Your brain is wired to make financial mistakes. Overspending, avoiding investments, and repeating money patterns happen because of how your mind processes decisions, not because you lack willpower.

At Top Wealth Guide, we’ve found that a wealth mindset shift isn’t about motivation-it’s about rewiring the neural pathways that control your financial behavior. This post shows you exactly how to do it.

In This Guide

Why Your Brain Sabotages Your Wallet

Your brain runs on patterns, and most of those patterns were installed before you had any control over them. Confirmation bias makes you notice only the financial information that supports what you already believe-if you think you’re bad with money, you’ll fixate on every purchase mistake and ignore your successes. Loss aversion damages your decisions even more. Neuroscience shows that losing $100 hurts roughly twice as much as gaining $100 feels good, which is why most people hold onto losing investments far too long instead of cutting losses and moving capital to better opportunities. Anchoring bias traps you to the first number you hear; salespeople quote inflated prices first because your brain uses that anchor to evaluate everything that follows. The real problem isn’t that you lack discipline. Your brain’s decision-making shortcuts were designed for survival in a resource-scarce environment, not for building wealth in 2025.

Your Spending Patterns Started in Childhood

Money beliefs form between ages 5 and 12, shaped by early experiences and environmental influences. If your parents fought about bills or expressed anxiety about affording things, your brain wired itself to see money as scarce and stressful. That childhood pattern doesn’t disappear-it strengthens through repetition. Every time you avoid checking your bank balance or feel guilty about spending, you reinforce the same neural pathway your parents carved out. Dopamine plays a significant role here: your brain releases dopamine when you spend money, which creates a reward loop that feels good in the moment but undermines long-term wealth. The spending feels like relief from anxiety, not actual financial progress. Breaking this requires something most people never do-identifying the exact money message you absorbed. Write down three specific money situations from your childhood and the emotions attached to them. Then ask yourself which of those situations you unconsciously recreate today. High earners typically had parents who treated money as a tool to manage, not a source of shame. They learned early that discussing money openly was normal, which meant they could ask for raises, negotiate better deals, and invest without emotional resistance.

How Your Brain Filters Financial Opportunities

The reticular activating system in your brain acts like a filter for information-it surfaces what you focus on and ignores everything else. If you believe you can’t afford opportunities, your brain literally won’t show them to you. A person earning $50,000 who thinks freelance work is impossible won’t notice the three gig opportunities their coworker mentions casually. Someone convinced they’ll never invest won’t see the low-cost index fund options available through their employer. This isn’t mystical thinking; it’s how attention works. Your brain processes roughly 11 million bits of information per second but only about 40 bits reach conscious awareness. Your beliefs determine which 40 bits you notice. The solution is deliberately retraining what you pay attention to.

