Before you can figure out how to calculate rental yields, you need to grasp the fundamental concept. At its core, rental yield is a simple yet powerful metric that compares the annual rental income a property generates to its total cost. This percentage gives you a quick, at-a-glance snapshot of an investment's earning power, allowing you to compare different opportunities on a level playing field.

In This Guide

- 1 Why Rental Yield Is a Critical Investment Metric

- 2 Gross Rental Yield: Your First Quick Check

- 3 Calculating Net Rental Yield: What You Actually Pocket

- 4 What’s a Good Rental Yield in Your Market?

- 5 Common Mistakes When Calculating Rental Yields

- 6 Using Rental Yield in Your Investment Strategy

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How often should I recalculate my rental yield?

- 7.2 2. Is my mortgage payment included in the net rental yield calculation?

- 7.3 3. What is the difference between rental yield and cap rate?

- 7.4 4. Can a property with a negative net yield still be a good investment?

- 7.5 5. How can I accurately estimate expenses for a new property?

- 7.6 6. Is a higher rental yield always better?

- 7.7 7. What are the best tools for calculating rental yield?

- 7.8 8. Does a short-term rental (like Airbnb) change the yield calculation?

- 7.9 9. Is there a difference in calculating yield for commercial versus residential properties?

- 7.10 10. How much do property management fees impact net yield?

Why Rental Yield Is a Critical Investment Metric

So, why do experienced investors obsess over this number? Think of rental yield as a key vital sign for your property's financial health. It shows you the annual return you're making from rent alone, measured against the property's value.

Getting a handle on this percentage helps you make much smarter decisions with your money. It's a universal yardstick that lets you compare wildly different properties on an even playing field. You can use it to see if that downtown condo actually performs better than a suburban duplex, cutting right through the marketing hype to see which one truly delivers.

Yield Isn't the Whole Story: Understanding Total Return

It’s easy to get rental yield mixed up with your total Return on Investment (ROI), but they're two very different things. Knowing the difference is key to seeing the full picture of your investment's performance.

- Rental Yield: This is all about cash flow. It zeroes in only on the income you make from rent.

- Total ROI: This is the big-picture number. It includes your rental income plus any change in the property's value over time, whether that's appreciation or depreciation.

Let's say you bought a property for $200,000, and it's bringing in $18,000 in rent per year. That gives you a gross yield of 9%. This simple math provides a solid baseline for judging a property's potential, a concept you'll see emphasized in in-depth market reports like Cushman & Wakefield's analysis on the DNA of real estate.

Ultimately, if you're asking yourself is real estate a good investment, mastering rental yield is your first step. It gives you the hard data you need to start building a truly profitable portfolio.

Gross Rental Yield: Your First Quick Check

Think of gross rental yield as your first, back-of-the-napkin calculation. It's the number most investors crunch right away because it gives you a quick, clean look at a property's income potential before all the messy operating costs get involved.

Honestly, it’s the simplest way to get a feel for how hard your money might work for you.

The formula itself is as straightforward as it gets:

(Annual Rental Income / Total Property Cost) x 100 = Gross Rental Yield %

This quick bit of math spits out a percentage, showing you the raw return from rent alone. Naturally, a higher percentage looks better on paper and suggests stronger potential cash flow.

