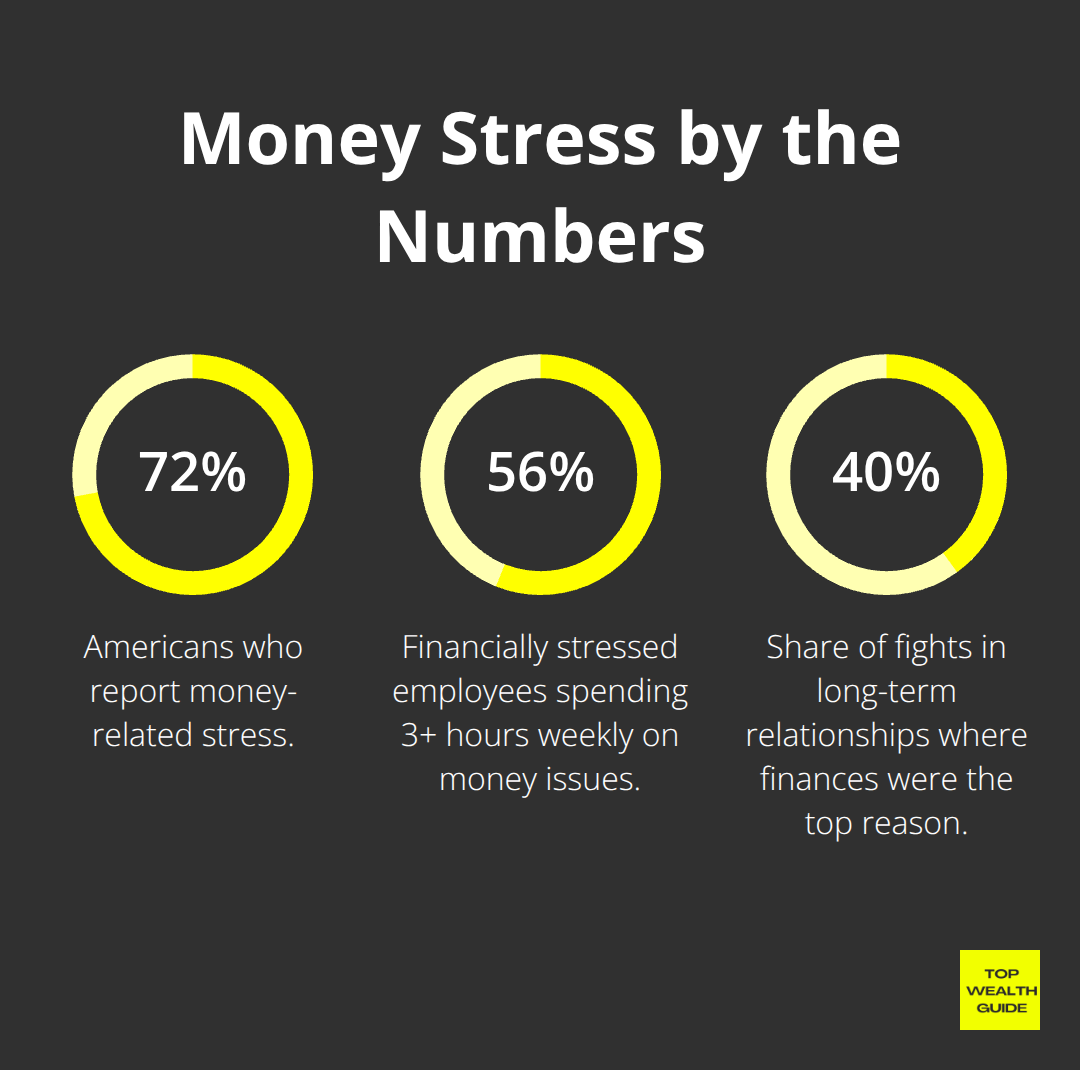

Money stress—it’s messing with 72% of Americans. Yeah, you heard right. The American Psychological Association says financial stress is like a bad rash that just won’t go away, impacting everything from your sleep to your friendships to your job performance. It’s not just your bank account that takes a hit…it’s your whole life’s ecosystem.

