Successful cryptocurrency investment strategies aren't about chasing the latest hype coin on social media. It's about bringing a disciplined, structured approach to a market known for its wild swings. The real key is to get past pure speculation and start using proven methods—like long-term holding, consistent investing, and smart diversification—to build a digital asset portfolio that can weather the storms.

In This Guide

- 1 Beyond the Hype: Navigating Modern Crypto Investing

- 2 Building Your Crypto Portfolio for the Long Haul

- 3 Choosing Your Path: Active vs. Passive Crypto Investing

- 4 Diversifying Your Crypto Portfolio Like a Pro

- 5 Smart Risk Management for Crypto Investors

- 6 Frequently Asked Questions About Crypto Investing

- 6.1 1. How much should I invest in cryptocurrency as a beginner?

- 6.2 2. What is the simplest crypto investment strategy for a newcomer?

- 6.3 3. How do I choose which cryptocurrencies to invest in?

- 6.4 4. What are the main differences between HODLing and day trading?

- 6.5 5. Are high-yield opportunities like staking and yield farming safe?

- 6.6 6. How often should I rebalance my crypto portfolio?

- 6.7 7. What should I know about cryptocurrency taxes?

- 6.8 8. How can I identify and avoid crypto scams?

- 6.9 9. What is the role of stablecoins in a crypto portfolio?

- 6.10 10. What are the best tools for managing a crypto portfolio?

Jumping into crypto can feel like you're trying to guess the weather in a hurricane. But with a solid strategy in hand, that guesswork turns into a calculated plan. This guide is here to cut through all that noise and show you exactly how experienced investors navigate the market with confidence. We’re moving past generic tips to give you a real framework for building a strong portfolio.

If you're just starting, it's worth getting a handle on the basics. Our article explaining what cryptocurrency is and how it works is a great place to begin.

The ultimate aim here is to match the right strategies to your personal financial goals, whether you’re looking for steady growth over the long haul or targeting more active, short-term gains.

Aligning Strategy With Your Financial Goals

Let's get one thing straight: there's no magic, one-size-fits-all strategy. The right approach for you depends entirely on your situation—your tolerance for risk, your investment timeline, and how much time you can actually dedicate to managing it.

That said, nearly all successful crypto investors I've seen operate on a few core principles:

- A Long-Term Vision: Most veterans in the space treat crypto as a long-term asset. They're focused on holding solid projects through the inevitable market cycles, not panic-selling based on a bad day.

- Serious Risk Management: This is non-negotiable. Protecting your capital is everything. It means only investing what you can truly afford to lose and setting firm rules for when to take profits or cut your losses.

- Constant Learning: The crypto world moves incredibly fast. If you're not keeping up with new tech, market trends, and regulatory changes, you're flying blind. Staying informed is essential for making good decisions.

Mastering these fundamentals is what shifts your mindset from that of a gambler to a strategic investor. It’s this very perspective that separates those who build lasting wealth from those who get burned by the volatility.

Now, let's dive into some of these battle-tested approaches that can give you the confidence to navigate this landscape.

Building Your Crypto Portfolio for the Long Haul

In the world of crypto, patience is your secret weapon. The headlines are full of wild price swings and overnight millionaires, but real, sustainable wealth is often built with a long-term mindset. It’s about choosing a strategy and sticking with it, rather than getting caught up in the daily market frenzy.

The most well-known strategy is simply HODLing. It started as a typo in an old forum post but has since become a core philosophy: buy a solid asset and hold on for dear life, through the highs and the lows. Think about it—investors who bought Bitcoin or Ethereum years ago and didn't panic-sell during the major crashes have seen incredible returns over time. It’s a testament to the power of conviction.

Turn Volatility into an Advantage with Dollar-Cost Averaging

If trying to perfectly time the market gives you anxiety, then Dollar-Cost Averaging (DCA) is the strategy for you. It's a beautifully simple concept that takes all the guesswork out of the equation. You just invest a fixed amount of money at regular intervals—say, weekly or monthly—no matter what the price is doing.

Real-Life Example of DCA in action:

Imagine you decide to invest $100 into Ethereum (ETH) on the 1st of every month for three months.

- Month 1: ETH is priced at $2,000. Your $100 buys you 0.05 ETH.

- Month 2: The market dips, and ETH is now $1,500. Your $100 buys you 0.067 ETH.

- Month 3: The market recovers, and ETH hits $2,200. Your $100 buys you 0.045 ETH.

After three months, you've invested $300 and acquired a total of 0.162 ETH. Your average purchase price is approximately $1,852 per ETH, even though the price was higher in two of the three months. You automatically bought more when the price was low, lowering your average cost.

This disciplined approach is becoming even more relevant as the market matures. Bitcoin, for example, has seen its volatility trend downward over the past five years, which has helped attract more serious institutional investors. In fact, its rolling 5- and 10-year returns have beaten high hurdle rate thresholds over 90% of the time. You can find some great analysis on the rise of institutional Bitcoin demand from SSGA.

At their core, both HODLing and DCA are about one thing: discipline. Taking emotion out of the driver's seat and focusing on steady accumulation is how you set yourself up for long-term success.

If you’re ready to put these foundational strategies to work, our complete guide on how to invest in cryptocurrency is the perfect place to start. Whether you're a total beginner or a seasoned pro, these methods provide a clear path forward in the digital asset space.

Choosing Your Path: Active vs. Passive Crypto Investing

One of the first big questions every crypto investor faces is how involved they want to be. The good news is you don't have to be glued to your screen, watching every market tick, to be successful. Your strategy should fit your lifestyle, your stomach for risk, and how much time you can realistically set aside.

This really boils down to two main camps: active and passive investing.

Active investing is for the hands-on crowd. These are the traders who thrive on the daily pulse of the market, frequently buying and selling to catch short-term price swings. Think of it as a constant dance with market volatility.

On the flip side, passive investing is more of a "set it and forget it" game plan. The goal here is long-term growth, letting your assets quietly appreciate over time with very little day-to-day management. This is where strategies like HODLing (holding on for dear life) or Dollar-Cost Averaging come into play. If you're not familiar with the latter, our guide on what is Dollar-Cost Averaging is a great place to start.

Comparing Active vs Passive Crypto Investment Approaches

To help you figure out where you fit, it helps to see these two approaches side-by-side. Each one demands a different mindset and skillset. This breakdown should give you a clearer picture of which path aligns with your personal goals and resources.

| Characteristic | Active Investing | Passive Investing |

|---|---|---|

| Primary Goal | Short-to-medium term profits | Long-term capital appreciation |

| Example Strategies | Day Trading, Swing Trading, Arbitrage | HODLing, Staking, Dollar-Cost Averaging |

| Time Commitment | High (Daily or weekly monitoring) | Low (Periodic check-ins, e.g., quarterly) |

| Risk Level | Higher (Due to market timing & volatility) | Generally Lower (Focus on time in the market) |

| Required Skills | Technical analysis, market sentiment reading | Fundamental analysis, patience, discipline |

| Best For | Experienced traders who enjoy deep market analysis and have significant time to commit. | Investors with a long-term outlook who prefer a hands-off approach and want to minimize stress. |

