The BRRRR strategy — it’s the real estate hack where investors get to play financial jenga while stacking up wealth with rentals. Here’s the rub: A lot of folks trip up during the analysis phase. They either walk right past the gold mine or end up paying way too much for a dilapidated shack.

Enter Top Wealth Guide. We’re here to demystify the whole BRRRR analysis gig with steps you can actually follow. You’ll be scrutinizing deals like a pro in no time, steering clear of blunders that suck your returns dry.

In This Guide

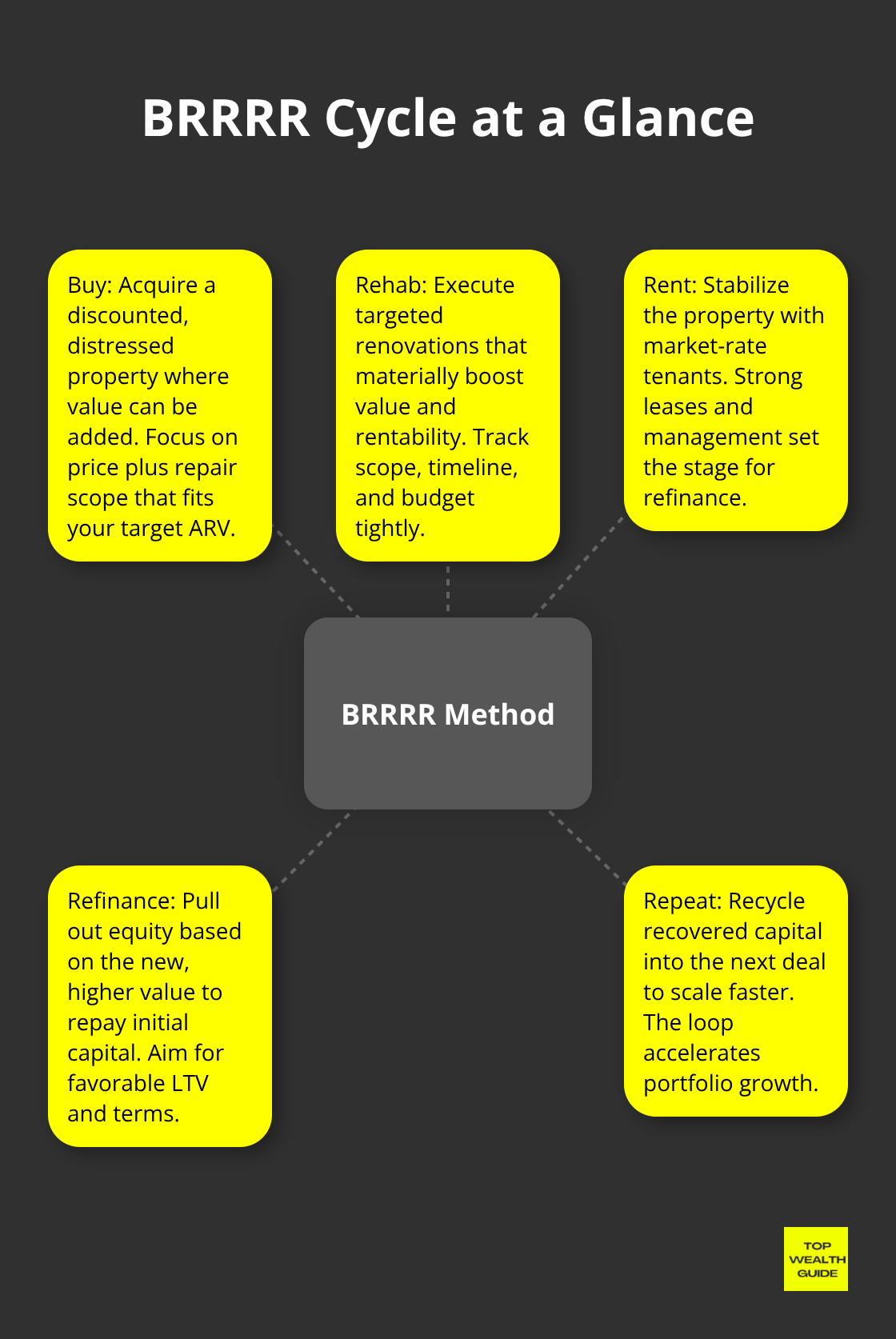

What Makes BRRRR Different from Regular Real Estate Investing

Think of BRRRR as your money-making merry-go-round – it’s the fast track to building wealth if you’re savvy enough to hop on. BRRRR stands for Buy, Rehab, Rent, Refinance, and Repeat. Yes, it’s a mouthful, but it’s also a masterstroke. You swoop in on rundown properties, give them a facelift that boosts value, rent them out to bring in some sweet cash flow, and then – here’s where it gets fancy – you refinance based on that new, pumped-up value and get your original moolah back. Rinse and repeat, my friend. It’s like putting your dollars on a never-ending loop instead of parking them in a single spot.