Now, here’s the deal. At Top Wealth Guide, we’re convinced that savvy money management isn’t just for Wall Street wannabes or spreadsheet junkies. It can actually yank you out of this destructive cycle. The right moves can turn your financial drama into a narrative of, well, zen-like composure and genuine confidence.

In This Guide

What Financial Stress Does to Your Body and Mind

Financial stress – it’s not just about your bank balance being in the red. The folks over at the University of South Australia tell us that money troubles come with a grab bag of physical symptoms: chronic headaches, insomnia, digestive issues, and yep, that elevated blood pressure. When you’re living paycheck to paycheck or buried under a mountain of debt, your cortisol levels are basically throwing a non-stop rave, wrecking your immune system. And get this – among financially stressed employees distracted at work, 56% spend three hours or more per week trying to sort out their money woes-that’s a big chunk of your brain sweating over cash instead of actually, y’know, working.

The Physical Toll of Money Problems

Your body’s basically acting like there’s a wild beast outside your cave when financial stress hits. University of Nottingham studies tell us your stress response to financial issues is as intense as facing down a saber-tooth tiger. This chronic stress turns into inflammation, crushes your immunity, and speeds up aging like it’s on fast forward. People drowning in financial stress report 50% more physical aches and pains than those cruising with stable finances. The connection? Crystal clear: when your savings account looks like a barren desert, your energy levels nosedive too.

Career Performance Takes a Direct Hit

Financial stress – it’s a productivity wrecking ball in the workplace. Research uncovers that financial stress impacts job performance and work engagement. You drift off in meetings, miss deadlines, and skip networking because your wallet’s on lockdown. It’s a vicious circle-crappy performance means no promotions, and the financial squeeze just tightens. All that money stress hogs your mental bandwidth, leaving peanuts for career moves or inventive solutions.

Relationships Crumble Under Money Pressure

Finances were the top reason for squabbles in 40% of fights among folks in long-term relationships. Money stress morphs people into irritability machines, then makes them clam up and go all defensive. You bail on social outings ’cause, spoiler alert, they cost money, isolating yourself when you need your support squad most. Daily debates about spending chip away at trust and intimacy. Kids in these stress-riddled households? They clock in with more behavioral hiccups and academic hurdles, snowballing the damage to the next generation.

The silver lining? You can smash this ugly cycle by setting a solid financial foundation-cue smart money management systems that actually deliver. Whether you’re tackling debt payments squeezing your budget or making moves toward financial freedom, getting a grip on your finances dials down the mental and physical stress.

