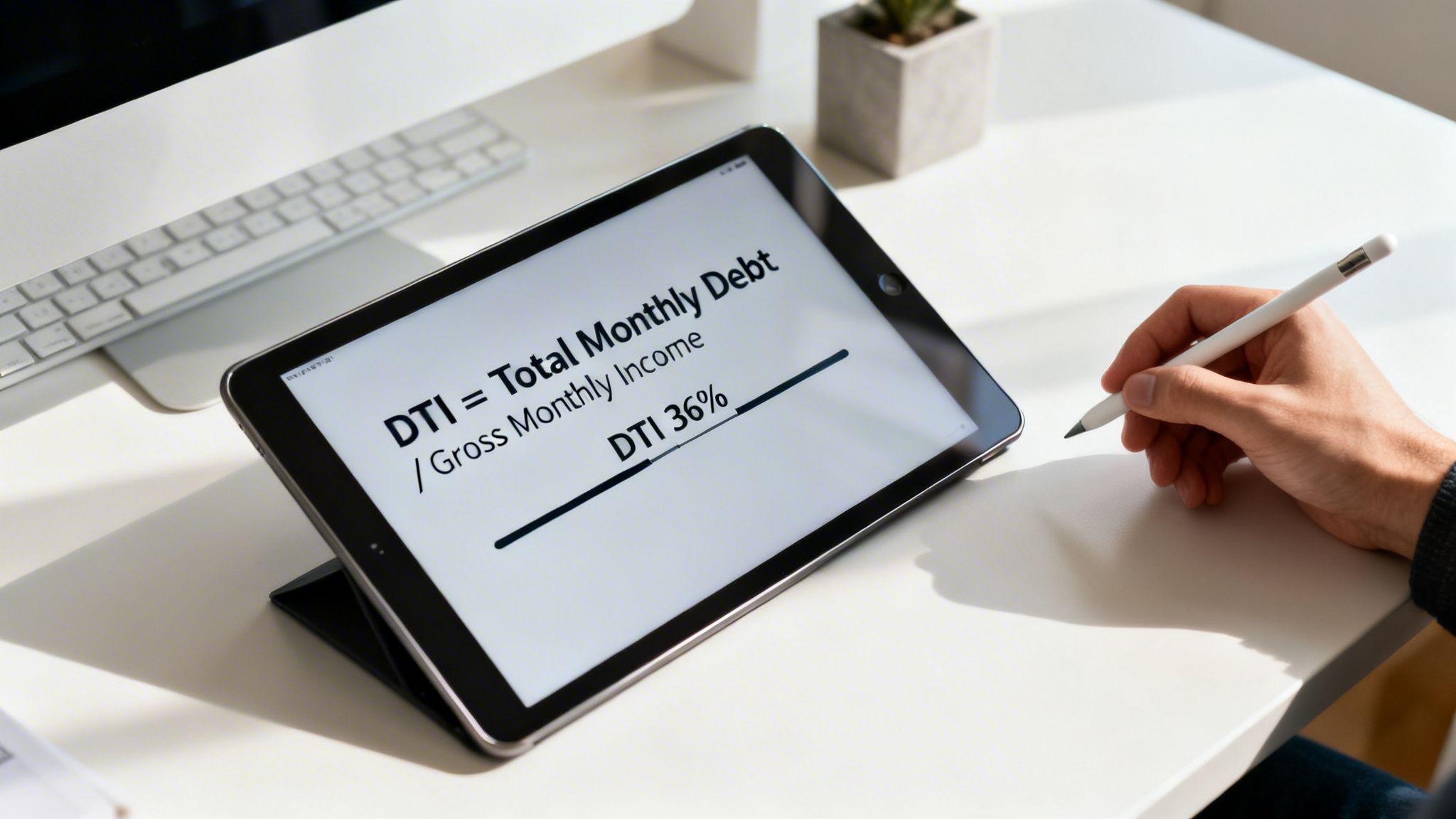

To calculate your debt-to-income ratio, you simply divide your total monthly debt payments by your gross monthly income. This percentage serves as a quick snapshot of your financial health for lenders. Most lenders prefer a ratio below 36% before extending new credit, and understanding this calculation is a foundational step toward building genuine wealth.

