Most people trying to build wealth fail — not because they lack hustle or brains, but because their goals are cozy, fuzzy, and pretending to be plans. No specific target. No measurable milestones. No deadline. In short — no map… and then surprise when you’re lost (and frustrated).

At Top Wealth Guide, we’ve seen firsthand that the difference between people who actually build wealth and those who merely dream about it boils down to one blunt thing: how you set—and obsessively track—your financial goals. This guide shows you exactly how to do it.

In This Guide

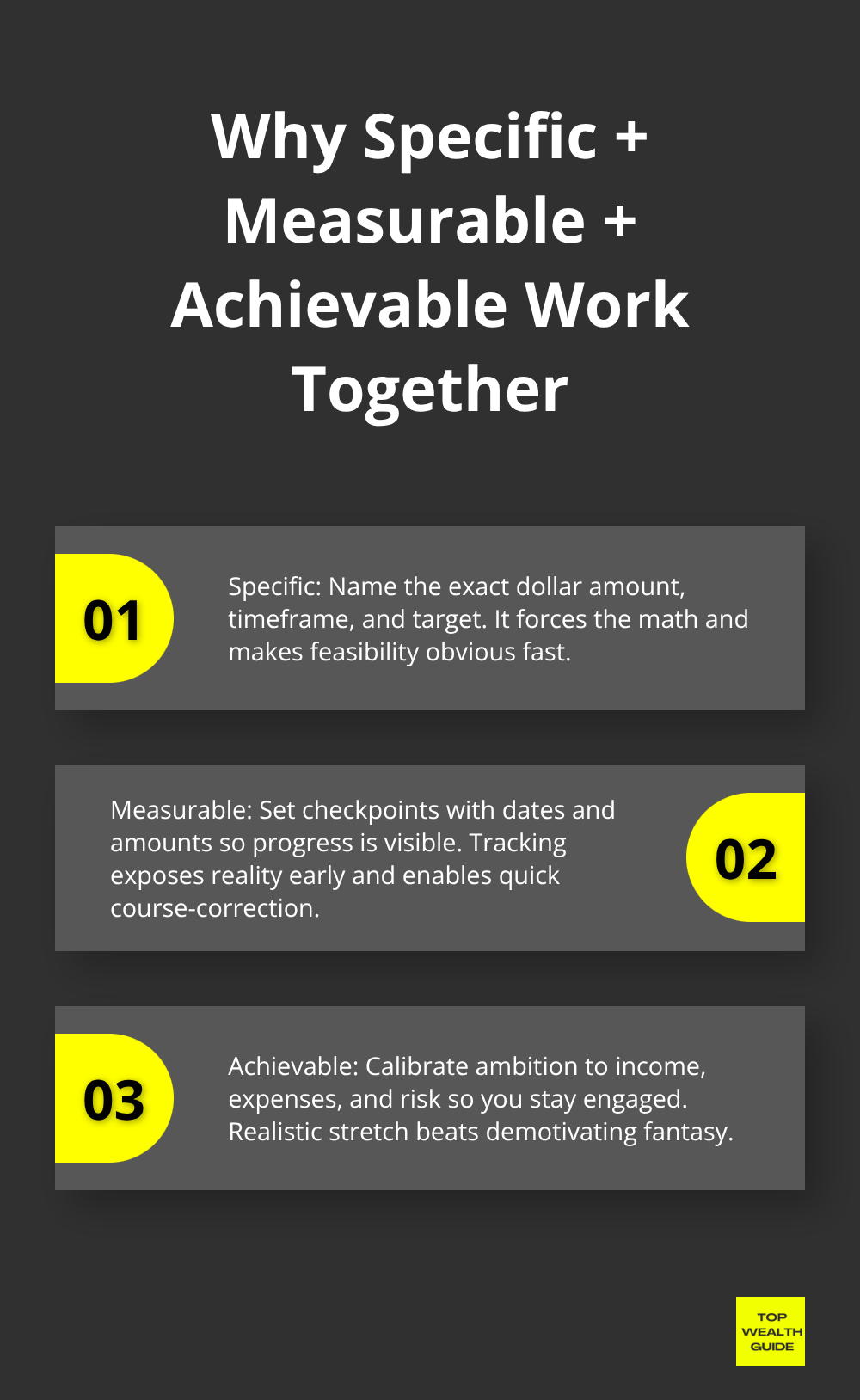

What Makes Goals Smart

Vague goals are the silent killer of wealth. Saying “I want to save more” is basically announcing you’re auditioning for the role of financially mediocre – with enthusiasm. The gap between people who actually build wealth and those stuck in the same spot five years later is specificity. Call it what it is: a brutal, clarifying taxonomy. A specific goal names the exact amount, the exact timeframe, and the exact target. Not “save for retirement” – that’s a hope. Specific is: accumulate $500,000 in your 401(k) by age 55. Not “pay off debt” – that’s feel-good noise. Specific is: eliminate $15,000 in credit card debt within 18 months. Specificity forces you to do the math. It forces you to confront whether your current income and spending actually support that target. Vague goals let you wear the illusion of progress like a participation trophy – while doing nothing different. Specific goals give you a binary truth: it either works, or it doesn’t – and you know quick.

Measurable Progress Stops Self-Deception