Building a Foundation for Smart Money Management

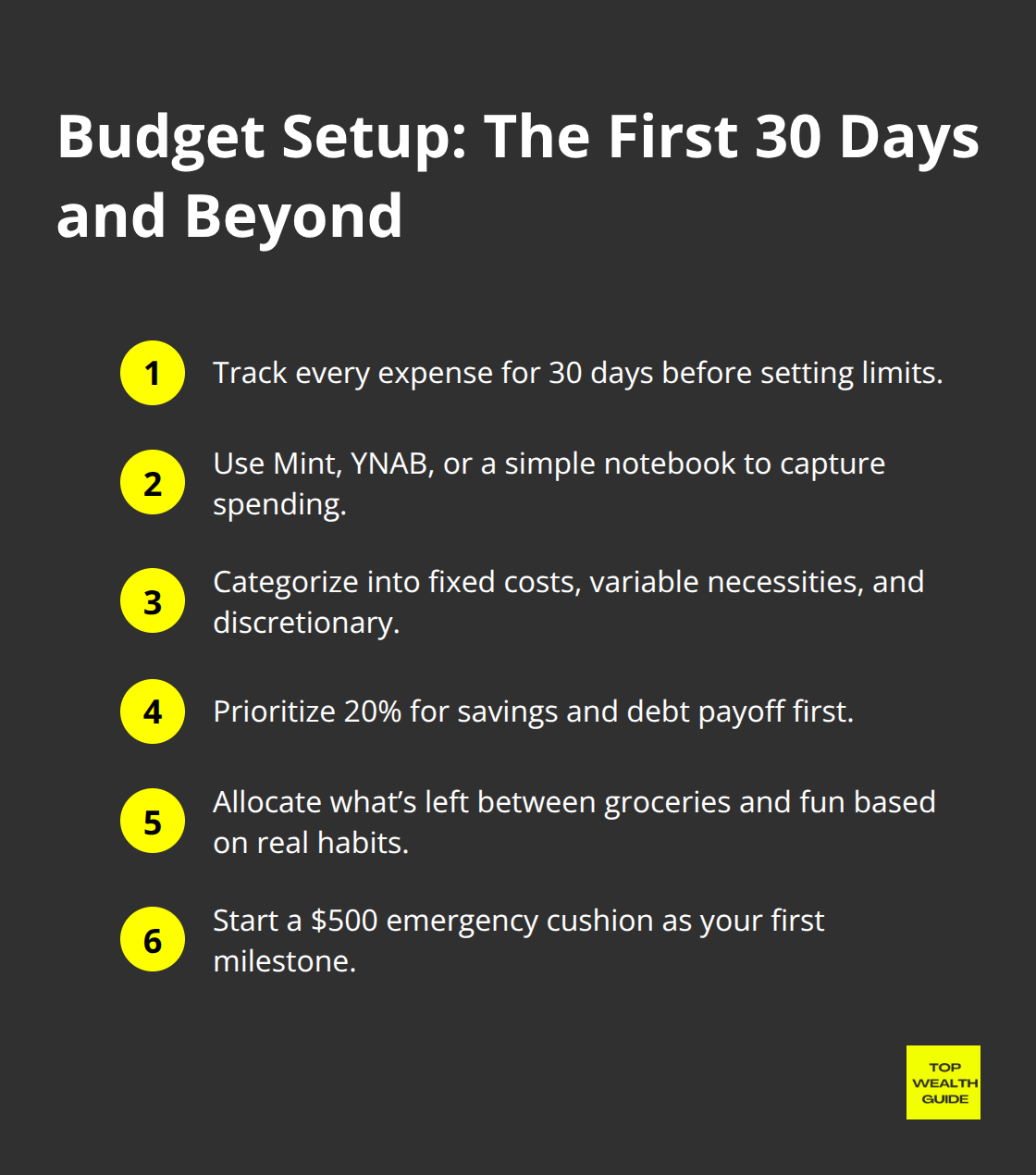

Here’s the thing-budgets often turn into an arena where dreams go to die. Why? Because folks design these pie-in-the-sky budgets instead of ones grounded in reality. A budget that actually delivers starts with you tracking your expenses for 30 days-before setting any limits. Apps like Mint or YNAB make this a breeze (and hey, even a good ol’ notebook gets the job done). Some research out of the University of South Australia found that just one month of tracking leads to a 23% drop in overspending.

Your budget? Needs three buckets: fixed costs like your rent, variable necessities like groceries, and then the fun stuff-discretionary spending. The 50/30/20 rule? Sounds cute but flops for most ’cause it misses the personal touch. Instead, lock in your fixed costs first, earmark 20% for savings and killing off debts, and then divvy up what’s left between groceries and guilty pleasures according to how you’re actually spending.

Emergency Funds That Match Your Reality

You’ve heard the mantra: stash six months’ worth of expenses for emergencies! But let’s be real-that’s ignoring how tough things are for most. Start with a $500 cushion as your first win. High-yield savings accounts at places like Marcus or Ally? Paying around 4.30% APY these days (which turns your rainy-day fund into a cash machine instead of just dead weight).

Set up a $25 weekly autopilot transfer to this fund-don’t even think about it. Once you hit $500, aim for $1,000, and then one month of living costs. If you’re earning under $50k a year, aim for a three-month buffer, not that textbook six-month spiel. The Empower study shows people spend four hours a day mentally juggling their finances, but just letting auto-contributions handle the fund slashes this stress by 60%.

Debt Elimination Without the Fluff

Let’s set this straight-the debt avalanche method crushes the debt snowball every. single. time. Mathematically. Line up all your debts with interest rates and minimums, then unleash the big guns on the highest rate while you stick to minimums on the rest. With credit cards averaging 21% interest, these can eat your wealth alive quicker than any stock market gains.

