Building wealth through investing is one part smart decisions and one part smart tax planning. While market gains are exciting, the capital gains tax can significantly reduce your net returns if not managed proactively. Understanding how to legally and effectively minimize this tax is not just for the ultra-wealthy; it's a critical skill for any serious investor looking to maximize their portfolio's long-term growth. Failing to implement effective capital gains tax strategies means leaving a substantial portion of your earnings on the table, money that could otherwise be reinvested to compound your wealth further.

This guide moves beyond generic advice to provide a detailed roundup of nine powerful and actionable strategies. We will explore each method with clear, real-world examples, step-by-step implementation guides, and a balanced look at the pros and cons. Our goal is to equip you with the knowledge to make informed decisions that align with your specific financial situation and investment goals.

Whether you're an experienced investor refining your approach or a beginner building a foundation for financial success, this comprehensive listicle will be your go-to resource. We'll cover everything from foundational techniques like Tax-Loss Harvesting and long-term holding to more advanced options such as Opportunity Zone investing and Charitable Remainder Trusts. By the end, you'll have a clear framework for legally deferring, reducing, or even eliminating capital gains taxes, ensuring you keep more of your hard-earned money working for you.

In This Guide

- 1 1. Tax-Loss Harvesting

- 2 2. Long-Term Holding Strategy

- 3 3. Opportunity Zone Investing

- 4 4. Charitable Remainder Trusts (CRTs)

- 5 5. 1031 Exchange (Like-Kind Exchange)

- 6 6. Asset Location Optimization

- 7 7. Gifting Appreciated Assets

- 8 8. Installment Sale Strategy

- 9 9. Step-Up in Basis at Death Strategy

- 10 Capital Gains Tax Strategies: A Side-by-Side Comparison

- 11 Integrating Tax Strategies into Your Overall Wealth Plan

- 12 Frequently Asked Questions (FAQ)

1. Tax-Loss Harvesting

Tax-loss harvesting is a powerful capital gains tax strategy that turns market downturns into tax-saving opportunities. It involves strategically selling investments at a loss to offset capital gains realized from other, more successful investments. By doing this, you can significantly lower your overall tax bill for the year.

The core principle is simple: capital losses cancel out capital gains. If your losses exceed your gains, you can use up to $3,000 of the excess loss to reduce your ordinary income, such as your salary. Any remaining losses can be carried forward indefinitely to offset gains in future years. This makes it an essential tool for long-term investors in taxable brokerage accounts.

How to Implement Tax-Loss Harvesting

Implementing this strategy requires careful planning to avoid the "wash-sale rule," which disallows a loss deduction if you buy a "substantially identical" security 30 days before or after the sale.

- Identify Losing Positions: Regularly review your portfolio to find assets trading below your purchase price (cost basis).

- Sell the Asset: Realize the capital loss by selling the underperforming security.

- Offset Gains: Apply the loss against any capital gains you've realized during the year. Short-term losses are first applied to short-term gains, which are taxed at higher rates, making this particularly effective.

- Replace the Asset (Optional): To maintain your target asset allocation, you can immediately reinvest the proceeds into a similar, but not identical, investment. For example, if you sell a specific S&P 500 ETF, you could buy a different S&P 500 ETF from another provider.

Real-Life Example: Sarah is an investor who realized a $10,000 gain from selling shares of Apple. In the same year, she noticed her investment in an energy sector ETF was down by $8,000. She sold the ETF, realizing the $8,000 loss. The loss offset $8,000 of her gain, so she only had to pay capital gains tax on a net gain of $2,000. To maintain her energy sector exposure without violating the wash-sale rule, she immediately reinvested the proceeds into a different energy ETF with a similar investment objective.

2. Long-Term Holding Strategy

Patience is more than a virtue in investing; it's one of the most effective capital gains tax strategies available. The long-term holding strategy involves keeping an investment for more than one year before selling. This simple act of waiting allows your gains to be classified as long-term, which qualifies them for significantly lower tax rates compared to short-term gains.

