Tiny financial screw-ups… they don’t just vanish. Nope, they snowball into gigantic losses over the years. You kick the can down the road on investing or splurge when you shouldn’t? Boom—you’re potentially kissing over $1 million goodbye by the time you retire.

Our team over at Top Wealth Guide—what do we see? The same old story with investors fumbling their way to building that robust, long-term wealth. But hey, it’s not all doom and gloom. Spot these wallet-draining blunders early on, and you’ve got the upper hand to steer your ship in the right direction and safeguard your financial future.

In This Guide

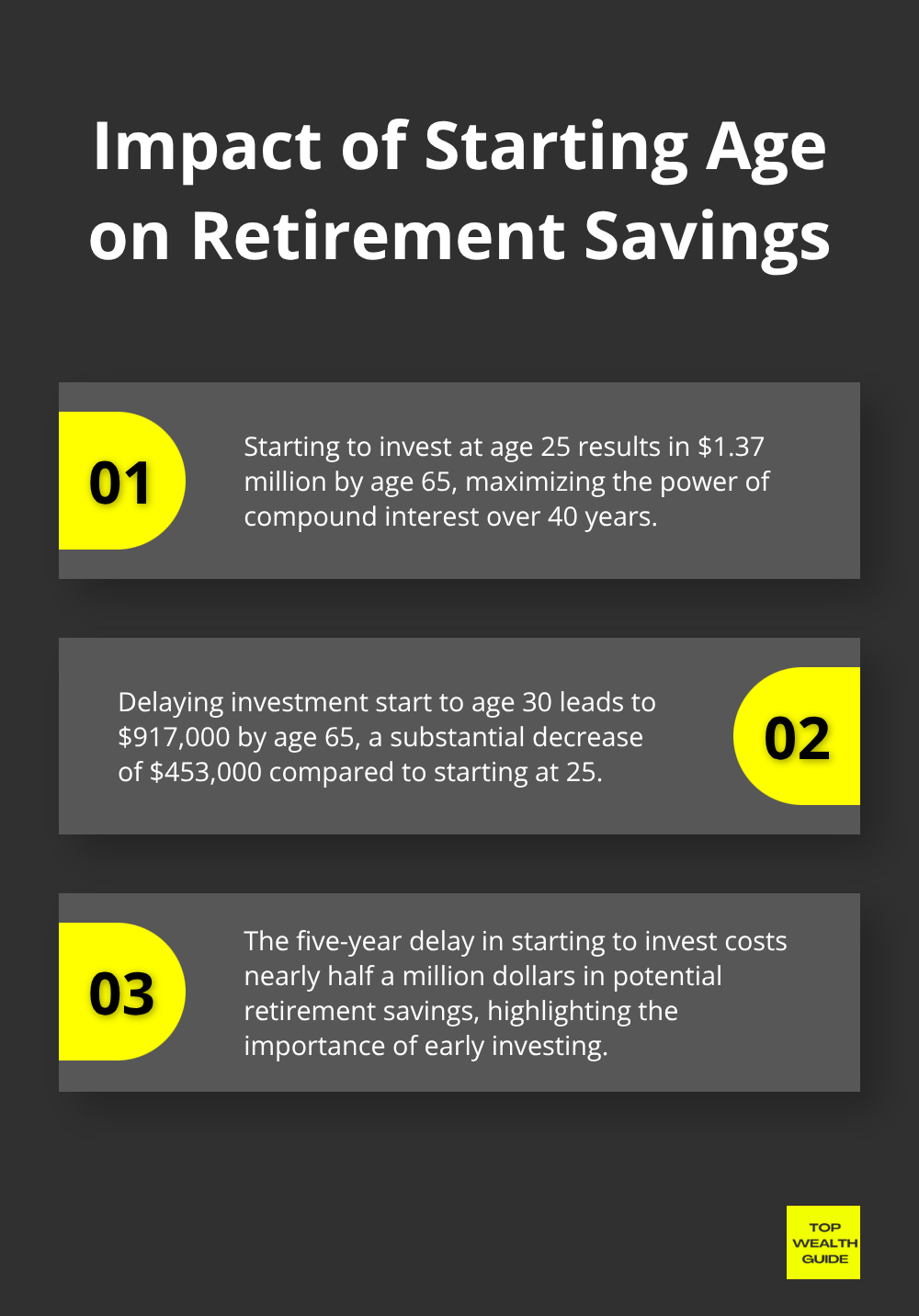

Why Starting Late Costs You a Fortune

The numbers weave a harsh tale about when you start investing. Picture this: a 25-year-old tosses $200 into an investment every month at a 7% annual return. Fast forward to 65, and boom – you’re looking at $1.37 million. Push that start to 30… and yeah, you’re left with just $917,000. Those five years? They strip away $453,000 from your future self, thanks to compound interest – a ruthless beast if ever there was one. The longer you wait, the scarier the math gets.

