If you've heard the term "cryptocurrency investing for dummies," you know it’s really about one thing: turning a complex topic into simple, actionable steps. Forget the intimidating jargon for a moment. You can get started with just a small amount of money and a clear plan, and this guide is designed to be your roadmap.

In This Guide

- 1 Your Simple Start in Cryptocurrency Investing

- 2 How Cryptocurrency and Blockchain Actually Work

- 3 Getting Your Hands on Your First Crypto: A Step-by-Step Guide

- 4 Building Your First Crypto Portfolio

- 5 Keeping Your Crypto Investments Safe

- 6 5 Common Traps That Catch New Crypto Investors

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How much money should I start with?

- 7.2 2. Which cryptocurrency should I buy first?

- 7.3 3. What’s the difference between a hot wallet and a cold wallet?

- 7.4 4. Do I have to pay taxes on my crypto?

- 7.5 5. What happens if I lose my private keys?

- 7.6 6. Can I buy a fraction of a Bitcoin?

- 7.7 7. What does 'Not Your Keys, Not Your Coins' mean?

- 7.8 8. What is a stablecoin?

- 7.9 9. Is it too late to invest in cryptocurrency?

- 7.10 10. How do I spot a crypto scam?

Your Simple Start in Cryptocurrency Investing

Diving into the world of crypto can feel like learning a new language overnight. Headlines scream about wild price swings, and technical terms like “blockchain” or “private keys” can make it feel totally out of reach. But the truth is, it’s more accessible now than ever before.

Let’s think about a beginner, we’ll call her Alex. She was curious about crypto but worried about the risks, so she decided to start small by investing just $100. At first, the process seemed like a huge hurdle—picking an exchange, verifying her identity, and making that first purchase. But by following a simple, step-by-step process, Alex got past those initial challenges and turned her confusion into a solid foundation of understanding. This guide is built to give you that same clarity.

Key Takeaway: The goal isn't to become a crypto genius overnight. It's about taking small, informed steps to build your knowledge and portfolio safely.

This approach breaks everything down into manageable chunks. You don't need a background in finance or tech to get started—just a willingness to learn the basics and a cautious strategy. For a deeper look at the core concepts, our complete guide on cryptocurrency for beginners is a great place to begin.

By the time you finish this article, you'll have a clear path forward. You'll be equipped with the practical knowledge to:

- Understand what cryptocurrency is and where its value comes from.

- Take the first real steps to buy your first digital asset.

- Learn how to keep your investments secure right from the start.

This guide will help you go from being a curious outsider to a confident participant, ready to invest smartly and safely.

How Cryptocurrency and Blockchain Actually Work

Before you put a single dollar into crypto, you absolutely need to get a feel for the technology behind it. The engine driving every cryptocurrency is something called blockchain, and it's a lot more intuitive than it sounds.

Think of it like a shared digital ledger—almost like a global spreadsheet—that's copied and kept in sync across thousands of computers all over the world. Every new set of transactions is bundled into a "block." Once that block is full and verified, it’s permanently attached to the previous one, creating a literal chain of blocks.

This structure is what makes the whole system so secure. If someone wanted to go back and change a transaction, they wouldn't just have to alter one block. They'd have to change that block and every single block that came after it, on thousands of computers, all at the same time. It's practically impossible, which is why blockchain doesn't need a bank or central authority to keep things honest.

Your Digital Keys and Wallet

So, how do you fit into this system? Your access is controlled by a pair of cryptographic keys, which work together like a super-secure digital safe deposit box.

- Public Key: This is like your bank account number. It's an address you can safely share with anyone who wants to send you crypto.

- Private Key: This is the secret key to your box. It proves the crypto at your public address belongs to you and is used to sign off on any transactions you make. You should never, ever share your private key with anyone.

These keys live inside your digital wallet, which is the app or device you'll use to manage your crypto. If you want to dive deeper, our guide on what is cryptocurrency and how does it work breaks it all down.

