Most investors don’t lose their wealth to crashes — they do it to themselves. At Top Wealth Guide, we’ve watched the same tragic loop play out: panic selling, fee-bleeding products, terrible timing (and yes, ego) — and decades of compound gains vanish like they never existed.

The good news? Almost all of these errors are preventable. Seriously — understanding what destroys wealth is step one. Do that, and you move from reactive noise to deliberate compounding. Simple, boring, effective.

In This Guide

How Fear and Greed Hijack Your Portfolio

Fear Locks In Losses When Markets Fall

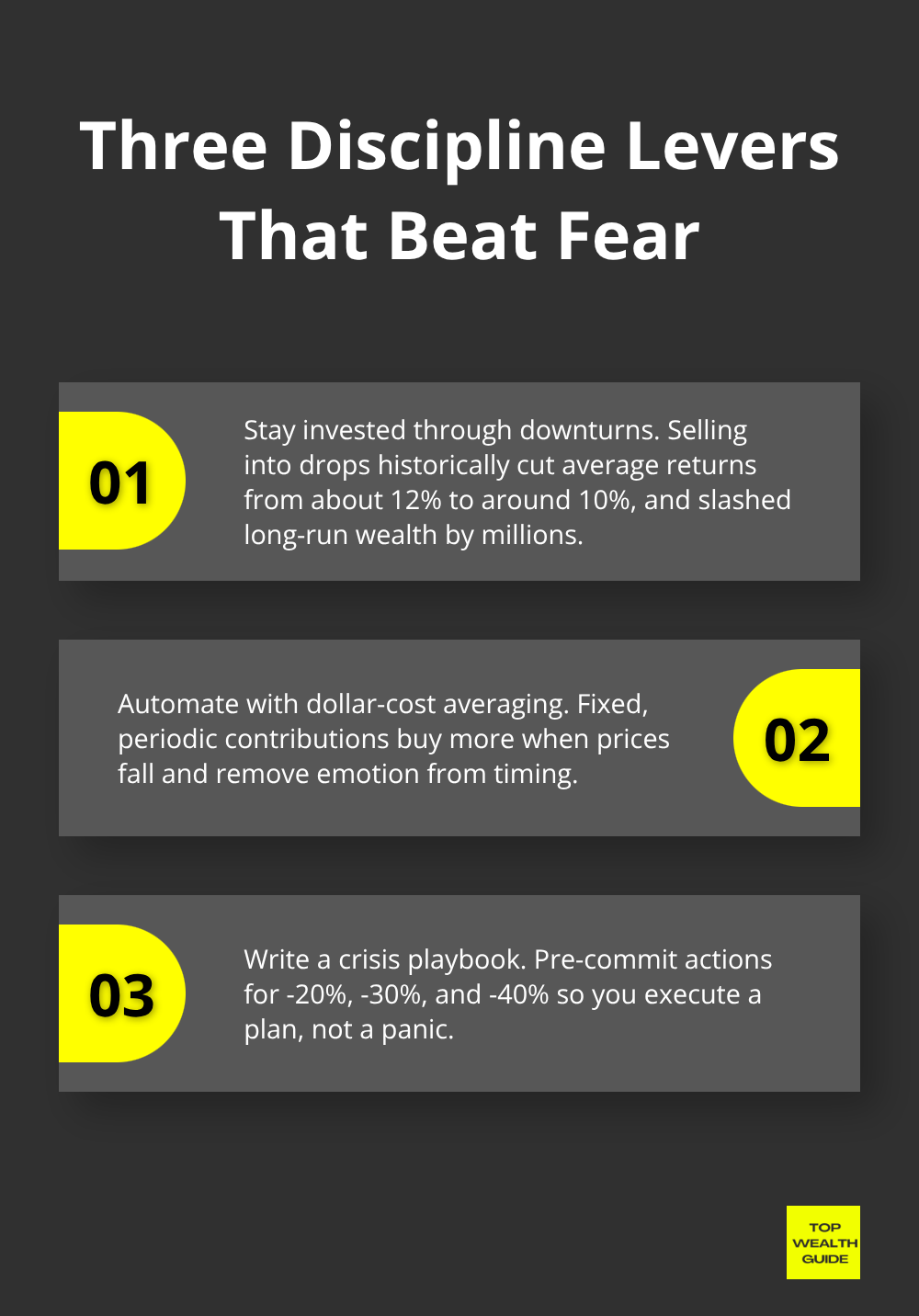

Fear is the fastest route to turning a portfolio into a self-fulfilling tragedy – sell during the drop, lock in the loss, and watch what could’ve been vaporize. When stock markets crashed during COVID-19, a lot of people panicked and sold near the bottom. The numbers are merciless: Morgan Stanley’s analysis shows that investors who stayed invested from 1980 through February 2025 averaged about 12% annual returns; those who sold during downturns averaged around 10%. Over 45 years with steady contributions, buy-and-hold investors ended up with roughly $6.1 million versus about $3.6 million for the market-timers. The math doesn’t negotiate – one emotional decision costs you millions.

The cure isn’t more courage – it’s architecture. Automate contributions so you buy more when prices fall, not sell more. That’s dollar-cost averaging – boring, mechanical, and undefeated at removing the human from the worst part of the equation. You don’t have to feel brave; the system does the heavy lifting.

Chasing Hot Sectors After Rallies Destroys Returns

Buying after a big run? Congratulations – you’ve just volunteered to buy the top. After strong rallies, people pile into hot sectors (FOMO in action), pay peak prices, then watch sentiment flip and those same positions crater. It’s the disposition effect – we hold losers too long and sell winners too soon – and it reliably underperforms a disciplined plan.

