The BRRRR method… a game-changer for real estate investors — it’s like magic for your money. You just keep recycling that capital over and over. But here’s the rub: most folks hit a wall when it comes to cracking the financing puzzle that makes it all tick.

Financing for the BRRRR gig? It’s a juggling act with multiple players — different funding, different stages. But fear not. At Top Wealth Guide, we serve the playbook — which lenders to tap and when — plus the hacks to dodge those pesky financing roadblocks that can nuke your deals.

In This Guide

Which Financing Options Work Best for BRRRR Deals

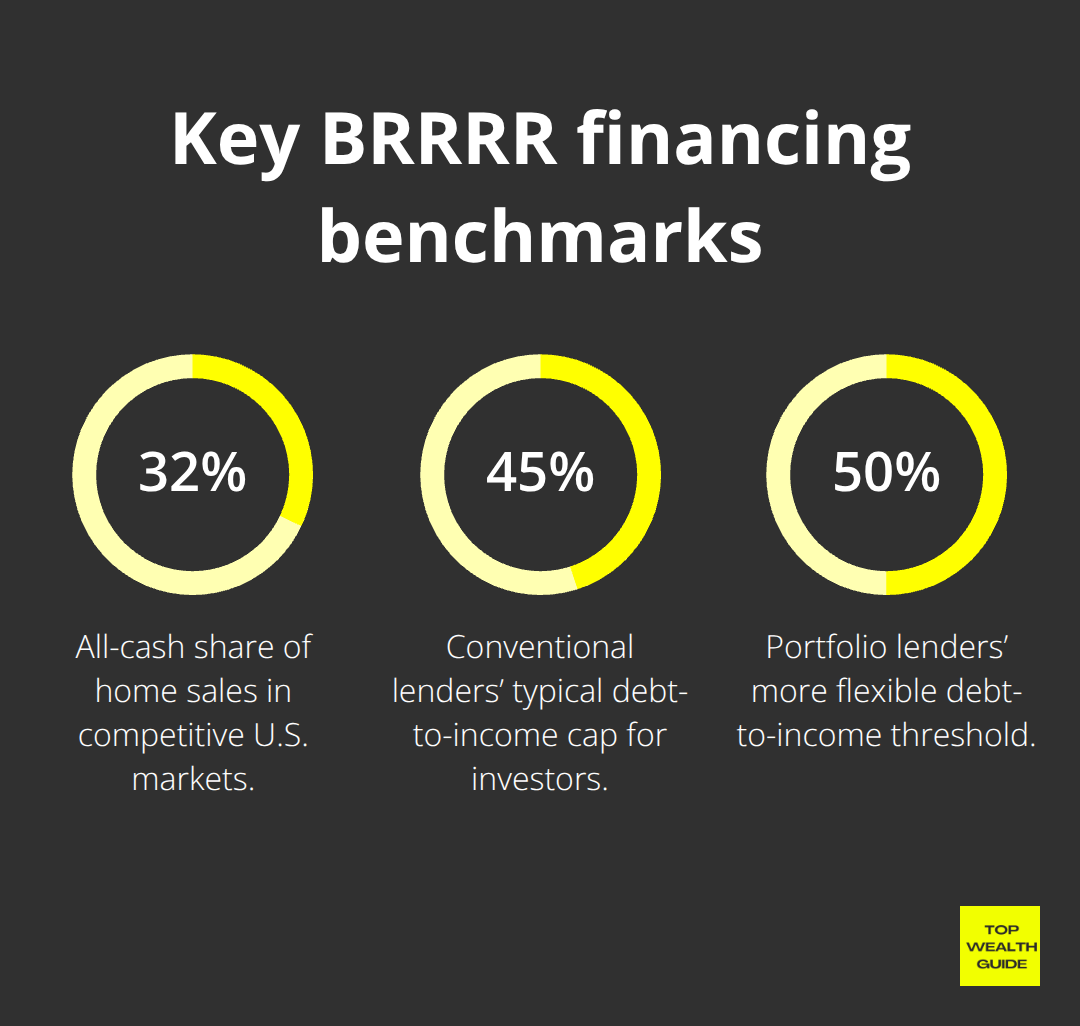

Your financing strategy-it’s make or break for your BRRRR success. Choose wrong, and boom, you’re leaking money faster than a sieve. Traditional banks? Sure, they’ve got the lowest rates around, 7-8% for investment properties. But get ready to play the patience game, because they’re slow… like, real slow. Think 20-25% down payments and drawn-out approval processes. Enter portfolio lenders-these guys? Total game-changers. They hold loans in-house, cranking out closings in a crisp 15-20 days, compared to the sluggish 45-60 days of conventional banks.

