The crypto circus hit a whopping $2.3 trillion in 2024. What does that mean for investors? Timing — now more than ever — is king. Figuring out which cryptocurrency is your ticket to the moon? That’s a cocktail of studying market fundamentals, tech adoption (or lack thereof), and keeping an eye on those regulatory boogeymen.

Here at Top Wealth Guide, we dive into the crème de la crème of investment opportunities. Strategies? Yeah, we’ve got a bunch — designed to help you craft a crypto portfolio that’ll thrive in this rollercoaster of a market. Buckle up.

In This Guide

Which Cryptocurrencies Dominate the Investment Landscape

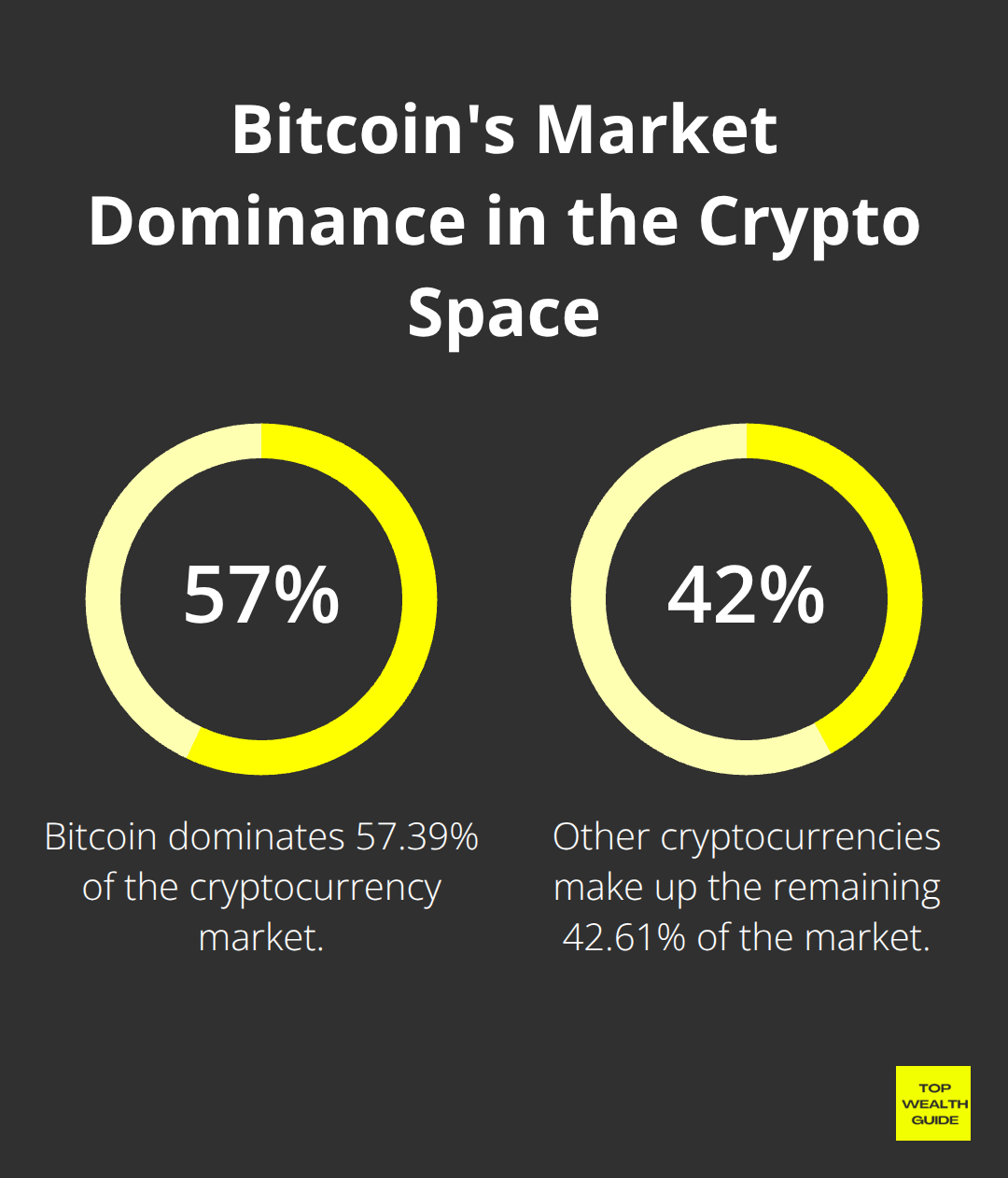

Bitcoin sits at-wait for it-$115,970.58 as of September 2025. It’s claiming a whopping 57.39% market dominance, having skyrocketed by an eye-popping 186,802,431% since July 2010. What do these numbers scream? Institutional validation. Heavyweights like MicroStrategy and Tesla are holding Bitcoin like it’s going out of style, and spot Bitcoin ETFs from the likes of BlackRock and Fidelity attracted billions mere moments after getting the nod. With a cap of 21 million coins, you’re looking at scarcity-something traditional currencies, frankly, dream about.

Ethereum Powers the Future of Finance

