7% globally in 2024, yet thumbs-up ratings on compensation are flaccid at 30%. Folks are pulling in $150,000 and somehow spending $145,000, which leaves peanuts for growing any kind of wealth-even when they’re raking in three times the median household income.

Tax Brackets Punish Income Growth Without Wealth Strategy

That dreaded progressive taxation-it’s got high earners cornered, especially if the financial playbook isn’t in their repertoire. Jump from $50,000 to $100,000 and… surprise! Your take-home doesn’t double. Uncle Sam’s got a 22-24% hold on anything over $89,450-and that’s without state taxes taking a cut. High earners watch 35-45% of their bump vanish to taxes-meanwhile, they’re missing out on those juicy tax-advantaged, wealth-building moves that the money savvy are all over.

Poor Money Decisions Multiply With Bigger Paychecks

Here’s the kicker-when financial illiteracy meets big bucks, you’ve got a costly quagmire. High earners are lugging around $80,000 in student loans, financing luxury rides, and blowing too much on swanky digs. They’re chasing pricey financial products, forking over fees to advisors hawking commissioned stuff, making decisions straight from the emotion playbook. Cash education? Nope. Bigger paychecks do nothing but supercharge the bad money habits, turning high incomes into negative net worth, year after year of serious earnings.

The gap is glaring when you look at how the money-literate navigate wealth, no matter what’s coming in the door.

What Makes Financial Education Beat High Income

Financial education – it transforms your money mojo, and the math backs it up. Bigger paychecks? They’re not the golden ticket. Just look at the numbers churned out by the National Endowment. Plenty of folks get blindsided by financial hurdles, but those schooled in the monetary arts? They navigate them like a seasoned pilot. It all clicks when you understand compound interest – Einstein wasn’t joking calling it the eighth wonder. Get this: you earn $40,000, stash away $200 monthly at a 7% return, and boom… $525,000 after 30 years. Meanwhile, someone pulling in $100,000 but waiting ’til their 40s? Needs $800 each month to hit the same mark. Ouch.

Master the Money Multiplication Formula

Compound interest – think snowball barreling downhill. Starts tiny, ends mighty. The S&P 500, with a 10% annual return over 90 years, means every buck you invest doubles roughly every 7 years. Kick things off with $1,000 at 25, do zilch more, and hit $16,000 by retirement. Delay it ’til 35? That grand barely crawls to $6,727. Financial education helps you spot these gems early, automating investments before lifestyle splurges sneak in.