And guess what? They’re not too fussy about credit scores either-they’ll take you on around a 620, and they’ve got this laissez-faire attitude to debt-to-income ratios, up to 50%. They care more about the deal itself rather than drowning you in red tape.

Hard Money and Private Lenders Lead the Speed Game

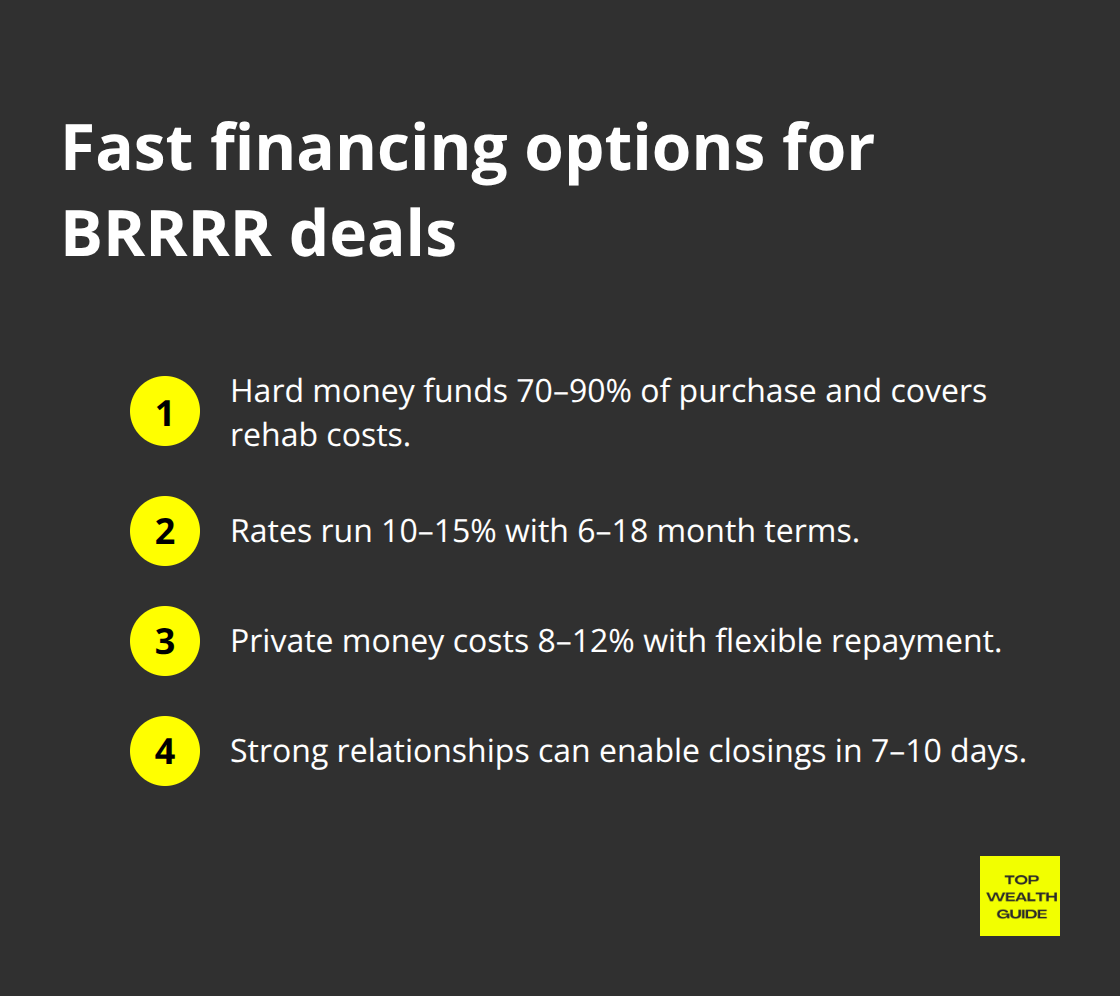

Let’s dive into the fast lane-hard money lenders. In the BRRRR world, speed is your new best friend. Spot a distressed property? These asset-based rockstars are all over it, funding 70-90% of the purchase price, plus covering all your rehab costs. We’re talking rates between 10-15% with terms lasting 6-18 months. Private money from individuals? Even sweeter deal-think 8-12% rates and wonderfully flexible repayment schedules.

The wizardry? It’s in those relationships you’re brewing long before the money game even starts. Real estate investment groups are your allies, linking you up with private lenders who get your local market vibe and can clinch deals in a flash, like 7-10 days when opportunity’s knocking.

Creative Financing Strategies That Actually Work

Got a self-directed IRA? A neat tool, but it’s got rules-no buying property you or a disqualified person owns, and no backdoor perks from your self-directed property. On the flip side, seller financing? Now there’s something to chew on. Motivated sellers carry the note at way-below-market rates (especially handy with landlords tired of the hustle, just looking for that steady paycheck). And hey, house hacking in BRRRR deals? With FHA loans, only 3.5% down and you get to skate by with relaxed credit requirements.

Joint ventures with capital partners? Smart move. Split those profits 50-50-they bring the dough, you bring your managerial mojo. Perfect for newbies who’ve got the brain but lack the bankroll.

Bridge Loans Fill the Gap Between Purchase and Refinance

Bridge loans anyone? They’re your short-term financial fix, a neat little bridge to more permanent financing. Sure, they’ll cost you 8-12% interest, but they let you snap up deals and finish renovations without stressing about cash flow. Most require a 20-30% down, zoning in on the property’s after-repair value instead of dissecting your personal financials.