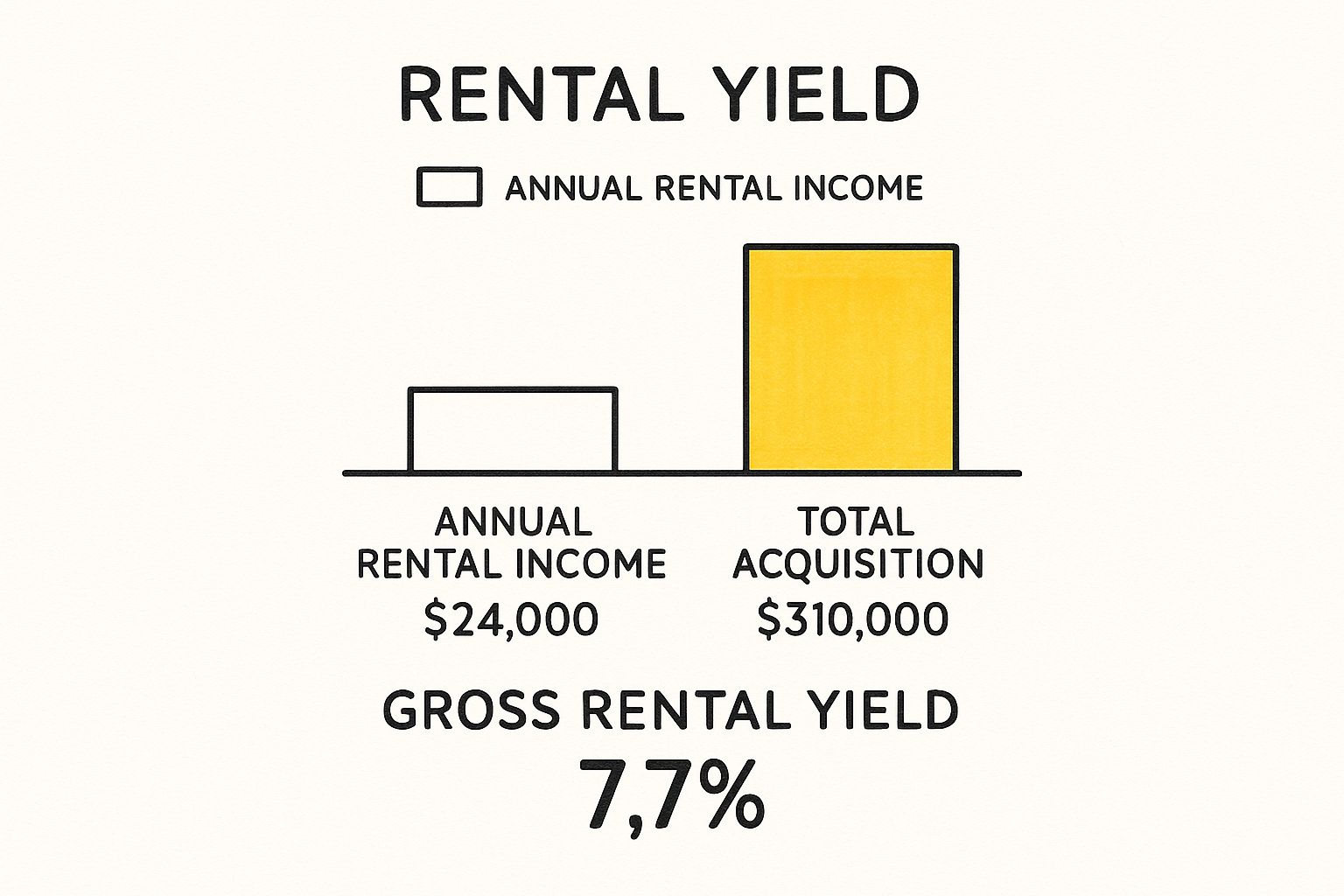

Let’s Run the Numbers: A Real-Life Example

Okay, let's put this into practice. Imagine you've found a two-bedroom condo you're thinking of buying as a rental.

- Purchase Price: $300,000

- Closing Costs & Minor Fixes: $10,000

- Expected Monthly Rent: $2,100

First things first, let's figure out your Total Property Cost. I see new investors make this mistake all the time—they only look at the purchase price. Trust me, you have to include all your upfront costs, or you'll get a misleadingly high yield that will only lead to disappointment later.

- Total Property Cost = $300,000 (Price) + $10,000 (Closing Costs, etc.) = $310,000

Next, what's your Annual Rental Income? Easy enough.

- Annual Rental Income = $2,100 (Monthly Rent) x 12 = $25,200

Now, just plug those numbers into the formula:

- ($25,200 / $310,000) x 100 = 8.13%

So, the gross rental yield for this condo is 8.13%.