In This Guide

- 1 Your Financial X-Ray: Why Your DTI Ratio Matters

- 2 Getting the Right Numbers for Your DTI Calculation

- 3 Seeing DTI in Action: Real-World Scenarios

- 4 What Your DTI Ratio Really Tells Lenders (and You)

- 5 What to Do If Your DTI Is Too High

- 6 Frequently Asked Questions About DTI Ratios

- 6.1 1. Does DTI Affect My Credit Score?

- 6.2 2. Should I Use My Take-Home Pay or My Full Salary?

- 6.3 3. How Do Lenders Handle My Unpredictable Income?

- 6.4 4. Are My Day-to-Day Living Expenses Part of DTI?

- 6.5 5. What Happens if I Co-signed a Loan for Someone?

- 6.6 6. Do My Deferred Student Loans Count?

- 6.7 7. Can a Great DTI Make Up for a Bad Credit Score?

- 6.8 8. Does My Rent Payment Count Toward My DTI?

- 6.9 9. How Often Should I Calculate My DTI?

- 6.10 10. Can I Exclude a Debt I'm About to Pay Off?

Your Financial X-Ray: Why Your DTI Ratio Matters

Think of your Debt-to-Income (DTI) ratio as a financial check-up. It's one of the first numbers a lender examines to gauge your ability to handle monthly payments and repay a loan. This single percentage can significantly influence your chances of getting a mortgage or determine the interest rate you'll secure on a car loan.

Knowing your DTI is a crucial part of responsible financial management. For instance, if your total monthly debts amount to $2,000 and your gross monthly income is $8,000, your DTI is a very healthy 25% ($2,000 ÷ $8,000 = 0.25).

Historically, the DTI ratio gained prominence as a key lending metric after the 2008 financial crisis, when lax credit standards contributed to widespread economic instability. It became a critical health indicator for both financial institutions and borrowers.

A low DTI demonstrates to lenders that you maintain a healthy balance between your earnings and your obligations. It signals that your finances are not overextended, and you can comfortably manage an additional loan payment.

Key Takeaway: Your DTI is more than just a figure on a loan application—it's a direct measure of your financial flexibility. A lower ratio frees up income for saving, investing, and seizing opportunities as they arise.

DTI At a Glance: What Lenders Look For

To provide a clearer picture of where you might stand, here’s a breakdown of how lenders typically interpret different DTI ratios. Understanding these thresholds is a key aspect of improving your financial literacy and can help you strategize for your next major financial decision.

| DTI Ratio | Lender Perception | Investment Potential |

|---|---|---|

| 36% or Less | Ideal. You are viewed as a low-risk borrower, making you eligible for the most favorable loan terms and interest rates. | High. You have substantial capacity to take on new debt for investments, such as rental properties. |

| 37% to 43% | Acceptable. You will likely be approved, but you may face higher interest rates or more stringent loan conditions. | Moderate. Lenders will proceed with caution. A larger down payment or significant cash reserves may be required. |

| 44% to 50% | High-Risk. Approval becomes challenging. Lenders might require a co-signer or could deny the application outright. | Low. Most conventional investment loans will be inaccessible until you improve your ratio. |

| Over 50% | Very High-Risk. Loan approval is highly improbable from most traditional lenders. | Very Low. Your primary focus should be on debt reduction before considering any new leveraged investments. |

Ultimately, a strong DTI ratio opens doors, providing more options and better terms when you decide to borrow.

Getting the Right Numbers for Your DTI Calculation

An accurate debt-to-income ratio is only as good as the numbers you plug into it. Before you even think about the math, you have to get a handle on what lenders actually consider "debt" and what they see as your real gross monthly income.

Getting this part right isn't just a box-ticking exercise for a loan application; it’s about getting an unvarnished look at your own financial health.

What Counts as Debt?

When a lender talks about debt, they’re specifically looking at your recurring, contractual monthly payments—the ones that show up on your credit report.

