Penny stocks at under $5 a pop — they’re the wild west of investing. Huge upside, sure… but you gotta sift through ’em like you’re on a treasure hunt. Most folks just scroll through the top 100 penny stocks, throwing darts without a map—often overlooking hidden gold.

At Top Wealth Guide, we’ve zeroed in on what really pulls you ahead in this game. It’s all about the telltale signs—financial health, market stance, and, of course, the smarts of the people running the show. The savvy investor always does their homework before diving in.

In This Guide

What Separates Winners from Losers in Penny Stocks

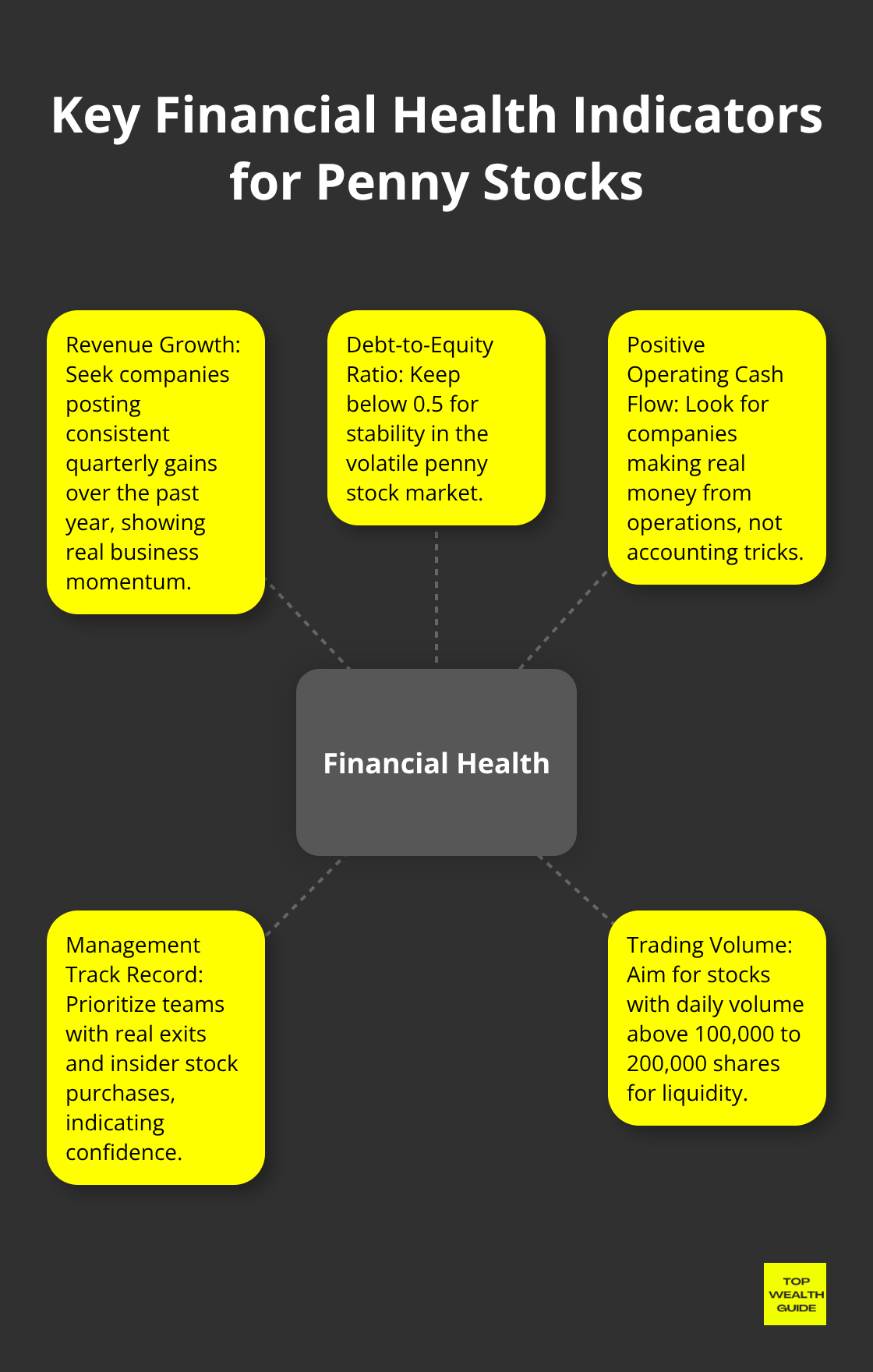

The penny stock graveyard-where dreams go to die. Companies look great on paper and then… down they go. Smart money? Yeah, it chases three non-negotiables. Separates the wheat from the chaff. First? Revenue growth. The ultimate yardstick. Firms that keep posting quarterly gains over the past year? They’re talking real business mojo. Seek those who show cooked numbers, not just pie-in-the-sky projections or so-called partnerships that sound good but make zero bucks.

Financial Health Indicators That Matter

Debt-to-equity ratios-keep them below 0.5. That’s your ticket to stability in the penny stock jungle. Look at a company like Expion360. It’s rolling with a $5 million market cap and is not just burning through investor cash, but actually making some cheddar with their lithium battery tech. Check those balance sheets-positive operating cash flow over the last two quarters? That means these guys are making real money from operations, not some accounting smoke and mirrors.

Management Teams That Deliver Results

Fancy degrees? Meh. Management teams with real exits get the job done. Peek at insider purchase patterns through those SEC filings. When execs buy their own stock? That’s a neon sign flashing confidence about future catalysts. Steer clear of companies where leadership is always issuing new shares or cashing out. Track record over credentials, every single time.

Volume and Liquidity Requirements

Volume above 100,000 to 200,000 shares daily is a must-have. Makes for smooth sailing in and out. No getting stuck when market moods flip. Low-volume stocks? They can tank 30% on a whisper of selling. But those with high volume? They laugh at selling pressure, keeping your ship steady.

These basics lay the groundwork for spotting penny stocks with a shot at growth. Next up? Zeroing in on specific sectors where these principles can turn up the best chances for success.

