Most investors march with the herd—buying what’s shiny, selling when the sirens blare. At Top Wealth Guide, we believe the smartest investment move is often the exact opposite of what everyone else is doing (because crowds are emotional, slow, and expensive).

This blog post shows you, plainly and unapologetically, how to harvest profit from market inefficiencies by thinking differently. You’ll get practical contrarian tactics—real, actionable moves, not motivational wallpaper—spot genuine opportunities, and avoid the classic mistakes that derail most traders… because being alive in the market is better than being theatrically right.

In This Guide

What Actually Makes Contrarian Investing Work

Stock Prices Reflect Expectations, Not Reality

Contrarian investing is gloriously simple: you buy what others are dumping and sell what everyone’s worshipping. The logic isn’t mystical – it’s arithmetic: prices are a forecast, not a ledger. Michael Mauboussin nailed it – stock prices reflect market expectations, not reality. When optimism runs hot, risk compounds; when pessimism goes nuclear, opportunity shows up on sale.

Buffett’s 1988 Coca‑Cola move is the case study you hand to skeptics. He plowed over $1 billion into a mature, “boring” brand while the crowd chased shiny, faster-growing things. By 2020 that call looked like clairvoyance – roughly a 1,550% return – not because Coke suddenly became sexy, but because the market had mispriced the durability of its brand and pricing power. The company wasn’t broken – sentiment was.

David Dreman’s work confirms the same rhythm: low P/E and low P/B stocks persistently outperformed over decades. Why? Markets overreact to short-term trouble – fear overshoots, optimism overshoots – and that creates mean-reversion rents. Sentiment pulls prices away from fundamentals; contrarians step into the gap.

Contrarian Investing Differs Fundamentally from Momentum

Don’t confuse contrarian bets with momentum plays. Momentum chases winners – stocks with strong upward velocity and improving storylines. Contrarians hunt graveyards – assets the crowd has abandoned despite intact economics. You don’t fight durable momentum (hello, Nvidia) and expect to win; you avoid value traps by distinguishing temporary pessimism from permanent decay.

Look at 2008 – not luck, disciplined differentiation. Michael Burry saw the mispricing years before the collapse and made roughly $100 million personally (and hundreds of millions for investors) by shorting the mortgage market. David Tepper bought deeply discounted CMBS and banks during the panic and generated a 132% return in 2009. Buffett’s pref shares in Bank of America in 2011 – a panicked, conviction-sized bet – paid off when sentiment normalized. These weren’t random punts; they were disciplined bets where fundamentals and price diverged materially.