Ethereum’s priced at $4,504.36 with a market cap hitting $543.70 billion, but honestly, it’s not just about the price here. The real deal is its sheer utility. Ethereum processes over 1.6 million transactions each day, as of March 2025, and it’s the backbone for thousands of decentralized apps. Switching to proof-of-stake? Genius move-99.9% drop in energy usage, and it makes Ethereum a sweetheart for ESG-focused institutions. Then there’s its deflationary mechanism that burns more ETH than it produces when activity spikes. Simple math: supply shrinks, demand grows.

High-Growth Alternatives Worth Your Attention

Solana is blasting off at $235.33 with a staggering 106,868% gain since 2020, processing a mind-boggling 50,000 transactions per second at a fraction of Ethereum’s cost. Cardano? Priced at $0.87, offering those sweet 5-6% annual rewards through staking, while also flaunting the energy efficiency that Bitcoin can only admire from afar. XRP sitting at $3.04 after clearing up the mess with SEC litigation-now that’s set up for cross-border payment adoption by big banks. These aren’t Bitcoin killers; they’re like specialized tools-solving problems that Bitcoin and Ethereum don’t tackle head-on.

Smart investors-listen up-know each crypto has its own role to play in a balanced portfolio. The trick is knowing which factors sift out the champions from the has-beens in this ever-evolving space. For rookies, get your learning hat on with how to invest in cryptocurrency. That foundational knowledge? It’s gold before diving headfirst into specific coins.

