Embarking on the journey to build and preserve wealth requires more than just earning a high income or picking a few winning stocks; it demands a deliberate, disciplined plan. Effective wealth management strategies are the bedrock of long-term financial security, providing a structured framework to grow assets, mitigate risks, and achieve your most ambitious financial goals. This is not about chasing fleeting market trends but about implementing time-tested principles tailored to your unique circumstances.

In this comprehensive guide, we will dissect ten powerful strategies that form the cornerstone of sophisticated wealth management. We will move beyond generic advice to provide actionable insights, real-world examples, and detailed comparisons to help you understand not just the 'what,' but the 'why' and 'how' behind each approach. Whether you are focused on aggressive growth, steady income generation, or capital preservation, these strategies will equip you with the knowledge to make informed decisions. We will explore everything from foundational principles like asset allocation and diversification to more advanced concepts like tax-efficient investing and behavioral finance. Think of this as your personal blueprint for navigating the complexities of the financial markets and building a resilient portfolio designed to stand the test of time. Let’s dive into the strategies that can transform your financial future.

In This Guide

- 1 1. Masterful Diversification: Your First Line of Defense

- 2 2. Strategic Asset Allocation: The Blueprint for Your Portfolio

- 3 3. Tax-Efficient Investing Strategy

- 4 4. Dollar-Cost Averaging: The Power of Consistency

- 5 5. Real Estate Investment Strategy

- 6 6. Value Investing Strategy

- 7 7. Strategic Income Generation: Creating Consistent Cash Flow

- 8 8. Systematic Rebalancing: The Art of Portfolio Discipline

- 9 9. Risk Management and Insurance Strategy

- 10 10. Behavioral Finance and Emotional Wealth Management Strategy

- 11 10-Strategy Wealth Management Comparison

- 12 Integrating Your Strategies into a Cohesive Financial Plan

- 13 Frequently Asked Questions (FAQ) about Wealth Management Strategies

- 13.1 1. What is the single most important wealth management strategy for a beginner?

- 13.2 2. How often should I rebalance my portfolio?

- 13.3 3. Is real estate a necessary part of a wealth management plan?

- 13.4 4. At what net worth should I start thinking about tax-efficient investing?

- 13.5 5. Can I implement these wealth management strategies on my own, or do I need a financial advisor?

- 13.6 6. How does my age affect my wealth management strategy?

- 13.7 7. What's the difference between wealth management and financial planning?

- 13.8 8. How does inflation impact my wealth management strategy?

- 13.9 9. What is the role of an emergency fund in a wealth management plan?

- 13.10 10. How can I manage my emotions and avoid making bad investment decisions?

1. Masterful Diversification: Your First Line of Defense

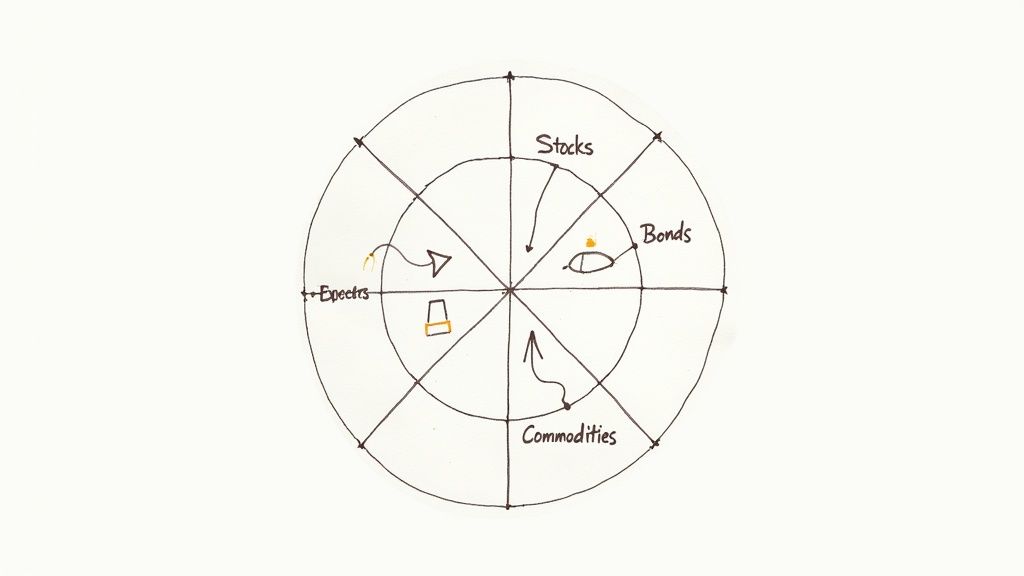

Diversification is the foundational principle of sound investing and a cornerstone of effective wealth management strategies. It involves strategically spreading your investments across various asset classes, sectors, and geographic regions. The core idea, popularized by pioneers like Harry Markowitz through Modern Portfolio Theory, is that different assets react differently to the same economic events. By owning a mix of assets that don't move in perfect sync, you can buffer your portfolio against volatility, reducing the impact of a significant downturn in any single area.

