Should you sell stocks to pay off debt? The short answer is, it depends. This isn't a cop-out; it's the beginning of a crucial financial calculation that balances immediate relief against long-term growth.

The decision boils down to one core question: Is your debt costing you more in interest than your investments are likely to earn after taxes? If the interest rate on your debt is crushing the returns you're seeing in the market, then yes, strategically selling some stocks could be a brilliant financial move.

In This Guide

- 1 The Core Dilemma: Debt Drag vs. Investment Growth

- 2 Running the Numbers: The Math Behind the Decision

- 3 Why High-Interest Debt Changes Everything

- 4 Navigating the Tax Impact of Selling Stocks

- 5 The Hidden Risks: Opportunity Cost and Market Timing

- 6 Smarter Alternatives to Selling Your Investments

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. Should I sell stocks to pay off my mortgage early?

- 7.2 2. Is it ever a good idea to sell stocks from a 401(k) or IRA to pay debt?

- 7.3 3. Does it make sense to sell stocks during a market downturn to pay off debt?

- 7.4 4. How do I decide which specific stocks to sell?

- 7.5 5. What about student loans? Should I sell stocks to pay them off?

- 7.6 6. Will selling stocks affect my credit score?

- 7.7 7. Should I sell my "safe" dividend stocks to pay off debt?

- 7.8 8. What is the opportunity cost of selling stocks?

- 7.9 9. Are there any alternatives to selling stocks?

- 7.10 10. How can I calculate the "break-even" point for my decision?

The Core Dilemma: Debt Drag vs. Investment Growth

Think of your finances as a tug-of-war. On one end, you have high-interest debt, relentlessly pulling your net worth down and costing you real money every month. On the other end, you have your stock portfolio, working to build your wealth through market growth and the magic of compounding.

The trick is figuring out which side is pulling harder.

Making this call requires a clear-headed look at the math, not an emotional reaction to a scary credit card balance or a fluctuating stock ticker. Getting a handle on this fundamental conflict is the first step. While a simple "yes" or "no" would be nice, the right answer is always personal. It lives in the details of your financial situation. A solid grasp of concepts like cash flow management is crucial for making these kinds of wealth-building decisions.