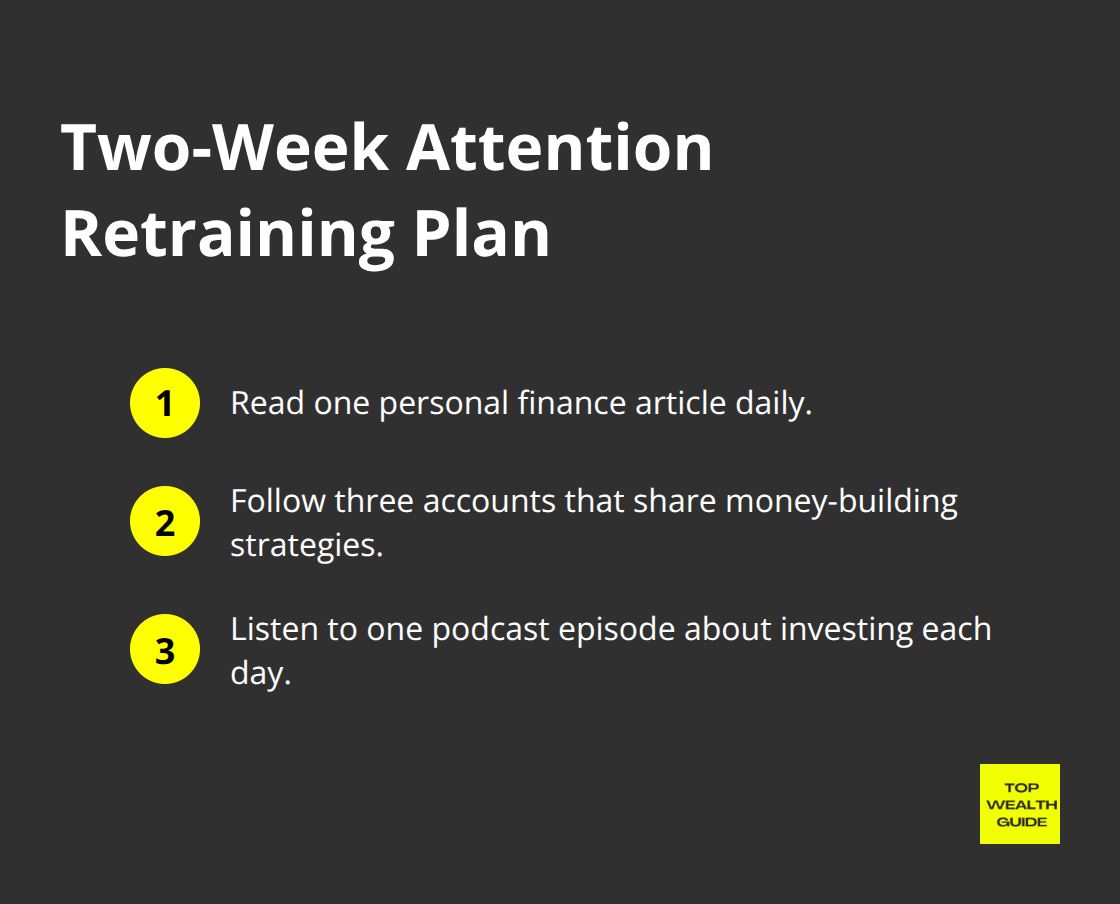

For the next two weeks, read one article about personal finance daily, follow three accounts on social media that discuss money-building strategies, and listen to one podcast episode about investing. Your brain will start surfacing financial opportunities you previously overlooked because you’ve shifted what registers as important. People who built wealth didn’t have special access to information; they simply trained their brains to recognize opportunity when it appeared.

Rewire Your Attention to Unlock Hidden Opportunities

Your current financial situation reflects the opportunities your brain has allowed you to see. When you shift your focus, you shift your results. Start by auditing the content you consume each day. Most people absorb financial information passively through news feeds that emphasize scarcity and crisis, which reinforces the belief that wealth is out of reach. Instead, actively choose sources that highlight money-building strategies and real examples of people who changed their financial trajectory. This single change-what you read, watch, and listen to-rewires which opportunities your brain surfaces. Within weeks, you’ll notice side gig possibilities, investment options, and negotiation moments you previously walked past. The shift happens not because new opportunities suddenly exist, but because your brain now recognizes them. This foundation of attention retraining prepares you to implement the specific strategies that actually transform your financial behavior.

How to Actually Break Financial Habits That Hold You Back

Identify Your Trigger and Replace the Action

Your destructive money habits aren’t character flaws-they’re neural patterns that fire automatically until you interrupt them. The key is identifying your specific trigger and replacing the action with something concrete, not willpower. If you spend money when stressed, the trigger is stress, not weakness. Instead of relying on motivation to stop, you need a different action: take a five-minute walk, call a friend, or review your budget on your phone. Research on habit loops shows that habits strengthen through repetition and associations with environmental cues, but replacing the middle action rewires your brain within weeks.

Start today by writing down one money habit you want to break-overspending on coffee, avoiding investment accounts, or checking your balance obsessively. Then identify the exact trigger: is it boredom, anxiety, social pressure, or something else? Once you know the trigger, design a replacement action that takes less than two minutes.

For example, if you impulse-buy online when bored, your replacement action could be opening your investment app and adding $5 to your portfolio instead. The friction of switching accounts activates a different part of your brain than clicking checkout. After two weeks of this replacement, your brain starts recognizing the trigger differently because you’ve created a new pathway. The old habit doesn’t disappear, but it weakens while the new one strengthens.

Use Visualization to Activate Neural Networks

Visualization works because your brain cannot distinguish between a vividly imagined experience and a real one-both activate the same neural networks. Instead of vague affirmations like “I am wealthy,” create a specific financial goal with a number and timeline, then spend three minutes daily imagining the details of living with that outcome. If your goal is saving $20,000 by December 2025, visualize yourself opening your banking app and seeing that number. Picture the relief you feel, the decisions you can now make, the stress that lifts. Practice this right before sleep and immediately after waking, when your brain is most receptive to rewiring.

Pair visualization with one daily action aligned with that goal-increasing your income by $50 per week, cutting one recurring expense, or investing automatically. This combination of mental rehearsal and concrete action creates the neural reinforcement your brain needs to shift your financial behavior. The visualization alone won’t build wealth, but it primes your brain to recognize and act on opportunities that support your goal.

Automate Your Way to Financial Discipline

Discipline is not a personality trait; it’s a skill built through repetition. Set up automatic transfers to a separate savings account on payday so you never see the money in your main account. Automate your investments through your employer’s 401k or a low-cost brokerage so the action happens without decision fatigue. Research shows that self-control strategies significantly reduce spending and increase saving.

Your brain will resist the first week because the new routine feels unnatural, but within three weeks, the automated action becomes your default. The strongest financial performers don’t have more willpower-they have fewer decisions to make because they’ve automated the behaviors that matter most. This approach removes the emotional component from your financial decisions and lets your systems do the work instead.

Build Momentum Through Small Wins

Each time you execute your replacement habit or follow through on an automated action, your brain releases dopamine-the same neurotransmitter that powered your old destructive habits. This time, however, the dopamine reinforces a behavior that builds wealth instead of undermining it. Track these small wins in a simple notebook or phone note. Write down when you chose your replacement action instead of the old habit, when you completed your visualization practice, or when an automated transfer hit your account. After two weeks, you’ll have concrete evidence that your brain is rewiring itself.

These small wins compound. The person who replaces one impulse purchase with a $5 investment today will have rewired enough neural pathways within a month to handle larger financial decisions with less emotional resistance. Your brain recognizes patterns through repetition, and each successful execution of a new behavior strengthens the neural pathway that supports it. This foundation of rewired habits prepares you to implement the visualization and goal-setting practices that accelerate your wealth-building trajectory.

How Real People Rewired Their Financial Brains

The Daily Habits of Wealth Builders

Warren Buffett spends approximately six hours daily reading financial documents and annual reports, a habit he established decades ago. Reading helped shape Buffett’s investment style, and this shaped his ability to spot undervalued companies before markets caught up. Noah Kagan, founder of AppSumo, dedicates Tuesday mornings to learning new skills and reviewing his financial performance. These aren’t exceptions-they’re the standard practice among wealth builders. The difference between someone earning $50,000 and someone earning $500,000 rarely comes down to luck. It comes down to which financial information they’ve trained their brain to recognize and act on.

How Attention Shifts Create Real Results

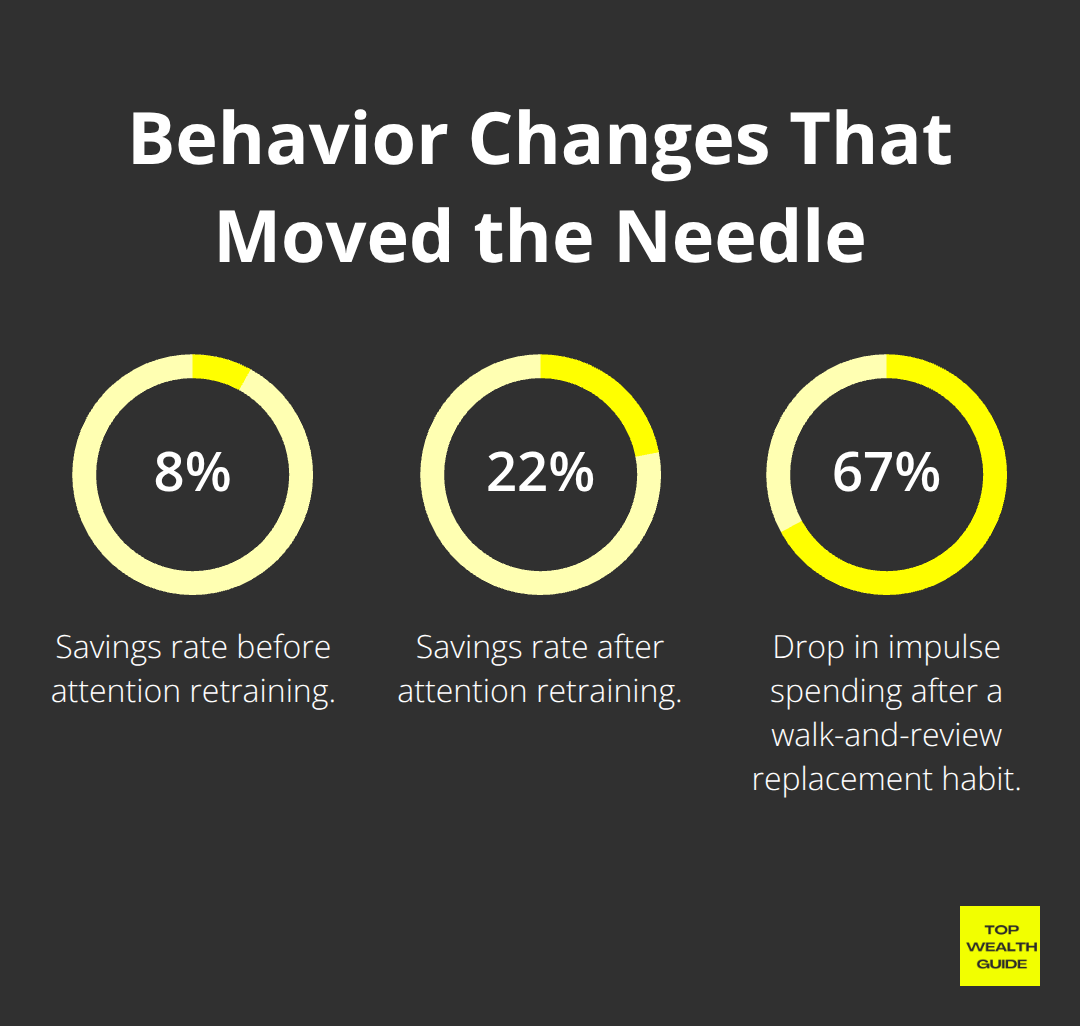

A software developer earning $85,000 annually stopped avoiding her investment accounts and instead spent ten minutes weekly reviewing her 401k allocation. Within six months, she naturally thought about asset allocation during conversations with colleagues. Her brain had rewired to surface investment opportunities she previously ignored. She increased her annual savings rate from 8 percent to 22 percent, not through deprivation, but because her brain now registered saving as important.

Another professional stuck in a pattern of stress-spending whenever work deadlines intensified replaced that habit with a five-minute walk and a review of his net worth spreadsheet. The walk broke the anxiety trigger, and reviewing his progress released dopamine from accomplishment instead of shopping. Within four weeks, his impulse spending dropped by 67 percent according to his transaction history. The spending urge didn’t disappear-his brain simply learned to satisfy the need differently.

Automation Accelerates Wealth Accumulation

High earners across different industries treat financial learning as non-negotiable time, not optional self-improvement. A real estate investor transformed from breaking even to building a seven-figure portfolio after spending the first six months reading three books on real estate finance and listening to investor podcasts during her commute. She wasn’t smarter than her peers-she simply rewired her brain to recognize property deals and financing strategies others missed. She now closes two to three investment properties annually.

The pattern holds across entrepreneurs and traders: those who automated their financial systems within their first year of earning income accumulated wealth faster than those who relied on manual decisions. One trader who struggled with revenge trading after losses implemented a mandatory 30-second pause before executing any trade. He would review his trading plan during that pause. This single friction point rewired his decision-making within three months. His annual returns improved from negative 12 percent to positive 8 percent. His brain learned that losses were data points to analyze, not emotional wounds requiring immediate action.

The Proof in Real Performance

These aren’t theoretical examples-they’re patterns repeated across professionals, entrepreneurs, and investors who deliberately changed what their brains paid attention to and how they responded to financial triggers. Each person took one specific action (attention retraining, habit replacement, or automation) and watched their financial outcomes shift within weeks or months. The mechanism remained consistent: repeated practice rewired neural pathways, which changed decision-making, which produced measurable results in income, savings, and investment returns.