You cannot manage what you don’t measure – and this isn’t motivational fluff. It’s behavioral economics with a stopwatch. Plenty of folks set financial goals and then treat tracking like optional maintenance – check only in December and act shocked that nothing moved. Measurable progress stops self-deception by creating accountability and exposing reality. If your goal is to save $7,500 over two years for an emergency fund, you need monthly checkpoints. Month one should show roughly $312. Month six – $3,750. Those checkpoints tell you in real time whether you’re on pace or off the rails, and they give you a shot at course-correcting fast. The act of tracking changes behavior – a spreadsheet is brutal honesty. You can’t ignore a shortfall when it glares back at you every month.

Achievable Goals Keep You in the Game

Ambition is sexy – delusion is demotivating. If you make $50,000 a year and set a goal to save $100,000 in twelve months, you’ve already quit before the race starts. Achievable goals keep you in the game because they’re calibrated to your actual income, actual expenses, actual life. That doesn’t mean timid. It means realistic and aggressive in the right way. Someone earning $80,000 might reasonably shift spending, reroute bonuses, and save $12,000 a year – smart, doable. That same person should not declare a $40,000-in-a-year target and then feel the soul-crushing burnout when they miss it. Achievable keeps you engaged; impossible collapses motivation. And yes – build in contingency. If interest rates spike or your industry slows, the target should bend (not break). The goal is steadfast; the plan is adaptable.

Why Specificity, Measurability, and Achievability Work Together

These three are not optional features – they’re a system. A specific goal without measurable milestones leaves you guessing. A measurable goal that’s unrealistic breeds frustration and abandonment. An achievable goal without specificity is just a wish.

Together, they form the framework that turns intention into action. The next section shows you how to build a complete wealth-creation roadmap that separates short-term wins from long-term wealth objectives-and how to prioritize them so you actually move forward.

