Sequence of returns risk is the financial equivalent of bad timing. It’s the danger that a string of poor investment returns early in your retirement can wreck your entire plan, even if your long-term average returns look great on paper.

When you’re saving and investing, the order of your returns doesn’t matter all that much. But once you start withdrawing money, the game changes completely. The sequence of those returns suddenly becomes one of the biggest threats to your financial security.

In This Guide

- 1 The Retirement Timing Lottery

- 2 A Real-World Look At The 1973 Bear Market

- 3 How to Stress-Test Your Retirement Plan

- 4 Actionable Strategies To Manage Sequence Risk

- 5 How To Build Your Personal Defense Plan

- 6 FAQ: Common Questions About Sequence of Returns Risk

- 6.1 1. Does sequence of returns risk matter if I’m still saving for retirement?

- 6.2 2. Is holding more cash the best way to avoid this risk?

- 6.3 3. How does the 4% Rule relate to sequence of returns risk?

- 6.4 4. Can a good financial advisor really help with this?

- 6.5 5. Which mitigation strategy is the best one?

- 6.6 6. Does inflation make sequence risk worse?

- 6.7 7. Are bonds a good defense against sequence risk?

- 6.8 8. What is the opposite of sequence of returns risk?

- 6.9 9. How often should I review my sequence risk strategy?

- 6.10 10. Can annuities help mitigate this risk?

