Market timing—a siren’s call promising quick profits if you can nail the exact moments to jump in and out of investments. Yeah, sure. At some point, most investors are seduced by this strategy, thinking they can outsmart the market with a little clever timing. Spoiler alert: they can’t.

We at Top Wealth Guide dived deep into decades of performance data to put this debate to bed, once and for all (yes, really). The results? They might just blow your mind, making you rethink your entire investing game plan.

In This Guide

What Makes Market Timing So Tempting Yet Dangerous

Market timing – it’s about predicting when asset prices will rise or fall, aiming to buy low and sell high to rake in those sweet returns. Sounds like a breeze, right? Spoiler: It’s not. You’re supposed to nail two perfect decisions here: when to dive out of the market and when to leap back in. Even the “pros” – fund managers, investors – are constantly chasing this elusive prize, using a cocktail of technical analysis, economic indicators, and moving averages to guide their trades.

Popular Techniques That Promise Easy Profits

Let’s talk about those tactics: things like the 50-day and 200-day moving average crossovers, keeping an eye on the VIX market volatility index, and tracking economic barometers like unemployment rates or GDP growth. And then there’s the belief in seasonal trends – some swear certain months historically outperform others. These methods spin a web of control over an inherently unpredictable market.

The Brutal Reality Check Numbers Reveal

Numbers don’t lie. The data smacks a dose of brutal truth at market timing addicts. Dalbar’s annual study consistently finds that your average equity investor lags behind the S&P 500, mostly because they can’t get the timing right. Miss even just the 10 best trading days over 20 years, and your returns? Cut nearly in half. Ouch. Skip the 30 best days, and you’re staring at returns dwindled to almost zilch.

It’s even bleaker for the so-called experts – the mutual fund managers who live and breathe timing – barely keeping up with benchmarks regularly. Morningstar data shows active funds often struggle to outperform passive ones over the long haul.

