Dividend reinvestment—what’s that all about? It’s like turning your everyday stock ownership into a turbocharged wealth-building machine. Instead of taking the cash and heading to your favorite coffee joint, those dividends… yeah, they just roll back into buying more shares. It’s compound growth on steroids, folks.

Top Wealth Guide has watched investors pull a magic trick on their portfolios—doubling returns like they had a secret sauce. And all they did was swap cash dividends for automatic reinvestment. It takes almost zero effort, but the payoff? Big time, long-term wealth. Simple, right?

In This Guide

How Do DRIPs Actually Work?

The DRIP Mechanics That Build Wealth

So, here’s the deal – DRIPs (Dividend Reinvestment Plans) are like a financial autopilot that flips your dividends into more shares, pronto. When your favorite company goes, “Hey, here’s some cash,” you don’t just pocket it. Nope, it gets magically morphed into new shares, at the current market price, with zero commission fees. That’s right – zero. It’s all about that compounding effect, people. Think of it as a snowball – it just keeps getting bigger each time, even if your dividends are a puny $15. Every little bit adds up.

Two DRIP Types That Matter

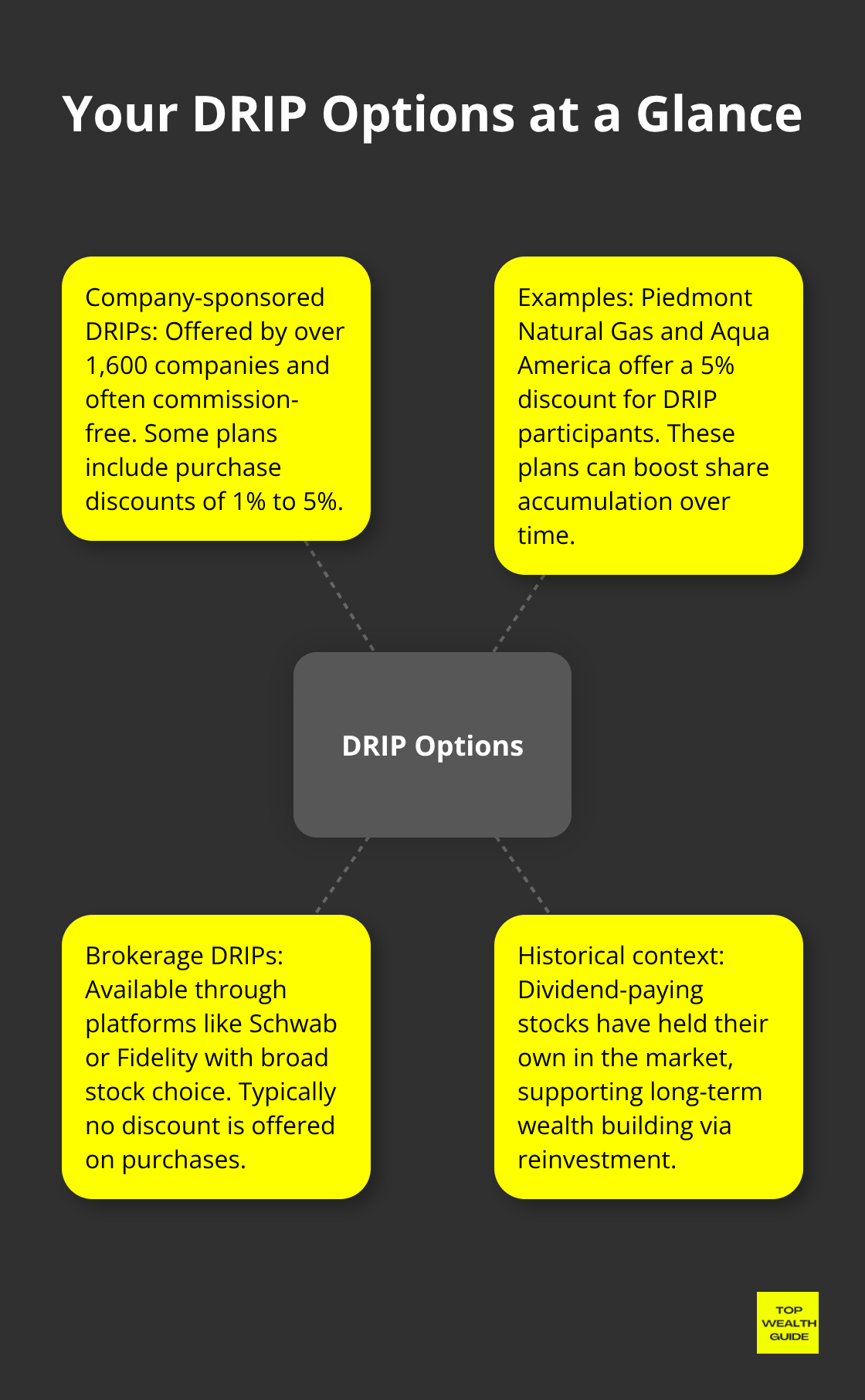

Here’s where it gets interesting. We’ve got two flavors of DRIPs. First up, the company-sponsored ones.

Big names like Coca-Cola or Johnson & Johnson are in on this party (with over 1,600 companies offering these sweet deals). Sometimes, they throw in a 1-5% discount – just because. Piedmont Natural Gas, Aqua America… yep, they love to hand out a neat 5% off for DRIP-savvy folks. Then, there are brokerage DRIPs, courtesy of platforms like Schwab or Fidelity. Sure, you get more stock choices, but don’t expect that discount love. Yet, here’s the kicker – dividend-paying stocks historically hold their own in the market. So, pick your poison – either route helps in stacking up that wealth. Dividend-paying stocks.

Compound Growth in Action

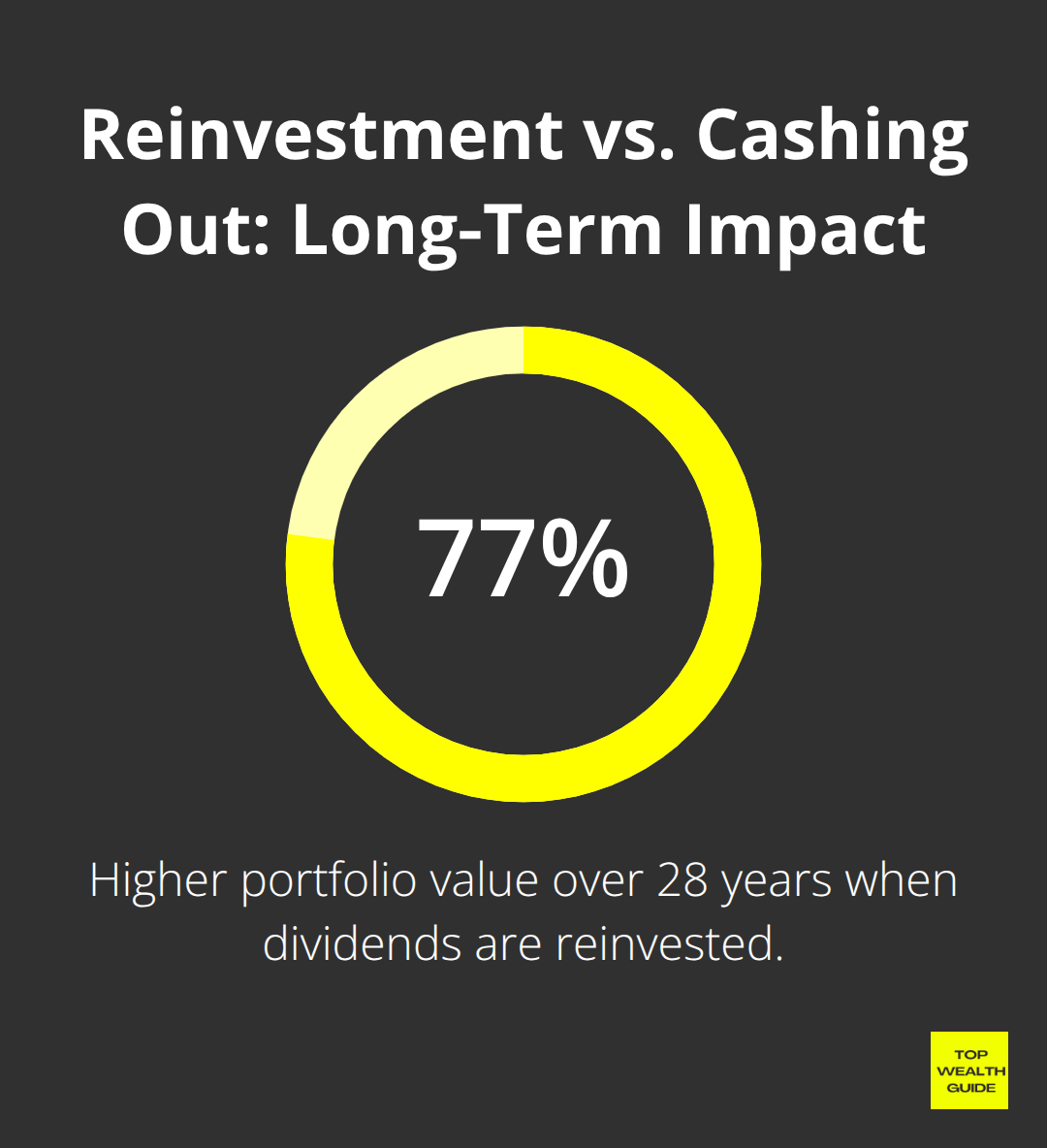

Here’s the cold, hard cash evidence. A starting point of 20K could explode into a hefty $319,504 over 28 years with dividend reinvestment. Without it? You’re looking at just $180,256.

What a snooze. That whopping 77% boost is thanks to gobbling up more shares when the market’s down – and those dividends? They’re joining the compound growth party. Reinvested dividends aren’t just pocket change – they’re the gears turning your modest quarterly payouts into significant wealth machines – no hands-on management needed.

Got the DRIP mechanics down? Good. Now, it’s time to pick the path that’s right for your personal investment mission and portfolio – and get that money train rolling.

Which DRIP Setup Works Best for You

Direct Company vs Brokerage DRIPs

Let’s cut to the chase-direct company DRIPs are the heavyweight champs for those serious about stacking some serious wealth. We’re talking big players like Coca-Cola and Johnson & Johnson, and a bunch more you’ll find here. The allure? Commission-free reinvestment and zero fees. Here’s the kicker… some even throw down discounts of 1% to 5% on every share purchase. Piedmont Natural Gas and Aqua America top the charts with a hefty 5% discount for DRIP participants-that’s like finding a $20 bill in an old jacket.

Switch gears to brokerage DRIPs-Schwab or Fidelity, anyone? You get more stock picks but lose out on the discounts. It’s simple math, really: direct DRIPs let you keep more of your cash with lesser costs. And hey, you’re dealing with the company directly-no middleman nonsense.

Stock Selection That Actually Matters

Enter the Dividend Aristocrats-the stalwarts of the S&P 500, upping their dividends every single year for the last quarter-century. These titans provide a rock-solid foundation for DRIP investments with their reliable dividend growth record. When the market wobbles, dividend payers offer an enticing trio: income, toned-down risk, and robust long-term potential.

So, what’s the magic formula? Look for payout ratios under 60% to buffer against dividend cuts. Companies that overshoot this often falter in tough times (yeah, looking at you, cyclical industries). Also, keep your eyes on 5-10% annual dividend growth rather than chasing those sky-high yields. A modest 3% stock with an 8% annual dividend increase outpaces a flat 6% yielder when you leverage that sweet, sweet compounding.

Tax Reality Check

It’s time to face the music-every reinvested dividend gets taxed as regular income in the year it lands, despite you not pocketing the cash. Brokers like Schwab hand over 1099-DIV forms that lay bare your dividend income, reinvested or not. Each DRIP buy is a new tax lot with its own cost base and purchase date-miss this, and tax season becomes a horror flick.

Want to dodge this tax train? Hold your dividend stocks in Roth IRAs. Tax-free growth amplifies the power of DRIP investments when Uncle Sam’s hands are tied (especially over 20+ years).

Now that you’ve got your DRIP setup down and nailed the pick of great dividend stocks, it’s time to finesse your timing and management skills to turbocharge your wealth-building game.

When Should You Start Your DRIP Strategy

Market Timing That Actually Works

Stop waiting for that mythical perfect moment to ride the market wave. The sweet spot to kick off your DRIP strategy? Right now-even more so when the market’s in the gutter. During downturns, your dividends snag more shares for the same dough. Fidelity research points out those investors who keep plowing dividends back into shares during tough times can see a 6.06% average annual return over a decade. Volatility is your ally here-it’s like a sale on stocks every time your dividends hit.

The 2008 financial debacle was a case in point-folks who held onto their DRIP allocations? They ended up with a slew of shares bought at bargain-basement prices. Forget trying to crack the market timing code-let dollar cost averaging via DRIPs carry the load.

Portfolio Management That Builds Real Wealth

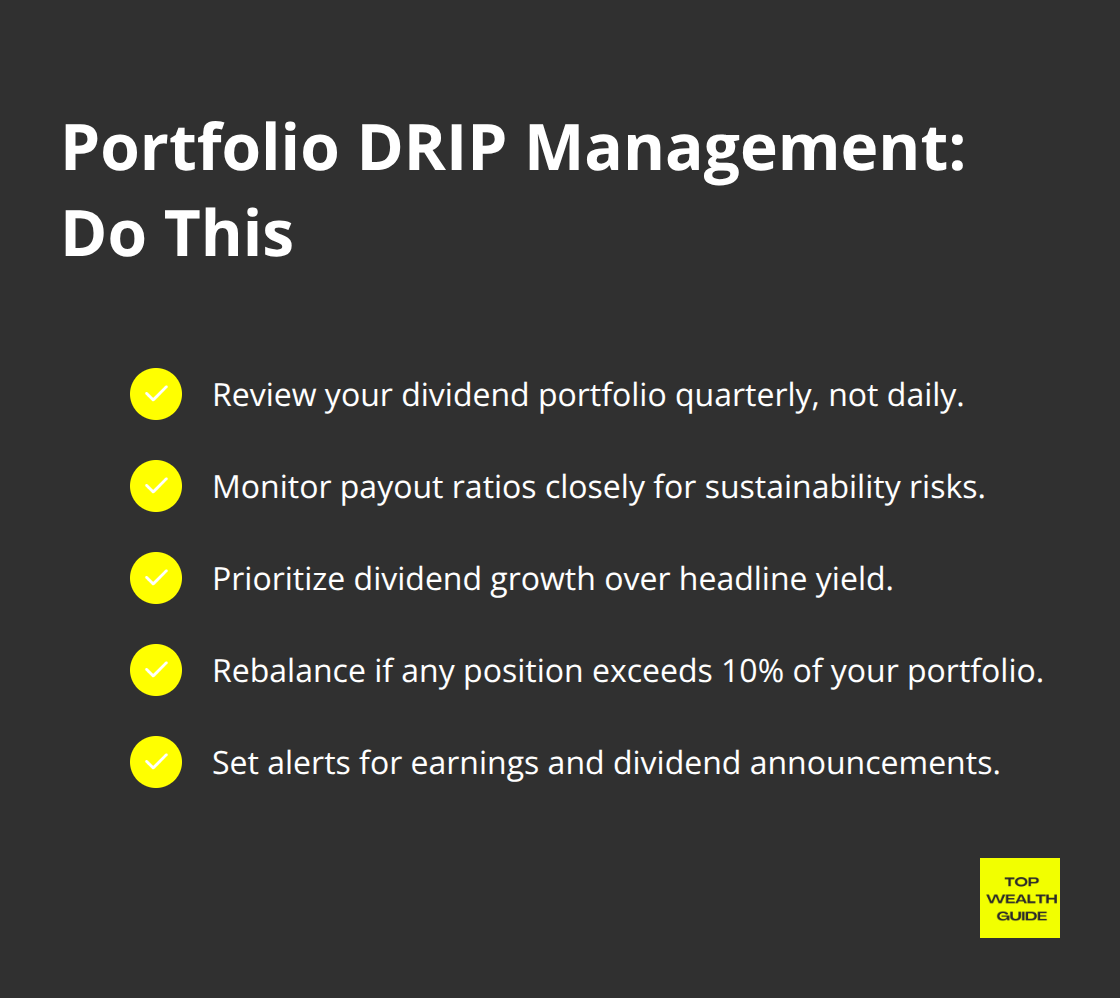

Take a breather, check your dividend portfolio once a quarter-not daily. Keep an eagle eye on payout ratios like they’re your favorite TV show-they show how much of its profits a company spins off as dividends, crucial for judging long-term sustainability. Just ask General Electric-they handed out too much and chopped their dividends big time in 2017.

Pay more attention to dividend growth than to the flash of high yields. A 3% yield growing dividends at 8% a year outpaces a 6% yielder stuck in neutral over the long haul. Mix things up if any position swells beyond 10% of your portfolio to sidestep concentration risk (you don’t want to go all-in on one company). Set notifications for earnings updates and dividend news to spot trouble brewing early.

Time Horizons That Maximize Compounding

Your age? It sets the clock on your DRIP strategy. Under 40? Go all-in on dividend growth stocks with horizons of 20-30 years-a hotbed for compounding magic. Nearing retirement? Time to blend it up-stick with growth-focused DRIPs for most of your stash, but shift 40% to beefier yields for income.

Hartford Funds shows dividends have delivered a 1.8% annual boost over decades, with reinvestment doing wonders. Start small-toss monthly bits into dividend ETFs if stock picking seems dizzying (it’s a safer intro while you get the hang of it), then level up to direct company DRIPs as you get smarter.

Final Thoughts

Dividend reinvestment… it’s like turning regular stock ownership into a money-making machine. The numbers? They don’t lie-reinvested dividends can pump up portfolios by 77% more over 28 years compared to just cashing out. That’s right, turning $180,256 into $319,504 on the same starting amount. Crazy, huh?

So, here’s your move. Get a brokerage account set up-Schwab, Fidelity… you name it-for the full DRIP experience. Or, if you fancy those tasty discounts, go straight to the company’s plan. Zero in on those Dividend Aristocrats-yeah, the ones with payout ratios under 60% and a solid track record of raising dividends for over 25 consecutive years.

The trick? Jump in now-don’t hang around waiting for some market fairy tale. Downturns? They work in your favor, letting you pick up more shares on the cheap when dividends kick in. Over at Top Wealth Guide, we’ve watched folks pile up serious wealth. How? Sticking to these tried-and-true, low-effort dividend reinvestment tactics that pack a punch over the long haul.