High-yield dividend stocks — what’s the deal? They’re like that reliable roommate who always pays rent on time. You get steady income while your portfolio quietly bulks up. We’re talking yields over 4%… yep, more bang for your buck. Perfect fit for anyone hunting income-focused investments.

Over here at Top Wealth Guide, we’ve done the homework — checked the receipts — and found the top dividend stocks delivering not just strong yields but also rock-solid financial stability. This guide is all about our picks for 2025 and, more importantly, the nuts and bolts you gotta scrutinize before you dive into investing.

In This Guide

What Are High-Yield Dividend Stocks

High-yield dividend stocks – yeah, those are the ones dishing out cash distributions to shareholders on a quarterly basis. We’re talking rates that usually top 4% annually. The math here – dead simple. Just divide the annual dividend per share by the stock’s current price, then multiply by 100. A stock pegged at $50, shelling out $2.50 a year? That’s a solid 5% yield coming your way. Take a peek at LyondellBasell; they’re dangling yields north of 10%, while United Parcel Service is offering a tempting 7.77%, according to the latest from analysts.

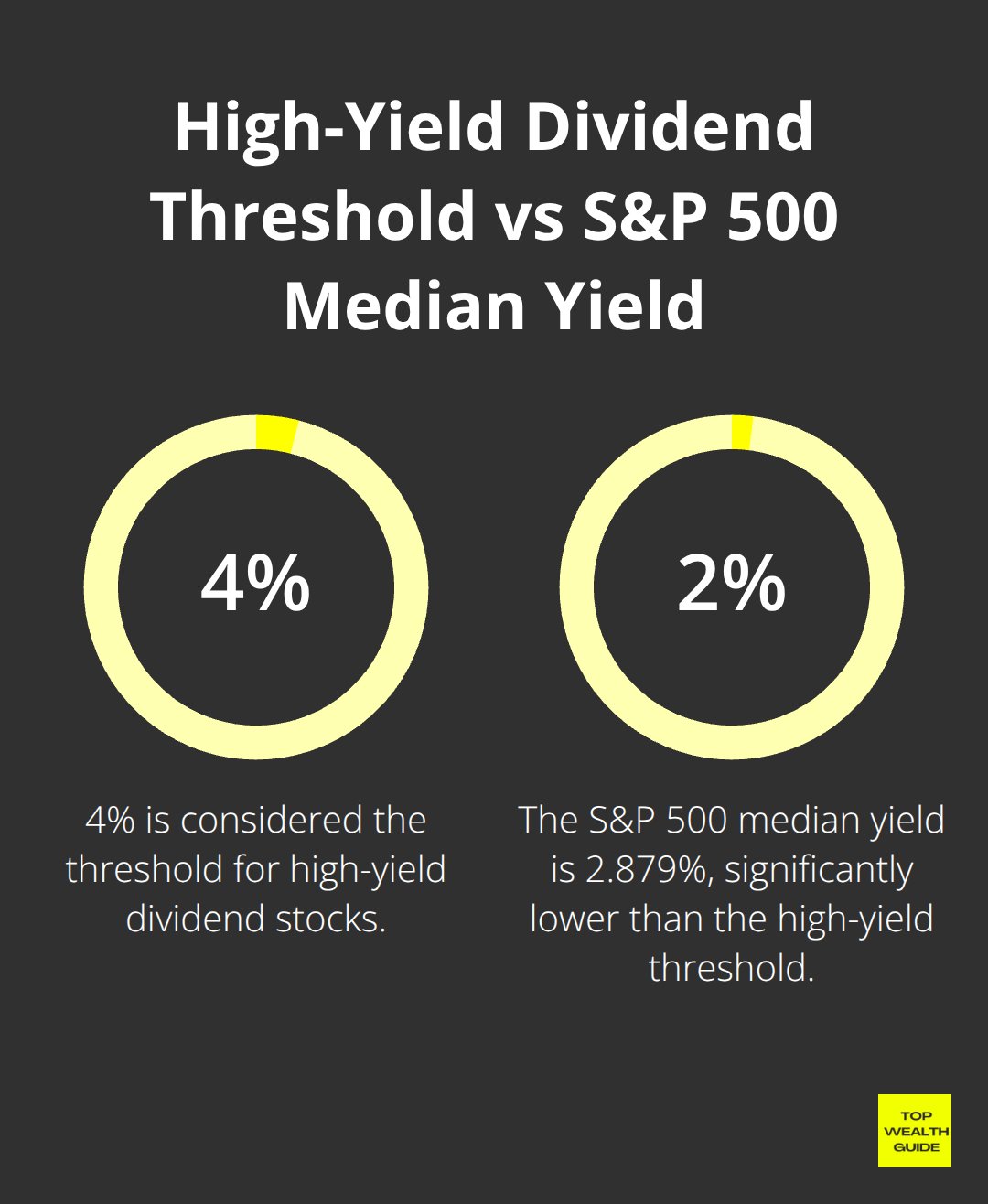

The 4% Threshold That Matters

So, what’s the big deal with 4%? Most finance gurus say anything past that hits high-yield territory. The S&P 500 is chilling with a median yield of just 2.879%. So, 4% and beyond? Yeah, that’s the sweet spot for those income-hungry portfolios. But be warned – yields over 8%? That’s the scarlet letter of dividend land, often signaling rough waters ahead. Walgreens Boots Alliance flashed an 8.7% yield before hitting the brakes on dividends due to financial hiccups. The smart money targets that cozy 4% to 7% range, where companies can keep the cash flowing without tanking their long-term health.

High-Yield vs Growth Dividend Strategies

It’s a clash of the titans – high-yield stocks focused on instant income versus those growth dividend contenders banking on share price hikes. Take Verizon Communications for instance. They’ve hiked dividends for 21 continuous years and currently sport a 6.33% yield – a poster child for high-yield strategy. Meanwhile, growth dividend companies like Texas Instruments lean towards a modest 3.1% yield but watch out – their payouts have exploded by 258% over the last decade. Income seekers gravitate to high-yield for the immediate cash-in-hand, while those plotting for the future lean towards growth dividends for juicy, compounded returns.

Key Characteristics That Define High-Yield Stocks

You want the skinny on high-yield stocks? They’re the offspring of mature industries with cash flows that scream stability, yet the growth opportunities… not so hot. Utilities, real estate investment trusts (REITs), energy moguls – that’s the usual lineup. These companies boast revenue streams you can set your watch to, mostly because they can toss their costs down the line to consumers or ride those lengthy contracts that have an iron-clad grip on their income.

The cream of the high-yield crop mixes tasty current yields with a rock-solid financial foundation – precisely what we’re digging into with our top stock selections for 2025. Expect us to cut through the noise and bring you the picks that matter.

Top High-Yield Dividend Stock Picks for 2025

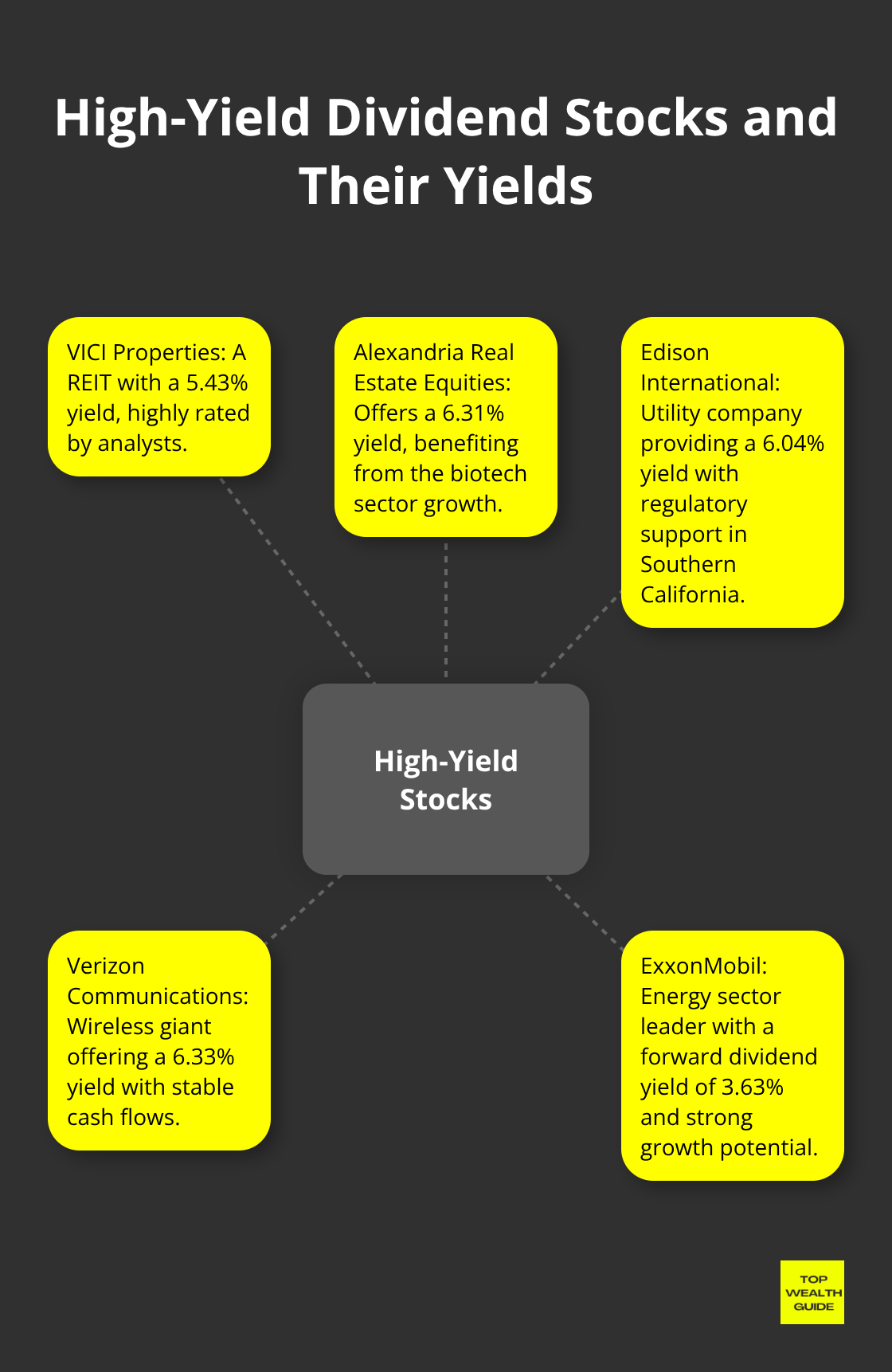

Real Estate Investment Trusts with Strong Track Records

Let’s break it down-with VICI Properties, you’re grabbing a REIT that pops a 5.43% yield. Analysts throw a Buy rating at it like confetti. It grabs casino properties and collects rent like clockwork, predictable and steady. Alexandria Real Estate Equities isn’t slacking either, flashing a 6.31% yield thanks to the not-so-minor biotech explosion. Tenancy rates? Hovering over 95%. Translation? The properties aren’t sitting empty. All this means is a mix of tenants, making failures less of a nail-biter.

Utility Powerhouses That Deliver Consistent Returns

Now, dive into Edison International. It dishes out a 6.04% yield and plays nicely in the regulatory sandbox of Southern Cal. Think infrastructure upgrades with a side of rate increases given the thumbs-up by state regulators. Verizon Communications, a.k.a. the wireless cash cow, spins a decent 6.33% yield. In a world where dropping your phone means dropping your link to civilization, stable cash flows are the norm. Bottom line? These utility giants are running the show, thanks to their can’t-do-without services.

Energy Sector Champions Worth Your Attention

ExxonMobil is flexing a value 19% shy of Morningstar’s $135 estimation, but it’s got a forward dividend yield of 3.63% to draw attention. They’ve cleaned up their balance sheet since 2020 and are spending wisely in the Permian Basin. Oneok is out here delivering a solid 5.74% yield, and it’s all about natural gas operations without losing sleep over price jumps. SLB comes in, tag-teaming with the global uptick in drilling and screaming the bonuses of oilfield services.

So, there it is-solid picks with kudos-worthy fundamentals. Yet, it ain’t just about chasing yields. You’ve got to separate the gold from the fool’s gold. Know which dividend stocks are real deals before diving in.

Key Factors to Consider When Investing in High-Yield Dividend Stocks

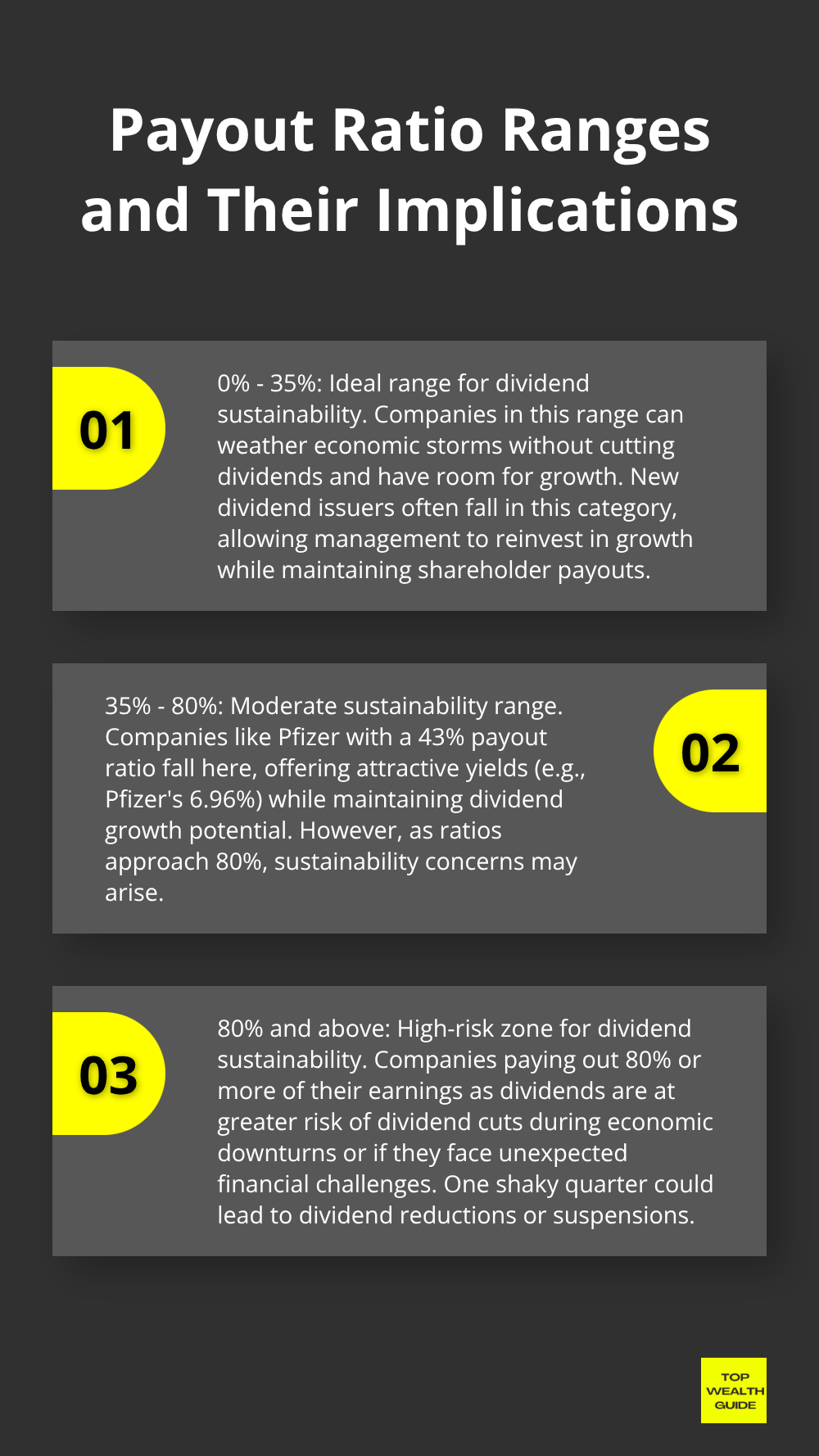

Payout Ratios Reveal Dividend Sustainability

Here’s the deal with payout ratios-they spill the beans on dividend sustainability. You’ve got companies burning through 80% of their earnings on dividends…they’re practically juggling dynamite. Take Pfizer, for example-they’re playing it cool with a 43% payout ratio, and bam, delivering a 6.96% yield. No wonder they’ve been bumping up dividends for 16 consecutive years. Now, stack that against companies with payout ratios in the 90% range…one shaky quarter, and bye-bye dividends.

Wise investors scope out payout ratios hovering between 0% and 35%. Why? Because companies in this sweet spot ride out economic storms without cutting dividends. It’s a playground where newbie dividend-issuers hang out, letting management reinvest in growth while keeping the cash flowing to shareholders.

Free Cash Flow Beats Reported Earnings

Why chase paper when you can chase cash? Yep, companies flush with cash are in the driver’s seat to keep and amp up their dividends. Earnings-those can be jazzed up with accounting hocus-pocus, but cash flow? It tells it like it is. Medtronic’s on record to return a cool 50% of their free cash to shareholders, which makes that 3.06% yield feel rock solid.

Think energy companies like SLB-they’re on track to share more than half of their free cash flow, making their 3.18% yield seem as dependable as a sunrise, even more so than their free cash-challenged rivals. Seek out companies that crank out consistent free cash flow and cover dividends by 1.5 times-that’s the buffer against the occasional hiccup.

Sector-Specific Risks That Destroy High Yields

Ever-watchful for yield’s enemy number one-sector risks. Case in point: energy yields can evaporate like a puddle in the desert when commodity prices dive. Oil titans coasting at $100 per barrel can turn into dividend nightmares rolling in at $40 (cue 2020’s oil price cliff dive). Real estate plays limbo with interest rates-up come the rates, down go property values, and the cost to refinance? Through the roof.

Utility firms seem bulletproof until regulators come swinging…shredding allowed returns or doling out pricey environmental mandates. Tempted by those tobacco yields like Altria’s at 6.41%? With falling consumption and litigation lurking, those dividends are walking a tightrope.

Financial Health Indicators You Can’t Ignore

Let’s not skip the debt-to-equity ratio-the tell-all of how deep a company is into its debt trenches relative to shareholder equity. Going heavy on debt often means dividends get sidelined when the going gets tough. Solid balance sheets with bearable debt? They’re the unsung heroes of consistent dividend payouts through economic twists and turns.

Keep an eye on more than just the yields-revenue growth trends are the unsung divining rods. Companies bleeding revenues find it a slog to keep dividends afloat long-term, irrespective of present payout ratios. When checking out top stocks, beeline for those boasting attractive yields paired with rock-hard fundamentals.

Final Thoughts

High-yield dividend stocks – they’re the bread and butter that growth stocks just can’t lay a finger on. Picture this: yields from 4% to a juicy 7% that pump cash into your pockets every few months while your portfolio does its little dance of appreciation. Truth bomb – the numbers tell the tale. Dividend stocks? They’ve historically crushed it with a 9.2% average annual return, compared to the measly 4.3% of their dividend-shy counterparts.

Here’s the game plan: zero in on the fundamentals. Go for payout ratios under 80%, find companies swimming in strong free cash flow, and hang your hat on sectors where the revenue streams are as predictable as a sunrise. Think along the lines of REITs like VICI Properties, reliable utilities such as Edison International, and energy giants like ExxonMobil – and you’ve got yourself a recipe for balancing yield with sustainability (income-focused portfolios, take note).

Ready for the next step? Open that brokerage account and start your journey with dividend aristocrats – these are the giants who’ve bumped up payouts for over 25 consecutive years. Spread your investments across sectors to dodge unnecessary risks, and let those dividends roll right back in to turbocharge your returns. Your posse at Top Wealth Guide has your back with the market smarts and practical tools to spot the top stocks for dividends and grow wealth through some savvy strategic income investing.

1 Comment

Pingback: Portfolio Tracking Tools Every Smart Investor Uses - Top Wealth Guide - TWG