Their magic? Insanely quick, closing in 5-7 days. That’s your competitive edge in sizzling markets where cash is king… or queen, whatever-cash gets you the crown.

Now that you’ve wrapped your head around these financing paths, it’s go time-from making that initial purchase to the grand finale refinance.

How Do You Actually Execute BRRRR Financing Step by Step

Alright, the purchase phase – it’s like a sprint with distressed properties. Hard money lenders, they don’t mess around, closing deals in about 7-10 days, but here’s the kicker: they want 20-30% down, and, oh yeah, points from 2-5% of the loan amount. Portfolio lenders? They’re a bit more chill, closing in 15-20 days with conventional rates hovering around 7.5-8.5%… only catch? You need a credit score that’s not in the basement – think above 680.

In the frenetic world of competitive markets – cash is king. Look, 32% of home sales are paid in cash. Savvy players? They leverage home equity lines to mimic cash offers, then bam, refinance right after closing to keep that financial engine revving.

Hard Money Lenders Accelerate Your Purchase Timeline

Hard money lenders – they’re about the property’s value, not your life savings or credit score. They’ll finance 70-90% based on that after-repair value (ARV) jazz. Sure, they have higher rates, but for speed when cash buyers are breathing down your neck? Priceless.

Private lenders in your network may be your ace in the hole, offering sweeter deals than the big institutional guys. Real estate investment groups? They put you on speed dial with folks who get the local scene, and could close in 5-7 days when you’re ready to pounce.

Construction Draws Fund Major Renovations

Construction draws – that’s your ticket for major makeovers. These lenders release funds in stages as work wraps up, with private lenders letting you ride on interest-only payments while you transform a pumpkin into a palace over 6-12 months. Pro tip: stash 15-20% extra in contingency funds because renovation costs love to surprise you, sneaking up like ninjas depending on your project’s ambitions.

Track every penny and paper trail like a hawk – conventional lenders love to put renovation costs under the microscope when they eyeball your refinance app. Credit cards with 0% intro rates can cover small stuff under $10,000, but don’t even think about swiping for big structural revamps.