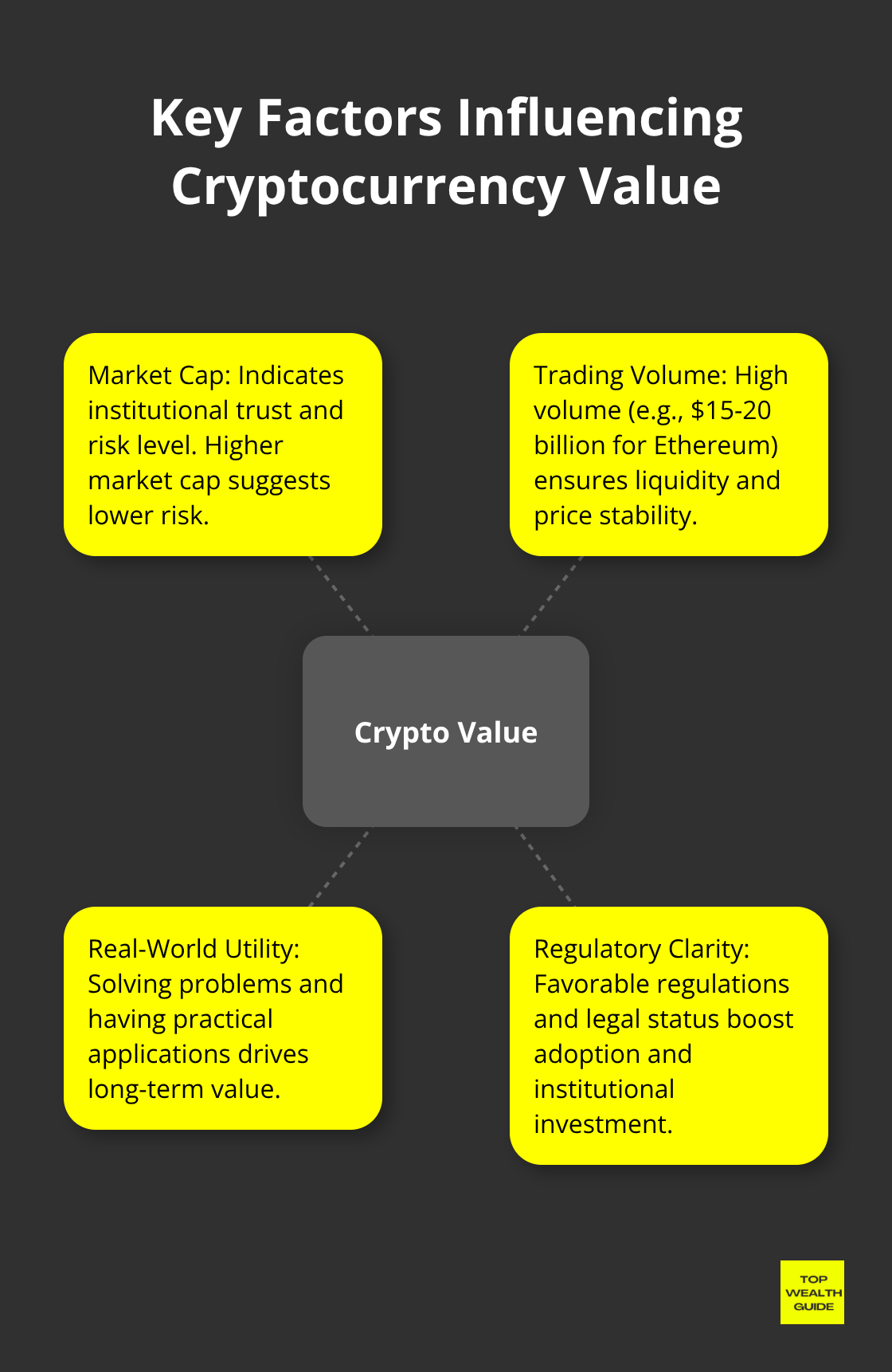

What Makes a Cryptocurrency Worth Your Money

Market cap – that’s where the rubber meets the road in crypto. Trust me, it’s telling a story. Bitcoin’s market cap? It whispers “institutional trust,” while anything under $1 billion? Well… it’s waving a big, red flag: high risk. And let’s not kid ourselves, volume is the secret sauce. Look at Ethereum, moving $15-20 billion a day. No sweat buying or selling – your moves won’t shake the market. But here’s the kicker, according to Coinbase data: coins under $100 million in daily volume? They wobble, with mega trades swinging prices by 20-30%.

Volume Analysis Protects Your Exit Strategy

Before you even think about dropping a dollar, peek at CoinMarketCap’s 24-hour volume. Seriously, low volume is like quicksand when you’re trying to make a clean exit. Big league cryptos keep their volume steady as a surgeon’s hand (think Bitcoin, at $25-35 billion daily). Compare that with your wild, weekend warrior altcoins – it’s a roller coaster. Stability here is the golden ticket for the big suits to come and go without rocking the boat.