The Retirement Timing Lottery

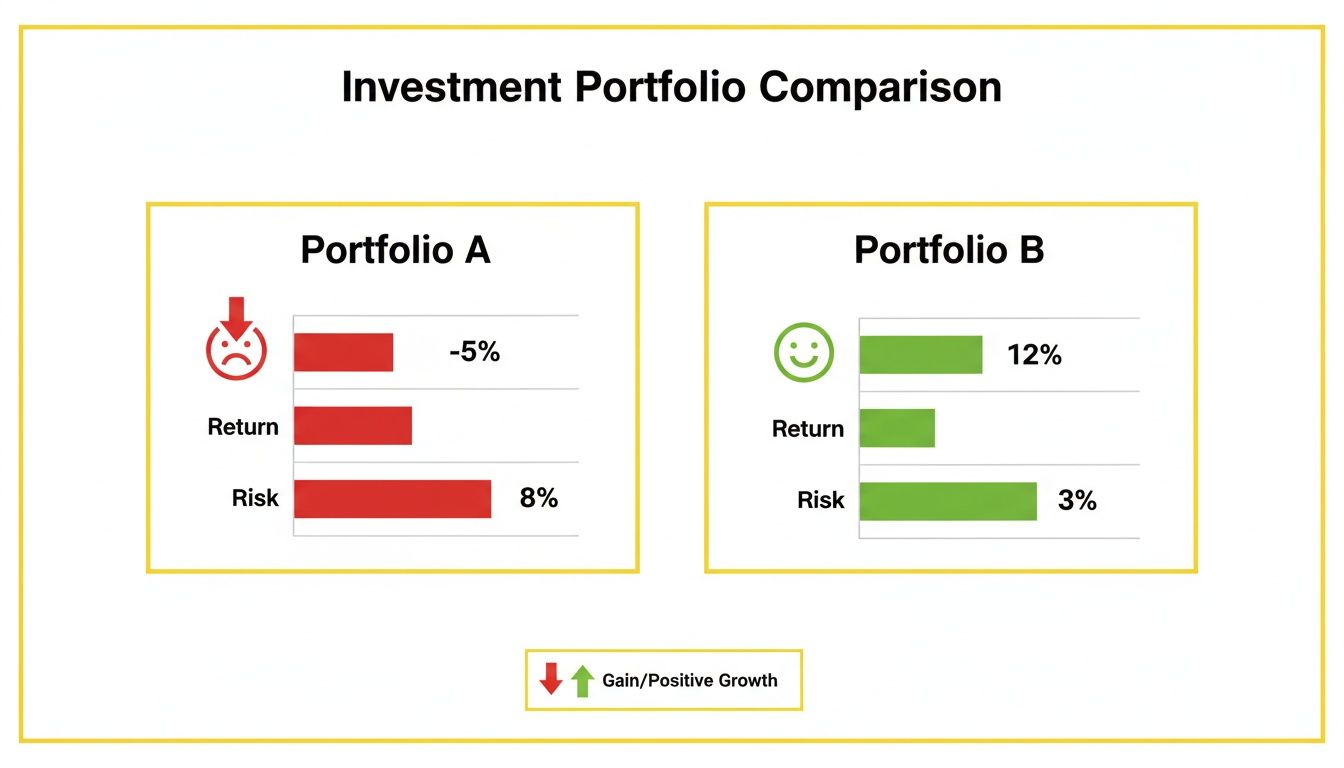

Think of it like a lottery you never signed up for. Imagine two friends, Alex and Ben, who both retire with a $1 million portfolio. They invest in the exact same way and, over the next 25 years, their investments achieve the very same average annual return.

Alex retires just as the market takes off, enjoying several years of strong gains. Ben, however, retires right before a major market downturn, facing losses in his first few years. Even with identical average returns, Alex will likely end his retirement with a healthy nest egg, while Ben could run out of money entirely.

This isn't a fluke; it's sequence of returns risk in action.

Why Early Losses Are So Destructive

When you withdraw money from a portfolio that's down, you're forced to sell more shares at low prices to get the cash you need. This locks in your losses and leaves you with a much smaller asset base.

When the market eventually recovers, your shrunken portfolio simply doesn't have the horsepower to bounce back. You've sold off too many of your "growth engines" at the worst possible time.

The Power of a Strong Start

On the flip side, if you get strong returns in your first few years of retirement, your portfolio grows even as you make withdrawals. This early growth creates a powerful cushion that helps insulate your nest egg from future downturns. Your portfolio becomes far more resilient because you’re selling fewer shares to generate the same income.

The key takeaway is simple but profound: when your returns happen can make or break your retirement.

To see this in black and white, let's look at how two identical portfolios can end up in wildly different places, all because of timing.

How Return Timing Impacts Two Identical Portfolios

This table shows two retirees, both starting with $1,000,000 and withdrawing $50,000 (5%) each year, indexed to 2% inflation. Both portfolios earn the exact same average return of 7% over 10 years, but the order of those returns is reversed.

| Year | Portfolio Value (Bad Timing) | Return | Portfolio Value (Good Timing) | Return |

|---|---|---|---|---|

| Start | $1,000,000 | $1,000,000 | ||

| 1 | $849,000 | -10% | $1,199,000 | +25% |

| 2 | $745,038 | -6% | $1,324,848 | +15% |

| 3 | $655,735 | -5% | $1,363,037 | +7% |

| 4 | $628,471 | +5% | $1,328,048 | +2% |

| 5 | $627,767 | +10% | $1,198,386 | -5% |

| 6 | $636,897 | +12% | $1,059,251 | -6% |

| 7 | $652,382 | +15% | $877,105 | -10% |

| 8 | $654,642 | +12% | $849,240 | +5% |

| 9 | $655,593 | +12% | $859,444 | +10% |

| 10 | $754,710 | +25% | $1,004,574 | +25% |

After just three years, the portfolio with a bad start has shrunk to just over $655,000, while the portfolio with a good start has grown to over $1.3 million. Even though the first portfolio gets phenomenal returns later on, the early damage was too severe to fully recover from.

This stark difference, driven only by the timing of returns, is why understanding this risk is non-negotiable for anyone nearing or in retirement.

As the visual shows, a portfolio hammered by early losses struggles to survive, while one that gets a strong start builds a lasting foundation. Acknowledging this reality is the first step toward creating a retirement plan that can withstand the inevitable ups and downs of market volatility.