The tax differential is substantial. Short-term capital gains, from assets held for one year or less, are taxed as ordinary income at rates as high as 37%. In contrast, long-term capital gains are taxed at preferential rates of 0%, 15%, or 20%, depending on your taxable income. This strategy aligns perfectly with a "buy-and-hold" philosophy, rewarding investors who focus on an asset's fundamental value over time rather than short-term market fluctuations.

How to Implement the Long-Term Holding Strategy

Successfully applying this strategy requires discipline and careful tracking. The goal is to consciously cross the 366-day threshold before realizing a gain.

- Track Your Purchase Dates: Keep meticulous records of when you acquire each asset. Mark your calendar for the date each investment officially becomes a long-term holding (one year and one day after purchase).

- Plan Your Sales: When you decide to sell a profitable asset, check its holding period first. If it's close to the one-year mark, consider waiting a few more days or weeks to qualify for the lower tax rate.

- Use Specific Lot Identification: If you bought shares of the same stock at different times, instruct your broker to sell the specific lots that have been held for over a year. This is known as "specific identification."

- Align with Your Investment Thesis: This tax strategy should support, not dictate, your investment decisions. A long-term hold makes sense if you still believe in the asset's future growth potential. Discovering how to effectively manage your wealth for long-term growth is a key part of this process.

Real-Life Example: Michael, an investor in the 32% tax bracket, has a $20,000 gain on a stock. If he sells after holding it for 11 months, the gain is short-term and taxed at his ordinary income rate of 32%, resulting in a $6,400 tax bill. By waiting just one more month, the gain becomes long-term and is taxed at 15%, reducing the tax bill to $3,000. This simple act of patience saves him $3,400.

3. Opportunity Zone Investing

Investing in Opportunity Zones is an innovative capital gains tax strategy designed to spur economic development in distressed communities. Established by the 2017 Tax Cuts and Jobs Act, this program allows investors to defer, reduce, and potentially eliminate capital gains taxes by reinvesting them into Qualified Opportunity Funds (QOFs). These funds then deploy capital into designated low-income areas, funding projects from real estate development to new business ventures.

The primary benefit is tax deferral. An investor can postpone paying taxes on recent capital gains until December 31, 2026, or until they sell their QOF investment, whichever comes first. The most significant advantage, however, is that if the QOF investment is held for at least 10 years, any appreciation on that investment can be completely tax-free. This creates a powerful incentive for long-term, community-focused investing. For more information on using real estate for financial growth, explore strategies for building wealth with real estate.

How to Implement Opportunity Zone Investing

Successfully leveraging this strategy requires timely action and thorough due diligence. The process is more complex than standard investments and involves strict adherence to IRS regulations.

- Realize a Capital Gain: You must first have a capital gain from the sale of an asset, such as stocks, a business, or real estate.

- Invest in a QOF: You have 180 days from the date the gain was realized to reinvest the gains (or a portion of them) into a Qualified Opportunity Fund.

- Elect Deferral: File Form 8949 and Form 8997 with your tax return to officially elect to defer the gain.

- Hold for Tax Benefits: To achieve the maximum benefit (tax-free appreciation), you must hold the QOF investment for a minimum of 10 years.

Real-Life Example: An entrepreneur sells her business, realizing a $2 million capital gain. Within 180 days, she invests that $2 million into a QOF that is developing a mixed-use property in a designated Opportunity Zone. She defers paying taxes on her initial gain. She holds the QOF investment for 12 years. By the time she sells, the investment has grown to $3.5 million. Because she held it for over 10 years, the entire $1.5 million in appreciation is completely tax-free.

4. Charitable Remainder Trusts (CRTs)

A Charitable Remainder Trust (CRT) is a sophisticated estate-planning tool that merges philanthropy with powerful tax advantages. It's an irrevocable trust that allows you to donate highly appreciated assets, receive an immediate tax deduction, avoid capital gains taxes upon the sale of the asset, and generate an income stream for yourself or others for a set period.

