Compound interest — the eighth wonder of the world for a reason. This little mathematical sorcery turns your pennies into a fortune over time. Think exponential growth, not your boring, run-of-the-mill linear kind.

Here’s the kicker: so many folks are leaving piles of cash on the table (we’re talking millions) because the lightbulb hasn’t gone off on this. At Top Wealth Guide, we’ve seen it way too often. The secret? Start early. That’s the golden ticket… the dividing line between sipping margaritas in retirement or grinding away until you’re 80.

In This Guide

How Does Compound Interest Really Work?

Compound interest – it’s where your money not only does its day job but moonlights on weekends. So, your $1,000 turns into $1,060 at a 6% gig. But catch this – next year, you earn 6% on the full $1,060, not that boring old $1,000. An extra $3.60 might feel like pocket change now, but give it 30 years… and, well, you’ll see the magic.

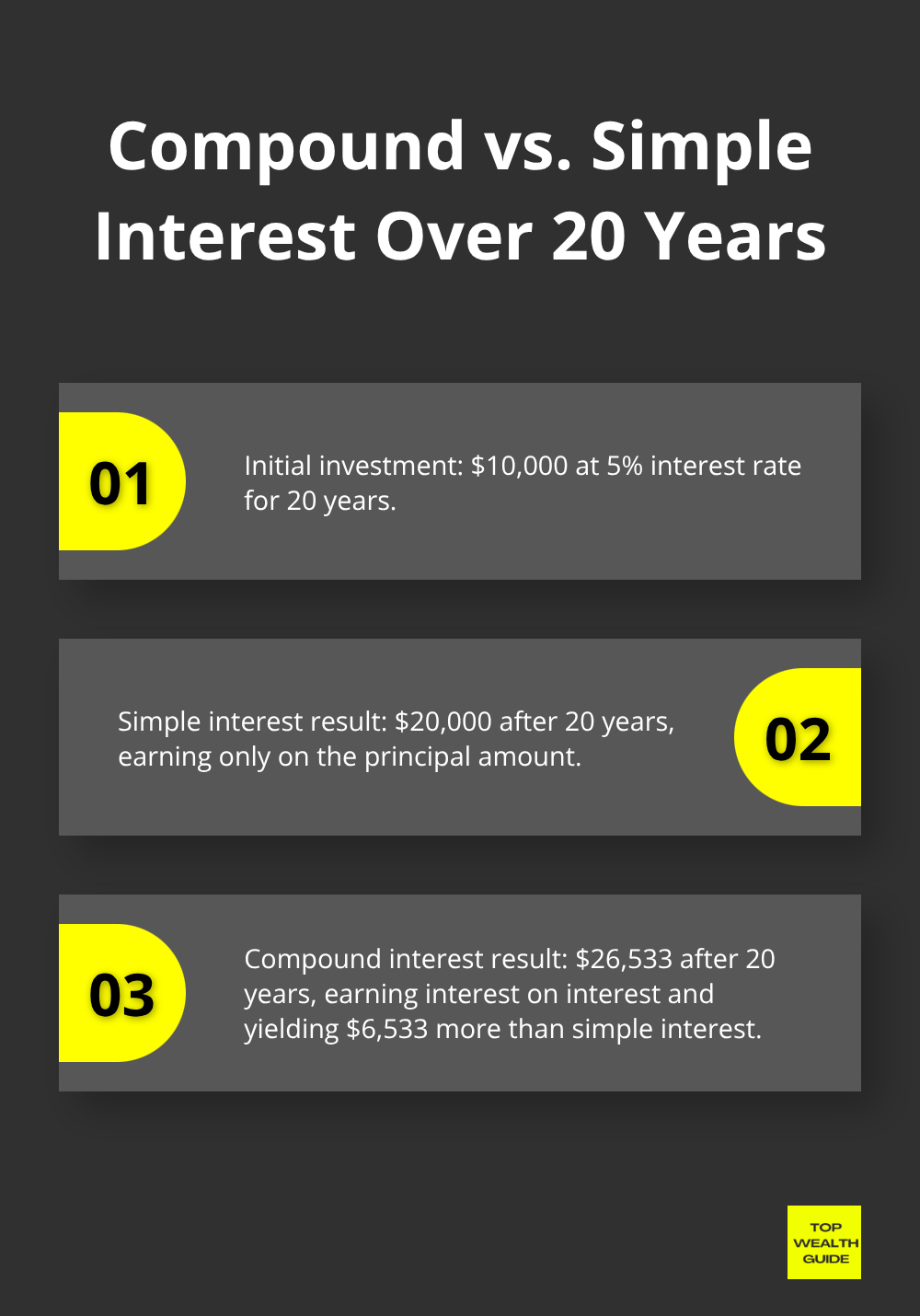

Simple Interest Gets You Nowhere Fast

Simple interest – it’s the complacent roommate who only pays rent on the original lease. You toss $10,000 into a simple interest account at 5%, and voila, you get $500 every year. Do the math for 20 years and you’re staring at $20,000. Meanwhile, compound interest at that same gig hands you $26,533. Yup, $6,533 more for doing absolutely zilch. The Federal Reserve might be busy tinkering with monetary screws to fuel economic growth, but even their research agrees – longer the ride, wilder the difference.

Frequency Changes Everything

Think of daily compounding as coffee on speed. A $10,000 investment at 10% heady annual interest balloons to $25,937 after a decade if compounded monthly. On a measly annual compounding diet, it limps to just $20,000. That’s about $6,000 extra for doing nothing but compounding more often. (Most high-yield savings accounts are daily buffet fans, while CDs are monthly or quarterly snackers.)