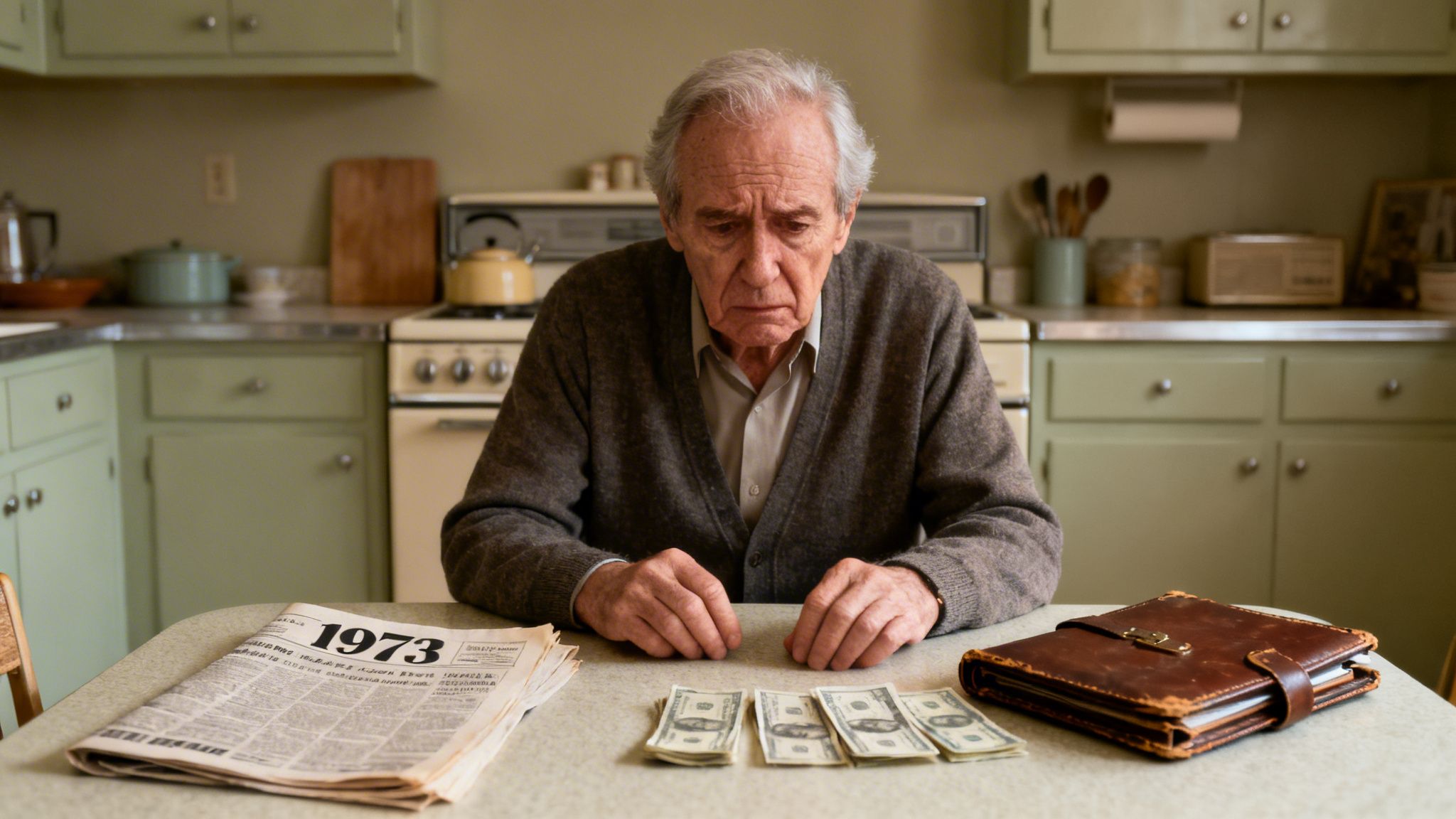

A Real-World Look At The 1973 Bear Market

To really understand how destructive sequence-of-returns risk can be, let's go back in time. Hypothetical scenarios are one thing, but nothing hits home quite like a real market crash that caught an entire generation of retirees off guard. I'm talking about the 1973-1974 bear market—a perfect storm of economic chaos.