Final Thoughts

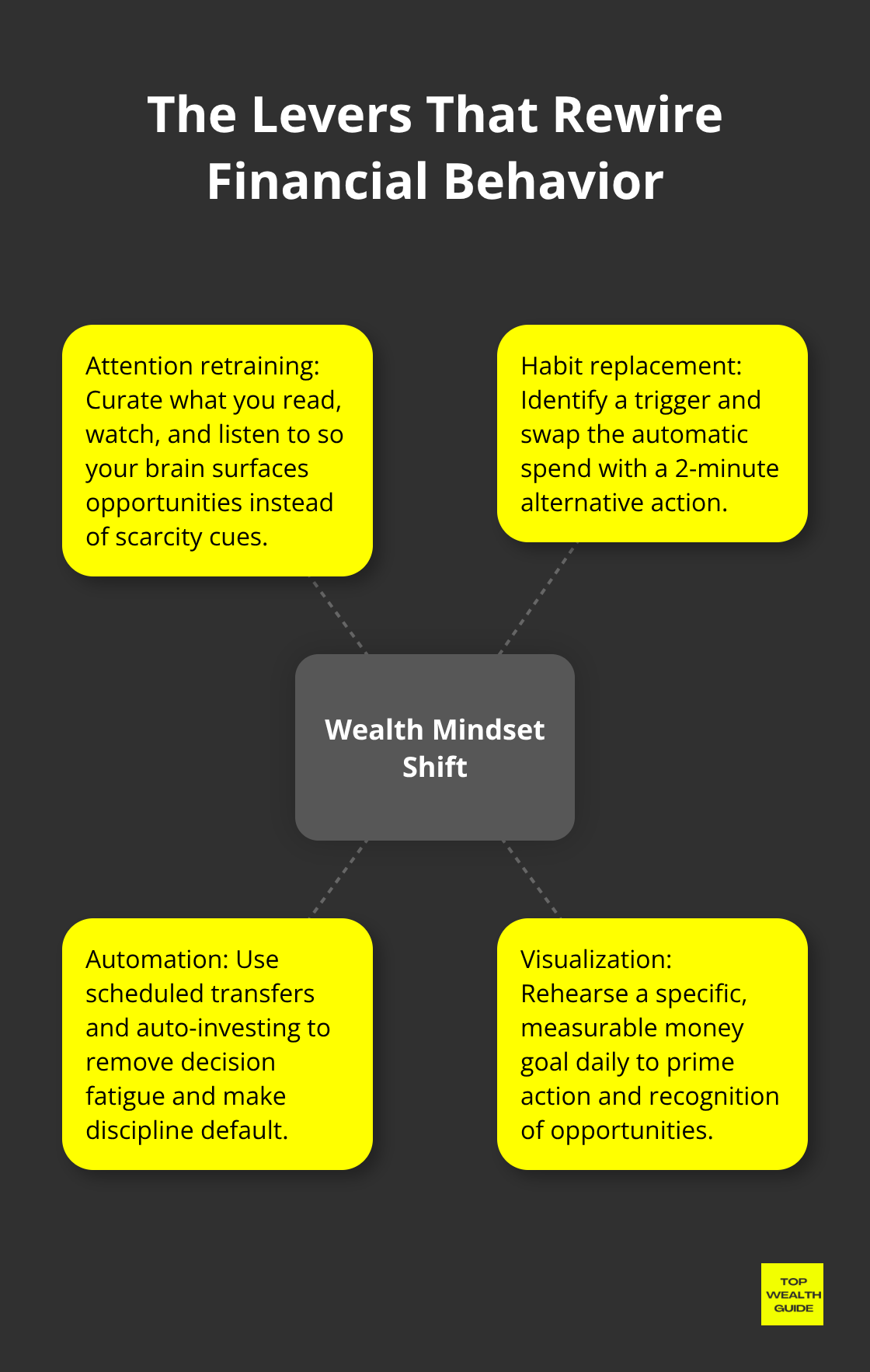

Your brain rewires itself through repeated action, not through reading about rewiring. The strategies in this post work because they target the specific neural pathways that control your financial decisions-attention retraining shifts which opportunities your brain surfaces, habit replacement breaks the automatic patterns that drain your money, and automation removes decision fatigue so discipline becomes your default. The wealth mindset shift happens when you combine these practices consistently over weeks and months.

Warren Buffett became one of the world’s best investors by building a reading habit that trained his brain to recognize undervalued companies. The software developer who increased her savings rate from 8 percent to 22 percent rewired her attention to focus on investment opportunities instead of avoiding them. The trader who stopped revenge trading inserted a 30-second pause that gave his brain time to access rational analysis instead of emotional reaction. These examples show that financial transformation comes from deliberate practice, not motivation.

Start with one practice this week and execute it for three weeks without adding anything else. Choose either attention retraining, habit replacement, or automation based on your biggest financial obstacle right now. After three weeks, your brain will have begun rewiring that specific pathway, and you’ll notice the change in your decisions and results. Visit Top Wealth Guide for additional resources on personal finance, investing, and wealth-building strategies that support your long-term financial goals.

![Can You Rewire Your Brain for Financial Success [2025] Can You Rewire Your Brain for Financial Success [2025]](https://topwealthguide.com/wp-content/uploads/emplibot/wealth-mindset-shift-hero-1770657087-1024x585.jpeg)