Why Transaction Costs Kill Timing Profits

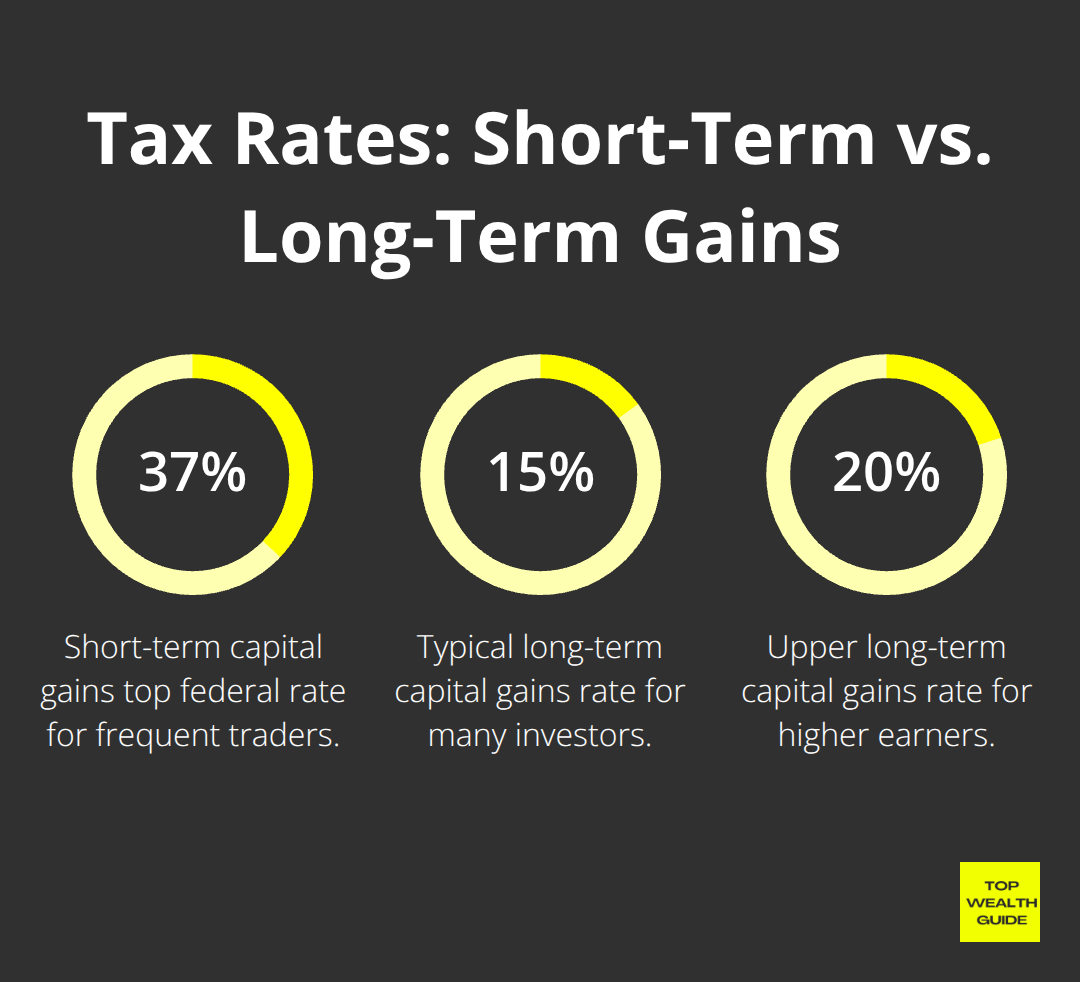

And let’s not forget transaction costs and taxes – they slice and dice market timing profits quicker than you can say “capital gains.” Every trade lights up fees, and trading often dumps you into short-term capital gains land, where tax rates soar to 37% compared to the cushier 15-20% for long-term holdings (which, trust me, adds up big time).

Then toss in emotional decision-making, and you’ve got a cost cocktail.

Fear pushes you to sell during market nosedives; greed tempts you to buy at peaks. Remember the 2008 financial crisis? Investors freaked out and sold near the pits in March 2009, only to see the market rally 26% by year’s end. Market timing turns investing from a rational wealth-building endeavor into a high-stakes gamble, fattening brokers’ wallets while depleting yours.

So, the big question hanging in the air – what happens if investors ditch the timing game entirely and roll with a different strategy?

Why Buy and Hold Beats Market Timing Every Time

The gist? Buy and hold-it’s like the antidote to all that Wall Street noise. It’s the real secret sauce for building wealth. Here’s the play: time in the market beats timing the market, every single time. We’re talking about scooping up some quality investments and then holding on to them. Hold them like they’re that limited edition, can’t-live-without-it concert ticket from your youth-keep ’em for years, decades even, and let compound growth do its voodoo. The S&P 500 is the poster child of this strategy, delivering stellar returns to those who can stomach the wild ride of market highs and lows.

The Compound Growth Machine That Never Stops

Want to see buy and hold in its natural habitat? Look no further than Warren Buffett’s Berkshire Hathaway. Drop a cool grand into it back in ’65, and by 2021, you’re looking at over 27 million bucks. That’s compound growth-simple, yet powerfully effective. Reinvest those dividends, let your capital appreciate… and voila, wealth-exponentially multiplied. Fidelity says folks who parked their cash in the S&P 500 for 20-year stretches haven’t lost a dime, whereas those dipping in for shorter periods? Risk city. The longer you stick with quality investments, the more they morph your cozy little savings into substantial baller status.

Tax Benefits That Boost Your Returns

Here’s where it gets sweeter-buy and hold flips the tax script. Long-term fans pay just long-term capital gains rates, a mellow 0% or 15% for most, versus the hefty ordinary income tax from short-term plays. Cha-ching, you’re saving big every year, all contingent on your income bracket. Market timing aficionados, however, get slammed with short-term gains taxes which hack away at their returns quicker than they realize. Patience isn’t just a virtue; it’s lucrative, thanks to the IRS cutting you a break on those taxes (and your portfolio nods in thankful agreement).