The process involves transferring assets like stocks or real estate into the trust. The trustee then sells the assets and reinvests the proceeds to provide income payments to you. Because the trust is a tax-exempt entity, it does not pay capital gains tax when it sells the asset, preserving the full value for investment. At the end of the trust's term, the remaining assets are donated to the charities you designated.

How to Implement a Charitable Remainder Trust

Setting up a CRT is a formal legal process that requires professional guidance, but it's one of the most effective capital gains tax strategies for large, appreciated assets.

- Consult Professionals: Work with an experienced estate planning attorney and a tax advisor to draft the trust document and ensure it meets your financial and charitable goals.

- Transfer Appreciated Assets: Fund the trust by transferring highly appreciated, low-basis assets. This maximizes the tax benefit by avoiding the largest potential capital gains.

- Sell and Reinvest: The trustee sells the assets within the tax-exempt trust. The full, pre-tax value of the sale proceeds can then be reinvested to generate income.

- Receive Income and Deduction: You receive income payments according to the trust's terms (typically for life or a set number of years) and claim an immediate partial income tax deduction for the charitable portion of your contribution.

Real-Life Example: A retired couple has $2 million in tech stock with a cost basis of only $200,000. Selling it would trigger a large tax bill. Instead, they transfer it to a CRT. The trust sells the stock tax-free. The couple receives an annual income of $100,000 (5% of the initial value) for the rest of their lives and gets a significant immediate charitable tax deduction. When they both pass away, the remaining funds in the trust go to their alma mater, fulfilling their philanthropic goals.

5. 1031 Exchange (Like-Kind Exchange)

A 1031 exchange is one of the most powerful capital gains tax strategies available to real estate investors. Named after Section 1031 of the U.S. Internal Revenue Code, it allows you to defer paying capital gains taxes when you sell an investment property, as long as you reinvest the proceeds into another "like-kind" property. This tool lets investors grow their portfolios without the immediate tax drag from profitable sales.

The core principle is to continuously roll gains from one real estate investment into the next, deferring the tax liability indefinitely or until you finally sell for cash years down the line. It's a cornerstone strategy for building substantial real estate wealth over time, famously used by large-scale developers and individual investors alike to scale their holdings.

