Investment… a changing beast, trying to pin it down is like catching mist with your hands. Welcome to 2025, folks, where your choice of account is either a golden ticket or a ticket to nowhere. People—so many of them—are throwing cash into accounts that might as well have “bad idea” stamped on them.

Cue Top Wealth Guide. We dove headfirst into the muck of tax laws and market whims (oh, the joys) to decipher what makes the cut in account prioritization land. We’ve outlined—no fluff, no jargon—where your dollars should hang out first, depending on your income, age (yes, it matters), and what dreams you’re chasing with those bucks.

In This Guide

Tax-Advantaged Retirement Accounts to Prioritize

401(k) and Employer Match Benefits

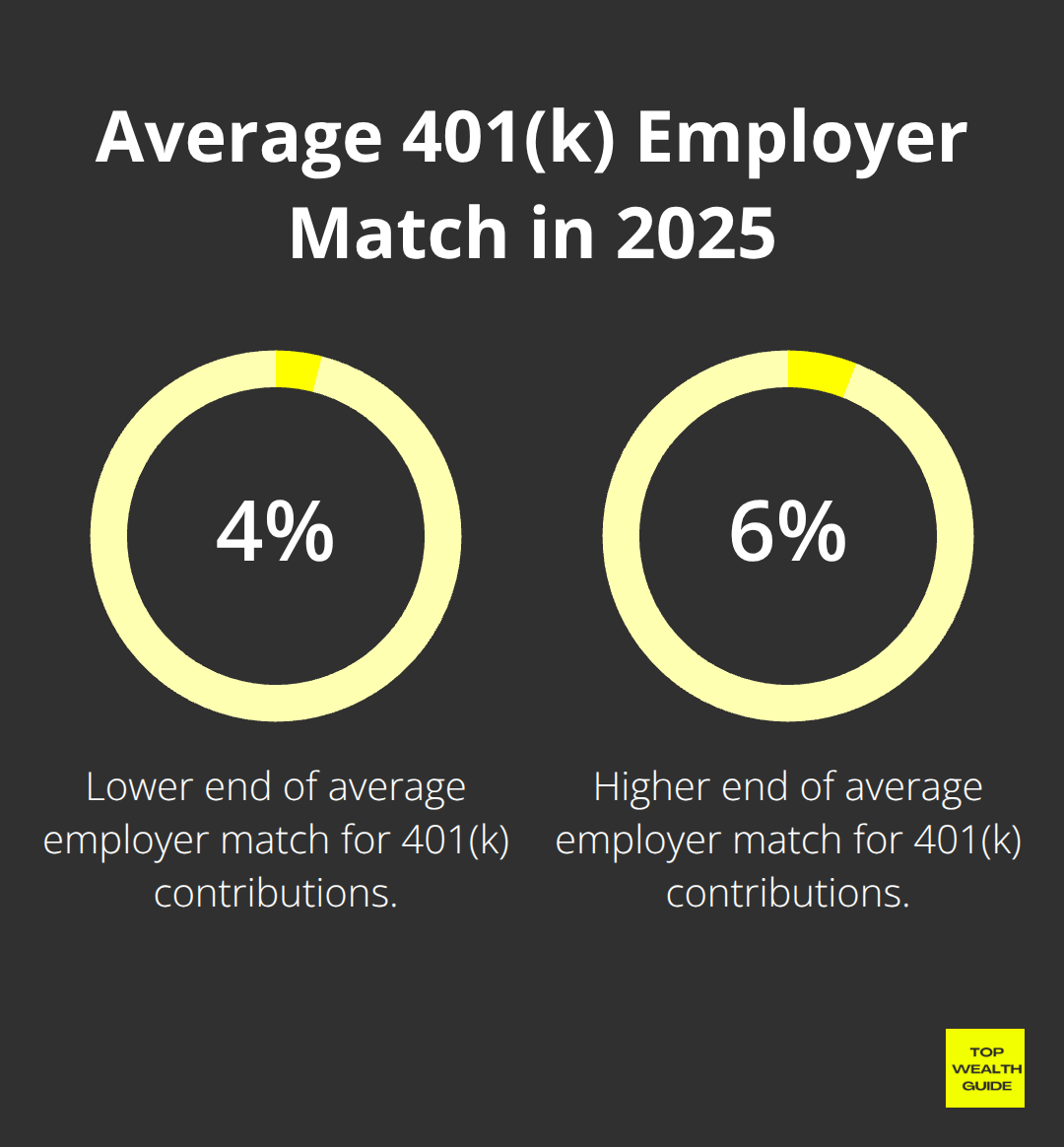

Alright, the 401(k)… it’s like this undisputed champion of retirement accounts, especially when your employer decides to sprinkle some extra cash on top through employer match contributions. In 2025, we’re looking at an average employer match floating between 4% and 6% of your compensation. The name of the game? A 50% partial match on your contributions.

Got some cash to stash away? You can shove $24,000 into your 401(k) for 2025, with a sweet bonus of $7,500 if you’re in the 50+ club. Miss the employer match? That’s like tossing free money out the window. Priority numero uno: max out that match before eyeballing any other accounts.

Roth IRA vs Traditional IRA Considerations

So, you’re playing the tax game… and for those earning under $146,000 as single filers in 2025, the Roth IRA is your MVP. Pay the tax man now, and then glide into retirement with tax-free withdrawals. Traditional IRAs? Sure, they give you a tax break today, but watch out for those future tax bills that could spike later.

For the young guns, Roth accounts are like a golden ticket-decades of tax-free growth ahead. The contribution limits in 2025 are at $7,000, plus an extra $1,000 if you’re past the half-century mark. High earners… don’t sweat it; there’s a backdoor Roth conversion strategy to sidestep those pesky income caps.

SEP-IRA and Solo 401(k) for Self-Employed