This is a great starting point for comparing this property against others you might be considering. It’s a solid initial metric, but remember, this is just the beginning of the story. It doesn't tell you anything about the ongoing expenses you'll have to cover.

If you want to play with the numbers and see how different scenarios pan out, using a good real estate investment calculator can be a huge help.

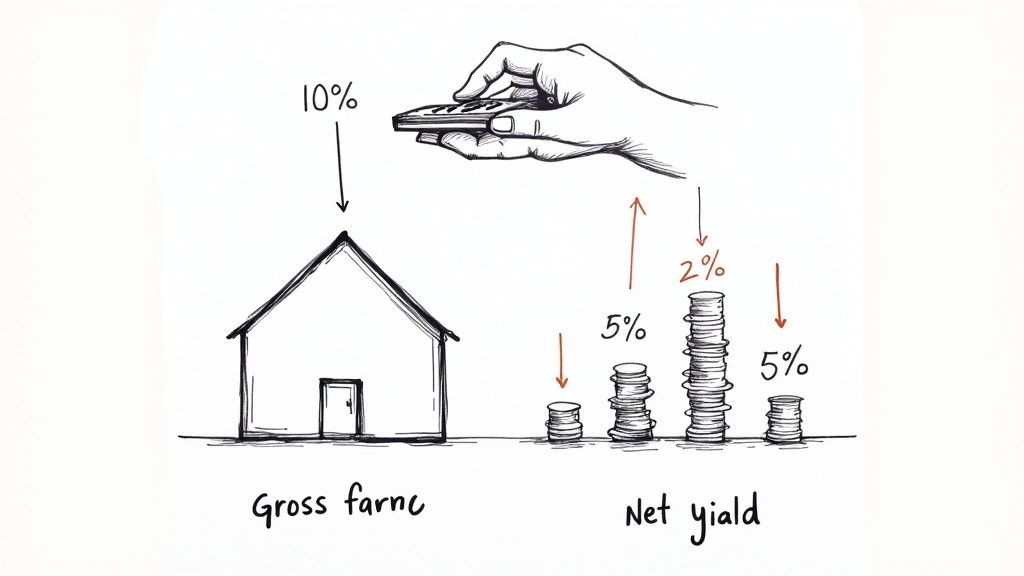

Calculating Net Rental Yield: What You Actually Pocket

Gross yield is a great starting point—a quick-and-dirty number to see if a property is even in the ballpark. But it's only half the story. If you want to understand what a property really earns you, you need to calculate the net rental yield. This is the number that shows your true cash flow after you’ve paid all the bills.

This calculation is what separates the pros from the amateurs. It forces you to get honest about the real costs of owning and maintaining a rental property, moving beyond just the rent check you collect each month.

The infographic below shows the simple calculation for gross yield we talked about earlier. It gives us a nice, optimistic figure to begin with.

Now, let's peel back the layers and subtract the operating expenses to find out what you’re actually left with.

Tallying Up Your Annual Operating Expenses

To get to your net yield, the first thing you have to do is add up all the annual costs of keeping the property running (excluding your mortgage payment). These expenses can sneak up on you if you don't plan for them.

Here are the usual suspects you'll need to account for:

- Property Taxes: A non-negotiable annual expense set by your local government.

- Landlord Insurance: This is crucial. It’s different from a standard homeowner’s policy and is designed to protect you as the owner of a rental.

- Maintenance & Repairs: Things break. A good rule of thumb is to budget 1% of the property’s value each year for upkeep. On a $300,000 condo, that’s $3,000 a year you should have set aside.

- Property Management Fees: If you’re not managing it yourself, expect to pay a pro anywhere from 8-12% of the monthly rent.

- HOA or Condo Fees: Common in condos and some neighborhoods, these fees cover shared amenities and maintenance.

- Vacancy Costs: Your property won't be occupied 100% of the time. I always recommend budgeting for at least one month of vacancy, which means setting aside 5-10% of the annual rent.

Remember, many of these costs can work in your favor come tax time. To get the full picture, I highly recommend reading our guide on property investment tax deductions. It can make a huge difference to your final return.