Time Multiplies Your Wealth

Start squirreling away $200 a month at age 25, and with a 6% return, you’re looking at $393,700 by age 65. Flip the calendar to start at 35 and you’re sobering at $201,100. Those extra 10 years nearly double the loot. Consider a savvy 20-year-old who invests wisely with $1,000 today at a 7.2% growth – they end up with around $32,000 at age 70. Wait a decade, and that nest egg shrinks to $16,000. Americans highly value their golden years, but so many miss the train simply because they start too late.

The Rule of 72 Reveals Your Timeline

Chop 72 by your annual interest rate and you unlock the mystery of how long it’s gonna take your money to double. At 6% interest, you’re looking at a 12-year doubling period (72 ÷ 6 = 12). At a 10% pace, you’re practically sprinting with a double every 7.2 years. This nifty trick – the Rule of 72 – offers a back-of-the-envelope look at why higher returns pull their weight over the marathon. Though, to be fair, the real world has a habit of throwing curveballs into those projections.

Those numbers? They aren’t just abstract equations – they’re the bricks and mortar of wealth creation, laying down the foundation for the financial palace of your dreams.

What Does $10,000 Really Become After 30 Years?

So, let’s strip away the corporate baloney and dive into what compound interest really gives you in plain greenbacks. You drop $10,000 into the mix at a 7% annual return, and voilà, after 30 years, you’re looking at $76,123. Now, crank up that return to 10%, and you’re not just whistling Dixie-you’re holding $174,494. Boom, that extra 3% return? Yeah, that’s nearly $100k more landing in your bank account. Check it: the S&P 500‘s been cruising at an average of 10.5% yearly since 1957, making these numbers a realistic bullseye for those who play the long game.