If you’re flying solo in the business world, Solo 401(k) plans got your back-$69,000 limit in 2025, combining both employee and employer contributions. Compare that to the SEP-IRA with its 25% income cap, and it’s clear-Solo 401(k) wins the round. Raking in $100,000 in self-employment income? Yeah, you’re storing way more in a Solo 401(k) than any other option.

And don’t stress over paperwork-keep things smooth until your account climbs to $250,000-ideal for freelancers, consultants, and small biz maestros looking for major tax perks minus the red tape headaches.

Just remember, while these retirement accounts are tax wizards, they’re like vaults that lock down your funds until the magic age of 59½. So, make sure your complete investment strategy plugs that gap with some taxable accounts too.

Taxable Investment Accounts and Their Strategic Role

High-Yield Savings and Money Market Accounts

High-yield savings accounts – ever heard of them? They’re not your grandma’s savings accounts, that’s for sure. Some hit 3.65% APY while, meanwhile, the national average is scraping the barrel at 0.40%. Why let your cash gather dust when it could be gathering green? Money market accounts from online banks like Marcus by Goldman Sachs and Ally Bank blow traditional banks out of the water by 300-400 basis points.

Your emergency fund – that stash for a rainy day (or a monsoon) – it belongs in these high-yield havens, not in some backwater checking account. The FDIC has your back up to $250,000 per depositor. Safe, profitable. Online banks? They cut out the middleman and hand the savings to you in the form of higher interest rates.

Brokerage Accounts for Flexibility and Growth

Taxable brokerage accounts… think of them as your financial playground – no locked gates, no guardians telling you to wait ’til you’re older. Fidelity and Charles Schwab have tossed out commission fees for stock trades. Translation: cheaper wealth-building outside the retirement confines.

Tax treatment? Oh, it’s on your side. Long-term capital gains are capped at 20% for high earners – ordinary income hits a whopping 37%. The smart crowd holds dividend champions like Johnson & Johnson and Coca-Cola here, riding the qualified dividend rates of 15-20%. This tax-efficient investing strategy? It’s a ninja move against the higher ordinary income tax rates that pillage traditional retirement account withdrawals.