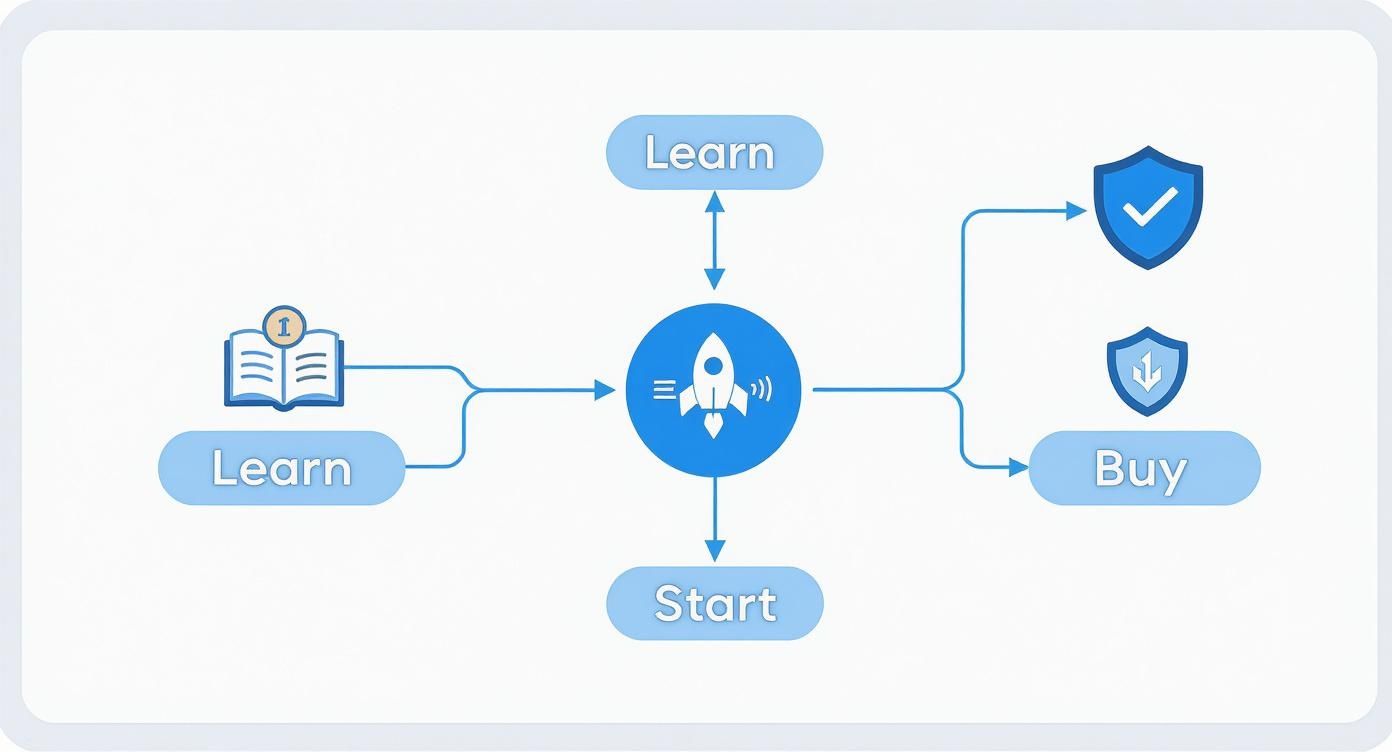

The path for a beginner usually follows these fundamental steps: getting educated, making that first purchase, and, most importantly, learning how to keep your assets safe.

As the infographic shows, a smart start in crypto isn't just about buying; it's a mix of learning the ropes, taking practical steps, and prioritizing security from day one.

Real-World Examples of Major Cryptocurrencies

It's a common mistake to think all cryptocurrencies do the same thing. In reality, they're designed for wildly different purposes, and knowing the difference is key to investing wisely. A great way to see this is by comparing the two giants of the industry: Bitcoin and Ethereum.

Key Insight: Not all cryptocurrencies are trying to be digital money. Many are designed to power applications, create new financial systems, or solve specific problems.

Here’s a simple look at how Bitcoin and Ethereum differ in practice:

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Primary Use Case | A store of value and a payment system. People often call it "digital gold." | A platform for developers to build decentralized applications (dApps) and smart contracts. |

| Analogy | Like a bar of gold—it's a scarce asset people use to store and protect their wealth. | Like a global, decentralized app store where anyone can build and run new programs. |

| Network Focus | To securely process and verify peer-to-peer financial transactions. | To run complex, automated code (smart contracts) that power a new version of the internet. |

| Real-Life Example | Sending money to someone in another country with much lower fees than a bank wire. | Creating a piece of digital art (an NFT) that automatically pays the artist a royalty every time it's resold. |

This distinction is crucial for any new investor. You're not just buying different coins; you're investing in different technologies with entirely different goals. And the world is taking notice. For example, crypto transaction volume in the Asia-Pacific region recently jumped by 69% year-over-year, hitting $2.36 trillion. While Bitcoin still dominates with over $1.2 trillion in inflows, the whole ecosystem is growing, signaling that it's becoming a more integrated part of the global economy. You can dig into more of this data in the 2025 crypto adoption index from Chainalysis.com.