The Math That Makes BRRRR Superior

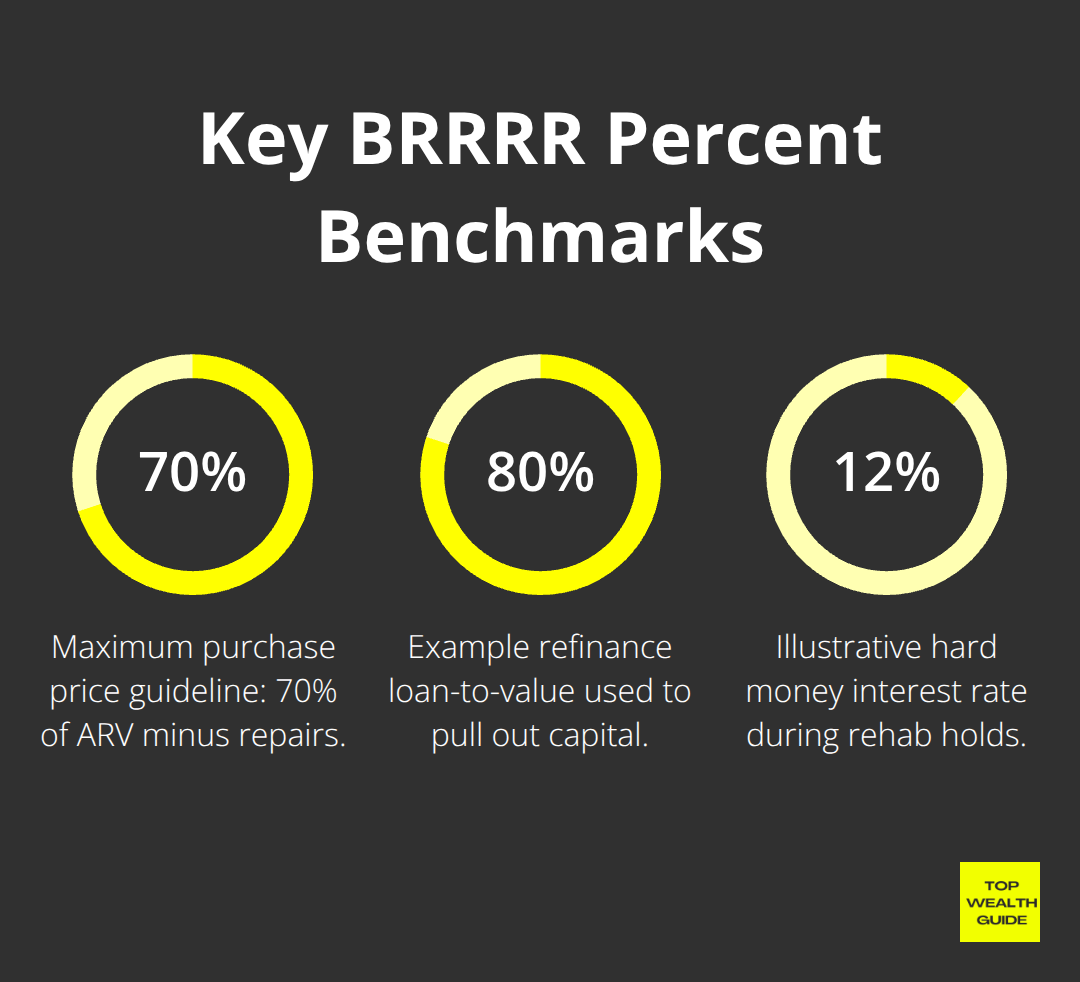

Let’s break it down – regular investors might slap $50,000 down on your average $250,000 home and just… sit tight. BRRRR maestros are playing a different game. They snag a fixer-upper for $150,000, throw in $30,000 for improvements, et voilà, you’ve got a $250,000 gem. After refinancing at 80% of its value, they snag $200,000 – almost all of their initial $180,000 back in their pocket. The BRRRR playbook is all about snapping up, sprucing up, and then lifting off with your capital back in hand. Keep your eyeballs on the After Repair Value, total project costs, refinance potential, and your cash flow after covering all the bills.

Why Speed and Leverage Beat Patience

BRRRR is like the espresso shot in your real estate latte – it’s all about recycling that capital ASAP instead of waiting for market forces to work their leisurely magic over years. While the traditionalist investors are twiddling their thumbs for market appreciation, BRRRR aficionados craft equity right out of the gate with targeted renovations. Sure, hard money lenders want their cut with higher rates for short bursts, but if you nail it, the equity you create more than pays for these short-term costs. Those smart renos can drive up value that makes those temporary financing fees just a step in your aggressive wealth-building waltz.

The Capital Efficiency Advantage

Your usual rental properties? They’re like the capital vortex – they pull in your down payment and keep it for ages. Not with BRRRR. You’re untangling your cash within 6-12 months courtesy of shrewd refinancing. This capital efficiency hustle means you can command $1 million in real estate with just $200,000 spread over five BRRRR maneuvers, rather than getting cozy with just one standard $250,000 deal. The compounding power goes into overdrive as each dollar reinvents itself over and over instead of sitting tight and dusty.

With all that brilliance in your back pocket, let’s dive into the nitty-gritty of how to sift the gold from the dross – identifying those killer deals and dodging the money sinks.

