Saving money safely while earning interest has become more attractive than ever. High yield savings accounts now offer rates that actually keep pace with inflation, making them worth serious consideration alongside traditional investments.

At Top Wealth Guide, we believe the real question isn’t which option wins-it’s how to use them together. This guide breaks down the numbers, risks, and tax implications so you can build a strategy that matches your actual financial goals.

In This Guide

What High Yield Savings Accounts Actually Pay Right Now

Current APY Rates and How They Compare

A high yield savings account is a bank deposit account that pays significantly more interest than traditional savings accounts at brick-and-mortar banks. As of January 2026, current APY rates for high yield savings accounts reach up to 3.75% APY, compared to the national average savings rate of just 0.39%. That’s roughly 10 times higher. Online banks like Axos Bank and Rising Bank offer competitive rates with minimal barriers to entry. Other options continue to provide solid returns for depositors seeking better yields than traditional savings accounts.

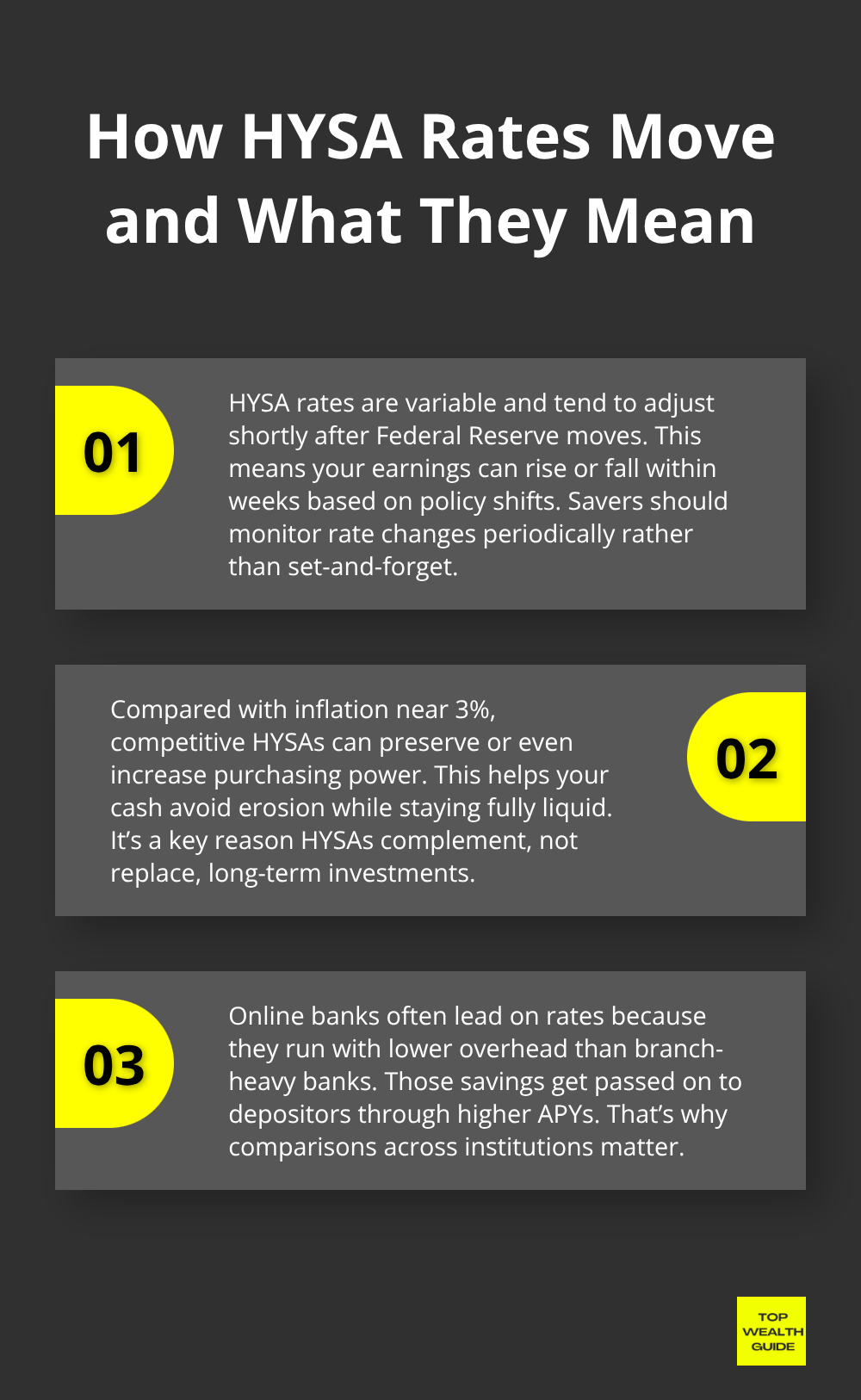

Online banks offer these rates because they operate with lower overhead costs than physical branches, so they pass those savings to depositors. These rates are variable, meaning the Federal Reserve’s decisions directly affect what you earn. When the Fed adjusts rates, many HYSAs follow suit within weeks. If you compare a high-yield account to inflation holding around 3%, you actually build real purchasing power instead of watching your cash erode.

Opening an Account and Understanding the Mechanics