This is a crucial distinction. Your DTI calculation doesn't care about your grocery bill, how much you spend on gas, or your electricity costs. Those are essential budget items, of course, but they aren't considered debt in this context. If you're looking to get a better grip on those daily expenses, our guide on budgeting for financial freedom is a great place to start.

Here’s what lenders are adding up for your monthly debt total:

- Housing Payments: Your full PITI (principal, interest, taxes, and insurance) for a mortgage, or your monthly rent.

- Car Loans: The required monthly payment on any auto loan.

- Student Loans: The minimum monthly payment, even if the loan is currently in deferment or forbearance.

- Credit Card Minimums: Lenders use the minimum payment due, not your total balance.

- Personal Loans: Any fixed monthly payments for installment loans.

- Court-Ordered Payments: Things like alimony and child support are always included.

A Quick Word of Warning: A common mistake I see is people assuming a deferred student loan won't count against them. Lenders absolutely count it. If there's no official payment on your credit report, they'll often estimate one, typically using 1% of your total loan balance as the monthly figure.

Nailing Down Your Gross Monthly Income

Your gross monthly income is your total pay before a single penny is taken out for taxes, health insurance, or retirement contributions. Think of it as the top-line number on your pay stub, not the net amount that actually lands in your checking account.

For salaried folks, this is pretty simple. For everyone else, it takes a little more digging.

How Different Income Types Are Treated

| Income Type | How Lenders Calculate It | Common Pitfalls to Avoid |

|---|---|---|

| Salaried (W-2 Employee) | Your annual salary divided by 12. Simple as that. | Using your take-home (net) pay instead of your gross pay. It’s an easy mistake that will throw off your numbers. |

| Self-Employed / Freelancer | They'll typically average your net income from the last 24 months of tax returns, then divide by 12. | Not having two years of consistent, documented income. A single great year usually isn't enough. |

| Rental Income | They look at your net rental income (rent collected minus PITI and other expenses) as documented on your tax returns. | Forgetting to subtract property taxes, insurance, and maintenance costs from the total rent you collect. |

Front-End vs. Back-End DTI: What’s the Difference?

You'll often hear lenders talk about two types of DTI, and it's good to know what they mean.

Front-End DTI (The Housing Ratio): This one is simple. It only looks at your proposed monthly housing payment (PITI) against your gross monthly income. It's a quick gut-check on how affordable a specific property is for you.

Back-End DTI (The "Real" DTI): This is the big one. It takes your housing payment plus all those other debts we listed—car loans, student loans, credit cards—and measures them against your income.

While both are useful, nearly every lender will focus on your back-end DTI as the true measure of your ability to take on new debt. It gives them the complete picture of your financial obligations.

Seeing DTI in Action: Real-World Scenarios

The theory behind DTI is simple, but it really clicks when you see it applied to real-life financial situations. Let's walk through a few different examples to see how income, debt, and financial goals all play a role in the final number.

Scenario 1: The Salaried Employee Eyeing an Investment Property

Meet Alex. Alex is a software engineer bringing in a steady $120,000 a year, which works out to a gross monthly income of $10,000. They're ready to jump into real estate investing by purchasing their first rental property and need to know where they stand.

First, let's get a handle on Alex's current monthly debt obligations:

- Primary Mortgage (PITI): $2,200

- Car Loan: $450

- Student Loan (minimum payment): $350

- Credit Card (minimum payments): $100

- Total Existing Monthly Debt: $3,100

The new rental property they're looking at comes with an estimated monthly PITI of $1,800.

Front-End DTI (The New House Payment)

For this calculation, the lender is just looking at the new housing payment against Alex's income.

- ($1,800 New PITI) / ($10,000 Gross Income) = 18%

An 18% front-end ratio looks fantastic. It tells a lender that the new property payment, on its own, is very manageable for Alex.

Back-End DTI (The Big Picture)

Now for the number that lenders really care about. This one lumps all of Alex's debts together, including the proposed mortgage on the rental.