Today’s Mispricings Are Visible and Measurable

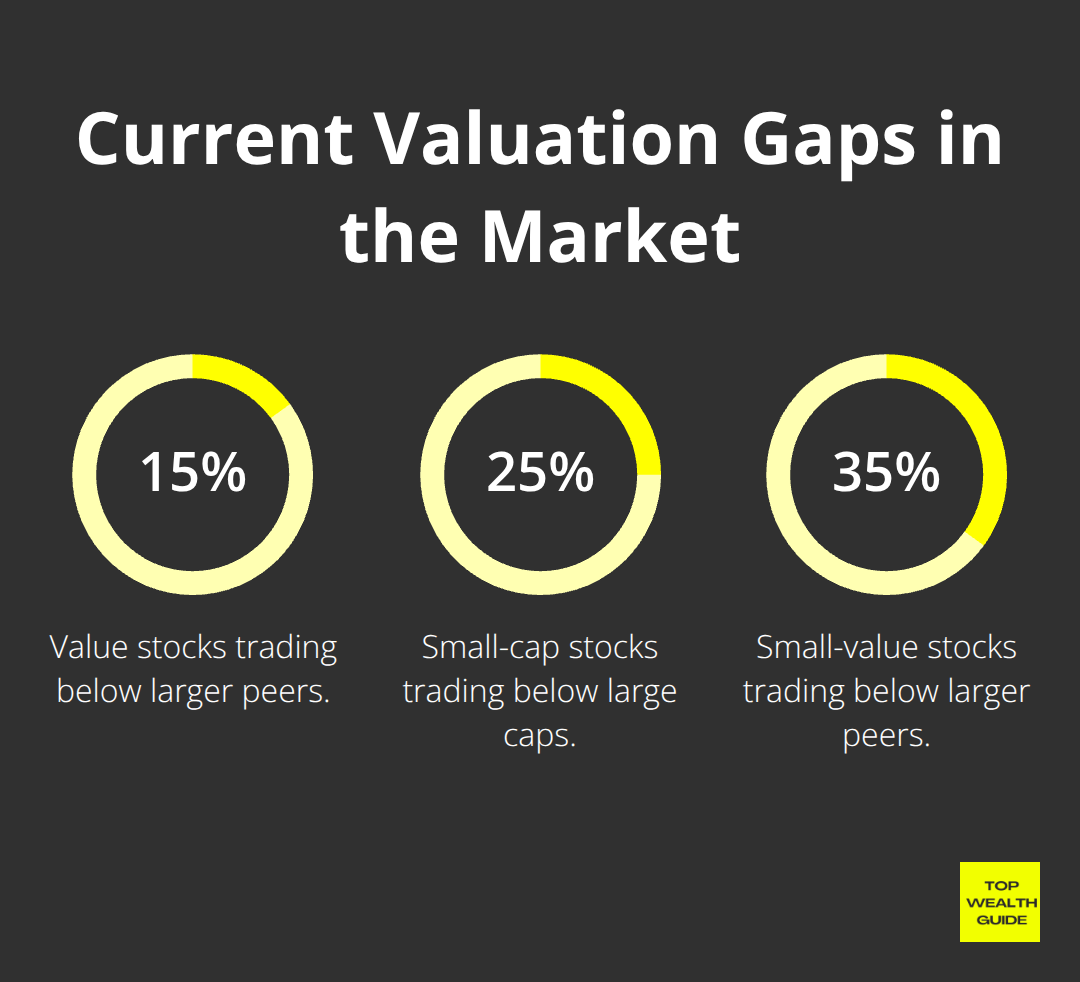

The dislocations aren’t philosophical – they’re quantifiable. Value stocks trade at about a 15% discount, small-caps around 25%, and small-value closer to 35% versus larger peers. Those gaps don’t exist because the market is efficient; they exist because capital is stacked into AI and mega-cap growth, leaving whole swaths priced as if extinction were imminent.

Emerging markets – Korea, China, parts of Latin America – delivered some of the best returns in 15 years, yet U.S. investors sit underexposed. Weird, right? The market’s concentration is extreme: the top 10 constituents now represent 36% of the index, up from 23% five years ago – a crowding that amplifies risk and creates contrarian opportunity in whatever the mob has consigned to the bargain bin.

That imbalance is practical – and actionable. It’s the soil from which robust, repeatable strategies grow.

How to Spot and Act on Underpriced Assets

The Three Signals That Reveal Mispricings

The gap between price and value – that’s where contrarians live. Right now small-cap stocks sit roughly 25% cheaper than their large-cap cousins, and small-value stocks trade at about a 35% discount. Not a fluke – capital is sprinting toward AI mega-caps and abandoning entire neighborhoods of the market, pricing them like the apocalypse is imminent.