Opening a high yield savings account takes minutes online, typically requiring just your Social Security number, address, and initial deposit. Funds transfer electronically from your checking account, and most accounts offer unlimited transfers via ACH or debit card, though some banks still impose withdrawal limits from legacy banking rules. Your deposits receive protection through FDIC insurance protection limits of $250,000 per depositor, meaning your principal stays completely safe even if the bank fails.

Interest compounds daily and posts monthly, so a $50,000 balance earning 4.35% APY generates roughly $182 monthly in interest. Understanding compound interest calculation formula helps you see how small daily gains accumulate into meaningful returns over time. The tax angle matters: any interest over $10 per year triggers a Form 1099-INT, and that interest gets taxed as ordinary income at your marginal rate.

Maximizing Your Strategy With Multiple Accounts

A smart move involves opening multiple HYSAs at different banks for separate savings goals-one for emergencies, another for a down payment, a third for vacation. Each account receives its own $250,000 insurance coverage, and you can track progress on specific objectives without mixing money together. This approach also lets you compare rates across institutions and shift funds to whichever account offers the best APY at any given time.

Now that you understand how HYSAs work and what rates you can actually earn, the real decision becomes whether these accounts alone meet your financial goals or whether you need to combine them with other investment vehicles.

When Should You Move Money From Savings Into the Stock Market

High yield savings accounts and stock market investments serve completely different financial purposes, and treating them as competitors misses the point. A 4.35% APY in a savings account beats inflation and protects your principal, but stocks historically return around 10% annually, which compounds into serious wealth over decades. The real question is timing: which money goes where, and when should you shift from one to the other.

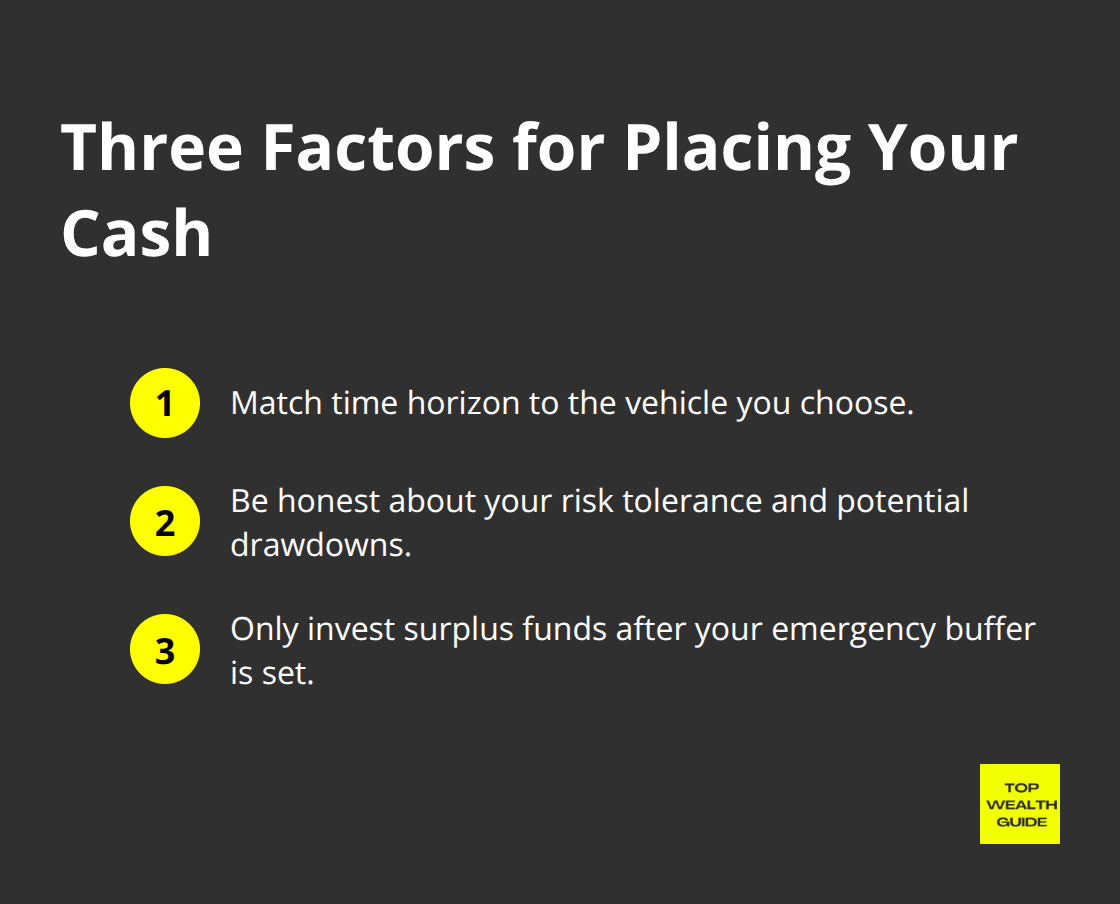

Three Factors That Determine Where Your Cash Belongs

The decision hinges on three concrete factors. First, assess your time horizon honestly. Money you need within two years should stay in high yield savings because stock market downturns can be brutal in short windows. A bear market can easily drop portfolio values 20-30%, and if you need that cash for a home down payment in eighteen months, you might be forced to sell at a loss.

Conversely, money earmarked for retirement in fifteen years belongs in stocks because you can weather volatility and capture that average annual return.

Second, examine your actual risk tolerance by considering what happens if your investment drops 25% tomorrow. If that scenario keeps you awake, stocks aren’t right for you regardless of time horizon. Third, only invest money you won’t panic about during downturns. An emergency fund absolutely stays in high yield savings at full liquidity, while surplus income after emergencies and obligations can venture into equities.

How Taxes Shift the Advantage Toward Stocks

The tax angle creates another meaningful difference between these two options. High yield savings accounts gets taxed as ordinary income at your marginal rate, potentially reaching 37% for higher earners. Stock investments in taxable accounts benefit from long-term capital gains rates of 15-20% if held over one year, making them significantly more tax-efficient for wealth building. Dividend stocks trigger similar preferential treatment, whereas frequent trading generates short-term capital gains taxed as ordinary income.

This tax advantage compounds over decades and explains why investing surplus cash in index funds often outpaces saving despite higher volatility. Someone earning an extra $500 monthly after expenses should invest that rather than park it in savings earning 4.35%, because thirty years of stock market contributions will generate substantially more wealth than savings interest alone.

Building Your Foundation Before Moving to Stocks

A practical framework emerges from this analysis. Build your emergency fund first in high yield savings covering three to six months of living expenses depending on job stability. Once that foundation exists and you’ve eliminated high-interest debt, direct surplus income into low-cost index funds through automated monthly contributions. This approach removes emotion from investing and lets compound growth work without requiring you to time the market perfectly.

The mechanics of moving money from savings into stocks matter less than understanding which accounts serve which purpose. Your next step involves comparing the specific investment vehicles available to you and determining which ones align with your risk tolerance and timeline.

High Yield Savings Accounts vs Bonds, CDs, and Real Estate

How Bonds and Bond Funds Compare to HYSAs

Bonds and bond funds deliver higher yields than HYSAs but expose you to interest-rate risk and credit risk if you hold anything beyond government securities. Medium-term corporate bond funds can yield 4.5% to 5.5% according to current market data, but they lack FDIC insurance and will decline in value if the Federal Reserve raises rates unexpectedly. A $50,000 bond fund investment could easily drop to $47,500 if rates spike, whereas your HYSA stays at exactly $50,000 plus earned interest. Government bonds offer safety but typically pay less than corporate bonds, making them less attractive for yield-focused investors. The real cost of chasing higher bond yields appears when interest rates move against you and your principal shrinks temporarily or permanently.

Understanding Certificates of Deposit and Their Tradeoffs

Certificates of deposit lock your money for specific terms (three months to five years) in exchange for guaranteed rates currently ranging from 4% to 5.2% depending on maturity length. The tradeoff is severe: if you withdraw early, you forfeit three to six months of interest, making CDs unsuitable for any money you might need within the locked period. A CD ladder strategy staggers maturities across five years so you preserve liquidity and avoid locking all funds at one rate, reducing reinvestment risk when rates fall. This strategy works well for money you genuinely won’t touch, such as funds earmarked for a specific goal two years away. Money market accounts sit between HYSAs and CDs, offering slightly higher yields around 3.8% to 4.1% while allowing check writing and debit card access, but many impose higher minimum balances of $2,500 to $10,000 and monthly fees if balances drop below those thresholds.

Real Estate as a Long-Term Wealth Builder

Real estate investing requires capital ranging from $50,000 to $100,000 for a rental property down payment, illiquidity lasting years or decades, and active management through tenant screening, repairs, and tax filings. A rental property might produce 6% to 8% annual returns through rent and appreciation, but you cannot access that capital in an emergency without selling the entire property, a process taking months and incurring 5% to 10% in transaction costs. Property values fluctuate with local market conditions, and unexpected repairs can eliminate an entire year’s profit. Real estate works best for investors with substantial reserves elsewhere and a genuine commitment to property management or the funds to hire professionals. The illiquidity makes real estate fundamentally different from HYSAs, which you can access within one business day.

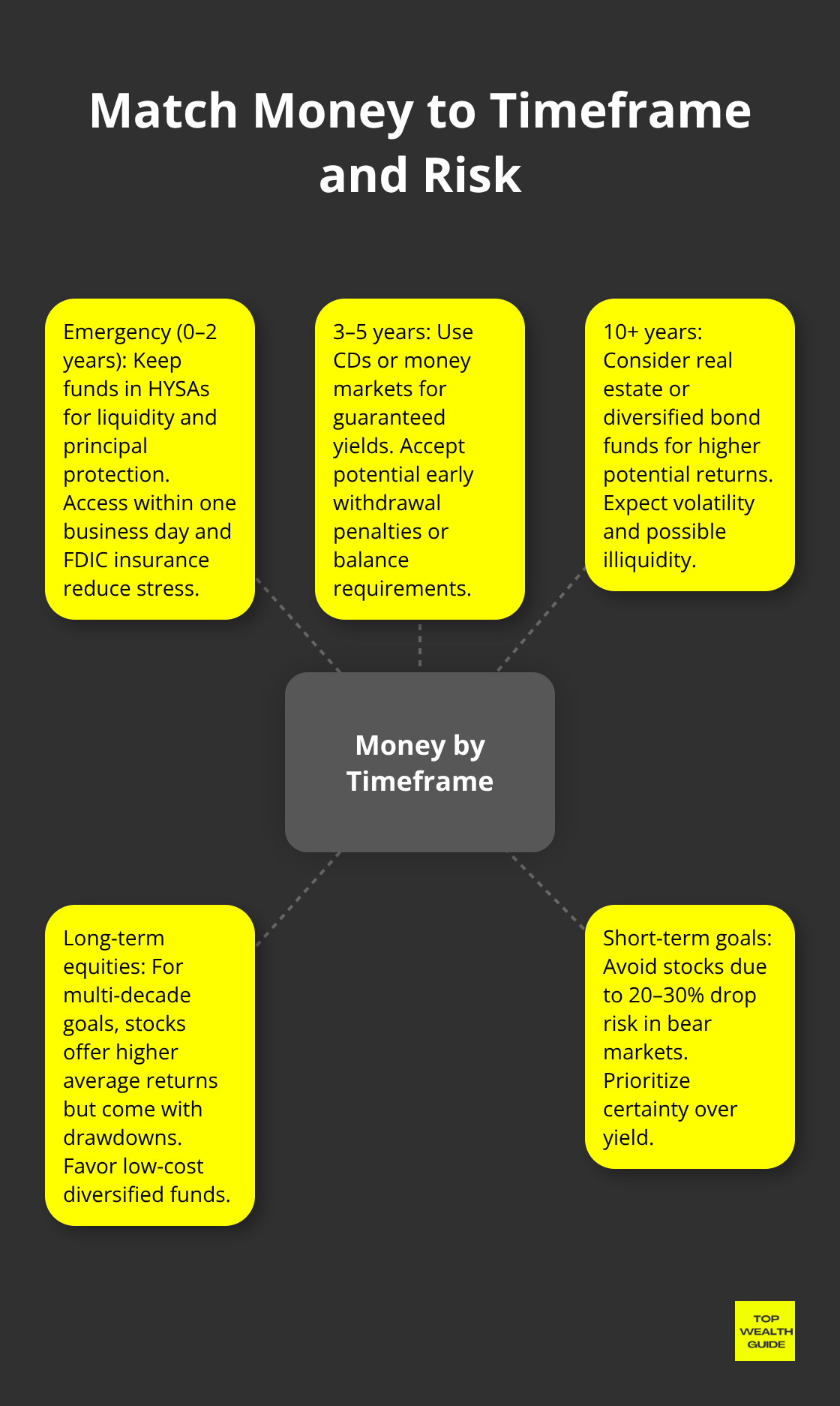

Matching Money to Purpose and Risk Level

Emergency funds and money needed within two years belong in HYSAs because you need immediate access without penalty and principal protection matters more than yield. If you have surplus cash sitting beyond your emergency fund for three to five years, CDs offer better guaranteed returns than HYSAs without requiring you to monitor interest rates or bond market volatility. If you can invest for ten-plus years and tolerate seeing your account value fluctuate month to month, real estate or diversified bond funds can outpace HYSA returns, but only after accounting for taxes, fees, and the opportunity cost of capital locked away. The mistake most people make involves chasing yield on every dollar instead of building a tiered system where different money serves different purposes at different risk levels and liquidity points.

Final Thoughts

The choice between high yield savings accounts and investment options isn’t binary-your financial success depends on deploying each tool for its intended purpose. Start by establishing your emergency fund in a high yield savings account earning 4.35% APY or higher, which protects you from unexpected expenses without forcing you to sell investments at losses during downturns. Three to six months of living expenses in liquid, FDIC-insured accounts provides genuine peace of mind and prevents poor financial decisions when life throws curveballs.

Once your emergency reserves are solid, surplus income after expenses and obligations should flow into diversified stock investments through low-cost index funds or ETFs. The tax advantage alone justifies this approach: long-term capital gains rates of 15-20% beat the ordinary income rates applied to savings interest, and this difference compounds dramatically over decades. Someone investing $500 monthly for thirty years will accumulate substantially more wealth through stocks than through high yield savings, despite the volatility.

For money with specific timelines between two and five years, certificates of deposit or money market accounts offer better guaranteed returns than savings accounts without requiring you to monitor stock market fluctuations. We at Top Wealth Guide help you build these strategies with practical frameworks and actionable insights tailored to your specific situation. Your next step is assessing your current emergency fund status and calculating how much surplus income you can direct toward investments monthly.

![High Yield Savings Accounts vs Investment Options [2026 Guide] High Yield Savings Accounts vs Investment Options [2025 Guide]](https://topwealthguide.com/wp-content/uploads/emplibot/high-yield-savings-hero-1768843063-1024x585.jpeg)