Distressed properties… those are the hidden gold mines in real estate, folks. We’re talking below-market jewels that can supercharge your BRRRR strategy from ho-hum returns to serious wealth growing—it’s like finding a Picasso at a garage sale.

Here at Top Wealth Guide, we’ve cracked the code, pinpointing the precise tactics that the pros use to sniff out and nab these properties. Buckle up, because we’re going to take you on a journey to build a pipeline of deals so profitable, it’ll make your spreadsheet look like it was on steroids.

In This Guide

What’s the Deal with Distressed Properties and BRRRR?

So, here’s the scoop: Distressed properties-real estate misfits, if you will-are where owners hit financial snags, or the buildings are just screaming for some TLC. Maybe it’s foreclosure looming, whatever the case, these places look pretty sad. Think overgrown lawns, windows all boarded up, paint peeling off like a bad sunburn. Scares the average buyer right off. But for those in the know? A goldmine of opportunity as foreclosure waves ride in.

The Low-Price Jackpot

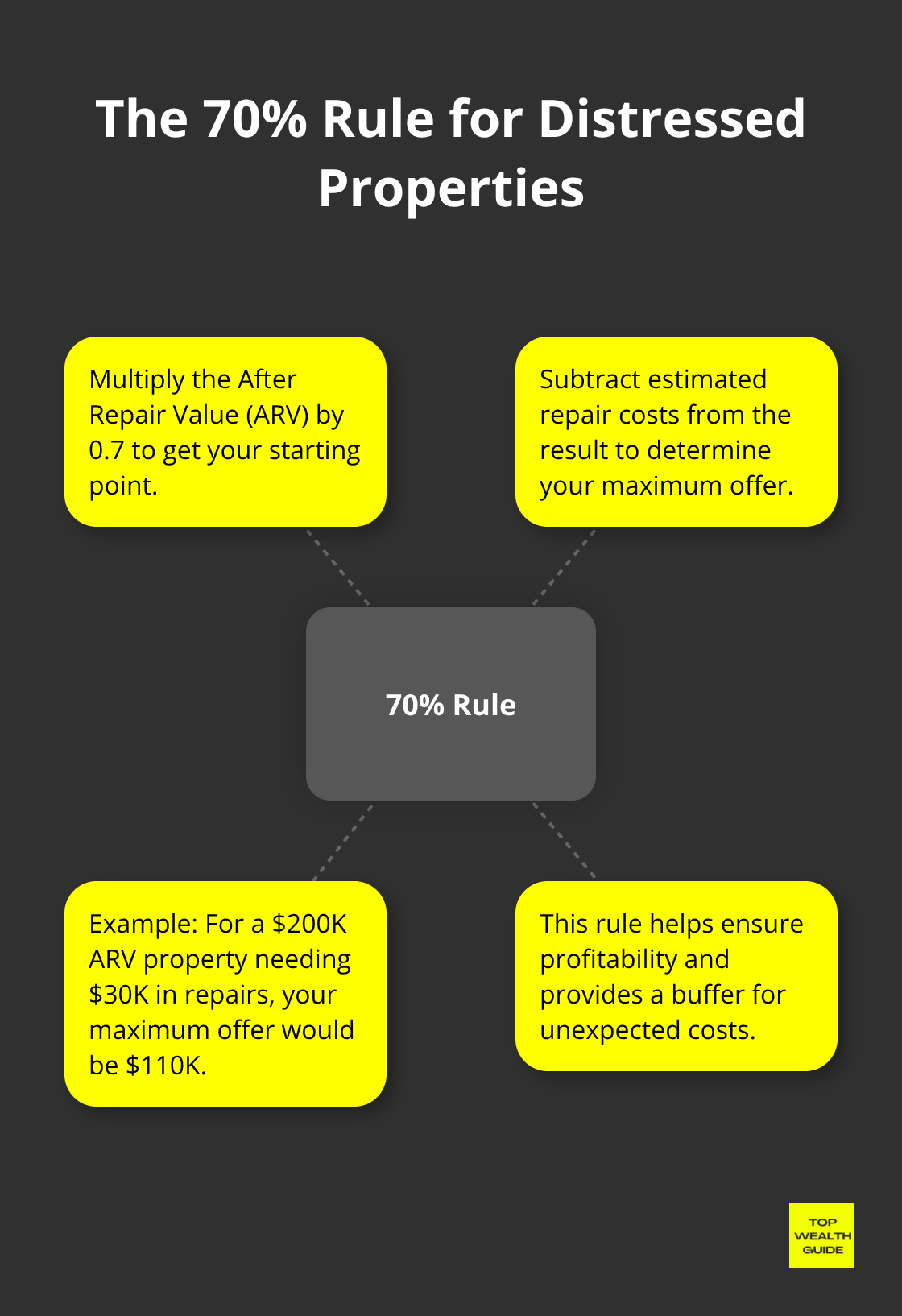

Distressed properties-bargain bonanza, folks. These babies go 20% below the usual asking price. Why? Sellers are in a hurry, plain and simple. Banks don’t want ’em-those maintenance bills and taxes sting. And homeowners? Better a fast sale than a credit nightmare. Remember the 70% rule? Nail that and you’ve struck gold; buy plus fix-up costs must be under 70% of its shiny new worth once repaired-and distressed digs fit this snugly.

The BRRRR Match Made in Heaven

Let’s talk BRRRR. This method and distressed piles are like peanut butter and jelly. Buy a needy $150,000 home that flips into $220,000 after tweaks-you’re minting equity like a federal reserve. Turn it from fixer-upper to rent-ready, get it appraised on full throttle, then? Cash-out refi to recoup your cash. You just can’t pull this off with those overpriced market-ready spots.

Why the Average Buyer Ducks Out

Many buyers, and heck, even some investors, run like the wind from distressed stuff. They want the easy ride-don’t have the vision or dough for big fixes. First-timers? Won’t get loans if the house crumbles or screams safety hazards. A skimpy buyer group? It pushes prices down-a cash buyer’s dream. These properties sell for chump change because, honestly, most people just don’t want the hassle.

So now, we’ve peeled back the layers on why distressed properties and BRRRR are such a savvy move. Next moves? Get sharp at spotting these diamonds in the rough where you’re hunting.

Where Do You Find These Distressed Diamonds?

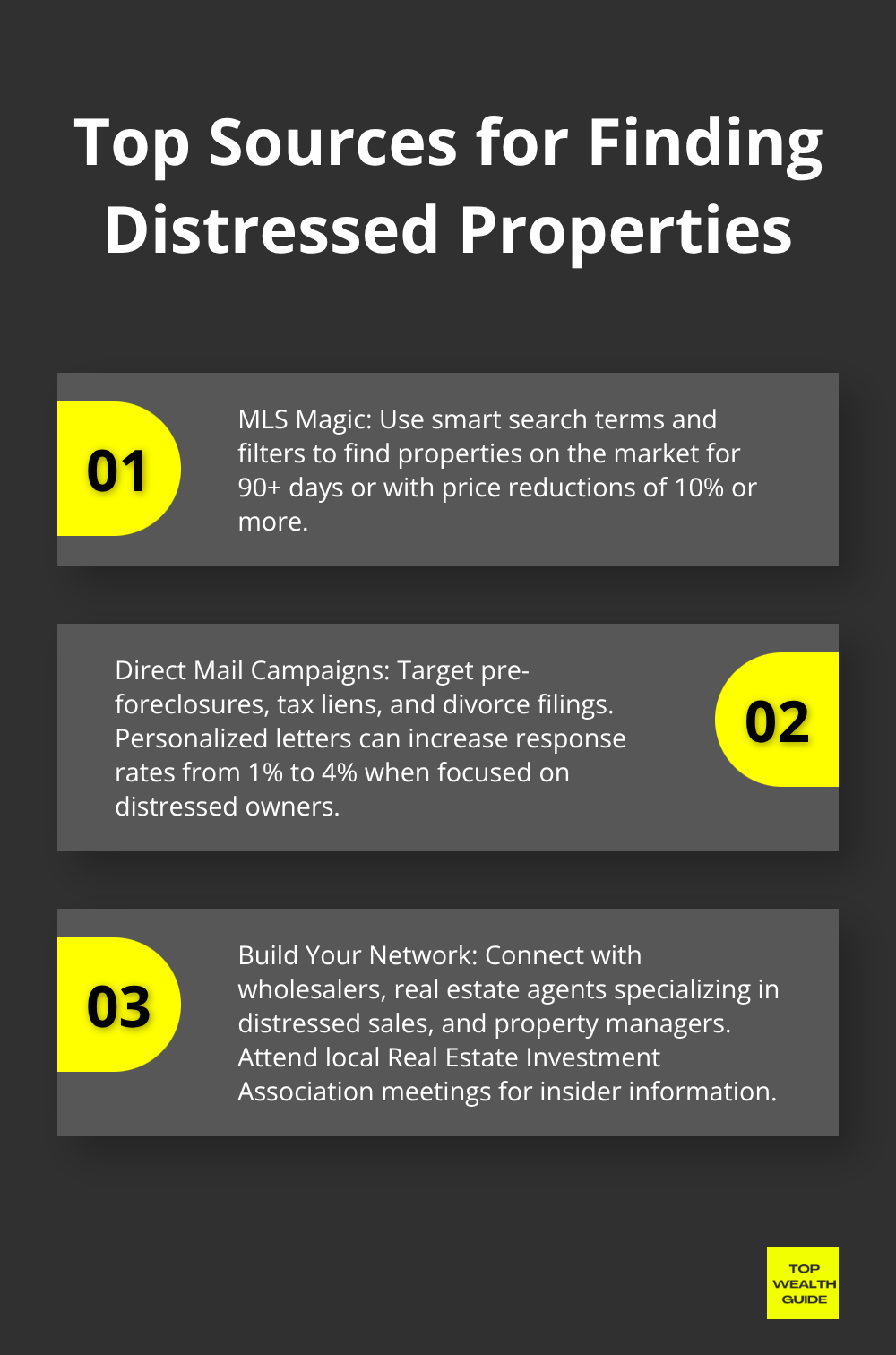

MLS Magic With Smart Search Terms

So, here’s the deal – the Multiple Listing Service is like a hidden treasure chest of distressed properties, waiting for the savvy investor to crack it open… but you gotta know how to play the game. Here’s a tip: tweak your MLS filters for properties stranded on the market for 90+ days, slash prices by 10% or more, and hunt for those juicy keywords like “motivated seller,” “cash only,” “handyman special,” or “TLC needed.” Time on the market usually means bargains galore. Zoom in on specific conditions – “estate sale,” “foreclosure,” or “short sale.” Most agents? They miss these nuggets, handing you an edge to score deals before the herd catches on.

Direct Mail Campaigns That Actually Work

Forget the tired “We Buy Houses” clichés everyone trashes. Laser-focus on homeowners with their backs against the wall – courtesy of public records. Snag lists from courthouse dramas like Notice of Default, tax lien tangles, and divorce filings. Then, pen personal letters to owners battling code violations or debt-laden property taxes. Bet you didn’t know – pre-foreclosures are 3.15% of all U.S. homes, with Florida housing a whopping 57,696 of them. Aim your mail at absentee owners of raggedy properties, landlords drowning in tenant troubles, and seniors struggling with inherited estates. Response rates soar from a measly 1% to a sweet 4% if you zero in on folks in distress, rather than carpet-bombing neighborhoods.

Build Your Network of Deal Finders

Wholesalers? They’re like your early warning system buzzing with leads, so buddy up with 3-5 hustling wholesalers in your area. Real estate agents who know distressed sales? They’ve got the scoop on auctions, sometimes before it even hits public records. Property managers? They’re knee-deep in chat with landlords eager to unload problem properties. Hit up your local Real Estate Investment Association meetings – it’s like a goldmine of insiders. FYI, REO auction action is buzzing, with vacant properties ticking up by 31% from last year to reach a five-year high.

Online Platforms and Auction Sites

Platforms like Zillow and Realtor.com? They’re your trusty sidekicks for filters on property conditions and price chops. Set alerts for homes dropping prices like it’s hot – that’s your distress siren blaring. Auction.com? It’s the king of distressed properties coast to coast, boasting 7.5 million registered accounts. Don’t sleep on local courthouse websites, where auction and foreclosure listings spill the beans before the market does. It’s all real-time updates, so you’re ahead of the pack while the others lag on dusty old playbooks.

Now that you’ve got the lowdown on where to unearth these diamonds in the rough, it’s time to crunch the numbers and see if the moolah stacks up for your BRRRR strategy.

How Do You Crunch the Numbers on Distressed Properties?

The Make-or-Break Metrics

Let’s talk real estate, folks-specifically, the numbers game with distressed properties. The 70% rule-think of it as your financial GPS. Once you nail the After Repair Value, multiply it by 0.7 and knock off the repair costs. Simple math: for a $200K ARV property needing $30K in TLC, your ceiling offer is $110K. Next up, cash flow analysis-it’s not rocket science. Make sure you’re pocketing at least $200 each month after all your financial obligations have been squared away.

And then there’s the 1% rule; it beckons for rent to be 1% of the total investment. San Fran’s got issues-hovering at 0.4%, while a place like Cleveland rocks at 1.8%. ROI? Greater than 15% on your cold, hard cash (not on what you forked out to buy the place). This filter sifts out the lucrative deals from the financial black holes.

Renovation Cost Reality Check

Contractors tell tall tales, budgets take off, and nasties hide behind every wall. Add a cool 20% to every estimate they scribble down-honestly. Kitchens can set you back $15K-$35K, bathrooms $8K-$15K, and if your HVAC’s packing up, that’s $5K-$8K. Foundation woes? You’re looking at $10K-$40K.

Three is the magic number for estimates on major work-don’t buy before you’ve prowled through every room with a seasoned contractor. Structural engineers will lighten your wallet by $500 but could save you more-if they spot foundation cracks or a sagging roof before you’re in too deep. Permits cost whatever-Chicago might fleece you $500 for a bathroom, while some rural back-of-beyond towns just shrug it off.

Negotiation Strategies That Work

Distressed sellers crave speed and certainty over a few extra bucks. Cash offers closing in seven days? They beat the pants off offers tied up with financing-and you can even lowball by 10%. Flash those proof-of-funds statements and ditch inspection contingencies where you can. Sellers fear flops more than they love big offers.

Seek out properties begging for a makeover-all those turn-offs ward off retail buyers. Yank out the laundry list of flaws during negotiations-leaky roof, ancient wiring, dodgy foundation-that’s your artillery for price cuts. Most sellers are one step ahead of you; they know the score and expect you to come in under.

Due Diligence Essentials

Title searches are like bread and butter-unearthing liens, back taxes, all that jazz-consider $400 spent worthwhile. Property taxes are notorious for showing up unfashionably late, creating a hefty $5K-$15K farewell gift at closing. Check those utility bills, HOA fees, special assessments-you’re not just buying the property, you’re adopting its past financial indiscretions.

Order pro inspections for foundation, roof, electrical, plumbing-these are the cash sinks and safety concerns. Cosmetic checks? Pfft. Please. It’s the structure that counts-because a lick of paint won’t rescue a sinking foundation.

Financing Your Distressed Property Purchase

Hard money lenders are your pals for 65%-75% property value loans at 10%-18%-short and spicy, three to 36 months. Portfolio lenders flirt with 7-9% interest and serve up closings in two weeks. Private investors-they’re your dark horse-8-12% interest over six months, beating banks for swiftness and adaptability. Going all-cash? Sure, it zips through the bureaucracy, but it also locks up capital like Scrooge during Christmas.

Check out partnership routes-where you’re on the hunt and handle the flips, while your partners bankroll the operation. Easier to juggle multiple properties without drowning your own funds in the process.

Final Thoughts

So, you’re diving into profitable distressed properties? Buckle up – it demands a systematic approach. Think of it like a scavenger hunt, but with real money on the line. Your MVP? The MLS – it’s your primary source if you know how to filter for those properties hanging out for 90+ days with those juicy price reductions. And then, there’s the charm of old-school direct mail campaigns. Aim ’em at pre-foreclosure homeowners and tax lien properties, and you might just hit a response rate up to 4%… if you do it right.

Numbers – yeah, they never lie in this game. Stick to the 70% rule, have a ‘surprise’ fund (20% extra for those delightful renovation curveballs), and pin down properties bringing at least $200 monthly cash flow. Need a competitive edge? Cash offers with seven-day closings – they pack a punch over financing when dealing with motivated sellers (especially the ones sweating over foreclosure deadlines).

Your BRRRR success? It hinges on snagging properties below market value ripe for profitable renovation. Why distressed properties? Opportunity, plain and simple – most folks side-step the hassle and complexity. At Top Wealth Guide, we gear investors up for wealth building via real estate investing strategies that zero in on long-term portfolio growth.