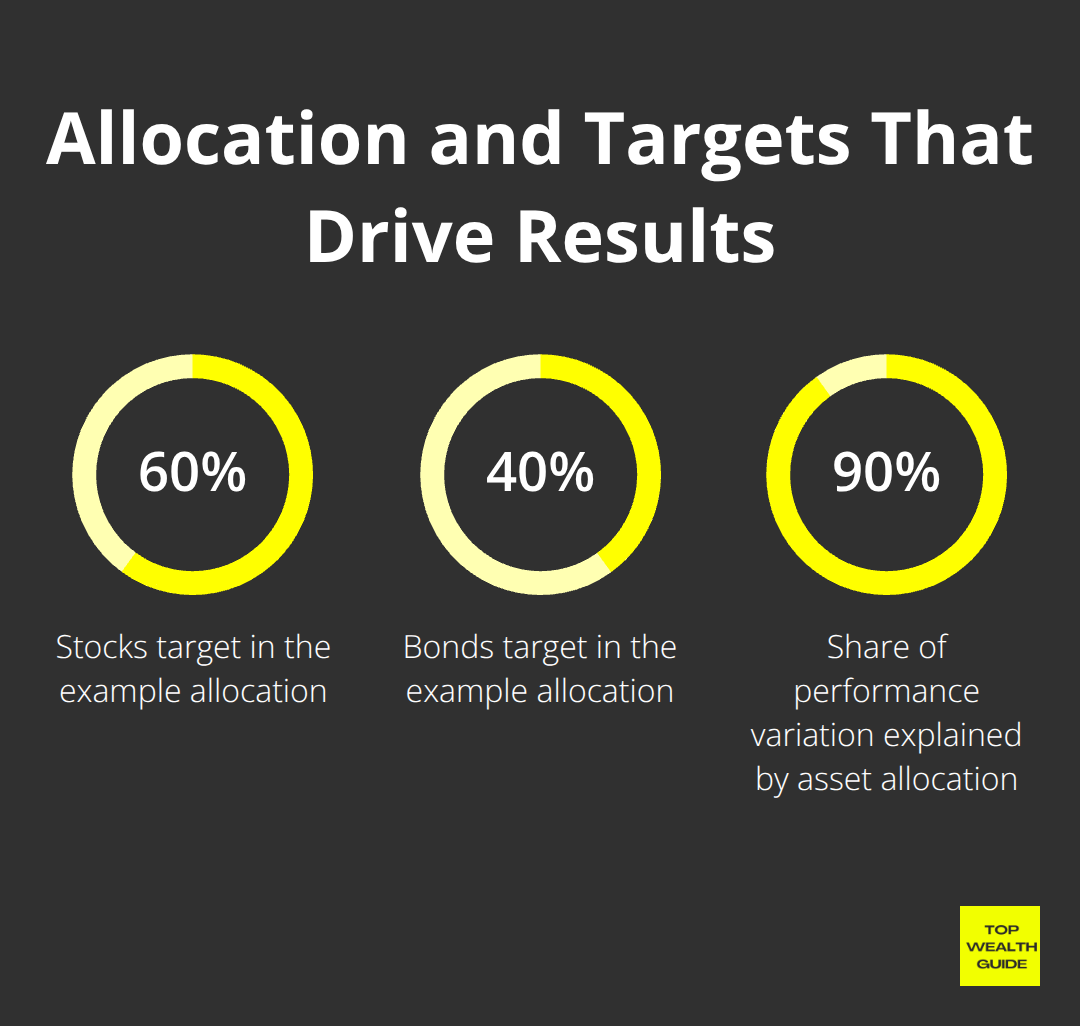

Fix it before feelings show up. Write a rebalancing rule and stick to it. If your target is 60% stocks, 40% bonds and stocks explode to 70% – rebalance back to 60%. You force yourself to sell high and buy low without having to wrestle with your impulses. Rebalance at least annually – or whenever you drift more than five percentage points. Simple. Effective. Slightly humiliating for your inner gambler.

A Crisis Playbook Prevents Panic Decisions

You need a crisis playbook – not a prayer. When markets tumble, most people either freeze or hit the eject button. So treat your plan like a fire drill: write down what you’ll do at -20%, -30%, -40% (yes, actually write it). When the downturn arrives, you’ll execute a plan you already agreed to – which is a lot easier than trying to negotiate with fear in real time.

Short-term headlines are noise – don’t let them drive long-term decisions. Your portfolio should reflect your goals and time horizon, not tomorrow’s trending story. This kind of discipline also exposes the next big mistake: building portfolios without proper diversification or asset allocation. Don’t be that person.

Lack of Diversification and Poor Asset Allocation

Plowing all your money into a handful of stocks-or worse, one sexy sector-feels like genius when the market’s handing out trophies… until one earnings miss or one regulatory slap turns that swagger into a wipeout. The math is relentless – a 50% drop requires a 100% gain to break even. Most folks don’t have the stomach, the patience, or the time horizon for that kind of recovery. Diversification isn’t some timid, boring choice-it’s the difference between a lifetime of compounding and a headline about ruin. Data proves it: investors holding a broad cocktail of stocks, bonds and other assets across sectors and geographies outperform the lone-wolf, bet-the-house crowd over multi-decade stretches. Vanguard’s work is blunt about it – asset allocation accounts for roughly 90% of portfolio performance variation, not your hot stock picks. If you’re hunting the next unicorn or betting the ranch on a single theme, you’re ignoring the thing that actually moves the needle.

Total Market Index Funds Eliminate Single-Stock Risk

Total market index funds fix the single-stock nightmare instantly. Buy a total U.S. stock market ETF and you’re instantly invested in thousands of companies across every sector-no PhD in finance required, no binary risk tied to one CEO’s mood, and costs that are laughably low (think ~0.03%). Add an international fund for geographic ballast, match bonds to your time horizon, and you’ve constructed a portfolio that actually behaves like a plan. Shorter goals (five years or less)? Bonds matter-materially. Thirty-year retirement horizon? Stocks should dominate. The trick: set your allocation once-then shut the door on opinion.

Allocation Drift Sneaks Concentration Back In

Here’s where the plan dies: complacency. You start 60/40, markets rip, and before you know it you’re 75/25-concentration sneaks back in via the back door. Rebalance annually, or whenever you drift more than five percentage points from target. This forces you to sell the winners and buy the laggards-the exact opposite of what your instincts will scream for, which is precisely why it works.

Rebalancing Enforces Buy-Low, Sell-High Discipline

Rebalancing isn’t optional-it’s the mechanical enforcement of the sacred rule: buy low, sell high. When markets implode, rebalancing forces you to pick up stock at discounted prices. When markets froth, it makes you trim and lock gains. This isn’t theory; it’s behavior documented across thousands of portfolios. Put a calendar reminder in January (or after any major market move), check the math, and move money where it needs to go. Use a robo-advisor or a human advisor-they’ll make the decisions for you and remove another emotional trap.

A mediocre plan executed with discipline will beat a brilliant plan executed intermittently. Your allocation should be boring, your rebalancing mechanical, and your feelings-irrelevant. But even the best-diversified portfolio can bleed returns slowly and stealthily through one silent killer: the fees you pay to manage it.