Real-World Problems Drive Long-Term Value

Ethereum – it’s not just any token, it’s a problem-solver, running $180 billion in decentralized finance apps. That’s not just hype, that’s utility with a capital U. And Chainlink? It’s the Paul Revere of crypto, connecting blockchain data to the real world, with big names like SWIFT and Google Cloud in its corner. That’s creating legit demand for LINK. Then there’s Solana, blitzing through 50,000 transactions a second at a fraction of a cent each. It’s taking the stage for applications Ethereum’s expensive fees can’t touch.

Regulatory Clarity Separates Winners from Losers

2024 was a game-changer – the SEC gave the nod to Bitcoin and Ethereum ETFs, and BlackRock’s IBIT vacuumed up $27 billion in its debut year. Ripple’s partial win against the SEC in 2023? It’s not just a win, it’s a launchpad, despite the ongoing courtside drama. These regulatory victories are like rocket fuel for early birds in the market. But our privacy pals – Monero and Zcash? They’re facing a headwind from exchanges that’s stunting their growth.

Then there’s geography playing its hand: Japan and Switzerland are rolling out the welcome mat for crypto, while China’s rules are keeping everyone on edge. These global playbooks? They set the stage for which cryptos the big money can legally dance with, and when institutions jump in, that’s when things really take off.

How Should You Structure Your Crypto Investment Strategy

Here’s the deal-dollar-cost averaging. It’s your trusty sidekick if you’re just dipping your toes into the crypto waters… helping you keep your cool when prices yo-yo. It’s like this: toss a fixed sum into Bitcoin each month-rain or shine, high or low. Platforms like Kraken? Gemini? Set them to auto-pilot for that same dollar amount, week in, week out. Why? It eases those wild market swings and keeps those pesky emotions out of play.