Building Your Wealth-Creation Roadmap

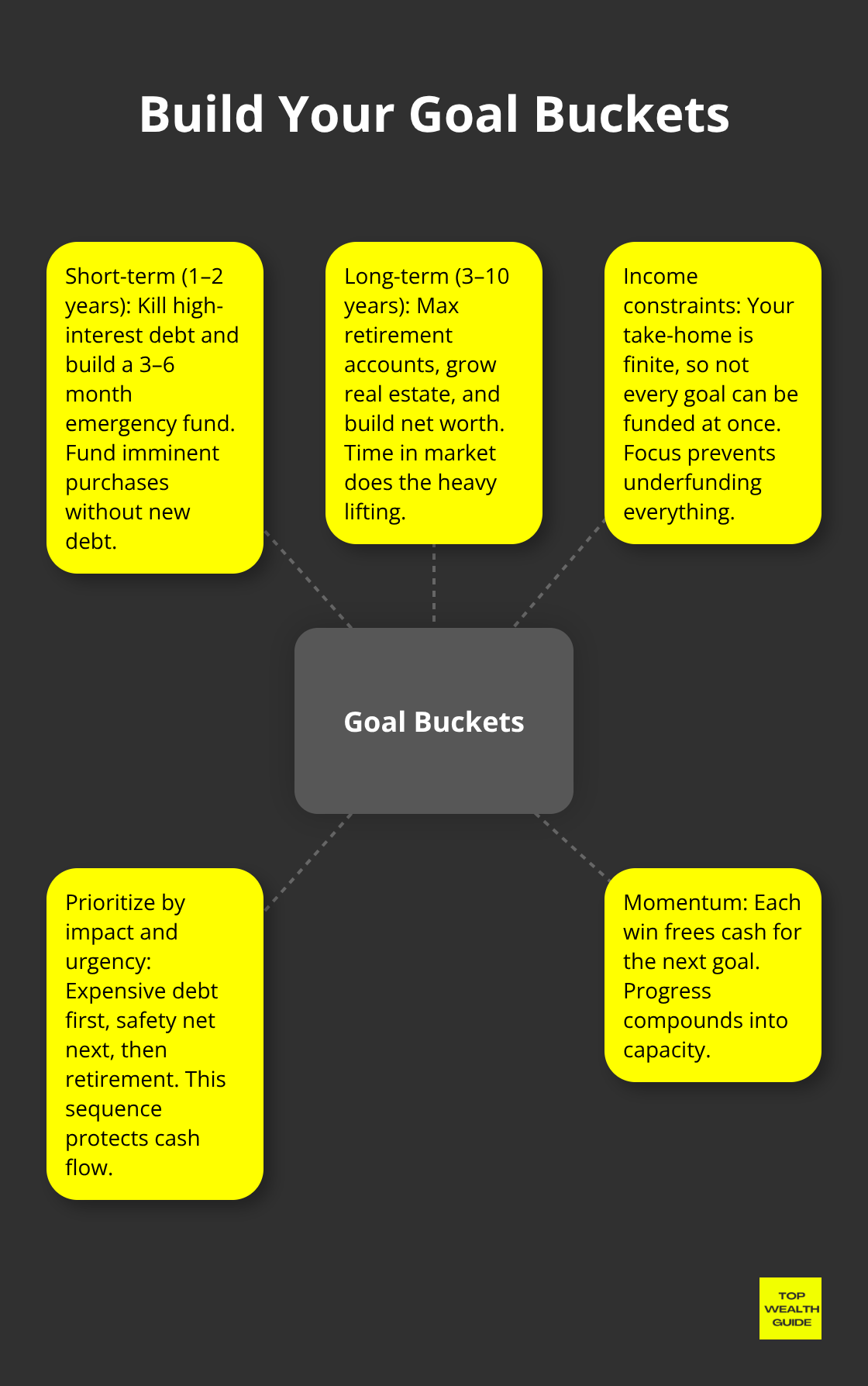

Separate Short-Term Goals from Long-Term Wealth Objectives

The instant you can name three specific, measurable, achievable goals – the real work begins. Most people self-sabotage here by giving every goal equal urgency. They shove everything into year one, sprint until March, and decide goal-setting is for suckers. Reality is simpler and harsher: goals live on different timelines and wield different financial gravity.

A $15,000 credit card balance at 22% interest is hemorrhaging cash every month-that’s an emergency. A five-year house down payment matters too, but it doesn’t deserve the same monthly beatdown right now.

Start by splitting goals into two buckets: short-term (one to two years) and long-term (three to ten years). Short-term fixes the pain points-eliminate high-interest debt, build a three to six-month emergency fund, or save for an imminent purchase. Long-term shapes wealth-max retirement accounts, stack real estate, grow net worth. This matters because your income is finite. If you take home $6,000 a month after taxes and try to fund emergency savings, debt payoff, retirement, and a vacation all at once-you’ll fund nothing well. Predictable result: frustration… then quit.

Prioritize Goals Based on Impact and Timeline

Priority is simple: follow impact and urgency. High-interest debt (credit cards, personal loans above 10%) goes first-every month it sits you hand money to lenders. Emergency fund comes next-without it, one car repair or a surprise medical bill drags you back to square one. Retirement contributions slot in after-not because retirement is less important, but because time is on its side; starting at 35 differs from starting at 45, yet both still work.

This sequence prevents scattershot funding. You stop trying to do everything and start doing what matters. Momentum follows: kill the debt, build the safety net, then accelerate accumulation. Each win funds the next priority-compound effect, but for sanity.

Align Goals with Your Income, Assets, and Risk Tolerance

Once you’ve sequenced priorities, match them to real capacity. Brutal honesty replaces optimism here. If you make $80,000 a year, spend $2,500 a month, and have $1,200 in debt payments, you’ve got roughly $1,300 left each month to fund goals. Now the math is real: can you simultaneously put $200 toward an emergency fund, $300 into retirement, and $400 at debt? Yes-that’s $900, leaving $400 for contingencies or a little life. Add a fourth goal that needs $500 more? No. That’s the conversation most people dodge-and why they fail.