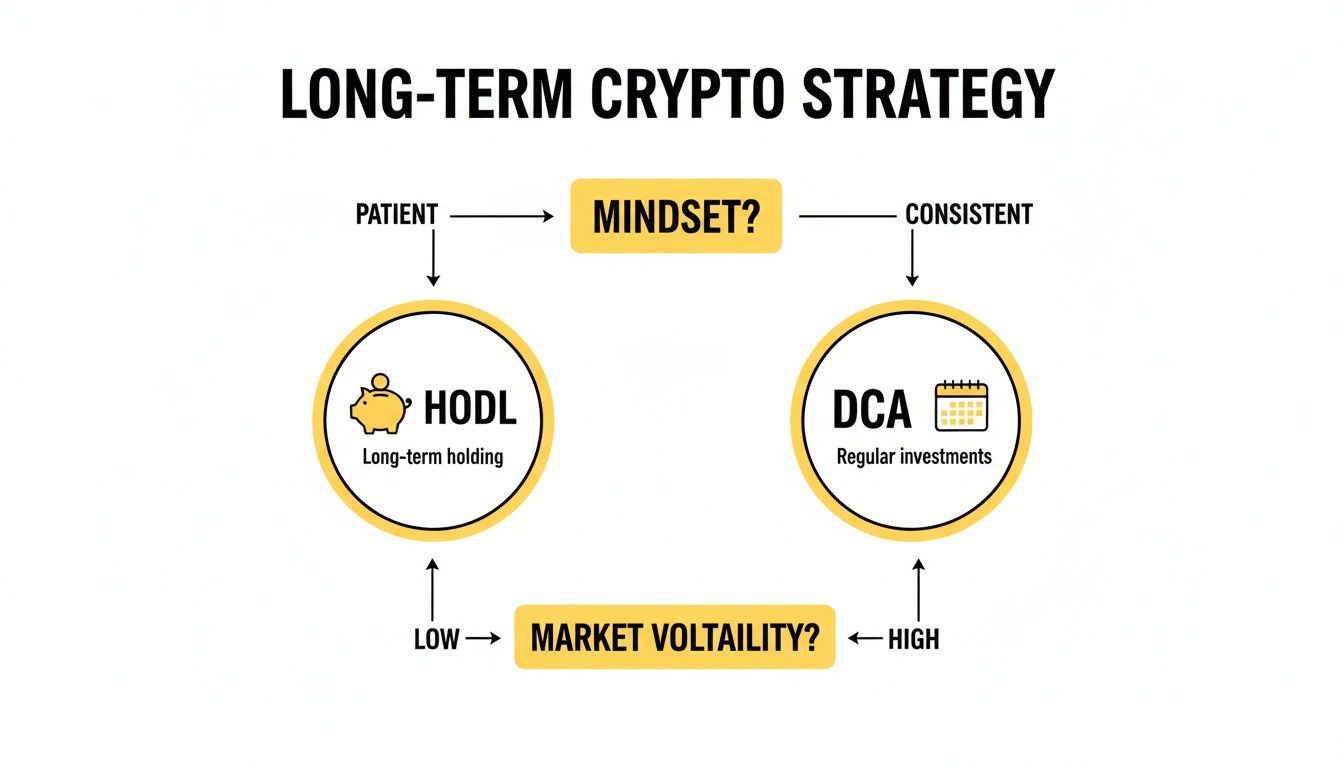

This flowchart is a great visual for thinking through the long-term, passive side of things.

As you can see, a patient investor who can handle big swings might be a natural HODLer. Someone who prefers a more disciplined, consistent approach will likely find Dollar-Cost Averaging a much better fit.

The most important first step is an honest look in the mirror. Be realistic about your goals, how much time you can truly give, and what kind of investor you want to be. That self-awareness is the foundation of any successful crypto strategy.

Diversifying Your Crypto Portfolio Like a Pro

You’ve heard the old saying: "Don't put all your eggs in one one basket." That wisdom has never been more relevant than in the wild world of crypto. A smartly diversified portfolio is your best shield against the market's infamous volatility and your key to unlocking growth across the entire digital asset space.

Simply holding Bitcoin and Ethereum isn't a strategy—it's a start. Real diversification means spreading your capital across different types of crypto assets, where each one has a specific job to do for your portfolio.

Building a Balanced Portfolio

I like to think of a crypto portfolio in layers, each with its own risk profile and potential for reward. A solid approach is to build a structure with a mix of established giants, high-growth up-and-comers, and a solid safety net. This kind of balance is what helps smooth out the crazy swings over the long haul.

A resilient portfolio could look something like this:

- Foundational Large-Caps: This is your core. Typically, this means putting 50-70% into proven projects like Bitcoin (BTC) and Ethereum (ETH). They bring a degree of stability and have a battle-tested track record.

- Promising Altcoins: Dedicate 20-40% of your funds to smaller, high-potential projects. Look at booming sectors like Decentralized Finance (DeFi), Artificial Intelligence (AI), or Web3 gaming. They’re certainly riskier, but the growth ceiling is much higher.

- Stablecoins: Always keep 5-10% in stablecoins like USDC or USDT. This is your dry powder—a cash reserve that lets you buy the dip when the market panics or simply lower your overall risk. You can also put these to work. Our cryptocurrency staking guide for passive income generation shows you how.

Making Data-Informed Decisions

So, how do you know if your allocation makes sense? One of the best ways to pressure-test your plan is through backtesting. This is where you use historical data to simulate how your chosen portfolio would have performed in past market cycles.

To get a clear picture, you really need a solid foundation of historical data to validate your cryptocurrency investment strategies—at least three years is a good rule of thumb to properly gauge potential returns and risks. For a deeper dive into how pros use this data, check out the resources on Amberdata's blog.

Backtesting isn't a crystal ball, but it's a powerful reality check. It helps you see how your strategy might behave under stress, test your own risk tolerance, and fine-tune your approach based on cold, hard data instead of gut feelings.

Smart Risk Management for Crypto Investors

In the wild world of crypto, what really separates the successful investor from the speculator is smart risk management. It all boils down to one golden rule that you simply can't break: only invest what you are genuinely prepared to lose. This isn't just a suggestion; it's the foundation of a sound strategy, ensuring a sudden market swing doesn't wreck your entire financial well-being.