Portfolio Allocation That Actually Works

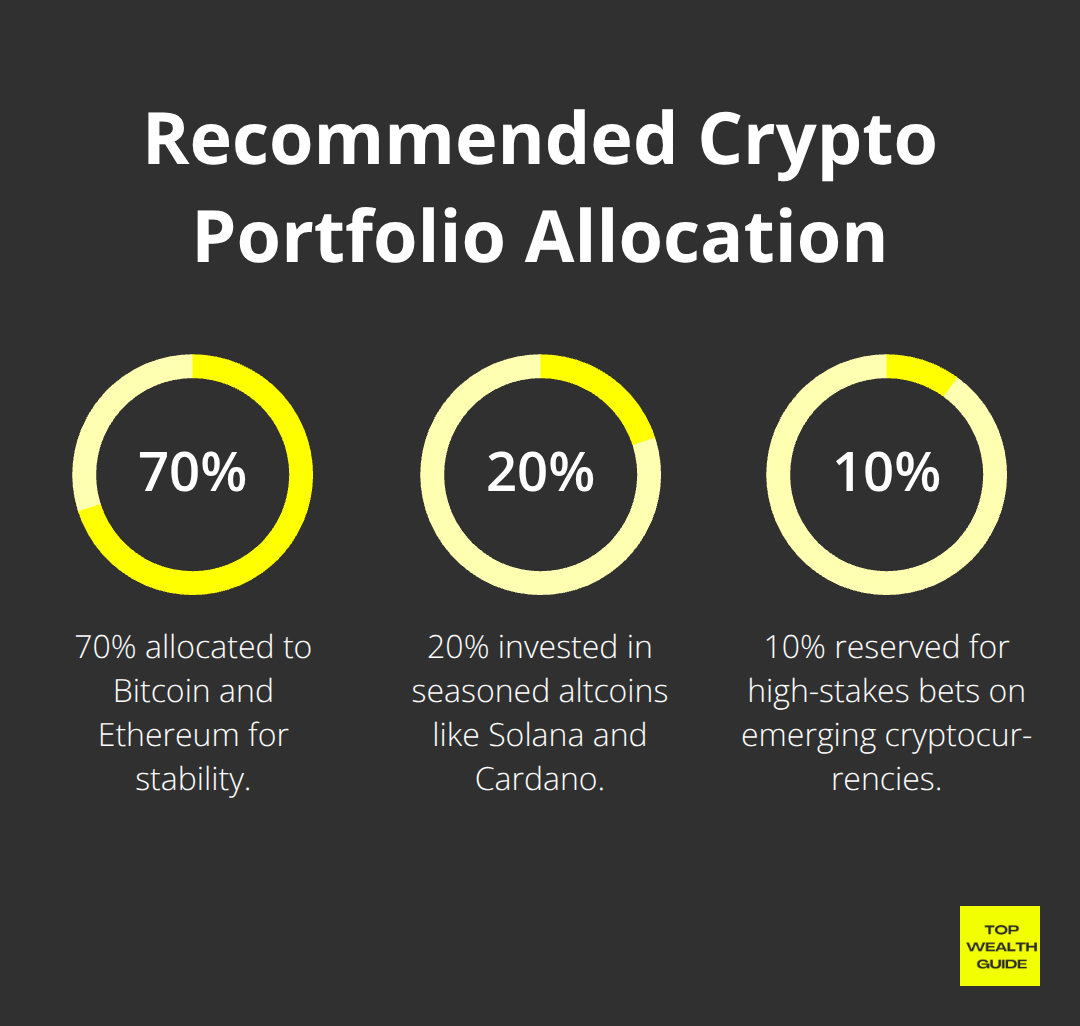

Enter the 70-20-10 rule-your new BFF for building a winning crypto portfolio, backed by the big shots in institutional research. Throw 70% into Bitcoin and Ethereum, 20% into seasoned altcoins (think Solana, Cardano), and 10% into those high-stakes bets. This game plan lets you chase gains while keeping your risks in check. Time to rebalance? Do it quarterly if things drift over 5% from your goals. Remember, it’s not about nailing the winner every time-it’s about smart sizing. Don’t gamble more than 2% of your total stash on any altcoin that’s not top 10 by market cap.

Risk Controls That Prevent Portfolio Destruction

Take a peek at risk management strategies-your lifeline in the stormy seas of volatility, keeping losses in check. Stops? Set ’em at 25% below your average cost for Bitcoin and Ethereum, 35% for those trusty altcoins. And let’s talk exchange risks-keeping more than 30 days’ worth on any platform? Not a chance. Enter hardware wallets-Ledger, Trezor-store 80% of your assets there. Manage your crypto life with apps like CoinTracker… smarter taxes, happier you. Quick tip: keep six months of cash for expenses in traditional assets before throwing serious money into crypto chaos. Only 5% of your net worth in crypto until you’re a pro-handle those 80% dips like a champ, no sweat. Use those wealth management strategy tips… it’s all about long-term growth.

Final Thoughts

So, what’s the hottest cryptocurrency to throw your money at right now? Well, that depends on how much excitement you can handle and how long your patience runs. Bitcoin – the granddaddy of them all – still stands strong with a safety net of institutional backers and that whole “digital gold” vibe. Then there’s Ethereum, ready to rock with its smart contract playground and those deflationary curves that keep growth on the horizon. Toss in contenders like Solana and Cardano, and you’ve got yourself a party of diversification for those who’ve been around the block a few times.

But hey, crypto success isn’t just luck – it’s a game of discipline, research, and knowing your limits. That 70-20-10 allocation thing? It’s like a seesaw of stability and potential that keeps you from toppling over. And don’t even get me started on dollar-cost averaging… leveling out the crazy ride one bit at a time. But remember – don’t gamble more than you can stomach losing, and definitely keep your treasure in a hardware wallet (think 80% offline, safe from any exchange hiccup).

Next up? Craft a killer investment strategy that doesn’t revolve solely around crypto. We at Top Wealth Guide dish out the real goods on personal finance and wealth-building – because true wealth? It’s about playing the long game across all the asset board. Savvy investors know, crypto’s just a slice of that diversified pie baked for long-term gains.

1 Comment

Pingback: How to Invest in Cryptocurrency Your First Steps