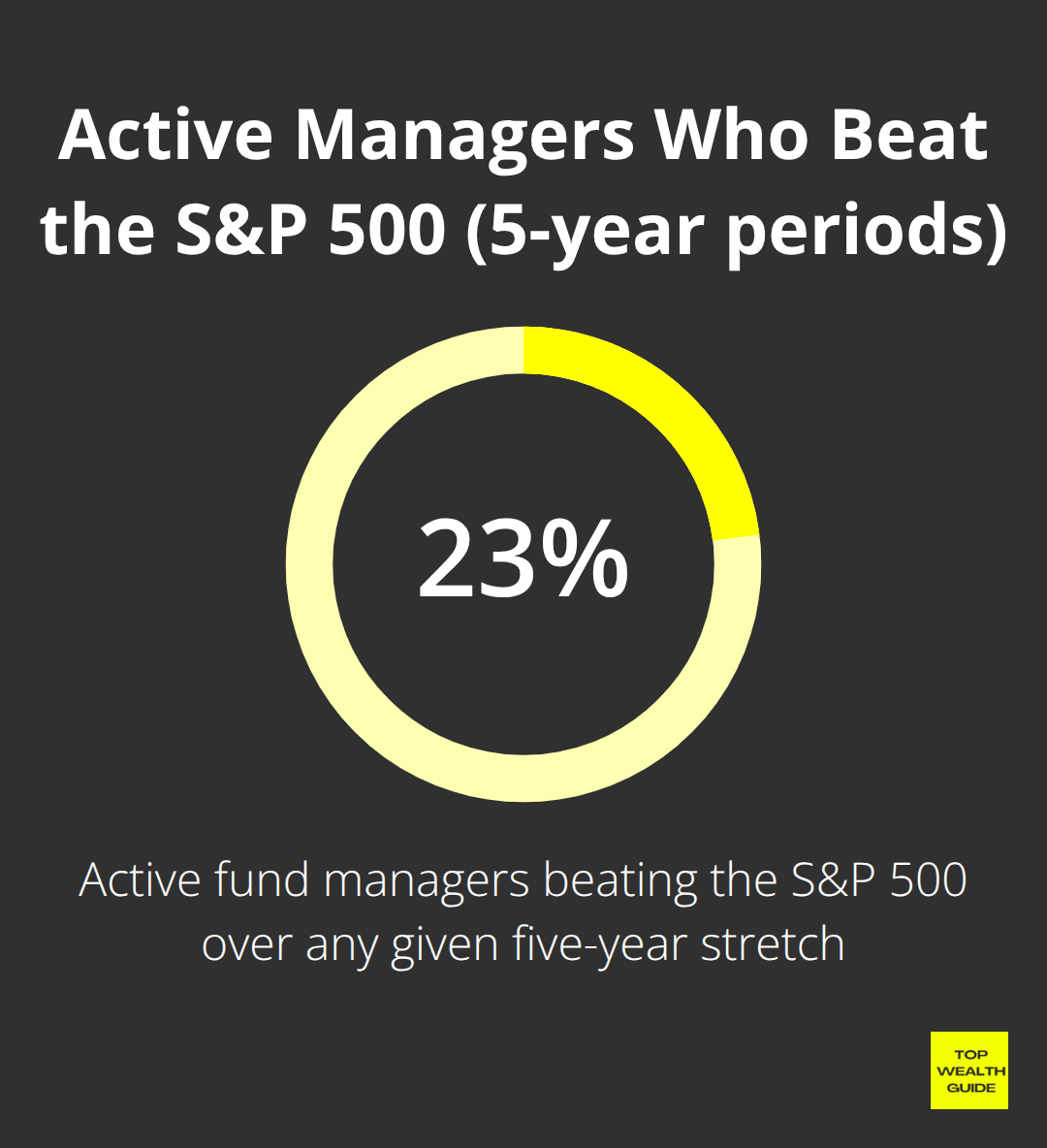

Most investors — let’s be honest — end up in the red when trying to outperform market returns with individual stock picks. The hard truth: research consistently shows that a mere 23% of active fund managers manage to beat the S&P 500 over any given five-year stretch.