True diversification is more than just owning a large number of different stocks; it's about owning different types of investments. A portfolio heavily concentrated in technology stocks, for example, is not well-diversified, even if it includes dozens of companies. A downturn in the tech sector could still lead to substantial losses. This strategy is your first line of defense because it aims to preserve capital and smooth out returns over the long term, ensuring one market shock doesn't derail your financial goals.

How to Implement Masterful Diversification

Putting this powerful strategy into action requires a thoughtful approach that goes beyond basic asset allocation.

-

Diversify Across and Within Asset Classes: Start with a broad mix, such as stocks, bonds, and real estate. Then, drill down further. Within your stock allocation, include a mix of large-cap, mid-cap, and small-cap companies, as well as both growth and value stocks. For bonds, hold a combination of government and corporate bonds with varying maturities.

-

Embrace Geographic Diversification: Don't limit your investments to your home country. Allocating a portion of your portfolio to international markets, including both developed and emerging economies, can protect you from domestic economic downturns and provide exposure to global growth engines.

-

Utilize Low-Cost Funds: For most investors, Exchange-Traded Funds (ETFs) and index funds are the most efficient tools for achieving broad diversification. A fund like Vanguard's Total Stock Market Index Fund (VTSAX) provides instant ownership in thousands of U.S. companies, eliminating the need to pick individual stocks. To expand your knowledge on this topic, consider exploring this guide to investment diversification beyond stocks and bonds.

Real-Life Example: During the "dot-com bubble" of the early 2000s, investors heavily concentrated in tech stocks saw their portfolios decimated. An investor who was diversified with bonds, international stocks, and real estate would have experienced a much smaller drawdown, as these other asset classes performed differently during the tech crash.

2. Strategic Asset Allocation: The Blueprint for Your Portfolio

Strategic asset allocation is the blueprint that dictates how your investment portfolio is divided among different asset categories. While diversification spreads risk, asset allocation determines the fundamental character and risk-return profile of your portfolio. This crucial wealth management strategy involves setting target allocations for asset classes like stocks, bonds, and real estate based on your specific financial goals, time horizon, and personal risk tolerance. The concept, heavily influenced by the work of Nobel laureate Harry Markowitz, is built on the premise that the allocation decision is the primary driver of long-term investment returns.

Unlike market timing, which involves trying to predict short-term market movements, strategic asset allocation is a disciplined, long-term approach. A classic example is the "60/40" portfolio, which allocates 60% to stocks for growth and 40% to bonds for stability and income. This strategy is essential because it aligns your investments with your life stage. A young investor with decades until retirement can afford a more aggressive allocation (e.g., 90% stocks), while someone nearing retirement would adopt a more conservative mix to preserve capital.

How to Implement Strategic Asset Allocation

Executing this strategy requires a clear understanding of your personal financial landscape and a commitment to periodic maintenance.

-

Define Your Investor Profile: Your first step is to honestly assess your risk tolerance, financial goals (e.g., retirement, education), and time horizon. Answering these questions will determine the appropriate mix of growth-oriented assets (stocks) versus stability-focused assets (bonds and cash).

-

Set Target Allocations: Once your profile is defined, establish specific target percentages for each asset class. For instance, a moderate-risk investor might aim for 60% stocks, 30% bonds, and 10% real estate. This serves as your portfolio's North Star.

-

Review and Rebalance Annually: Market performance will cause your allocations to drift from their targets. If stocks have a great year, they may grow to represent 70% of your portfolio, making it riskier than intended. Rebalancing, which involves selling some of the outperforming assets and buying more of the underperforming ones, brings your portfolio back in line with its strategic targets. You can find more information in this guide to optimize your portfolio with smart asset allocation.

Real-Life Example: Consider two investors, Sarah (age 30) and Tom (age 65). Sarah, with a 35-year time horizon, might choose an aggressive 80% stock / 20% bond allocation to maximize growth. Tom, who is retired, might opt for a conservative 40% stock / 60% bond allocation to prioritize capital preservation and income generation. Their asset allocations are strategically tailored to their different life stages.