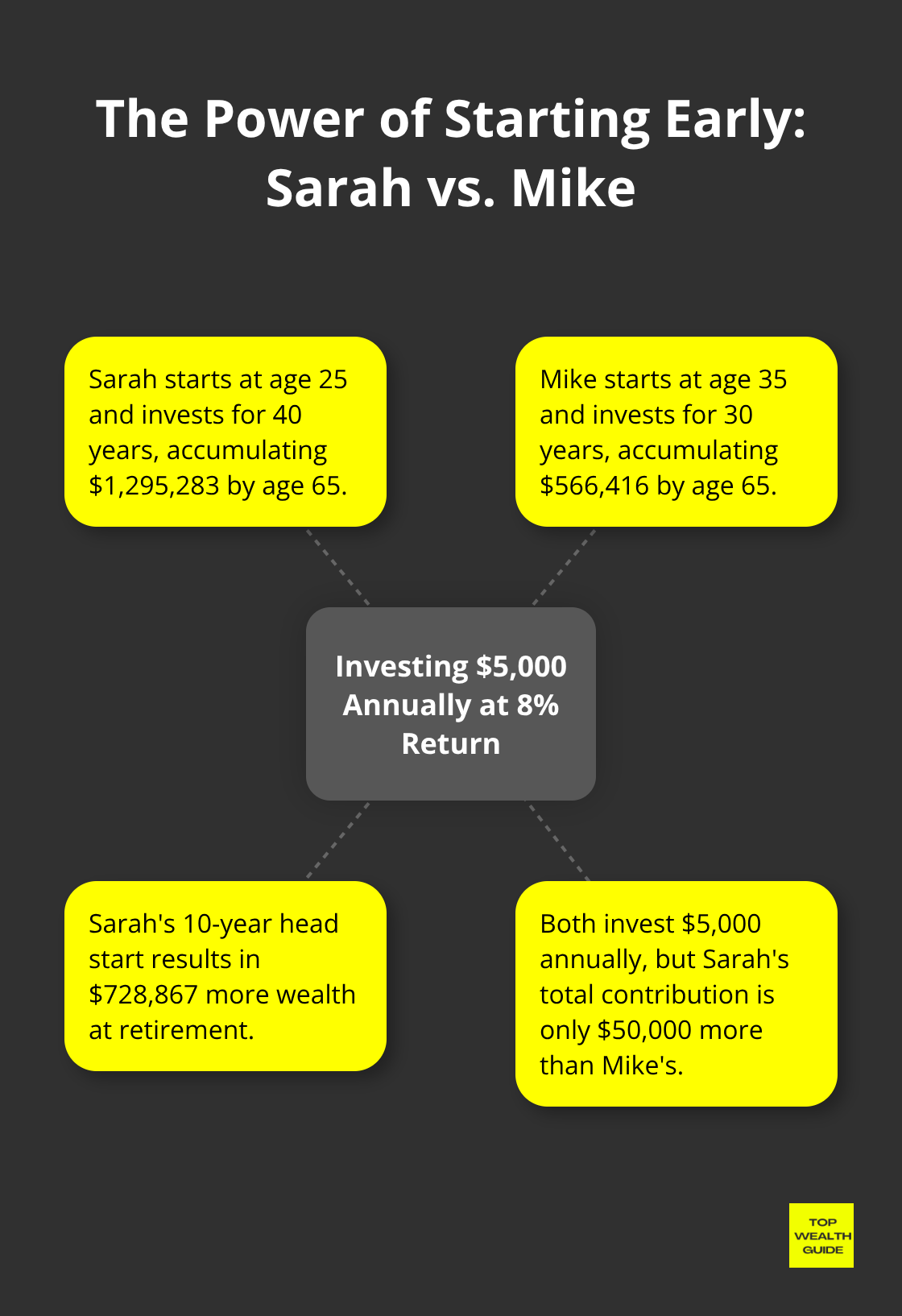

Early Birds Capture the Biggest Gains

Here’s where time puts its suit and tie on and means business. Sarah starts dropping $5,000 a year into the pot at 25 with an 8% return. Fast forward to age 65, and she’s sitting on a cool $1,295,283. Her pal Mike? He hits snooze, waits till 35, rolls out the same game plan, and winds up with $566,416. Sarah only pitched in $50,000 more over those additional 10 years but cashed out with a whopping $728,867 extra. Getting in early? It’s clutch, and too many folks miss the memo when they drag their feet on investing. Want a jaw-dropper? A 20-year-old tossing in $2,000 yearly until age 30 and then chilling? They’re beating someone who starts at 30 and throws in $2,000 yearly until they’re 65.

Interest Rate Differences Create Wealth Gaps

Small fries? These tiny rate differences-do the math over decades, and they mushroom into massive chasms of wealth. Take a $50,000 bill tossed into the grinder for 25 years. At 4%, you’re seeing $133,292. Push it to 6%? That balloons to $214,548. Then crank it to 8%, and you’re at $342,424. That paltry 4% difference between the min and max scenarios? Yeah, that’s an extra $209,132 in your pocket. High-yield accounts are peeking at around 4.3% to 4.35% a year right now, while those diversified stock portfolios have historically spun 8% to 10%. The Federal Reserve’s numbers give it to you straight: Americans who choose growth investments crush it, accumulating 3 to 4 times more wealth by retirement age.