Here at Top Wealth Guide, we’ve crunched the numbers, sifted through the data, and what have we found? Solid gold — well, not literally, but proven stock-picking methods that actually generate superior returns. Cue the drum roll… because we’re diving into strategies that zero in on value investing essentials, pinpoint growth stocks, and embrace dividend-focused techniques — all in a bid to outsmart the market.

In This Guide

Value Investing Fundamentals That Generate Returns

Let’s fasten our seatbelts, folks. Value investing-it works because it zeroes in on a big market glitch: emotional overreactions. Picture this-investors hit the panic button and dump solid companies like they’re going out of style due to hiccups that are probably just blips. We’ve got the smart crew moving in then. The data-Fama and French-scream it loud and clear: value stocks leave growth stocks eating dust over the long haul and serve up a superior average rate of return.

Identifying Undervalued Stocks Using Financial Metrics

Let’s get down to brass tacks-price-to-earnings ratios. They’re your compass, your north star. They tell you what the market thinks compared to actual company earnings. Get this-companies trading at a discount are often diamonds in the rough. You’re looking for debt-to-equity ratios south of 0.5 for real financial muscles, and return on equity over 15%-that screams smart management. Zero in on firms churning out steady free cash flow-this guy gives you the real profitability picture, not some cooked-up earnings mumbo jumbo.

Warren Buffett’s Approach to Long-Term Value Creation

Take a page from the Oracle of Omaha-Warren Buffett’s value investing. He’s not chasing fair businesses with a bow on top; he’s after those ‘wonderful businesses at fair prices’. Just look at Berkshire Hathaway-Apple’s his golden goose, sitting at 47% of the holdings because it’s got that brand power plus nice, steady cash flows. The secret sauce? It’s all about companies with economic moats-think long-lasting competitive edges safeguarding fat profit margins. Coca-Cola flaunts its global network like a champ in this league.

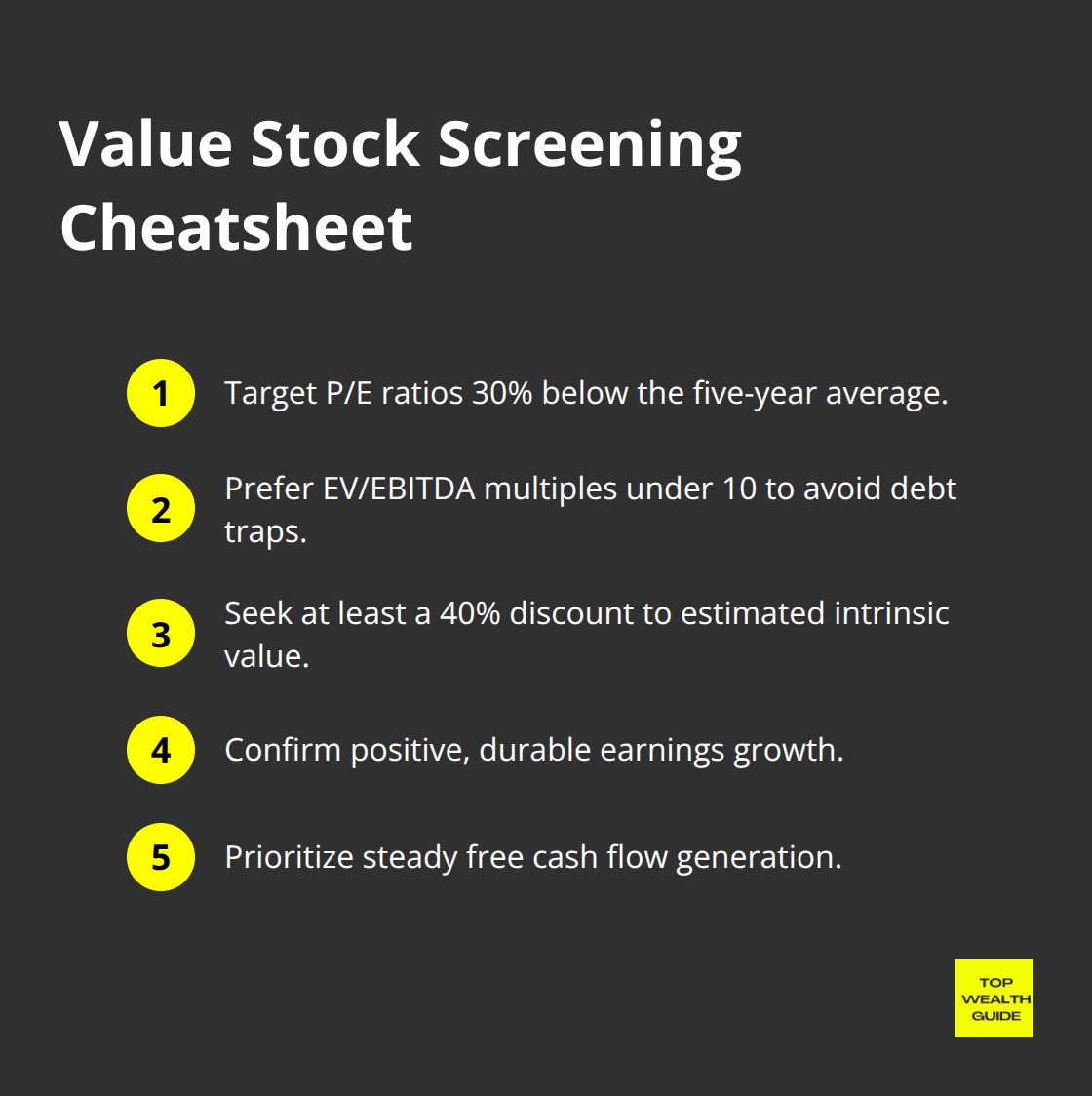

Screen for Low P/E and Price-to-Book Ratios

The drill-hunt for companies sporting P/E ratios a cool 30% lower than their five-year norm while still enjoying that sweet earnings growth. Toss in enterprise value-to-EBITDA ratios under 10 to steer away from debt traps. The pros? They’re fishing for stocks trading at least 40% below what they’re truly worth; that’s how you get that juicy margin of safety.

It’s about pouncing on securities that seem like steals through solid fundamental analysis-that’s your ticket to gains that pop.

Now, while value investing might be the bread-and-butter of market-busting strategies, growth stocks-they offer a whole different ball game. They’re how you ride the wave of skyrocketing companies capturing those fresh market chances.

Growth Stock Selection Methods

Alright, let’s dive into the wild world of growth stocks. We’re talking about the kind of innovative mavericks that ditch the safety net and go full throttle on revenue acceleration and market grab. The numbers, folks, they speak volumes: Fidelity’s got the data-growth stocks crank out 15-20% annual returns compared to the market’s snooze-fest 10%. The secret sauce? Look for companies with consistent growth patterns-no one-hit wonders here, only sustainable growth dynamos.

Amazon? Total case in point-it crushed the revenue growth game for over a decade, morphing from book retailer to cloud computing overlord.

Revenue Growth Rate Analysis and Market Expansion Potential

Here’s the play: sniff out those companies that consistently post quarterly revenue growth and leave analyst expectations in the dust by 5% or more. Netflix nailed this during the streaming takeover, cranking up the revenue charts from 2010-2018 while it went worldwide. Zero in on businesses with total addressable markets that scream potential for ongoing expansion. Think software moguls like Microsoft-cranking out cloud services as businesses leap to digital transformation.

Technology and Healthcare Sector Opportunities

Let’s talk tech-28% of the S&P 500’s pie is tech stocks, but quite a few still wear a price tag that makes sense next to their growth rates. Then you’ve got healthcare-a goldmine driven by demographic trends. Companies crafting groundbreaking treatments can see their stock values triple faster than you can say FDA approval. Remember Moderna? Its COVID vaccine frenzy sent shares skyrocketing 434% in 2020-biotech boomtown, right there.

