Sovereign Wealth Funds (SWFs)‒those towering behemoths of finance‒are reshaping global markets and international relations as we know it. Here at Top Wealth Guide, we’ve watched these state-owned investment colossi swell in influence and complexity over time.

So, what the heck is a Sovereign Wealth Fund? And more importantly, how does it spin its financial web across the globe? Knowing this stuff is not just important… it’s crucial for anyone with a toe in global finance or a passing interest in economic policy. This guide? It’ll take you on a grand tour of the SWF engine room—exploring their inner guts, the ripples they send through markets, and what the future might have in store. Buckle up.

In This Guide

What Are Sovereign Wealth Funds?

Definition and Key Characteristics

Sovereign Wealth Funds (SWFs)… imagine a treasure chest stuffed with surplus revenues from places like oil, trade balances, or foreign exchange reserves. Now, let’s put these chests in the hands of governments-yeah, those folks tasked with making sure the train stays on its rails. These SWFs aren’t just sitting back and collecting dust; no, they dive into stocks, bonds, real estate, and even some exotic investments. Their mission? Grow national wealth, stabilize economies, and safeguard future prosperity.

Here’s the kicker-SWFs play the long game. While Wall Street’s hyper-caffeinated traders chase quick returns, SWFs are like Zen masters meditating for decades, riding out market storms. This patient capital approach lets them back big ideas that might take a minute-okay, maybe a few years-to see the light of day.