High Fees Are Killing Your Returns More Than You Think

Active Managers Rarely Beat Their Fee Burden

Active fund managers charge 0.5% to 2% annually-a number that feels small until compound interest does its slow, brutal work. Vanguard data from December 31, 2024 shows their average fund expense ratio at 0.07% versus the industry average of 0.44%. Over 30 years that gap isn’t small anymore – it morphs into hundreds of thousands of dollars evaporated into management fees. Someone in a 1% fee fund and someone in a 0.07% fund can watch the same market and end up worlds apart-because one had more of their gains quietly siphoned off. The math is merciless: the active manager must outperform enough to cover fees before delivering any value. 65% of all large-cap U.S. equity funds underperformed their indexes – proof that most don’t clear that bar.

Hidden Trading Costs Drain Wealth Silently

Fees are the headline – trading costs are the silent killer. Every trade brings commissions, bid-ask spreads, and market impact. High-turnover funds (think: trading like it’s a hobby) force you to pay taxes and fees on moves that, statistically, underperform a buy-and-hold strategy. Those hidden trading costs add up-0.5% to 1.5% a year for many active strategies-which is money that leaves your account and never comes back. Favor funds with turnover under 20% and expense ratios under 0.15%. Total market index ETFs do this like it’s easy. A total U.S. stock market ETF charges about 0.03% and turns over maybe 5% per year. Not a compromise-an outright win.

Loaded Products Trap You From Day One

Loaded mutual funds, annuities with surrender charges, “actively managed” separate accounts-these products are designed to generate revenue for the seller. Not to grow your wealth. A loaded fund tacks on 4% to 6% up front-so you start 4% behind before the market moves. Annuities with 2% annual fees and multi-year surrender charges are wealth-destruction dressed up in safe-sounding language. If it feels like the product exists to keep you captive-well, that’s because it does.

Low-Cost Accounts and Tax Efficiency Win

The antidote is annoyingly simple: cheap funds, tax-advantaged accounts, automatic contributions. Begin with the 401(k) match-if your employer is giving you free money, take it-then Roth IRA, then taxable brokerage. Use low-cost ETFs and index funds.

Tax-loss harvesting can turn market pain into tax relief in taxable accounts. Set up automatic contributions-monthly additions beat timing the market every day of the week. And use portfolio trackers so you monitor progress without turning every dip into existential dread.

Fee-Only Advisors Deliver Real Value

If you want human help, hire a fee-only advisor (not commission-based) and check credentials. Expect to pay 0.5% to 1% for honest portfolio management. That’s money-yes-but a good advisor stops you from panic selling or owning tax-inefficient junk, which often pays for their fee immediately. The gap between a 0.5% fee advisor and a 1.5% load fund is roughly 1% per year-translate that over 30 years and you’re looking at something like 30% of your long-term returns. Stop bleeding money to unnecessary middlemen.

Final Thoughts

The pattern repeats across millions of portfolios – panic selling when the headlines flash red, dumping into a single “home run” stock, and bleeding returns to fees… These aren’t accidents – they’re predictable human behaviors that vaporize wealth when fear or greed grabs the wheel. An investor who stayed disciplined from 1980 through February 2025 averaged roughly 12% annually and built about $6.1 million with steady contributions. The market-timer – the headline-reactor who sold into downturns – averaged 10% and ended with roughly $3.6 million. That $2.5 million gap? Emotional decisions, not superior market insight.

Fee drag compounds the hemorrhage. Holding a 1% active fund versus a 0.07% index fund costs you roughly 30% of long-term returns over three decades – yes, thirty percent. You don’t need to be smarter than everyone else; you need to avoid the traps most people fall into. Automate contributions so you buy more when prices fall (do it blind – out of sight, out of panic), build a diversified portfolio matched to your time horizon, rebalance annually to enforce buy-low/sell-high discipline, and use low-cost index funds instead of loaded products.

The pivot from chasing hot stocks to embracing mechanical discipline separates wealth builders from wealth destroyers. We at Top Wealth Guide help investors construct strategies tied to actual goals – not the latest market noise. Visit Top Wealth Guide to explore actionable frameworks for building long-term wealth.