Picture this: you've just retired in 1973 with a $200,000 portfolio, ready to start the next chapter. But the market had other plans. It delivered a one-two punch in what became the second-longest bear market on record. Stocks dropped about 8% in 1973, followed by a brutal 15% plunge in 1974.

By the time the dust settled at the end of 1974, a retiree's nest egg could have shrunk by nearly 30%. It’s a sobering example of how a poorly timed market downturn can gut a portfolio right when you need it most. If you want to dig deeper into this period, Morningstar's analysis offers some great insights.

This wasn't just a loss on paper. For new retirees needing to draw an income, it was a real-world disaster.

The Perfect Economic Storm

The 1970s weren't just about a stock market slump. A mix of nasty ingredients created a toxic brew for anyone's retirement savings:

- The OPEC Oil Embargo: An oil embargo in late 1973 sent energy prices through the roof, shocking the global economy and kicking off a period of runaway inflation.

- Stagflation: For the first time, the U.S. was hit with "stagflation"—a nasty and unusual cocktail of a sluggish economy, high unemployment, and soaring prices.

- High Inflation: Between 1973 and 1981, inflation ran wild, averaging an eye-watering 9.3% a year. That meant retirees had to pull out more and more money just to keep up with the cost of living.

This combination created a vicious cycle that was especially punishing for those living off their investments.

Double Jeopardy: The Retiree's Dilemma

A retiree in 1973 was in a classic "double jeopardy" situation. They were getting hammered from two sides at once, creating a problem far bigger than either issue on its own.

On one hand, their portfolio's value was tanking in the bear market. On the other, high inflation was forcing them to withdraw bigger and bigger sums just to pay for groceries and gas. This is the very definition of a negative sequence of returns.

To get the cash they needed, they had to sell off more shares at rock-bottom prices. This didn't just hurt; it permanently locked in their losses and kneecapped the portfolio's ability to bounce back when the market eventually recovered.

Every withdrawal was like pulling a brick from an already crumbling wall. The damage done in those first two years reverberated for decades, forcing many to completely change their retirement plans or face the real possibility of outliving their money. The 1973 bear market is a powerful lesson, transforming sequence of returns risk from a financial theory into a tangible, historical threat that shows exactly why planning for it is non-negotiable.

How to Stress-Test Your Retirement Plan

After seeing how a string of bad market years can derail a nest egg, you're probably wondering what the odds are for your own retirement. It's a fair question. While looking back at history is useful, it doesn't tell you what the future holds. The good news is, we don't have to rely on simple guesswork. We have powerful ways to see how a retirement plan might hold up under pressure.

The goal isn't to perfectly predict the future—nobody can do that. Instead, it's about understanding the range of possible outcomes your portfolio could face. This lets you find the potential breaking points in your strategy long before you actually retire.

Introducing Monte Carlo Simulations

One of the best tools for the job is a Monte Carlo simulation. Think of it as a financial crash-test dummy for your portfolio. Instead of assuming a single, average rate of return every year, a Monte Carlo analysis runs your plan through thousands of different, randomly generated market scenarios.

It shuffles the deck every time, mixing up good years, terrible years, and so-so years in countless combinations. This gives you a much more realistic picture of what could happen.

Each one of these thousands of simulations answers one simple question: "In this particular sequence of returns, did the money last?" When the computer is done, you get a probability score. For example, it might show your plan has a 90% probability of success, meaning your portfolio survived in 9,000 out of 10,000 possible futures. A high score like that can give you real confidence. A lower score is a clear signal that it's time to make some adjustments.

Of course, what "success" means depends on you. You can learn more about determining your investment risk tolerance to figure out what comfort level you're aiming for.

What History Tells Us About Risk

While simulations help us look forward, history keeps our feet on the ground. When you dig into the data, you find that while truly awful return sequences are possible, they aren't as common as our fears might lead us to believe.