Refinance Timing Determines Your Success

Hit the refinance button 30 days before that hard money loan comes knocking at midnight to dodge extension fees – breaking it down to 1-2% monthly. Conventional lenders? They play hard to get, needing a 6-month seasoning period before reconsidering a loan. Portfolio lenders have looser grips but offset it with a 0.25-0.5% rate bump.

Appraisers are all about those 90-day comparable sales – time your refinance like a pro when similar renovated gems have just swapped hands nearby. Loan-to-value ratios – that’s your ticket to extracting cash from your property, a.k.a., refinancing’s holy grail.

Perfect execution is key, but spoiler alert: roadblocks will appear faster than you can say BRRRR strategy. Brace for the bumps that trip up even seasoned investors.

What Financing Obstacles Will Tank Your BRRRR Deal

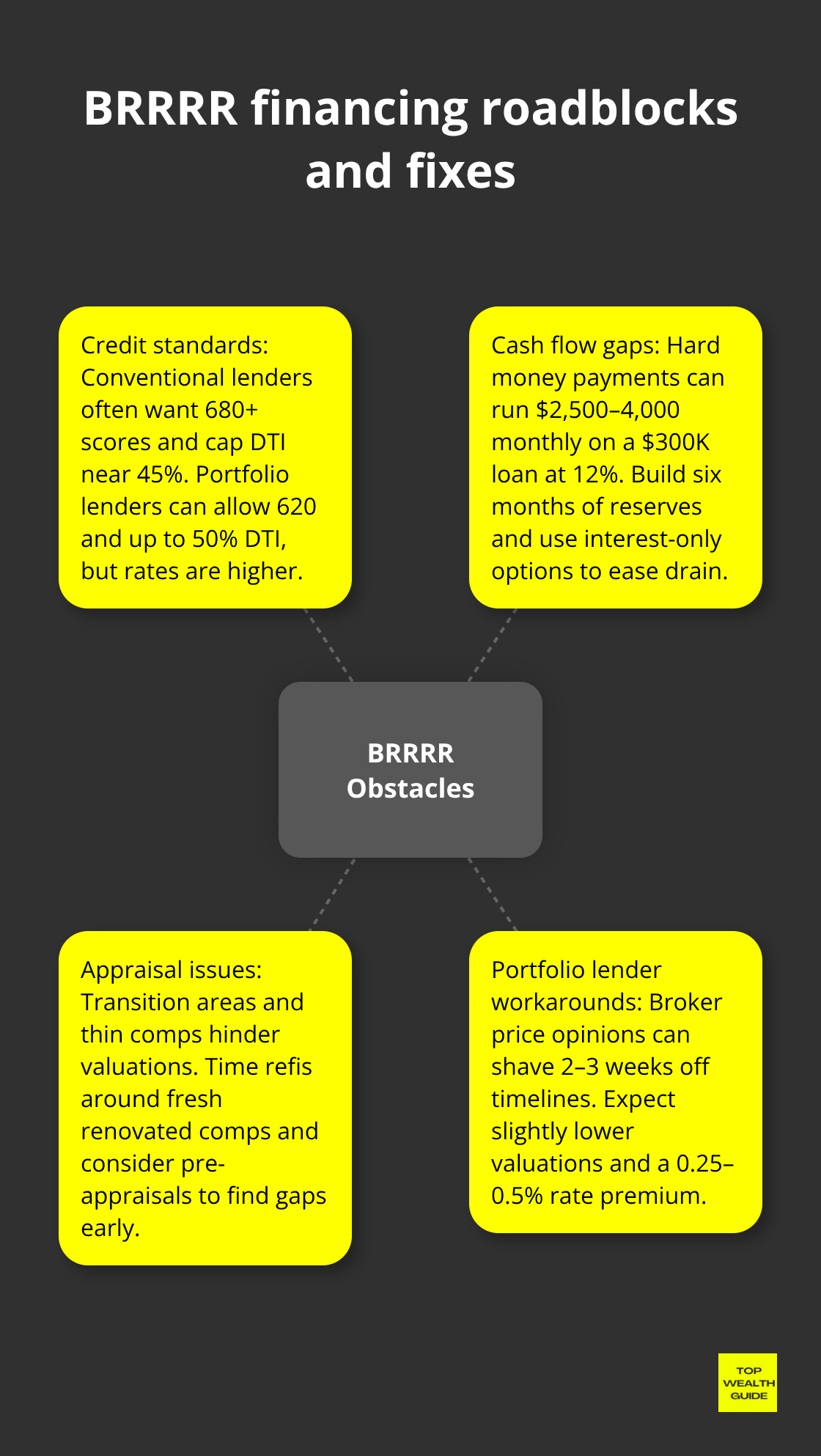

Credit standards slam BRRRR investors hard – we’re talking conventional lenders hunting for credit scores north of 680 and tapping on debt-to-income ratios up to 45% if you’re diving into investment properties with decent credit scores and reserves. And, oh boy, the relief squad (portfolio lenders) steps in with a more forgiving 620 minimum score and a 50% debt-to-income threshold, but don’t pop the champagne just yet – they slap you with rates that are 0.5–1% juicier. Most lenders wave through cash-out refinance without waiting if you snagged the property via inheritance or some legal jackpot, giving a boost to those fast-track qualifying situations.

Cash Flow Gaps Create the Biggest Headaches

Those hard money payments? They siphon the green fast – think $2,500–4,000 monthly on a $300,000 loan cruising at 12% interest. Construction draws lend a hand, yet hold your horses because lenders like to cling onto 10-15% until you cross the finish line. Savvy investors? Yeah, they’re stacking 6-month payment reserves and opting for interest-only construction loans to curb the cash drain. Need backup liquidity? Credit lines hover around – but brace yourself – 8-11% rates in those wild 2024 markets.

Appraisal Problems Kill Your Refinance Dreams

Appraisers – they squirm with renovated properties when they hit those transition neighborhoods. Picture them hunting for three comparable sales within a 90-day window and aiming for similar square footage. Rural spots? Even hairier with fewer comps. The game plan? Time that appraisal when some spiffy renovated places just clinched nearby sales. Smarty investors, they fork out for pre-appraisals during renos to unearth valuation gaps early on ($400-600)… but that move averts those $50,000+ refinance nightmares.

Portfolio Lenders Offer Faster Solutions

Portfolio lenders flip the script with broker price opinions penned by licensed real estate brokers instead of standard certified appraisers. This hack slashes 2-3 weeks off refinance timelines while tolerating slightly skimpier valuations. They zoom in on the deal rather than getting tangled in conventional red tape, wrapping things up quicker and flexing more, though you’ll face rates 0.25-0.5% plumper than the old-school banks.

Final Thoughts

The success of the BRRRR method-like mixing just the right cocktail-depends on getting the perfect lender for each phase of your investment journey. Here’s the breakdown: Hard money lenders are your go-to for the initial purchase phase. They zip through closings in 7-10 days. Then you’ve got portfolio lenders-they’re the cool cats in the refinance scene, with their flexible underwriting standards. Speed is king when you’re rolling in competitive markets, where cash offers snag 32% of the deals.

Your financing game plan? Be like a social butterfly-cultivate relationships with private lenders who have a pulse on local markets and can close things faster than you can say “under a week.” During renovations, construction draws from these lenders help you juggle cash flow like a pro. Interest-only payments? They keep your capital intact for your next big score. And those portfolio lenders? They’re the goldilocks option for refinancing-allowing lower credit scores (hello, 620) and lenient debt-to-income ratios, trimming 2-3 weeks off appraisal timelines with their broker price opinions.

Kick off your first BRRRR deal by snagging pre-approvals with both hard money and portfolio lenders. Build a hefty 6-month payment reserve fund and schmooze with private investors through local real estate circles. Time is of the essence-aim to refinance 30 days before your hard money loans hit their expiration date to dodge costly extensions. We’re here at Top Wealth Guide, offering you the full monty on real estate investing strategies to pave your path to property investment success.