Most people think building multiple income sources means working yourself to exhaustion. At Top Wealth Guide, we believe income streams diversification should actually reduce your stress, not add to it.

The truth is that the right approach to creating additional money sources involves smart systems, clear boundaries, and knowing when to say no. This blog post shows you exactly how to build sustainable income without burning out.

In This Guide

Identify Your Starting Point: Skills and Assets You Already Have

The fastest way to start a second income stream is to stop searching for something new and start examining what you already own. Your existing skills, knowledge, and underutilized assets form your foundation. A study by Tom Corley analyzing self-made millionaires found that most built their wealth by monetizing what they already knew rather than learning entirely new fields. If you possess subject expertise in anything-accounting, writing, design, fitness, or teaching-you can convert that into immediate income. The same applies to physical assets sitting idle: a spare bedroom, a parking space, tools in your garage, or your car can generate income with minimal effort.

Start by listing three skills you use regularly at your job and three assets you own but underutilize. Then ask yourself which combination could realistically produce money within 30 days. This exercise takes 15 minutes and often reveals income opportunities you’ve overlooked for years.

Test Demand Before You Commit Time and Money

The second mistake people make is building an income stream nobody wants. Validate demand first by offering your service or product to your immediate network at a low price or for free. If you think you can tutor high school math, offer five free sessions to friends and collect honest feedback on your teaching style, pacing, and whether they’d pay for it. If you want to rent out parking space, post it on a local Facebook group for two weeks at a low rate and track how many inquiries you receive.

This costs almost nothing and takes one to two weeks. Platforms like Airbnb, Turo for car rentals, or TaskRabbit let you test demand in real markets with minimal upfront investment. The data matters: if zero people inquire about your parking space in two weeks, that market doesn’t work. If you get five inquiries in two weeks, you’ve found something worth scaling. This approach prevents you from spending months building a service nobody will pay for.

Align Your Income Stream With Your Actual Life

The most common reason people abandon side hustles is misalignment with their lifestyle. If you have young children and unpredictable free time, a side hustle requiring consistent evening hours will fail. If you hate client communication, freelance service work will drain you. If you live in a rural area, a local service business won’t work.

Instead, match the income stream to your actual constraints. Someone with unpredictable schedules should choose asset-based income like renting parking space or a storage shelf on Poshmark, where the work happens asynchronously. Someone who loves teaching but has limited hours should create one online course on Udemy or Teachable rather than commit to weekly tutoring sessions. Someone in a remote location should skip local services and focus on digital products or affiliate marketing.

The difference between sustainable income and burnout often comes down to this single decision. Choose something that fits your life now, not the life you wish you had. Once you’ve selected your first income stream, the next step involves building systems that actually run without your constant attention-which is where most people fail.

Automating and Systematizing Your Income Streams

The moment you launch a second income stream, the temptation to manage every detail yourself becomes overwhelming. Most people fail not because their income stream is bad, but because they refuse to build systems that operate without their constant supervision. The difference between someone earning $500 a month from a side hustle and someone earning $2,000 from the same type of work almost always comes down to automation and delegation, not harder work or longer hours.

Map Your Tasks and Identify What to Cut

Start with the income stream already producing money. List every single task you perform each month: client communication, invoicing, content uploads, customer service replies, payment processing, inventory checks. Write down how many hours you spend on each task and how much you could pay someone to do it. This exercise typically reveals that 60 to 70 percent of your time goes to tasks worth $10 to $15 per hour, while only 20 to 30 percent goes to activities that actually require your expertise. Your job becomes eliminating the low-value work, not adding more income streams.

If you tutor high school students and spend five hours weekly answering parent emails, scheduling sessions, and processing payments, a virtual assistant could handle this work for $8 to $12 per hour on Upwork or Fiverr. Those same five hours at your tutoring rate ($40 to $60 per hour) could generate $200 to $300 in additional income if freed up. The math forces you to delegate.

Automate the Repetitive Work First

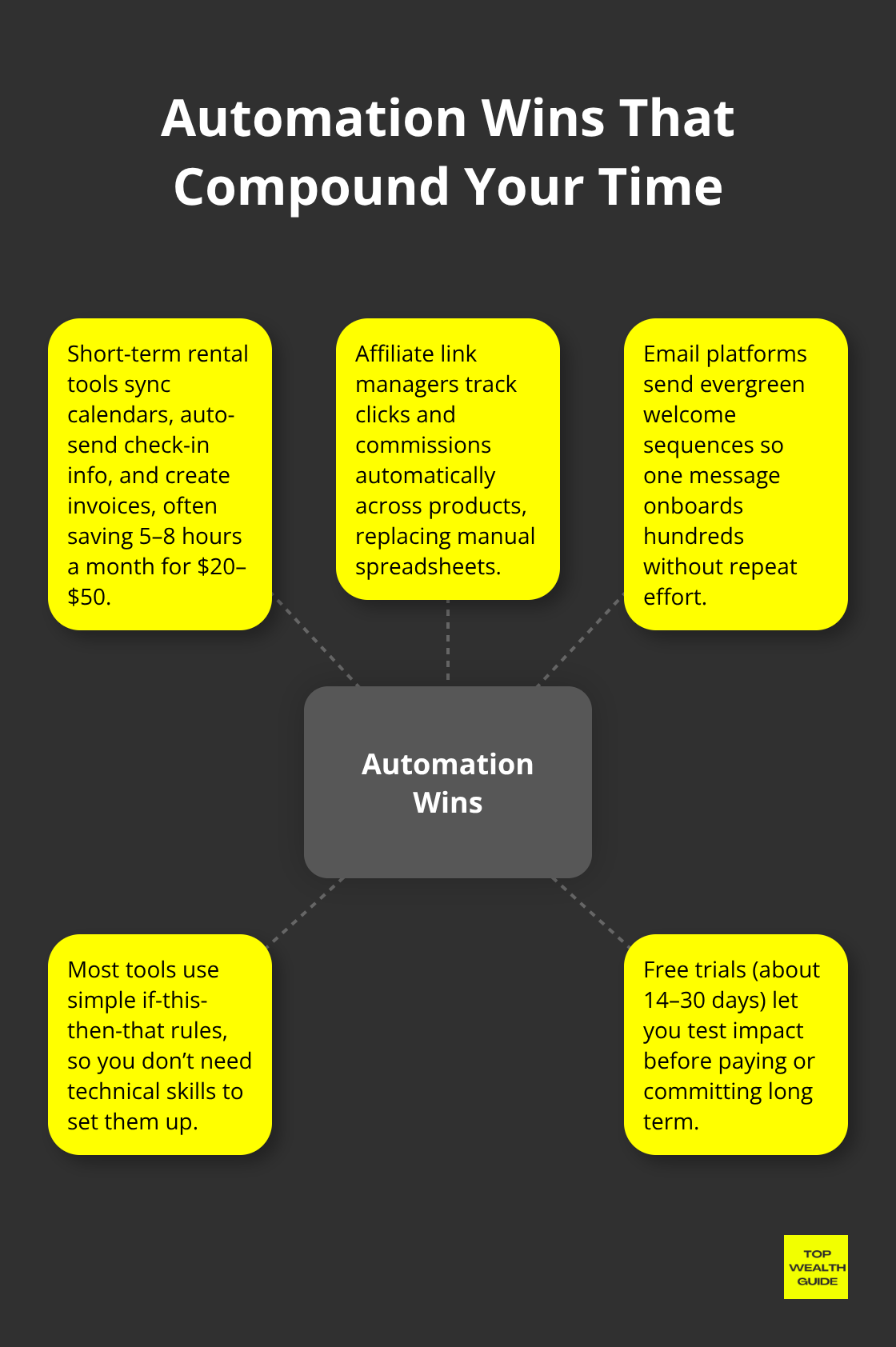

Automation software removes entire categories of tasks without hiring anyone. If you run a rental property on Airbnb or Vrbo, automation tools like Hostaway or Hospitable sync your calendar across platforms, send check-in instructions automatically, and generate invoices without your involvement. The time saved per month: five to eight hours. The cost: $20 to $50 monthly.

Affiliate marketers use tools like LinkTrackr or Pretty Links to automatically track clicks and commissions across multiple products, eliminating spreadsheet work. Email marketing platforms like ConvertKit or Mailchimp automatically send welcome sequences to new subscribers, so you write the email once and it works for hundreds of people without additional effort. These tools don’t require technical skill; they operate through simple if-this-then-that logic. Identify one repetitive task in your income stream right now and search for automation software that handles it. Most platforms offer free trials lasting 14 to 30 days, so you can test before paying.

Outsource Tasks That Drain Your Energy

Delegation differs from automation because it transfers work to another person rather than eliminating it through software. Outsource anything that doesn’t require your unique skill or that someone else can do faster. If you sell digital products on Etsy, you don’t need to handle customer service inquiries yourself. A part-time customer service contractor at $12 to $15 per hour can respond to questions about shipping, sizing, and refunds, leaving you to focus on product design and marketing.

If you run an affiliate marketing blog, you don’t need to write every article yourself. Hiring writers on platforms like Upwork means you can publish three times weekly instead of once, tripling your traffic and income potential without working longer hours. Real estate investors commonly hire property managers at 8 to 12 percent of monthly rental income to handle tenant communication, maintenance requests, and rent collection. The property manager costs $200 to $400 monthly on a $2,500 rental income, but frees you from daily management headaches and often identifies maintenance issues faster than an absent owner would.

Build Systems That Scale Without You

The separation between your time and your income is what actually creates financial security without exhaustion. Once you’ve automated repetitive tasks and delegated energy-draining work, your income stream runs with minimal daily input from you. This foundation matters because it determines whether you can add a third or fourth income stream without collapsing. Someone managing a rental property through a property manager, an affiliate blog with outsourced writers, and a digital course with automated email sequences can handle all three without working more than 10 to 15 hours weekly. Someone trying to manage all three personally would need 40 to 50 hours weekly and would burn out within months. The systems you build now determine your capacity to grow later.

How to Protect Your Energy While Building Multiple Income Streams

The systems you built in the previous section create space for multiple income sources, but space alone doesn’t prevent burnout. The real danger emerges three to six months in when the initial excitement fades and you’re managing three income streams that each demand attention at unpredictable times. This is where most people fail, not because the income streams don’t work, but because they never established boundaries around when work happens. The difference between someone thriving with four income sources and someone collapsing under two comes down to one decision: treating your time like a scarce resource that requires protection, not something to sacrifice whenever income demands it.

Establish Work Windows for Each Income Stream

The first action is to establish specific work windows for each income stream rather than allowing work to bleed into your entire week. If you manage a rental property, a digital course, and freelance writing, assign one day per week to property management tasks, one day to course updates and student emails, and specific hours on three other days to writing projects. Outside these windows, you don’t check email from any of these income sources. A property manager handles urgent tenant issues. Your course platform sends automated emails to students. Your freelance clients know your response time is 24 hours, not 24 minutes.

Research shows that constant task-switching reduces productivity and increases cortisol levels, the stress hormone responsible for burnout. Consolidating work into focused blocks allows you to accomplish more in fewer hours while your nervous system recovers between blocks. Track your actual hours for two weeks in each income stream using a simple spreadsheet or app like Toggl Track. Most people discover they’re spending 15 to 20 hours weekly on income streams they thought took five hours. This awareness forces the difficult conversation: either you’re not delegating enough, you’re not automating enough, or the income stream isn’t worth the time it demands.

Separate Income Streams by Energy Cost, Not Revenue

Separate your income streams by energy cost, not money earned. A rental property that generates $1,500 monthly but demands 12 hours of your attention when tenants have problems costs more energy than an affiliate marketing site generating $800 monthly with three hours of work. Many people optimize for income and ignore energy, which guarantees eventual collapse.

Spend one week documenting not just hours spent but your emotional state during each income stream activity. Note whether tasks leave you energized, neutral, or drained. Delegate or automate everything in the drained category first. If customer service emails drain you, hire someone immediately, even if it costs $300 monthly. That $300 is an investment in your sustainability, not an expense. If you dread updating your course content every month, either record video lessons once and reuse them for two years, or sell the course and redirect that income stream entirely.

Conduct Monthly Reviews to Prevent Collapse

Schedule a two-hour monthly review on the same day each month where you assess each income stream’s performance and your energy levels. During this session, calculate revenue per hour for each stream, note which tasks consistently get delayed or avoided, and identify which income sources actually align with your current life situation. People’s circumstances change.

A side hustle perfectly suited to your schedule six months ago might no longer work if you changed jobs or your family situation shifted. The monthly reset gives you permission to pause underperforming or energy-draining income streams without guilt.

If a $400-monthly income stream requires 15 hours of work and leaves you exhausted, pausing it for three months while you focus on higher-return activities isn’t failure. It’s strategic. Research on sustainable productivity from periodic rest shows that people who periodically rest specific projects maintain higher output across their remaining work than those who push through fatigue. Establish a rule: if an income stream hasn’t generated profit in 90 days or consistently drains more energy than its income justifies, you pause it, not abandon it. You can restart it later when circumstances change.

Final Thoughts

Income streams diversification only works when you build it sustainably. Most people fail not because their income sources are bad, but because they refuse to systematize their work or establish boundaries around when work happens. The monthly review habit matters most-track revenue per hour for each stream, note which tasks consistently get delayed, and give yourself permission to pause income sources that no longer fit your life.

Your next step is simple: list three skills you use regularly and three assets you own but underutilize, then pick one combination that could realistically produce money within 30 days. Test it in your network for two weeks, then build one automation or delegation system before you add a second income stream. The goal isn’t to work harder; it’s to build income that works for you, and Top Wealth Guide provides step-by-step frameworks and practical tools to help you implement these strategies without guesswork.