Getting Your Hands on Your First Crypto: A Step-by-Step Guide

Alright, enough theory. It's time to bridge the gap between understanding crypto and actually owning some. This can feel like a big leap, but I'll walk you through every step of the way, just like I would for a friend.

We'll cover picking the right place to buy, getting your account set up, making that first purchase, and most importantly, keeping your new assets safe. Let's get started.

Choosing Your First Crypto Exchange

Your first big decision is where to buy. Think of an exchange as a marketplace for cryptocurrencies. For a beginner, the best ones are easy to navigate, have strong security, and reasonable fees. You don't want to get overwhelmed right out of the gate.

A few names pop up constantly for good reason. They've built reputations for being reliable starting points. Here’s a quick look at how some of the most popular platforms stack up for newcomers.

Comparing Top Crypto Exchanges for Beginners

When you're just starting, you don't need a thousand features you'll never use. You need a platform that's clear, secure, and doesn't hit you with surprise fees. This table breaks down what matters most.

| Exchange | Best For | Ease of Use | Key Feature |

|---|---|---|---|

| Coinbase | Absolute Beginners | ★★★★★ | The cleanest, most intuitive interface for first-time buyers. |

| Gemini | Security-Conscious Beginners | ★★★★☆ | Strong emphasis on regulation and insurance, giving peace of mind. |

| Kraken | Those Planning to Grow | ★★★☆☆ | Starts simple but offers advanced features as your knowledge grows. |

| Binance | Widest Coin Selection | ★★★☆☆ | Access to hundreds of different cryptocurrencies beyond the basics. |

Each platform has its own personality—Coinbase and Gemini are often praised for their clean, simple interfaces, making them fantastic for your first buy. For a more detailed breakdown, you can check out our guide on the best cryptocurrency exchanges for beginners.

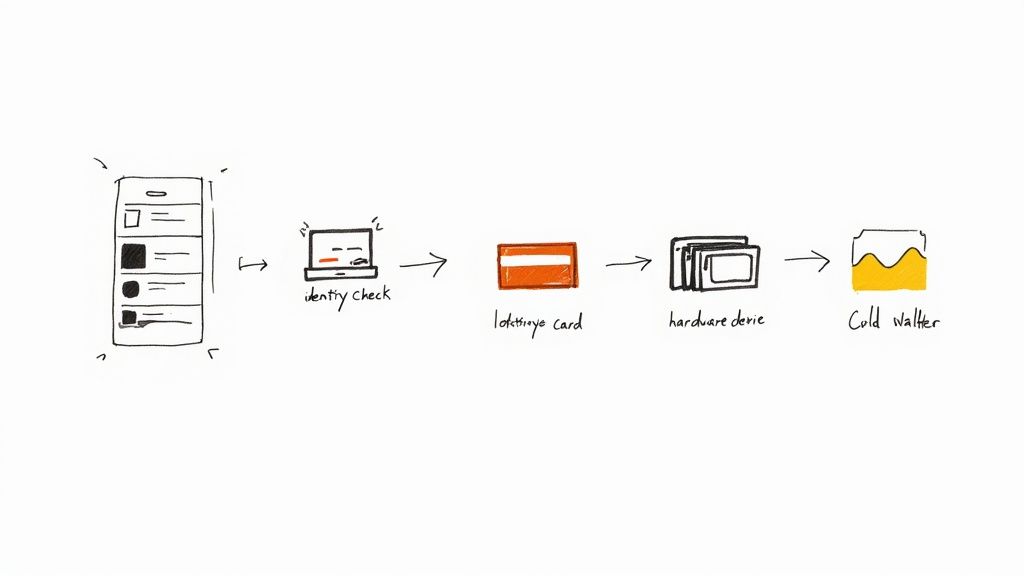

Setting Up Your Exchange Account

Once you've picked your exchange, it's time to create an account. This part is a lot like opening a new bank account online. Because these platforms deal with money, they are required by law to verify who you are.

