Looking for those top stocks? It’s not just about a gut feeling or getting swept up in market buzz. Savvy investors—yep, the ones who actually win—use solid metrics and methodical analysis to uncover companies with genuine growth potential.

Here at Top Wealth Guide, we distill the crucial tools and strategies that set apart the stock geniuses from the trend-chasers. The winning formula? It’s all about merging fundamental analysis with smart timing… to craft a portfolio that delivers steady gains over the long haul.

In This Guide

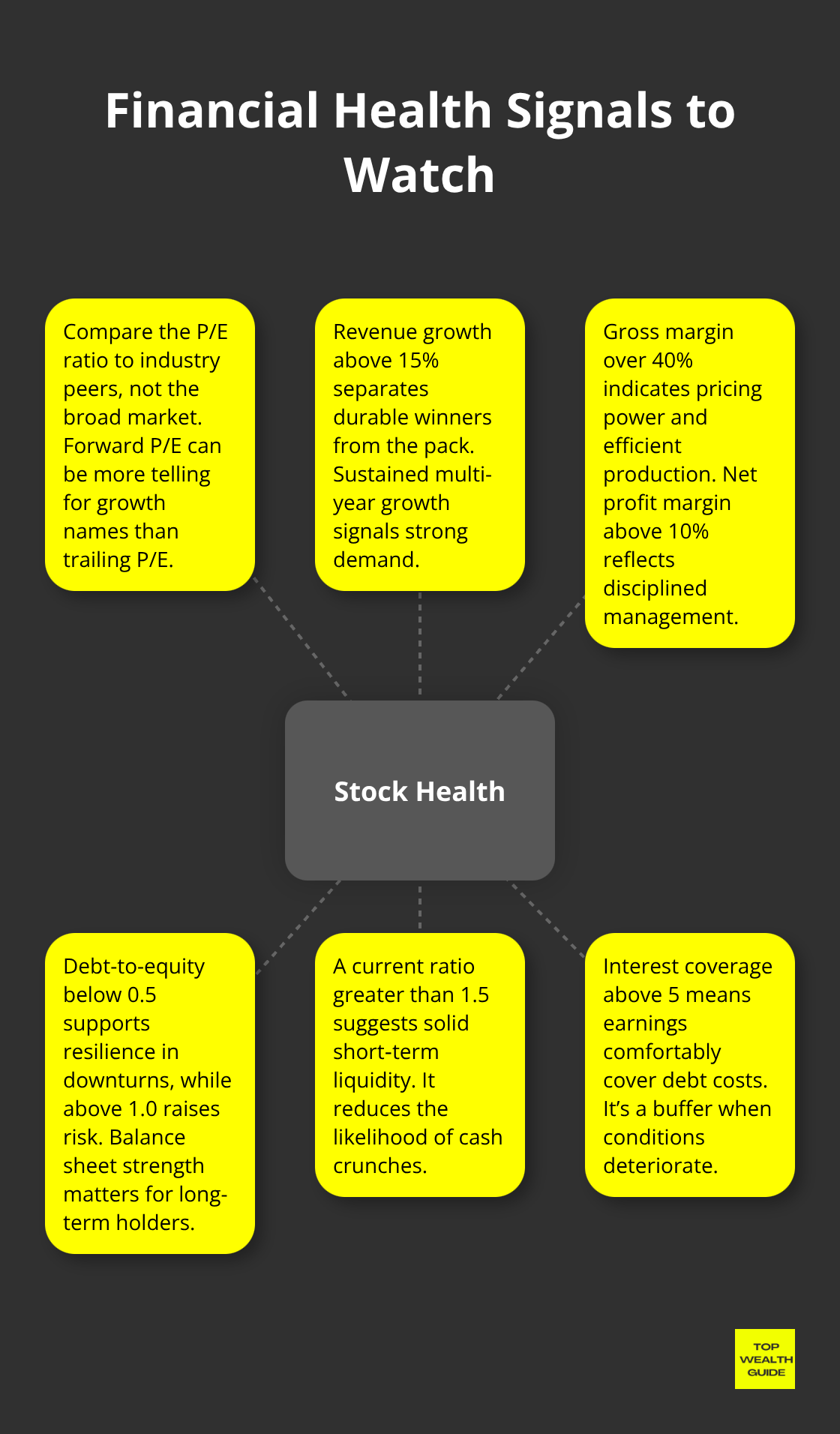

Key Metrics for Evaluating Stocks

The P/E ratio – it’s like the Swiss Army knife for evaluating stocks, but folks, let’s be real, most people are using it wrong. A “healthy” P/E ratio – yeah, it’s like landing a plane blindfolded – varies wildly depending on the sector. Agriculture’s sitting pretty at 35, financial services around 37. Tech stocks? They’re off the charts, often over 30 when they’re riding that growth wave. Utility companies having P/E ratios over 20? Uh-oh, red flag. They’re likely overvalued. The trick? Size up a stock’s P/E ratio against its industry compadres, not just any market Joe. Forward P/E ratios – those are your crystal balls, based on projected earnings – offer sharper reveals than trailing P/E ratios, especially for growth champs. But, word to the wise, take analysts’ projections with a salt mine… inaccurate much?

