Sovereign wealth funds… let’s break it down. They’re these big financial heavyweights that throw their shadow across the global economic stage. Picture this—giant state-controlled entities swimming in cash, thanks to natural resources or trade surpluses. They’re not your average piggy banks.

At Top Wealth Guide (yeah, we keep an eye on these things), we know how these funds can shake markets and economies to their core. This isn’t just money-talk—it’s about understanding the crazy power these funds wield and why folks from Wall Street to government halls are paying attention. Dive in with us… the world of sovereign wealth funds is like a thriller novel you didn’t know you needed to read.

In This Guide

What Are Sovereign Wealth Funds?

Sovereign wealth funds (SWFs) – state-owned giants in financial disguise. These funds aren’t your run-of-the-mill investment vehicles; they’re massive vaults of cashola, often coming from a nation’s natural resource jackpots or trade windfalls. They take all this cash and scatter it across global assets like some sort of financial Johnny Appleseed.

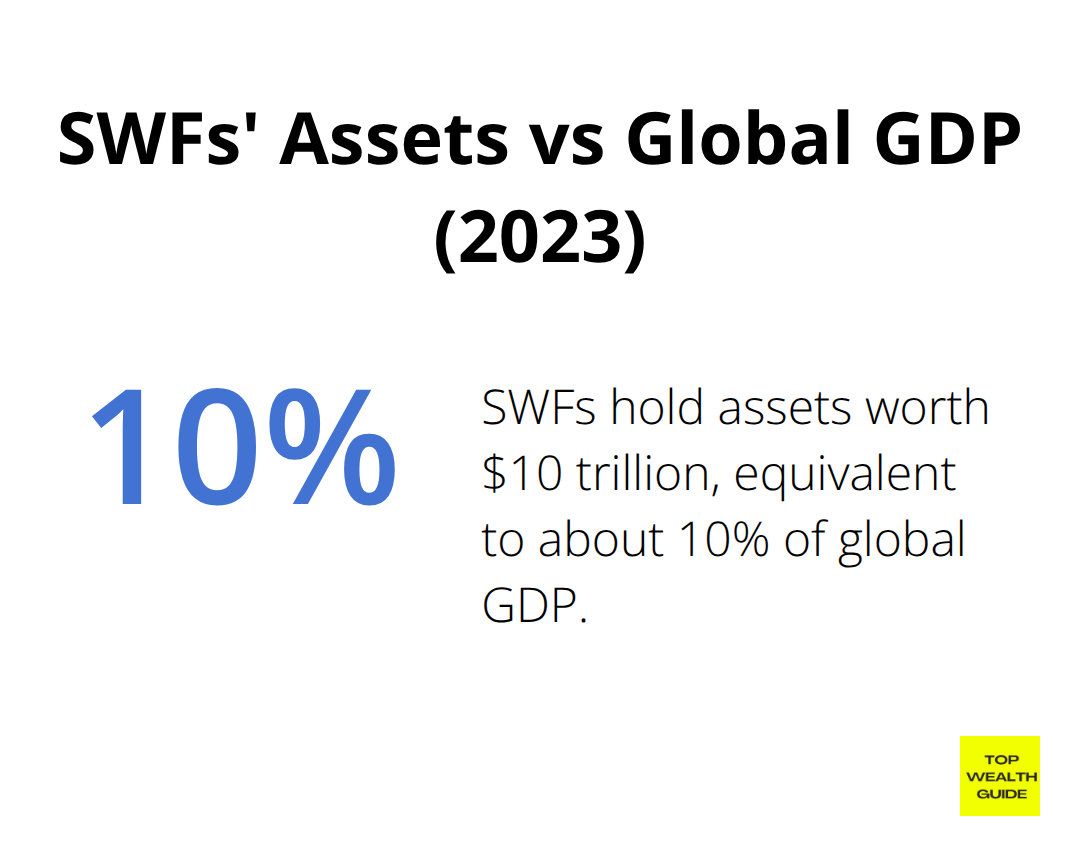

As of 2023, SWFs are sitting on a mountain of more than $10 trillion in assets. Put it in perspective: if SWFs were their own country, they’d be a heavyweight in the global economic arena.