It’s a straightforward process:

- Sign up with your email and create a very strong, unique password. Don't reuse one from another site!

- Complete the Know Your Customer (KYC) process. This usually involves uploading a picture of a government-issued ID, like a driver's license.

- Enable two-factor authentication (2FA) immediately. This is non-negotiable. It adds a crucial layer of security, requiring a code from your phone to log in.

The screenshot below from Coinbase shows a typical sign-up page. It’s designed to be simple and guide you through the process without any confusion.

Making Your First Purchase

With your account funded and verified, you’re ready for the exciting part. Buying your first crypto is usually just a few clicks away.

- Find the “Buy/Sell” or “Trade” button on the dashboard.

- Enter the amount you want to spend in your local currency (e.g., $50).

- Choose the cryptocurrency you want to buy (Bitcoin or Ethereum are common first choices).

- The exchange will show you a preview, including the transaction fees and how much crypto you'll receive. Review it carefully.

- If it all looks good, hit that "Buy" button.

And that's it! You're officially a crypto owner. Always pay attention to the fee breakdown before you confirm—no one likes surprises.

Where to Store Your Crypto: Choosing a Secure Wallet

Now that you own crypto, you need a safe place to keep it. Leaving it on the exchange is convenient, but it’s a bit like leaving your cash with the store clerk. For true ownership and security, you need your own wallet.

There are two main types:

- Hot Wallets (Software): These are apps or browser extensions connected to the internet. They're great for small amounts and frequent use. Example: MetaMask or Trust Wallet.

- Cold Wallets (Hardware): These are physical devices that store your crypto offline, like a personal vault. They offer maximum security for long-term holdings. Example: Ledger or Trezor.

Moving your assets to a personal wallet you control is a fundamental part of the crypto ethos. Just remember to back up your wallet’s seed phrase (a list of 12-24 words) and store it somewhere incredibly safe and offline.

“Remember, securing your private keys is as important as making your first purchase.”

The industry's growth underscores the need for self-custody. The State of Crypto Report 2025 highlighted some incredible numbers. In 2025, the total market cap blew past $4 trillion, mobile wallet users jumped by 20%, and stablecoin transactions hit a staggering $46 trillion. With $175 billion now in crypto ETPs (a 169% increase!), more people are getting involved, making personal security more critical than ever.

Tips for a Smooth First Purchase

Want to make sure everything goes off without a hitch? Here are a few pro tips:

- Do a test run: Before you invest a larger sum, try buying a very small amount, like $20 worth of a stablecoin (e.g., USDC). This lets you experience the whole process, from buying to transferring, without the stress of market volatility.

- Watch the fees: Network fees can fluctuate. Sometimes, waiting a few hours can save you a few dollars.

- Use limit orders (eventually): Once you're comfortable, learn to use a "limit order" instead of a "market order." This lets you set the exact price you’re willing to pay, giving you more control.

- Don't keep everything on the exchange: It's fine to keep a small amount on the exchange for trading, but move the majority of your holdings to a personal cold wallet for long-term security.

Common Mistakes to Sidestep

Many beginners stumble over the same few hurdles. Here’s how you can leapfrog them:

- Sloppy verification: Double-check that the name and details you enter match your ID perfectly to avoid delays.

- Ignoring the fee breakdown: Always look at the final confirmation screen to see exactly what you're paying in fees.

- Skipping security setup: Don't put this off. Enable 2FA and other security features before you deposit any money.

- "Fat-fingering" an order: Always, always, always double-check the numbers before you click "confirm."

Avoiding these simple mistakes will make your entry into the crypto world feel smooth, secure, and empowering.

Now, you have the map. Go make that first purchase.

Building Your First Crypto Portfolio

Taking that first plunge into crypto is exciting. Yet buying a single coin is only the opening act—you’re really stepping into the world of strategic investing when you assemble a portfolio.

Think of diversification as your safety net. Just as you wouldn’t stash all your cash under one mattress, spreading funds across multiple cryptocurrencies softens the blow if one asset falters.

A Sample Beginner Portfolio Allocation

Let’s say you have $1,000 ready to invest. This illustration shows how a newcomer might blend stability and upside.

- 50% in Bitcoin (BTC) – $500: Bitcoin often earns the nickname “digital gold.” It’s the most established coin, providing a sturdy anchor in a sea of volatility.

- 35% in Ethereum (ETH) – $350: Ethereum goes beyond a simple payment system. As a platform for decentralized applications, it carries unique growth potential.

- 15% in Stablecoins (e.g., USDC) – $150: Stablecoins peg to the U.S. dollar, offering a safe harbor. They act like dry powder, letting you jump on bargains when prices dip.

This mix delivers a strong foundation, exposure to innovative networks, and a ready reserve for market swings.

Common Crypto Investment Strategies

Once your portfolio is in place, pick a management style that fits your goals and temperament. Are you in it for the long haul, or do you enjoy monitoring price swings?

Key Insight: Your chosen approach shapes every decision—whether you weather downturns or chase short-term gains.

You can explore these approaches in more depth in our guide on cryptocurrency investment strategies.

Before you settle on a method, compare the main options side by side:

Comparing Common Crypto Investment Strategies

| Strategy | Risk Level | Time Commitment | Potential Returns | Best For |

|---|---|---|---|---|

| HODLing (Buy & Hold) | Medium-High | Low | High (Long-Term) | Investors with a long-term belief in crypto's growth. |

| Dollar-Cost Averaging | Medium | Low | Steady (Long-Term) | Beginners who want to build a position slowly without timing the market. |

| Staking | Low-Medium | Low | Moderate (Passive Income) | Those looking to earn rewards on the crypto they already hold. |

Choosing the right path means aligning your comfort with risk, the hours you can dedicate, and the returns you aim for.

By 2024, the global crypto market sits at around USD 5.7 billion, with forecasts pointing toward nearly doubling by 2030. The hardware side—everything from mining rigs to secure wallets—was valued at USD 5.15 billion in 2024, underlining the infrastructure growth that supports this space.

Discover more insights about the cryptocurrency market size on grandviewresearch.com.

Keeping Your Crypto Investments Safe

If you remember one thing about crypto security, make it this: “Not your keys, not your coins.”

This isn't just a catchy phrase; it’s the golden rule. When your crypto sits on an exchange, you’re essentially trusting someone else to hold your money for you, just like a bank. But the whole point of crypto is that you can be your own bank. That means taking security into your own hands is not just an option—it's a responsibility.

Think of this section as your non-negotiable security playbook. Following these steps isn’t just a good idea; it’s essential for anyone serious about protecting their digital assets from the very real threats out there.

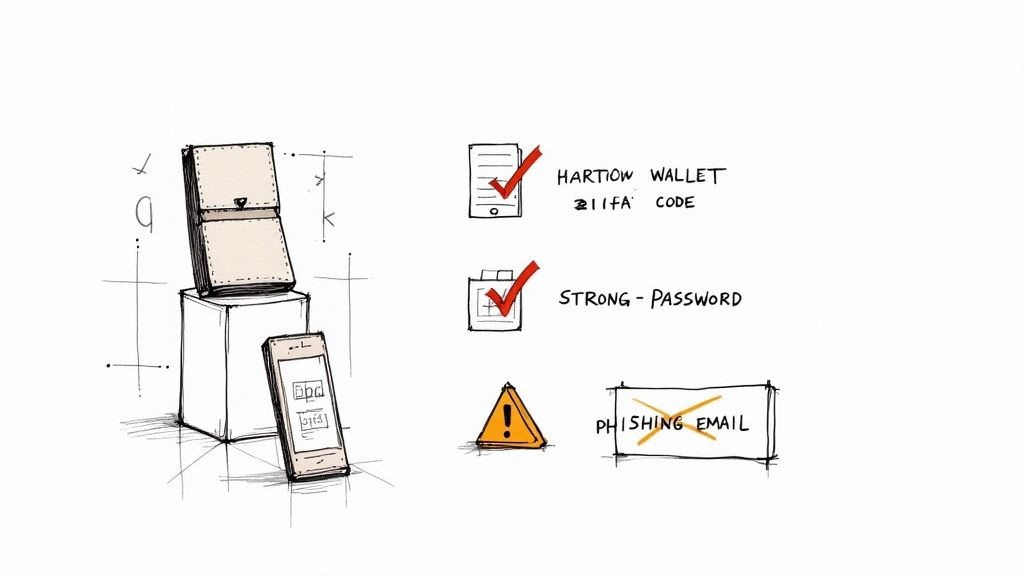

Your Essential Security Checklist

The good news is that you don’t need a degree in cybersecurity to keep your investments safe. It really just comes down to a few disciplined habits. Start with these from day one, and you’ll build a solid defense.