Lower Costs Mean Higher Net Returns

Let’s talk dollars-Vanguard pegs actively managed fund expense ratios at a fat 0.71% yearly when passive index funds daintily tiptoe in at just 0.06%. Translation? Those trading costs? Kaput-when you play the long game instead of jumping around. Take a six-figure portfolio; you’re saving around $650 a year in fees alone by opting for low-cost index funds over active management. Fast forward a couple of decades-those savings snowball into tens of thousands added to your kitty.

So, the existential question remains-how do these tactics really weigh up across varied market climates and over time? Let’s dive in.

Which Strategy Actually Makes You More Money

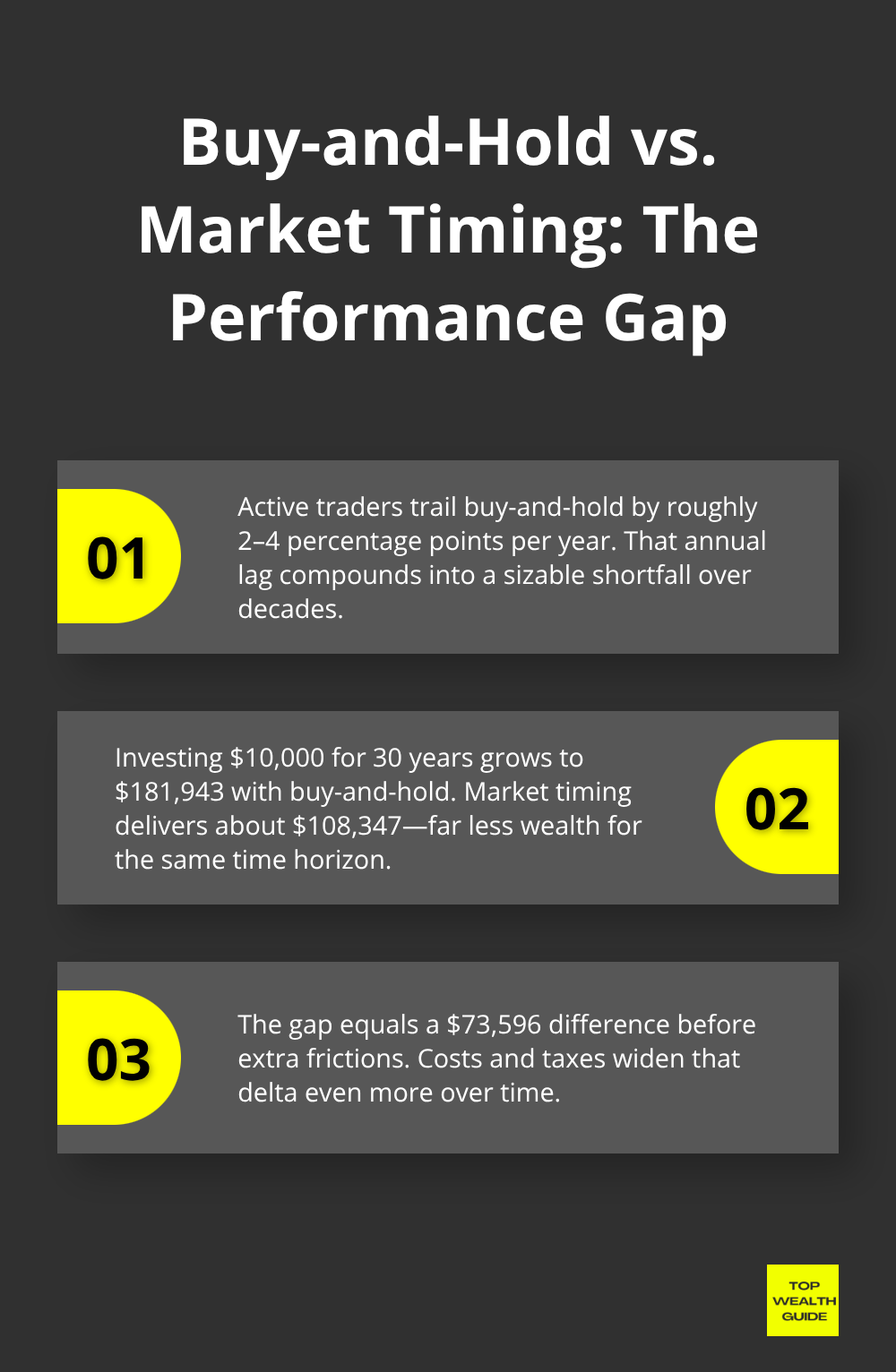

The numbers – oh boy, the numbers – are not kind to the market timing fans. Vanguard’s comprehensive analysis paints a pretty grim picture. The S&P 500… yeah, it’s rolling out the welcome mat for those patient buy-and-hold folks, while the active traders? Well, they’re trailing by 2-4 percentage points every year. Picture this: $10,000 just sitting pretty for 30 years turns into $181,943 with buy-and-hold; but if you’re dancing the market timing tango, you’re looking at a mere $108,347. That’s a glaring $73,596 difference.

And it gets worse – factor in costs and taxes, and it’s like pouring salt in the wound.

Risk Profiles Tell the Real Story

Market timing isn’t just a pocket-pincher – it’s a risk amplifier. The standard deviation numbers are screaming: market timers juggle a 18-22% volatility, while buy-and-hold folks chill with 15%. Translation? Timing strategies are a roller coaster – and not the fun kind – of wild gains and stomach-churning losses, leading to stress and, you guessed it, even worse decisions.

The wise minds at University of California found households trading like there’s no tomorrow underperform a value-weighted market index by a whopping 9%. Why? Fear and greed driving poor timing. Meanwhile, those buy-and-hold folks? They’re snoozing through the market cycles, smiling as the S&P 500 shines bright with positive returns in 73% of calendar years since 1950.