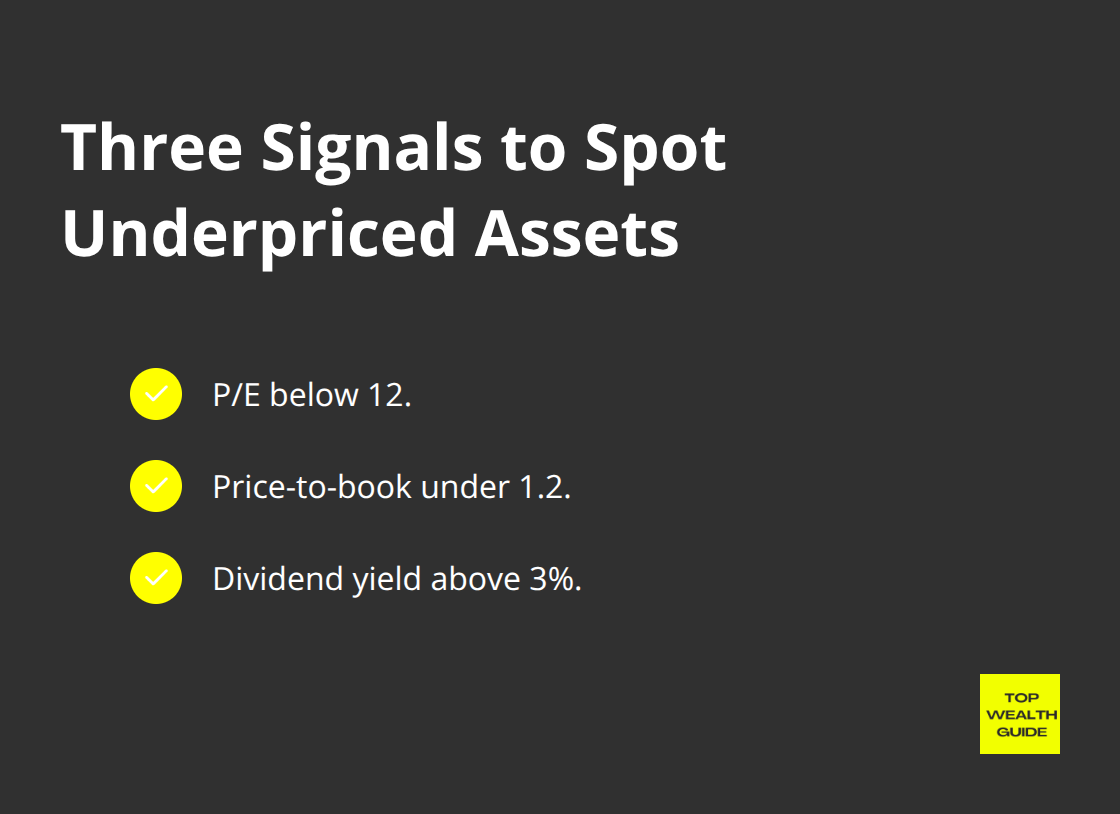

Look for three concrete signals: a P/E below 12, price-to-book under 1.2, and dividend yields north of 3%. Not random cutoffs – these are Dreman’s framework, tested over decades to surface mean-reversion candidates. Start with your brokerage screener or Morningstar and filter for all three. Most will disappoint.

Some will stay underwater for months. But the handful that reverse-when they do-they typically deliver outsized returns because the market’s pessimism was theatrical, not fundamental.

Insider Buying as a Contrarian Red Flag

Second signal: insider buying. When executives and directors open their wallets after a collapse, that’s not PR – that’s a literal vote of confidence. Check SEC filings for open-market purchases; concentrated buying after bad news is a contrarian red flag worth digging into. It tells you people with the most information believe the stock is mispriced.

Analyst Sentiment Disconnects Reveal Opportunity

If a stock has plunged 40% in six months but analysts still slap on hold or sell – read the earnings transcript. Listen to management – compare today’s multiples to the company’s historical norms. Often you’ll find a temporary glitch (supply-chain hiccup, CEO shuffle, sector rotation), not structural rot. Warren Buffett’s Bank of America play in 2011 is the textbook example: the stock was torched by panic, the balance sheet largely intact; he bought preferreds yielding 6%, waited for sentiment to normalize, and the position paid richly.