How Do You Analyze a BRRRR Deal Step by Step

Finding Your Sweet Spot Price and Renovation Budget

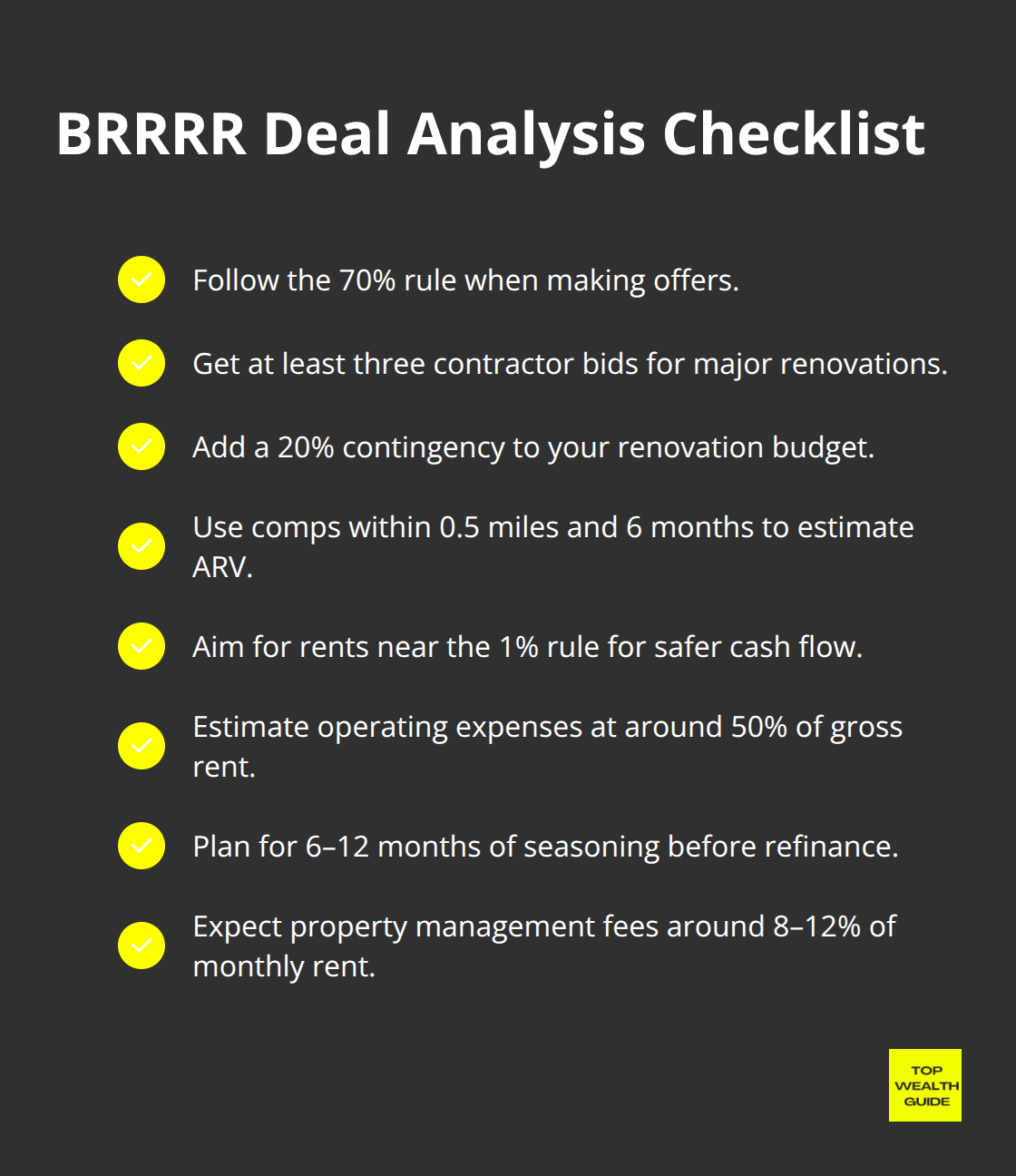

Think about the 70% rule like your guiding star – keep it in sight. Never, ever pay more than 70% of the after repair value minus renovation costs. So, if a property’s gonna be worth $300,000 after you spruce it up and it needs $40,000 worth of work, aim to snag it for no more than $170,000. Too many would-be moguls skip this essential math and then scratch their heads when the whole thing nosedives.

Got a property that needs some love? Get three contractor quotes for those big renovations. Quotes can go all over the map – like variances of 30% or more. And don’t forget a 20% contingency buffer for those pesky surprises behind the walls in older homes.

Hard money lenders? They want thorough renovation budgets – so list it all out, from flooring at $3 a square foot to kitchen upgrades that might run you around $15,000 for mid-range finishes.

Nail Your After Repair Value and Monthly Rent Calculations

Dig into those comps – within 0.5 miles and 6 months old – and nail down your ARV. Zillow tells you renovated homes might pop 20% in value, but bank appraisers? They’re the caution team – they’ll lean toward those lower comps. They zero in on recent sales data rather than what you wish it could be.

When it comes to rental income, scour current listings and recently rented digs in your area. The 1% rule is your go-to – if monthly rent covers or exceeds that mortgage, you’re at least breaking even. San Francisco? Good luck hitting it. The Midwest? Often crushes it. Use rental hubs like Rentometer and check out property managers for solid rent guesstimates.

Calculate Operating Expenses and Cash Flow

Operating expenses at 50% of gross rent and remember BiggerPockets shines a light on 8-10% vacancy rates. Factor them all in – taxes, insurance, maintenance, property management fees varying between 8-12% of monthly rent.

Oh and property taxes – location matters. Texas averages 1.8% annually, while Hawaii’s chill at 0.3%. Insurance? Depends where you’re at and how old the home’s bones are (25% more if it’s ancient). Maintenance reserves? Set aside 5-10% of monthly rent for those sneaky repairs.

Determine Your Refinance Potential and Capital Recovery

When it comes to refinancing, most lenders float you 75-80% of ARV after a swanky 6-12 month seasoning period. Got that $300,000 appraisal post-reno? You’ll likely cash out $225,000-$240,000. Your total outlay? Just $210,000 for purchase, renovation, and holding. You’ll claw back most of that initial stash.

Wanna know your cash-on-cash return? Divide the annual cash flow by the dough left in the deal. Sharp investors? They’re shooting for minimum returns in the 15-20% ballpark. Refinancing’ll drag on for 30-45 days, so keep an eye on those pricey hard money timelines. Some go with DSCR loans ’cause they zero in on the property’s cash flow, not personal income.

Now, with your head wrapped around the analysis framework, dive into the specific tools and real-world illustrations that’ll sharpen your calculations. Peek at a BRRRR method calculator to streamline your process and ensure you’re sharp as a tack in evaluating deals.

What Tools Actually Work for BRRRR Analysis

Free Tools That Beat Expensive Software

Ditch the pricey software draining your bank account each month. BiggerPockets throws you a lifeline with their free BRRRR calculator – and this thing is robust, covering every base with ease. It crunches the numbers on purchase price, rehab costs, ARV, rental income, and refinance scenarios like a pro. For the spreadsheet devotees (you know who you are), whip up a Google Sheets template that tracks acquisition costs, renovation expenses, and refinance dynamics with a few simple columns. Ask around any real estate investor forum, and they’ll tell you these options outshine those wallet-draining apps like REI Network or Property Evaluator, which slap you with a $50-100 monthly fee for bells and whistles you’ll never use.

Memphis Duplex Deal That Delivered Strong Returns

Picture this: a savvy Memphis investor snags a duplex for $85,000, throws in $25,000 for some slick kitchen updates, bathroom overhauls, and a fresh paint job all around. Fast forward – property now appraises at $160,000 and rakes in $2,400 every month from both sides. After refinancing at 75% loan-to-value, our investor extracts $120,000, leaving only $15,000 of personal capital in the game. Annual cash flow ticks up to $3,300 post-expenses – a textbook example of a solid cash-on-cash return. They sidestepped classic missteps, securing three contractor bids with an $8,000 spread (and smartly padded the budget by 15% for those curveballs that always pop up).

Fatal Analysis Mistakes That Kill Deals

Let’s be real: most investors totally scramble their ARV estimates by leaning on outdated comps or dipping from a different neighborhood pool. Keep it tight-sales within a 0.5-mile radius and no older than 90 days, or prepare for warped numbers. Another deal breaker? Underestimating those pesky hold costs during renovation. Budget for mortgage payments, insurance, utilities, and taxes throughout your entire rehab journey. Hard money loans running at 12% interest plus points can slap you with a $2,000-3,000 tab monthly on a $200,000 loan.

The Refinance Timing Trap

Here’s the kicker-thinking you can just waltz into a refinance right after renovation. Most lenders want to see 6-12 months of seasoning before rolling out the red carpet. Plan for longer hold periods that gobble up your returns. This waiting game can force you into a prolonged dance with costly hard money loans, and if your calculations are off… ouch. Say goodbye to those rosy projected returns.

Final Thoughts

So here’s the deal-nailing BRRRR analysis is what makes some investors fat stacks, while others just hemorrhage cash. The 70% rule? Accurate After Repair Value (ARV) calcs? Realistic reno budgets? That’s your bread and butter. Don’t forget to factor in those 6-12 month seasoning periods and the notorious 50% operating expense ratios, or you’re cruising for a bruising.

Your initiation into the BRRRR club begins with some solid market sleuthing. Zoom in on neighborhoods where rental demand is popping and homes are going for 20-30% below market. It’s all about those relationships, folks-get cozy with contractors, hard money lenders, and property managers before you’re in the thick of it (start small, think single-family homes needing just a nip and tuck, not a total overhaul).

Here at Top Wealth Guide, we’ve got your back, steering you through the murky waters of real estate strategy with sharp tools and killer market insights. In BRRRR analysis, numbers are your best buds. Stick to the gold-standard metrics, cushion your budgets for any curveballs, and double-check those comps within a tight 0.5-mile, 90-day window.