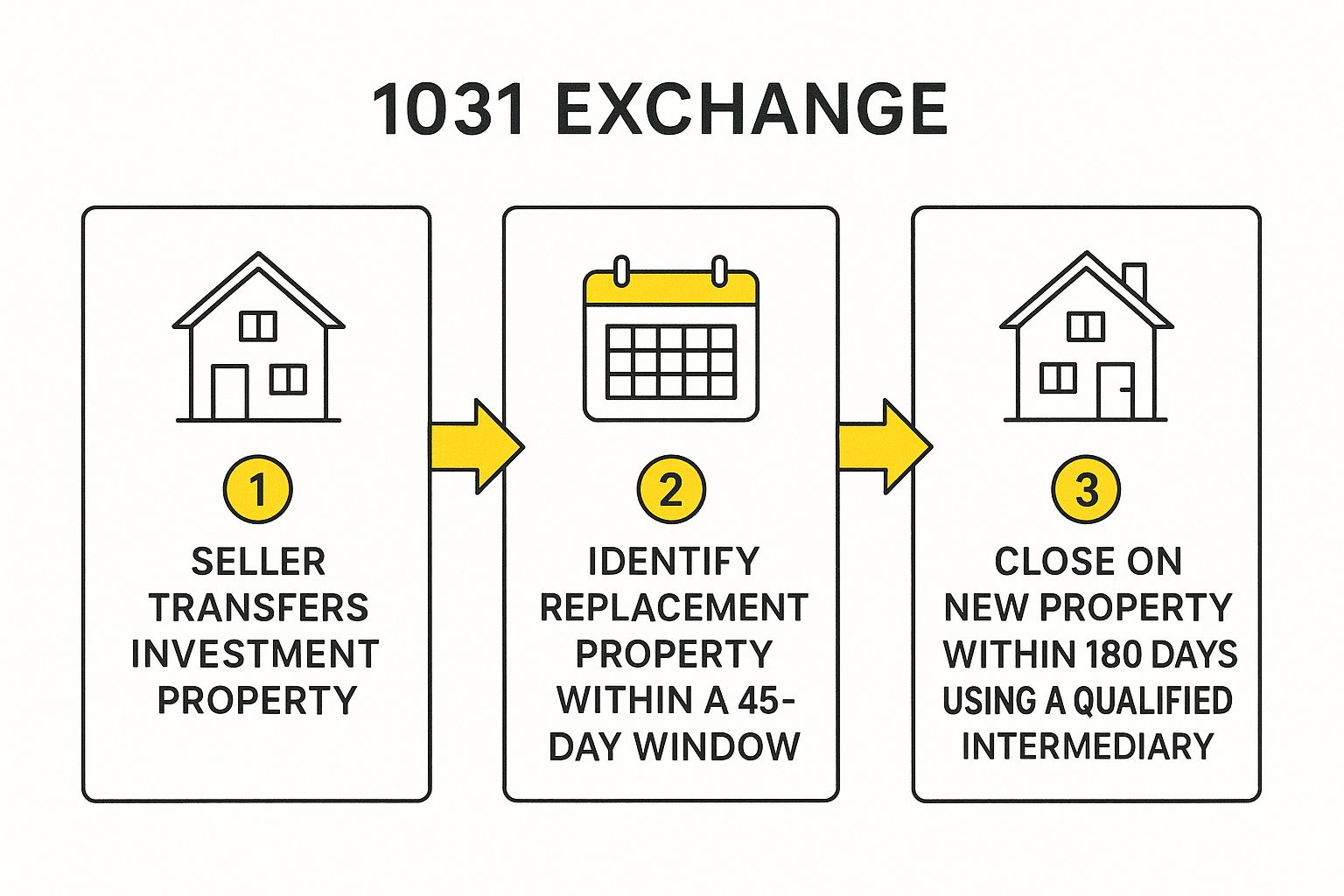

The following diagram illustrates the strict timeline and process flow required for a successful 1031 exchange, which involves a Qualified Intermediary and firm deadlines.

As the process shows, investors must adhere to a tight 45-day window to identify a new property and a 180-day window to close the purchase, making preparation critical.

How to Implement a 1031 Exchange

Successfully executing a 1031 exchange requires careful adherence to IRS rules and deadlines. Missing a step can disqualify the transaction and trigger a significant tax bill.

- Engage a Qualified Intermediary (QI): You cannot touch the sale proceeds yourself. A QI must hold the funds in escrow between the sale of your old property and the purchase of your new one.

- Identify Replacement Properties: Within 45 days of selling your property, you must formally identify potential replacement properties. You can use the "3-property rule" (identify up to three properties of any value) or the "200% rule" (identify any number of properties as long as their combined value doesn't exceed 200% of your sold property's value).

- Close on the New Property: You must close on one or more of the identified replacement properties within 180 days of the original sale.

- Ensure Equal or Greater Value: To fully defer taxes, the new property's value and debt must be equal to or greater than the old property's. Any cash received or debt relief is considered taxable "boot."

Real-Life Example: An investor, Maria, sells a duplex she bought years ago for $300,000 for its current market value of $800,000, realizing a $500,000 gain. Instead of paying taxes, she initiates a 1031 exchange. Within 45 days, she identifies a small apartment building listed for $1 million. She closes on the new property within the 180-day window. This move defers all her capital gains taxes, allowing her to leverage the entire $800,000 from the sale into a larger, income-producing asset. Explore more about property investment tax deductions to complement this strategy.

