Spotting top stocks in today’s whirlwind market is like playing chess with a squirrel—unexpected moves everywhere. But don’t fret. At Top Wealth Guide, we’ve concocted a solid game plan to help you sniff out the high-flyers.

Picture this: we merge financial wizardry, keep our finger on the pulse of market trends, and throw in a good hard look at who’s steering the ship (company management) to give you a full-bodied take on potential stock champs.

Think of this guide as your trusty sidekick, arming you with the tools and smarts to steer the turbulent seas of stock investments with some serious swagger.

In This Guide

Decoding Financial Metrics for Stock Success

So, here’s the deal – at Top Wealth Guide, we’ve got the financial metrics thing down because, really, numbers are the unsung heroes telling us which stocks are strutting their stuff. They lay out a company’s vibe so you can spot the winners. Let’s dive into the essentials.

The P/E Ratio: A Valuation Compass

The Price-to-Earnings (P/E) ratio – think of it as your trusty compass in the chaotic world of valuations. How do we get it? Take a company’s stock price, slice it by its earnings per share, and voilà! A low P/E might scream “undervalued gem,” while a high one? Either overpriced, or maybe just hyped with sky-high growth dreams.

Case in point – August 2023, Apple’s P/E stood at 30, Amazon flexing at around 60. Does that mean Amazon’s overcooked? Nah, could just be their growth mojo. Always smart to keep these P/Es in the same sandbox – industry-wise – for more context.

EPS: Profitability in Focus

Earnings Per Share (EPS) – it’s like the pulse of profitability per share. You see rising EPS, you often see stock prices playing catch-up.

Take Q2 2023, Microsoft flaunted an EPS of $2.69, up from $2.23 the previous year. That 20% jump? Yeah, it’s a neon sign of profitability taking a victory lap.

ROE: Efficiency Indicator

Return on Equity (ROE) – the efficiency whisperer. It shows off how slick a company is at turning shareholders’ equity into cold hard profits. Do the math by dividing net income by shareholders’ equity. A high ROE? That’s management strolling down efficiency avenue.

Look at 2022, Coca-Cola had a ROE of 44%, PepsiCo topped it with 53%. That’s PepsiCo, flexing their muscle with shareholders’ dough more efficiently.

Debt-to-Equity: Financial Stability Meter

Debt-to-Equity ratio – the balance sheet’s scale. A low ratio is peace of mind, stability. But hey, sometimes a little debt fuels the growth engine.

Take Tesla, the innovator, sitting pretty with a 0.08 debt-to-equity ratio in Q2 2023 – practically no debt. Ford? Up at 2.84, packing leverage – that’s potential expansion fuel.

Free Cash Flow: Growth Potential Gauge

Free Cash Flow (FCF) – cash leftover after all the bills and upkeep are paid. Key for dividends, buybacks, or expansion dreams.

In 2022, Alphabet had $60 billion in FCF; Meta chimed in with $18.1 billion. Gives you a peek into who’s got more coins to splash on future moves or keep shareholders smiling.

Don’t be a metrics monogamist – no single stat will serenade the full story. Embrace the holistic view, blend metrics like a smoothie – add industry trends and company mojo. Now, let’s ride into how market currents and industry waves pick those stock stallions.

Riding Market Waves for Stock Success

At Top Wealth Guide, we’re all about breaking it down – identifying top-performing stocks is a puzzle that goes way beyond just crunching numbers. It means seeing the forest for the trees, nailing market trends, and spotting the industry dynamics that can launch a company’s success into the stratosphere. So, let’s dive into how you can ride these waves and pinpoint potential MVPs in the stock game.

Sector Rotation: The Timing Game

Markets? They’re like teenagers – they cycle through phases, and you gotta know who’s wearing the crown when. Sector rotation – it’s all about jumping in and out of sectors as the economy does its thing through different business cycle vibes. Keep an eagle eye on economic indicators and rates. Why? Because knowing what sectors might hit home-run status next is a game-changer.

Take rising interest rates – they throw a bone to financial stocks but can send utility stocks into a tailspin. By getting the hang of these sector rotations, you can stay ahead of the herd.

When you’re scouting a company’s prospects, do yourself a favor and look beyond just market share. Scope out the secret sauce – unique selling points, brand loyalty, and those high walls keeping competitors at bay. Apple is the poster child here – they’ve got competition snapping at their heels, but their ecosystem keeps customers glued like there’s no tomorrow, cranking their revenue through the roof.

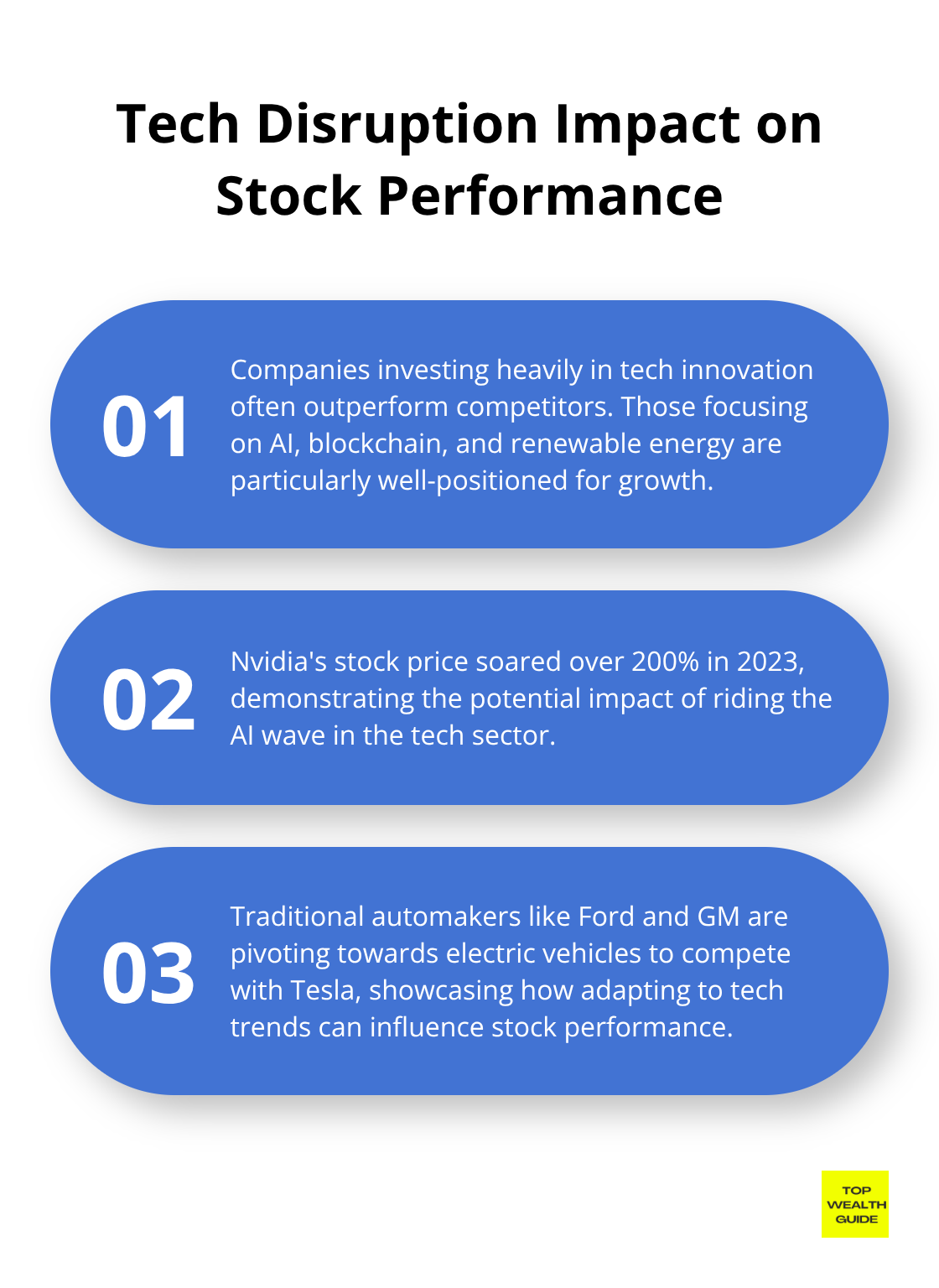

Keep your peepers on companies shaking up their domains. Take Nvidia – they’re riding the AI wave and saw their stock price soar over 200% in 2023. Yep, those numbers don’t lie.

Tech Disruption: The New Norm

Every company today? They’re in bed with technology to some degree. Those who dive headfirst into tech innovation? Often leave the rest in the dust. Zero in on companies pouring cash into research and development – especially in the realms of AI, blockchain, and renewable energy.

Look at the likes of Ford and GM – they’re turning the ship towards electric vehicles to wrestle with Tesla. How they navigate this shift could make a world of difference in their stock game in the years to come.

Regulatory Landscape: A Two-Sided Coin

Regulations – they can be the wind beneath your wings or the anchor that drags you down. Keep your finger on the policy pulse to see whose boat’s getting rocked in potential investments. The Inflation Reduction Act has sent ripples across the energy sector. On the flip side, Big Tech faces tighter scrutiny – putting Meta and Google in the hot seat.

But hey, regulations aren’t just doom and gloom; they’re also opportunities. Banks that roll with the punches of new financial regulations often carve out a fresh edge.

Marrying these market insights with the trusty financial metrics? That’s how you lay the groundwork for unearthing those sneaky top-performers. It’s not just about scouting good companies – it’s about finding those shining at the right time and in the right place. Now, let’s pivot to another crucial piece of the stock performance puzzle: how company management and strategy play their cards.

Who’s Steering the Ship: Evaluating Company Leadership and Strategy

So, at Top Wealth Guide, here’s the thing… we get that a company’s mojo is all about who’s steering the ship and where they’re headed. This chapter? We’re diving deep into the art and science of eyeballing leadership effectiveness and strategic swagger to spot those potential market movers.

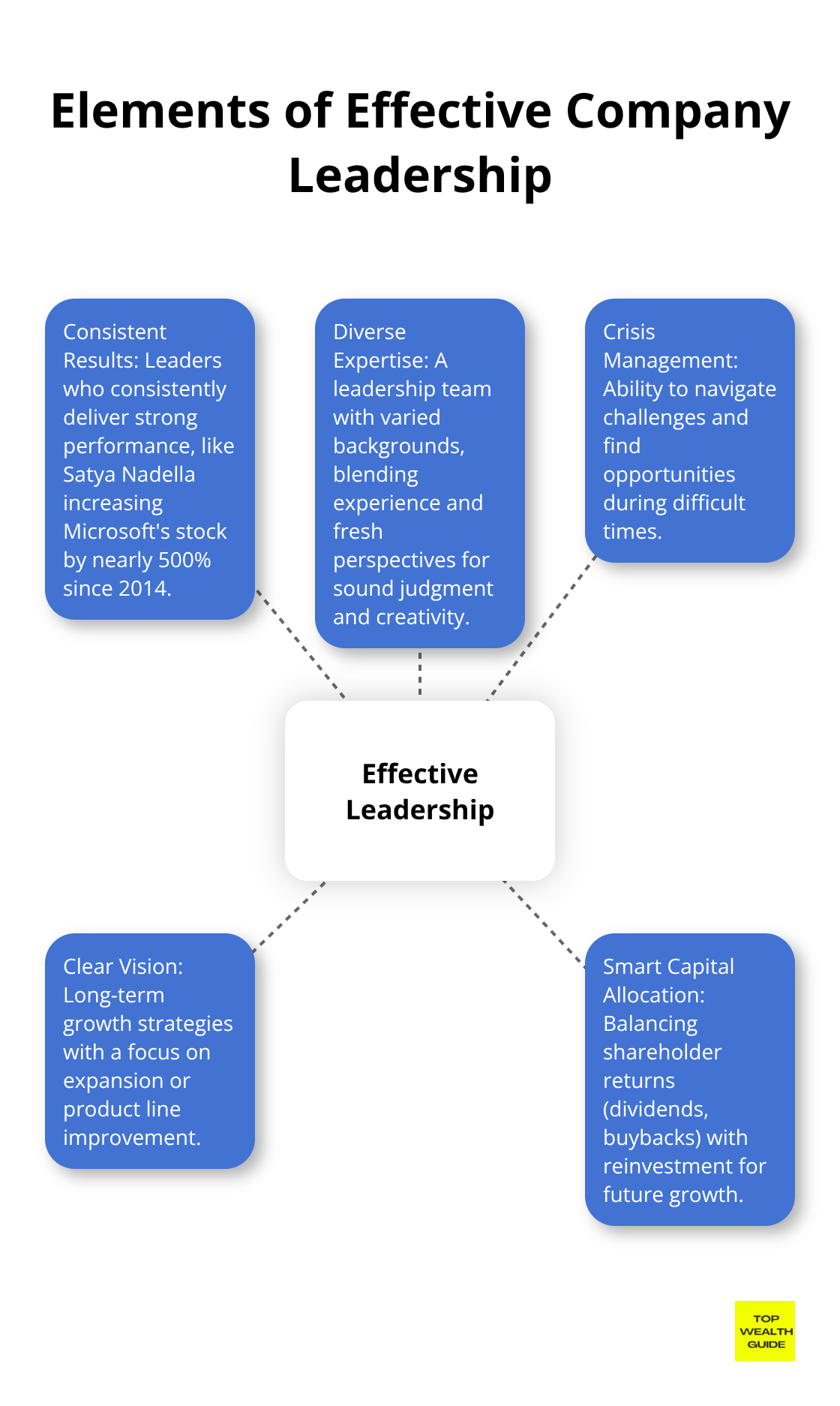

Leadership That Delivers Results

Zoom in on the C-suite’s scoreboard. You want execs who have consistently hit it out of the park. Microsoft’s own Satya Nadella is a prime example-since he took the reins in 2014, Microsoft’s stock has rocketed by nearly 500%.

And, don’t just ogle the CEO. Peek under the hood at the entire leadership crew. Are these folks bringing something new to the table? Diverse backgrounds? Old guard meets new blood is often a recipe for sound judgment and creativity.

Dive into their past challenges. Crisis management-check. Pioneering new paths-yup. These are the superheroes who’ll navigate storms and find the sun.

Governance That Protects Investors

Governance? Not just a bunch of legal jargon-it’s your investment’s fortress. Seek out companies with independent boards, no puppet shows here. Berkshire Hathaway nails this, securing investor confidence for eons.

Scope out what the top brass is taking home. Is their paycheck performance-based? If not, alarms should be blaring. But those shunning the greed tornado? Worth a deeper look.

Growth Strategies That Make Sense

Long-range growth roadmaps are crucial. Think: Does the company have a crystal-clear vision? Are they spreading their wings into fresh territories or revamping the currently tepid line-up?

Take Amazon-leaping from online malls to the cloud cosmos with AWS has been a game-changer. This move has accelerated Amazon’s growth trajectory, with AWS generating $90.8 billion in 2023. That’s no pocket change.

Beware of the trend-chasers-jack of all trades, master of none. Often, the focused strategy wins the prize.

Smart Capital Allocation

Watch how the big fish swim with their cash. Dividends and buybacks spill the beans about their priorities. Apple? They’ve shelled out over $550 billion to shareholders through dividends and buybacks since 2012. Investors are smiling, and growth continues.

(But, watch out if buybacks steal the spotlight from reinvestment-it might be a dead-end signal.)

R&D: The Future Factory

Keep an eye on the R&D ticket. Companies that splash cash on R&D are often setting the stage for blockbuster growth. Pharma giants show us how it’s done-Pfizer splurged $13.8 billion on R&D in 2022, proving its drive to churn out new meds and stay on top.

Yet, there’s a trick-R&D needs to tango with the financials. Top-heavy R&D sans revenue? That’s a red flag waving.

Final Thoughts

So, picking the best stocks… it’s a mix, right? You gotta lean on the numbers – those trusty financial ratios, sure, but there’s more to it. Think market trends, industry vibes, and who’s at the helm. It’s kind of like cooking; you need a bit of spice with that substance. And hey, whatever your approach, make sure it vibes with your wallet’s dreams, how much risk you can sleep with, and when you might need the cash.

The stock market doesn’t do “constant” – it’s a rollercoaster. Those who win? They bend with the tides. Economic flips, tech boom (or bust), and Uncle Sam’s latest rules all play their parts. At Top Wealth Guide, we’ve got your back – with resources that sharpen your game and tools that keep you ahead of the curve (and not just any tools, ones you’ll actually use).

Top Wealth Guide isn’t just a name; it’s a mission. We’re here to arm you with know-how – to see through the noise and grab hold of your wealth dreams. Spotting the big winners in stocks? It’s art and science, a bit of James Bond and Einstein. Strategy, analysis, a good dose of learning… that’s the secret recipe.

1 Comment

Pingback: Can You Afford an Investment Property? Use Our Calculator - Top Wealth Guide - TWG