3. Tax-Efficient Investing Strategy

It's not just about what you earn; it's about what you keep. This is the core principle behind tax-efficient investing, a critical wealth management strategy that focuses on minimizing the tax drag on your portfolio's returns. Every dollar paid in taxes is a dollar that can't be reinvested to compound over time. By making smart, tax-aware decisions, investors can significantly enhance their long-term wealth accumulation. This strategy involves carefully considering where you hold certain assets (asset location), when you sell them, and how you can leverage tax-advantaged accounts.

Tax-efficient investing acknowledges that your after-tax return is the only return that truly matters. A high-grossing investment can quickly become mediocre once taxes are factored in. For example, an investment generating an 8% annual return in a high-tax state could effectively yield less than 4% after federal and state taxes are paid. This strategy is essential for high-net-worth individuals and anyone serious about maximizing their financial growth, as it directly impacts the real-world performance of your investments.

How to Implement a Tax-Efficient Investing Strategy

Integrating tax efficiency into your portfolio requires a deliberate and ongoing process. It's about making conscious choices to shield your returns from unnecessary taxation.

-

Prioritize Tax-Advantaged Accounts: Always start by maximizing contributions to accounts like a 401(k), IRA, or Roth IRA. These vehicles offer either tax-deferred growth or tax-free withdrawals, providing the most powerful tax shield available to most investors.

-

Strategic Asset Location: Place your least tax-efficient assets in tax-advantaged accounts. For instance, high-yield corporate bonds or actively managed funds that generate significant short-term capital gains belong in an IRA or 401(k). Conversely, hold highly tax-efficient assets, like broad-market index funds or growth stocks you plan to hold long-term, in your taxable brokerage accounts.

-

Practice Tax-Loss Harvesting: Don't wait for market downturns to be a source of stress. Use them as an opportunity to sell investments at a loss to offset capital gains elsewhere in your portfolio. This technique can be used to offset up to $3,000 in ordinary income annually, providing a direct tax benefit. For a deeper understanding of this approach, you can explore more about capital gains tax strategies.

Real-Life Example: An investor, Maria, holds a high-turnover mutual fund that generates significant short-term capital gains each year. By holding this fund inside her tax-deferred 401(k), she avoids paying taxes on those gains annually. In her taxable brokerage account, she holds a low-cost S&P 500 ETF, which generates minimal taxable events, thus maximizing her after-tax returns across her entire portfolio.

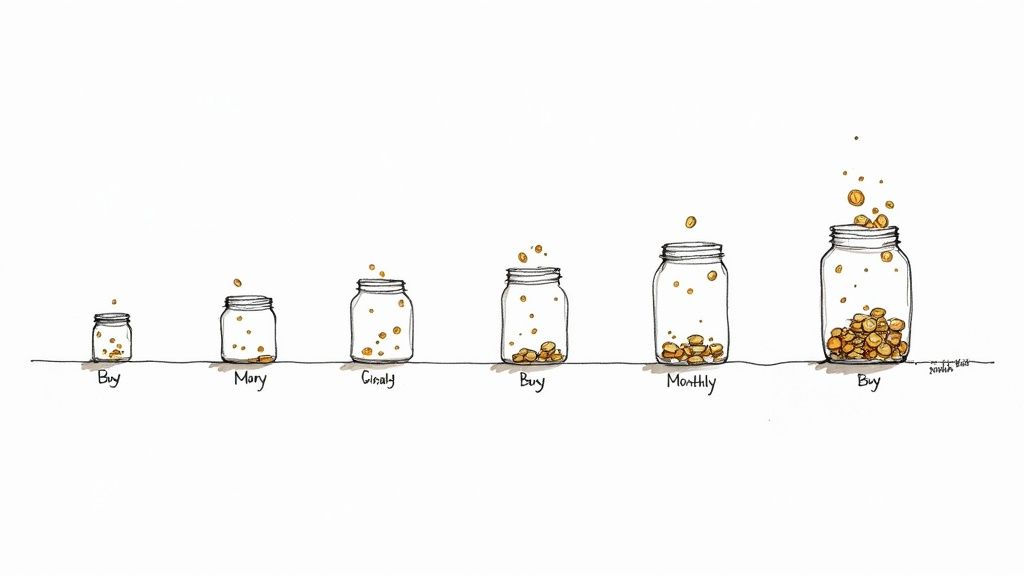

4. Dollar-Cost Averaging: The Power of Consistency

Dollar-cost averaging (DCA) is a disciplined investment technique that removes the emotion and guesswork from entering the market. It involves investing a fixed amount of money at regular, predetermined intervals, regardless of whether the market is up or down. This systematic approach, championed by institutions like Vanguard and Fidelity, is a core component of many long-term wealth management strategies because it helps mitigate the risk of investing a large sum at a market peak.

The primary advantage of DCA is its ability to reduce the impact of volatility. When prices are low, your fixed investment buys more shares; when prices are high, it buys fewer. Over time, this can lead to a lower average cost per share compared to making a single lump-sum investment. It is a powerful strategy for building wealth steadily, turning market fluctuations from a source of anxiety into a potential advantage.

How to Implement a Dollar-Cost Averaging Strategy

Executing a DCA plan is straightforward and relies heavily on automation to ensure consistency.

-

Automate Your Investments: The most effective way to practice DCA is to make it automatic. Set up recurring transfers from your bank account to your brokerage account or take advantage of automatic 401(k) payroll deductions. This "set it and forget it" approach ensures you stick to the plan without second-guessing.

-

Choose Appropriate Investments: DCA works exceptionally well with broad-market, low-cost index funds and ETFs. These funds provide instant diversification, and their lower expense ratios ensure that fees don't significantly erode your returns over the long term.

-

Stay the Course During Downturns: The true test of a DCA strategy is sticking with it when the market is falling. It's tempting to pause contributions, but these are precisely the times when your fixed investment amount buys the most shares, potentially accelerating your long-term growth. To deepen your understanding, you can explore this guide to master dollar-cost averaging for steady wealth growth.

Real-Life Example: During the 2008 financial crisis, an investor automatically contributing $500 per month to an S&P 500 index fund would have seen their contributions buy significantly more shares as the market bottomed out. By continuing to invest through the downturn, they dramatically lowered their average cost and were well-positioned for the subsequent market recovery, achieving substantial gains.

5. Real Estate Investment Strategy

Real estate investment is a powerful component of a comprehensive wealth management strategy, involving the purchase, management, and sale of property to generate income or capital appreciation. As a tangible asset, it offers a distinct advantage by providing diversification away from traditional financial markets like stocks and bonds. Popularized by figures like Robert Kiyosaki, this strategy is prized for its potential to generate consistent cash flow, offer tax advantages, and act as a hedge against inflation as property values and rents tend to rise with the cost of living.

Unlike purely financial assets, real estate allows investors to use leverage, controlling a large asset with a relatively small amount of capital via a mortgage. This can significantly amplify returns. Whether through rental income from single-family homes, leasing commercial spaces, or the capital gains from "flipping" a property, real estate provides multiple avenues for wealth creation. It is a cornerstone strategy because it combines income, growth, and utility in a single asset class.

How to Implement a Real Estate Investment Strategy

Successfully integrating real estate into your portfolio requires careful planning and a clear understanding of the market dynamics.

-

Select Your Investment Vehicle: Determine your approach based on your capital and time commitment. You can buy physical properties like single-family rentals or commercial buildings. For a less hands-on approach, consider Real Estate Investment Trusts (REITs) like Realty Income, which trade like stocks and provide dividend income, or explore real estate crowdfunding platforms for fractional ownership.

-

Analyze Deals Meticulously: Before purchasing a physical property, conduct thorough due diligence. Calculate key metrics like the capitalization rate (cap rate) to measure profitability and the cash-on-cash return to understand the return on your initial investment. Focus on markets with strong job growth, population increases, and favorable landlord-tenant laws.

-

Prepare for Contingencies: Real estate is not a passive investment. Maintain an emergency fund equivalent to 6-12 months of operating expenses to cover vacancies, unexpected repairs, and other costs. For those wanting to reduce the day-to-day workload, hiring a reputable property management company is an excellent option. To deepen your understanding, review this detailed real estate investment guide.

Real-Life Example: An investor purchases a duplex for $400,000 with a 20% down payment ($80,000). They rent out both units, generating a positive monthly cash flow after covering the mortgage, taxes, and insurance. Over time, the tenants' rent payments pay down the mortgage while the property value appreciates. This investor is building equity using leverage and generating a passive income stream simultaneously.

6. Value Investing Strategy

Value investing is a time-tested investment philosophy that prioritizes buying companies for less than their underlying worth. Pioneered by figures like Benjamin Graham and famously practiced by Warren Buffett, this strategy involves deep fundamental analysis to identify businesses that the market has undervalued. The core principle is that a stock's market price is different from its intrinsic business value. By purchasing quality companies at a significant discount, investors aim for long-term capital appreciation as the market eventually recognizes their true worth.