Panic and Euphoria as Your Trading Calendar

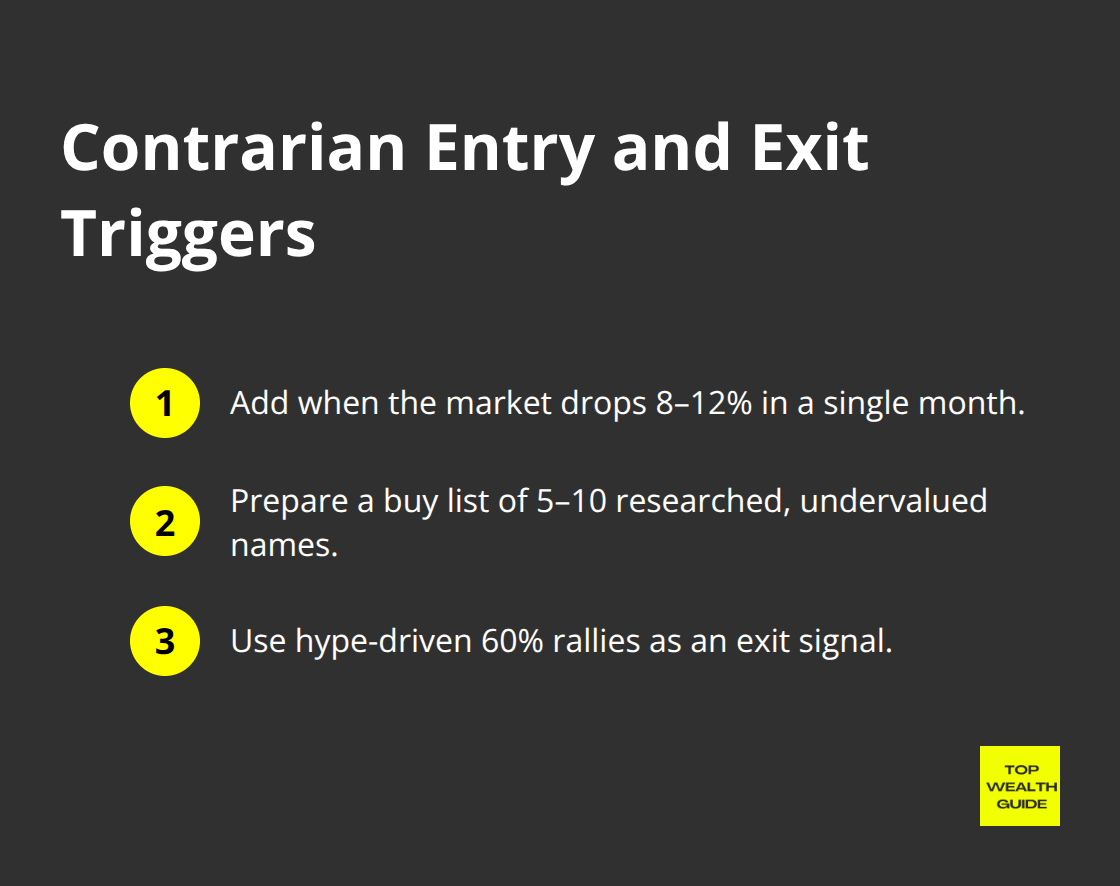

Panic and euphoria – those are the contrarian’s calendar marks. 2008 delivered classic opportunities (think Michael Burry, David Tepper) because they acted while everyone else was frozen. April 2025? A sharp selloff that lasted days – a textbook add point for disciplined contrarians. Build a buy list of 5–10 undervalued names you’ve actually researched, then add when the market drops 8–12% in a single month.

That rule strips emotion out of the equation.

Conversely – when a stock you own rallies 60% and the media cycles into daily worship (CNBC features, Reddit orgies), that’s your exit signal – not a cue to buy more.

Tools and Metrics to Time Your Moves

Emerging markets – Korea, China, parts of Latin America – delivered some of the strongest returns over the last cycle partly because Western investors ignored them during peak dollar strength and AI mania. They weren’t broken; they were out of fashion.

Use the VIX as your contrarian alarm. Above 30: fear is real. Below 15: complacency rules. Those extremes matter. Also watch analyst upgrades/downgrades – an onslaught of downgrades in a sector often foreshadows reversal.

Make a dumb-simple spreadsheet: watch list, entry price, target, exit rules. Remove discretion. When price hits your entry – buy. When fundamentals bust or sentiment shifts irreparably – sell. That system beats gut feel every time and positions you to own the mispricings that show up when the crowd panics or celebrates without thinking.