The Employer Match You Throw Away

Most companies toss in an extra 3-6% of your salary if you chip into your retirement plan, yet 23% of eligible employees sit on the sidelines according to Vanguard’s 2024 data. Skip out on a $3,000 annual match for a decade… and you’re basically tossing $30,000 of free cash straight into the wind – not even counting potential growth. That overlooked match could balloon to over $130,000 by retirement with a solid 7% return. Seriously, walking away from this benefit is like flushing some of the easiest money you’ll ever find.

The Compound Interest Trap Most People Fall Into

Every dollar not invested at 25? Yeah, it has to magically turn into $4 by 35 – still banking on that 7% return. The National Financial Educators Council dropped a bombshell: financial illiteracy cost Americans $1,015 each in 2024. Starting your investment journey at 35 instead of 25? Get ready for a bunch more years chasing the same retirement dreams. The compound growth window? It slams shut real quick, and no amount of aggressive saving later on really makes up for those early, lost years.

But hey, a late start isn’t the only thing sneaking up on your wealth. Even the early birds can mess it all up – letting lifestyle drags empty their accounts faster than they can stack them.

Why Your Paycheck Raises Keep You Broke

Scored that promotion, huh? Winning, or so you think. Reality check: as soon as you pocket a few more bucks, most folks shred their financial future – fast. The median American? Saving just 3.6% of income, per the Federal Reserve. And then there’s lifestyle inflation – wrecking even that measly stash. A $10,000 raise lands in your lap, and what do you do? Upgrade the car, splash on a fancier pad, and suddenly, dinner out isn’t once a week – it’s three. Poof! In a few short months, every extra penny – gone, and often more besides.

The Credit Card Death Spiral

Welcome to high-interest debt hell, where your lifestyle boost becomes financial quicksand. Credit card rates – still sky-high. So, your $5,000 splurge is racking up serious interest. Overshoot your budget by $25 a week on dining (one decent meal out), and you lose $1,300 annually that could crush debt or fatten your savings. In 2024, Americans blew $1,015 each on financial mistakes, per the National Financial Educators Council. Most of it? Overspending while drowning in costly debt.