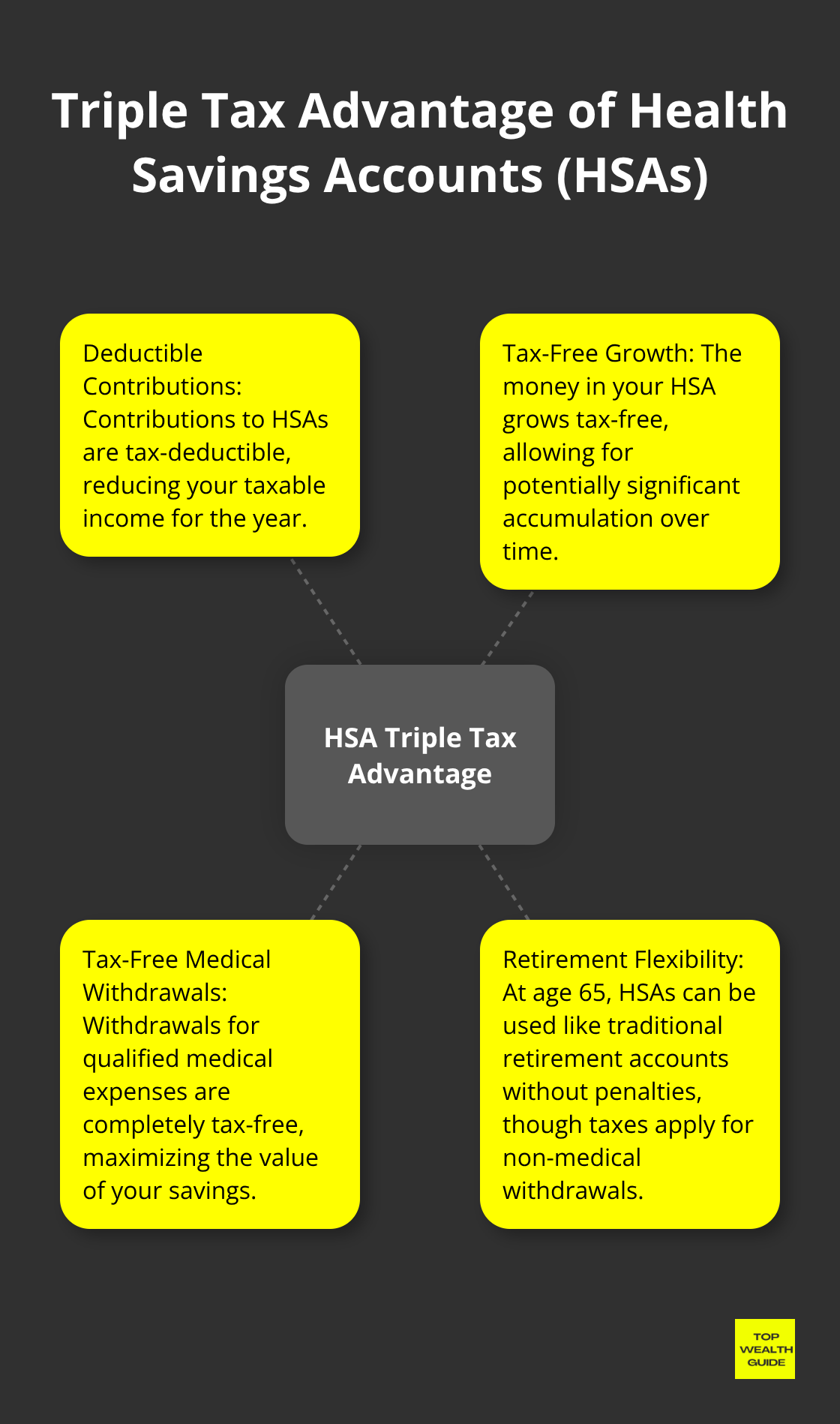

Health Savings Accounts as Triple Tax Advantage

Health Savings Accounts – the holy grail of tax benefits. Deductible contributions, tax-free growth, and tax-free medical withdrawals. Contributor limits in 2025? $4,300 for individuals, $8,550 for the fam. Hit 65 and HSAs morph into retirement accounts, free from penalties – though anything non-medical gets clubbed by ordinary income tax.