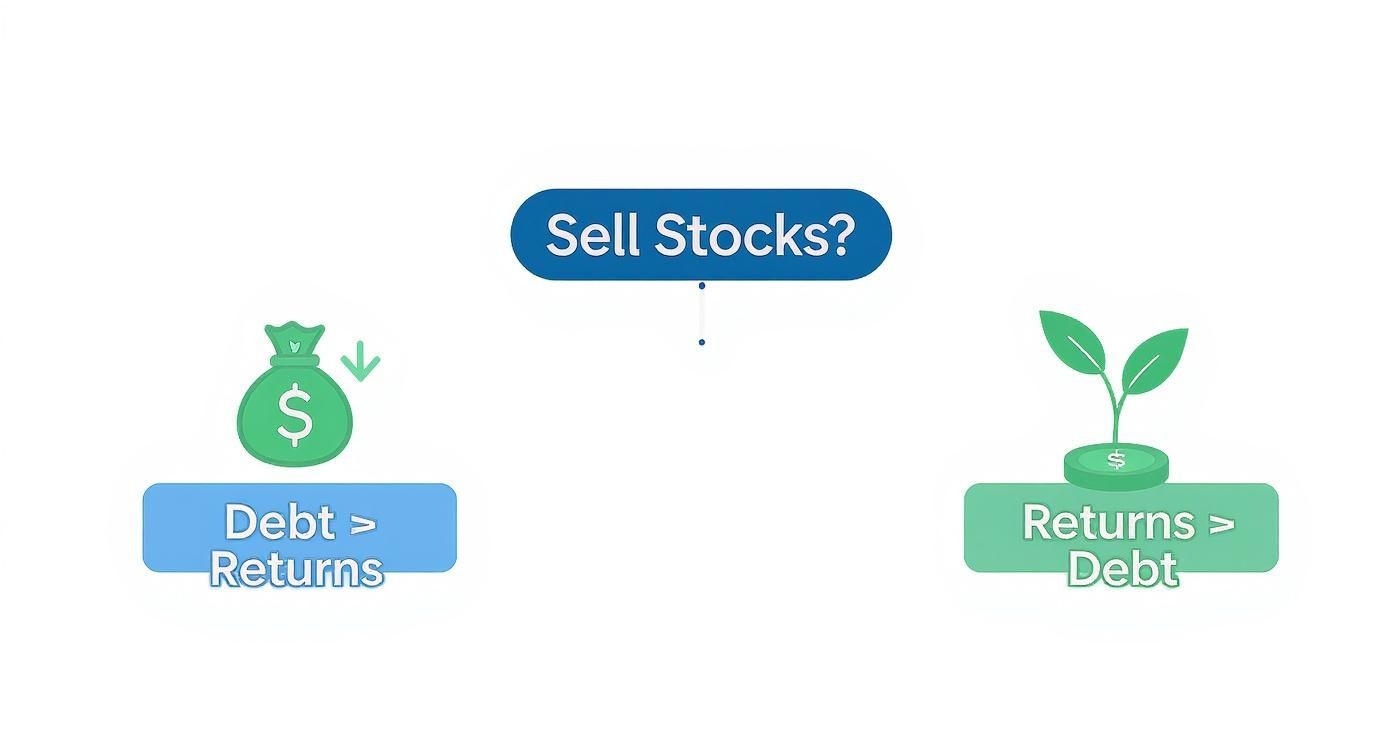

This visual decision tree breaks down the core question, showing the two main paths you can take in this financial tug-of-war.

As you can see, when your debt's interest rate is higher than your expected investment returns, paying it off provides a guaranteed, risk-free return on your money. You simply can't say that about the stock market.

Decision Matrix: When to Sell vs. When to Hold

Sometimes you just need a quick snapshot to see where you stand. Use this comparison table to gauge whether selling stocks might be a smart move versus when it's better to let your investments grow.

| Scenario | Consider Selling Stocks | Consider Keeping Stocks & Investing |

|---|---|---|

| Debt Interest Rate | High (18%+ on credit cards, personal loans) | Low (3-7% on a mortgage, federal student loans) |

| Investment Outlook | You have a short-term investment horizon or expect low/negative returns. | You have a long-term horizon (5+ years) with strong growth potential. |

| Risk Tolerance | You are risk-averse and the peace of mind from being debt-free is a top priority. | You are comfortable with market volatility for the chance of higher potential rewards. |

| Financial Stability | Debt payments are straining your monthly budget and causing significant financial stress. | You can comfortably afford all debt payments without compromising your financial goals. |

| Guaranteed Return | Paying off a 20% APR credit card is a guaranteed 20% return on your money. | Your potential market return (e.g., 8-10%) is likely to outperform the debt's low interest rate. |

This table provides a solid framework for your decision. If you find yourself nodding along with the points in the "Consider Selling Stocks" column, it’s time to take a serious look at your numbers.

Running the Numbers: The Math Behind the Decision

To get this right, you must move past gut feelings and dig into the actual math. The decision hinges on a simple comparison: your debt’s interest rate versus the after-tax return you can realistically expect from your stocks.

Think of it this way: paying off debt gives you a guaranteed, risk-free return on your money. If you’re carrying a credit card balance at a 22% APR, every dollar you pay down is like earning a 22% return. No risk, no market swings. Trying to beat that in the stock market is a tall order, especially after accounting for taxes.

A Real-Life Example: Sarah's Stocks vs. Credit Card Debt

Let's meet Sarah. She’s in a common situation and needs to figure out what to do.

- Her Debt: A $10,000 credit card balance with a punishing 22% APR. This debt costs her $2,200 per year in interest alone.

- Her Investments: A $20,000 taxable brokerage account with a $5,000 unrealized profit. She has held the stocks for several years.

Her 22% interest rate is a clear financial emergency. The real question is how taxes impact her decision to sell.

The Critical Role of Capital Gains Tax

Whenever you sell investments for a profit in a standard brokerage account, you owe capital gains tax. The amount depends on how long you've held the stock.

- Short-Term Capital Gains: Assets held for one year or less. Profits are taxed at your regular income tax rate (e.g., 24%, 32%, etc.), which is quite high.

- Long-Term Capital Gains: Assets held for more than one year. These get a much friendlier tax rate, usually 0%, 15%, or 20%, based on your income.

Since Sarah has held her stocks for several years, her $5,000 gain qualifies for the long-term rate. Let's assume she falls into the 15% bracket.

The crucial step is to subtract taxes from your investment proceeds to find your true, take-home cash. Selling stock is a taxable event, and it reduces the amount you actually get to use.

If Sarah sells $10,000 of her stock to wipe out the card balance, we need to calculate her taxable gain. Since her portfolio is 25% profit ($5,000 gain on a $20,000 portfolio), the gain on her $10,000 sale is $2,500.

- Tax Bill: $2,500 (gain) x 15% (long-term tax rate) = $375

- Net Cash from Sale: $10,000 (sale) – $375 (tax) = $9,625

While she nets slightly less than the full debt amount, she can wipe out the vast majority of it. By eliminating this debt, she achieves a guaranteed 22% return on that money. This is a far more powerful and certain financial move than hoping her portfolio continues to grow. Comparing this to the average rate of return for stocks, which is historically around 10%, makes the high cost of her debt undeniable.

Why High-Interest Debt Changes Everything

Not all debt is created equal. Grasping this difference is the key to deciding whether you should sell stocks to pay off debt. The interest rate is the whole story here—it's what separates a manageable financial tool from a wealth-destroying emergency.

Think of high-interest debt as trying to run up a down escalator. You can be investing and taking steps forward, but that debt is pulling you backward even faster, making it feel like you're getting nowhere.

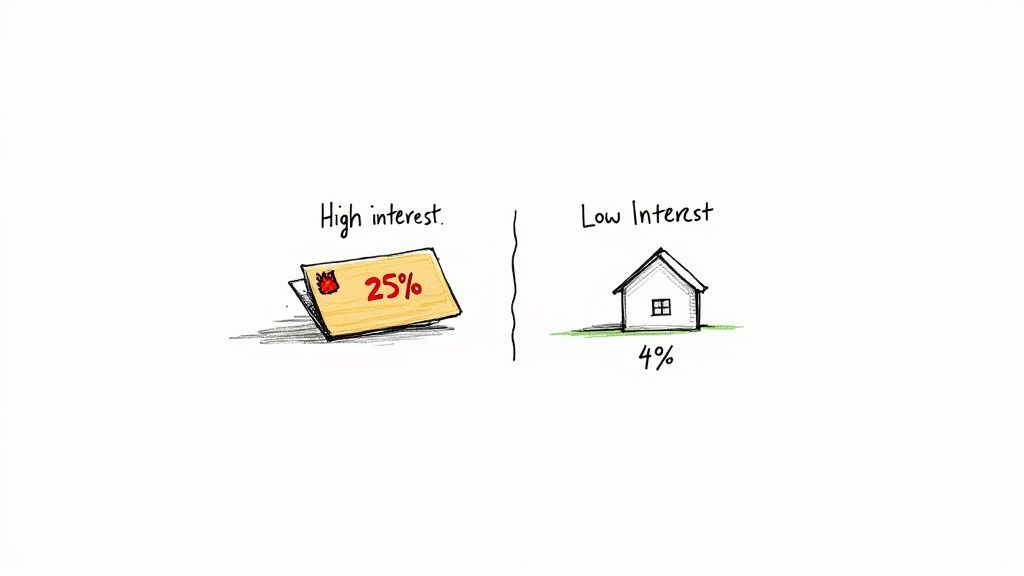

"Good Debt" vs. "Bad Debt": A Simple Framework

"Good debt" is typically used to acquire assets that can grow in value or increase your income potential, such as mortgages or federal student loans. These almost always have low, fixed interest rates, and the interest may even be tax-deductible.

"Bad debt" is the destructive kind. It's usually for consumable goods or services and comes with punishingly high interest rates. Credit card debt, payday loans, and personal loans with sky-high APRs are the prime suspects.

Expert Insight: Paying off a credit card with a 25% APR is the equivalent of earning a guaranteed, risk-free, tax-free 25% return on your money. You will not find an investment that can reliably and safely match that return anywhere.

Conversely, selling stocks that have historically returned 8-10% per year to pay off a 4% mortgage is often a poor long-term trade. You’d be sacrificing larger potential gains to eliminate a cheap, manageable loan. The first step is to categorize your debts and identify the high-interest emergencies. For a structured approach, the debt snowball method can be a huge help.

Comparing Debt Types and Repayment Strategies

This table provides a clear, side-by-side look at the two worlds of debt and the strategy that usually makes the most sense for each.

| Debt Characteristic | High-Interest Debt (e.g., Credit Cards) | Low-Interest Debt (e.g., Mortgage) |

|---|---|---|

| Average APR | 18% – 30%+ | 3% – 8% |

| Financial Impact | Rapidly compounds, aggressively destroying your net worth and cash flow. | Slow, predictable payments; principal builds equity over time. |

| Opportunity Cost | The cost is extremely high; your investments must beat the APR after taxes. | The cost is low; market returns are very likely to outperform the interest rate. |

| Recommended Action | Strongly consider selling stocks to eliminate this guaranteed financial drain. | Avoid selling stocks; continue investing while making regular payments. |

At the end of the day, high-interest debt is a mathematical emergency. Low-interest debt is a manageable tool. Understanding that core difference allows you to make a calculated financial move, not an emotional one, putting you back in control.

Selling stocks to pay down debt feels straightforward, but it's easy to forget one crucial detail: the IRS views it as a taxable event. Overlooking this can lead to a surprise tax bill that chips away at the financial progress you were trying to make.

Any profit you realize from selling an investment is a capital gain. How much tax you owe on that gain comes down to one simple question: how long did you own the stock?

Long-Term vs. Short-Term Capital Gains Explained

The clock starts ticking the day you buy an investment, and that timeline directly determines your tax rate.

- Short-Term Capital Gains: You owned the stock for one year or less. Any profit is taxed as ordinary income, at the same high rates as your salary (up to 37%).

- Long-Term Capital Gains: You held the stock for more than one year. You get a much better deal. Your profit is taxed at special long-term rates, which are 0%, 15%, or 20%, depending on your income.

Real-Life Impact: Imagine you sell stock for a $10,000 gain. If it's short-term, you could owe as much as $3,700 in federal taxes. If it's a long-term gain taxed at 15%, your bill would be only $1,500. That’s a $2,200 difference—money that could have gone toward your debt.

When you sell stocks, the money you actually have to pay off debt is the sale price minus the capital gains tax. Always calculate this after-tax amount to see if your plan still makes sense.

Tax-Advantaged Accounts and Savvy Strategies

A critical word of caution about retirement accounts: Tapping into a 401(k) or a traditional IRA to pay off debt is almost always a costly mistake. Withdrawing funds before age 59½ typically triggers a painful 10% early withdrawal penalty on top of ordinary income taxes. It’s an incredibly expensive way to get cash and should be an absolute last resort.

However, you can use the tax code to your advantage with tax-loss harvesting. This involves selling investments that are down in value to "harvest" the loss. You can then use that capital loss to cancel out capital gains from your profitable sales, slashing or even eliminating your tax bill. Our guide on capital gains tax strategies explores this in more detail.

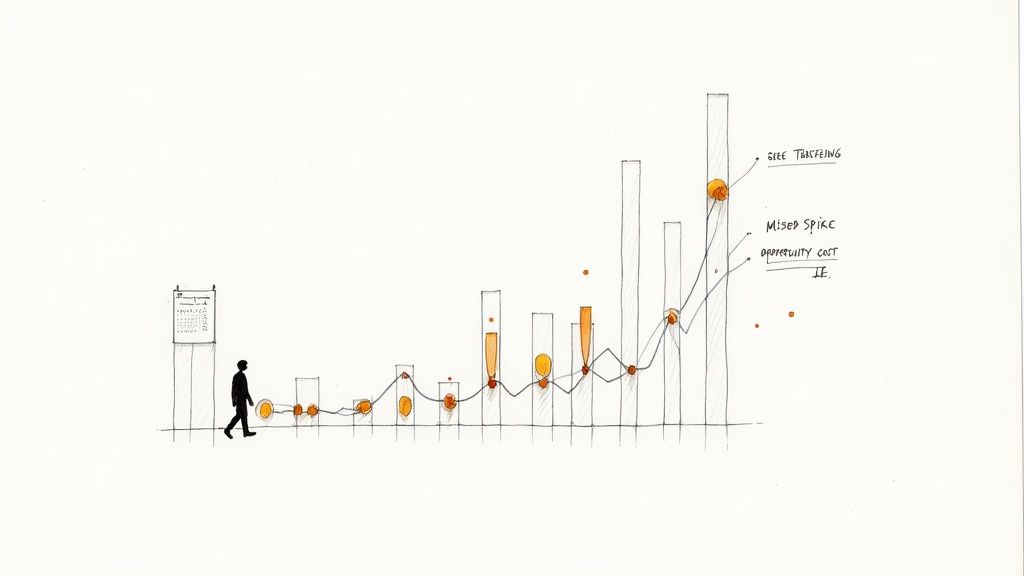

The Hidden Risks: Opportunity Cost and Market Timing

While running the numbers is a great start, it doesn't paint the full picture. Selling your stocks brings hidden risks into play that can be just as impactful as the math.

The biggest one is opportunity cost: the potential future growth you completely forfeit the moment you cash out.

Think about it this way: you could pay off a 5% loan today by selling stocks you expect will earn an average of 8% over the next decade. While you get the immediate relief of being debt-free, your future self is quietly taking a net loss. You've traded long-term wealth for short-term comfort.

The Fool's Errand of Timing the Market

It’s incredibly tempting to think you can game the system: sell high before a dip, wipe out your debt, and then reinvest just before the market takes off again.

If only it were that easy. The truth is, timing the market is a notoriously difficult game that even seasoned professionals rarely win. Missing just a handful of the market's best days can devastate your long-term returns. Understanding market volatility is crucial to respecting just how unpredictable short-term swings can be.

Many investors get spooked by headlines about high government debt, thinking it’s a sure sign of a crash. But history often tells a different story.

Selling investments out of fear is usually a reaction to short-term noise. It often means abandoning a solid long-term plan, and the real cost isn't just the money you take out—it's the future growth you'll never get to see.

For example, looking at data from 1975 to 2022, countries with government debt over 100% of their GDP actually saw their stock markets go up about two-thirds of the time. Nations like Italy and Belgium have had these high debt levels for over 30 years, yet their stock markets delivered average annual returns of 10.8% and 12.0%, respectively. This shows that broad economic headlines are often poor predictors of market performance, which hammers home the danger of trying to time your exit. You can dig into more data on country debt and stock returns from Dimensional.

Smarter Alternatives to Selling Your Investments

Before you hit that ‘sell’ button and liquidate your portfolio, hold on. Cashing out your investments is a permanent decision—one that comes with tax bills and forfeits all future growth on those assets.

The good news is, there are several powerful ways to attack your debt that don't involve touching your long-term wealth-building engine. These alternatives are all about redirecting your cash flow and getting strategic, not about sacrificing the assets you've worked so hard to grow.

Proven Debt Repayment Strategies

The most effective debt-tackling methods don't require you to sell a single share. Instead, they weaponize your existing income to pay down balances efficiently.

- The Debt Snowball: This method is about psychology and momentum. You list your debts from smallest to largest and throw every extra dollar at the smallest one first. Once it’s gone, you roll that payment into the next smallest debt. Those quick wins create an incredible sense of progress that keeps you motivated.

- The Debt Avalanche: If you're purely focused on the numbers, this is your strategy. You target the debt with the highest interest rate first, regardless of the balance. By eliminating your most expensive debt, you save the maximum amount of money on interest over time. It’s the most mathematically efficient path to becoming debt-free.

The real magic behind both the snowball and avalanche methods is that they give you a clear, actionable plan. Debt can feel overwhelming, but these systems turn a huge, scary goal into a series of manageable monthly steps.

Actionable Tactics to Free Up Cash

Beyond a structured repayment plan, you can make practical moves right now to find more money in your budget.

One of the best moves is consolidating high-interest credit card debt into a single personal loan or a 0% APR balance transfer card. If you can lock in a lower, fixed interest rate, you immediately reduce how much interest you're paying and simplify your life with one payment.

Don't be afraid to pick up the phone. Call your credit card companies and ask them to lower your interest rate—you'd be surprised how often they say yes, especially if you have a solid payment history.

Finally, get creative. Can you start a side hustle? Can you comb through your budget and find an extra $100-$200 a month? It might not sound like a lot, but that extra cash can make a huge dent over time, all without disrupting your investment strategy.

Frequently Asked Questions (FAQ)

Here are answers to the 10 most common questions people ask when considering selling stocks to pay off debt.

1. Should I sell stocks to pay off my mortgage early?

For most people, the answer is no. Mortgage rates are typically low (3-7%), and the interest is often tax-deductible. The historical average return of the stock market (8-10%) is likely to outperform your mortgage rate, meaning you build more wealth over the long term by keeping your money invested.

2. Is it ever a good idea to sell stocks from a 401(k) or IRA to pay debt?

This should be an absolute last resort. Withdrawing from a traditional 401(k) or IRA before age 59½ usually triggers a steep 10% early withdrawal penalty plus ordinary income taxes. This makes it an extremely expensive way to get cash and can severely damage your retirement savings.

3. Does it make sense to sell stocks during a market downturn to pay off debt?

It's generally a bad idea. Selling in a down market means you "lock in" your losses, getting less cash for your assets. Market history shows that downturns are followed by recoveries. A more patient approach is often to wait for the market to rebound while using other strategies to manage your debt.

4. How do I decide which specific stocks to sell?

If you decide selling is the right move, be strategic:

- Prioritize taxable accounts over tax-advantaged retirement accounts.

- Sell stocks held for more than one year to qualify for lower long-term capital gains tax rates.

- Consider selling shares that are at a loss (tax-loss harvesting) to offset gains from other sales.

5. What about student loans? Should I sell stocks to pay them off?

It depends on the interest rate. For low-interest federal student loans (e.g., under 6%), it's often better to keep investing. For high-interest private student loans (e.g., over 8%), selling some investments could make mathematical sense, especially if the rate is higher than your expected after-tax investment return.

6. Will selling stocks affect my credit score?

No, selling stocks does not directly impact your credit score. However, paying off a loan or credit card with the proceeds will positively affect your score by reducing your credit utilization ratio and overall debt load.

7. Should I sell my "safe" dividend stocks to pay off debt?

Even "safe" dividend stocks carry market risk and their value can fluctuate. The decision still comes back to the math. If a credit card is costing you 22% in interest, that guaranteed savings will almost certainly outperform the dividend yield plus appreciation of a "safe" stock over the short term.

8. What is the opportunity cost of selling stocks?

Opportunity cost is the future growth you give up when you sell an asset. If you sell a stock that would have grown by 30% over the next three years, that lost potential gain is your opportunity cost. This is the biggest hidden risk of selling to pay off low-interest debt.

9. Are there any alternatives to selling stocks?

Yes, plenty! Before selling, consider:

- Debt consolidation: Using a personal loan to pay off high-interest cards.

- Balance transfer cards: Moving debt to a 0% APR card.

- Budgeting: Aggressively cutting expenses to free up cash.

- Increasing income: Through a side hustle or asking for a raise.

10. How can I calculate the "break-even" point for my decision?

Your break-even point is where your debt's interest rate equals your expected after-tax investment return. For example, if your debt has a 9% APR and you are in the 15% long-term capital gains tax bracket, your stocks would need to earn roughly 10.6% pre-tax just to break even with the guaranteed return of paying off the debt. Any debt with an interest rate higher than that is a clear candidate for elimination.