Momentum Indicators and Technical Analysis Tools

Here’s where we crank the dial: blend your fundamental analysis with momentum indicators, the compass for trend strength and weaknesses. Growth stocks kissing 52-week highs with a volume uptick? They’re likely to keep the party going for months. Tesla’s 2020 rocket ride? Classic story-technical breakouts paving the way for a jaw-dropping 743% gain as the EV revolution gets its day in the sun.

But let’s keep it real-big returns mean higher volatility. Enter dividend stocks, the trusty sidekick to growth stocks, offering stable income that keeps your portfolio on an even keel when the market party gets a little too rowdy.

Dividend Stock Strategies for Consistent Income

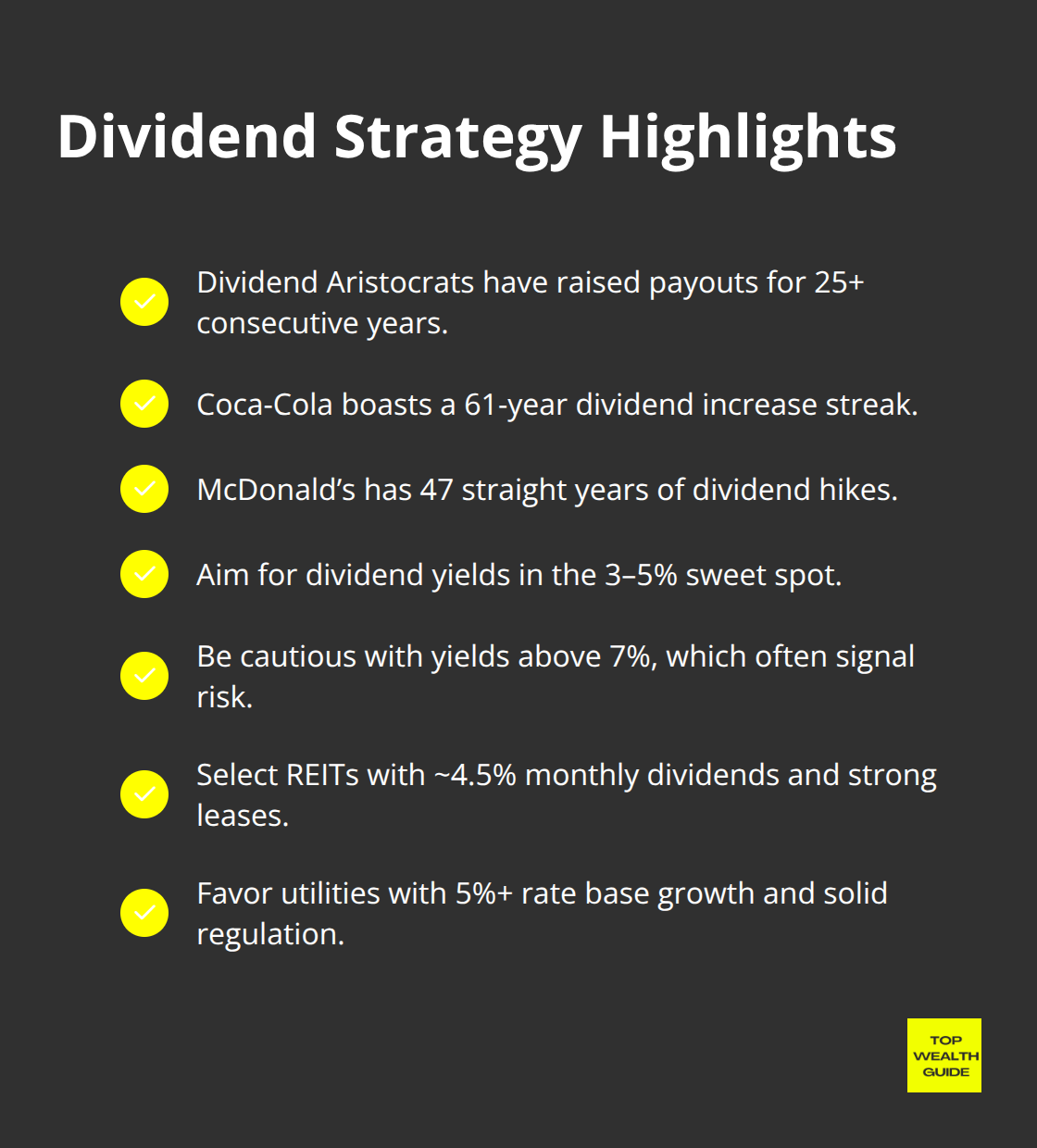

Oh, the joy of dividend stocks-those steady anchors in the tumultuous sea of market chaos. When the market’s doing its crazy dance, sending growth portfolios into a tailspin, dividend stocks just keep on printing… cash. We’re talking about the Dividend Aristocrats here, folks-these S&P 500 stalwarts have cranked up dividends every year for a jaw-dropping 25 years straight. Picture this: companies like Johnson & Johnson and Procter & Gamble, flexing their dividend muscles for over half a century. That’s real financial swagger, people-management that knows its stuff, come rain or shine.

Dividend Aristocrats and Their Track Records

In the face of recessions, market meltdowns, and whatever else the economy throws their way, these champs don’t flinch. Coca-Cola? It’s on a 61-year dividend-boosting spree, while McDonald’s clocks in with 47 years of annual hikes. The S&P 500 Dividend Aristocrats index tracks these reliable giants since it sprung to life on May 2, 2005.

For investors craving a little less drama, this focus on rock-solid performers beats the rollercoaster ride of pure growth plays.

Yield vs Growth Balance in Portfolio Construction

So, what’s the smart move for a dividend devotee? Juggle today’s income with tomorrow’s growth. By embracing dividend growth, you get those delightful payments rising every year, even as markets wobble. Just look at Microsoft-its dividend yield might be chilling at 2.8%, but a triple-digit payout increase over ten years speaks volumes. Throw in some impressive stock price gains, and you’ve got a winner. Aim for dividend yields between 3-5%-a sweet spot that dodges the ugly yield traps (a yield north of 7% is usually shouting “danger” in a megaphone).