This approach is one of the most respected wealth management strategies because it focuses on tangible business metrics rather than market sentiment or speculative trends. It treats buying a stock as buying a piece of a real business. For instance, Warren Buffett's long-term investment in Coca-Cola was based on its powerful brand, global distribution, and consistent cash flow, which he believed the market was undervaluing at the time. This focus on durable business quality at a reasonable price is what defines the value investing mindset.

How to Implement a Value Investing Strategy

Adopting a value-oriented approach requires patience, discipline, and a commitment to thorough research. It is less about timing the market and more about buying excellent businesses when they are on sale.

-

Look for Durable Competitive Advantages: Identify companies with what Warren Buffett calls a "moat," a sustainable competitive advantage that protects them from competitors. This could be a powerful brand, network effects, or low-cost production capabilities.

-

Calculate Intrinsic Value: Before investing, determine a company's intrinsic value using methods like discounted cash flow (DCF) analysis or by evaluating its assets and earnings power. This calculation gives you a benchmark against which to compare the current stock price.

-

Demand a Margin of Safety: The cornerstone of value investing is buying with a "margin of safety." This means only purchasing a stock when its market price is significantly below your calculated intrinsic value. This discount provides a buffer against errors in judgment or unforeseen business setbacks.

-

Adopt a Long-Term Horizon: Value investing is not a get-rich-quick scheme. It often takes years for an undervalued company's true worth to be reflected in its stock price. A holding period of five years or more is common to allow the investment thesis to play out.

Real-Life Example: In the 1980s, Warren Buffett's Berkshire Hathaway began accumulating shares of The Coca-Cola Company. While some analysts were concerned about short-term challenges, Buffett saw an iconic global brand with immense pricing power and an unparalleled distribution network that was being undervalued by the market. His investment, based on long-term intrinsic value, has since generated billions in returns.

7. Strategic Income Generation: Creating Consistent Cash Flow

Strategic income generation is one of the most vital wealth management strategies, especially for those approaching or in retirement. It focuses on building a portfolio that produces a steady and predictable stream of cash flow from assets like dividends, interest, and rental income. Unlike growth-focused strategies that rely on capital appreciation, this approach prioritizes creating a sustainable income to cover living expenses without needing to sell off core assets.

This method, championed by figures like John Bogle through his emphasis on dividend-paying index funds and by countless retirement planners, provides financial stability and reduces reliance on market timing. When stock prices are volatile, a consistent dividend or interest payment provides a reliable return, offering peace of mind and preserving your capital base. The goal is to turn your accumulated wealth into a dependable "paycheck" that supports your lifestyle.

How to Implement Strategic Income Generation

Building a robust income stream requires careful asset selection and a multi-faceted approach to sourcing cash flow.

-

Build a Dividend Growth Portfolio: Focus on high-quality companies with a long history of consistently increasing their dividend payments, often called "Dividend Aristocrats." These businesses typically have strong balance sheets and stable earnings, making their payouts more reliable. Monitor key metrics like the dividend payout ratio to ensure sustainability.

-

Diversify Your Income Sources: Relying on a single source of income is risky. A well-rounded strategy includes multiple streams, such as coupon payments from a bond ladder, distributions from Master Limited Partnerships (MLPs), and rental income from real estate properties or REITs. This diversification protects your cash flow if one source underperforms.

-

Reinvest for Compounding: During your wealth accumulation years, reinvest all dividends and interest payments automatically. This powerful technique, known as compounding, accelerates portfolio growth by purchasing more income-producing shares, which in turn generate even more income.

Real-Life Example: A retiree builds a portfolio consisting of dividend-paying stocks like Johnson & Johnson, a bond ladder of U.S. Treasuries, and a Real Estate Investment Trust (REIT) that owns shopping centers. This combination provides three distinct income streams: quarterly dividends from the stocks, semi-annual interest payments from the bonds, and monthly distributions from the REIT, creating a diversified and reliable monthly income to cover living expenses.

8. Systematic Rebalancing: The Art of Portfolio Discipline

Rebalancing is the disciplined process of realigning your portfolio back to its original target asset allocation. Over time, as different assets grow at different rates, your carefully constructed portfolio will drift. For instance, a strong bull market might cause your stock allocation to swell from a target of 60% to 70%, making your portfolio riskier than you intended. Rebalancing, championed by institutions like Vanguard and automated by robo-advisors, is the mechanism that systematically trims overperforming assets and buys underperforming ones, ensuring your risk exposure stays consistent with your financial plan.

This strategy is a powerful, yet often counterintuitive, component of wealth management strategies. It forces you to adhere to the classic investing mantra: "buy low, sell high." Instead of chasing hot performers, you are systematically locking in gains from assets that have done well and reinvesting them into assets that are currently undervalued or have lagged. This disciplined approach prevents portfolio concentration, manages risk, and can enhance long-term, risk-adjusted returns by imposing a logical framework on your investment decisions.