6. Asset Location Optimization

Asset location is a sophisticated capital gains tax strategy that focuses on placing different investments across various account types to minimize your overall tax burden. Instead of just deciding what to own (asset allocation), this strategy addresses where to own it. By holding tax-inefficient assets in tax-advantaged accounts, you can shield their returns from high tax rates, enhancing your long-term, after-tax wealth.

The core principle is to match an investment’s tax characteristics with the right account type. Tax-inefficient investments, like bonds and REITs that generate frequent ordinary income, are best placed in tax-deferred (Traditional IRA/401k) or tax-free (Roth IRA) accounts. Conversely, tax-efficient investments, such as broad-market index funds held for the long term, are better suited for taxable brokerage accounts where you can benefit from lower long-term capital gains rates.

How to Implement Asset Location Optimization

Properly implementing asset location requires a holistic view of your entire investment portfolio across all accounts, not just one.

- Categorize Your Accounts: Divide your holdings into three buckets: taxable (brokerage), tax-deferred (Traditional IRA/401k), and tax-free (Roth IRA/HSA).

- Identify Tax-Inefficient Assets: Pinpoint investments that generate high, regular income taxed at ordinary rates. These include corporate bonds, high-dividend stocks, REITs, and actively managed funds with high turnover.

- Place Assets Strategically: Move your most tax-inefficient assets into tax-deferred or tax-free accounts. Place your most tax-efficient assets, like index funds or individual stocks you plan to hold long-term, in your taxable account. Assets with the highest growth potential are ideal for Roth accounts to maximize tax-free growth.

- Manage Rebalancing Thoughtfully: When you rebalance your portfolio, do so across accounts. For example, instead of selling stocks in your taxable account to buy more bonds, you could direct new 401(k) contributions toward your bond funds to achieve your target allocation without triggering a taxable event.

Real-Life Example: David has a taxable brokerage account, a Traditional 401(k), and a Roth IRA. He holds his high-yield corporate bond fund inside his 401(k), where the interest income grows tax-deferred. He holds a high-growth tech stock in his Roth IRA, ensuring all its future appreciation will be tax-free. Finally, he holds his S&P 500 index fund in his taxable account, where it generates minimal taxable dividends and will be subject to lower long-term capital gains rates when he eventually sells decades from now.

7. Gifting Appreciated Assets

Gifting appreciated assets is one of the more generous capital gains tax strategies, allowing you to reduce your tax burden while supporting family members or charitable causes. Instead of selling a highly appreciated investment and paying the tax yourself, you transfer the asset to a recipient who is in a better position to handle the tax consequences, or to an organization that is tax-exempt.

The strategy hinges on transferring your cost basis along with the asset. When you gift stock to a family member in a lower tax bracket, they inherit your original purchase price. If they sell, they will pay capital gains tax at their lower rate, which could even be 0%. Gifting to a qualified charity is even more powerful, as it provides you with a tax deduction for the asset's fair market value and completely eliminates the capital gains tax liability.

How to Implement Gifting Appreciated Assets

Properly executing this strategy requires understanding gift tax rules and the recipient's financial situation.

- Identify Appreciated Assets: Select long-term holdings (held over a year) with significant unrealized gains.

- Choose a Recipient: This could be a child, grandchild, or other relative in a low tax bracket (ideally the 0% or 15% long-term capital gains bracket) or a qualified public charity.

- Transfer the Asset: Work with your brokerage to transfer the shares or property directly. Do not sell the asset first and then gift the cash, as this triggers the capital gains tax for you.

- Document the Transfer: Provide the recipient with the original cost basis and purchase date for their records. For charitable gifts, obtain a receipt for your tax deduction.

Real-Life Example: A grandmother in the 20% long-term capital gains bracket wants to help her grandson with a down payment for his first home. She owns $50,000 worth of stock with a $10,000 cost basis. Instead of selling the stock and paying an $8,000 tax ($40,000 gain x 20%), she gifts the shares directly to her grandson. The grandson, who has a low income, is in the 0% long-term capital gains tax bracket. He sells the stock, pays no federal tax on the gain, and uses the full $50,000 for his down payment, effectively saving the family $8,000.