For instance, one deep dive into S&P 500 data from 1900 to 2019 found some wild numbers. The absolute worst-case theoretical three-year stretch would have been an annualized real return of -25.4%. But in reality, no historical three-year period was ever that bad. The closest we got was during the Great Depression (1929-31), which saw a -23.5% annualized return.

This shows that sequence of returns risk, while scary, has often been more manageable in practice than in theory, especially if your timeline is longer. If you're a data nerd, you can read the full research on historical return sequences here.

The takeaway is clear: while we must prepare for the worst, the historical record shows that well-structured plans have a strong track record of weathering market storms. Stress-testing helps ensure your plan is one of them.

Ultimately, by pairing forward-looking simulations with a sober look at the past, you can build a truly robust retirement strategy. This data-driven approach turns abstract anxiety about sequence of returns risk into a concrete, actionable plan for building a resilient financial future. You can spot the weaknesses and strengthen them long before you hand in your resignation.

Actionable Strategies To Manage Sequence Risk

Knowing what sequence of returns risk is puts you ahead of the game, but building a solid defense is how you win. The good news is you don't have to cross your fingers and hope for the best. Several proven strategies can insulate your portfolio from a market beating right after you retire.

Think of these tactics as giving yourself options. Instead of being forced to sell stocks when they're down just to pay your bills, you can create a buffer that lets your investments recover.

The goal isn't to dodge risk entirely—that’s impossible. It's about managing it so that a few bad years at the start don't derail your entire retirement plan.

Implement The Bucket Strategy

A really popular and intuitive method is the bucket strategy. It’s exactly what it sounds like: you mentally sort your money into three different buckets based on when you’ll need to spend it.

- Bucket 1 (Short-Term): This is your immediate cash reserve. It holds 1-3 years of living expenses in super-safe places like cash, money market funds, or short-term CDs. If the market tanks, you draw from this bucket and leave your other investments alone.

- Bucket 2 (Mid-Term): This bucket is for expenses you anticipate in the next 4-10 years. It’s usually a balanced mix of stocks and bonds, aiming for some modest growth without being too aggressive.

- Bucket 3 (Long-Term): Here’s your growth engine. It’s filled with investments you won’t touch for 10+ years, so it can be heavily weighted toward stocks to chase higher long-term returns.

This setup gives you a tremendous psychological boost. You can sleep better at night knowing your immediate needs are completely covered, no matter what the stock market is doing.

Use A Dynamic Withdrawal Strategy

The old 4% rule assumed you’d take out the same inflation-adjusted amount every year, rain or shine. A dynamic (or flexible) withdrawal strategy is much smarter—it adapts your spending to what the market is actually doing.

By simply taking less money out when your portfolio is down, you leave more capital invested, giving it a fighting chance to bounce back. On the flip side, you can afford to spend a little more in the good years.

One common way to do this is with a "guardrail" approach. You set upper and lower limits for your portfolio’s value, and if you cross one, it triggers an automatic adjustment to your withdrawal amount. This kind of built-in flexibility is a powerful defense against the forced selling that makes sequence risk so damaging. For more on tweaking your portfolio, check out our guide on portfolio rebalancing strategies.

Establish A Retirement Glide Path

You’ve probably heard of a glide path for retirement, where you gradually shift from stocks to bonds as you get closer to your last day of work. A retirement glide path continues that same logic after you’ve retired.

For example, you might enter retirement with a 60% stock and 40% bond portfolio. Over the first decade, you could systematically shift that mix toward a more conservative 50/50 or even 40/60 allocation.

This steadily reduces your exposure to stock market swings as you get older, helping you preserve the wealth you’ve already built.