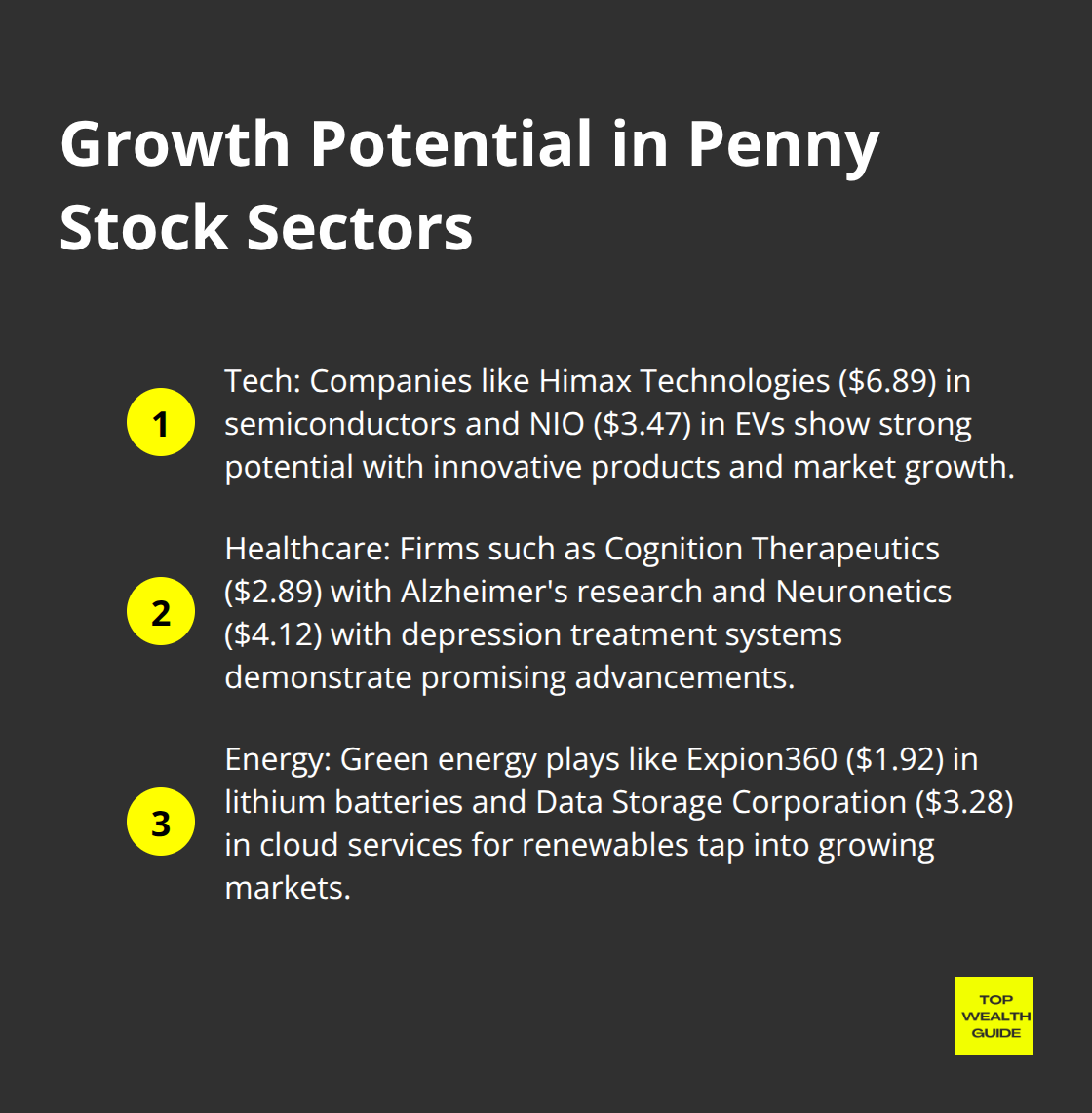

Which Penny Stocks Show Real Growth Potential Right Now

So, here we go… tech stocks are driving the penny stock excitement train, and it’s got solid tracks. Let’s talk Himax Technologies-at $6.89, it’s flirting with the edge of the classic penny stock definition but gives you semiconductor action in the automotive and AR game. They pulled in $155.4 million from their small and medium display driver gig-down 2.2%, sure, but still throwing punches above its weight class. Then there’s NIO at $3.47… owning a healthy slice of the massive Chinese EV pie, boasting a 39.6% uplift over just one month as of October 2024. Their battery-swap magic-something Tesla wishes it had-helps set them apart. Bitfarms? At roughly $2.15, they’re riding the Bitcoin wave, smashing it with 71.5% on the monthly gains chart as crypto shows signs of life anew.

Healthcare Stocks With FDA Catalysts

Now, onto healthcare, where Cognition Therapeutics at $2.89 is gunning for Alzheimer’s breakthroughs with their CT1812 pill. We’re smack in Phase 2 trials, folks. Neuronetics, meanwhile, is chilling at $4.12… their NeuroStar system for depression scored 28% gains last month. And with Medicare’s stamp of approval, it’s a recurring dollar deal traditional pharma can only dream of. Cue Inspire Veterinary Partners at $1.85, piecing together animal care with a $7 million market cap, eying that juicy $25 billion vet industry boom.

Energy Plays That Ride the Green Wave

Expion360 is dominating at $1.92 per share with their lithium-iron-phosphate batteries… all about marine and RVs, tapping that $4.2 billion market like a pro. Then there’s Data Storage Corporation, clocking in at $3.28 and seeing a 41.7% return on the month. They’re basically providing the cloud legs for renewable energy’s journey. These guys are thriving on the tidal wave of energy transition investments-global investments are sky-high, like north of $5.6 trillion from 2025 to 2030. Douglas Elliman at $1.45 might seem like your regular real estate player, but they’re all about solar perks and green badges, grabbing those sweet 20% premiums.

Listen, smart investors know chasing potential isn’t enough in penny stock land. The true mastery? Juggling those inherent risks while amping up potential gains with sustainable growth strategies.

How Do You Survive Penny Stock Volatility

So here’s the deal – penny stocks are a wild ride. MarketWatch says they swing 25% daily. That’s not a typo. It’s like a rollercoaster without a seatbelt. One tweet, a tiny earnings miss, or an FDA hiccup – your money could vanish quicker than morning coffee. The SEC? Yeah, they’re waving red flags for a reason. The bid-ask spreads? 5-10% – meaning you’re already playing catch-up before you even start. The savvy investors? They slap a 15% max on stop-losses and don’t risk more than 2% of their whole portfolio on a single penny stock. Remember Bitfarms? A 40% nosedive over three days despite Bitcoin doing the cha-cha up the charts. Those who played by the rules? Managed losses. The rest? Flattened.

Research Beyond the Hype

Let’s ditch the pump-and-dump hype machines. Real talk – SEC filings are your new best friend. Form 10-K annual reports, 8-K current reports – they give you the real tea. Look for firms pulling in at least $1 million quarterly and showing positive gross margins. Check those insider trading moves via Form 4 filings. Execs buying with their own cash – a vote of confidence. Selling? That’s your cue to bolt. EDGAR database – use it – free and full of filings. Finviz stock screener? Filters penny stocks by juicy metrics like P/E ratios under 15, debt-to-equity under 0.5. The real winners? They’re putting in 3-4 hours per stock researching before pulling the trigger. The lazy crowd? Ends up feeding the fraudsters – just like FINRA warns.

Position Sizing That Protects Your Wealth

Approach penny stocks with, let’s say, extreme caution. Do the homework; know your risk threshold. Never exceed 1% of your total portfolio on one of these little market mosquitoes. Got $50k to toss around? Keep penny stock exposure tiny. One stock maxes out at $500. The pros? They stick to this script because, overnight, poof – zero. Spread your bets across 10-15 different stocks to dilute the risk. Energy stocks like Expion360? Don’t dump your whole penny cache there – oil price swings can tank the lot. And hey, keep 6 months of living expenses in cash. Penny stocks – not for gambling. It’s money you can part with – fully and completely – like a longstanding love affair. But before any of that, lock down a financial fortress. Secure the base before chasing the thrill.

Final Thoughts

Making it big with penny stocks? Forget luck-discipline is your best buddy here. The real champs keep their eyes peeled for companies clocking in quarterly revenue growth north of 15% and debt-to-equity ratios under 0.5. Oh, and having a solid management team doesn’t hurt either. It’s all about the volume game-stick with stocks that swap hands over 200,000 times a day to steer clear of those nasty liquidity traps.

What separates the pros from the folks just rolling the dice? Risk management, my friend. Keep your thrills in check-never toss more than 1% of your cash into a single penny stock, and cap your total penny stock thrills at 5%. Stop-losses maxed out at 15% are your safety net, and let’s be honest-dig through every SEC filing before your wallet gets any lighter. Those top 100 penny stocks lists buzzing around social media? Yeah, mostly just disasters waiting to unfold.

Start off easy, say $500 tops per position, and zoom in on sectors with some obvious oomph-think biotech firms on the brink of FDA nods, tech outfits cranking up those revenue streams, or energy squads surfing the green wave. Companies like NIO, Cognition Therapeutics, and Expion360-they’ve got the chops you’re after. But, listen up-build your wealth foundation first with diversified portfolios, that rainy-day fund, and rock-solid financial planning before letting penny stocks sneak into your strategy. Keep it small, keep it speculative, and keep it smart.