Market crashes… they’re like financial hurricanes, washing away years—decades—of progress in the blink of an eye. Remember 2008? It shredded $11.2 trillion in market value. Come 2020, the pandemic swooped in and poof—$6 trillion gone in six weeks. Yikes.

At Top Wealth Guide, we preach the gospel of smart wealth preservation by getting your ducks in a row before things go south. The real trick? Keeping your portfolio safe without scrambling during the chaos. Prep-work, folks, not panic buttons. That’s the name of the game.

In This Guide

What Happens to Your Money During Market Crashes

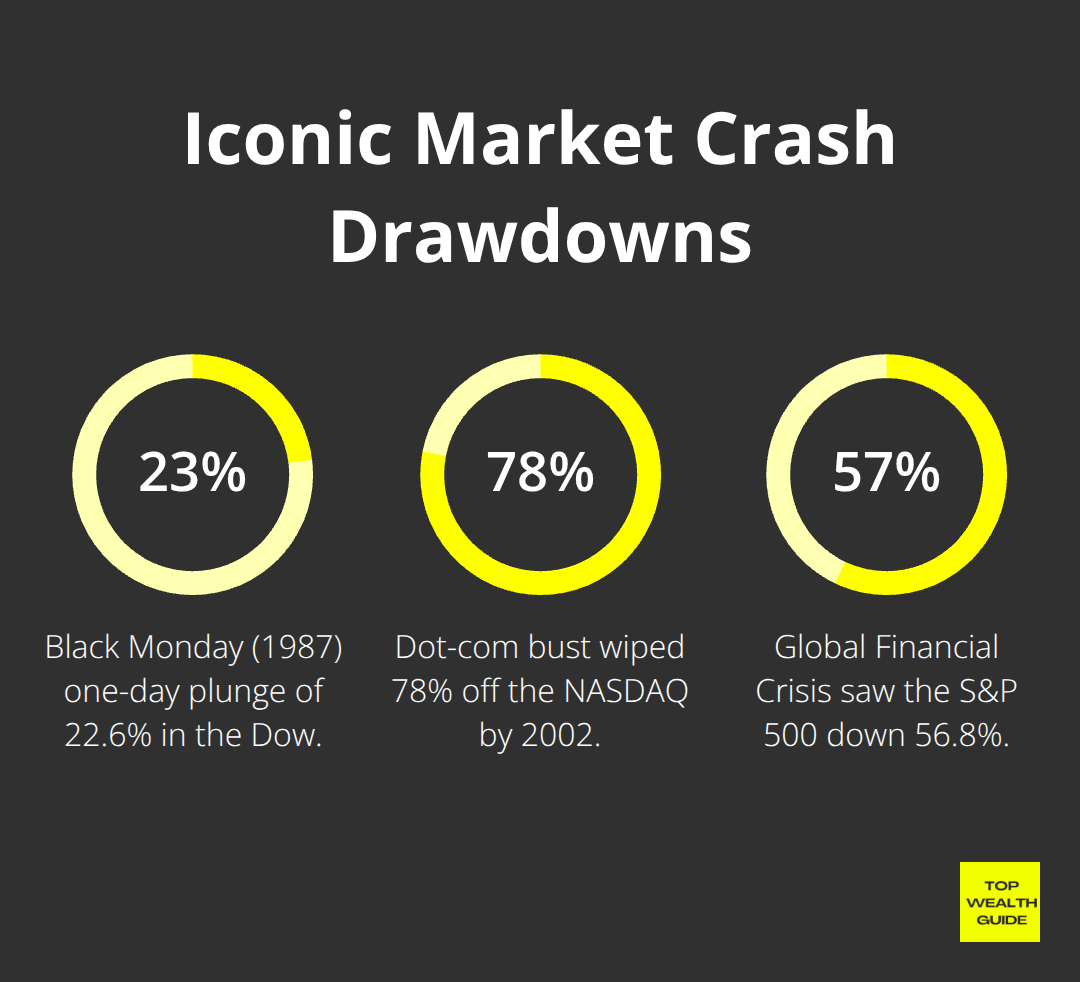

Market crashes follow predictable patterns-the kind that lay waste to portfolios that are caught napping. The 1929 Great Crash? Annihilated 89% of the Dow Jones over three agonizing years. Black Monday, 1987? A gut-punch with a 22.6% dive in just one day. The dot-com bubble? Ripped 78% out of NASDAQ by 2002. And then there’s the 2008 financial meltdown-wiped out 56.8% of the S&P 500.

Recovery time? Grab a popcorn… it varies. The 1929 setback took 25 years to crawl back, but 2020’s pandemic plunge? Just five months to bounce back.

Asset Performance During Downturns Shows Clear Winners and Losers

Assets-oh, they react like divas during crashes. Stocks? They’re the first to hit the floor, with growth stocks typically falling 40-60%, while value stocks thumb their noses a bit less dramatically, dropping 20-30%. Bonds are the calm in the storm-especially Treasury securities-as investors scurry away from risk as if it were a lit firecracker. Gold historically had its moment, hanging around $900 during the 2008 crisis, peaking at $1000, but then… took a nosedive of 25% between July and September 2008. Real estate? The tortoise of the assets-slower on the decline, 15-30% over 2-3 years, but it mopes around in the dumps much longer. Cash? Oh, cash is king during these times-not for sexy returns but for that enviable purchasing power when everything else is in the dumps.

Investor Mistakes That Destroy Wealth During Volatility

Panic selling-it’s the call of the siren that locks in colossal losses, the ultimate blunder. Case in point: those poor souls who sold in March 2020? Yep, they missed the fastest recovery ever. Timing the bottom-hah! A clown show people keep watching; even the pros stumble on this 80% of the time (thanks, Morningstar). Doubling down on losers? That’s how you get forced into ugly fire sales of your other holdings. And let’s talk about ignoring diversification-it’s playing with fire exactly when you should be building your protection net.

Same old story-they repeat because human psychology? It’s running the show more than fundamentals when crashes hit. Fear spreads faster than a viral TikTok trend, and investors keep making decisions guided by their guts, not brains-compounding their misery. So, what’s the play? Build a fortress around your wealth before the hurricane hits.

What Actually Protects Your Portfolio When Markets Collapse

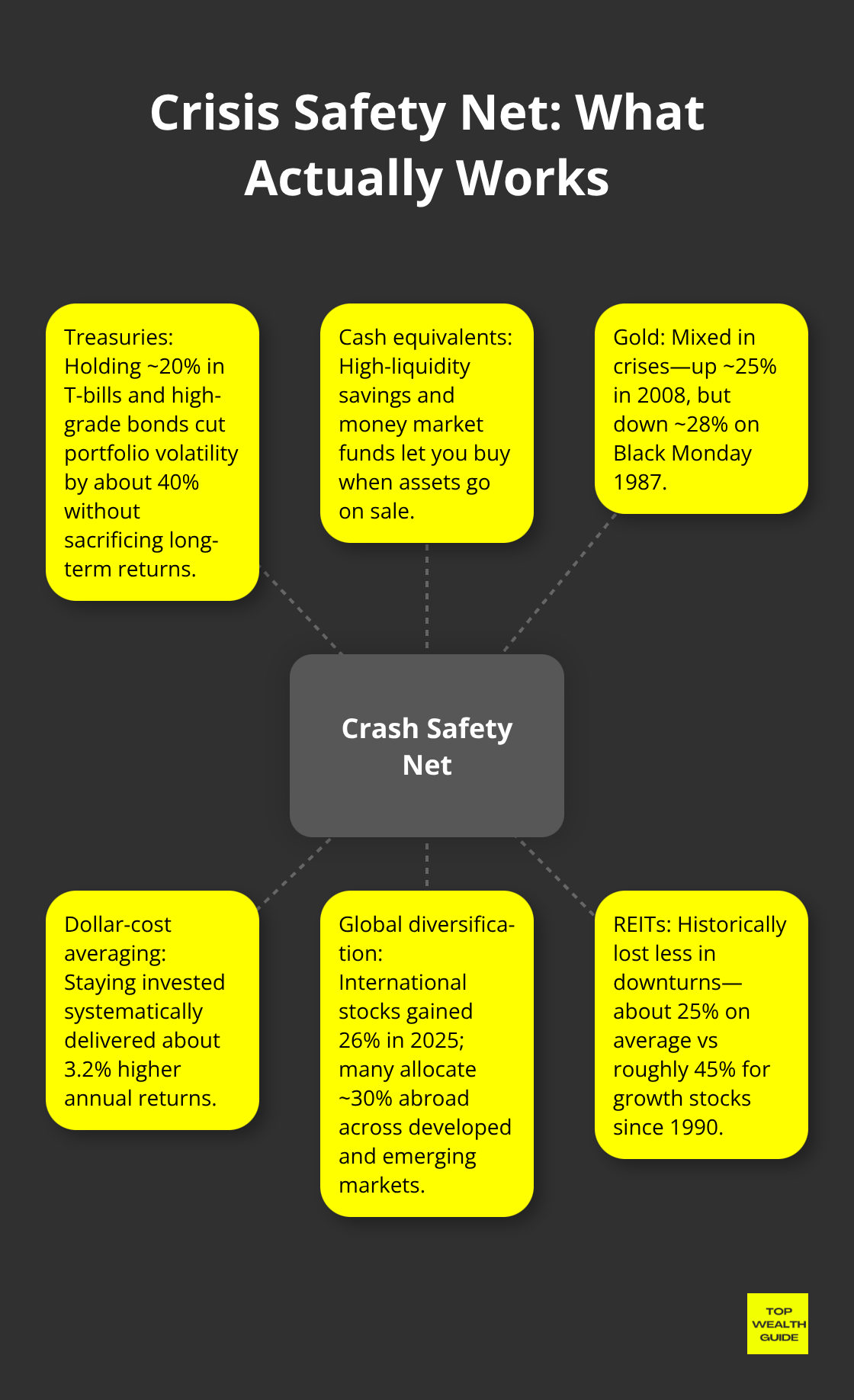

So, you think you’re diversified with that classic 60-40 stock-bond split? Think again. Real diversification means hopping on the express train past just two asset classes-think 8-10. Take 2008, for instance. S&P 500 tanked a staggering 56.8%, but commodities? Only down 36%. And TIPs? They clocked an impressive 20% gain. Yeah, that’s the power of spreading your wings.

Want to talk geographic diversification? Oh, it’s a game-changer. In 2025, international stocks strutted with a 26% gain (all in dollar terms) while our good ol’ US markets just shuffled around. The savvy folks? They’re putting 30% globally, split halfway between mature markets and those buzzing emerging economies. Check out Real estate investment trusts-they’re the real MVPs of past crashes. Every downturn since 1990, REITs have lost way less (only about 25% on average versus a whopping 45% for growth stocks).

Treasury Securities Provide the Ultimate Safety Net

Now, let’s talk security blankets-Treasury securities. These are gold when the world feels like it’s ending. Crisis hits, investors go hunting for safety and liquidity, and these government-backed gems are like a warm hug. The Federal Reserve Bank of St. Louis has the stats to back it up-holding 20% in Treasury bills and high-grade corporate goodies cuts volatility by 40%, no long-term gain sacrifices needed.

People love gold… but cash? Cash equivalents like beefy savings accounts and money market funds give you the edge-buy low when the market’s on a clearance sale. Forget all the gold jazz-its track record during crises is a mixed bag: 25% up in 2008, but 28% down in ’87’s Black Monday. Yikes.

Dollar-Cost Averaging Eliminates Timing Guesswork

Now, onto dollar-cost averaging-yes, it’s the no-brainer way to avoid the mindset traps that make your wealth disappear during those roller-coaster periods. Vanguard’s got decades of data proving it-3.2% higher annual returns if you stick to systematic investments through thick and thin. How? Your regular investments snap up more shares at bargain prices, supercharging gains once the market regains its groove.

Automate those monthly investments-$500, $1000-into diversified index funds and snub the sensational headlines. It’s how Warren Buffett’s Berkshire Hathaway pulled in 20% annually for decades. Buy when fear is the dominant theme.

This approach doesn’t just cushion your wealth-it’s the cornerstone of rock-solid financial resilience. Your portfolio becomes just one part of a bigger, stronger safety net.

How Strong Is Your Financial Foundation Beyond Investments

Let’s cut to the chase-your stock portfolio means zilch if your financial house isn’t in order. Seriously, people obsessing over the next Apple while sitting on $5,000 in credit card debt at 24% interest…it’s financial hara-kiri. The Federal Reserve’s Survey of Consumer Finances? It tells us 40% of Americans can’t scrape together $400 for an emergency without borrowing. Remember 2008? Those with emergency funds? They rode it out 3x smoother than folks living paycheck to paycheck.