Monthly Contributions Accelerate Growth

Now, mix in monthly contributions and watch the fireworks show. Start with $10,000, throw $500 into the hat monthly at 8% returns (a pretty fair shot for balanced portfolios), and after 20 years, you’re holding $394,772. Wait 30 years, and that smashes into $745,180. Those consistent contributions? They’re like rocket fuel for the compound engine firing fresh ammo every month. Peek at dividend stocks or real estate investments for some solid returns. The insider tip? Automation-set up those auto-transfers so you never flake on a contribution and can go on auto-pilot.

These nuggets show why sharp investors zero in on three bullet points: time, rate of return, and how often you toss money into the ring. Master these three elements, and you’ll be laying the bricks for generational wealth.

How to Supercharge Your Compound Interest Returns

The gap between financial champs and chumps-let’s break it down. Three moves: start immediately, pick the right vehicles, and seriously, don’t touch those gains. Marcus Goldman Sachs shows us a tale of two investors-begin at 22, not 32, and you’re looking at 60% more wealth when you retire. That ten-year wait? Costs you six figures.

Get that investment account open this week. Not next month-this week. Vanguard’s got the data to back it up: delay a year, and 90% of folks-yeah, never catch up.

Choose High-Yield Vehicles That Actually Work

Forget those 0.01% bank accounts-totally yawns. Marcus, Ally? They’re dangling a tasty 4.35% on high-yield accounts. For serious growth, think low-cost index funds like VTSAX with its lean expense ratio of 0.04%. Fidelity’s FZROX-no fees. Just tracks the total stock market.

Every 1% in fees you dodge? Turns into $200k over three decades on a $100k stake. Treasury I Bonds are dishing out 5.27% and deflecting inflation. Max those 401k contributions to $23k, and juice that IRA to $7k to slap Uncle Sam away from your gains.

Reinvest Every Dollar You Earn

Automatic dividend reinvestment? It’s like the gift that keeps giving. Coca-Cola die-hards reinvesting since 1980? Flipped that $1,000 into $52,000 instead of a measly $16,000. Brokers like Schwab and Fidelity-offering automatic dividend reinvestment plans for free.

Pulling out early? Slaughters compounding returns. Yank $50k at 45, and you’re kissing $400k goodbye come retirement if you were riding 8% returns. Pretend those investment accounts don’t exist until you hit 65.

Automate Your Success

Set up those $500 transfers monthly-keeps the contributions rolling even when the going gets tough. Dollar-cost averaging? It’s your volatility smoother-buying more shares when the market dips. Most brokers? They’ve got automatic investment plans snatching up fractional shares.

Let the math do the heavy lifting-take emotions out of it. Automated systems save you from punting during market nosedives or getting all-in during the bull charge.

Final Thoughts

Alright, let’s talk compound interest-it’s like a time machine for your money. Start early (25 vs. 35), just $200 a month, and you’ll see one of those mind-blowing charts that makes you feel like a genius. We’re talking an eye-popping $393,700 vs. a meh $201,100 by retirement. Magic? Nope, just math. (Your returns have little returns, and the cycle feeds itself like a snowball on steroids…over decades).

Want the secret sauce? Time and consistency. Oh, and make sure to choose the right rides for your money. High-yield accounts at 4.35%? They’re dunking on the average savings account. Index funds? Keep those under 0.1% expense ratios and you’ll retire like a boss. And automatic dividend reinvestment? That’s turning a thousand bucks into $52k in 40 years, compared to a measly $16k without. Yes, $16k is the sad trombone here.

Hit the gas on action-don’t get lost in analysis paralysis. Seriously, open that investment account now. Automate $500 a month. Max out your 401k to $23k and your IRA to $7k for some sweet tax advantages. At Top Wealth Guide, we see way too many folks waiting for the Green Light of Perfection that never freakin’ comes. The best time to start? Yesterday. Next best? Today.