8. Installment Sale Strategy

The installment sale strategy is a sophisticated method for deferring capital gains tax by spreading the proceeds from a large sale over several years. Instead of receiving a lump-sum payment, the seller finances the purchase for the buyer and receives payments in installments. This allows you to recognize the gain proportionally as you receive the money, potentially keeping you in a lower tax bracket and improving long-term cash flow.

This approach is particularly valuable when selling a highly appreciated asset, such as a business, real estate, or farmland. By distributing the gain over time, you can avoid the massive tax liability that would result from recognizing the entire profit in a single tax year. This technique effectively smooths out your taxable income and can lead to significant overall tax savings, making it one of the most effective capital gains tax strategies for large transactions.

How to Implement an Installment Sale

Properly structuring an installment sale requires careful legal and financial planning to ensure compliance and mitigate risk.

- Structure the Agreement: Draft a formal installment sale agreement that specifies the total sale price, down payment, interest rate, and payment schedule.

- Secure the Note: Protect your interest by securing the promissory note with collateral, which is often the asset being sold. This gives you the right to repossess the asset if the buyer defaults.

- Set an Appropriate Interest Rate: The interest you charge must be at least the Applicable Federal Rate (AFR) set by the IRS. Failing to do so can result in "imputed interest," where the IRS treats a portion of the principal as interest, creating unexpected tax consequences.

- Report the Sale Correctly: Use IRS Form 6252, Installment Sale Income, to report the sale and calculate the portion of each payment that constitutes taxable gain for that year. Note that any depreciation recapture must be reported as ordinary income in the year of the sale and cannot be deferred.

Real-Life Example: A farmer is retiring and sells his family farm, which has a cost basis of $200,000, for $2.2 million to a younger farmer. This creates a $2 million capital gain. To avoid a massive tax bill in one year, they structure a 10-year installment sale. The farmer receives $220,000 per year. Each year, he recognizes only $200,000 of the gain. This keeps him in the 15% long-term capital gains bracket annually, whereas a lump-sum sale would have pushed a large portion of the gain into the 20% bracket and triggered the Net Investment Income Tax, saving him tens of thousands in taxes over the life of the note. This method is a key tool in plans for how to create generational wealth.

9. Step-Up in Basis at Death Strategy

The step-up in basis at death is a cornerstone of multi-generational wealth transfer and one of the most powerful capital gains tax strategies available. This estate planning tool allows you to pass on highly appreciated assets to your heirs without them incurring the capital gains tax liability you would have faced if you had sold them. At the time of your death, the cost basis of these assets "steps up" to their fair market value on that date.

This means all the built-in capital gains accumulated during your lifetime are completely eliminated. Your beneficiaries can then sell the assets immediately with little to no capital gains tax, as their new cost basis is essentially the same as the selling price. While it doesn't reduce your taxes during your lifetime, it's a critical strategy for preserving family wealth across generations.

How to Implement the Step-Up in Basis Strategy

Effective implementation requires integrating this strategy into your broader financial and estate plan. The key is to hold, rather than sell, assets with the largest unrealized gains.

- Identify Appreciated Assets: Pinpoint assets in your portfolio, such as stocks, real estate, or a family business, that have appreciated significantly in value.

- Hold Until Death: Instead of liquidating these assets and triggering a large tax bill, hold them as part of your estate. This requires ensuring you have sufficient liquidity from other sources to fund your lifestyle.

- Title Assets Correctly: The way assets are titled can impact the step-up. For instance, in community property states, proper titling can allow for a full step-up on the entire value of an asset for a surviving spouse.

- Plan for Estate Taxes: While this strategy avoids capital gains tax, the assets are still part of your estate. Ensure your total estate value is below federal and state estate tax exemption limits to avoid trading one tax for another.