The Origin and Evolution of SWFs

SWFs – an idea that hit the scene mid-20th century. The Kuwait Investment Authority was the trailblazer in 1953. They put their oil money to work – and others quickly picked up the playbook.

But SWFs really took off in the 2000s. Oil-rich Gulf states rode the wave of sky-high oil prices and decided to spread their wealth far and wide, stretching beyond just barrels of crude.

Types of SWFs: Diverse Financial Powerhouses

SWFs come in flavors, each with its own mission:

- Stabilization Funds: Think of these as financial airbags. They cushion the blow when commodity prices go haywire. Norway’s Government Pension Fund Global is a standout example, steering a whopping $1.74 trillion with a slick 6.44% annual return since 1998.

- Savings Funds: Picture a nation’s piggy bank. These aim to save up for tomorrow. The Abu Dhabi Investment Authority, packing over $850 billion, is a prime example.

- Strategic Development Funds: These are the growth engines. They rev up domestic economies and boost jobs. Look at Saudi Arabia’s Public Investment Fund – jumping headfirst into sectors like renewable energy and AI.

The Global Impact of SWFs

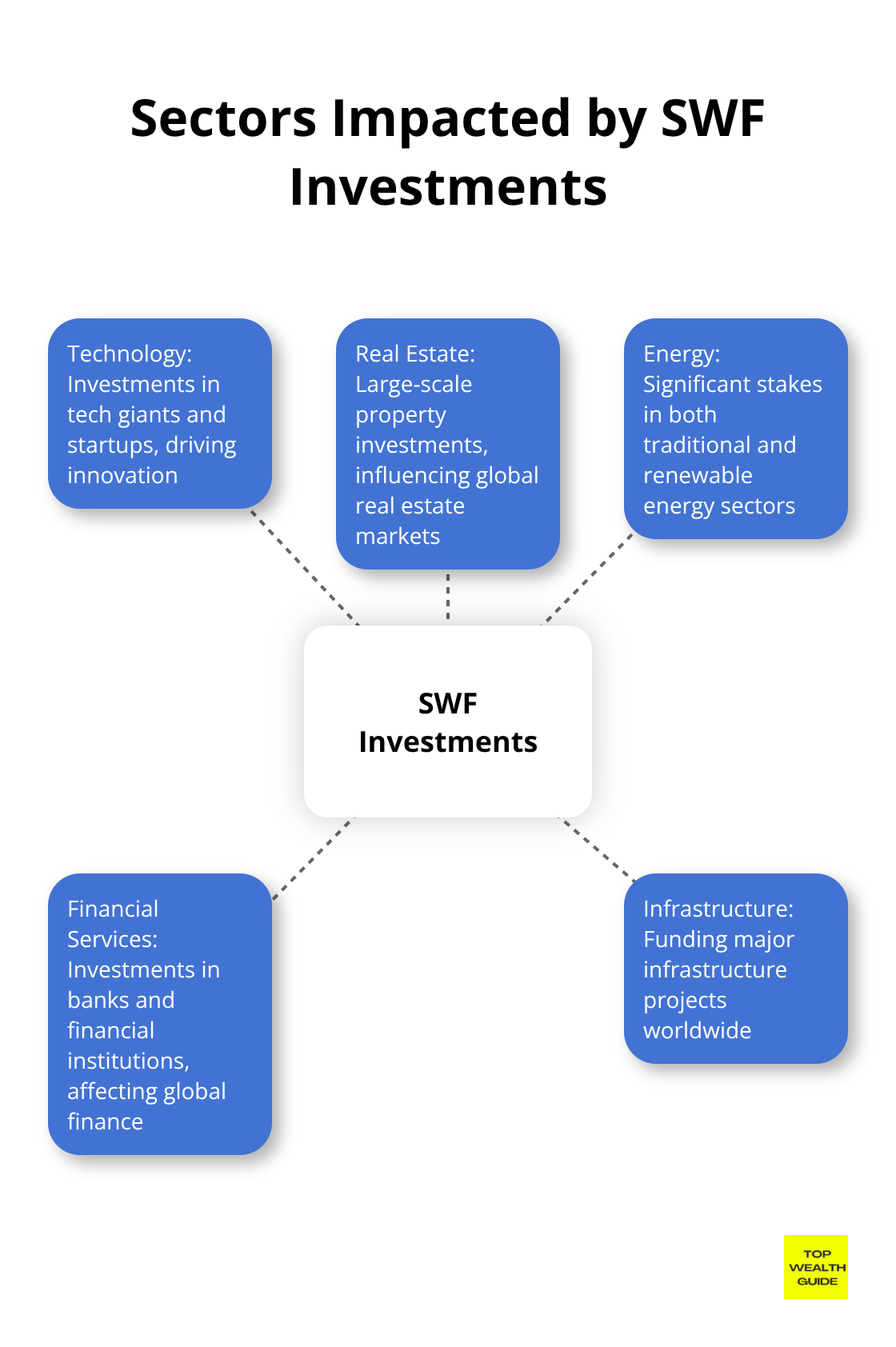

SWFs don’t just sit around; they mold the global finance stage. Just last year, they plowed $257.5 billion into 743 deals – flexing some serious financial muscle.

But wait, there’s a catch – rising SWFs have sparked national security jitters and fears of market meddling. The U.S. and Europe are snooping around these foreign investments more than ever, bringing in new rules and oversight.

Still, SWFs keep on cruising, broadening their horizons beyond standard assets. They’re diving into alternative realms like private equity and hedge funds. Some, like Qatar and Saudi Arabia’s funds, are even staking claims in tech powerhouses, marking a pivot to strategic plays in emerging tech.

The Future of SWFs: Trends and Challenges

Looking ahead, a few big trends for SWFs are crystal clear:

- Making a beeline toward sustainability and ESG (Environmental, Social, and Governance) ventures

- Cranking up the transparency and playing by global rules (think Santiago Principles)

- Diving into fresh sectors, especially tech and renewable energy

These shifts will undoubtedly reshape SWFs’ playbooks, stamping their mark across the global stage.

The saga of sovereign wealth funds captivates economists, policy wizards, and investors alike. Their moves send shockwaves through economies, swaying everything from stock charts to job stats. Next up, we dive into why these financial behemoths matter to both investors and nations around the globe.

How Sovereign Wealth Funds Shape the Global Economy

Economic Shock Absorbers

Think of sovereign wealth funds (SWFs) as the unsung heroes-economic stabilizers of the global scene. Take Norway’s Government Pension Fund Global, for instance. It’s not just some piggy bank; it’s the country’s cushion against the rollercoaster of oil revenue … it’s a long-haul lifeline, insurance, and financial reserve all in one.

But that’s not all-SWFs are the engine for economic diversification. Look at the United Arab Emirates, which swerved away from the oil-only highway. The UAE, with its oil and gas goldmine, managed to dodge the infamous “oil curse.”

Market Influencers

SWFs are movers and shakers in global markets, wielding serious clout with their hefty investments. In 2022 alone, we’re talking about $257.5 billion pumped into various sectors. That’s enough to jolt market dynamics and tweak investor vibes.

Check out the China Investment Corporation (CIC). It’s got assets over $1.3 trillion-yeah, trillion. Its moves are like a global megaphone…a 20% hike in U.S. stock holdings back in 2020 rippled through markets, shifting trends and asset prices.

Strategic National Investments

SWFs are the chess pieces for national strategy. Look at Saudi Arabia’s Public Investment Fund (PIF)-it’s placing bets on big hitters like Uber and Lucid Motors. They’re not just investing; they’re repositioning the kingdom for the future, eyeing tech and innovation.

Singapore’s Temasek Holdings is another one playing the long game. It’s reshaping Singapore into a tech titan, stoking the flames of local startups, and rolling out the red carpet for tech giants. It’s rocket-fueling Singapore’s global tech cred.