Comparing Popular Strategies To Mitigate Sequence Risk

Every strategy offers a different flavor of protection. The right one for you depends on your personality, spending flexibility, and how hands-on you want to be. This table breaks down the key differences.

| Strategy | How It Works | Best For | Considerations |

|---|---|---|---|

| Bucket Strategy | Divides money into short, mid, and long-term pools to fund expenses without selling stocks in a downturn. | Retirees who want a clear, intuitive system for managing cash flow and the peace of mind that comes with it. | Requires some active management to refill the buckets and can be less tax-efficient if not set up correctly. |

| Dynamic Withdrawals | Adjusts annual spending based on portfolio performance and preset rules (like guardrails). | Retirees with flexible spending habits who are comfortable with their income varying from one year to the next. | You have to be disciplined enough to cut spending in down years, which is easier said than done. |

| Retirement Glide Path | Automatically reduces stock market exposure over time, shifting the portfolio to more conservative investments. | Retirees who prefer a more automated, "set-it-and-forget-it" plan and want to lower their risk profile as they age. | Could limit your portfolio's long-term growth by selling stocks too early or too aggressively. |

In the real world, the best plan often borrows from multiple playbooks. You might use a two-year cash bucket for security while also applying a flexible withdrawal rule to the rest of your portfolio. By layering your defenses, you can build a truly resilient plan to combat sequence of returns risk.

How To Build Your Personal Defense Plan

Knowing the theory behind sequence of returns risk is one thing, but applying it to your own life is where the rubber meets the road. A generic plan just won't cut it. The right strategy for a 55-year-old starting a long retirement will look completely different from the plan for someone retiring at 67 with more predictable costs.

Crafting your personal defense plan means getting specific. It's about creating a written, concrete retirement income strategy that acts as your financial North Star. This document goes beyond how much you’ve saved and details exactly how you'll generate a steady paycheck, especially when the market gets rocky.

Tailoring Strategies to Your Profile

The most effective strategies are always the ones that fit your personal situation. While there’s no magic bullet, we can see how different approaches work for different people.

Let's look at a couple of real-world examples:

- The Early Retiree (Age 55): Facing a retirement that could easily last 35+ years, this person has a long window of vulnerability. A smart approach might be to combine a three-year cash bucket for immediate spending with a dynamic withdrawal rule. This gives their larger, stock-heavy portfolio the breathing room it needs to grow long-term, while the cash buffer prevents them from having to sell assets during a downturn.

- The Traditional Retiree (Age 67): This person might value certainty and simplicity above all else. They could decide to use a slice of their savings to buy an annuity that covers all their essential bills—housing, utilities, groceries. With their core needs guaranteed, the rest of their portfolio can be managed with more flexibility, knowing the lights will always stay on no matter what the market does.

In both scenarios, the plan is built around their specific timeline, comfort with risk, and income requirements.

The Most Important Strategy: Mastering Your Mindset

All the brilliant financial modeling in the world can be completely torpedoed by one emotional reaction: panic-selling. When the market drops, the gut instinct to sell everything to "stop the bleeding" is incredibly strong. But for a retiree, this is the most destructive move you can make. It turns a temporary paper loss into a permanent, irreversible one, locking in the worst possible outcome.

Your written retirement income plan is your best defense against emotional decisions. During a downturn, it serves as a pre-committed contract with your future self, reminding you that you have a system in place to weather the storm.

Staying disciplined isn't about ignoring your emotions; it’s about having a plan so solid that it can override your fear. This is where a dedicated cash reserve, much like an emergency fund, becomes a powerful tool. Knowing you have years of expenses covered without touching your stocks makes it infinitely easier to stay the course. To learn more, check out our guide on how to build an emergency fund.

Your personal defense plan is both a financial blueprint and a psychological shield. It’s the combination of practical money strategies and the mental strength to see them through when it counts.

FAQ: Common Questions About Sequence of Returns Risk

Once you start digging into the reality of sequence of returns risk, a lot of questions pop up. It’s a concept that can feel a bit counterintuitive at first. Let's walk through some of the most common ones to help you get a firm grasp on how this all works in the real world.

1. Does sequence of returns risk matter if I’m still saving for retirement?

For the most part, no. Sequence of returns risk is really a problem for people who are taking money out of their portfolio, what we call the "decumulation" phase. When you're still saving and investing (the "accumulation" phase), market downturns can actually be your friend. Think about it: when you're consistently buying into a down market, you're scooping up more shares for the same amount of money. The real danger zone is that critical transition period—roughly the 5 to 10 years before and right after you retire.