- ($3,100 Existing Debt + $1,800 New PITI) / ($10,000 Gross Income)

- Which is: $4,900 / $10,000 = 49%

A back-end DTI of 49% is getting into the red zone. While not an automatic "no," it's high enough to make many lenders nervous, especially for an investment property. To get approved, Alex might need to bring a larger down payment to the table, pay off an existing loan to lower the ratio, or maybe even look for a less expensive rental to get that DTI under the more comfortable 43% threshold.

Scenario 2: The Freelancer Seeking a Personal Loan

Next up is Maria, a freelance graphic designer who wants a personal loan to build a proper home office. Because her income isn't a fixed salary, lenders will need to average her earnings, usually over the past two years, to establish a reliable gross monthly income.

Looking at her tax returns, Maria earned $72,000 last year and $84,000 the year before. A lender will average this out: ($72,000 + $84,000) / 2 = $78,000 annually. For her DTI calculation, that gives her a gross monthly income of $6,500.

This simple infographic breaks down the two core parts of every DTI calculation.

Nailing down your recurring debts and your true gross income is the key to getting an accurate DTI figure.

Here’s what Maria’s current monthly debts look like:

- Rent: $1,500

- Car Lease: $300

- Credit Card Minimums: $250

- Total Monthly Debt: $2,050

Putting It All Together

- $2,050 (Total Debt) / $6,500 (Gross Income) = 31.5%

With a DTI of just 31.5%, Maria is in great shape. Lenders will see her as a low-risk borrower with plenty of breathing room in her budget to comfortably take on a new loan payment.

Scenario 3: The Seasoned Real Estate Investor

Finally, let's look at David, a professional real estate investor with several properties. His DTI calculation is a bit more involved because he's juggling multiple streams of income and debt.

David has a W-2 job that pays $8,000 per month. He also owns three rental properties that bring in $7,500 in total gross rent. Most lenders won't use 100% of that rental income; they typically apply a 75% factor to account for potential vacancies and maintenance costs. So, they'll add $5,625 ($7,500 x 0.75) to his income.

- Total Gross Monthly Income: $8,000 (W-2) + $5,625 (adjusted rentals) = $13,625

His debt picture is also bigger. It includes his primary home plus the mortgages on all three rentals.

- Primary Home PITI: $2,500

- Rental 1 Mortgage: $1,600

- Rental 2 Mortgage: $1,400

- Rental 3 Mortgage: $1,200

- Business Loan: $500

- Total Monthly Debt: $7,200

The Final DTI

- $7,200 (Total Debt) / $13,625 (Total Income) = 52.9%

A 52.9% DTI would be an immediate disqualifier for most conventional loans. But for a pro investor like David, other doors might be open. Lenders may offer him products like DSCR loans, which prioritize the investment property's ability to generate cash flow over the investor's personal DTI. This high ratio is a strong signal that David has probably pushed his conventional borrowing power to its limit for the time being.

What Your DTI Ratio Really Tells Lenders (and You)

Your debt-to-income ratio is one of the most important numbers in your financial life, but it’s often misunderstood. It’s not just some box to check on a loan application; it's a powerful indicator of your financial health and your ability to take on new debt without overextending yourself.

For lenders, it’s a quick-glance risk assessment. For you, it’s a roadmap to financial flexibility.

Getting a handle on how lenders and savvy investors view this ratio is the first step toward getting better loan offers and setting yourself up for financial success. A low DTI doesn't just open doors—it gets you the VIP treatment, complete with lower interest rates and more favorable terms.

The Lender's Playbook: The 28/36 Rule

When you're in the market for a mortgage, you'll hear a lot about the 28/36 rule. Think of it less as a strict law and more as a trusted guideline that most lenders use to gauge whether a borrower is a safe bet.

- The "28" is your front-end ratio. It suggests that your total housing payment—that’s your mortgage principal, interest, taxes, and insurance (PITI)—should ideally be no more than 28% of your gross monthly income.

- The "36" is your back-end ratio. This is the big one. It means your total monthly debt payments, including the new mortgage, car loans, credit cards, and student loans, shouldn't exceed 36% of your gross monthly income.