Types of Sovereign Wealth Funds

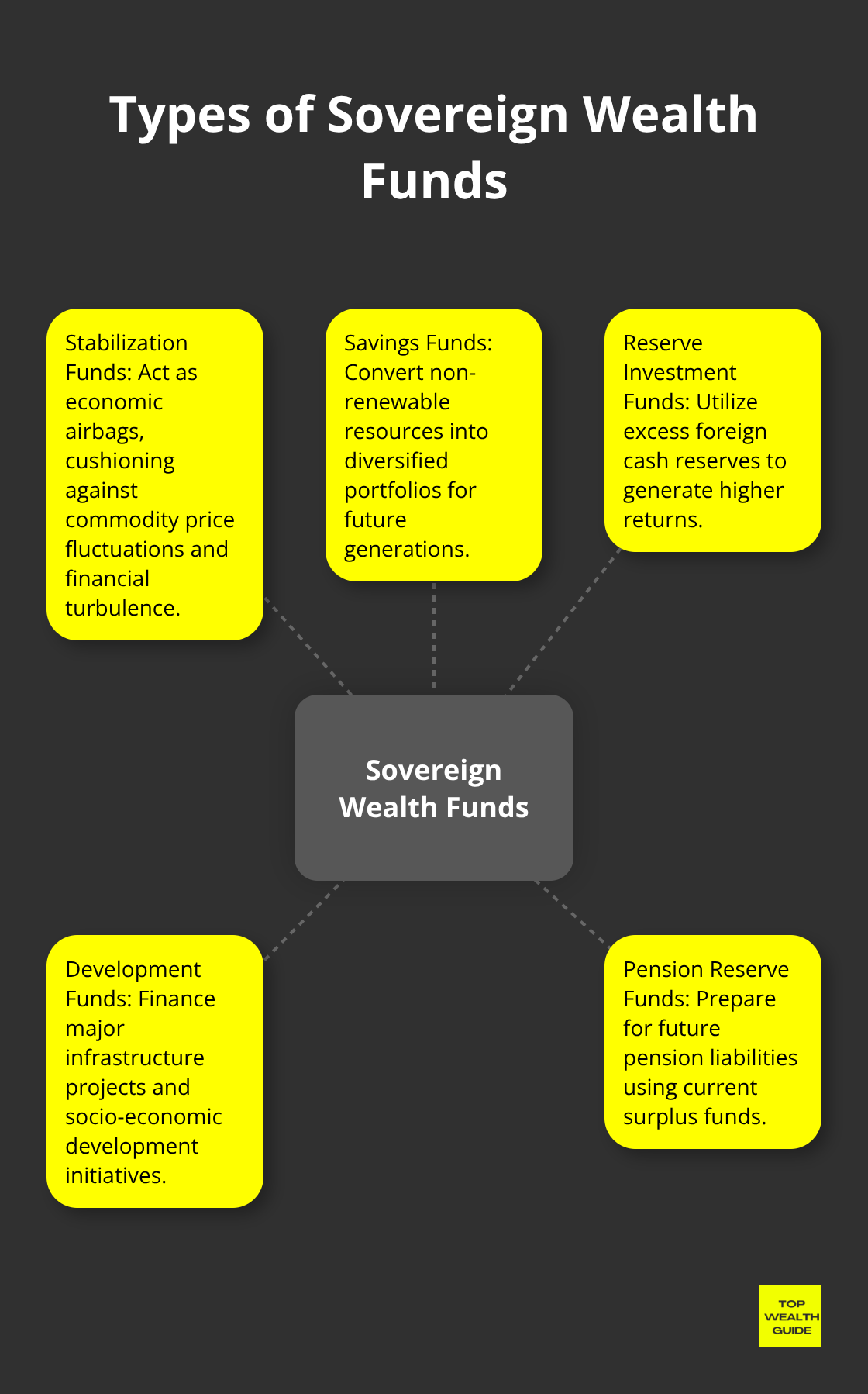

Now, SWFs aren’t cut from just one mold. Nope, these funds roll out in a buffet of flavors, each with its own focal point:

- Stabilization Funds: Think of these as the airbags of a country’s economy-there when commodity prices go haywire or when financial turbulence hits.

- Savings Funds: Turning oil (or any non-renewable loot) into a lush portfolio for the kids and grandkids.

- Reserve Investment Funds: Taking extra foreign cash reserves for a spin so they can rack up some nice returns.

- Development Funds: Funding the big projects-roads, schools, and more-because Rome wasn’t built in a day.

- Pension Reserve Funds: Getting ready to handle pension liabilities like a boss with today’s extra cash.

Historical Context and Evolution

Let’s jump in the time machine back to 1953-enter the Kuwait Investment Authority, the OG of SWFs. With oil revenues flowing, they pioneered the idea of not sticking all their eggs in the oil basket.

Flash forward to the 1970s oil boom, more nations jump on the bandwagon. The Abu Dhabi Investment Authority-boom, a new heavy-hitter in finance. Norway’s government got in the game in 1990, and now they’ve got the biggest SWF out there-over 11,793 billion kroner, no less.

Then the 2000s roll in and-surprise-it’s not just oil folks playing. China shows up with its $200 billion China Investment Corporation in 2007, and suddenly the balance of global economic power has a new contender. Today, these SWFs manage a jaw-dropping $10 trillion in assets, steering the ship of global markets and geopolitics in some big ways.

So, if you’re trying to get the lay of the land in global finance, understanding these mega-funds and their strategies isn’t optional-it’s essential. Get ready to uncover their operations and see how they’re shifting the global economic tides.

How Sovereign Wealth Funds Operate

Funding Sources and Investment Strategies

Sovereign wealth funds – those gigantic pools of cash that countries sit on – are not just a mattress for cash. They’re out there, on the global stage, doing what they do best: investing. Most of these SWFs are living off revenues from commodities or have foreign exchange stockpiled by central banks. Think about places like China – they’re flipping parts of their trade surplus reserves into SWF ventures. And Singapore? Temasek Holdings took off with state-owned startups and, like a beast, expanded into the wild.

These funds have no interest in just letting money sit around. They’re actively playing in various investment ponds, building a mixed bag of portfolios. The Norwegian Government Pension Fund Global holds a muscle-bound 1.5% of all listed companies – talk about flexing those financial muscles.

When it comes to strategy, there’s everything and the kitchen sink. The smart money is on long-term growth and stability – easy on the fast money, thank you very much. From snapping up government bonds to loving on those reliable blue-chip stocks, they’re even grabbing chunky bits of companies. Abu Dhabi’s Mubadala? Their eyes are on tech, baby. Others have a love affair with real estate or big infrastructure deals.

Governance Structures and Management

Now, don’t think SWFs are running wild without some adult supervision. They’ve got governance structures more intricate than your hottest new app. Enter, the board of directors or trustees – a mix of government folk, financial wizards, and sometimes even foreign advisors all bringing their A-game.

For the nitty-gritty, you’ve got professional investment teams – that’s your day-to-day money jockeys, making those strategies come alive and fending off underperformance. They’re raiding top private industry for talent, luring them in with fat paychecks and the chance to get up-close-and-personal with billion-dollar portfolios.

Ah, but here’s the rub: politics lurk. Norway keeps things chill with strict rules, keeping those political fingers out of the pie. Others? Not so much. Sometimes they’re totally tight with government agendas – which may or may not distract from financial goals.