Revenue Growth Reveals True Business Health

Revenue growth over 15% – that’s your golden ticket, distinguishing winners from the “meh” crowd. Consistent growth over three years? It shows Johnny down the block is buying what they’re selling. Then you’ve got the profit margins. We’re talking serious insight into operational “oomph.” Gross margins clocking in above 40%? That’s some sweet pricing leverage. Net profit margins breaking past 10%? Standing ovation for managerial genius. And if margins are shrinking even while revenue’s climbing? That’s a red alert, my friends – you’re likely dealing with pricing pinches or ballooning costs, both in the no-bueno zone for stock health.

Debt Levels Determine Survival During Downturns

Now, the debt-to-equity ratio – it’s the stock market’s version of a canary in the coal mine. Companies with this ratio below 0.5? Those are your rocks, steady through economic tempests without need for panic-fueled shareholder dilution. High-debt darlings with ratios over 1.0? They’re a bankruptcy waiting to happen in a recession. Best to steer clear if you’re in it for the long haul.

A current ratio surpassing 1.5? That’s your green light for decent short-term liquidity. And if the interest coverage ratio’s above 5? Rest easy, they’re covering debts even when the balance sheets take a nosedive.

Cash Flow Metrics That Matter Most

Free cash flow per share – forget the spreadsheet guesswork, this is the real-deal indicator of a company’s cash magic (not just smoke-and-mirrors accounting). Companies raking in free cash flow over $2 per share are in the boom zone, outperforming the penny-pinchers. An operating cash flow margin above 15%? That’s a solid sign of sharp operations and cash turnover. Keep your eyes peeled for companies where free cash flow jumps faster than net income, because there, my friend, is where you find top-notch earnings that actually translate into cash in the bank.

The right research tools and platforms will guide you to analyze these metrics like a pro, letting you snag opportunities before they hit everyone else’s radar.

Research Tools and Resources for Stock Analysis

Yahoo Finance and Google Finance… skip ’em. They’re basically the training wheels of stock screening-everyone and their grandma uses them, so no edge there. Enter Finviz, the heavyweight champ of free stock screening. It’s got over 70 filters, from technical indicators to fundamental ratios to insider trading data. Their heat maps? Show sector performance in real-time. And their elite screener? It lets you filter by analyst upgrades from the past week. Meanwhile, FinanceCharts offers superior charting with over 150 technical indicators, and TradingView taps into social sentiment from 50 million users-crucial for timing your moves.

Professional Research That Actually Moves Markets

Morningstar’s analyst reports-these aren’t just any reports. When they give a stock a 5-star nod, its price jumps an average of 3.2% within 48 hours, by their own stats. Zacks Investment Research uses its proprietary ESP system to rank stocks, outperforming the S&P 500 by 26% annually over a decade. Seeking Alpha collects insights from over 15,000 contributors, but stick to writers with proven returns above 15% annually.

Sure, Wall Street analyst consensus moves stock prices, but here’s the twist-buy ratings get juicy when only 60% agree. Universal agreement? That’s usually the sign the train’s already left the station.

SEC Filings Reveal What Companies Hide

Form 10-K annual reports-dive into the management discussion section. That’s where execs spill the beans on their real challenges and growth issues. Form 8-K reports announce material events within four days, giving you the jump before it hits mainstream media. Insider trading forms like Form 4? They show when execs buy their own stock-Warren Buffett is all over this. Watch for companies with frequent 8-K amendments. It’s a red flag for accounting shenanigans. The EDGAR system? It’s your pipeline to real-time corporate filings-but it’s a goldmine most investors overlook.

Advanced Screening Techniques That Work

The smart money folks? They’re mixing data sources-combine Finviz screening with SEC filing alerts and pro analyst upgrades to spot opportunities way before the retail hordes do. Set custom alerts for insider buying over $1 million-after all, execs don’t gamble their cash without expecting major gains. Filter for companies sporting over 20% revenue growth with debt-to-equity ratios below 0.3-this combo flags robust growth narratives before they hit the mainstream radar.