-

Use a Hardware Wallet: Often called a "cold wallet," this is a small physical device that keeps your private keys completely offline. By doing this, you make it practically impossible for hackers to get to your funds over the internet. It's the highest level of security you can get for any crypto you plan on holding for the long term.

-

Enable Two-Factor Authentication (2FA) Everywhere: Make this your first line of defense on every single account you own. Use an authenticator app like Google Authenticator or Authy instead of SMS texts. Why? SMS-based 2FA is vulnerable to "SIM-swapping," where a scammer convinces your cell provider to switch your number to their phone.

-

Create Strong, Unique Passwords: This is basic but critical. Never, ever reuse passwords. Get a reliable password manager to generate and store ridiculously complex passwords for you. It’s a simple step that shuts down one of the most common ways people get compromised.

Key Takeaway: Your security should have layers, like a fortress. Your hardware wallet is the vault, 2FA is the guarded gate, and your strong password is the key to that gate. Each layer makes a potential attack that much harder.

As you get more comfortable, you might want to explore trading platforms that operate differently from the centralized ones we've discussed. You can learn more by reading this comprehensive guide to decentralized exchange crypto to see how they work.

Recognizing and Avoiding Common Scams

Scammers in the crypto space are clever and constantly evolving their tactics. Your best defense is simply knowing what to look for. One of the most common threats is phishing, where attackers create fake emails or websites that look exactly like the real deal to trick you into giving up your login details or private keys.

To keep yourself safe:

- Always double-check the URL in your browser's address bar before you enter any information.

- Never click on suspicious links you receive in emails, texts, or direct messages.

- Be extremely skeptical of "too good to be true" offers. No one is giving away free Bitcoin or guaranteeing massive returns.

Here’s a quick way to spot the difference between a legit platform and a phishing scam:

| Feature | Legitimate Platform | Phishing Scam |

|---|---|---|

| Urgency | Rarely creates false urgency to log in. | Often uses threats like "Your account will be suspended!" |

| Requests | Will never ask for your private keys or seed phrase. | Frequently asks for your secret keys to "verify" your wallet. |

| Sender | Emails come from official, verifiable domains. | Emails often have typos or come from slightly altered domains. |

A Quick Note on Crypto Taxes

Finally, let’s talk taxes. Staying on the right side of the law is a crucial part of being a responsible investor. In the U.S. and many other countries, cryptocurrencies are treated as property. That means any time you sell, trade, or even spend your crypto for a profit, you could owe capital gains tax.

It is absolutely vital to track every single transaction right from the start. Use a crypto tax software tool or even a simple spreadsheet to record the date, amount, and the value in your local currency for every move you make. This simple habit will save you from a world of pain when tax season rolls around. When in doubt, consulting a tax professional who gets crypto is always a smart move.

5 Common Traps That Catch New Crypto Investors

It's easy to get swept up in the excitement of your first year in crypto. But let's be honest—it's also a minefield of mistakes that have tripped up countless beginners. Knowing what these traps are ahead of time can save you a lot of money and a whole lot of stress.

One of the biggest blunders is throwing more money into the market than you can truly afford to lose. It's a classic rookie move, often driven by seeing someone else's big win on social media and thinking, "that could be me!" This leads directly to another pitfall: chasing hype without doing any real homework.

Let's break down the most common mistakes:

- Betting the Farm: This is rule number one. If you're investing money you need for rent, bills, or other essentials, you’re setting yourself up for financial pain and panic-selling at the worst possible time.

- FOMO (Fear of Missing Out) Trading: You see a coin skyrocketing and jump in at the top, terrified of missing the rocket ship. The problem? That rocket is often about to head back down, leaving you with losses.

- Ignoring the Hidden Costs: Those little transaction fees don't seem like much at first, but they add up fast. If you're not paying attention, fees can easily eat up 5–15% of your profits.

- Sloppy Security: This one is non-negotiable. Your private keys are the only thing that proves you own your crypto. Treating them carelessly—like sharing them or storing them insecurely—is like leaving your bank account password on a public bulletin board.