How to Implement Systematic Rebalancing

Executing a rebalancing strategy requires setting clear rules and sticking to them, removing emotion from the investment process.

-

Establish a Rebalancing Schedule: The most common approach is calendar-based rebalancing, where you review and adjust your portfolio on a set schedule, such as annually or semi-annually. This creates a consistent, easy-to-follow routine.

-

Use Allocation Thresholds: An alternative method is to set percentage-based triggers. For example, you might decide to rebalance whenever any single asset class deviates by more than 5% from its target. If your 60% stock allocation grows to 65%, you would trigger a rebalancing event. This approach is more responsive to market volatility.

-

Leverage New Contributions: To minimize taxes and transaction costs, use new cash inflows to rebalance. Instead of selling your overperforming assets, direct new contributions exclusively to your underweighted asset classes until your target allocation is restored. This is a highly efficient technique for investors who are still in the accumulation phase.

Real-Life Example: An investor with a target 60% stock / 40% bond allocation sees a major stock market rally. At their annual review, they find their portfolio has drifted to 70% stocks / 30% bonds. They sell 10% of their stock holdings—locking in profits—and use the proceeds to buy bonds, bringing their allocation back to the original 60/40 target and reducing their portfolio's overall risk.

9. Risk Management and Insurance Strategy

While growing wealth is crucial, protecting it from unforeseen events is equally important. Risk management is a defensive wealth management strategy that involves identifying potential financial threats and implementing measures to mitigate their impact. It acts as a safety net, ensuring that unexpected life events such as illness, accidents, or premature death do not derail your long-term financial plan and erase years of hard-earned progress.

This strategy isn't about avoiding risk altogether; it's about intelligently transferring the financial consequences of catastrophic risks to an insurance company. For a predictable premium, you shield your assets from unpredictable and potentially devastating losses. This defensive approach is foundational because without it, even the most aggressive and successful investment portfolio remains vulnerable to being wiped out by a single unfortunate event, forcing you to liquidate assets at the worst possible time.

How to Implement a Risk Management and Insurance Strategy

Building a robust defensive plan requires a multi-layered approach that addresses the most common threats to financial stability.

-

Build a Strong Emergency Fund: This is your first line of defense for smaller, more common emergencies like job loss or unexpected repairs. Aim to hold 3 to 6 months' worth of essential living expenses in a liquid, high-yield savings account. This fund prevents you from needing to sell investments or take on high-interest debt during a crisis.

-

Secure Appropriate Life and Disability Insurance: For those with dependents, term life insurance is a non-negotiable tool to replace lost income. Similarly, long-term disability insurance is critical, as the statistical probability of becoming disabled during one's working years is significant. A policy that replaces 60-70% of your income can protect your greatest asset: your ability to earn.

-

Protect Your Assets with Liability Coverage: As your net worth grows, so does your exposure to lawsuits. An umbrella liability policy provides an extra layer of protection on top of your existing home and auto insurance. It's an inexpensive way to safeguard your entire portfolio from a major legal judgment. Review your insurance coverages annually to ensure they align with your current net worth and life circumstances.

Real-Life Example: Dr. Evans, a surgeon with a high income and a net worth of $2 million, suffers a hand injury that prevents her from performing surgery. Because she has a robust long-term disability insurance policy, she receives 65% of her income tax-free, allowing her to cover her family's living expenses and continue saving for retirement without having to sell off her investments.

10. Behavioral Finance and Emotional Wealth Management Strategy

Traditional finance assumes investors are rational, but behavioral finance acknowledges a crucial truth: humans are emotional beings. This modern wealth management strategy, pioneered by figures like Daniel Kahneman and Richard Thaler, focuses on understanding and mitigating the cognitive biases that lead to poor financial decisions. It implements systems to counteract powerful emotions like fear and greed, which often cause investors to buy high during market euphoria and sell low during panics.

This strategy is not about eliminating emotions but about building a framework that prevents them from derailing your long-term plan. Biases like loss aversion (feeling the pain of a loss more than the pleasure of an equal gain), overconfidence, and herd mentality can lead to significant wealth destruction. By acknowledging these human tendencies, you can create a disciplined approach that prioritizes logic over impulse, ensuring your financial journey is guided by your goals, not by market noise.

How to Implement Behavioral Finance and Emotional Wealth Management

Putting this strategy into practice involves creating guardrails that protect your portfolio from your own worst instincts.