Once you’ve got that rule locked in, it's time to get specific. Before you even buy, decide what your profit target is. Just as crucial is knowing when to cut your losses. A stop-loss order is your best friend here—it’s an automated trigger that sells your crypto if it falls to a certain price. Think of it as an emergency exit that prevents a bad day from turning into a catastrophic one. Getting a handle on how to determine your investment risk tolerance is the first real step in drawing these lines in the sand.

Protecting Your Digital Assets

Your investment choices might be brilliant, but they're worthless if your assets aren't secure. Not all crypto storage is the same, and knowing the difference is absolutely essential to keeping your portfolio safe.

When it comes to wallets, there's always a trade-off between easy access and rock-solid security. Here’s a practical comparison:

| Wallet Type | Primary Use | Security Level | Key Characteristic | Real-Life Analogy |

|---|---|---|---|---|

| Hot Wallet | Daily trading, frequent transactions | Lower | Connected to the internet (e.g., mobile app, browser extension) | Your physical wallet holding cash for daily use. |

| Cold Wallet | Long-term HODLing, large holdings | Highest | Offline storage (e.g., USB-like hardware device) | A secure bank vault for your life savings. |

A simple way to think about it: a hot wallet is like the cash in your pocket, perfect for small, everyday spending. Your cold wallet is the bank vault, reserved for the serious money you can't afford to risk.

You don't have to look far to find stories of exchange hacks and market crashes that have wiped people out. Those are harsh, but valuable, lessons. For anyone serious about being in this space for the long haul, protecting your capital with smart security and a disciplined exit plan isn't just an option—it’s everything.

Frequently Asked Questions About Crypto Investing

1. How much should I invest in cryptocurrency as a beginner?

Start small. A common guideline is to allocate only 1-5% of your total investment portfolio to crypto. This amount should be money you can afford to lose without impacting your financial stability. Never invest essential funds, like your emergency savings or rent money.

2. What is the simplest crypto investment strategy for a newcomer?

Dollar-Cost Averaging (DCA) is by far the most beginner-friendly strategy. It involves investing a fixed amount of money at regular intervals (e.g., $50 every week) regardless of the price. This removes the stress of trying to time the market and helps average out your purchase cost over time.

3. How do I choose which cryptocurrencies to invest in?

Thorough research is critical. Start by studying the project's whitepaper to understand its purpose and technology. Investigate the founding team's background and experience. Check for an active and genuine community on platforms like Twitter or Discord. Finally, analyze the tokenomics—how the tokens are distributed and used—to avoid projects with red flags like founders holding a majority of the supply.

4. What are the main differences between HODLing and day trading?

HODLing is a passive, long-term strategy where you buy and hold assets for months or years, riding out market volatility. Day trading is an active, short-term strategy that involves making multiple trades within a single day to profit from small price movements. HODLing requires patience, while day trading requires significant time, technical skill, and emotional control.

5. Are high-yield opportunities like staking and yield farming safe?

They offer attractive returns but come with significant risks. Impermanent loss is a major risk in yield farming, where you can lose value if the prices of your deposited tokens diverge. With staking, risks include slashing penalties (losing funds if your validator misbehaves) and lock-up periods that prevent you from selling during a market downturn.

6. How often should I rebalance my crypto portfolio?

For most long-term investors, rebalancing every 3 to 6 months is sufficient. The goal is to trim assets that have grown disproportionately large and reinvest the profits into underperforming assets to return to your original target allocation (e.g., 60% BTC, 30% ETH, 10% Altcoins).

7. What should I know about cryptocurrency taxes?

In many jurisdictions, including the US, cryptocurrencies are treated as property for tax purposes. This means you may owe capital gains tax when you sell, trade, or even use crypto to buy goods or services. It is crucial to keep detailed records of all your transactions. Consult with a tax professional to understand your specific obligations.

8. How can I identify and avoid crypto scams?

Be skeptical of anything that sounds too good to be true. Major red flags include promises of guaranteed high returns, pressure to invest quickly (FOMO tactics), anonymous project teams, and poorly written whitepapers. Never share your private keys or seed phrases with anyone.

9. What is the role of stablecoins in a crypto portfolio?

Stablecoins (like USDC or USDT) are pegged to a stable asset like the US dollar. They serve two main purposes: 1) as a safe haven to park your funds during market volatility without cashing out to fiat currency, and 2) as a tool to earn yield through lending or staking with lower price risk than other cryptocurrencies.

10. What are the best tools for managing a crypto portfolio?

For tracking your investments, platforms like CoinGecko and CoinMarketCap are industry standards. Most major cryptocurrency exchanges offer built-in features for setting up recurring buys (for DCA) and portfolio performance tracking. For security, a hardware wallet from a reputable brand like Ledger or Trezor is essential for long-term storage.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.