Fact: Fidelity says retirees should brace for an average of $172,500 on health care and medical expenses during retirement. HSAs in low-cost index funds? They’ll cover those costs, delivering decades of tax-free growth. HSAs… they’re outmuscling Roth IRAs for those in the know.

The trick? It’s all in knowing how each account type meshes with your financial canvas and timeline.

Account Prioritization Strategy Based on Your Financial Situation

Your finances – really, they call the shots on where your cash goes first. And man, conventional wisdom? Often just gets it oh-so-wrong. Start simple: snag yourself that $1,000 emergency fund in a high-yield savings account. Forget that “three to six months of expenses” drivel that financial gurus love. This little cushion takes care of immediate panic-mode moments, letting you focus on cranking up your wealth. Once that’s in the bag, lean into snagging those employer 401k matches up to the hilt, then squeeze out Roth IRA contributions up to $7,000 annually if you’re not crossing $146,000 as a single filer in 2025.

Emergency Fund First Approach

Build that emergency fund – thoughtfully, not frantically. Obsessing over six months’ expenses? Locks away too much dough in snoozeville accounts while you could be raking in higher returns elsewhere. Kick off with $1,000 in a high-yield account that’s dishing out over 4% APY. This little chunk covers most car hiccups, medical surprises, or pesky appliance meltdowns, all without tanking your investment hard work.

Nail down those employer matches and max the retirement funds first, then beef up your emergency stash to cover three months. High earners? Keep it tight – your stable cash flow and spread-out investment accounts are cruising right past any cash piles sneaking in measly returns.

Income Level and Tax Bracket Considerations

Here’s the kicker – your tax bracket, it flips the script entirely. For folks in the 12% bracket? Dive headlong into Roth accounts – front those taxes now while rates are lounging low. Hit that 22% bracket or higher, though, and you’re dialing traditional 401k contributions to ax that tax bill. Meanwhile, top earners soaring above $230,000 get tangled in the 32% bracket and should max traditional retirement accounts first, then get sneaky with those backdoor Roth moves.

Self-employed pros pulling in $100,000? You’re shoveling $25,000 into a SEP-IRA or cruising up to $69,000 in a Solo 401k. Seriously, these smash regular IRAs for business savants and freelancers chasing killer tax edges.