"Doing your own research" isn't just a catchphrase; it's your best defense. That means digging into a project's official whitepaper, seeing what the developers are actually building, and getting a feel for the community—not just blindly following a tip from a random influencer.

“The best way to avoid beginner traps is to have a plan before you buy a single coin.”

Build a Smarter Process from Day One

You wouldn't start a road trip without a map, so don't start investing without a plan. Decide on your strategy—what are your goals? When will you take profits? When will you cut losses?

Set a strict monthly budget for crypto and stick to it. Before you use an exchange, understand its fee structure. And most importantly, make a habit of reviewing your security practices regularly.

By simply sidestepping these common mistakes, you’ll be building the discipline and confidence of a seasoned investor. This is how you move from being a beginner to being in control of your crypto journey.

Frequently Asked Questions (FAQ)

Jumping into crypto always comes with a lot of questions. It's a new and often confusing space, so let's clear up ten of the most common hurdles that new investors face.

1. How much money should I start with?

Start with an amount you would be completely okay with losing. Seriously. Think of it as the price of your education. Many people dip their toes in with $50 or $100, which is more than enough to learn how buying, selling, and securing crypto works without putting real financial pressure on yourself. The goal here isn't to get rich quick; it's to get comfortable with the process.

2. Which cryptocurrency should I buy first?

When you're just starting, it's a good idea to stick with the big names: Bitcoin (BTC) and Ethereum (ETH). They've been around the longest, have the most investor activity, and there's a mountain of information available on them. This makes them a much more stable and predictable entry point compared to the wilder, more volatile world of smaller altcoins.

3. What’s the difference between a hot wallet and a cold wallet?

Think of it like your everyday cash versus your savings account. A hot wallet is connected to the internet—like an app on your phone or computer—which makes it super convenient for quick trades and transactions. On the other hand, a cold wallet is a physical device, like a special USB drive, that stays completely offline. It’s the vault for your crypto, offering the best protection against hackers. If you plan to hold for the long term, a cold wallet is a must.

4. Do I have to pay taxes on my crypto?

Yes, you almost certainly do. In the U.S. and many other countries, crypto is treated as property for tax purposes. That means if you sell, trade, or even use your crypto to buy something at a profit, you’ll likely owe capital gains tax. The absolute best advice I can give you is to start keeping meticulous records of every single transaction from day one.

5. What happens if I lose my private keys?

Losing your private keys is like losing the only key to a bank vault that no one else can open—not even the bank. Your funds are gone for good. There’s no "forgot password" link or customer service line to call. This is why writing down your seed phrase and storing it in a safe, secure place is probably the most important thing you'll do.

6. Can I buy a fraction of a Bitcoin?

Absolutely! A single Bitcoin is divisible down to eight decimal places. You don't need tens of thousands of dollars to get in the game. You can buy just a few dollars' worth to start, which is a perfect way to get your feet wet.

7. What does 'Not Your Keys, Not Your Coins' mean?

This is a core mantra in the crypto world. It's a simple warning: if you leave your crypto on an exchange, you don't truly own it—the exchange does. They control the private keys. If that exchange gets hacked, goes bankrupt, or freezes your account, your funds could vanish. The only way to have 100% control is to move your assets to a personal wallet where you hold the keys.

8. What is a stablecoin?

A stablecoin is a type of crypto designed to hold a steady value because it’s pegged to a real-world asset, most often the U.S. dollar. Coins like USDT and USDC aim to always be worth $1. Traders use them as a safe place to park money between trades without having to cash out of the crypto ecosystem entirely.

9. Is it too late to invest in cryptocurrency?

The days of buying a Bitcoin for a few bucks are long gone, but that doesn't mean the train has left the station. The industry as a whole is still young and evolving. New technologies and use cases are popping up all the time, and many experts believe there’s still plenty of room for growth. Just remember, that potential always comes with risk.

10. How do I spot a crypto scam?

Your best defense is a healthy dose of skepticism. Be instantly wary of anyone promising guaranteed high returns with zero risk—that simply doesn't exist. Scammers love to use social media to create a sense of urgency and hype. If an offer sounds too good to be true, it is. And never, ever share your private keys or seed phrase with anyone.

At Top Wealth Guide, our mission is to provide clear, actionable knowledge to help you build your financial future with confidence. Whether you're interested in stocks or crypto, our resources are here to help you make smarter decisions. Explore more insights and strategies on our website to continue your journey.