Compound growth — the magical power that somehow morphs a humble $10k into a whopping $100k over time. It’s like having a little financial wizard quietly working its magic in the background. How does it happen? The math. Yep, just patient investing, and the math does the rest.

Over at Top Wealth Guide, we’ve cooked up a guide that’s all about helping you tap into this financial sorcery. Equipped with compound growth calculators, you’ll see — plain as day — how your money can snowball into a mini fortune, given the time it needs to stretch its legs and grow. Voilà!

In This Guide

How Does Compound Growth Actually Work?

The Mathematics Behind Exponential Wealth Creation

Compound growth – it’s the magic that turns your dollars into mini money factories. Let’s break it down: not only do you earn returns on your original pile, but on every penny those dollars generate too. So, slap down $10,000 at a 7% annual return, and you pocket $700 the first year. Year two? You rake in 7% on $10,700, netting you $749. Fast forward a couple of decades, and you’ve got a snowball rolling downhill.

Picture this – a 25-year-old chips in $200 every month at a 6% return. By hitting 65, they’re sitting on roughly $393,700, according to TIAA. Now, if this person waits ‘til they’re 35 to start the exact same way, they end up with just $201,100. That decade’s delay? It costs a whopping $192,600 in what could’ve been chilling on a beach money.

Real Numbers That Prove Compound Growth Power

Enter Warren Buffett and his juggernaut, Berkshire Hathaway – living proof of compound growth with a jaw-dropping annual return of 19.9% from 1965 to 2022. A cool $10,000 plunked down in ‘65? Today that’s a monstrous $364 million. Want something more within reach? Check the S&P 500’s historical average rate of return featuring 10.54% annually.

Now, someone funnelling $500 monthly for three decades at this average return ends up with $1,130,244. Contributions? Just $180,000. The gap – $950,244 – all of that is the compound magic.

Since 1980, the S&P 500 has been popping bottles with a total return of 7,670%, which translates to an annual 12.1% return. Astonishing, right?

Time Amplifies Every Dollar’s Growth Potential

If you’re wondering when to jump on the savings train, earlier is better. Way better. Take Carolina – she stashes away $100 every month from 25 to 35 and then hits pause. At 65, she’s got $160,300 with those 6% returns. Andy? He decides to kick off at 45, puts away $100 monthly till 65, and wraps up with just $49,970 – and that’s after 20 years to Carolina’s 10. Her early hustle bags an extra $110,330.

Even a five-year lag can wreak havoc on your goals. Start $1,000 at 20 and watch it balloon to $32,000 with 6% returns by age 70. Wait until 30 and that’s only $16,000.

So, lesson learned – whip out those compound growth calculators, stat. They’re essential for any savvy investor mapping out their future – knowing when to dive in and how to keep their investment strategy aimed at the stars.