-

Create a Written Investment Policy Statement (IPS): This is your financial constitution. An IPS formally documents your investment goals, risk tolerance, and rules for buying, selling, and rebalancing. When emotions run high, you can refer back to this logical, pre-committed document to guide your actions.

-

Automate Your Decisions: Set up automatic contributions and rebalancing. Committing to dollar-cost averaging, where you invest a fixed amount regularly regardless of market conditions, removes the temptation to time the market. This disciplined approach ensures you buy more shares when prices are low and fewer when they are high.

-

Control Your Information Diet: Limit your exposure to sensational financial news and daily portfolio check-ins, as this can trigger emotional responses. Instead, schedule quarterly reviews to assess your portfolio against your IPS. Working with a financial advisor can also provide a crucial buffer, offering an objective perspective during periods of volatility.

Real-Life Example: During the sharp market drop in March 2020, many investors panicked and sold their stocks at a loss. An investor with an Investment Policy Statement (IPS) reviewed their document, which stated they would not sell during market downturns and would rebalance if their stock allocation fell below a certain threshold. Instead of selling, they followed their plan, bought more stocks at low prices, and benefited significantly from the subsequent market rebound.

10-Strategy Wealth Management Comparison

| Strategy | Implementation Complexity | Best For | Key Advantage | Potential Downside |

|---|---|---|---|---|

| Diversification | Low to Moderate | All investors | Reduces portfolio volatility and concentration risk. | May dampen returns from a single high-performing asset. |

| Asset Allocation | Moderate | Goal-oriented investors (e.g., for retirement). | Aligns portfolio risk with individual goals and time horizon. | Requires periodic rebalancing to maintain targets. |

| Tax-Efficient Investing | High | High-income earners in taxable accounts. | Maximizes after-tax returns, increasing long-term wealth. | Complex rules and requires careful asset placement. |

| Dollar-Cost Averaging | Low | New investors or those investing regularly. | Removes emotion and reduces risk of market timing. | May underperform lump-sum investing in a rising market. |

| Real Estate Investing | High | Investors seeking income and tangible assets. | Potential for cash flow, appreciation, and tax benefits. | Illiquid, requires significant capital and management. |

| Value Investing | High | Patient, research-oriented investors. | Potential for high returns by buying undervalued assets. | Requires deep analysis and can underperform in growth markets. |

| Income Generation | Moderate | Retirees or those needing consistent cash flow. | Provides a predictable income stream to cover expenses. | May have lower growth potential than pure equity strategies. |

| Systematic Rebalancing | Low to Moderate | All investors with a target asset allocation. | Maintains desired risk level and enforces discipline. | Can incur transaction costs and taxes. |

| Risk Management | Moderate | Everyone, especially those with dependents. | Protects assets from catastrophic, unforeseen events. | Insurance premiums are an ongoing cost. |

| Behavioral Finance | Low | Investors prone to emotional decision-making. | Prevents costly mistakes driven by fear or greed. | Requires self-awareness and strict adherence to rules. |

Integrating Your Strategies into a Cohesive Financial Plan

Throughout this guide, we have explored ten distinct yet interconnected wealth management strategies, each serving as a powerful tool in your financial arsenal. From the foundational principles of diversification and asset allocation to the nuanced tactics of tax-efficient investing and behavioral finance, the path to building and preserving wealth is not about mastering a single trick. Instead, it’s about skillfully weaving these individual threads into a cohesive, resilient, and deeply personal financial tapestry.

Think of it this way: your asset allocation is the architectural blueprint for your financial house. Diversification across asset classes like stocks, bonds, and real estate provides the structural integrity, ensuring your portfolio can withstand market shocks. Strategies like dollar-cost averaging and value investing are the disciplined construction methods you use to build your wealth brick by brick, while tax-loss harvesting and utilizing retirement accounts act as the insulation, preventing valuable returns from leaking out.

From Individual Tactics to a Unified System

The true power of these wealth management strategies is unlocked when they work in concert. A portfolio, no matter how brilliantly allocated, will drift off course without regular rebalancing. An aggressive growth strategy focused on income generation becomes dangerously fragile without a robust risk management plan, including adequate insurance and a solid emergency fund.

Similarly, even the most sophisticated investment analysis can be completely undermined by emotional decision-making. Recognizing and managing your own behavioral biases is the psychological mortar that holds your entire financial structure together, preventing you from buying high in a panic or selling low out of fear. The goal is to move beyond a collection of isolated tactics and build a unified, dynamic system that works for you around the clock.