Consolidation loans with outfits like SoFi or LightStream can offer you rates between 6-12% if you qualify, slashing interest expenses substantially right off the bat. Automate your debt payments to dodge those nasty late fees and stay on track with your plan. A golden nugget that most miss? Throwing an extra $50 monthly at that $5,000 credit card debt at 18% saves you $1,847 and slashes the repayment period by 28 months.

These key steps establish the kind of foundation you need to get your money stress off your back and start pushing toward real wealth-building momentum.

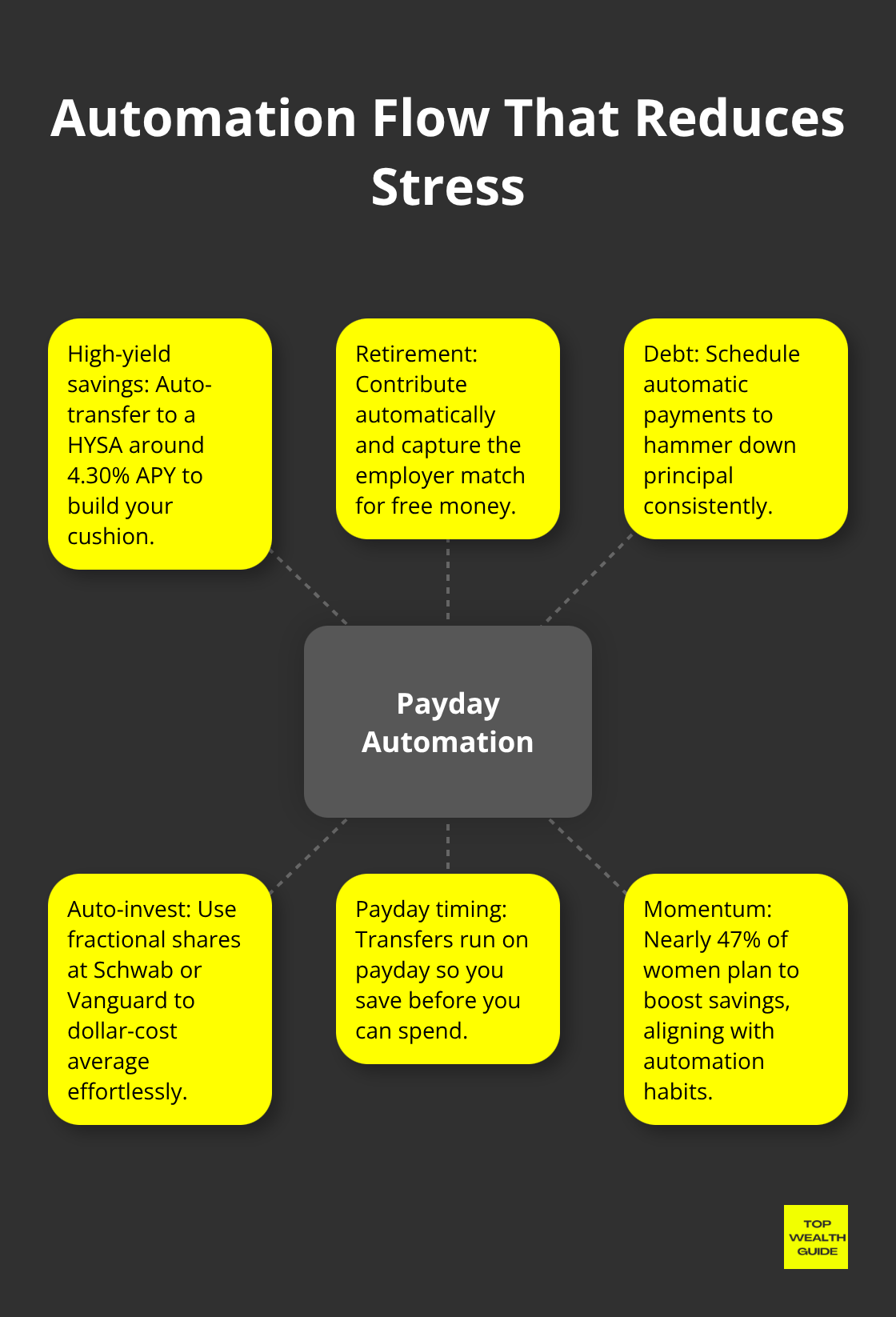

How Automation Eliminates Financial Stress

Automation is your new best friend in the money game-turning the exhausting daily hustle into a slick, autopilot system that works harder than you do, even when you’re catching Zs. Here’s a fun fact: nearly half of women (47% to be exact) are gearing up to boost their savings this year. The smart move? Set those automatic transfers to kick in on payday-forget waiting until it slips your mind. Imagine your checking account as a sender of goodies to three destinations: a high-yield savings account at 4.30% APY, retirement accounts (grab that employer match-it’s free money, people), and debt payments that hammer down those principal balances like a game of Whac-A-Mole.

And here’s the kicker-firms like Schwab and Vanguard throw in free automatic investments with fractional shares, letting you dollar-cost average into index funds with zilch effort.

Smart Investment Allocation Without the Complexity

Target-date funds are like training wheels for bikes-ditch them if you want to build real wealth. The S&P 500? Yeah, it’s been a beast over the past decade, trouncing the paltry 6.8% returns of typical target-date funds crammed with bonds. Here’s a play for you: put 80% into total stock market index funds with expense ratios under 0.05%, and throw the other 20% into international developed markets. Max out those Roth IRAs at $7,000 for 2024, but here’s a secret move most people miss: after maxing out retirement accounts, funnel cash into taxable accounts. Schwab’s SWTSX and Vanguard’s VTSAX charge a laughable 0.03% in fees (That’s $3 a year for every $10,000 invested-compare that to the $100+ active funds want from you).

Multiple Income Streams That Actually Scale