How to Use Compound Growth Calculators Effectively

Essential Variables That Drive Your Results

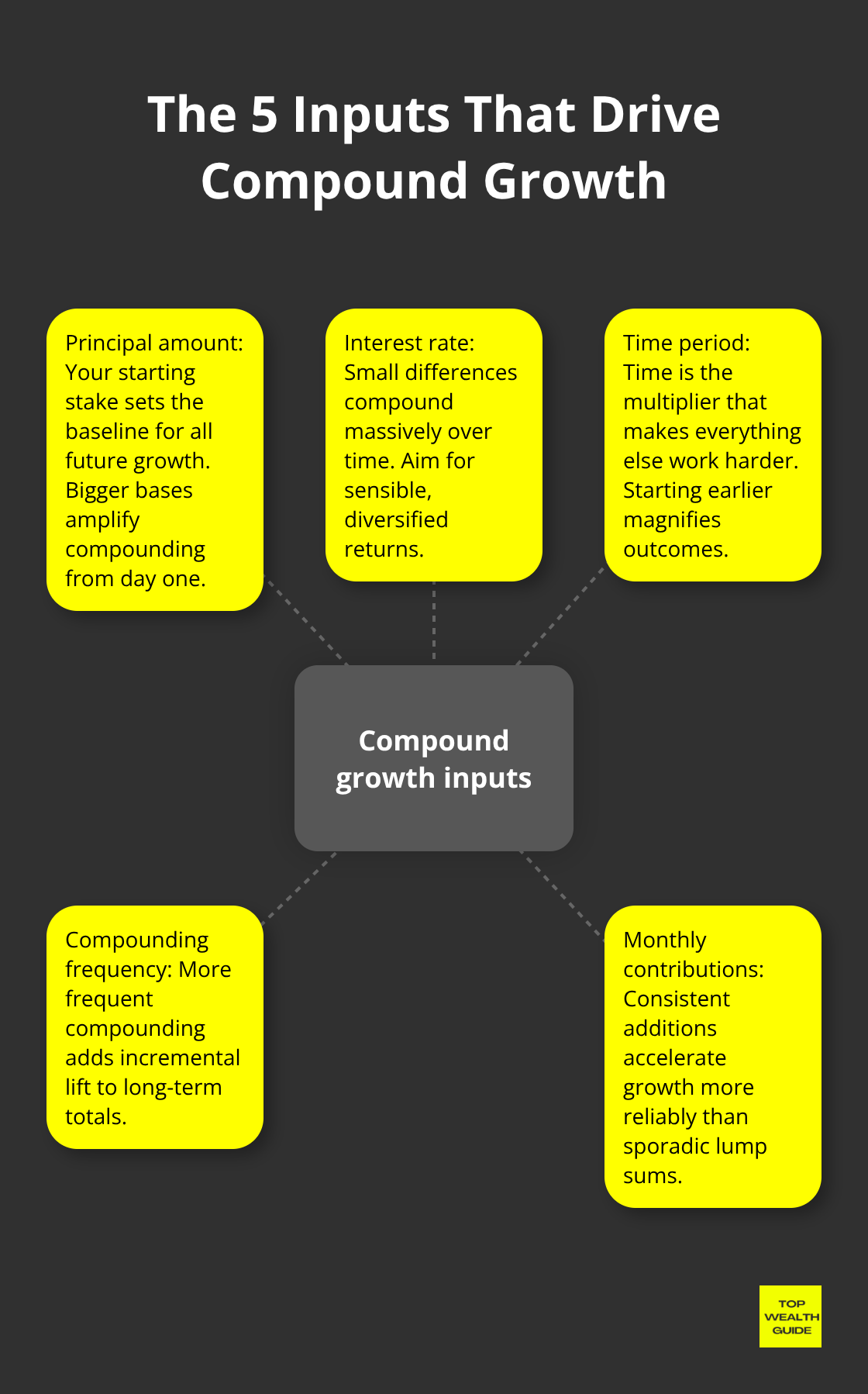

Five variables determine your compound growth trajectory… and mastering them separates the pros from the dabblers. First, your principal amount-it’s your starting block, whether you’re kicking things off with $1,000 or diving in at $100,000, this number is your power-up gauge.

Interest rate? That’s your wind beneath the wings-compound interest shows how different rates are like turbo boosts over time.

The time period-think of it as your secret sauce that enhances all other ingredients. Those extra five years from, say, age 60 to 65? They can throw an extra $200k into your retirement cocktail. Then, we’ve got compounding frequency, an underrated player-compound interest isn’t just about numbers, it’s about timing… monthly adjustments are the vibe here. Meanwhile, monthly contributions? They’re the divide between legit empire builders and the weekend warriors (a solid $300 a month beats the scatter-brained $10,000 lump efforts).

Kick things off with a compound interest calculator for the basics, then sprinkle in some market magic. Start conservatively-think 6% for diverse setups, 4% for the bond lovers, 10% for the thrill-seekers.

Test, tweak, repeat… adjust one lever at a time. Bump those monthly contributions up in $100 chunks to reveal impact waves. And don’t sleep on inflation-it’s the sneaky villain, so swipe 2.5% off nominal returns for a real-deal picture. Savvy folks run three scenarios: the pessimistic (at 4%), the realistic (at 7%), and the dreamer’s delight at 10%.

Interpreting Results That Actually Matter

Zero in on total accumulated wealth-forget just the interest-that final tally? It marks your financial freedom horizon. Stack up your total contributions against the finale to see the mighty hands of compounding at work. If you tossed in $180k but wound up with $800k, compound interest just handed you $620k as a parting gift.

Find your break-even point where compound magic outdoes your total contributions-usually between year 15-20 at 7% returns. Forget short-term blips under 10 years-compounding demands patience for payoffs. Watch for those acceleration phases… that’s when your growth line gets its groove back (read: after year 20 when interest outpaces what your monthly hustle adds).

Now that you’ve got the savvy on using these calculators like a pro, let’s dive into which top tools and platforms serve up the most spot-on projections for crafting your investment journey.

Which Calculators Deliver the Most Accurate Growth Projections

Free Tools That Actually Work

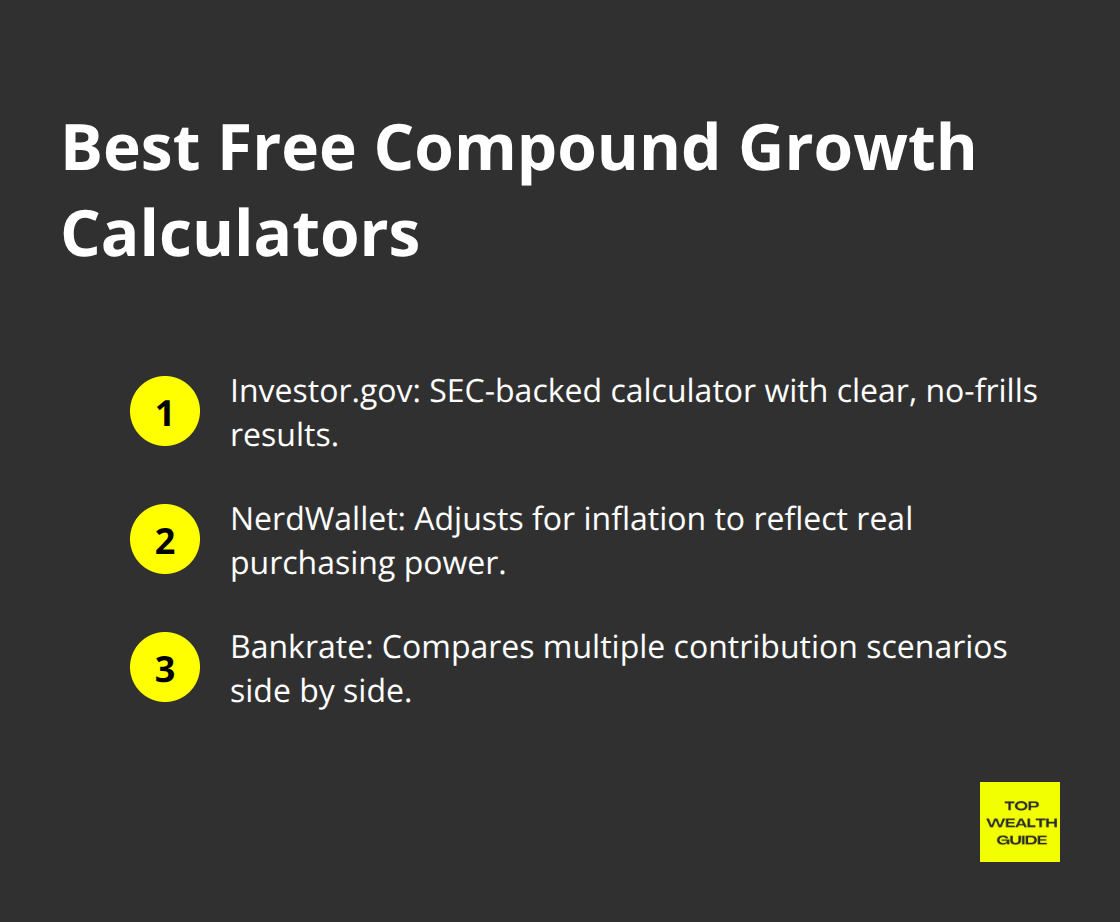

Alright, let’s break it down. First up, we’ve got the Investor.gov compound interest calculator. This thing is… legit. It’s the one armed with the SEC’s trusty backing, giving you straight-up, crystal-clear calculations with zero marketing fluff. Think of it as the calculator that gets the job done-monthly contributions, compounding frequencies-it’s all there. And, guess what? You won’t get ambushed by a pitch for some overpriced financial product.

Sliding into second place, we’ve got NerdWallet’s calculator with that nifty inflation adjustment feature. Just knock off 2.5% from those impressive returns, and bam… you’ve got the real deal on your purchasing power growth. Over at Bankrate, they’re the go-to for scenario planning, letting you stack up and compare three contribution amounts in a nice, neat layout.

And those basic bank calculators? Yeah, no. They’re like that lowball offer in a high-stakes poker game-designed to make their savings accounts seem… almost exciting.

Professional Platforms for Serious Investors

Now, for the big leagues-cue the Monte Carlo simulators. This is where the kids get separated from the adults. Case in point, Personal Capital’s free retirement planner-it’s running a whopping 1,000 scenarios using real-deal historical market data. Instead of a single guess, it’s showing you the full range of ‘could-be’ outcomes.

And Morningstar? Clocking in at $34.95 a month, it’s serving up premium projections with fancy tax-loss harvesting calculations and asset allocation optimization. Fidelity’s got a similar Monte Carlo analysis on the house-but only if you’re coughing up a minimum of $25K as an account holder.

These sophisticated tools dive deep into market volatility, sequence-of-returns risk, and asset class correlations-stuff that simple calculators essentially sleep on.

Mobile Apps That Track Real Progress

Personal Capital’s mobile app is where reality checks into your investment accounts-tracking that compound growth stuff in real-time. Daily updates, unraveling how every blip in the market affects your long-term game.

Then there’s YNAB, tying budgeting to investment tracking, calculating on the fly how those extra monthly dollars speed up your compound growth journey. Meanwhile, Acorns takes your spare change from everyday purchases and invests it-showing growth projections based on your real contributions.

Let’s not forget Mint, standing by to compare your portfolio growth against your OG compound interest calculations. It’s that dashboard that highlights when life overtakes-or lags behind-your best-laid plans (because… reality checks are a necessity).

Considering more than just traditional securities? Dive into a real estate investment calculator. It’s the tool to crunch numbers on property investments alongside the usual suspects for all-round growth projections.

Final Thoughts

Compound growth… it’s the secret sauce that turns small seeds into giant money trees. Wait too long, and that tree’s gonna be a shrub. Start at 25 instead of 35, and we’re talking hundreds of thousands more when you retire. Look at the scoreboard-Carolina’s sitting on $160,300, while Andy’s got $49,970. Timing? It’s the MVP, folks.

Here’s the kicker-early and consistent wins the game. A $500 monthly drop into the market at 10%… and boom, over $1.1 million after 30 years. And guess what did most of the heavy lifting? Yup, compound growth. It’s like the gift that keeps on giving-$950,244 worth, precisely (thank you, historical market performance and smart folks sticking it out). These aren’t just numbers from the realm of fantasy-real humans, real decades, real wealth.

The next step you take is the real power move. Best timing? Pffft. Action beats perfection. Open that investment account today, even with just a Benjamin, and start charting your path to financial badassery. Got questions like, what’s the magic number to contribute? Spoiler: The real secret is just to start. Don’t wait for stars to align-just get moving.

And hey, Top Wealth Guide is in your corner, offering tools and insights to guide you to the promised land of smart investments. What’s pressing on your mind about compound growth? Most are hung up on the ‘how much,’ but the golden ticket is starting now, not in some elusive ‘perfect moment’ that never really turns up.

1 Comment

Pingback: Market Timing vs Buy and Hold Which Strategy Wins? - Top Wealth Guide - TWG