The single biggest mistake I see new investors make is underestimating their operating expenses. If you budget for vacancies and maintenance from day one, you protect your cash flow from those inevitable surprise costs.

Gross Yield vs. Net Yield: A Real-Life Comparison

Let's stick with the same condo example to see just how much these expenses impact the numbers. It’s a real eye-opener.

Here is a side-by-side comparison that shows exactly why experienced investors live and die by the net yield figure.

| Metric | Gross Yield Calculation | Net Yield Calculation |

|---|---|---|

| Annual Rent | $25,200 | $25,200 |

| Annual Expenses | Not Included | -$8,660* |

| Net Income | N/A | $16,540 |

| Total Property Cost | $310,000 | $310,000 |

| Final Yield | 8.13% | 5.34% |

*Annual Expenses Breakdown: $3,600 (Taxes) + $1,200 (Insurance) + $2,600 (HOA) + $1,260 (Vacancy @ 5%) = $8,660

See the difference? That optimistic 8.13% gross yield quickly becomes a much more realistic 5.34% net yield once the real costs are factored in. This is the number that tells you whether the investment is truly working for you.

What’s a Good Rental Yield in Your Market?

So, you've crunched the numbers and have your rental yield. The big question now is, "Is this a good return?" The truth is, there’s no magic number. What’s considered a fantastic yield in one city might be a total flop in another. It all comes down to your specific market, the type of property you own, and what you’re trying to achieve as an investor.

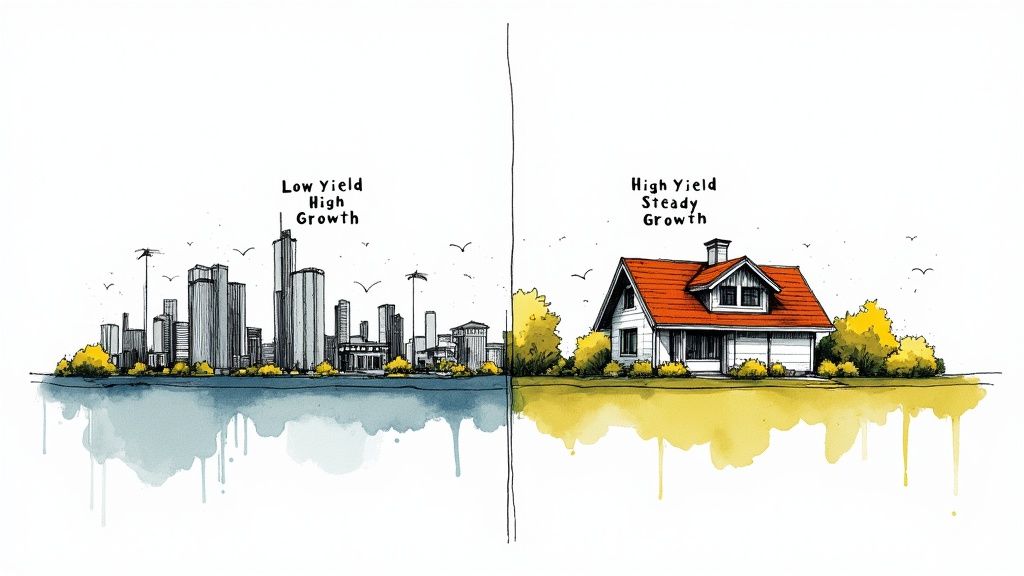

Think of it this way: a slick condo in a booming tech hub might only pull a net yield of 3-4%. Investors in that market are playing the long game, banking on the property's value skyrocketing over time rather than focusing on immediate cash in their pocket.

On the flip side, you could have a duplex in a quiet Midwestern suburb generating a solid 7-9% net yield. Here, the strategy is all about strong, predictable cash flow every month, even if the property's value only creeps up slowly. Getting your head around this cash flow versus appreciation trade-off is key to setting realistic goals.

It's All About Market Dynamics

You can't evaluate a yield in a vacuum. Broader economic trends have a huge impact on what you can expect. For instance, rental prices went on a rollercoaster ride in many areas between 2019 and 2023 due to inflation and market shifts. If rents are climbing but property prices are holding steady, your yield can get a nice boost. You can explore more data on rental housing trends to get a feel for these forces.

To give you a rough idea of where your numbers might fall, here’s a general guide:

| Net Rental Yield | What It Usually Means | Investor's Main Focus |

|---|---|---|

| 3-5% | Typical for hot urban markets with high appreciation potential. | Building long-term equity. |

| 5-8% | A great, balanced return in many stable, healthy markets. | A good mix of monthly income and growth. |

| 8%+ | An outstanding yield, often found in cash-flow-first markets. | Maximizing immediate, consistent income. |

Ultimately, the "right" yield is the one that aligns with your personal investment strategy. If you're wondering if this approach to building wealth is still viable, our deep dive into whether real estate investing is still profitable is a must-read.

Common Mistakes When Calculating Rental Yields

The math for rental yield seems straightforward, but where investors really get into trouble is with the assumptions they make. I’ve seen it happen time and again: a new investor gets excited by a high gross yield, only to realize later that they overlooked crucial details that torpedo their actual profits.

Spotting these common pitfalls is the key to figuring out how to calculate rental yields that reflect reality.

One of the biggest blunders right out of the gate is only using the property's sticker price for your calculation. People forget that the total acquisition cost includes a lot more than just the sale price. You've got closing costs, inspection fees, and any immediate repairs needed just to get the place rent-ready. Ignoring these inflates your yield on paper, creating a false sense of security from day one.

Overlooking The Real Costs Of Ownership

Another trap is getting too optimistic about your ongoing expenses. To get a truly accurate net yield, you have to be brutally honest about what it really costs to be a landlord.

Here are a few of the most common miscalculations I see:

- Underestimating Maintenance: People often quote the "1% rule," which suggests budgeting 1% of the property’s value for annual maintenance. That’s a decent starting point, but for an older home or a property in a place with harsh winters, you should be setting aside closer to 2-3%. A new roof can easily erase years of profit if you haven't planned for it.

- Forgetting Vacancy: Assuming you'll have a tenant paying rent 100% of the time is a rookie mistake. It just doesn't happen. A safer bet is to budget for at least one month of vacancy each year, which is about 8.3% of your annual rent. This buffer protects your cash flow when you're searching for a new tenant.

- Ignoring Capital Expenditures (CapEx): These are the big-ticket items that don't happen often but hit hard when they do—things like replacing all the windows or repaving a driveway. You absolutely have to set aside a separate chunk of cash every month specifically for these future costs.

A rental property is a business, plain and simple. If you're not accounting for every single cost—from property management fees to landscaping—you're working with a fantasy number, not a real investment metric.

Getting these numbers wrong can mean the difference between a successful investment and a serious financial headache. Before you even think about making an offer, it’s a good idea to run the numbers through an investment property loan calculator to get a clearer picture of all the potential costs you'll be facing.

Using Rental Yield in Your Investment Strategy

Knowing your rental yield is a great start, but it's really just one piece of the puzzle. An experienced investor knows that yield tells you about cash flow today, but it doesn't give you the full story of a property's potential.

Think of rental yield as your cash flow engine. It’s the immediate, tangible income your property brings in relative to what you paid for it. To make smart, well-rounded decisions, though, you have to look at how that engine fits into the entire financial vehicle.

Balancing Cash Flow and Long-Term Growth

Every property investment strikes a balance between making money now (cash flow) and making money later (appreciation). The right balance for you really depends on your personal financial goals.

- Cash-on-Cash Return: If you financed your property, this metric is your best friend. It measures your annual pre-tax cash flow against the actual cash you put in—your down payment and closing costs. This shows you the true return on the money that left your pocket.

- Total ROI: This is the big one. Total ROI combines your net rental income for the year with the property's appreciation in value. It gives you a complete, 360-degree view of how your investment performed.

The classic debate among investors is whether to chase high-yield properties for immediate income or bet on high-growth areas for future appreciation. Honestly, the most durable portfolios I've seen manage to do a bit of both.

It's also crucial to see how real estate stacks up against other options. In the UAE, for example, residential property appreciation has averaged around 1.82% annually over the last two decades. When you add in typical rental yields, total returns often land in the 7-10% range. That's solid, but it's worth noting that the S&P 500 has often delivered a higher total return during that same period. You can find more insights on real estate vs. stock performance to see the numbers for yourself.

At the end of the day, rental yield is an essential tool for sizing up a deal. Just make sure it’s informing your strategy, not dictating it.

Frequently Asked Questions (FAQ)

1. How often should I recalculate my rental yield?

You should recalculate your net rental yield at least once a year. Think of it as an annual financial check-up for your property. Expenses like taxes and insurance can change, and reviewing your numbers annually helps you understand your property's true performance and make informed decisions, like whether to adjust the rent.

2. Is my mortgage payment included in the net rental yield calculation?

No, mortgage payments (both principal and interest) are not included when calculating net rental yield. Yield is designed to measure the property's performance independent of financing. However, your mortgage is a crucial component of other important metrics, particularly your cash-on-cash return, which measures the return on your actual invested cash.

3. What is the difference between rental yield and cap rate?

While often used interchangeably, they measure different things. Rental yield calculates your return based on your total purchase price, making it a personal metric for your investment. Cap rate (Capitalization Rate) calculates the return based on the property's current market value. Essentially, yield tells you the return on your original cost, while cap rate tells you the return if you bought the property today.

4. Can a property with a negative net yield still be a good investment?

It's possible, but it’s a high-risk strategy focused on appreciation. In very hot markets, some investors are willing to accept a small monthly loss (negative cash flow) because they anticipate the property's value will increase significantly, providing a large return when they sell. This approach prioritizes long-term growth over immediate income.

5. How can I accurately estimate expenses for a new property?

Don't guess. For property taxes, look up public records for the property or similar ones in the area. Get insurance quotes from multiple providers. For maintenance and repairs, the "1% rule" (budgeting 1% of the property value annually) is a start, but be more conservative (2-3%) for older properties. For vacancy, a common rule of thumb is to budget for one month's rent per year (an 8.3% vacancy rate).

6. Is a higher rental yield always better?

Not necessarily. An unusually high yield can be a red flag for a property in a high-crime area, one with significant deferred maintenance, or a market with declining property values. A moderate, stable yield in a strong location with good appreciation potential is often a safer and more profitable long-term investment.

7. What are the best tools for calculating rental yield?

While many online real estate investment calculators are available, a simple spreadsheet in a program like Microsoft Excel or Google Sheets is one of the most powerful tools. It allows you to create a template, customize it for your specific needs, and easily compare multiple properties side-by-side.

8. Does a short-term rental (like Airbnb) change the yield calculation?

The formula remains the same, but the inputs become more volatile. Short-term rentals often generate higher gross income but also incur significantly higher operating costs, including higher management fees (20-30%), cleaning fees, utilities (which you typically cover), and more frequent maintenance. Accurately tracking these variable expenses is critical to determining a true net yield.

9. Is there a difference in calculating yield for commercial versus residential properties?

The basic formula is the same, but the expense structure can be very different. Many commercial leases are "triple net" (NNN), where the tenant is responsible for paying property taxes, insurance, and maintenance. This can lead to a more predictable and lower-effort income stream for the landlord compared to a typical residential property where the owner covers these costs.

10. How much do property management fees impact net yield?

Property management fees have a direct and significant impact on your net yield. Typically ranging from 8% to 12% of the monthly collected rent, this is one of the largest operating expenses. For a property renting at $2,100/month, a 10% fee amounts to $2,520 per year. This cost directly reduces your net operating income, and therefore your net yield, but can be well worth it for the time and hassle it saves.

Ready to put these insights into action and take control of your financial future? At Top Wealth Guide, we provide the strategies and tools you need to make smarter investment decisions. Explore our resources and start building your wealth today at https://topwealthguide.com.

1 Comment

Pingback: How to Buy Your First Rental Property in 6 Steps