Real-Life Example: An investor bought shares in a startup for $50,000 decades ago. At the time of her death, the stock is now worth $2 million. Her children inherit the stock with a new cost basis of $2 million. If they sell the shares the next day for $2 million, they owe zero capital gains tax. This rule single-handedly preserved nearly $2 million of wealth for the next generation that would have otherwise been significantly reduced by taxes if the original investor had sold before her passing. This is a fundamental concept for anyone looking to invest for generations and build a lasting legacy.

Capital Gains Tax Strategies: A Side-by-Side Comparison

To help you choose the right approach, this table compares the key aspects of each strategy.

| Strategy | Primary Benefit | Best For | Complexity | Key Consideration |

|---|---|---|---|---|

| 1. Tax-Loss Harvesting | Offsets gains with losses | Investors with taxable accounts and unrealized losses | Medium | Avoid the "wash-sale" rule by not buying identical assets within 30 days. |

| 2. Long-Term Holding | Lower tax rates (0%, 15%, 20%) | All investors, especially those with a long-term mindset | Low | Requires patience to hold assets for more than one year before selling. |

| 3. Opportunity Zones | Defer, reduce, and eliminate gains | Investors with significant capital gains and a 10+ year timeline | High | Strict 180-day investment deadline and long holding period for full benefit. |

| 4. Charitable Trusts | Avoid gains, get income & deduction | Philanthropic investors with highly appreciated assets | High | Irrevocable; requires professional legal and financial setup. |

| 5. 1031 Exchange | Indefinite tax deferral | Real estate investors upgrading or swapping properties | High | Strict 45-day identification and 180-day closing deadlines; for real estate only. |

| 6. Asset Location | Increases after-tax returns | Investors with multiple account types (taxable, IRA, Roth) | Medium | Requires a holistic portfolio view and strategic placement of assets. |

| 7. Gifting Assets | Shifts tax burden to lower bracket | Investors wanting to help family or donate to charity | Low | Gift tax limits apply, and recipient inherits your cost basis. |

| 8. Installment Sale | Spreads tax liability over years | Owners of businesses or real estate making a large sale | Medium | Buyer default risk; interest must be charged at the federal rate. |

| 9. Step-Up in Basis | Eliminates capital gains for heirs | Estate planning for multi-generational wealth transfer | Low | Does not reduce your taxes; benefits your beneficiaries after your death. |

Integrating Tax Strategies into Your Overall Wealth Plan

Navigating the landscape of capital gains tax can feel like a complex chess match, but as we've explored, you hold a powerful set of pieces. The strategies detailed in this guide, from Tax-Loss Harvesting to the Step-Up in Basis, are not isolated tactics to be used in a vacuum. Instead, they are interconnected components of a dynamic, comprehensive wealth-building machine. True financial mastery lies not just in understanding each strategy individually, but in knowing how to weave them together into a cohesive plan that aligns with your specific goals, timeline, and risk tolerance.

From Reactive Scrambling to Proactive Planning

The most significant shift you can make is moving from a reactive to a proactive mindset. Tax planning should not be an annual chore relegated to the frantic weeks before the filing deadline. It should be a continuous, integrated part of your investment process, reviewed and adjusted as your life circumstances and financial objectives evolve.

Consider the synergy between these approaches:

- Combining Gifting with Asset Location: You might choose to gift highly appreciated assets from a taxable account to a family member in a lower tax bracket, while simultaneously ensuring your most tax-inefficient assets are held in tax-advantaged accounts like an IRA or 401(k).

- Layering Deferral with Elimination: A real estate investor could use a series of 1031 exchanges over decades to build a substantial property portfolio. Upon their passing, their heirs could inherit these properties with a stepped-up basis, potentially eliminating decades of deferred capital gains tax forever.

- Integrating Charitable Goals with Tax Efficiency: A Charitable Remainder Trust (CRT) allows you to support a cause you care about while generating an income stream and receiving a significant tax deduction, turning philanthropic goals into a powerful part of your financial strategy.

Your Actionable Path Forward

Mastering these capital gains tax strategies is about more than just saving a few dollars; it's about fundamentally increasing the efficiency of your wealth creation. Every dollar not paid in taxes is a dollar that can be reinvested, compounding over time and accelerating your journey toward financial independence. This is how you transform your portfolio's gross returns into superior, long-term, after-tax net worth.

Your next steps should be clear and deliberate. First, review your current investment portfolio and identify highly appreciated assets. Second, assess your short-term and long-term financial goals. Finally, schedule a meeting with a qualified financial advisor or CPA to discuss which combination of these strategies best fits your unique situation. This proactive engagement is the single most important investment you can make in your financial future. By taking control of your tax destiny, you are not just managing your finances; you are actively architecting your legacy.

Frequently Asked Questions (FAQ)

1. What is the difference between short-term and long-term capital gains?

A short-term capital gain comes from selling an asset you held for one year or less. It's taxed at your ordinary income tax rate. A long-term capital gain comes from an asset held for more than one year and is taxed at lower preferential rates (0%, 15%, or 20%).

2. How does tax-loss harvesting work if my losses are greater than my gains?

If your capital losses exceed your capital gains for the year, you can use up to $3,000 of the excess loss to reduce your ordinary income (like your salary). Any remaining loss can be carried forward to future tax years to offset future gains.

3. Can I use a 1031 exchange for stocks or cryptocurrency?

No. The Tax Cuts and Jobs Act of 2017 limited 1031 exchanges to real property only. They can no longer be used for personal property like stocks, bonds, collectibles, or cryptocurrency.

4. What is the "wash-sale rule" and how do I avoid it?

The wash-sale rule prevents you from claiming a loss on a security if you buy a "substantially identical" one 30 days before or after the sale. To avoid it, either wait 31 days to repurchase the same security or reinvest in a similar but not identical one (e.g., a different S&P 500 ETF from another provider).

5. Is the step-up in basis strategy guaranteed to exist in the future?

While it is currently a core part of the U.S. tax code, the step-up in basis has been a topic of political debate. Future tax law changes could potentially limit or eliminate it, which is why staying informed on tax policy is important for long-term estate planning.

6. Do I have to pay gift tax if I gift appreciated stock to my child?

Not necessarily. In 2024, you can gift up to $18,000 per person per year without filing a gift tax return. If you gift more, you must file a return, but you likely won't pay taxes unless you exceed your lifetime gift and estate tax exemption (over $13 million per person in 2024).

7. Can I live in a property I acquire through a 1031 exchange?

No, not immediately. A 1031 exchange is for investment or business properties only. To eventually convert it to a primary residence, you must typically hold it as a rental property for a significant period (e.g., at least two years) to demonstrate investment intent.

8. What happens if the buyer in an installment sale defaults on payments?

If the buyer defaults, the seller can typically repossess the property, especially if it was used as collateral. However, this can have complex tax consequences, and you may need to report a gain or loss on the repossession. This is a key risk to consider.

9. Are Opportunity Zones a risky investment?

Yes, they can be. These funds invest in economically distressed areas, which carries inherent risk. The investments are often illiquid with long holding periods. Thorough due diligence on the specific fund manager and underlying projects is critical before investing.

10. When should I consult a professional about these strategies?

While simple strategies like long-term holding can be self-managed, you should consult a qualified CPA or financial advisor for more complex strategies like 1031 exchanges, CRTs, Opportunity Zones, and installment sales to ensure compliance and proper implementation.

Ready to move from theory to action? At Top Wealth Guide, we provide the tools, in-depth analysis, and expert insights needed to build a sophisticated and tax-efficient wealth plan. Visit Top Wealth Guide to access exclusive resources and take the next step in mastering your financial future.