2. Is holding more cash the best way to avoid this risk?

Holding cash is a powerful tool, but it's not a magic fix. Having a "cash buffer" to cover one to three years of living expenses is a fantastic strategy. It means you won't be forced to sell your stocks when they're down. But holding too much cash exposes you to inflation risk, as its buying power gets eaten away over time. The trick is finding that sweet spot: enough cash to navigate a downturn, but not so much that it drags down the long-term growth your portfolio needs.

3. How does the 4% Rule relate to sequence of returns risk?

The famous 4% Rule was actually created because of sequence of returns risk. Researchers looked back at decades of market history to find a withdrawal rate that could have survived the absolute worst-case scenarios, like retiring on the eve of the nasty 1973 market crash. So, the 4% guideline has sequence risk baked right into its formula. But many modern plans now lean towards more flexible withdrawal strategies that adjust spending based on how the market is doing. If you want to dive deeper, you can learn more about the safe withdrawal rate in our article.

4. Can a good financial advisor really help with this?

Absolutely, and in two key ways. First, on the technical side, an advisor has access to sophisticated software that can run Monte Carlo simulations to stress-test your plan. Second, on the human side, they act as a behavioral coach during scary market downturns. They provide the discipline and perspective to help you stick with your strategy and prevent you from making a costly emotional mistake, like panic-selling at the bottom.

5. Which mitigation strategy is the best one?

There's no single "best" answer. The right game plan for you is deeply personal and depends on your financial picture, risk tolerance, and retirement goals. The strongest retirement plans don't rely on just one tactic. They often layer several strategies together. For example, you might pair a "bucket strategy" for your short-term needs with a "glide path" to gradually lower the risk in your long-term portfolio. The best plan is the one that's thoughtfully designed for you.

6. Does inflation make sequence risk worse?

Yes, inflation is like throwing gasoline on the fire. When the cost of everything goes up, you're forced to pull more money out of your portfolio just to maintain your standard of living. If this happens while the market is also down, you've got a toxic combination. You're selling more assets at low prices, which can drain your portfolio at a frighteningly fast rate. This is exactly why the 1970s was such a nightmare for retirees.

7. Are bonds a good defense against sequence risk?

Traditionally, they've been the go-to solution. Bonds are a cornerstone of managing sequence risk because they are typically less volatile than stocks and often move in the opposite direction. When your stocks are tanking, the bond side of your portfolio provides stability and a source of cash for withdrawals. However, bonds aren’t totally risk-free. They have their own vulnerabilities, like interest rate risk and inflation risk.

8. What is the opposite of sequence of returns risk?

The opposite is getting lucky with a "good" sequence of returns—where you retire right into a booming market. This is like starting a long voyage with a powerful tailwind. When your portfolio gets a big boost in those first few years, it builds a massive cushion, even while you’re making withdrawals. That early growth can make your nest egg much more resilient to future downturns, dramatically increasing the odds that your money will last.

9. How often should I review my sequence risk strategy?

A good rule of thumb is to review your entire retirement income plan, including your strategies for handling sequence risk, at least once a year with a financial professional. An annual check-in keeps your plan aligned with your life and the current market environment. It's also smart to schedule a review after any major life event—a change in health, family, or your financial goals—to make sure your strategy still makes sense.

10. Can annuities help mitigate this risk?

For some people, yes, annuities can be a very effective tool. An annuity is a contract you buy from an insurance company that can provide a guaranteed paycheck for life, no matter what the stock market does. That reliable income can cover your essential living costs, meaning you don't have to pull as much money from your investment portfolio. By reducing the need to sell assets during a downturn, annuities tackle sequence risk head-on. They are complex products, so it's critical to evaluate them carefully with professional help.

At Top Wealth Guide, we are dedicated to providing the knowledge and tools you need to build a secure financial future. Our resources cover everything from stock market investing to real estate and beyond, helping you make informed decisions every step of the way. Explore our guides and start your journey to financial empowerment today at https://topwealthguide.com.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions