Cryptocurrency staking lets you earn passive income by holding and validating blockchain transactions. Instead of watching your crypto sit idle, you can put it to work and generate returns.

At Top Wealth Guide, we’ve created this guide to show you exactly how staking works, which coins offer the best rewards, and how to avoid costly mistakes. Whether you’re new to crypto or looking to optimize your holdings, you’ll find actionable steps to start earning today.

In This Guide

How Cryptocurrency Staking Actually Works

Understanding the Staking Mechanism

Cryptocurrency staking is the process of locking your digital assets into a blockchain network to validate transactions and earn rewards in return. Unlike mining, which requires expensive hardware and enormous electricity consumption, staking lets you earn passive income simply by holding approved cryptocurrencies. The mechanics are straightforward: you deposit your crypto into a staking contract, the network selects validators from the staker pool, and those validators confirm transactions. When they do their job correctly, the protocol automatically distributes new coins as rewards. Over $132 billion is currently locked in staking across proof-of-stake networks according to Staking Rewards, which shows this isn’t a fringe strategy anymore.

The Environmental and Efficiency Advantage

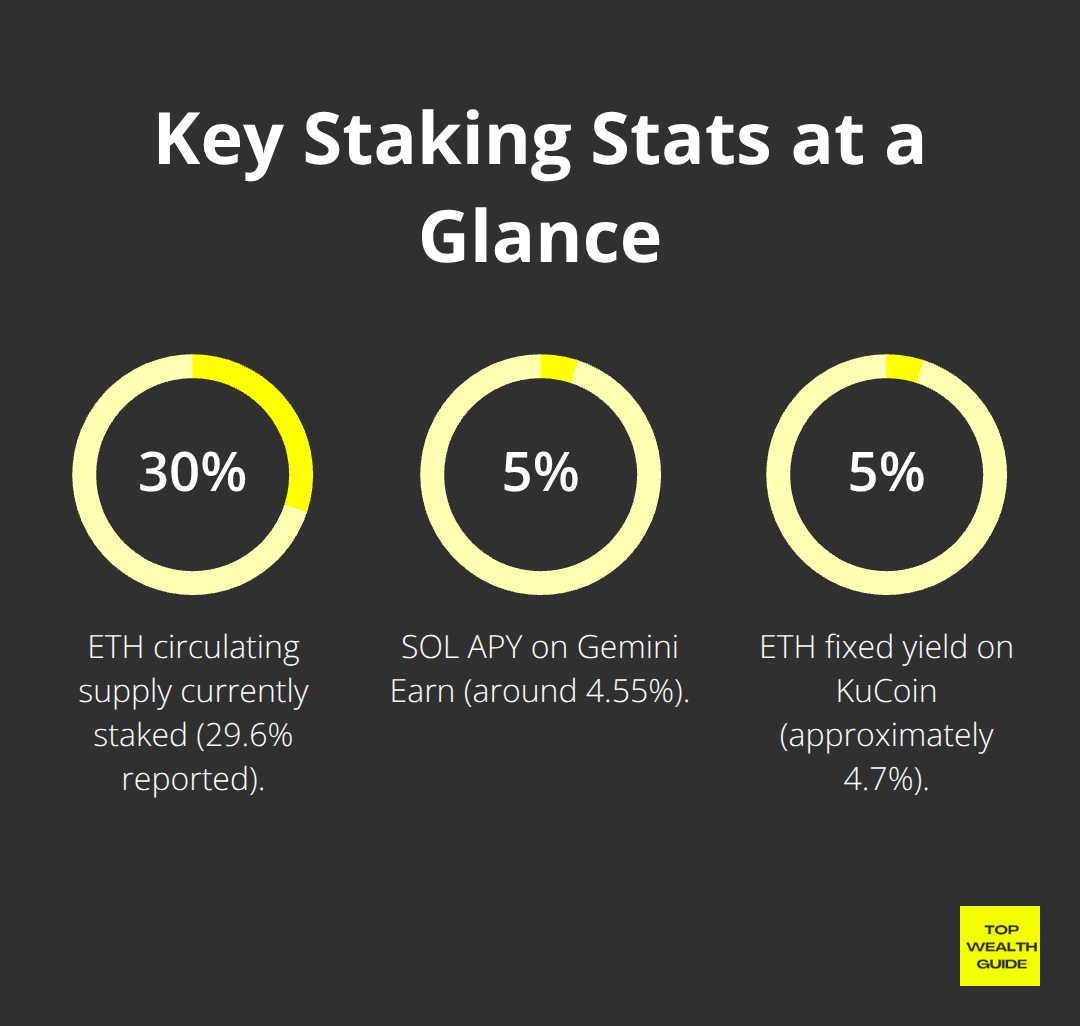

The shift from proof-of-work systems like Bitcoin to proof-of-stake networks like Ethereum 2.0 reduced energy consumption significantly, making staking not only profitable but also environmentally responsible. Ethereum’s transition demonstrates the trend: more than 10 percent of all ETH is now staked, with typical annual yields hovering around 4 to 5 percent for major assets like ETH, SOL, and ADA.

Comparing Yields Across Platforms

The reward structure depends entirely on how much you stake and how long you lock it up. Platforms like Gemini Earn, KuCoin Earn, Coinbase, and Binance.US all offer different yield rates for the same coins, so comparing options matters significantly. For example, SOL staking on Gemini currently pays around 4.55 percent APY, while KuCoin’s Ethereum 2.0 fixed yield reaches approximately 4.7 percent. The APY calculation is simple: it shows your annual percentage return on your staked amount, but this rate fluctuates based on network participation and how many validators are active.

Solo Staking vs. Pooled Staking

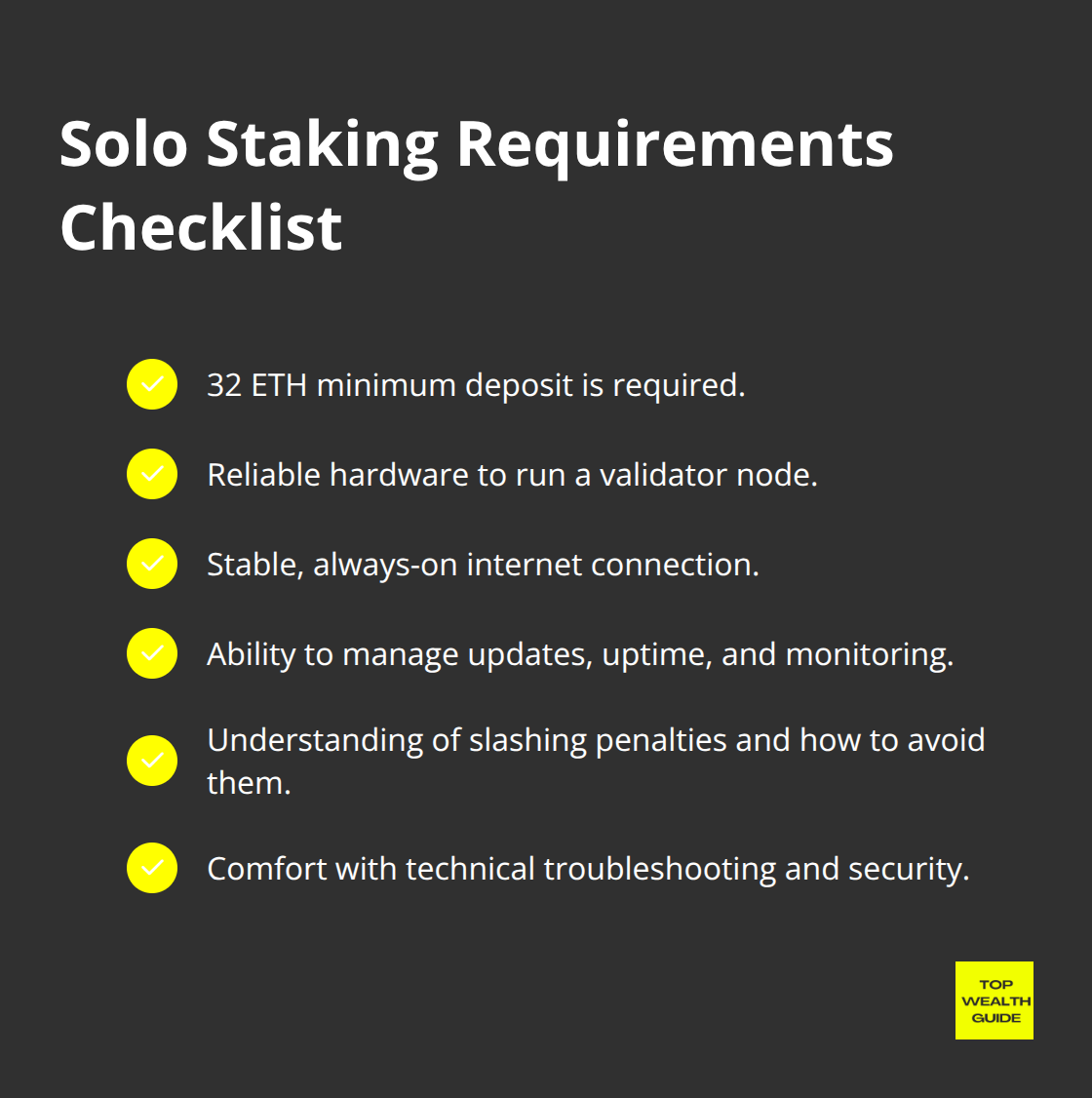

If you don’t have 32 ETH minimum for solo staking, staking pools combine funds from multiple users and split rewards proportionally. The tradeoff is significant: you’ll face lock-up periods during which you cannot sell or transfer your staked tokens, and price volatility during these periods can hurt your actual returns if the market moves against you.

Tax Obligations You Cannot Ignore

Tax complications also exist: the IRS treats staking rewards as ordinary income, potentially taxable at your full rate, and exchanges issue 1099-MISC forms when earnings exceed $600 annually. Understanding these tax implications before you commit funds will help you calculate your true net returns and avoid surprises at tax time. With these mechanics and constraints in mind, the next step is selecting which cryptocurrencies actually offer strong staking potential and which platforms align with your financial goals.

Starting Your Staking Strategy

Picking the right cryptocurrencies to stake requires looking beyond hype and focusing on network maturity, validator demand, and realistic reward rates. Ethereum, Solana, Cardano, Algorand, and Chainlink dominate the staking landscape because they have proof-of-stake systems with genuine transaction volume. According to Staking Rewards, ETH staking accounts for 29.6% of the total circulating supply, proving these networks have staying power. Before committing funds, check the current APY on platforms like Gemini Earn, KuCoin, Coinbase, and Binance.US, since rates fluctuate weekly based on network participation. SOL yields around 4.55 percent on Gemini while KuCoin’s ETH offering reaches 4.7 percent, so comparing these platforms directly saves you real money over a year. The critical factor most beginners miss is minimum deposit requirements: Coinbase requires only $1 to start SOL staking, while solo ETH staking demands 32 ETH worth tens of thousands of dollars. Start with coins that match your actual capital and your risk tolerance, not the ones promising the highest yields.

Which Staking Method Fits Your Situation

Solo staking gives you complete control but demands serious technical commitment and capital. You need 32 ETH minimum, reliable hardware running a validator node, stable internet connectivity, and knowledge of potential slashing penalties if your validator goes offline or behaves incorrectly.

Most people lack this setup, which is why staking pools and exchange-based services dominate. Platforms like Gemini, Coinbase, and Binance.US handle validator operations for you, eliminating the technical burden and letting you stake any amount. The tradeoff is straightforward: you sacrifice some autonomy for convenience and accessibility.

How Staking Pools Distribute Your Rewards

Staking pools combine funds from thousands of users and distribute rewards proportionally, making them ideal for anyone without 32 ETH. Lock-up periods vary dramatically by platform and coin, ranging from flexible withdrawal windows to months of complete illiquidity. Check these terms before depositing because being unable to sell during a market downturn can transform a decent return into a significant loss.

Tax and Regulatory Considerations

The IRS classifies staking rewards as ordinary income regardless of your method, so calculate your expected tax liability before committing. Availability varies by state and country, so verify your platform supports your location before opening an account. These factors directly impact your net returns and legal standing, making them essential to address upfront.

Moving Forward With Your Selection

Once you understand the differences between solo staking, pools, and exchange platforms, you can match your choice to your capital, technical skills, and time commitment. The next step involves evaluating the specific risks that accompany each approach and learning how to protect your stake from penalties and market volatility.

Protecting Your Stake While Boosting Returns

Compare Yields Across Platforms Before Committing

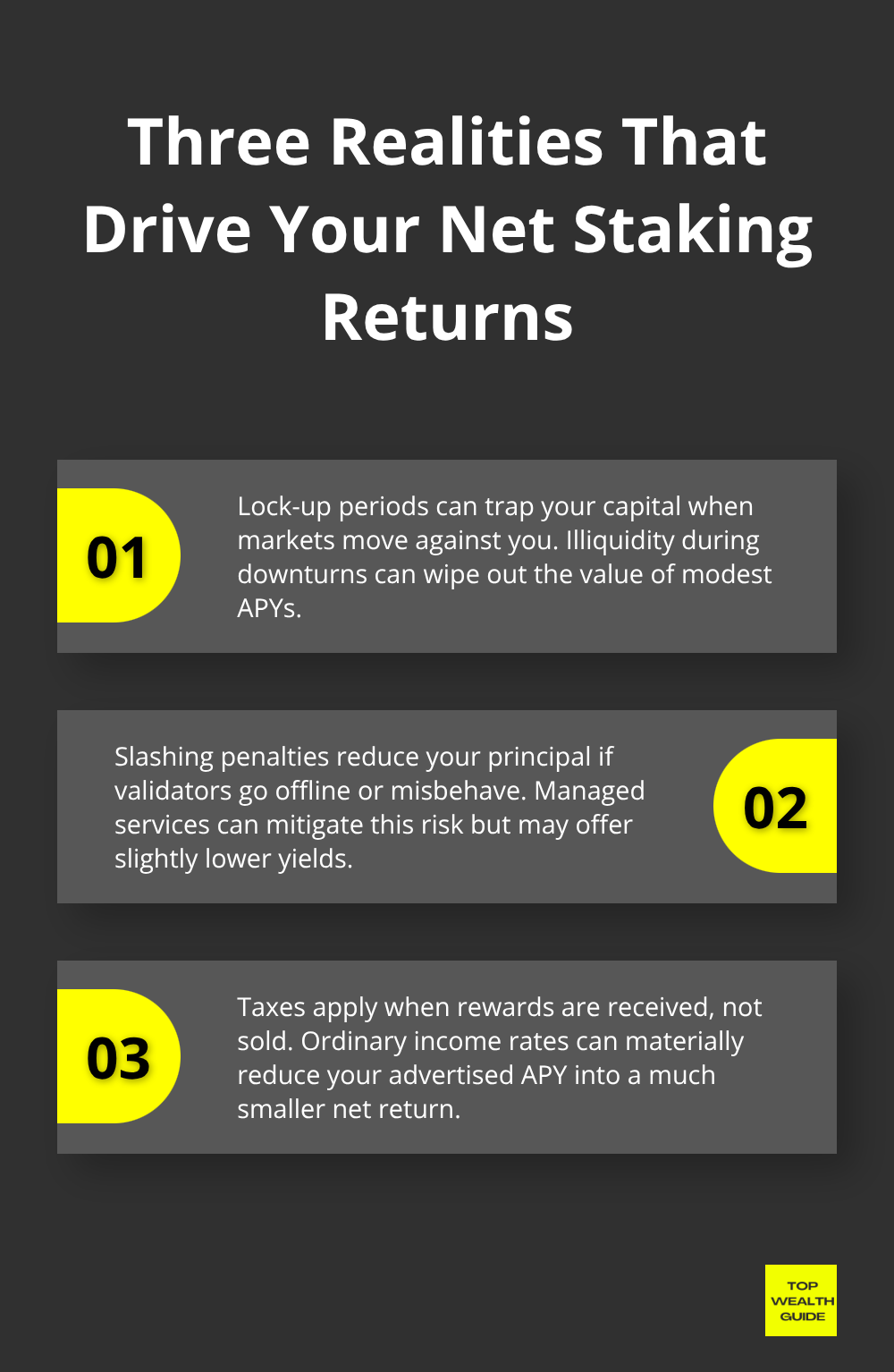

Maximizing staking returns requires understanding three harsh realities: lock-up periods trap your capital at the worst times, slashing penalties can erase gains instantly, and tax bills arrive regardless of whether your staking performed well. Most beginners ignore these factors until they face them directly, which is why addressing them upfront separates profitable stakers from frustrated ones.

The straightforward approach to higher returns involves comparing yields across platforms before you commit funds. Gemini Earn pays 4.55 percent APY for SOL while KuCoin reaches 4.7 percent for ETH, meaning a $10,000 stake generates $45 more annually on KuCoin, and this gap widens significantly with larger amounts. However, yield chasing without understanding lock-up terms costs more than you gain. If you stake on a platform with a six-month lock-up and the market crashes 30 percent during that period, your 4.7 percent return becomes meaningless.

Diversify Across Platforms and Coins

The real strategy involves diversifying across platforms and coins to smooth volatility while maintaining flexibility. Staking $5,000 in ETH on Gemini and $5,000 in SOL on Coinbase lets you access different yields without concentrating risk in a single validator or platform. Start with amounts you can afford to lose completely, because staking rewards are not guaranteed returns. This approach protects you from platform-specific failures and gives you access to your capital on different timelines.

Understand Slashing Penalties and Validator Risk

Slashing penalties represent the most misunderstood risk in staking. If your validator node goes offline or behaves dishonestly, the network penalizes your stake by reducing your balance directly, not just withholding rewards. Solo stakers running their own validators face this risk constantly, but exchange-based staking like Gemini or Coinbase handles validator operations for you, eliminating slashing entirely. This is why exchange staking suits most people despite slightly lower yields. The technical complexity of solo staking makes it unsuitable for anyone without serious infrastructure and expertise.

Calculate Your True Tax Liability

Tax complications demand immediate attention because the IRS treats staking rewards as ordinary income the moment you receive them, not when you sell. A $10,000 stake earning 4.5 percent annually generates $450 in taxable income, taxed at your marginal rate which could reach 35 percent or higher for high earners, meaning your actual net return drops from $450 to roughly $292. Exchanges issue 1099-MISC forms when your annual earnings exceed $600, creating an automatic paper trail the IRS can cross-reference. Calculate your expected tax liability before staking: multiply your stake amount by the platform’s APY, then multiply that result by your tax bracket. If you’re in the 32 percent bracket and staking $20,000 at 4.5 percent, you owe approximately $288 in taxes annually on $900 of rewards, reducing your real return to $612.

Evaluate Lock-Up Periods and Withdrawal Timelines

Lock-up periods vary dramatically across platforms, ranging from flexible daily withdrawals to complete illiquidity for months. Coinbase offers relatively quick unstaking timelines, while some staking pools impose 30 to 90 day delays before you can access your funds. Check these terms directly on each platform’s website because they change frequently and vary by coin. The harsh truth is that staking rewards only make sense if you’re willing to hold the underlying asset long-term anyway, because short-term traders face destruction from lock-up periods and taxes on top of market volatility.

Final Thoughts

Cryptocurrency staking offers a straightforward path to passive income if you approach it with realistic expectations and proper planning. Select coins with genuine network activity like ETH, SOL, or ADA, compare yields across platforms like Gemini and Coinbase, and account for taxes before committing capital. Most people underestimate how much the IRS takes, so calculate your tax liability upfront and subtract it from your expected returns.

Start small with amounts you’re comfortable holding for months or years. Deposit $500 or $1,000 into a platform like Coinbase or Gemini, watch how the process works, and track your actual returns against the advertised APY. After three to six months of experience, you’ll understand whether cryptocurrency staking fits your financial situation or whether other strategies serve you better.

We believe staking belongs in a diversified wealth-building strategy, not as your entire passive income plan. Combine staking with dividend stocks, real estate, and side income to reduce risk and accelerate wealth accumulation. For deeper guidance on building multiple income streams and optimizing your overall financial strategy, explore Top Wealth Guide’s comprehensive resources on investing and passive income generation.