These research staples give you a leg up to execute proven stock selection strategies, separating steady winners from the market noise.

Stock Selection Strategies That Work

Value investing, folks-it’s the old reliable. Beating the cool kids (a.k.a. growth investing) over the long haul, but only if you stay glued to the spreadsheets. Benjamin Graham’s crew, those old-school value disciples, they scooped up stocks priced below book value from 1926 to 2019 and hit a solid 13.4% annually-compare that to the market’s 10.1%, according to Research Affiliates. But here’s the kicker: it requires nerves of steel, my friends. Just look at Berkshire Hathaway-Buffett’s value mantra gave us a whopping 20.1% annual returns over 55 years. Growth investing has its charm, but oh boy, does it demand impeccable timing. Case in point-Cathie Wood’s ARK Innovation ETF: up 152% in 2020, then-boom-crashed 76% by 2022. Growth stocks? They’re the roller coaster ride-thrill during the highs, but watch out for portfolio wreckage during the downturns.

Value Stocks Outperform During Market Stress

When the market takes a nosedive, that’s when you separate the wheat from the chaff-or, you know, value champs from growth wannabes. Remember the 2008 financial fiasco? Value stocks dipped 36.8%, but growth stocks? A more harrowing 42.1% drop, Morningstar data tells us. Value stocks bounce back faster, ’cause they’re chilling at prices under their real worth. Those with price-to-book ratios under 1.5 and debt-to-equity ratios below 0.4? They’re the tough cookies during economic storms, unlike those high-flying growth guys. Warren Buffett’s Berkshire has this down pat-it’s packed with underestimated giants like Apple and Coca-Cola, throwing off cash like it’s a vending machine, regardless of market conditions.

Dividend Stocks Generate Reliable Income

Let’s talk Dividend Aristocrats, shall we? These champs of the S&P 500 have hiked dividends every year for a quarter-century-just tip your hat to S&P Dow Jones Indices. Coca-Cola, Johnson & Johnson-they’re the poster children, folks. They’re not just pumping dividends; they’re broadcasting management swagger and financial fortitude. Aim for dividend yields between 2.5% and 4.5%, with payout ratios no more than 60%. Yields over 8%? That’s a red flag waving-danger ahead, usually a dividend slash within a year. And REITs? Well, they distribute 90% of income as dividends, offering about 4% to 6% yields, but brace yourself-interest rate shifts hit them harder than a lead balloon.

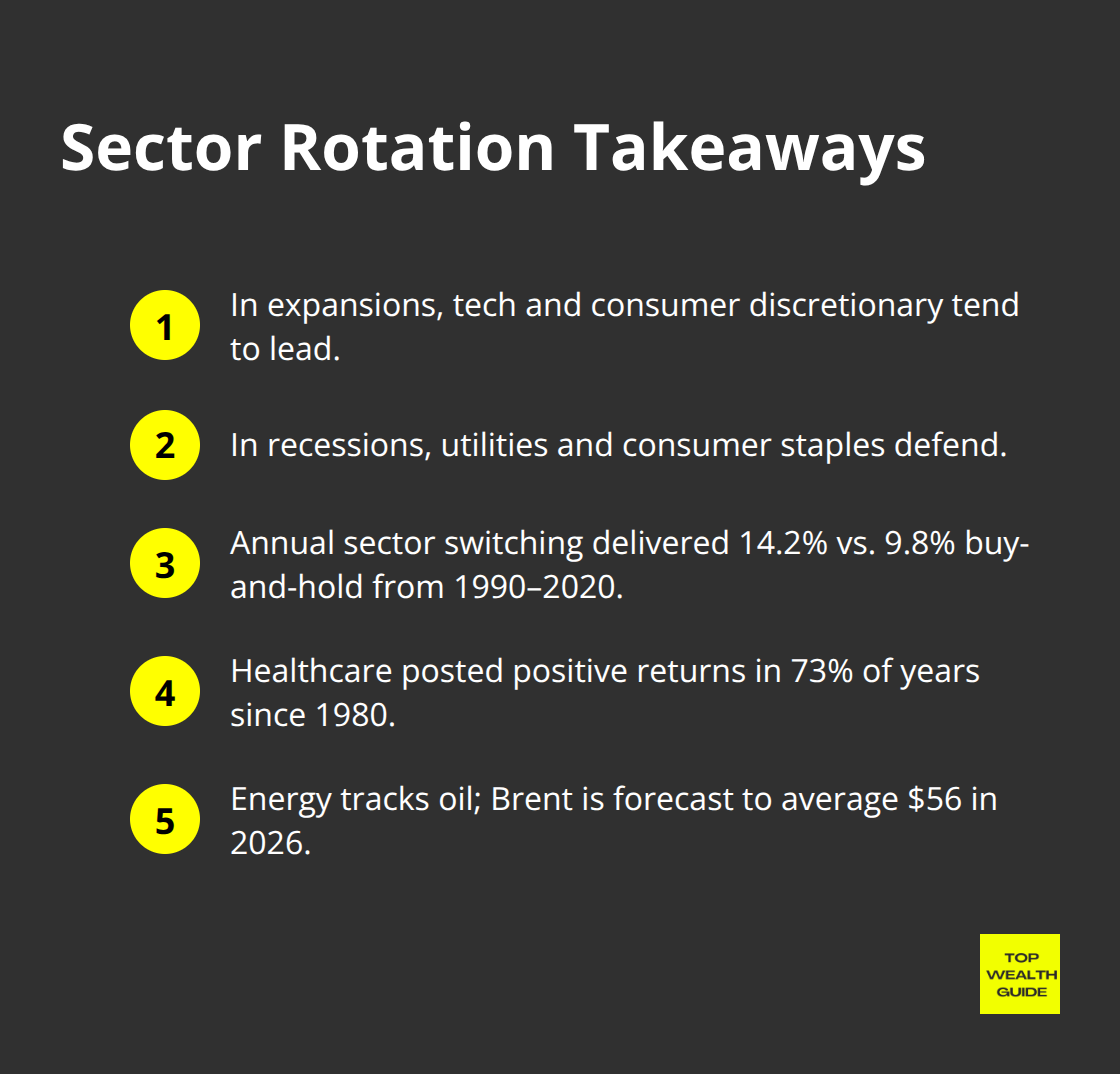

Sector Rotation Timing Beats Buy and Hold

Economic rollercoasters dictate sector winners and losers-like clockwork. Tech and consumer discretionary stocks ride high in expansions, while utilities and consumer staples play defense during recessions. Fidelity’s sector rotation data throws down the gauntlet-sector-switching annually produced 14.2% returns versus the good old buy-and-hold’s 9.8% from 1990 to 2020. Healthcare stocks? Consistent overachievers, logging positive returns in 73% of all years since 1980, which dubs them recession-proof wealth magnets.

Energy stocks? They tango with oil prices-keep your eyes on Goldman Sachs, predicting oil prices to average $56 per barrel for Brent crude in 2026.

Growth Stocks Require Perfect Market Timing

Chasing growth? It’s all about the timing, folks. Those high-growth trailblazers-revenue jumping 20% annually-but miss the timing, and it’s game over. The Nasdaq 100, loaded with growth stocks, shot up 37.8% in 2020, only to slide 33.1% in 2022. Growth stocks carry premium tags-usually 25 to 40 times earnings-leaving zero room for error. Just ask Tesla-a rocket ride from $85 in 2020 to $407 in 2021, then free-falling to $108 by 2022. The savvy growth investor? They lay in wait during market slumps when luxury stocks are on clearance. Success in investment psychology demands you size those positions systematically-never gamble more than a sliver of your portfolio on one horse in this wild race.

Final Thoughts

So, you’re looking to play the stock market game, huh? Let’s break it down. The top stocks – the ones you want a piece of – they’ve got three things in common: rock-solid metrics, reliable research tools, and those time-tested selection strategies. Think P/E ratios dragging below industry norms, revenue on a tear at over 15%, and debt-to-equity ratios lounging comfortably under 0.5. That’s what separates the beasts from the noise of the market jungle. When free cash flow per share is strutting above $2, you’re looking at real profitability – beyond the smoke and mirrors of accounting.

Your battle plan? Start with a blend of Finviz screens and SEC alerts. You want companies flexing 20% revenue growth and keeping debt light. Keep your ears to the ground for insiders throwing down more than $1 million and analysts suddenly seeing the light and upgrading stocks in the past week – these are often the whispers of momentum. Over the long haul, value stocks have been the tortoise to the growth hare, clocking in 13.4% annual returns against the market’s 10.1% average since the Roaring Twenties.

Dividend Aristocrats – the royalty of the market – offer that steady paycheck when things get wild, while playing the sector rotation game can amp up those returns to 14.2% annually. Here’s the thing: start small, spread your bets across sectors like you’re playing financial bingo, and never toss more than 10% of your stash on a single pony. We at Top Wealth Guide have got the insights and strategies you need – clear, actionable stuff to help you make smart moves that line up with your financial dreams.