Relying on a single income stream these days? That’s playing financial Russian roulette. Full-time freelancers are pulling in an average of $85,000 annually, says the Upwork Research Institute. And platforms like Teachable? They’re golden-they let you spin your expertise into courses with a cool $2,000-$5,000 paychecks each month. Real estate investment trusts (REITs)? They dish out 4-8% dividend yields with zero landlord headaches-just look at Realty Income, which has been doling out increasing monthly dividends for 29 years. Sure, snapping up rental properties in Nashville or Austin could net you 12-15% annual appreciation, but they also demand $50,000+ down payments. So start simple: go for dividend-paying stocks like Johnson & Johnson, which yield 3.1% annually, then let those payments reinvest automatically and watch your wealth compound like crazy.

Automate Your Debt Elimination Strategy

Debt-it’s like termites for your bank account. Set automatic payments that exceed the minimums by a cool 20%-this alone can chop your repayment time in half for most credit cards. With average interest rates at a steep 21%, carrying a $5,000 balance bleeds you of $1,050 each year in pure interest. Consider consolidation loans from SoFi or LightStream, where qualified borrowers can bag rates between 6-12%, dramatically slashing your interest costs. Make these payments automatic, synchronized to hit the same day each month, and watch those debt numbers start dropping like flies-without draining your mental resources.

Final Thoughts

Financial stress – it disappears when you get the right systems in place and just stick with them. Track your expenses for 30 days… then build a realistic budget prioritizing fixed costs and those pesky debt payments. Automate everything: savings transfers, bill payments, investments – you know, while you laser-focus on knocking out high-interest debt and beefing up that initial $500 emergency fund.

The long-term payoff? Huge. Folks with rock-solid money management systems report 60% less daily financial anxiety… and guess what? They sleep better, too. Relationships? They improve when money spats disappear. And career performance? It jumps when you’re not mentally juggling bills during meetings. Compound interest – that’s your wealth-building powerhouse (that $200 monthly investment, automated, could skyrocket to over $400,000 in 30 years).

Your action plan – it kicks off today: open a high-yield savings account, set up automatic transfers, and jot down all your debts by interest rate. We at Top Wealth Guide are here with practical strategies to help folks transition from financial stress to financial freedom. Visit Top Wealth Guide for more tools and calculators to speed up your journey.