Transparency and Accountability Measures

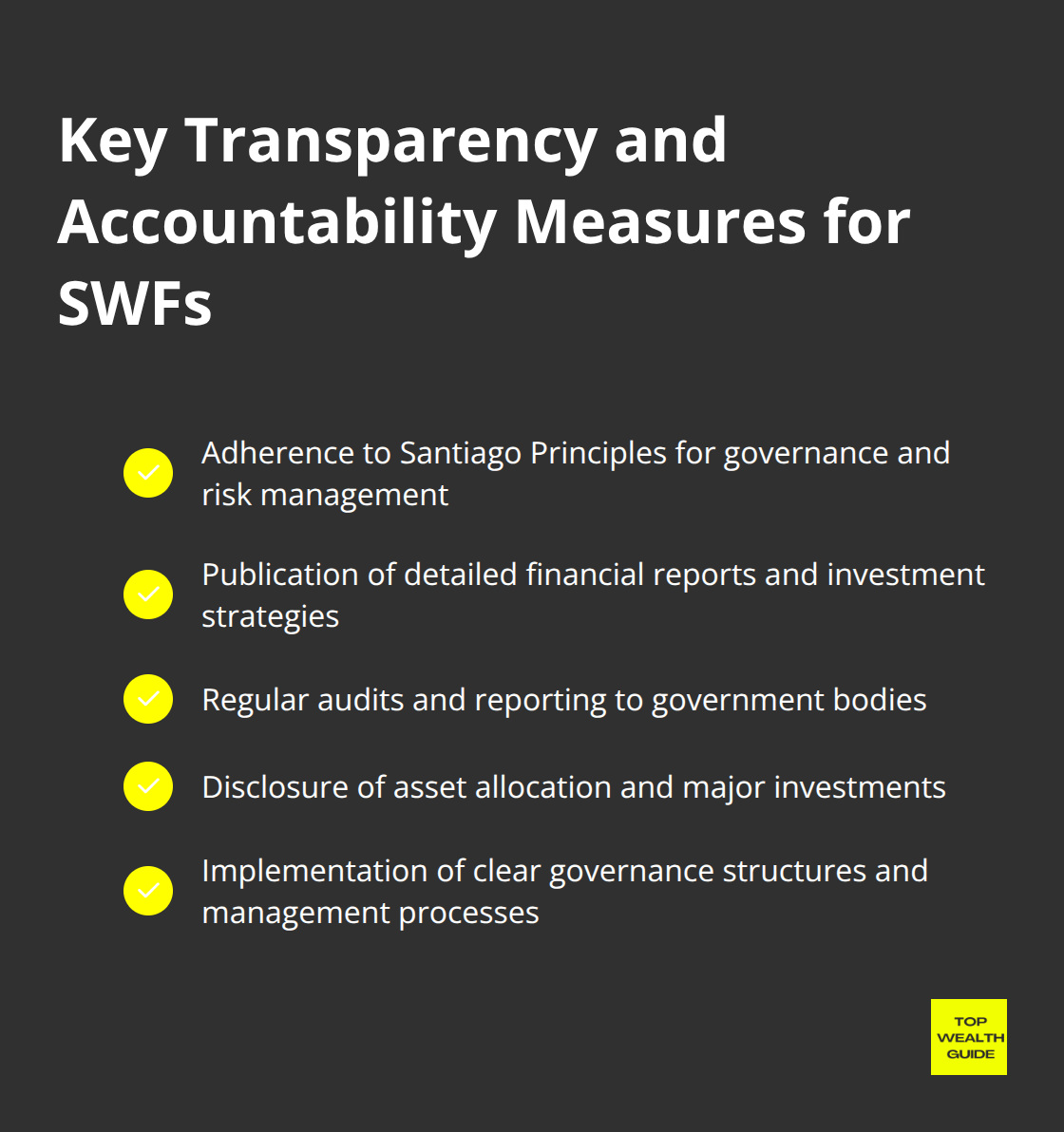

Transparency – oh boy, that’s the hot potato for SWFs. The whisperers say these massive vaults of cashola are just waiting to mess with markets like it’s their side hustle. So, what happened? The Santiago Principles showed up back in 2008 – let’s call them the playbook for solid governance, investment savvy, and risk management.

Some funds, like New Zealand’s Superannuation Fund, are spilling the tea. Detailed reports, right there for the world to see. Others? Maintaining that mystery. Whether they show all or hold back usually ties right back to the home country’s political vibe.

Accountability? It’s the wild west out there. Norway’s fund is taking it old-school, reporting to parliament and facing those audits. Meanwhile, some Middle Eastern SWFs might just be raising their glass in a toast to ruling families or small committees.

Lay it bare, and you gain more love from international partners. It certainly makes those cross-border plays smoother. Watch this space – as the gaze of global scrutiny sharpens, transparency might just be the name of the game for these financial titans.

The impact of SWFs? It’s got a big say in world finance. They’re not just big ol’ bank accounts. They sway markets, flex policy muscles, and redefine what it means to stand at the intersection of state might and private capital. Their footprint is a power move that brings questions about their role in global economics and the geopolitical playboard.

How Sovereign Wealth Funds Shape Global Finance

Market Movers and Shakers

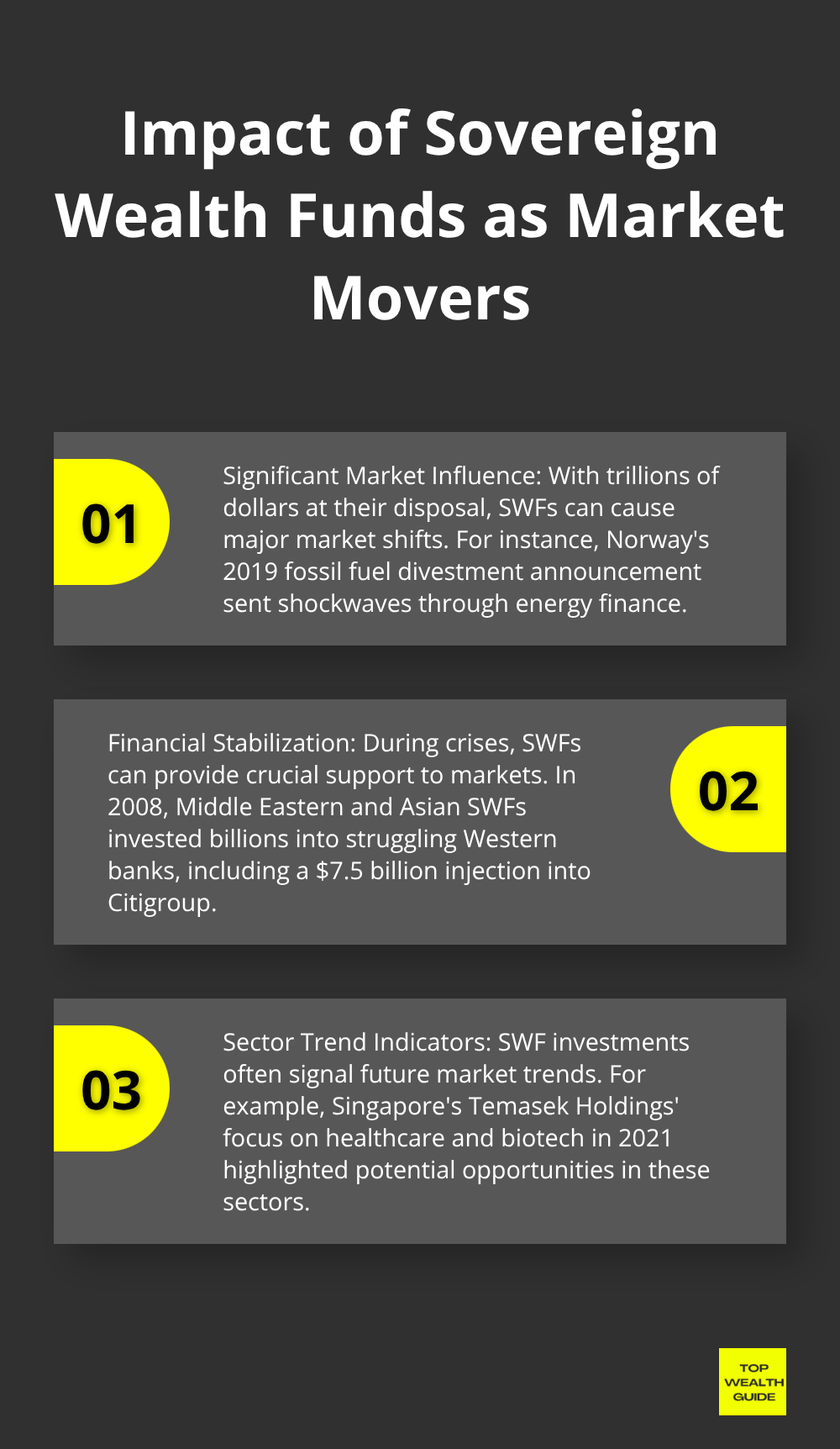

Sovereign Wealth Funds (SWFs) – think of them as the mega-banks of nations – are swinging some serious weight in the global marketplace. With trillions at their command, their every move sets off shockwaves. Take Norway’s 2019 fossil fuel divestment newsflash… it wasn’t a whisper; it was a megaphone announcement ringing through the corridors of energy finance.

Flashback to 2008, when the financial world was doing its best Titanic impression. SWFs from the Middle East and Asia dropped billions into Western banks on life support. Imagine $7.5 billion funneled into Citigroup by the big guardians from Kuwait and Abu Dhabi – a lifeline during the stormiest of weather.

Here’s a pro-tip: Want a window into the future? Watch where SWFs park their cash. When Singapore’s Temasek Holdings nudges into a sector, it’s like a cosmic vote of confidence. Its deep dive into healthcare and biotech back in 2021? Picture a neon sign flashing “Opportunity Ahead.”

Soft Power and Global Influence

SWFs aren’t just about the Benjamins; they’re soft power on a silver platter. These funds, with their strategic investments, do more diplomatic heavy lifting than a secret handshake ever could.

Consider China’s Belt and Road Initiative – it’s a masterclass in global chess. Backed by SWFs, China’s building a web of infrastructure that doesn’t just connect dots; it expands influence and locks down resources, while the rest of the world watches the chessboard.

Geopolitical moves? Subtle – like a ninja but with a checkbook. When Qatar’s sovereign fund snagged Harrods in 2010, it wasn’t merely a retail play… it was Qatar staking its claim on the global stage.

Domestic Economic Transformation

SWFs are the magic wands waving through domestic economies. Take the UAE, where SWFs are the maestros conducting economic symphonies, strumming away from oil dependence. Mubadala’s deep dive into tech and renewables is planting the UAE flag firmly in the innovation hub territory.

Cue Saudi Arabia’s Public Investment Fund (PIF) – spotlight on Vision 2030. With stakes in electric cars and the entertainment galaxy, the PIF isn’t just a player; it’s the architect crafting fresh industries and careers for Saudis.

During the COVID chaos, SWFs were the unsung heroes. As healthcare systems wobbled, sovereign funds stepped in, shoring up businesses and health initiatives like unassuming guardians of the economy.

Challenges and Concerns

However, let’s not sugarcoat it – SWFs aren’t all rainbows and buttercups. Their sheer size? It could distort markets and trip a few alarms over political strings attached to investments.

Transparency… not always their forte. The Santiago Principles came in to clean house and lay out the governance roadmap. But – spoiler alert – not every fund is on board, and practices vary as widely as opinions on social media.

Future Outlook

Looking ahead, SWFs are like those epic movie trailers – promising more influence in shaping global finance and reconfiguring geopolitics with every scene. Policymakers and investors: better keep their scorecards ready to dance around this intricate financial waltz.

Final Thoughts

Sovereign Wealth Funds (SWFs) – think financial powerhouses on steroids – have muscled their way into the heart of global economics and power dynamics. These aren’t your typical piggy banks. Born from surplus revenues, they’re now the big kids on the block, influencing markets, spurring economic development, and flexing soft power on a global scale. SWFs aren’t just playing around at home; they’re making waves far beyond – choosing strategies that range from playing it safe with conservative fixed-income portfolios to going all-in on aggressive equity stakes in the latest cutting-edge industries.

So, what’s the playbook moving forward for SWFs? Well, it’s a mix of opportunities and thickly veiled challenges. Expect to see these funds spreading their wings – diversifying into sectors like tech, renewable energy, and yes, healthcare. What’s driving this change? The ongoing shift towards sustainable and responsible investing. It’s the next big thing, folks. But let’s not kid ourselves – the elephant in the room is the potential political influence of SWFs and whether they might throw global markets off-kilter.

If you’re scratching your head, asking “What is a sovereign wealth fund?” – well, it’s more than a textbook definition. They’re the embodiment of the shifting tides in global economics and power dynamics. At Top Wealth Guide, we get it. SWFs aren’t just changing the game; they’re rewriting the rules. Knowing about these giants is key – whether you’re an investor, a policymaker, or just someone curious about where our global financial landscape is headed.