Your income, liabilities, and risk tolerance set the ceiling. Someone with $50,000 in student loans on a $35,000 salary needs a different playbook than someone with no debt and $120,000 income. The high-debt person should prioritize payoff and emergency savings before aggressive retirement contributions. The low-debt person can frontload retirement and capture employer match immediately. Risk tolerance shifts timelines too. Five years from retirement? Aggressive equity bets are reckless. Thirty with 35 years ahead? Bond-heavy conservatism underperforms your capacity.

Pick goals that fit your life-don’t pick goals that demand you become someone else. That clarity-knowing what you can actually fund, in what order, and why-turns fantasy into a working system. With a roadmap and priorities locked, the next job is spotting the mistakes that derail even decent plans-and learning to sidestep them before they cost you years.

Common Mistakes Wealth Builders Make with Goal Setting

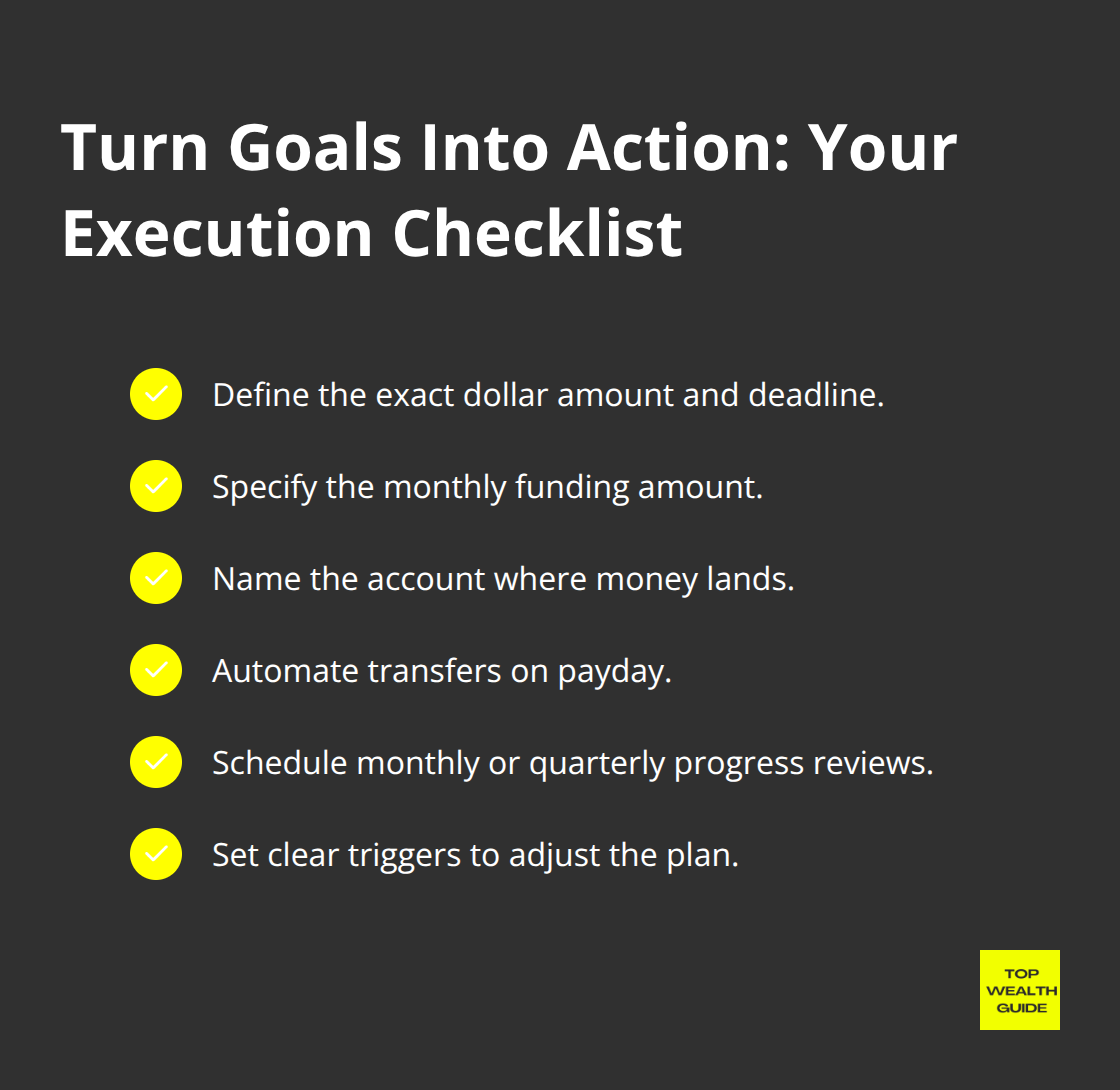

Written Plans Transform Goals Into Action

The biggest mistake isn’t picking the wrong goal-it’s setting one and then running it on hope. You wouldn’t run a business on intention alone (unless you like chaos)… yet most people manage their finances exactly that way. A goal lives in your head until you translate it into steps: the exact monthly savings amount, the specific account where money lands, the date you’ll review progress, the trigger that forces a plan adjustment. Without that, your goal is performance art-looks intentional but accomplishes nothing.

Write the goal down. Write how you’ll fund it each month. Write when you’ll measure it.

Vague execution kills specific goals faster than anything else. Someone earning $80,000 who says they’ll save $500 monthly for a down payment-sounds solid-means nothing without the mechanism. Is that $500 automatically transferred on payday to a separate account, or is it a hope you’ll remember to move it later? Automation wins because it removes decision‑making and excuses. The written plan also forces you to face real numbers: if your goal needs $500 monthly but you only have $300 after expenses and existing debt payments, the plan exposes that instantly. You either adjust the goal, extend the timeline, or find more income. Without documentation, you just wonder why progress stalls-then blame yourself or quit.

Economic Shifts Demand Plan Recalculation

The second critical failure is treating financial goals like they’re carved in stone-untouched by what happens in the economy or your life. Rates move, inflation moves, job markets move… and your plan needs to move with them.

Inflation hit 9.1% in June 2022 according to the Bureau of Labor Statistics, which means $20,000 of annual expenses in 2021 became roughly $21,820 in 2022. If your emergency‑fund target didn’t flex up, you actually fell behind. Economic conditions change constantly; your goals must flex too. This doesn’t mean abandoning every goal the moment the Fed twitches-it means scheduling quarterly reviews and asking the hard questions: what’s different since three months ago, and does my plan still make sense? A recession might push you to accelerate debt payoff because job security tightens. A boom might justify shifting money from emergency savings toward retirement contributions because income is stable. Ignoring these shifts is how people end up executing yesterday’s plan in today’s world-which guarantees suboptimal results.