REIT and Utility Stock Selection Criteria

Want a slice of regular income pie? REITs like Realty Income Corporation dish out monthly dividends around 4.5%, thanks to solid long-term leases and blue-chip tenants. Utility behemoths like NextEra Energy? They’ve got your back with quarterly payouts fuelled by regulated cash flows and unbreakable demand. What’s the play here? Hunt for REITs with funds from operations growth above 3% annually and keep debt-to-equity ratios under 40%. For utilities, zero in on firms with rate base growth over 5% and a great rapport with regulators in the hot zones.

Final Thoughts

The numbers are basically neon signs: value investing – it’s all about that steady outperformance through disciplined fundamental analysis. Meanwhile, growth stocks? They’re like fireworks… explosive returns if you’re okay with a bit of a roller coaster ride. Dividend strategies, though, they’re the safe harbor, with stalwarts like Johnson & Johnson holding up a 61-year payout streak. The real magic? It’s in mixing the potion – combining all three strategies rather than betting the farm on one horse.

Now, risk management… it’s your first line of defense. Let’s keep it simple: don’t put more than 5% of your portfolio in any single stock, no matter how much you love it. Spread your love across 15-20 positions that span different sectors and market sizes (it’s diversification, folks, your shield against company-specific grenades while still chasing that upside).

What about your action plan? Start with nailing down your investment goals and tolerance for risk. Hunt for value plays using P/E ratios that beat the industry norms, then scout for growth warriors showing revenue growth above 15% annually. Bring in some dividend aristocrats to anchor your income stability and dedicate a slice of your week to fundamental research while keeping a watchlist of the rising stars. We at Top Wealth Guide are your co-pilots, providing comprehensive guidance on building wealth through strategic investing with practical insights and actionable strategies.