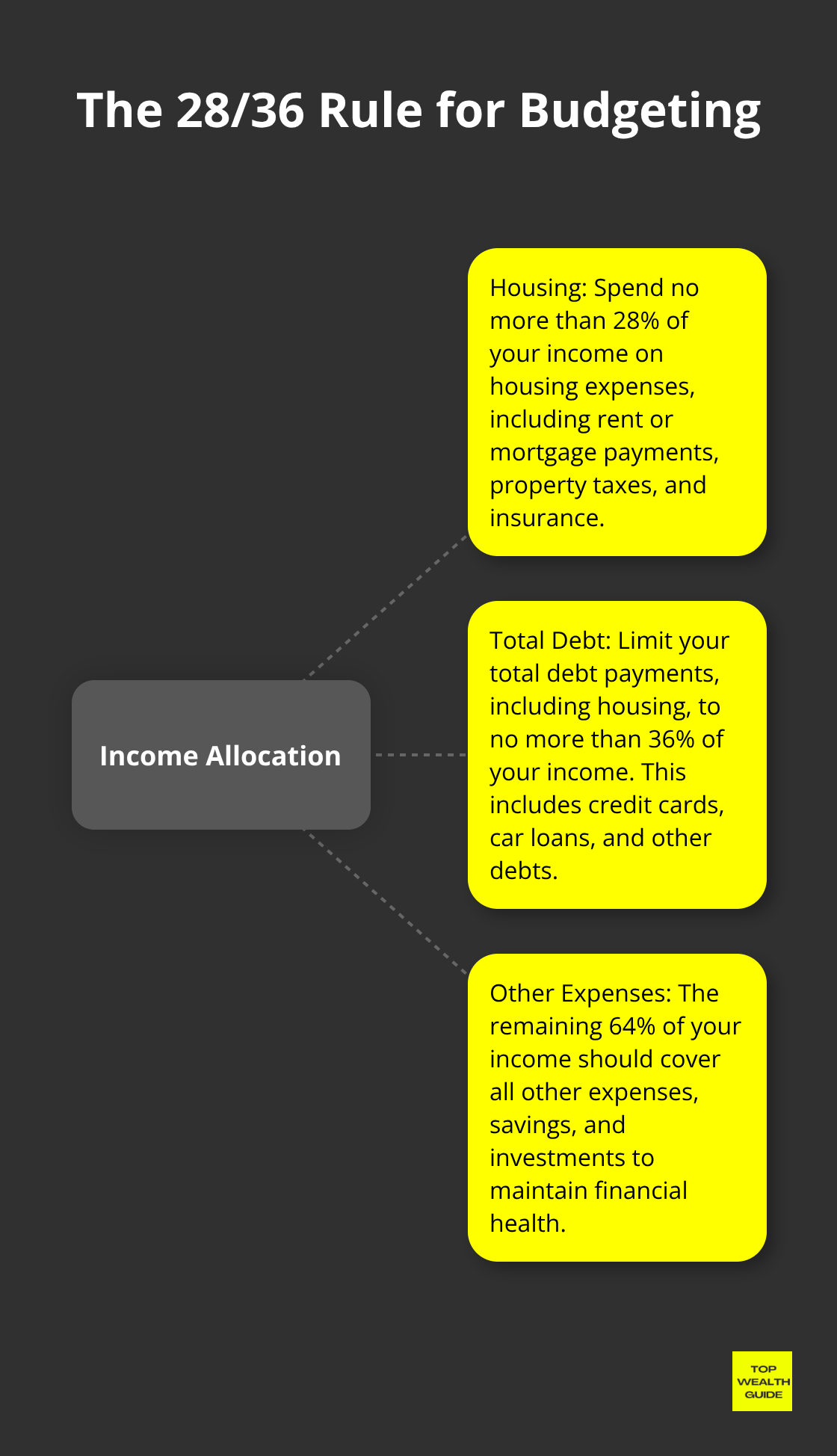

The Budget Blindness That Bankrupts You

Cluelessness about where your money goes every month? That’s a million-dollar mistake – literally. No expense tracking means you miss those $200-a-month subscription leaks, $500 in impulse buys, and lifestyle creep gobbling up every raise. The 28/36 rule? Spend no more than 28% of your income on housing and 36% on total debt. But without a clue, you’re bulldozing those limits. Try tracking every dollar for 30 days with Mint or YNAB – the jolt of seeing your spending reality will make you rethink, before your cash evaporates.

Sure, poor spending habits are wealth’s archenemy, but even eagle-eyed savers make epic investment blunders costing millions.

Why Bad Investment Moves Destroy Your Future

So, you think you’re a smart saver, huh? Well, hold onto your hats, because even the savviest can torpedo their own wealth with some seriously dumb investment choices. Let’s dive into DALBAR’s 2023 study to see the carnage-turns out the average equity fund investor ended the year with a staggering -21.17% while the S&P 500 only dropped -18.11%. That gap? It’s like screaming, “Hey, I’m using emotions to guide my investments!” Bad idea. Oh, and those market timing attempts? Spoiler alert-they flop big time. Missing those best trading days? Kiss your long-term growth goodbye. Speaking of odds…would you like to bet the house on day trading? Most professionals end up in the red. No joke-most traders fail consistently, market after market.

The Panic Selling Disaster

Remember the March 2020 rollercoaster-talk about a hot mess! Folks panicked, sold their stocks…and oops, they just missed the quickest market rebound in history. Those who bailed at rock bottom and never jumped back in? Lost out on 67% by year’s end. Schwab tells us that emotional investors get smoked by buy-and-hold strategies-they underperform by 2.9% each year. Over three decades, that emotional tax? It costs you $400K on a $300K investment. Do yourself a favor-set up automatic investments with Vanguard or Fidelity and leave emotions out of it.

The Cash Hoarding Trap

Seriously, all your cash chilling in savings earning a measly 0.5% while inflation is clocking in at 3.2%? Losing purchasing power year after year-it’s almost tragic. That $100K emergency fund you’ve been sitting on for 20 years? Now worth just $52K in today’s dollars. The smart play? Keep 3-6 months of expenses in high-yield savings at Marcus or Ally and put the rest to work. Even bond funds averaging 4-5% are a no-brainer compared to cash. And over 30 years, the opportunity cost of hoarding cash? A mind-blowing $800K in lost growth compared to stocks.

The Analysis Paralysis Problem

You’re knee-deep in research, yet still can’t pull that trigger-classic analysis paralysis. And it’s costing you more than just a few bad picks. Turns out, time in the market beats timing the market, always. Vanguard’s study says those holding out for the “perfect moment” are leaving an average of 7% annual returns on the table. Rather than twiddling your thumbs, start with broad market index funds like VTSAX or SPY if you’re torn over individual stocks. Perfect timing? Doesn’t exist. But consistent investing? That’s the real deal.

Final Thoughts

These financial blunders-oof, they stack up fast into some pretty staggering losses. We’re talking late investment starts bleeding a whopping $453K, while missed employer matches just flat-out obliterate $130K of growth potential. Then there are those emotional investment decisions … yeah, they underperform by 2.9% a year (which, believe it or not, adds up to $400K over three decades). And don’t even get me started on cash hoarding during inflation-it’s an $800K missed opportunity. Total it up, and you’re looking at a cool million in lost wealth. Yikes.

The antidote here? Well, it’s grabbing the bull by the horns and taking swift action-not waiting for the so-called ‘perfect timing.’ Start investing now, even if it’s just $50 a month. Snatch up every employer match out there, and let’s automate those contributions to boot those pesky emotions out of your decision-making process. Turn into an expense-tracking beast (apps like Mint are your new best friend), hold onto 3-6 months’ worth of expenses in cash, and toss the rest into broad market index funds.

Trust me-we see folks tripping over these same financial potholes year after year. It takes just a few small changes today to snowball into serious wealth tomorrow. Future you? They’re gonna be patting your back hard for choosing action over hesitation. Swing by Top Wealth Guide to find more genius moves to stack that wealth and dodge these financial blunders.