Your Actionable Path Forward

The journey to financial mastery is an ongoing process, not a final destination. Your plan must be a living document, designed to adapt as your life evolves, your goals shift, and the economic landscape changes. Here are your immediate next steps to turn knowledge into action:

- Conduct a Personal Audit: Review each of the ten strategies discussed. Which ones are you currently implementing? Where are the biggest gaps in your plan? Be honest about your strengths and weaknesses. Perhaps your asset allocation is sound, but you have completely neglected tax planning.

- Prioritize and Implement: You don't need to tackle everything at once. Identify the one or two strategies that will have the most significant impact on your financial situation right now. For a young investor, this might be automating contributions and embracing dollar-cost averaging. For someone nearing retirement, the focus might shift to income generation and risk management.

- Schedule Regular Reviews: The most effective wealth management plan is not set in stone. Commit to a quarterly or semi-annual review of your portfolio, goals, and strategies. This is your dedicated time to rebalance, assess performance, and make necessary adjustments based on your life circumstances, not on market noise.

Ultimately, mastering these concepts is about more than just accumulating numbers in an account. It is about gaining control over your financial destiny, creating security for your family, and building the freedom to pursue a life of purpose. By applying these proven principles with discipline and foresight, you are not just managing money; you are architecting your future and constructing a legacy of prosperity.

Frequently Asked Questions (FAQ) about Wealth Management Strategies

1. What is the single most important wealth management strategy for a beginner?

For a beginner, the most important strategy is a combination of diversification and dollar-cost averaging. Automating regular investments into a diversified, low-cost index fund (like an S&P 500 ETF) builds a disciplined habit and reduces the risks of market timing and over-concentration.

2. How often should I rebalance my portfolio?

Most experts recommend rebalancing either on a time-based schedule (e.g., annually or semi-annually) or when your asset allocation drifts by a predetermined percentage (e.g., 5-10% from its target). Annual rebalancing is sufficient for most long-term investors.

3. Is real estate a necessary part of a wealth management plan?

While real estate can be a powerful tool for income and diversification, it is not strictly necessary. You can achieve excellent diversification and returns through a mix of stocks and bonds alone. For those who want real estate exposure without direct ownership, Real Estate Investment Trusts (REITs) are an excellent, liquid alternative.

4. At what net worth should I start thinking about tax-efficient investing?

You should start thinking about tax efficiency as soon as you begin investing. Maximizing contributions to tax-advantaged accounts like a 401(k) or Roth IRA is a foundational step for everyone. More advanced strategies like tax-loss harvesting and asset location become increasingly important as your income and portfolio size grow.

5. Can I implement these wealth management strategies on my own, or do I need a financial advisor?

Many of these strategies, such as dollar-cost averaging into ETFs, can be implemented on your own through a brokerage account. However, a qualified financial advisor can be invaluable for creating a comprehensive plan, managing complex situations (like estate planning and tax optimization), and providing behavioral coaching during market volatility.

6. How does my age affect my wealth management strategy?

Age is a critical factor, primarily influencing your time horizon and risk tolerance. Younger investors can afford to be more aggressive (higher allocation to stocks) to maximize growth. Investors nearing or in retirement should shift towards a more conservative strategy that prioritizes capital preservation and income generation (higher allocation to bonds and dividend-paying assets).

7. What's the difference between wealth management and financial planning?

Financial planning is a broad process of setting financial goals and creating a roadmap to achieve them. Wealth management is a more comprehensive and specialized service that often includes financial planning but also incorporates investment management, tax strategy, estate planning, and risk management, typically for high-net-worth individuals.

8. How does inflation impact my wealth management strategy?

Inflation erodes the purchasing power of your money over time. An effective wealth management strategy must aim for returns that outpace inflation. Assets like stocks, real estate, and inflation-protected bonds (TIPS) are commonly used to hedge against inflation and grow real wealth.

9. What is the role of an emergency fund in a wealth management plan?

An emergency fund (3-6 months of living expenses in cash) is the foundation of risk management. It provides a crucial buffer against unexpected events like job loss or medical emergencies, preventing you from having to sell long-term investments at an inopportune time to cover short-term needs.

10. How can I manage my emotions and avoid making bad investment decisions?

The best way is to create a written Investment Policy Statement (IPS) that outlines your goals and rules. Automate your investments to enforce discipline, avoid checking your portfolio too frequently, and limit your exposure to sensationalist financial news. This creates a system that prioritizes your long-term plan over short-term emotional reactions.

Ready to take the next step and transform your financial plan with expert-backed tools and insights? At Top Wealth Guide, we provide in-depth resources, advanced calculators, and personalized guidance to help you implement these wealth management strategies effectively. Visit Top Wealth Guide to access the comprehensive tools you need to build and protect your wealth with confidence.