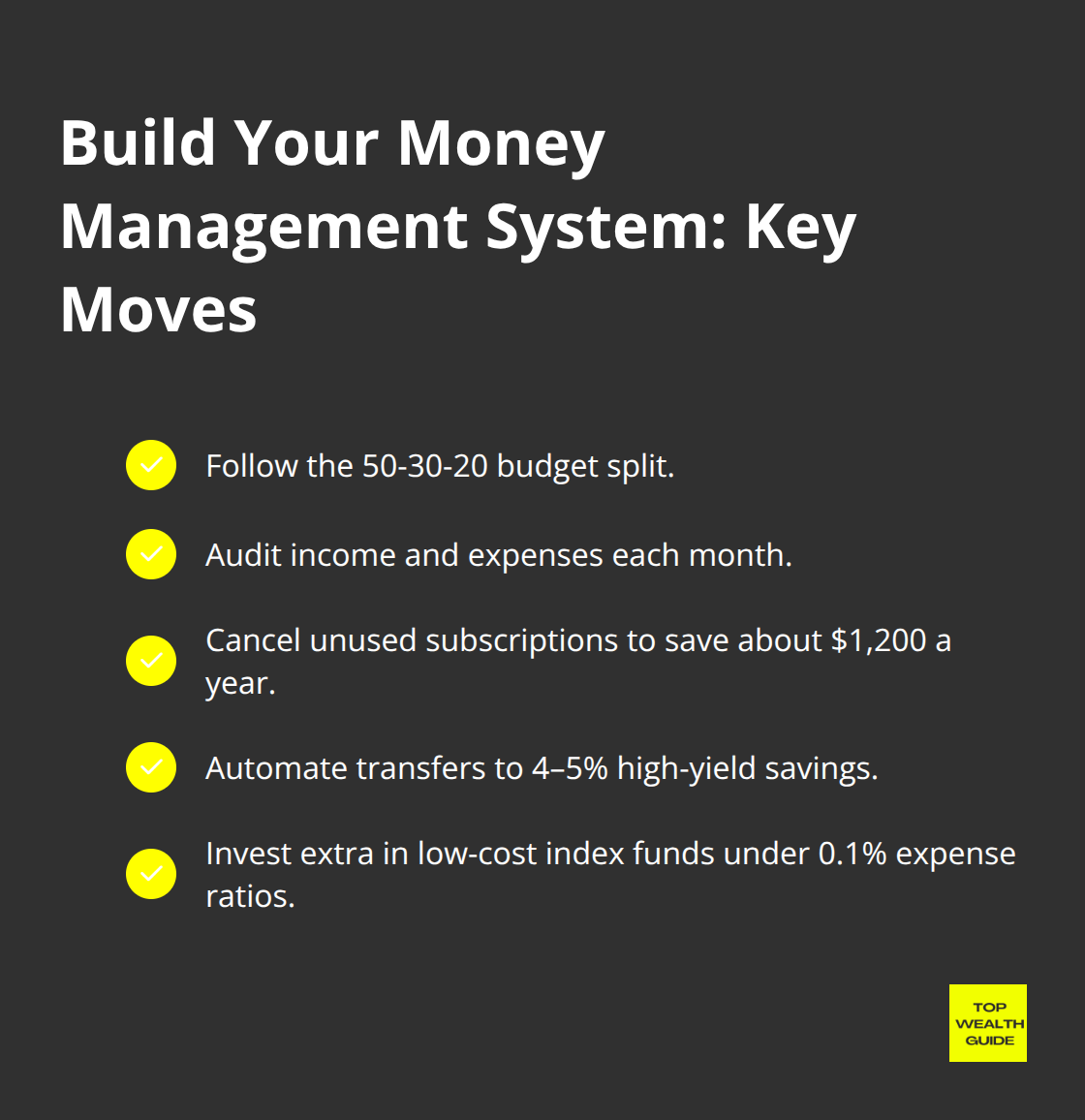

Build Your Money Management System

Wealth builders? They’re devotees of the 50-30-20 creed: 50% needs, 30% wants, 20% savings and debt wipe-out. The Federal Trade Commission says step one is eyeballing what you earn and burn. Most folks fritter away $1,200 a year on forgotten subscriptions (Netflix binges, Spotify marathons, gyms they’ve ghosted). The savvy ones? They automate squirreling cash into high-yield savings at 4-5%, shoveling extra into low-cost index funds with barely-there expense ratios under 0.1%.

This strategy – it trumps the high earners dawdling on the hamster wheel of spend-it-all.

Create Income Beyond Your Job

Financial education lights the path to passive income streams where high earners flounder. Real estate investment trusts shell out 3-8% dividends yearly, companies like Coca-Cola have showered dividends for over 60 years, and peer-to-peer platforms churn out 5-12% returns. The wealthy? They juggle 3-7 income streams while the average Joe clutches a single paycheck. Start tiny… $100 monthly into dividend-paying ETFs, let dividends snowball, and watch compound growth rocket your wealth narrative forward by decades.

These principles of financial education – they carve the true wealth architects from the high earners who end up broke. The proof’s in the pudding: cases where modest earners stockpiled millions, while six-figure big shots tangled with debt.

Who Actually Builds Wealth

Let’s break it down-wealth isn’t just about pulling in a big paycheck. Take Ronald Read, a guy working as a gas station attendant and janitor in Vermont, pulling minimum wage, who left behind a mind-boggling $8 million when he passed in 2014. How? He played the long game by snapping up dividend stocks, letting the earnings snowball over the decades, and living way below his means. Compare that with some fresh stats from the Fed-55% of adults have an emergency stash covering three months’ expenses in 2024. Meanwhile, data from the Organisation for Economic Co-operation and Development says folks with top-notch financial literacy stack up savings 20% more than those stumbling through their finances, regardless of what they’re pulling in.

The Millionaire Janitors and Broke Doctors

Let’s talk Anne Scheiber-an IRS auditor pulling in a paltry $3,150 a year but still amassed a whopping $22 million. Her secret? She picked apart those annual reports, picked up stocks in solid companies, and held on like a bulldog. Then there’s Theodore Johnson from UPS. He banked $70 million after throwing 20% of each paycheck into company stock right from the get-go. Now, flip it and look at doctors: They’re raking in big bucks, with research showing a weighted average of $6,509,474 in median lifetime earnings across all specialties. Yet, they’re often knee-deep in $300,000+ student debt, splurging on the good life, and hitting the investment scene late thanks to all that training.

Education Trumps Salary Every Time

Listen-the Jump$tart Coalition tracked students who got schooled in finance versus those who didn’t. Turns out, previous studies show that spiffing up teachers’ personal finance chops can boost how well they teach these money smarts. Adults earning $35,000 but armed with finance know-how often outpace those pocketing $85,000 without it, in terms of net worth over 20 years. Why? Because they’re savvy-they automate savings, dive into tax-savvy accounts, and dodge those high-fee investments that suck life (and money) out of returns.

High Earners Fall Into Expensive Traps

High rollers without the right education often fall headfirst into money pits like costly whole life insurance (fees chewing up 3-4% annually), actively managed funds draining 2%, and lifestyle debt that’s like financial quicksand. They go for the shiny leased luxury rides over trusty used cars, rack up credit card debt at a crazy 18-24% interest, and snap up oversized palaces that suck the cash right out of ’em. Financial smarts give you the roadmap to spot these wealth destroyers and steer clear before they sink your financial ship.

Final Thoughts

Financial education beats high income every… single… time. Why? Because it’s the ticket to multiplying money, not just earning it. The evidence is blinding: janitors hit millionaire status while doctors can end up cash-strapped. One group “gets” compound interest – the others… not so much. Financial smarts today can lay down decades of compound growth, leaving salary hikes in the dust.

Let’s break it down: You start tossing $200 a month into investments at 25 – boom, $525,000 by retirement. Wait until 35? Now you’re shelling out $800 a month for the same return. Time over income – every time. Here’s the game plan: Automate 20% of your paycheck into savings, dive into low-cost index funds, and track every cent (read one financial book a month, stay plugged into market trends, and get cozy with tax-advantaged accounts).

These tricks work whether you clock in $30,000 or $300,000. Over at Top Wealth Guide, we roll out the practical tools and educational content to build wealth from any starting line. The wealthy? Not because they were sipping some secret knowledge potion – but because they learned the money rules and played the game, and played it well.