While some government-backed loan programs might be more lenient, staying within these traditional guardrails makes you look like a prime candidate. At the end of the day, a lower DTI signals lower risk to the bank, and they'll often reward you with a better deal.

This isn't just theoretical. The 2007-2008 financial crisis was a brutal lesson in what happens when lending standards get too loose. In the years that followed, lenders and borrowers both became more cautious, and U.S. household debt service dropped from a high of 13.2% of disposable income down to about 10% by 2012. You can dig into more data on how economic shifts impact lending to see these trends for yourself.

The Investor's Edge: Why DTI is About Opportunity

For a real estate investor or anyone looking to build wealth, DTI is all about agility. A low ratio means you have the financial breathing room to jump on a good opportunity when you see one, whether it’s a fixer-upper property or a dip in the market.

It's simple: when your existing finances are rock-solid, lenders are far more willing to finance your next big move.

Investor Insight: Most seasoned real estate investors I know try to keep their personal back-end DTI well below 36%. This isn't just to make getting the next loan easier; it's a practical strategy to ensure they have enough cash flow to handle a surprise vacancy or a costly repair without breaking a sweat.

How DTI Directly Impacts Your Loan Approval and Terms

Your DTI has a real, tangible effect on the loan offers you receive. A lower ratio makes you a more compelling borrower, which can translate into thousands of dollars saved over the life of a loan through a better interest rate.

The table below breaks down how different DTI levels are typically viewed by lenders and what that might mean for your wallet.

Impact of DTI on Loan Approval and Terms

| DTI Ratio | Approval Likelihood | Potential Interest Rate | Loan Type |

|---|---|---|---|

| Below 36% | Very High | Most Competitive Rates | Conventional Mortgages, Prime Auto Loans |

| 37% – 43% | Good | Standard Rates | FHA Loans, Some Conventional Loans |

| 44% – 50% | Moderate | Higher Rates | Government-Backed Loans, Personal Loans |

| Over 50% | Low | Highest Rates (if approved) | Specialized or High-Risk Loans Only |

As you can see, a DTI under 36% puts you in the sweet spot for the best products and pricing. Once you creep above 43%, your options start to narrow, and the costs go up.

Ultimately, keeping a close watch on your DTI isn't just about getting approved for a loan. It's about securing quality debt on your terms, giving you the power to build a stronger financial future.

What to Do If Your DTI Is Too High

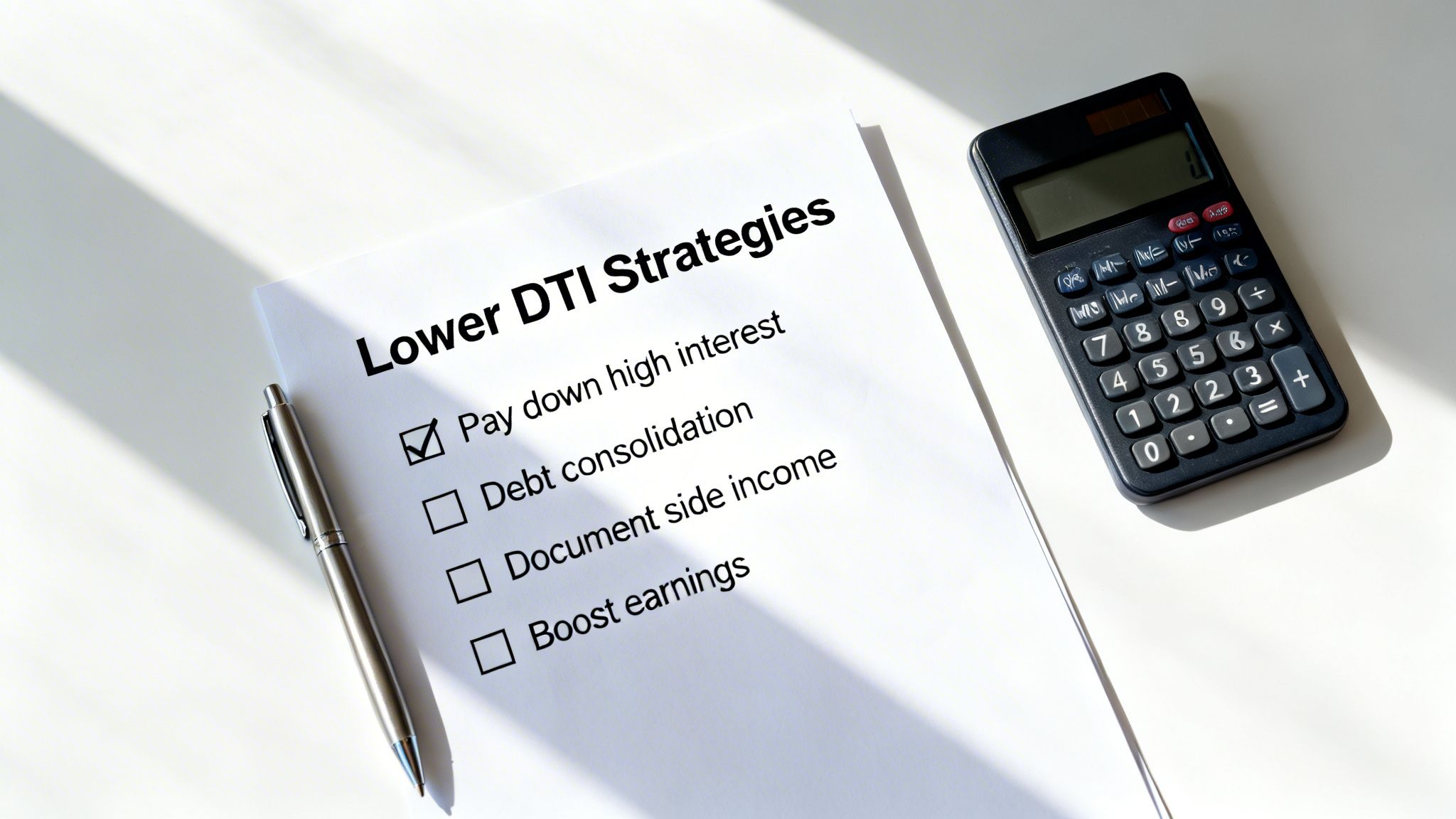

Found out your DTI is a bit on the high side? Don't panic. It's a common situation, and thankfully, it's one you can absolutely fix with a solid game plan. At its core, improving your DTI is about tipping the scales in your favor: either your monthly debt payments go down, or your gross monthly income goes up. The best-case scenario? You tackle both at once.

This isn’t about making huge, painful changes overnight. It’s all about making smart, consistent moves that add up. Over time, these small adjustments will give you more financial breathing room and open up better options when you're ready to borrow.

Attack Your Debt with a Plan

The most straightforward way to nudge your DTI down is to shrink your total monthly debt payments. A focused strategy will always beat making random extra payments here and there.

Pick Your Payoff Method: Two of the most effective strategies are the debt snowball and the debt avalanche. With the snowball method, you pay off your smallest debts first to get some quick motivational wins. The avalanche method, on the other hand, targets your highest-interest debts first, which is the route that saves you the most money in the long run. To see if it's right for you, explore our in-depth guide to the debt snowball method.

Think Carefully About Consolidation: A debt consolidation loan sounds great—roll several high-interest debts into one loan with a single, lower monthly payment. And it can be! But it only works if you secure a genuinely lower interest rate and, critically, you stop the cycle of accumulating new debt.

Get Creative with Your Income

The other half of the DTI equation is your income. You'd be surprised how much even a small, consistent boost to your monthly earnings can improve your ratio.

Document Every Penny: Do you have a side hustle, some freelance gigs, or get regular bonuses? Make sure you have the paperwork to prove it. Lenders won't take your word for it; they need to see a stable history, usually through tax returns or bank statements, before they'll count it toward your income.

Ask for That Raise: It's easy to undervalue yourself, but don't. Do some research on the going rate for your position and build a solid case for a raise at your main job. An extra few thousand dollars a year in salary can make a real difference to your DTI.

Pro Tip: If you're planning to apply for a loan or mortgage anytime soon, think twice before co-signing a loan for someone else. When you co-sign, that entire debt payment gets added to your monthly obligations in the lender's eyes. It can instantly inflate your DTI and put your own application at risk.

It's also interesting to see how DTI plays out on a global scale. A family earning $10,000 a month with $3,000 in debt has a 30% DTI, putting them in a great spot for a mortgage. But in some countries, much higher household debt is the norm.

Frequently Asked Questions About DTI Ratios

Here are answers to the 10 most common questions people have about their debt-to-income ratio.

1. Does DTI Affect My Credit Score?

No, your DTI ratio has zero direct impact on your credit score. Credit bureaus do not know your income, so they cannot calculate it. However, the factors that lead to a high DTI, such as high credit card balances and multiple loans, are the same factors that can lower your credit score. They are two different metrics that often reflect similar financial habits.

2. Should I Use My Take-Home Pay or My Full Salary?

Always use your gross monthly income for the calculation. This is your total earnings before taxes, health insurance, and retirement contributions are deducted. Lenders use this pre-tax figure to maintain a consistent standard for comparing all applicants, regardless of individual tax situations or retirement savings choices.

3. How Do Lenders Handle My Unpredictable Income?

If your income is variable (e.g., from commissions, bonuses, or freelance work), lenders need to see a stable and predictable history. The standard practice is to request two full years of tax returns and average the income over that 24-month period to establish a reliable monthly figure. A single good year or a one-time windfall typically won't be enough.

4. Are My Day-to-Day Living Expenses Part of DTI?

No. Your DTI calculation does not include everyday living costs like utilities, groceries, gas, or entertainment subscriptions. The ratio focuses exclusively on contractual debt obligations that appear on a credit report, such as loans and credit card minimum payments.

5. What Happens if I Co-signed a Loan for Someone?

When you co-sign a loan, lenders will almost always include the entire monthly payment in your debt calculations. It doesn’t matter if the primary borrower has never missed a payment. Legally, you are equally responsible for the debt, so it impacts your DTI as if it were your own.

6. Do My Deferred Student Loans Count?

Yes, absolutely. Even if your student loans are in deferment or forbearance and you are not currently making payments, lenders will not ignore the debt. If your credit report shows a $0 payment, they will estimate a monthly payment, typically calculated as 0.5% to 1% of your total student loan balance.

7. Can a Great DTI Make Up for a Bad Credit Score?

A fantastic DTI is a significant advantage, but it cannot completely offset a poor credit score. Lenders evaluate both DTI and credit history to get a comprehensive view of your financial health. A strong DTI might help you get approved with a lower credit score, but you should expect to pay a higher interest rate to compensate for the lender's increased risk.

8. Does My Rent Payment Count Toward My DTI?

It depends on the type of credit you are applying for. If you are applying for a non-mortgage loan (like a car loan or credit card), your current rent payment is included as a monthly debt. However, if you are applying for a mortgage to buy a home, the lender will replace your rent payment with the proposed new mortgage payment (PITI) when calculating your back-end DTI.

9. How Often Should I Calculate My DTI?

Checking your DTI once a year is a good financial health practice. More importantly, you should always calculate it before making any major financial decisions, such as buying a house or a car. This provides a realistic understanding of what you can comfortably afford and helps you set appropriate financial goals.

10. Can I Exclude a Debt I'm About to Pay Off?

Generally, no. If a debt obligation exists at the time of your application, it must be included in your DTI calculation. The exception is if you can provide concrete proof that the loan will be fully paid off within the next month or two. Some lenders may be willing to exclude it with proper documentation, but this is not guaranteed.

When it comes to paying down debt, making smart, strategic moves can make all the difference. To explore one such strategy, you might find our analysis on whether you should sell stocks to pay off debt helpful in seeing if it fits your personal financial plan.

At Top Wealth Guide, our mission is to provide you with the clear, actionable financial knowledge you need to build a secure future. We break down complex topics into easy-to-understand guides to help you make confident investment decisions. https://topwealthguide.com

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.