When Contrarian Bets Backfire

Distinguishing Bargains from Value Traps

Not every undervalued stock is a bargain – some are cheap because they’re busted. Cheap isn’t a thesis; cheap is a symptom. The difference between a mean-reversion sleeper and a permanent value trap usually shows up after you’ve already signed the ticket. Most contrarian wipeouts aren’t timing errors – they’re diagnostic failures. You saw a P/E of 8 and a 40% drop and asked, “Nice!” – when the right question was, “Why?” Is this losing-share to a competitor with better tech? Is the whole industry slowly dying? Or just a temporary panic over a supply-chain kink?

Michael Burry didn’t short mortgage bonds on a hunch – he dug into underwriting standards and default math for months. David Tepper didn’t buy banks in 2008 because he liked the ticker – he separated who had real assets from who had vapor. Their edge isn’t luck; it’s a process – rigorous, boring, relentless.

Building Your Pre-Purchase Checklist

Make a checklist – before you buy. Are insiders holding shares, or are they sprinting for the exits? Are earnings revisions trending up or down for the next two quarters? Does the company still set prices (pricing power), or are competitors stealing customers with better offers? If two of these three are pointing down, drop it. Sure – the stock might recover. But contrarian investing is supposed to stack probabilities in your favor, not hope for miracles.

Write the checklist down. Force yourself to answer the ugly questions out loud. If you can’t justify the position on paper, you won’t justify it when the market is feeding you to the sharks.

Managing Emotional Discipline in Your Positions

Emotional discipline separates survivors from people who think “YOLO” is an investment strategy. You buy at $40 – it falls to $28 – the pain is real, and your brain invents twelve reasons to dump and admit defeat. Flip it: you buy at $40, it rockets to $62, CNBC crowns the CEO a genius – ego whispers, “Double down.” Both impulses are capital killers.

Set entry, exit, and target levels before you click buy – and write them down. If fundamentals change and your exit is hit, sell – no drama. If your target is hit, trim – even if you believe it’ll keep running. The goal: replace the emotional veto with a repeatable system. Systems keep you in the game.

Position Sizing as Your Risk Guardrail

Position sizing in contrarian investing matters more than most admit. Don’t put more than 3–5% of your portfolio into any single contrarian bet – no exceptions, no brags. That constraint forces you to diversify across mispricings instead of throwing all chips at one seductive narrative. Owning five contrarian ideas at 3% each means a single dud costs you 3% – not 15%. That gap – the ability to survive losses – is the difference between compounding and blowing up.

Look at Buffett – he holds 5–10 core positions and channels conviction through discipline, not through reckless concentration. The math is merciless: smaller slices across multiple bets cut idiosyncratic risk and keep you solvent long enough for mean reversion to do its work.

Final Thoughts

Contrarian investing works because markets overshoot-irritatingly predictable, really. Fear and greed shove prices away from fundamentals, and the disciplined (and slightly masochistic) investor who tolerates temporary pain harvests the difference. The playbook isn’t exotic: buy when others panic, sell when others celebrate. The challenge is execution-emotional armor, a repeatable strategy, and the stomach to sit underwater for months while sentiment normalizes. That’s the discipline that separates outperformance from noise.

Not every cheap stock is a bargain-some are cheap because they’re broken. Value traps eat capital faster than headline disasters because they masquerade as opportunity. Distinguish temporary pessimism from permanent decay by asking the hard questions: competitive position, insider behavior, earnings trajectory-be brutal. Write your entry, target, and exit before you buy (no heroics), then act without hesitation when fundamentals crack or your exit triggers.

Small-cap value trades at roughly 35% discounts to larger peers, and emerging markets just delivered some of the strongest returns in 15 years while U.S. investors sat underexposed. Why? Capital clusters into fashionable themes-right now, AI mega‑caps-and abandons entire sectors. Practical approach: pick five undervalued names you’ve actually researched, size no more than 3–5% each, and build a stupid-simple spreadsheet with entry prices, targets, and exit rules. We at Top Wealth Guide believe contrarian investing unlocks wealth for investors willing to think independently-and manage risk with discipline.