Monthly Reviews Catch Derailment Early

The third mistake-failing to review and adjust regularly-is where most wealth builders actually die. You set a goal in January, feel sincere, then life happens. You don’t look again until November, discover you’re massively off track, feel defeated, and abandon it. Monthly or quarterly reviews prevent that collapse.

Pick a date-the first Friday of each month or the last day of each quarter-and spend 30 minutes reviewing progress against target. If you aimed to save $500 and only saved $320, you now have two months to course‑correct: cut discretionary spend, add side income, or extend the timeline. Catching that gap after two months is recoverable. Catching it after eleven months means the year is lost. Research shows investors who reviewed portfolios quarterly outperformed those who reviewed annually by nearly 2% per year-a massive difference over decades. The same principle applies to savings goals, debt payoff timelines, and net worth targets.

Regular review also reveals when circumstances genuinely changed and the goal needs a permanent reset. Maybe you took a lower‑paying job for more time with your kids-that’s real, and your savings targets should shift accordingly. But you only know that if you’re actually looking at the numbers monthly instead of hoping things work out.

Final Thoughts

Your financial goals aren’t optional accessories – they’re the foundation. Without them you’re not building wealth; you’re reacting to whatever crisis trips you up next. The gap between people who actually accumulate real wealth and those who drift forever is simple: one group writes specific, measurable targets – the other holds wishes and hopes.

Start with one goal, not five. Pick the single objective that will move the needle most right now (high-interest debt? that’s priority; no emergency cushion? build it first; otherwise, max the retirement contributions). One clear target beats ten fuzzy ones every single time. Write the goal down – exact dollar amount, deadline – then do the math: what must move out of your account each month to hit it.

Automate so money flows without your permission – put savings on autopilot, force your future self to behave better than your present self. Schedule a review (monthly or quarterly) and actually show up. Life shifts, markets wobble – adjust the plan but keep the goal. This week: define one specific financial goal and write it down. That single action separates you from the majority who talk about building wealth and never do the work.

Visit Top Wealth Guide to explore resources that support your financial goals and connect with advisors who can help you execute.