Global Economic Impact

The reach of SWFs? Far and wide goes the answer. They don’t just stay home-they push and pull global economic levers, nudging policy decisions and touching multiple sectors. Their investment choices are like distant thunder, signaling long-term trends that investors with their ears to the ground can’t ignore.

Watch this space…as SWFs mushroom in size and savvy, they’re set to become even heftier players on the global stage. They’ll be front-liners in tackling global issues, from climate shifts to tech revolutions.

Next up, we’re diving deep into the most standout sovereign wealth funds worldwide-analyzing their one-of-a-kind strategies and global shake-ups.

Global Titans of Sovereign Wealth

Norway’s Government Pension Fund Global: The Ethical Investor

Norway’s pension fund – it’s the behemoth of sovereign wealth funds, and they’re not just throwing darts at a board. They’ve got this whole ethical investment thing down to a science – nixing tobacco, nuclear weapons, and companies causing Mother Nature a major headache. And guess what … it’s working.

This fund is living proof that you can have your ethical cake and eat it too. If you haven’t already, maybe it’s time to sprinkle some ESG criteria into your own investment casserole. It’s all about those composite scores focusing on environment (E), social (S), and governance (G).

China Investment Corporation: The Diversification Master

CIC – or China Investment Corporation if you’re not into brevity – handles a casual $1.35 trillion in assets. And they’re playing the field internationally, with a portfolio that includes everything from public equities to fixed income, plus some alternative assets and the always handy cash products.

CIC is basically shouting from the rooftops: diversify, diversify, diversify! Don’t cram all your wealth into one nest of eggs. Domestic, international stocks, bonds, maybe dip your toes into REITs – that’s how you build a portfolio that can withstand the wild winds of fortune.

Abu Dhabi Investment Authority: The Long-Term Player

The ADIA, with its impressive $829 billion, plays the long game. They’re heavy into alternative investments – think private equity, real estate.

What’s the takeaway here? Patience isn’t just a virtue, it’s a strategy. Stop chasing the trends – let the short-term fluctuations take care of themselves. Set your sights on the horizon and start considering alternatives for those sweet, sweet potential returns.

Singapore’s GIC and Temasek Holdings: The Tech-Savvy Duo

Singapore’s dynamic duo – GIC and Temasek Holdings – hold a cool $744 billion. And they’re tech fanboys, with stakes in giants like Alibaba, Airbnb, DoorDash.

These guys get it. Tech’s not one piece of the pie – it’s the whole pastry. Still, don’t go all-in on the tech train; sprinkle in other sectors as a hedge against volatility.

So, here’s the deal: these SWFs are handing out golden nuggets of wisdom. Diversification, thinking ethically, playing it long-term, riding the technology wave – they’re not just buzzwords, they’re anchors for your personal investment game. And hey, you might want to chat with a financial advisor about applying these strategies to your wallet situation.

Final Thoughts

Sovereign wealth funds-yeah, those state-owned behemoths-are shaking up the global finance playground. We’re talking trillions in assets, folks. They’re not just the invisible puppeteers pulling economic strings, they’re the whole stage. These things shift economies, tilt markets, and decide more about your future than you’d like to admit. It’s not just about the Benjamins; these funds are crafting national strategies and dictating global economic rhythms.

Looking forward, these funds aren’t just going to sit there and count cash. Nope. Heads up-the real game is in sustainable investments and tech wizardry. But here’s the kicker-they’ll have to wade through geopolitical waters murkier than the Hudson River. No easy task, keeping with global standards while trying to save the planet and narrow down that chasm called economic inequality. This means new chances-and new chores.

Top Wealth Guide is your lighthouse in navigating how these sovereign giants impact your personal wealth playbook. We’re arming you with the wisdom to traverse this intricate finance landscape. Because let’s face it, if you want to get a grip on the 21st-century global finance game, you’ve gotta get to know these financial titans. Ready? Let’s roll.