The Hidden Costs That Crush Timing Profits

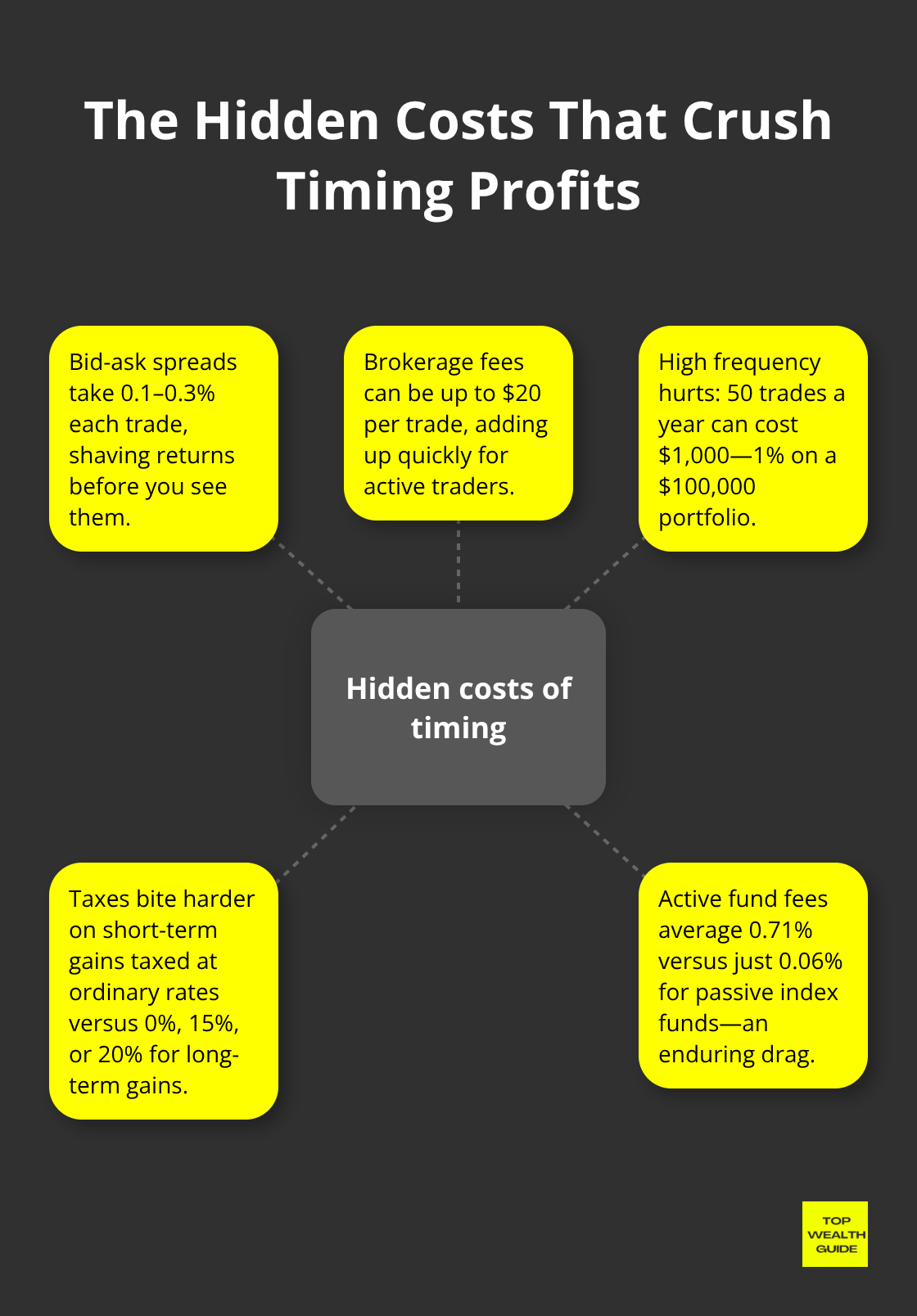

Ah, the stealth costs of market timing – they’re lurking, and they’re brutal. Every trade coughs up a bid-ask spread of 0.1-0.3%, not to mention those brokerage fees that can hit $20 a pop. So, if you’re wheeling and dealing 50 times a year? That’s $1,000 in costs on a $100,000 portfolio – a whole 1% gone before you’re even off the starting block.

Then there’s the tax man, slapping short-term capital gains with ordinary income rates, while the buy-and-hold crew enjoys a chill 0%, 15%, or 20% on long-term gains, depending on income. Trust Morningstar’s tax-adjusted data – that alone can cost active traders 1-2% a year. Toss in management fees for active funds at an average of 0.71%- versus a laughable 0.06% for passive index funds – and you’re looking at market timing as a surefire wealth demolisher, not a builder.

Performance Gaps Widen Over Time

Schwab says it loud and clear: frequent traders fork over an average of 0.8% annually in transaction fees alone, while buy-and-hold savvy investors using low-cost index funds pay a minuscule 0.03%. Let that sink in. Over 20 years, these “small” differences compound into staggering wealth gaps – the chasm between those who stick to a winning strategy and those hot on the heels of a quick buck.

Final Thoughts

Buy and hold … let’s just say it mops the floor with market timing. The data? Crystal clear. Market timing gets dunked on by a hefty 2-4% every year. Over time, that’s setting your cash on fire – poof – tens of thousands gone. Fast-track gains? More like fast-track headaches: higher costs, tax penalties, the kind of emotional rollercoaster that makes wealth evaporate.

If you’re close to retirement, you want stability – predictable growth. Low-cost index funds, my friends. Younger folks – listen up – that compound growth over decades? It’s like magic. Even if you like a bit of risk, keep 80-90% locked in buy and hold (live a little with the rest in speculative plays).

So, what’s the move? Open up a brokerage account, dive into broad market index funds. Look for expense ratios under 0.1% – yes, every decimal matters. Set up those automatic monthly contributions; detach from the chaos. We at Top Wealth Guide have tools and strategies to steer you right for a long-term win.