Emergency Fund Math That Actually Works

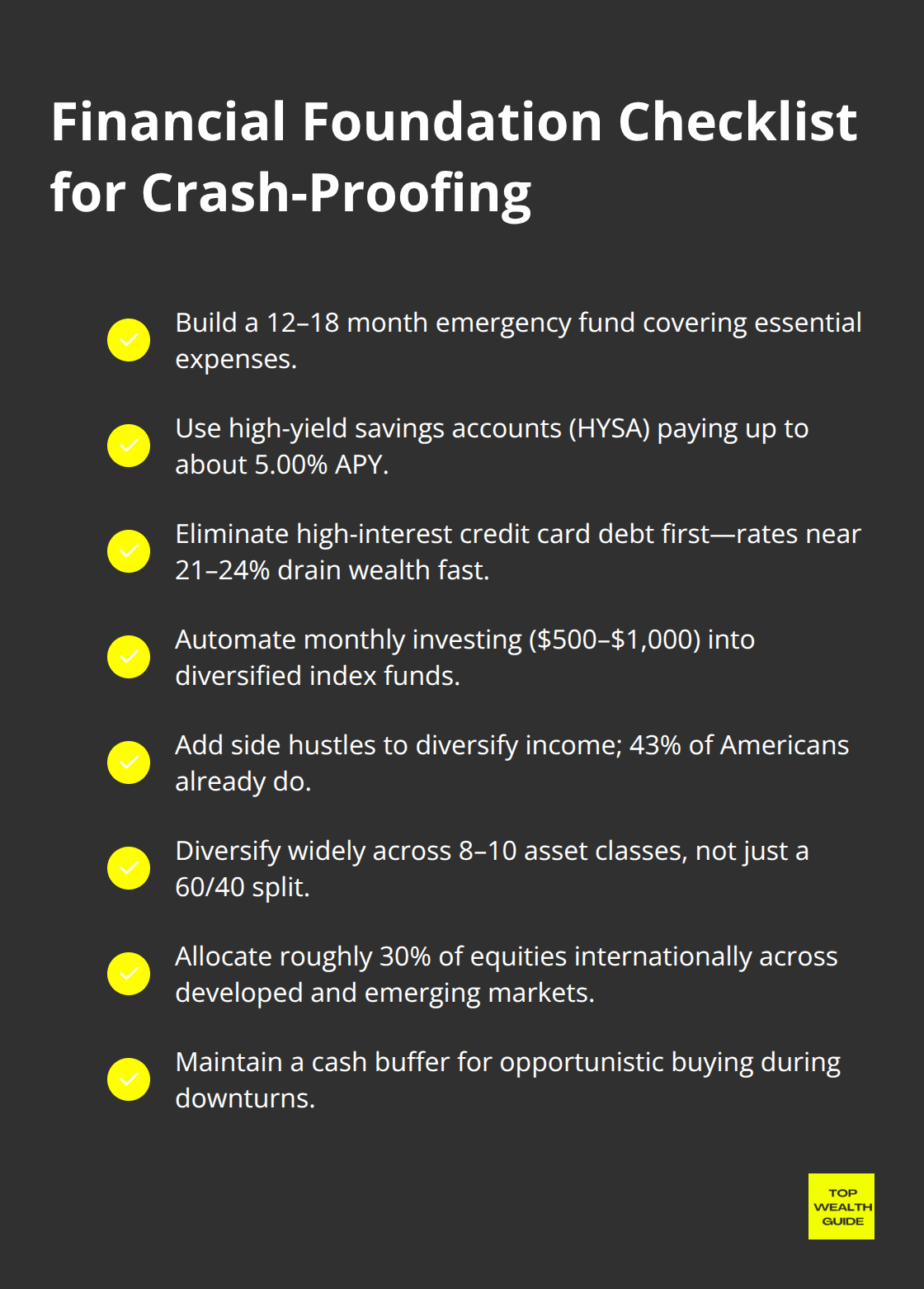

Ditch the old-school advice about saving three months of expenses. Like, who came up with that? Market crashes don’t follow a three-month calendar. The National Bureau of Economic Research shows recessions on average hang around for 11 months-2008 stretched to 18 months. The savvy folks? They stash 12-18 months of essential expenses in high-yield savings accounts with rates up to 5.00% APY. Check out Marcus by Goldman Sachs and Ally Bank-they’re offering some of the best deals.

When doing your math, think bare-bones survival, not your weekend brunch budget. Housing, utilities, minimum debt payments, groceries, insurance. Period. $80k earner but living on $3,500 monthly? Quick math: you’re parking $42,000-$63,000 in cash to stay afloat.

Debt Elimination Beats Investment Returns

Before you think investments, think zapping that high-interest debt. Credit cards? They’re averaging 21%-and they’re bleeding your money faster than stocks can earn it. The avalanche method is your friend here-rank those debts by interest rate, target the highest first, all while making minimum payments elsewhere.

Got $10,000 on a credit card at 24%? That’s $2,400 a year just in interest. Kill that debt and voilà-you’ve got yourself a 24% guaranteed return. No mutual fund is touching that kind of certainty.

Multiple Income Sources Create Unshakeable Security

Relying on one income source? In a crash, that’s a financial booby trap. According to the Bureau of Labor Statistics, 43% of Americans juggle side hustles. Winning gigs? Freelance writing, online tutoring, e-commerce…digital services that get you money. Platforms like Upwork and Fiverr-these connect your skills to paying clients, pronto.

Real estate buffs use rentals for that sweet passive cash flow (think $200-$400 monthly each door). The trick is crafting income streams that don’t hinge on your main gig or stock market whims. These alt revenue sources? They morph into your financial safety net when traditional employment wobbles-and they’re your ticket to lasting financial freedom.

Final Thoughts

Market crashes-they’re gonna happen. Facts, not fearmongering. The savvy (and the lucky) survive… but the truly smart ones? They thrive. It all boils down to prep. We’ve hit the must-dos: diversify like your life depends on it (spread across 8-10 asset classes), stash away 12-18 months of living expenses in cold, hard cash, dump that high-interest debt like last year’s fashion, and set up multiple income streams like a financial octopus.

Here’s the lowdown. Those who kept playing the investment game through the mess of 2008? Yeah, they saw 3.2% higher annual returns. Households with a financial cushion sailed through stormy seas three times smoother than those living paycheck to paycheck. Toss in some Treasury securities and… bam! You cut portfolio volatility by 40% without sacrificing those sweet long-term gains.

So, jump on it. Automate those investments, stack that emergency cash, and diversify your income source. The secret to wealth isn’t some crystal ball predicting the next market thud-it’s about being ready for the hit. Top Wealth Guide is your go-to for tools and insights to secure your financial fortress through any market mayhem.