Age and Time Horizon Factors

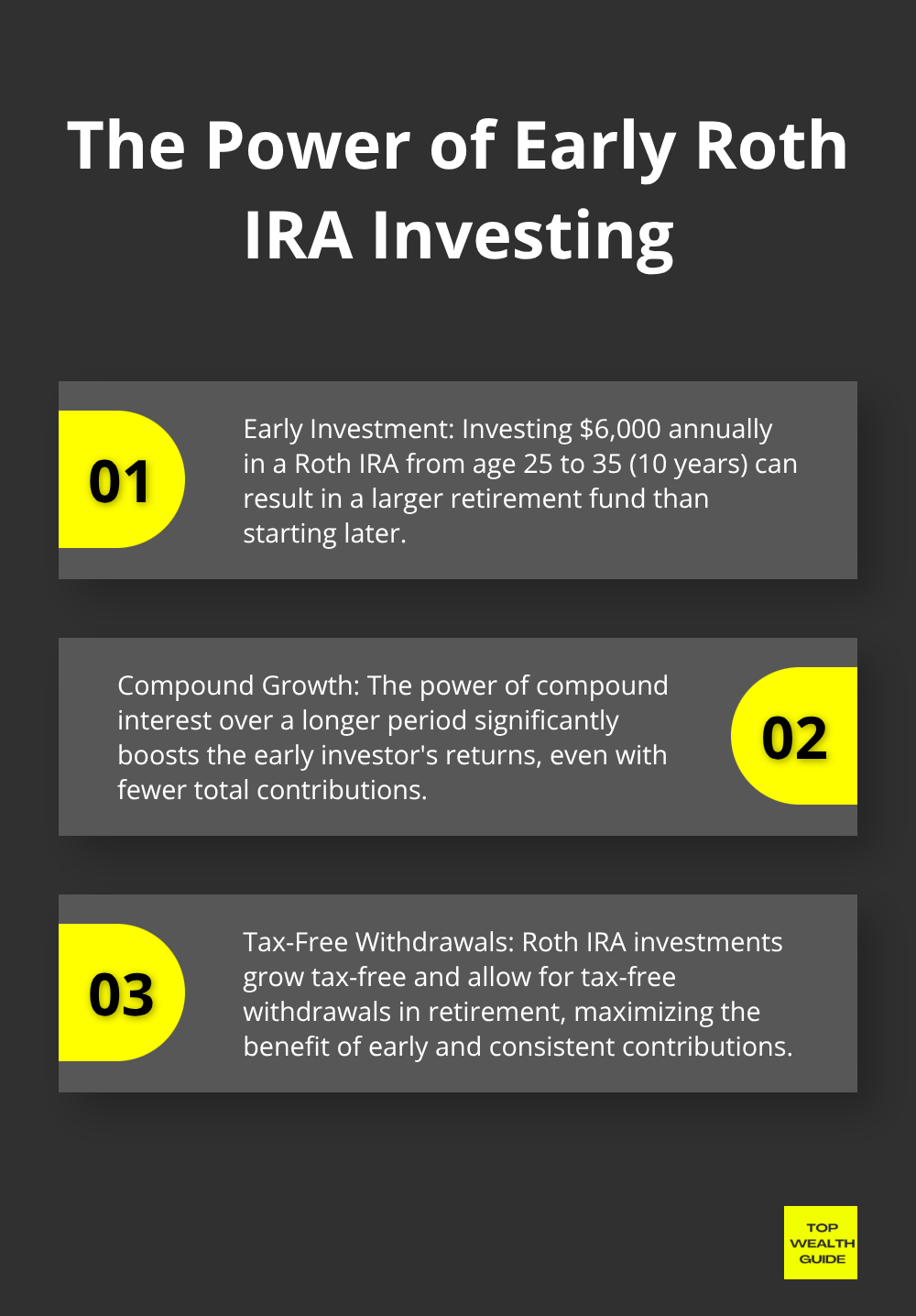

Age – it basically rewrites the rules from scratch. If you’re clocking in at 20s or 30s, you want 90% of your retirement stash parked in Roth accounts, sucking up today’s tax hits for sweet decades of tax-free joy. The math – just works. Toss $6,000 a year into a Roth IRA from age 25 to 35 (only 10 years) and you’re sitting prettier at retirement than someone who’s been grinding the same $6,000 from age 35 to 65.

Hit 50 and the catch-up contributions come knocking – that’s an extra $7,500 for 401k plans and $1,000 for IRAs in 2025. Folks on the edge of retirement – sharp turn to traditional accounts for fast tax breaks, then scheme those Roth conversions during early-retirement when your income cools off. The age 59.5 rule opens the floodgates to penalty-free retirement fun bucks, turning around withdrawal strategies and account preferences for those pre-retirement days.

Final Thoughts

Alright, folks, let’s talk portfolios in 2025 – what’s the play? You’re building a foundation… that emergency fund of a grand, parked in a high-yield savings account north of 4% APY. Next stop? Snag every dime of that employer 401k match. Seriously, it’s like they’re putting free money on the table – take it.

After that, if you’re hauling in under $146,000 as a solo act (filing single), max out those Roth IRA contributions. Running your own show? Solo 401k plans are where it’s at – leave the SEP-IRAs behind if you want to hit those upper contribution limits. And then we have the underappreciated heroes – HSAs. Triple tax breaks, $4,300 you can stash away in 2025. Young guns love the Roth, but if you’ve got more dollars and change – traditional accounts are your tax-deduction besties.

Here’s the kicker – your strategy? It’s a three-way tango between your age, earnings, and that ol’ tax bracket. Seasoned investors – you’re getting $7,500 on top for playing catch-up in those 401k plans. High-income earners above the 22% tax bracket? Hit those traditional accounts hard first, then think about sneaking into Roth via the backdoor. We’re here at Top Wealth Guide armed with the pro tips and strategies you need – keeping it simple, making it effective, and always aligning with your objectives and timeline.