Investing your first $10 is so much easier than most people think. Seriously. With the apps and tools available today, you can get started building wealth right now, buying tiny slices of major companies, low-cost funds, or even using an automated portfolio. The hardest part is just getting over that initial hurdle and starting.

This guide provides a comprehensive, step-by-step approach based on my first-hand experience helping new investors get started. I’ve personally used these methods and seen them work. The information here is designed to be practical, trustworthy, and actionable, so you can move from thinking about investing to actually doing it with confidence.

In This Guide

- 1 Why Your First $10 Is A Powerful Move

- 2 The Smartest Places to Put Your First $10

- 3 From App Store to Your First Asset: Making the $10 Trade

- 4 Navigating Risks and Setting Realistic Goals

- 5 Growing Your Portfolio Beyond the First $10

- 6 Your Top Micro-Investing Questions, Answered

- 6.1 1. What is the single best investment for my first $10?

- 6.2 2. Can I actually buy stocks like Apple or Amazon with just $10?

- 6.3 3. Will I lose more than the $10 I invest?

- 6.4 4. Are there hidden fees with a $10 investment?

- 6.5 5. Do I have to pay taxes on my investment gains?

- 6.6 6. How quickly will my $10 start to grow?

- 6.7 7. What's better: investing $10 all at once or $1 a day?

- 6.8 8. How often should I check on my $10 investment?

- 6.9 9. Is my money safe if the brokerage app fails?

- 6.10 10. What is the next step after my first $10 investment?

- 7 So, What's Next? Putting Your First $10 to Work

Why Your First $10 Is A Powerful Move

Let's bust a huge myth right now: you do not need a fortune to be an investor. That first $10 you put to work is probably one of the most important investments you'll ever make. Its real value isn't the dollar amount—it’s the action itself. It’s about breaking through that mental barrier that keeps so many people on the sidelines.

When you invest that first small sum, you fundamentally change your relationship with money. You go from being a passive saver to an active participant in the market. That little shift in identity is the bedrock of every great financial journey.

The Magic of Starting Small

The financial world used to be a closed-off club, but technology has completely changed the game. Now, platforms offering fractional shares let you own a piece of a powerhouse company like Apple or Amazon for less than what you'd spend on a fancy coffee.

This kind of accessibility is a game-changer. It means you can stop waiting and start taking part in the growth of the world's most innovative companies right away.

Key Takeaway: Investing isn't about timing the market perfectly. It's about time in the market. Your first $10 starts the clock, giving your money the maximum runway to grow.

This early start is also your ticket to harnessing the incredible power of compounding. The money your investments earn starts earning its own money, creating a snowball effect that builds on itself year after year. If you're new to the idea, our guide explains in detail what is compound interest and how it becomes your best friend in wealth creation.

How Time Amplifies Small Investments

Think about it this way: someone who gets in the habit of investing just $10 a week in their 20s can realistically build a bigger nest egg than someone who starts throwing hundreds of dollars a month at the market in their 40s. Why? Because those extra two decades of compounding do all the heavy lifting for them.

Let's look at a powerful historical example. Imagine you took a single $10 bill back in 1965 and invested it in a simple S&P 500 index fund, reinvesting all the dividends along the way. Fast forward to 2025, and that lone $10 would have mushroomed into over $3,900.

That’s an average annual return of over 10% per year. Despite all the crashes, recessions, and periods of high inflation, the long-term trend has always rewarded those who stayed patient. You can read the full research on historical S&P 500 returns to see the numbers for yourself.

At the end of the day, successful investing is a habit. And starting small is the secret to building that habit for a lifetime of financial growth.

The Smartest Places to Put Your First $10

Alright, you're ready to stop thinking about investing and actually do it. So, where does that first $10 bill go to start working for you? Let's skip the vague advice and get straight to the specific, modern tools that turn small change into a real stake in the market.

Deciding to start is often the biggest hurdle. Once you're in, you get to see the magic of compounding work for you. If you wait, you risk missing out on that growth.

The real takeaway here is that starting is the most important step. It's what unlocks the long-term benefits of your money making more money.

One of the best things to happen for new investors is the invention of fractional shares. Not too long ago, if a single share of a company like Apple or Amazon cost hundreds of dollars, you were simply out of luck.

Now, you can buy a tiny slice of that same share for just a few bucks. This means your $10 can get you a piece of a company you already know and love. It’s a brilliant way to begin because it makes the whole idea of "ownership" feel real and exciting. You're not just a customer anymore; you're an owner.

ETFs: Instant Diversification in One Go

Another incredibly powerful tool is the Exchange-Traded Fund (ETF). Just think of an ETF as a basket holding hundreds—or even thousands—of different stocks. When you buy a single share of an ETF, you instantly own a tiny piece of all the companies in that basket.

For example, an S&P 500 ETF gives you a stake in the 500 largest companies in the U.S. with a single trade. This is a cornerstone strategy for smart, long-term investors. Historically, the U.S. stock market has returned an average of about 10% per year over the long haul. Assuming that trend continues, your initial $10 in an S&P 500 fund could grow to over $250 in 30 years from compounding alone—and that's without you adding another penny.

You can dig into the numbers yourself and check out the historical performance of the S&P 500 to see its long-term potential.

Robo-Advisors: The Hands-Off Approach

If you'd rather "set it and forget it," then a robo-advisor might be your best friend. These are automated platforms that do the heavy lifting for you. They’ll ask a few simple questions about your goals and how much risk you're comfortable with, then build and manage a diversified portfolio for you, usually with low-cost ETFs.

All you have to do is deposit your $10. The platform takes care of all the rebalancing and investment decisions from there. It's the ultimate hands-off method, perfect for anyone who wants to invest without the stress of managing it day-to-day.

Real-Life Example: Sarah's First $10 ETF Investment

Sarah, a 22-year-old recent graduate, feels overwhelmed by stock picking but wants to start investing. She opens a micro-investing app on her phone. After linking her bank account, she deposits $10. Instead of trying to choose one company, she searches for an S&P 500 ETF (like VOO or IVV) and puts her full $10 into it. Instantly, her small investment is spread across giants like Microsoft, Apple, and Amazon. This single action gives her a diversified portfolio from day one with minimal stress.

Comparing Your $10 Investment Options

Choosing the right path depends entirely on your personal style and goals. To make it easier, here’s a quick head-to-head comparison of these popular micro-investing options.

| Feature | Fractional Shares | ETFs (via Micro-investing) | Robo-Advisors |

|---|---|---|---|

| Best For | Owning specific companies you believe in | Instant diversification and tracking a market index | Hands-off, automated investing and management |

| Control Level | High – You pick the exact stocks. | Medium – You pick the ETF, the fund handles stocks. | Low – The algorithm manages everything for you. |

| Minimum Investment | Often as low as $1 | Can be just $1 to buy a fraction of an ETF share | Often $0 – $10 to get started |

| Potential Risk | High – Risk is concentrated in a few companies. | Medium – Diversified, but still subject to market risk. | Medium – Diversified, but still subject to market risk. |

| Typical Fees | Commission-free on many platforms | Commission-free trades; fund has a low expense ratio | Small monthly fee or a percentage of assets (e.g., 0.25%) |

Each of these options is a legitimate and powerful way to put your first $10 to work. The "best" one is simply the one that aligns with how involved you want to be and your comfort with risk.

For a more detailed breakdown of these strategies, be sure to check out our complete guide on how to invest with little money.

From App Store to Your First Asset: Making the $10 Trade

It’s one thing to talk about investing, but it’s another to actually do it. That first trade can feel like a huge step, but the truth is, modern apps have made it ridiculously easy. This is where we put theory into practice and get you from zero to investor.

First things first, you need a brokerage. My advice? Go with a low-fee platform built for beginners. They usually have clean interfaces and, most importantly, zero commission fees on stock and ETF trades. If you're not sure where to start, our guide to the best investment apps for beginners breaks down the top players to help you find a good fit.

Once you pick an app, you’ll have to open an account. This part is regulated, so you'll need to share a bit of personal info.

What You'll Need to Sign Up

Don't be alarmed by the information they ask for—it's standard practice to comply with financial regulations. You'll typically need to provide:

- Your full legal name and date of birth

- Your home address

- Your Social Security Number (or equivalent tax ID)

This is all to verify you are who you say you are and to prevent fraud. Reputable brokerages use bank-level security to keep this data safe. Verification is often instant, and from there, you can connect your bank account.

Linking Your Bank and Funding Your Account

Connecting your bank is usually a breeze. Most apps use a secure service like Plaid that lets you log into your online banking right from the app to establish the link. It’s quick and encrypted.

Next, it’s time to move your money. A $10 deposit is all it takes to get started. Just be aware that it can take 1-3 business days for the funds to actually clear and be ready to invest. Some apps offer instant deposits, but it's not a universal feature.

Pro Tip: Don't just sit there waiting for the transfer to clear. Use those couple of days to poke around the app. Build a watchlist of stocks or ETFs you’re interested in (like a broad S&P 500 fund) and just get comfortable with the platform's layout.

Making Your First $10 Investment

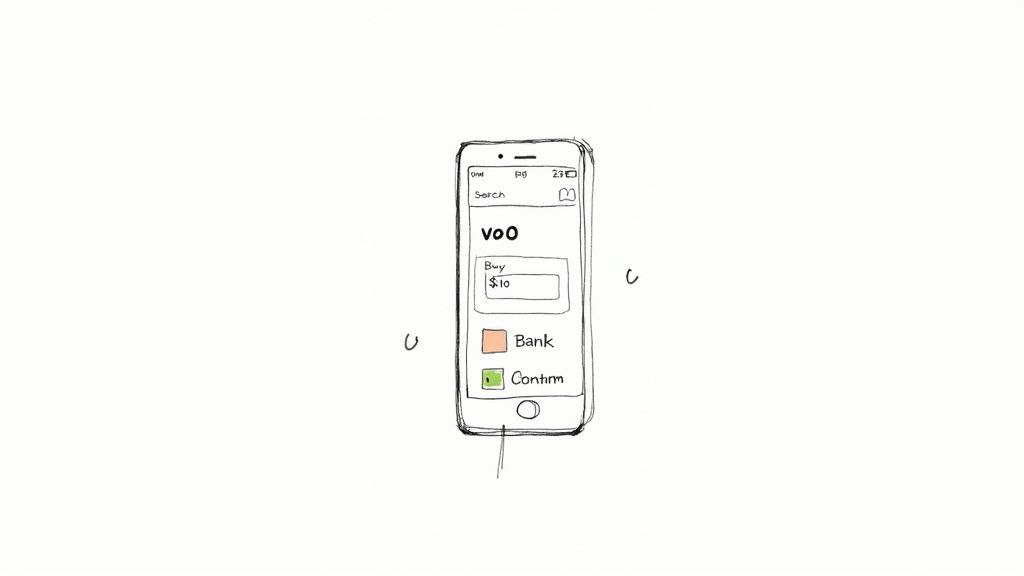

Okay, your account is funded. You're ready to go. The actual trade takes less than a minute. Let's walk through a classic first move: buying a fractional share of an S&P 500 ETF.

- Find What You Want: Look for the search bar in the app. This is your gateway.

- Search the Ticker: Type in the ticker symbol for a popular S&P 500 ETF, like ‘VOO’ or ‘IVV’. Think of a ticker as a stock's nickname on the market.

- Start the Buy Order: Tap on the ETF to pull up its profile page. You’ll see a big, friendly "Buy" or "Trade" button. Click it.

- Set Your Amount: This is key. The app will let you buy in dollars instead of whole shares. Enter $10.

- Confirm and You're Done: A final screen will pop up showing you're about to buy $10 worth of that ETF. Give it a once-over, hit "Confirm," and that's it. You're officially an investor.

Congratulations! It really is that simple. That small action is the first, and most important, step on your investing journey.

Let's get one thing straight: investing always comes with risk, even if you’re only starting with $10. The market doesn’t move in a neat, straight line—it has good days and bad days, and the value of your investments will bounce around. The sooner you get comfortable with that reality, the better investor you’ll become.

Think of that first $10 as your ticket into the game, not a lottery ticket. It’s your chance to learn the ropes of what is arguably the most powerful wealth-building machine in the world. The price of admission? A little patience.

Understanding Market Volatility

Market volatility isn't something to fear; it's simply the price you pay for the potential of long-term growth. History makes this crystal clear.

People love to talk about the S&P 500's average annual return, but "average" is rarely the reality in any single year. Looking at data from 1926 to today, returns only fell into that typical 8-12% "average" range a measly 8 times.

Most years were a bit of a rollercoaster. We've seen incredible highs like a +26.89% gain in 2021 and gut-wrenching lows like the -38.49% drop in 2008. The lesson here is simple: you have to be ready for the swings and resist the urge to panic when things get choppy. Your $10 is about the long journey, not the daily blips on the screen.

Diversification Is Your Best Friend

So, how do you handle this unavoidable risk, especially when you're just starting out? The answer is a word you'll hear over and over: diversification.

Throwing your whole $10 at a single, high-flying stock is basically betting it all on red at the roulette table. It might work, but the odds are stacked against you.

A much savvier move is to put that money into a broad-market ETF, like one that mirrors the S&P 500. In one single transaction, your tiny investment is suddenly spread across 500 of the biggest companies in America. If one or two have a bad quarter, you have hundreds of others to help balance things out.

My Advice: Think of diversification as your financial safety net. It won't stop you from losing money when the entire market goes down, but it's the absolute best strategy for smoothing out the ride and protecting your money over time.

Before you invest a single dollar, it’s crucial to understand how you'll react to these market swings. Getting a handle on your personal comfort level with risk is a foundational step. Our guide on how to determine your investment risk tolerance is the perfect place to start figuring that out.

Growing Your Portfolio Beyond the First $10

Congratulations—you’ve officially made your first investment. That first trade is a huge win. It moves you from the sidelines into the game, actively building your own financial future. So, what's next?

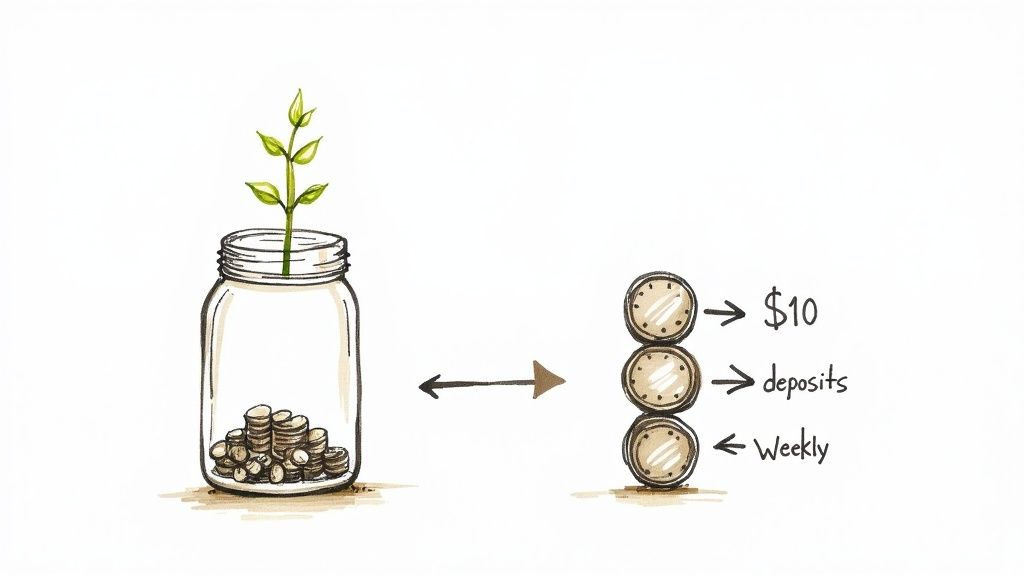

The secret isn’t some complicated, high-level strategy. It’s all about consistency. Your goal now is to turn that first step into a repeatable habit. This is where one of the most powerful and time-tested strategies comes into play: dollar-cost averaging.

Put Your Success on Autopilot

Dollar-cost averaging might sound intimidating, but it's dead simple. All it means is investing a set amount of money on a regular schedule, regardless of what the market is doing. For you, this could be an automatic $10 investment every single week.

Seriously, that's it. Most brokerage apps today let you set this up in a few taps. By putting the process on autopilot, you take emotion and guesswork completely out of the equation.

This one simple move does two critical things for you:

- It builds the habit. Investing becomes just another part of your financial routine, like paying a bill. No second-guessing.

- It smooths out the bumps. When the market dips, your $10 buys more of a share. When prices are high, it buys less. Over the long haul, this evens out your average cost and drastically reduces the risk of dumping all your money in right at a market peak.

By committing to a consistent schedule, you stop worrying about "timing the market" and instead focus on "time in the market"—which is how real wealth is built.

The Surprising Power of Small, Steady Steps

But does a measly $10 a week actually make a difference? You’d be surprised. A small, consistent stream of cash can grow into something pretty substantial over time, all thanks to the magic of compounding.

Let's run the numbers. Say you commit to investing just $10 every week into a basic, low-cost S&P 500 ETF.

| Timeframe | Total You Invested | Potential Value (at 10% avg. return) |

|---|---|---|

| 5 Years | $2,600 | Over $3,300 |

| 10 Years | $5,200 | Over $8,800 |

| 20 Years | $10,400 | Over $32,000 |

| 30 Years | $15,600 | Over $94,000 |

Note: The 10% average annual return is based on the historical performance of the S&P 500. Past performance never guarantees future results, but this gives you a clear picture of the potential.

What this table shows is how your small contributions start to snowball. Your money starts earning its own money, and that becomes the real engine for growth over time.

Your journey began with a single $10 investment. The path forward is just repeating that success, over and over again. Once that $10 weekly plan feels totally normal, look for chances to bump it to $15 or $20. Every little increase puts you on the fast track from a small start to a serious portfolio.

Your Top Micro-Investing Questions, Answered

1. What is the single best investment for my first $10?

For most beginners, the simplest and most effective first investment is a low-cost, broad-market index fund ETF, like one that tracks the S&P 500. This provides instant diversification, spreading your $10 across 500 of the largest U.S. companies, which is a much safer approach than picking a single stock.

2. Can I actually buy stocks like Apple or Amazon with just $10?

Yes, you can. Thanks to fractional shares offered by most modern brokerages, you can buy a small slice of any company's stock for as little as $1. So, your $10 can buy you a piece of high-priced stocks like Amazon or Apple.

3. Will I lose more than the $10 I invest?

No. When you buy stocks or ETFs, the absolute maximum you can lose is the amount you invested. Your $10 investment can go down in value, but you will never owe more money than you put in.

Most beginner-friendly platforms offer commission-free trading, so you won't pay a fee to buy or sell. The main cost to be aware of is the "expense ratio" on an ETF, which is a very small annual management fee (e.g., 0.03%) deducted automatically by the fund manager.

5. Do I have to pay taxes on my investment gains?

You only owe taxes on profits when you sell an investment for more than you paid for it. This profit is called a capital gain. As long as you hold onto your investment, its growth is not taxed.

6. How quickly will my $10 start to grow?

Investing is a long-term strategy, not a get-rich-quick plan. The real growth comes from compounding over many years. Don't expect to see significant returns in days or weeks. The goal of the first $10 is to build a habit, not to make a fast profit.

7. What's better: investing $10 all at once or $1 a day?

For such a small amount, investing the $10 all at once into a diversified ETF is the most practical approach. The key is to then set up a recurring investment (e.g., another $10 next week) to build the habit of consistency.

8. How often should I check on my $10 investment?

As little as possible. For a long-term investment, checking daily or weekly can cause unnecessary stress and lead to emotional decisions, like selling during a market dip. A quick check-in once every few months is more than enough.

9. Is my money safe if the brokerage app fails?

Yes. In the U.S., legitimate brokerages are members of the Securities Investor Protection Corporation (SIPC), which protects your securities up to $500,000 if the firm goes bankrupt. This ensures your investments are safe while you learn what is an investment account and get started.

10. What is the next step after my first $10 investment?

The most important next step is to make it a habit. Set up an automatic, recurring investment—even if it's just another $10 per week or per month. Consistency is what turns small beginnings into significant wealth over time.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions

So, What's Next? Putting Your First $10 to Work

It might feel like just ten bucks, but making that first investment is a huge deal. Seriously. You've just taken a massive step toward building a real financial future. Forget the dollar amount for a second—what you've really done is start a habit. You've proven to yourself that this is doable.

The most important thing to remember is that consistency beats intensity. Forget trying to time the market or waiting for a big lump sum to invest. A small, regular investing habit will do far more for you in the long run.

Your mission, should you choose to accept it? Pick one of the platforms we've talked about—whichever one felt right for you—and get that account open. Link your bank, transfer that first $10, and pull the trigger on your first trade.

That's it. Start there. Stay consistent. And give your money the time it needs to start working for you. You're officially an investor.

Here at Top Wealth Guide, our whole goal is to give you clear, no-fluff strategies to build your wealth, one small step at a time. For more deep dives into stocks, real estate, and crypto, check out all our resources at Top Wealth Guide.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions